Global Rigid Boxes Market Size, Share, Growth Analysis By Material Type (Paperboard, Plastic, Metal, Wood), By Box Style (Hinged Lid Boxes, Telescope Boxes, Shoulder Neck Boxes, Slide Boxes, Others [Book Style, Clamshell, etc.]), By End-Use Industry, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 135972

- Number of Pages: 342

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

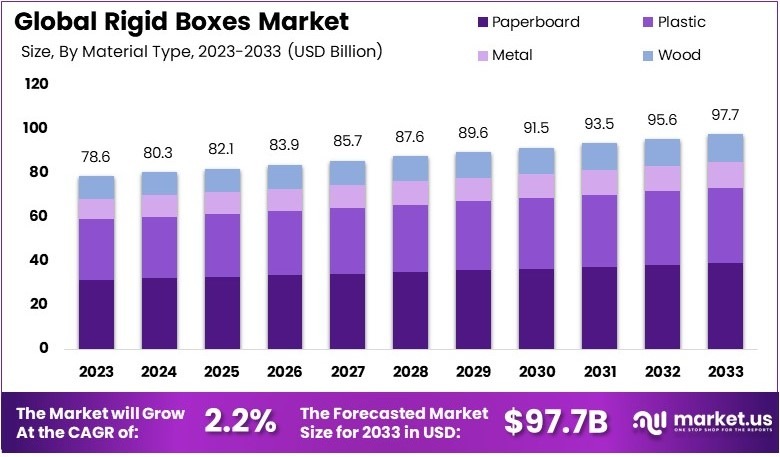

The Global Rigid Boxes Market size is expected to be worth around USD 97.7 Billion by 2033, from USD 78.6 Billion in 2023, growing at a CAGR of 2.2% during the forecast period from 2024 to 2033.

Rigid boxes are sturdy packaging containers made from high-density paperboard or similar materials. They are often used for luxury items, electronics, and gifts due to their durability and premium appearance. These boxes provide excellent protection and are favored for branding purposes.

The rigid boxes market comprises businesses involved in designing, manufacturing, and distributing rigid boxes. It caters to sectors like luxury goods, electronics, and e-commerce, focusing on premium packaging that enhances product protection, aesthetics, and consumer appeal.

Rigid boxes are growing in demand due to their durability and premium appeal, especially in industries like e-commerce and luxury goods. In 2023, global retail e-commerce sales reached $5.9 trillion, with projections exceeding $8 trillion by 2027, according to industry reports. This growth highlights the need for robust and attractive packaging solutions.

The rigid box market shows moderate saturation but remains competitive due to rising sustainability demands. Government regulations, such as the European Union’s PPWR targeting a 5% packaging reduction by 2030, emphasize eco-friendly materials. Similarly, U.S. Extended Producer Responsibility laws require producers to manage packaging waste, further driving demand for recyclable rigid boxes.

On a broader scale, rigid boxes play a critical role in reducing return shipment costs. As per Supply Chain Beyond, $32 billion worth of holiday returns were recorded in a single season, with 20%-30% related to damage. Consequently, the market benefits from offering sturdy solutions that minimize in-transit losses.

Locally, the rigid box industry boosts jobs and revenue through advanced manufacturing processes. Investments in recyclable and innovative designs cater to regulations and consumer preferences. Furthermore, the integration of local supply chains ensures efficient production while meeting global sustainability goals, strengthening both economic and environmental outcomes.

Key Takeaways

- The Rigid Boxes Market was valued at USD 78.6 billion in 2023 and is expected to reach USD 97.7 billion by 2033, with a CAGR of 2.2%.

- In 2023, Paperboard led by material, driven by sustainability and consumer preference for eco-friendly packaging.

- In 2023, Slotted Box was the top box style, favored for efficient storage and shipping.

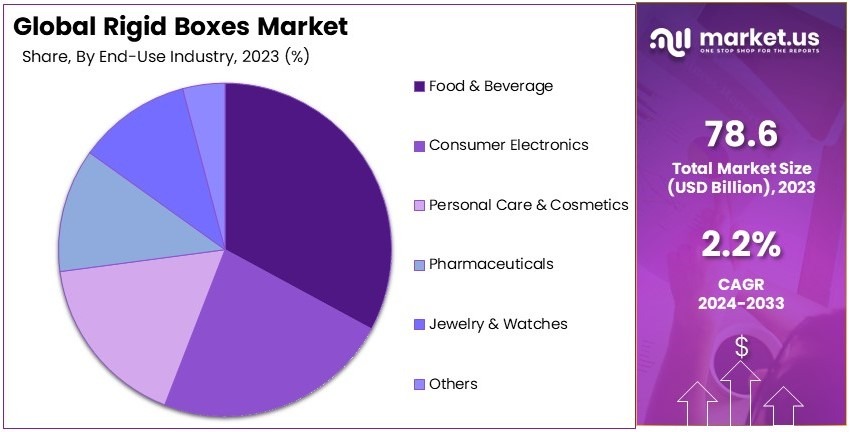

- In 2023, Food & Beverages was the largest end-use industry, reflecting demand for durable and aesthetic packaging.

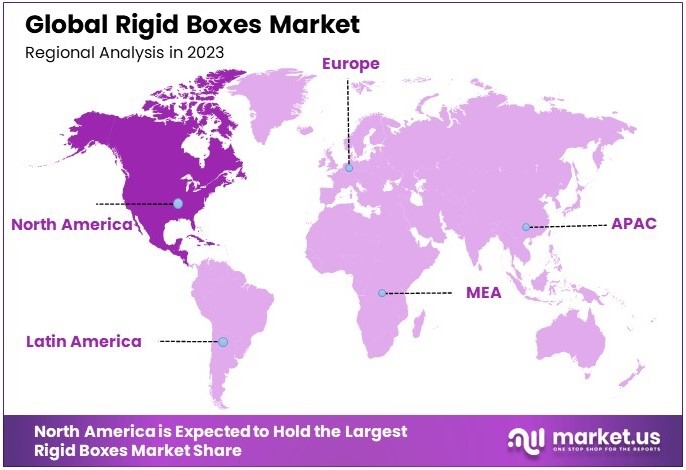

- In 2023, North America dominated, supported by advancements in packaging technologies and consumer demand.

Business Environment Analysis

The rigid boxes market has moderate saturation, driven by increasing demand across industries. According to OEC, global trade for cartons, boxes, and cases was valued at $11.4 billion in 2022, reflecting a 4.17% growth compared to the previous year. However, opportunities remain in niche and sustainable applications.

The primary consumers of rigid boxes are businesses, with 70% comprising medium to large enterprises and 30% consisting of small businesses and niche brands. These customers prioritize premium packaging for brand visibility and protection, aligning with the market’s focus on high-quality, durable solutions.

Product differentiation is critical for market success. For instance, in September 2024, Accel, Inc. installed advanced rigid box manufacturing equipment to enhance production capabilities. Such investments cater to evolving customer needs by offering innovative designs and efficient packaging solutions, ensuring competitive advantages in the industry.

Value chain integration plays a key role in optimizing operations. TCPL Packaging’s full acquisition of Creative Offset Printers by late 2023 highlights the trend of consolidating resources. Such moves strengthen supply chain efficiency and reduce production costs, enhancing profitability in the rigid boxes market.

Export-import dynamics further shape the rigid boxes market. China exported $1.7 billion worth of cartons, boxes, and cases in 2022, making it the top exporter. Conversely, the United States imported $966 million, indicating strong domestic demand and reliance on global supply chains.

Adjacent markets such as corrugated boxes and sustainable packaging complement the rigid boxes sector. With increasing e-commerce growth, the demand for innovative packaging solutions continues to rise. This alignment with adjacent markets ensures long-term growth opportunities while addressing evolving industry needs.

Type Analysis

The paperboard sub-segment dominates with 65% due to its sustainability and cost-effectiveness.

The rigid boxes market, when segmented by material type, clearly illustrates the dominance of the paperboard segment. This preference can largely be attributed to paperboard’s environmental benefits, affordability, and versatility in customization.

The material’s lightweight nature reduces shipping costs, while its recyclability appeals to increasingly eco-conscious consumers and businesses aiming to meet sustainability goals. Moreover, advancements in material science have enhanced the durability and aesthetic appeal of paperboard, making it an even more attractive option for companies across various sectors.

The plastic sub-segment, although not as dominant, plays a crucial role due to its durability and protective packaging qualities. This material is particularly valued in industries where the containment of moisture and air is critical, such as in consumer electronics and pharmaceuticals. Plastic rigid boxes also offer high resistance to impact, ensuring product safety during transportation.

Metal rigid boxes, often chosen for their robustness and premium appearance, are favored in the luxury goods sector, especially for packaging high-end electronics and fine jewelry. Their durability also makes them suitable for long-term storage, enhancing product longevity and customer satisfaction.

Wooden rigid boxes are less common but are highly valued for their aesthetic appeal and strength. They are frequently used for high-value items like luxury watches and bespoke artisan goods, offering a unique, eco-friendly packaging solution that also serves as a branding tool.

Box Style Analysis

Hinged lid boxes lead with 40% market share due to their convenience and security features.

Hinged lid boxes are predominant in the rigid boxes market by style due to their user-friendly design and secure closure, which are essential for items requiring frequent access. This style is particularly prevalent in the food and beverage and personal care sectors, where ease of use and product integrity are paramount.

Telescope boxes offer an excellent unboxing experience, often used for premium and gift products. Their design, which allows the box’s top part to completely cover the bottom part, provides ample space for branding and high-quality print finishes, contributing to the sub-segment’s role in market growth.

Shoulder neck boxes are distinguished by their design, where the neck of the box inserts into the base, offering an added layer of protection and an elegant presentation. This style is favored for luxury goods and high-end cosmetics.

Slide boxes, known for their drawer-like opening, provide a unique unboxing experience that has been leveraged by brands looking to differentiate their product presentation. Their ease of use and the protection they offer make them suitable for delicate items such as electronics and fine chocolates.

Other styles, such as book style and clamshell boxes, play niche roles in the market, often tailored for specific products or industries. Their unique designs cater to specialized packaging needs, thereby supporting the market’s diversity and expansion.

End-Use Industry Analysis

The food and beverage industry dominates the rigid boxes market with a significant share.

In the rigid boxes market segmented by end-use industry, the food & beverage sector emerges as the leader. This is driven by rigorous food safety regulations and the growing consumer preference for sustainable and innovative packaging solutions that ensure product freshness and integrity.

Rigid boxes in this segment often feature specialized barriers and coatings to prevent contamination and extend shelf life, which are critical factors in the industry’s reliance on this packaging type.

The consumer electronics sector utilizes rigid boxes for their protective qualities, which are essential for transporting sensitive devices. The robustness of these boxes helps prevent damage from impacts and vibrations, ensuring the safe delivery of electronics from manufacturers to end consumers.

In personal care and cosmetics, rigid boxes provide an essential combination of protection and premium presentation. Their customizable surface also allows for high-quality printing and branding, which is crucial for marketing in this visually driven industry.

The pharmaceuticals sector relies on rigid boxes for their structural integrity and barrier properties, which are vital for protecting medications from moisture, light, and contaminants, ensuring compliance with health and safety standards.

For jewelry and watches, rigid boxes not only offer security but also add a layer of luxury to the presentation, enhancing the overall customer experience and brand perception.

In other industries, such as luxury goods and fine arts, rigid boxes are chosen for their customizability and premium quality, which are aligned with the high standards expected in these markets. These segments, although smaller in volume, contribute significantly to the innovation and diversification of the rigid boxes market.

Key Market Segments

By Material Type

- Paperboard

- Plastic

- Metal

- Wood

By Box Style

- Hinged Lid Boxes

- Telescope Boxes

- Shoulder Neck Boxes

- Slide Boxes

- Others (Book Style, Clamshell, etc.)

By End-Use Industry

- Food & Beverage

- Consumer Electronics

- Personal Care & Cosmetics

- Pharmaceuticals

- Jewelry & Watches

- Others

Driving Factors

Increasing Demand for Sustainable Packaging Drives Market Growth

The rigid boxes market is significantly propelled by the increasing demand for sustainable packaging. Businesses are prioritizing eco-friendly materials like paperboard to meet environmental regulations and consumer preferences for green products.

Additionally, the growth in e-commerce and retail sectors contributes to this demand, as online retailers seek sturdy and attractive packaging to protect products during shipping and enhance customer experience.

Rising consumer preference for premium packaging also plays a crucial role, as consumers are willing to pay more for high-quality, aesthetically pleasing packaging that reflects brand value. Technological advancements in packaging design further support this growth by enabling the creation of innovative and sustainable rigid box solutions that cater to diverse industry needs.

Restraining Factors

High Production Costs Restraints Market Growth

Despite the positive outlook, the rigid boxes market faces several challenges that restrain its growth. High production costs are a significant barrier, as the manufacturing of rigid boxes often requires more expensive materials and sophisticated machinery compared to alternative packaging options.

Limited recycling infrastructure also poses a problem, particularly in regions where waste management systems are not well-developed, making it difficult to dispose of rigid boxes sustainably.

Additionally, competition from alternative packaging materials such as flexible packaging and biodegradable options can limit market share for rigid boxes, as these alternatives may offer cost advantages or align better with specific sustainability goals. Fluctuating raw material prices further exacerbate these restraints, causing uncertainty in production costs and pricing strategies.

Growth Opportunities

Expansion in Emerging Markets Provides Opportunities

The rigid boxes market is ripe with growth opportunities, particularly through the expansion in emerging markets. As economies in regions like Asia-Pacific, Latin America, and Africa develop, there is an increasing demand for sophisticated packaging solutions to support the growth of various industries.

Customization and personalization trends also present significant opportunities, as brands seek unique packaging to differentiate their products and enhance consumer engagement.

The integration of smart packaging technologies, such as QR codes and NFC tags, allows for interactive consumer experiences and better supply chain management, further driving market growth. Collaboration with luxury brands offers another avenue for expansion, as high-end products require premium packaging that rigid boxes can provide.

Emerging Trends

Adoption of Minimalist Design Aesthetics Is Latest Trending Factor

Recent trends in the rigid boxes market are shaping its future direction. The adoption of minimalist design aesthetics is becoming increasingly popular, as brands opt for clean, simple packaging that appeals to modern consumer tastes and conveys a sense of sophistication.

The use of eco-friendly inks and finishes is another trending factor, aligning with the global push towards sustainability and reducing the environmental impact of packaging materials.

Additionally, the incorporation of interactive elements, such as augmented reality features and personalized messages, enhances the consumer experience and fosters greater brand engagement. The rise of subscription box services also drives demand for innovative rigid box designs that can be easily customized and scaled to meet the needs of recurring deliveries.

Regional Analysis

North America Dominates the Rigid Boxes Market

North America leads the Rigid Boxes Market, holding the largest market share. This dominance is driven by strong demand from luxury goods, electronics, and food industries. Advanced manufacturing techniques and sustainability-focused innovations further strengthen the region’s leadership.

North America benefits from high consumer spending on premium products and the growing demand for luxury and durable packaging. The presence of major packaging manufacturers and innovations in recyclable materials boost market growth. The increasing popularity of subscription boxes also drives demand for rigid boxes.

The region’s strong e-commerce sector and established luxury goods market contribute significantly to the demand for rigid boxes. Consumer preference for eco-friendly and aesthetically pleasing packaging solutions aligns with North American companies’ focus on sustainable practices. High production standards and efficient supply chains enhance the region’s competitive edge.

Regional Mentions:

- Europe: Europe is a significant market, driven by demand for sustainable and luxury packaging. The region’s regulatory focus on eco-friendly materials supports steady growth in rigid boxes.

- Asia Pacific: Asia Pacific is growing rapidly, driven by e-commerce and consumer goods industries in countries like China and India. Affordable production and large-scale demand make the region a competitive player.

- Middle East & Africa: The region sees rising demand for rigid boxes due to expanding retail and food packaging sectors. Investments in modern packaging solutions are enhancing market growth.

- Latin America: Latin America is an emerging market, with growth driven by the food and beverage and e-commerce industries. Increasing investments in premium packaging solutions support its market potential.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

The Rigid Boxes Market is led by key companies providing premium and sustainable packaging solutions. These market leaders focus on innovation, quality, and environmental responsibility to meet the needs of industries such as luxury goods, electronics, and food. The top players emphasize customized designs and advanced production technologies.

International Paper is a global leader in packaging, offering high-quality rigid boxes with a focus on sustainable materials. The company leverages its extensive experience and scale to deliver innovative solutions for various industries.

Metsä Group stands out for its eco-friendly approach, using renewable and recyclable materials in rigid box production. Its commitment to sustainability appeals to environmentally conscious businesses and consumers.

Mondi plc excels in creating versatile and customizable rigid boxes. The company integrates branding and design innovation to enhance product presentation and customer engagement.

Smurfit Kappa Group is known for its advanced manufacturing capabilities and global reach. It provides durable and visually appealing packaging solutions, focusing on customer-specific requirements and efficient supply chains.

These companies shape the Rigid Boxes Market by combining quality with innovation and sustainability. They address evolving consumer preferences, such as the demand for eco-friendly packaging, while maintaining high standards of durability and design. Their leadership ensures the market remains dynamic and aligned with global trends.

Major Companies in the Market

- International Paper

- Metsä Group

- Mondi plc

- Great Little Box Company Ltd.

- Packaging Bee

- Stora Enso Oy

- Smurfit Kappa Group

- Schwarz Partners Packaging, LLC.

- Georgia-Pacific LLC

- Synergic Impressions Pvt Ltd.

- WestRock Company

- Madovar Packaging LLC

Recent Developments

- International Paper: In October 2024, International Paper completed its acquisition of DS Smith, a leading provider of sustainable packaging solutions. This acquisition strengthens International Paper’s global position by expanding its product offerings and customer base.

- Mondi: On October 9, 2024, Mondi agreed to acquire Schumacher Packaging’s assets in Germany, Benelux, and the UK for €634 million. This deal bolsters Mondi’s presence in Western Europe and increases its corrugated packaging capacity.

- Smurfit WestRock: In July 2024, Smurfit Kappa and WestRock merged to form Smurfit WestRock, a global leader in sustainable packaging solutions. This merger aims to enhance product offerings and operational efficiencies by leveraging combined synergies.

Report Scope

Report Features Description Market Value (2023) USD 78.6 Billion Forecast Revenue (2033) USD 97.7 Billion CAGR (2024-2033) 2.2% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material Type (Paperboard, Plastic, Metal, Wood), By Box Style (Hinged Lid Boxes, Telescope Boxes, Shoulder Neck Boxes, Slide Boxes, Others [Book Style, Clamshell, etc.]), By End-Use Industry (Food and Beverage, Consumer Electronics, Personal Care and Cosmetics, Pharmaceuticals, Jewelry and Watches, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape International Paper, Metsä Group, Mondi plc, Great Little Box Company Ltd., Packaging Bee, Stora Enso Oy, Smurfit Kappa Group, Schwarz Partners Packaging, LLC., Georgia-Pacific LLC, Synergic Impressions Pvt Ltd., WestRock Company, Madovar Packaging LLC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- International Paper

- Metsä Group

- Mondi plc

- Great Little Box Company Ltd.

- Packaging Bee

- Stora Enso Oy

- Smurfit Kappa Group

- Schwarz Partners Packaging, LLC.

- Georgia-Pacific LLC

- Synergic Impressions Pvt Ltd.

- WestRock Company

- Madovar Packaging LLC