Global Luxury Goods Market By Product Type (Apparel, Handbags and Purses, Footwear, Others), By End-User (Women, Men, Kids), By Distribution Channel (Retail Stores, Department Stores, Specialty Stores, Online Retailers, Company Websites, Other Distribution Channels), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 12522

- Number of Pages: 281

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

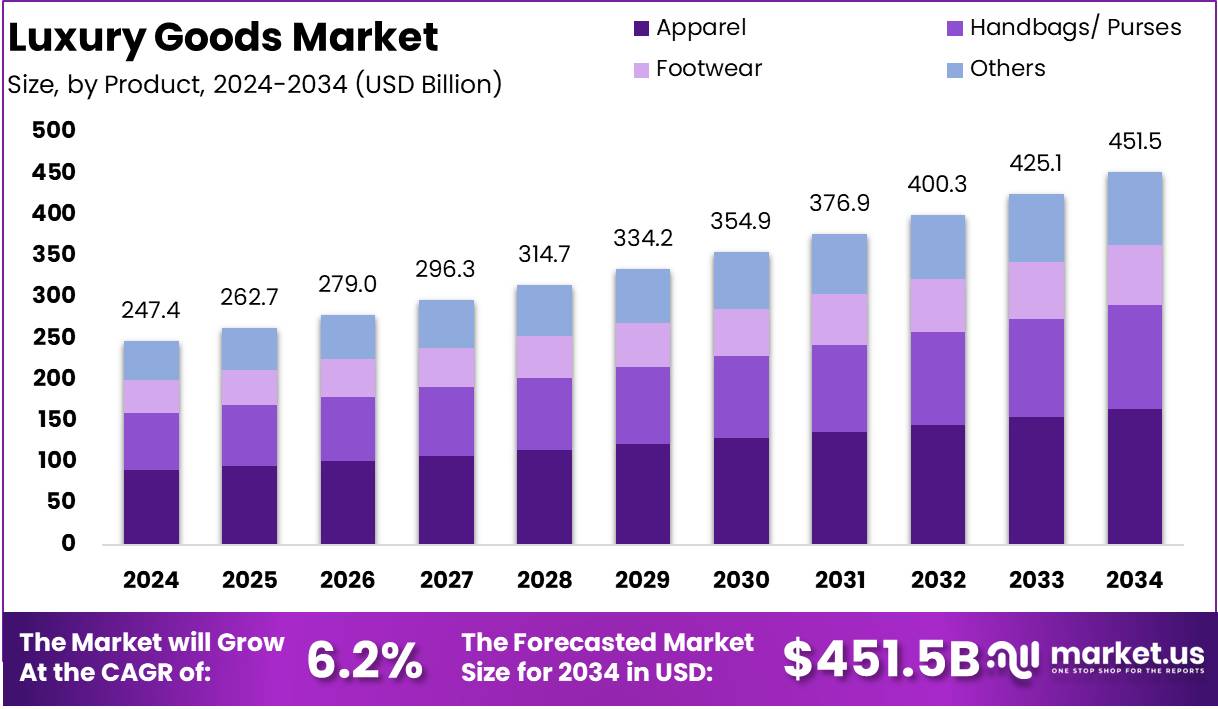

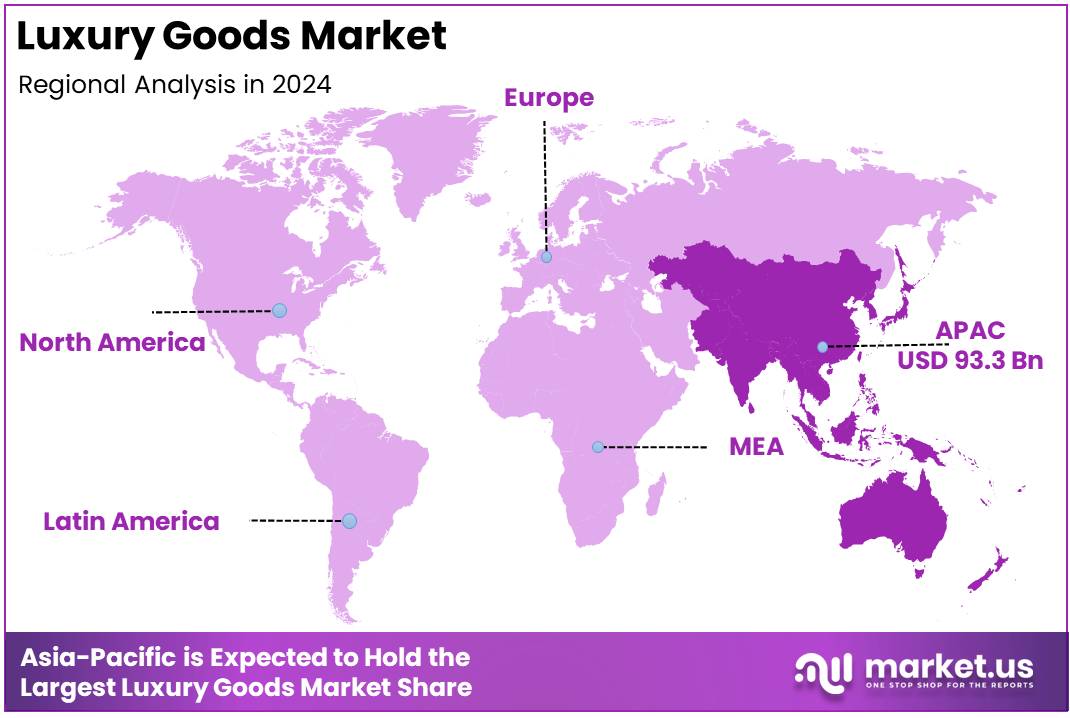

The Global Luxury Goods Market is expected to be worth around USD 451.5 billion by 2034, up from USD 247.4 billion in 2024, growing at a CAGR of 6.2% during the forecast period from 2025 to 2034. Asia Pacific dominated a 37.7% market share in 2024 and held USD 93.3 Billion in revenue from the Luxury Goods Market.

Year 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 Market Size 247.4 262.7 279.0 296.3 314.7 334.2 354.9 376.9 400.3 425.1 451.5 Market Size in USD, Bn 2024 TO 2034

Luxury goods encompass high-end items that offer superior quality and craftsmanship and are marketed primarily to affluent consumers. These goods often carry a prestige value beyond their functionality, ranging from fashion, jewelry, and watches to premium cars and fine wines. The desirability of luxury goods stems from their exclusivity, brand heritage, and status symbol.

The luxury goods market consists of selling premium products that are perceived as highly desirable and typically sold at higher price points. This market thrives on the consumer’s willingness to invest in goods that symbolize prestige and success, appealing to personal indulgence and social status aspirations.

Increasing global wealth and rising disposable incomes drive the luxury goods market. Enhanced online and mobile shopping platforms also support market expansion by making luxury goods more accessible.

Demand for luxury goods is bolstered by the growing middle and upper classes, particularly in emerging markets where consumers seek symbols of newfound economic status.

The integration of sustainability with luxury branding presents a significant opportunity, appealing to environmentally conscious consumers. Additionally, personalized and exclusive experiences are becoming increasingly important in differentiating luxury offerings in a competitive market.

The luxury goods market has exhibited resilient growth, underscored by a robust recovery from pandemic-induced lows. According to Deloitte, the top 100 luxury goods companies generated an impressive $347 billion in composite sales in FY2022. This recovery is indicative of the strong consumer confidence and the enduring allure of luxury brands, which continue to draw significant spending globally.

The market’s profitability has also seen a commendable rise, with a composite net profit margin reaching 13.4%, surpassing pre-pandemic levels and highlighting efficient operational adjustments and strategic pricing by leading companies.

However, regional disparities in market performance have become more pronounced. Bain’s analysis reveals that while the Americas have witnessed an 8% decline in luxury spending in 2023, markets in Asia, notably China and Saudi Arabia, have experienced strong growth.

This shift suggests a realignment of luxury consumption patterns, with Asian markets increasingly becoming pivotal to luxury brands’ growth strategies.

The data underscores the luxury goods sector’s robustness and adaptability, positioning it well to capitalize on emerging market opportunities and navigate the challenges in more stagnant regions. The sector’s ability to innovate and cater to the evolving preferences of a diverse global consumer base will likely continue to drive its expansion in the coming years.

Key Takeaways

- The global luxury goods market is projected to grow from USD 247.4 billion in 2024 to USD 451.5 billion by 2034, registering a CAGR of 6.2%.

- The apparel segment leads the luxury goods market with a dominant share of 36.4% in 2024.

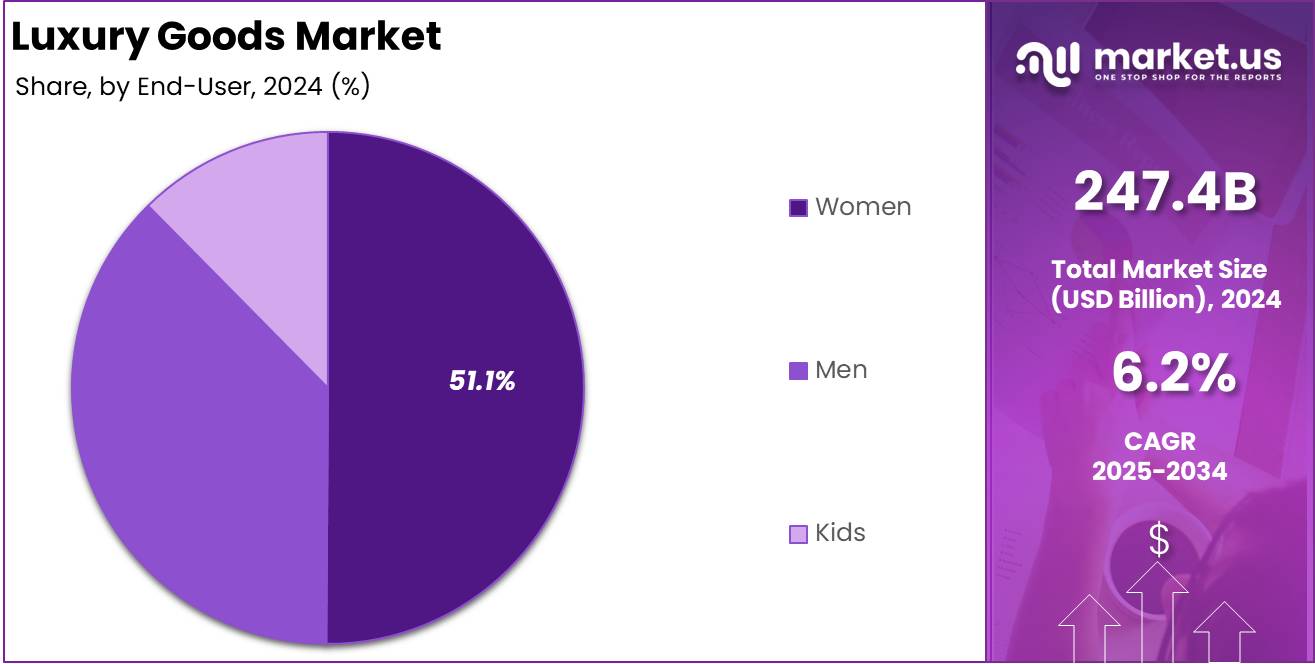

- The women’s segment remains the largest end-user category, holding a market share of 50.1% in 2024.

- Retail stores continue to be the leading distribution channel, accounting for 29.5% of the market in 2024.

- Asia Pacific dominates the luxury goods market with a substantial 37.7% share, valued at USD 93.3 billion in 2024.

By Product Analysis

In 2024, Apparel Dominating Segment of Luxury Goods Market with 36.4% Market Share

In 2024, the apparel segment emerged as the dominant product type in the luxury goods market, capturing a substantial market share of 36.4%. This segment continues to drive significant growth, fueled by increasing consumer demand for high-quality, designer clothing.

The demand for luxury apparel is supported by affluent consumers seeking exclusive and premium fashion, with trends shifting towards more personalized and tailored products.

The handbags and purses segment holds a notable 28.0% market share in the luxury goods market in 2024. This segment remains a key driver of the market, as handbags are often seen as status symbols, with consumers gravitating towards iconic brands and craftsmanship.

The continuous introduction of innovative designs and the growing appeal of luxury accessories further contribute to the strength of this segment.

Footwear is another significant contributor to the luxury goods market, accounting for 16.2% of the total market share in 2024. Luxury footwear is highly sought after for its superior quality, style, and durability. The rising demand for exclusive designer footwear and the influence of high-fashion trends are key factors that have driven growth within this segment.

The others category, which includes various luxury items such as jewelry, watches, and eyewear, captures 19.4% of the market share in 2024. This segment benefits from strong consumer interest in luxury accessories that complement fashion choices. The expansion of high-end experiences, such as exclusive services and bespoke products, further strengthens this segment’s position in the luxury market.

Global Luxury Goods Market, By Product Type, 2020-2024 (USD Billion)

Product Type 2020 2021 2022 2023 2024 Apparel 66.2 76.1 82.2 85.1 90.0 Handbags/ Purses 54.2 61.3 65.2 66.5 69.3 Footwear 29.7 34.1 36.7 37.9 40.1 Others 38.0 42.9 45.5 46.2 48.0 By End-User Analysis

In 2024, Women Dominating Segment of Luxury Goods Market with 50.1% Market Share

In 2024, the women’s segment is the dominant end-user category in the luxury goods market, capturing a substantial market share of 50.1%. This dominance can be attributed to the growing purchasing power of women globally, alongside their increasing interest in luxury fashion, accessories, and cosmetics.

Women continue to drive demand for high-end products, with a focus on exclusivity and high-quality craftsmanship, making them the key consumers of luxury goods.

Global Luxury Goods Market, By End-User, 2020-2024 (USD Billion)

End-User 2020 2021 2022 2023 2024 Women 92.7 106.1 114.1 117.6 123.9 Men 71.3 81.0 86.6 88.6 92.8 Kids 24.1 27.2 28.9 29.5 30.7 The men’s segment holds a strong 37.5% market share in the luxury goods market in 2024. This segment has seen steady growth, driven by an increasing focus on luxury apparel, accessories, and grooming products for men.

As consumer preferences evolve, men are increasingly investing in premium goods, including designer clothing, footwear, and luxury watches, further strengthening their presence in the market.

The kids’ segment represents 12.4% of the luxury goods market in 2024. While smaller in comparison to women and men, this segment has experienced significant growth as affluent parents seek premium products for their children.

Luxury clothing, accessories, and footwear for children have become a growing trend, with high-end brands offering exclusive lines targeting this demographic. The continued growth of this segment highlights the expanding market for luxury goods among younger consumers.

By Distribution Channel Analysis

In 2024, Retail Stores Dominating Segment of Luxury Goods Market with 29.5% Market Share

In 2024, retail stores remain the dominant distribution channel in the luxury goods market, capturing a significant market share of 29.5%. Retail stores continue to be the preferred shopping destination for consumers seeking an immersive, tactile experience with luxury items.

The in-store experience, featuring personalized customer service and the ability to physically engage with high-end products, contributes to the ongoing preference for retail stores among luxury consumers.

Department stores account for 21.0% of the luxury goods market in 2024. This distribution channel has maintained its importance due to its broad selection of luxury goods, allowing consumers to access multiple high-end brands under one roof.

The ability to offer a diverse range of luxury products, from apparel to accessories, positions department stores as key players in the market.

Specialty stores capture 15.0% of the market share in 2024. These stores, which focus on specific product categories such as luxury handbags or footwear, continue to attract discerning consumers seeking expertise and exclusivity. The specialized nature of these stores allows them to provide a curated selection of luxury items, appealing to consumers looking for a more focused shopping experience.

Online retailers hold a growing 17.9% share of the luxury goods market in 2024. E-commerce has seen a rise in luxury goods sales due to convenience, a wider selection, and the ability to shop from anywhere in the world. As more luxury brands expand their online presence, this channel continues to gain traction, particularly among younger, tech-savvy consumers.

Company websites capture 11.5% of the market share in 2024. Luxury brands are increasingly investing in their own online platforms to offer a direct-to-consumer experience. This channel enables brands to maintain greater control over the customer experience, ensuring a seamless, high-quality shopping journey that aligns with their luxury image.

Other distribution channels, which include pop-up stores, luxury auctions, and bespoke services, represent 5.1% of the market share in 2024. While smaller in comparison to traditional retail channels, these alternative channels offer unique shopping experiences that cater to niche luxury markets. The growing interest in exclusive events and personalized services is contributing to the gradual expansion of this segment.

Global Luxury Goods Market, By Distribution Channel, 2020-2024 (USD Billion)

Distribution Channel 2020 2021 2022 2023 2024 Retail Stores 57.0 64.5 68.7 70.0 73.0 Department Stores 41.0 46.3 49.1 50.0 52.0 Specialty Stores 27.5 31.5 34.0 35.1 37.1 Online Retailers 31.4 36.4 39.7 41.5 44.3 Company Websites 20.9 24.0 25.9 26.9 28.4 Other Distribution Channels 10.3 11.6 12.2 12.3 12.6 Key Market Segments

By Product Type

- Apparel

- Handbags/ Purses

- Footwear

- Others

By End-User

- Women

- Men

- Kids

By Distribution Channel

- Retail Stores

- Department Stores

- Specialty Stores

- Online Retailers

- Company Websites

- Other Distribution Channels

Drivers

Luxury Market Growth Drivers

The luxury goods market is propelled by several key factors that cater to the evolving demands of affluent consumers. Firstly, the surge in global wealth, especially in emerging economies, provides a broader base of consumers with the financial capability to purchase luxury items.

This demographic expansion is crucial as more individuals enter the upper-middle and high-income brackets. Additionally, the younger generation’s increasing appetite for premium brands, influenced by digital marketing and social media, significantly contributes to the market’s growth. These younger consumers are not only drawn to the quality and prestige of luxury goods but also to the exclusive experiences these brands offer.

Furthermore, innovations in technology and personalized services enhance the shopping experience, making luxury more accessible and appealing. The sector’s ability to adapt to consumer preferences, particularly through online platforms, ensures sustained interest and engagement, reinforcing its growth trajectory in an ever-competitive marketplace.

Restraint

Challenges in Luxury Market Expansion

Despite its growth, the luxury goods market faces significant challenges that could restrain its expansion. Economic fluctuations globally, such as inflation and currency volatility, impact consumer purchasing power, especially in less stable economies.

These economic uncertainties make it difficult for consumers to maintain their spending on high-end products, which are often seen as discretionary purchases. Additionally, the market is sensitive to geopolitical tensions and changes in trade policies, which can disrupt supply chains and affect the availability and cost of luxury goods. Another major challenge is the growing demand for sustainability in consumer products.

Luxury brands are under increasing pressure to demonstrate environmental responsibility, which requires rethinking supply chains and product designs to meet these new consumer expectations. These factors collectively pose risks to the stability and growth of the luxury goods market.

Opportunities

New Opportunities in Luxury Market

The luxury goods market is ripe with opportunities, particularly through digital innovation and geographical expansion. The increasing penetration of e-commerce platforms allows luxury brands to reach a broader audience, including younger, tech-savvy consumers who prefer shopping online.

This digital approach not only enhances customer engagement through personalized marketing strategies but also streamlines the purchasing process, making luxury more accessible. Furthermore, emerging markets such as China and India offer significant growth potential due to their rapidly expanding affluent populations and increasing consumer spending on luxury items.

Additionally, there is a growing trend towards sustainability in the luxury sector, with consumers increasingly valuing ethically sourced and environmentally friendly products. This shift presents a chance for luxury brands to innovate and capture the loyalty of a conscientious consumer base, thereby broadening their market reach and reinforcing their brand prestige.

Challenges

Navigating Challenges in Luxury Market

The luxury goods market encounters several challenges that could hinder its growth trajectory. Key among these is the increasing demand for sustainability, where consumers expect products to be both luxurious and environmentally friendly, challenging brands to innovate without compromising on quality or ethics.

Economic instability, including fluctuations in exchange rates and inflation, also poses a significant challenge, affecting consumer purchasing power and potentially reducing discretionary spending on luxury items. Additionally, the market is highly susceptible to geopolitical risks and changes in global trade policies, which can disrupt supply chains and affect the cost and availability of luxury goods.

The rise of counterfeit products further complicates the landscape, diluting brand value and consumer trust. Addressing these challenges effectively is crucial for sustaining growth and maintaining the allure of luxury brands in a competitive and rapidly evolving marketplace.

Growth Factors

Key Growth Drivers for Luxury Market

The luxury goods market thrives on several growth factors that continually adapt to consumer preferences and global economic trends. A significant driver is the burgeoning middle and upper classes in emerging markets, particularly in Asia, which introduce a new demographic of consumers with disposable income eager to invest in luxury items.

This is bolstered by the global increase in wealth, particularly among younger consumers who are drawn to luxury brands for their quality and status. Technological advancements in e-commerce and digital marketing have also expanded the reach and accessibility of luxury brands, making them more appealing to a tech-savvy generation.

Additionally, exclusive brand experiences and personalization are becoming increasingly important, as they enhance consumer engagement and loyalty. These factors collectively contribute to the sustained growth and resilience of the luxury goods market, even in fluctuating economic conditions.

Emerging Trends

Emerging Trends Shaping Luxury Market

The luxury goods market is witnessing several emerging trends that are reshaping consumer engagement and brand strategies. A prominent trend is the integration of digital technology, where augmented reality (AR) and virtual reality (VR) are being used to create immersive shopping experiences that blend the physical and digital realms.

This is particularly appealing to a tech-savvy, younger audience. Another significant trend is the rise of sustainability and ethical practices within the luxury sector, as consumers increasingly prioritize environmental impact and social responsibility in their purchasing decisions.

Additionally, there is a growing emphasis on personalization and customization, allowing consumers to have a hand in designing their luxury experiences, which enhances the value and exclusivity of the products. These trends are not only expanding the market’s boundaries but also ensuring its relevance and appeal to a broader, more diverse consumer base.

Regional Analysis

Asia Pacific Leads Luxury Goods Market with Largest Market Share of 37.7% in 2024

The global luxury goods market exhibits significant regional variations, with Asia Pacific emerging as the dominant region, holding a substantial 37.7% market share in 2024. The region’s luxury goods market is valued at USD 93.3 billion, driven by increasing disposable income, evolving consumer preferences, and strong demand from countries such as China, Japan, and South Korea.

The expansion of premium retail spaces, growth in e-commerce platforms, and rising influence of younger consumers contribute to the region’s continued dominance. The demand for high-end fashion, luxury accessories, and premium beauty products remains robust across urban centers, further strengthening Asia Pacific’s market position.

Global Luxury Goods Market, By Region, 2020-2024 (USD Billion)

Region 2020 2021 2022 2023 2024 North America 45.3 51.9 55.8 57.5 60.6 Europe 52.7 60.4 65.2 67.4 71.2 Asia-Pacific 71.7 81.4 87.0 89.1 93.3 North America remains a key market for luxury goods, supported by high consumer spending, a strong presence of affluent populations, and a well-established luxury retail infrastructure. The region benefits from a strong luxury brand presence across the United States and Canada, where premium lifestyle preferences and an increasing focus on personalized luxury experiences are key market drivers.

The growth of digital channels and direct-to-consumer strategies continues to influence purchasing behavior, contributing to the steady expansion of the luxury goods sector.

Europe, a traditional stronghold for luxury goods, continues to be a significant market, with major fashion capitals such as Paris, Milan, and London playing a crucial role in global trends. The region benefits from deep-rooted luxury brand heritage, a high concentration of luxury boutiques, and a consistent flow of international tourists. The demand for high-end fashion, fine jewelry, and premium cosmetics remains steady, supported by a loyal domestic consumer base and a strong tourism-driven luxury segment.

The Middle East & Africa market showcases a growing affinity for luxury goods, particularly in high-income regions such as the United Arab Emirates and Saudi Arabia. The luxury retail sector benefits from high per capita spending on premium goods, an expanding network of high-end shopping malls, and increasing demand for bespoke luxury experiences. Meanwhile, Africa’s luxury market, though still developing, is witnessing gradual growth, driven by increasing urbanization and rising wealth among affluent consumers.

Latin America’s luxury goods market is influenced by an expanding upper-middle-class segment and increasing brand accessibility in key markets such as Brazil and Mexico.

Economic fluctuations and currency volatility impact overall market dynamics; however, rising brand awareness and increasing interest in luxury fashion and accessories continue to drive market momentum. The region’s affluent consumers favor high-quality, premium goods, particularly within cosmopolitan hubs where luxury retail is expanding.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

The global luxury goods market in 2024 remains highly competitive, driven by a mix of heritage brands and dynamic market leaders leveraging innovation, sustainability, and digital transformation to maintain their dominance. LVMH Group, as the market leader, continues to set the benchmark with its diversified portfolio of luxury brands across fashion, jewelry, cosmetics, and wines & spirits.

Its acquisition-driven strategy and strong brand positioning ensure sustained growth. Similarly, Kering SA maintains a solid foothold with brands like Gucci, Balenciaga, and Saint Laurent, focusing on brand elevation, sustainability, and digital investments to drive sales.

Chanel Ltd., renowned for its timeless appeal, remains a leader in haute couture and premium fragrances, leveraging exclusivity and brand heritage. Prada S.p.A. has witnessed strong momentum by modernizing its brand image and embracing sustainability initiatives, enhancing consumer engagement.

Burberry Group PLC continues its strategic repositioning with an emphasis on British heritage, digital expansion, and sustainability-driven innovations. Ralph Lauren Corporation, with its blend of classic and aspirational luxury, focuses on North American and Asian expansion.

Richemont S.A., a dominant force in luxury watches and jewelry, strengthens its market presence through brands like Cartier and Van Cleef & Arpels, benefiting from the rising demand for high-end jewelry. CAPRI Holdings, owning Michael Kors, Versace, and Jimmy Choo, faces competitive challenges but continues to invest in brand elevation and omnichannel retail strategies.

Giorgio Armani and Brunello Cucinelli cater to ultra-high-net-worth individuals, maintaining exclusivity through craftsmanship and bespoke experiences. Other key players contribute to market dynamism through niche offerings and regional brand expansion, collectively shaping the luxury goods industry’s trajectory.

Top Key Players in the Market

- Burberry Group PLC

- Chanel LTD

- Kering SA

- LVMH Group

- Prada S.p.A

- Ralph Lauren Corporation

- Richemont S.A.

- CAPRI HOLDINGS

- Giorgio Armani

- Brunello Cuchinelly

- Other Key Players

Recent Developments

- In August 2023, Ralph Lauren Corporation announced the acquisition of a smaller luxury brand, aiming to expand its portfolio and increase market penetration in Asian markets, particularly focusing on luxury accessories.

- In June 2023, Richemont recently launched a new line of sustainably sourced jewelry, aiming to attract environmentally conscious consumers. This initiative underscores the company’s commitment to combining luxury with responsible sourcing practices.

- In March 2023, Giorgio Armani S.p.A has entered a strategic partnership with a tech startup to integrate AI into its design process, enhancing product innovation and customer personalization options.

Report Scope

Report Features Description Market Value (2024) USD 247.4 Billion Forecast Revenue (2034) USD 451.5 Billion CAGR (2025-2034) 6.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Apparel, Handbags/ Purses, Footwear, Others), By End-User (Women, Men, Kids), By Distribution Channel (Retail Stores, Department Stores, Specialty Stores, Online Retailers, Company Websites, Other Distribution Channels) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Burberry Group PLC, Chanel LTD, Kering SA, LVMH Group, Prada S.p.A, Ralph Lauren Corporation, Richemont S.A., CAPRI HOLDINGS, Giorgio Armani, Brunello Cuchinelly, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Burberry Group PLC

- Chanel LTD

- Kering SA

- LVMH Group

- Prada S.p.A

- Ralph Lauren Corporation

- Richemont S.A.

- CAPRI HOLDINGS

- Giorgio Armani

- Brunello Cuchinelly

- Other Key Players