Global Eyewear Market By Product(Spectacles, Frames, Lenses, Sunglasses, Plano, Prescription, Contact Lenses, Toric, Multifocal, Sphere, Other Product Types), By Gender(Men, Women, Unisex), By Distribution Channel(Optical Stores, Independent Brand Showrooms, Online Stores, Retail Stores), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: October 2024

- Report ID: 20673

- Number of Pages: 276

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

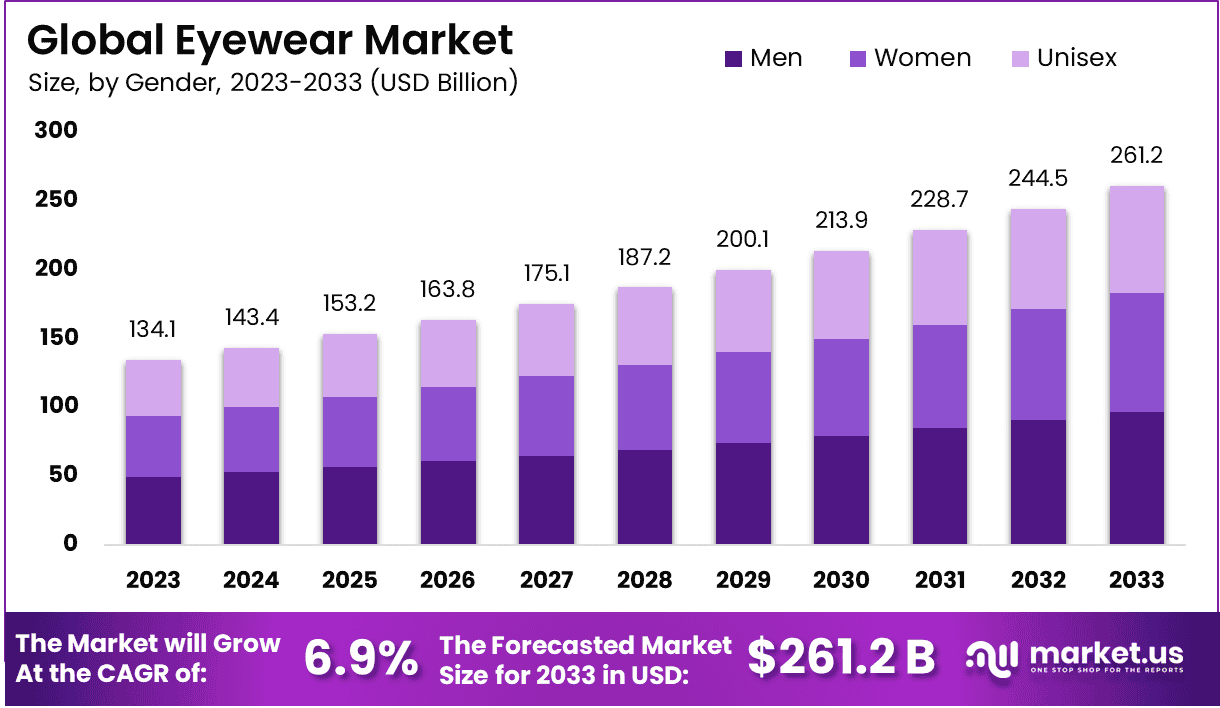

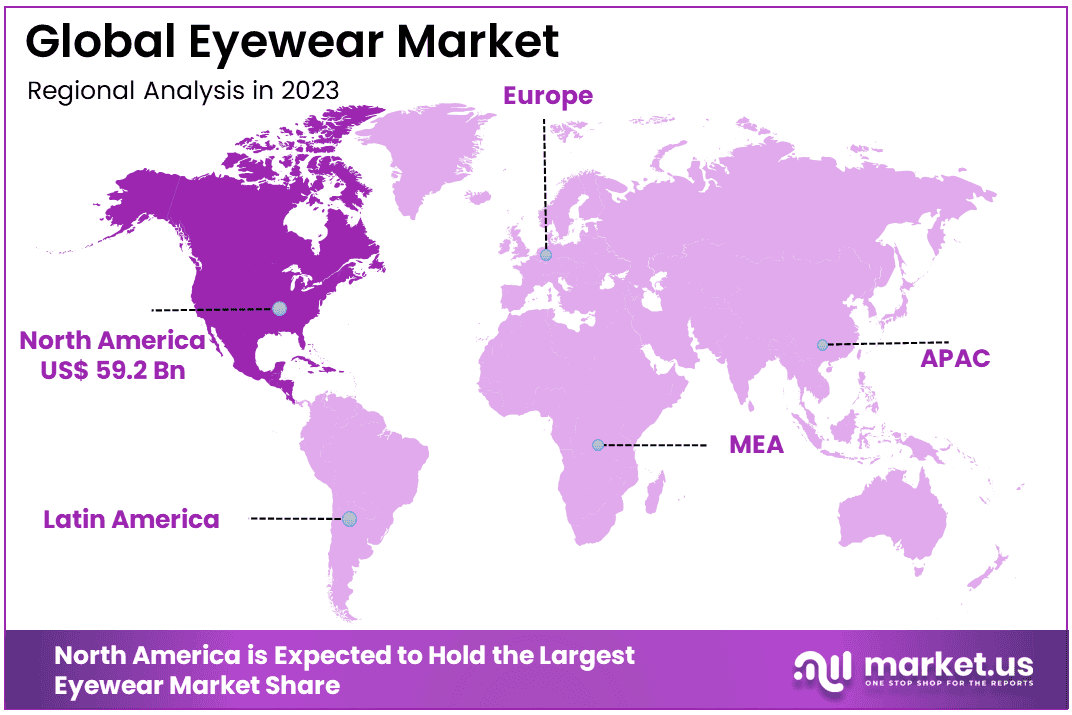

The Global Eyewear Market size is expected to be worth around USD 261.2 Billion by 2033, from USD 134.1 Billion in 2023, growing at a CAGR of 6.9% during the forecast period from 2024 to 2033. North America dominated a 44.2% market share in 2023 and held USD 59.27 Billion in revenue from the Eyewear Market.

Eyewear refers to products designed to aid or protect the eyes, commonly including prescription spectacles, sunglasses, and contact lenses. These items serve both functional and aesthetic purposes, correcting vision care, shielding eyes from harmful UV rays, and contributing to personal style.

Eyewear Market encompasses the global demand and supply for various eyewear products, driven by factors such as population aging, increasing prevalence of vision impairments, and fashion trends. The market is influenced by technological advancements, evolving consumer preferences, and health awareness, making it a significant segment within the healthcare and lifestyle sectors.

The eyewear market’s growth can be attributed to increasing global rates of myopia and presbyopia due to demographic shifts and digital screen exposure. Technological enhancements in lens materials and designs also propel market expansion.

Rising health consciousness and lifestyle changes are driving demand for eyewear. Consumers are increasingly opting for protective and corrective eyewear, fueled by awareness of UV hazards and digital eye strain.

There is a significant opportunity in the integration of digital technology with eyewear, including augmented reality applications and smart lenses. This innovation opens new avenues for market expansion into technology-driven products and services.

The eyewear market is poised for substantial growth, underpinned by demographic trends, technological advancements, and enhanced government support. The escalation in vision impairments among global populations, alongside growing health consciousness, has significantly boosted demand for both corrective and protective eyewear.

Significant government initiatives are playing a crucial role in expanding market access and fostering innovation within the eyewear sector. For instance, a recent update from health.qld.gov.au reveals that the Spectacle Supply Scheme (SSS) now allows eligible residents to access basic prescription spectacles biennially, reflecting a new Standing Offer Arrangement that started in July 2024.

This arrangement has expanded by 20% in the number of participating optometrists, by significantly enhancing community access to essential eyewear. Such policies not only increase the availability of eyewear but also stimulate market growth by making spectacles more accessible to a broader population.

Furthermore, substantial investments are being channeled into related sectors which indirectly support the eyewear industry. According to pib.gov.in, the Indian government has invested over Rs 95,000 crore in enhancing production capabilities across various sectors, including key components relevant to eyewear technology.

Additionally, the allocation of approximately Rs 10,229 crore under the Fund of Funds for Startups (FFS) scheme aims to spur innovation across diverse sectors. This investment is expected to drive advancements in eyewear materials and manufacturing processes, thus supporting the development of more sophisticated and technologically integrated eyewear products.

Key Takeaways

- The Global Eyewear Market size is expected to be worth around USD 261.2 Billion by 2033, from USD 134.1 Billion in 2023, growing at a CAGR of 6.9% during the forecast period from 2024 to 2033.

- In 2023, Spectacles held a dominant market position in the By Product segment of the Eyewear Market, with a 52% share.

- In 2023, Men held a dominant market position in the By Gender segment of Eyewear Market, with a 37% share.

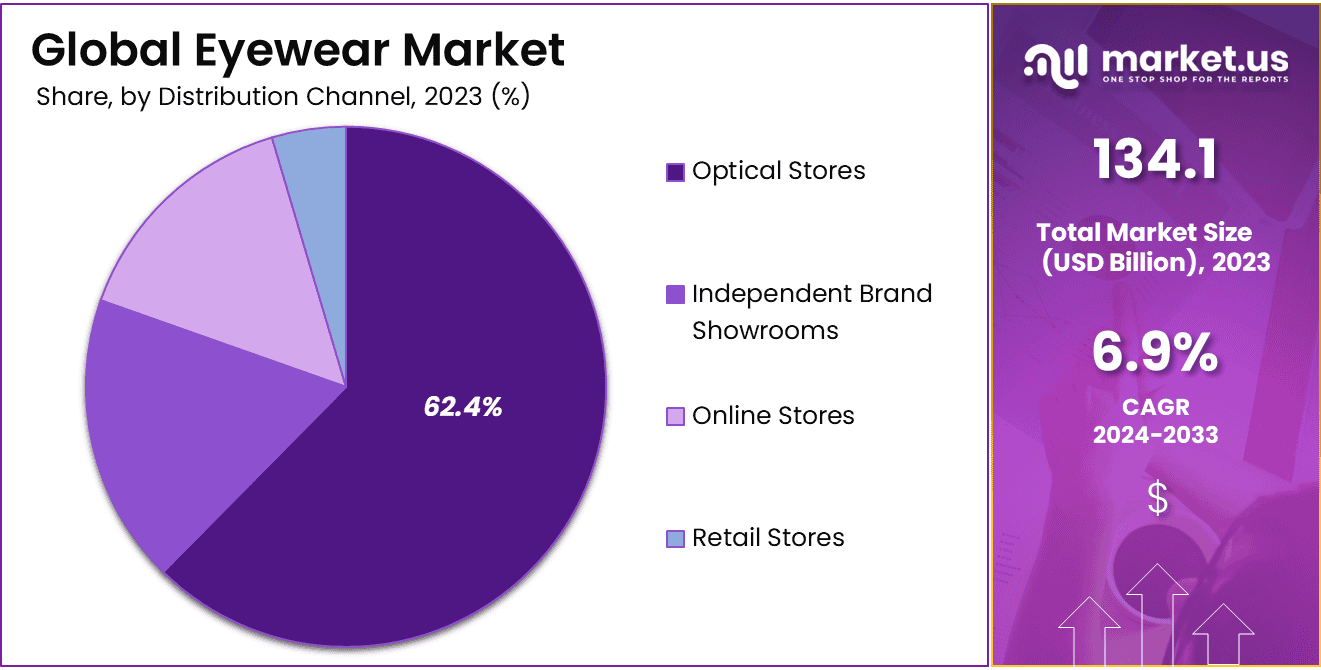

- In 2023, Optical Stores held a dominant market position in the distribution Channel segment of the Eyewear Market, with a 62.4% share.

- North America dominated a 44.2% market share in 2023 and held USD 59.27 Billion in revenue from the Eyewear Market.

By Product Analysis

In 2023, Spectacles held a dominant market position in the “By Product” segment of the Eyewear Market, commanding a 52% share. This category encompasses various product types including Frames, Lenses, Sunglasses, and Contact Lenses, with subcategories such as Toric, Multifocal, and Spherical lenses.

The market for Frames showed robust growth, driven by increasing consumer demand for both functional and fashion-forward options. Lenses, another significant category, have evolved with advancements in optical technology, contributing to their substantial market penetration.

Sunglasses and Plano glasses also accounted for a significant portion of the market, influenced by growing awareness of eye health and trends in personal style. Prescription eyewear continues to expand, fueled by the global increase in vision correction needs and digital screen usage.

The Contact Lenses segment, including Toric, Multifocal, and Sphere types, has experienced innovative shifts towards more comfortable and longer-wearing options. These innovations have enhanced user experience and acceptance, particularly in markets sensitive to convenience and comfort.

This comprehensive product diversity within the eyewear sector underscores the dynamic nature of consumer preferences and technological advancements, positioning spectacles and their associated products as essential commodities in personal healthcare and fashion.

By Gender Analysis

In 2023, Men held a dominant market position in the “By Gender” segment of the Eyewear Market, with a 37% share. This segment includes Women and Unisex categories as well. The male demographic has shown a significant preference for both functional and designer eyewear, driving substantial sales across multiple product types such as spectacles, sunglasses, and contact lenses. The increasing focus on fashion trends among men, coupled with a heightened awareness of eye health, has contributed to this segment’s growth.

Women’s eyewear, traditionally a strong sector, continues to evolve with the introduction of innovative designs and materials tailored to female consumers. This category remains crucial due to its diverse product offerings and the growing participation of women in outdoor activities necessitating protective eyewear.

The Unisex category, which appeals to all genders, has also seen growth, underscored by the trend towards gender-neutral fashion. This category benefits from a broad appeal, offering styles that transcend traditional gender boundaries, thus catering to a wider audience.

Overall, the eyewear market’s segmentation by gender highlights distinct consumer preferences and purchasing behaviors, reflecting broader social trends and advancements in eyewear technology and design.

By Distribution Channel Analysis

In 2023, Optical Stores held a dominant market position in the “By Distribution Channel” segment of the Eyewear Market, with a 62.4% share. This category is complemented by Independent Brand Showrooms, Online Stores, and Retail Stores. Optical Stores have been pivotal in providing personalized services such as eye examinations, expert consultations, and immediate adjustments, factors crucial for purchasing decisions in eyewear.

Independent Brand Showrooms also play a significant role, offering exclusive products and a branded experience that appeals to consumers seeking premium, niche eyewear. These showrooms benefit from brand loyalty and consumer trust in product quality and authenticity.

Online Stores have witnessed accelerated growth, driven by the convenience of browsing extensive catalogs and the ease of home delivery. The increasing confidence in online shopping, supported by improved virtual try-on technologies and flexible return policies, has expanded the market reach of eyewear products.

Retail Stores remain an important channel, especially in regions with limited internet penetration or where consumers prefer in-person shopping experiences. These stores offer the advantage of immediate product availability and the opportunity for customers to physically assess products.

Key Market Segments

By Product

- Spectacles

- Frames

- Lenses

- Sunglasses

- Plano

- Prescription

- Contact Lenses

- Toric

- Multifocal

- Sphere

- Other Product Types

By Gender

- Men

- Women

- Unisex

By Distribution Channel

- Optical Stores

- Independent Brand Showrooms

- Online Stores

- Retail Stores

Drivers

Eyewear Market Growth Drivers

The expansion of the eyewear market is primarily driven by increasing visual impairments and consumer awareness about eye health. As global populations age, there is a rising demand for prescription lenses and spectacles to address vision anomalies.

Additionally, the fashion influence in eyewear has significantly shifted consumer preferences, promoting frequent changes in eyewear for style rather than necessity, which broadens the market scope. Technological advancements have also played a crucial role, with innovations such as lightweight materials and anti-glare, blue light filtering lenses appealing to both young and older demographics.

Moreover, the growing accessibility and affordability of eyewear, fueled by online retailing, are key contributors to the market’s growth, enabling wider reach and convenience for consumers worldwide.

Restraint

Challenges Facing the Eyewear Market

The eyewear market faces significant challenges, primarily from the increasing popularity of corrective eye surgeries such as LASIK, which can reduce dependency on corrective eyewear. High costs associated with premium eyewear brands also pose a barrier for many potential customers, particularly in less affluent regions.

Additionally, the lack of insurance coverage for eyewear in many countries limits consumer purchasing power, especially for higher-priced options. The market’s growth is further constrained by the prevalence of counterfeit products, which not only compete with legitimate products on price but also potentially harm consumer trust and brand reputation.

Furthermore, stringent regulations and standards for eyewear products across different countries complicate the production and distribution process, impacting the market’s expansion and innovation pace.

Opportunities

Expanding Opportunities in the Eyewear Market

The eyewear market is ripe with opportunities, particularly through the integration of digital technology. Smart eyewear, equipped with augmented reality and health tracking features, is gaining traction, offering a new avenue for growth.

This tech-driven shift appeals especially to tech-savvy younger consumers and those involved in professional sectors where augmented functionalities can enhance productivity and health monitoring. The increasing penetration of online sales channels also presents a significant opportunity, as e-commerce platforms make it easier for consumers to access a wider variety of eyewear products at competitive prices.

Additionally, there’s a growing trend towards personalized eyewear solutions, driven by consumer desire for products that cater specifically to their style preferences and functional needs, potentially opening new market segments for manufacturers and retailers alike.

Challenges

Key Challenges in the Eyewear Market

Navigating the eyewear market presents several challenges, most notably the intense competition from both established players and new entrants. This competition pressures margins and necessitates continuous innovation and marketing efforts.

Regulatory compliance is another significant hurdle, as eyewear products must meet strict safety and quality standards, which vary by country and can involve costly certification processes. Furthermore, market saturation in certain segments, such as prescription eyeglasses, limits growth opportunities and pushes companies to explore niche markets or innovate with new materials and designs.

The rise of counterfeit products continues to plague the industry, undercutting sales and damaging brand integrity. Additionally, economic downturns and fluctuating disposable incomes can quickly alter consumer spending behavior, impacting overall market stability and growth prospects in the eyewear sector.

Growth Factors

Growth Factors in the Eyewear Market

The eyewear market is experiencing robust growth driven by several key factors. Increasing global awareness about eye health and the necessity for regular vision check-ups have significantly boosted the demand for prescription glasses and contact lenses.

The rise in screen time due to the extensive use of digital devices among all age groups has also heightened the need for protective eyewear, which filters harmful blue light and minimizes eye strain. Fashion trends play a crucial role, as eyewear has become a statement accessory, leading to consumers purchasing multiple pairs to match various outfits and occasions.

Additionally, improvements in eyewear materials and design technology are making glasses and contacts more comfortable, durable, and attractive, further enticing new customers. The expansion of online retail platforms offering convenient, accessible, and often more affordable options for eyewear also contributes to the market’s expansion.

Emerging Trends

Emerging Trends in the Eyewear Market

Emerging trends in the eyewear market are shaping its future, with a notable shift towards sustainability and technology integration. Consumers are increasingly seeking eco-friendly eyewear options, driving manufacturers to adopt biodegradable materials and eco-conscious production practices.

Technological advancements are also prominent, with the introduction of smart eyewear that incorporates augmented reality and connectivity features, appealing to a tech-savvy demographic. The customization trend is gaining momentum, offering consumers the ability to personalize their eyewear in terms of style, color, and functionality, enhancing customer satisfaction and loyalty.

Additionally, the blend of fashion and function continues to evolve, with eyewear becoming a key fashion accessory that complements personal style while providing necessary vision correction. This convergence of style and practicality is broadening the consumer base, attracting both fashion-forward individuals and those seeking functional eyewear solutions.

Regional Analysis

The eyewear market exhibits distinct characteristics across various global regions. North America dominates the sector, holding 44.2% of the market with revenues reaching USD 59.27 billion, driven by high consumer awareness about eye health and a strong presence of leading eyewear brands.

Europe follows, with a significant market share due to increasing fashion consciousness regarding eyewear and high disposable incomes, particularly in countries like Germany and France. Asia Pacific is witnessing rapid growth in the eyewear market, spurred by rising middle-class populations and expanding urbanization, particularly in China and India.

This region is also seeing a surge in digital device usage, boosting demand for protective eyewear. The Middle East & Africa region, although smaller in market size, shows potential due to a growing consumer base and increasing health and fashion awareness.

Latin America, too, contributes to the global eyewear market growth with rising disposable incomes and a growing emphasis on fashion eyewear among its youth population. Collectively, these regional markets underscore the diverse and expanding global reach of the eyewear industry, with North America leading in market share and revenue generation.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, Johnson & Johnson Vision Care, Inc., EssilorLuxottica, and CooperVision emerged as key players in the global Eyewear Market, each contributing distinct strengths and strategic approaches to the industry.

Johnson & Johnson Vision Care, Inc. continues to be a leader, particularly in the contact lens sector. The company’s focus on innovative products, such as its Acuvue Oasys with Transitions Light Intelligent Technology, reflects its commitment to combining eye health with technological advancement. Johnson & Johnson’s extensive R&D investments and strong distribution networks further solidify its market presence, providing it with a competitive edge in reaching diverse consumer bases globally.

EssilorLuxottica stands out for its integrated business model that spans from design and production to distribution. The merger of Essilor and Luxottica has created a powerhouse in the eyewear industry, combining Essilor’s expertise in optical lens technology with Luxottica’s prowess in eyewear design and retail. This synergy allows the company to offer a comprehensive portfolio of eyewear products, strengthening its hold on the market, particularly in premium eyewear segments.

CooperVision has made significant inroads in specialty lenses, focusing on toric and multifocal contact lenses that cater to niche markets. This focus has enabled CooperVision to carve out a substantial segment of the market, addressing specific consumer needs that are less covered by other major players. Its commitment to addressing complex vision challenges further enhances its reputation and market share.

Top Key Players in the Market

- Johnson & Johnson Vision Care, Inc.

- ESSILORLUXOTTICA

- CooperVision

- Carl Zeiss AG.

- Bausch & Lomb Inc.

- Safilo Group S.p.A.

- Charmant Group

- CIBA VISION

- De Rigo Vision S.p.A

- Fielmann AG

- Marchon Eyewear, Inc.

- Other Key Players

Recent Developments

- In September 2023, Safilo Group S.p.A., known for manufacturing and distributing high-end eyewear, secured a significant funding round amounting to $50 million. This funding is intended to fuel their expansion plans and increase their market presence in emerging markets, enhancing their global distribution channels.

- In June 2023, Carl Zeiss AG company launched a new range of precision eyeglass lenses designed to enhance digital screen usage, reflecting its focus on innovation tailored to modern lifestyle needs. Carl Zeiss AG specializes in high-quality optical products and technologies.

- In March 2023, Bausch & Lomb Inc. announced its acquisition of a smaller eyewear company specializing in therapeutic lenses. This move is part of their strategy to expand their product offerings in specialized market segments, particularly focusing on eye health solutions that address specific vision impairments.

Report Scope

Report Features Description Market Value (2023) USD 134.1 Billion Forecast Revenue (2033) USD 261.2 Billion CAGR (2024-2033) 6.9% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product(Spectacles, Frames, Lenses, Sunglasses, Plano, Prescription, Contact Lenses, Toric, Multifocal, Sphere, Other Product Types), By Gender(Men, Women, Unisex), By Distribution Channel(Optical Stores, Independent Brand Showrooms, Online Stores, Retail Stores) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Johnson & Johnson Vision Care, Inc., ESSILORLUXOTTICA, CooperVision, Carl Zeiss AG., Bausch & Lomb Inc., Safilo Group S.p.A., Charmant Group, CIBA VISION, De Rigo Vision S.p.A, Fielmann AG, Marchon Eyewear, Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Johnson & Johnson Vision Care, Inc.

- ESSILORLUXOTTICA

- CooperVision

- Carl Zeiss AG.

- Bausch & Lomb Inc.

- Safilo Group S.p.A.

- Charmant Group

- CIBA VISION

- De Rigo Vision S.p.A

- Fielmann AG

- Marchon Eyewear, Inc.

- Other Key Players