Global Contact Lenses Market By Material (Silicone Hydrogel Contact Lenses, Hybrid Contact Lenses, Gas-Permeable Contact Lenses, Others) By Design(Spherical Lens, Toric Lens, Multifocal Lens, Other Lens) By Distribution Channel (E-commerce, Eye Care Professionals, Others) By Usage (Daily Wear Lenses, Extended Lenses, Traditional Lenses) Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 104379

- Number of Pages: 328

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

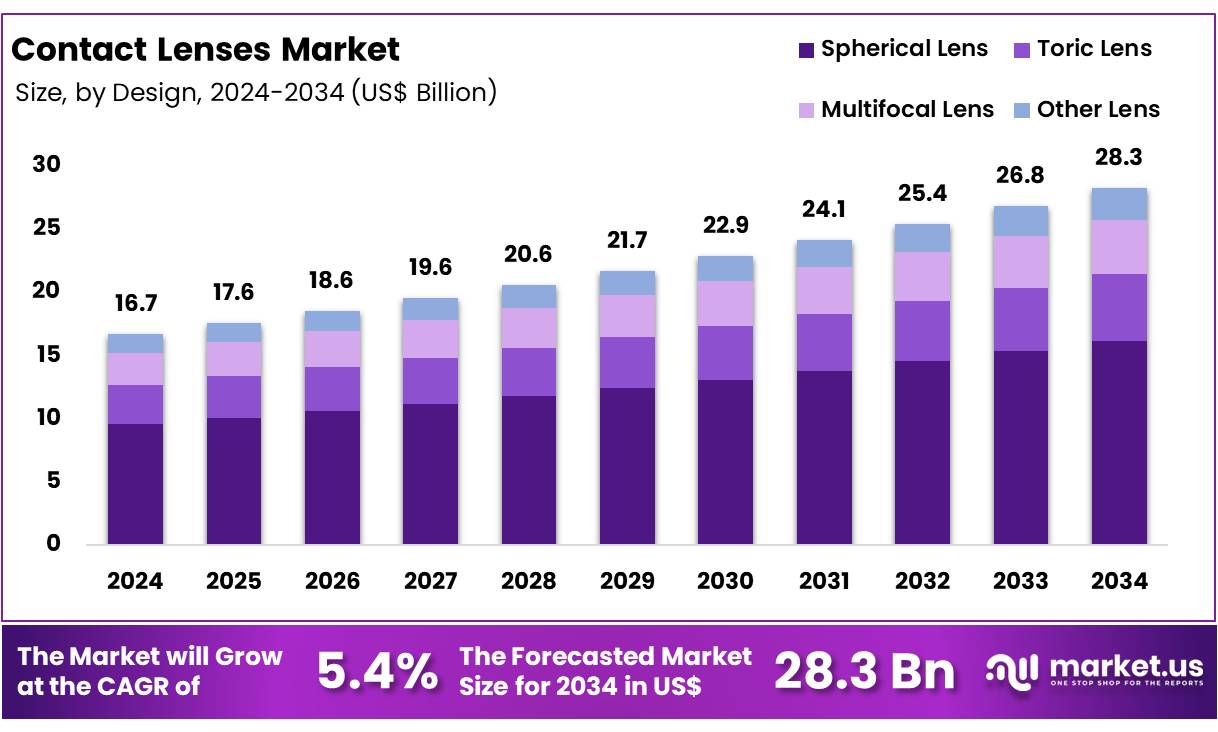

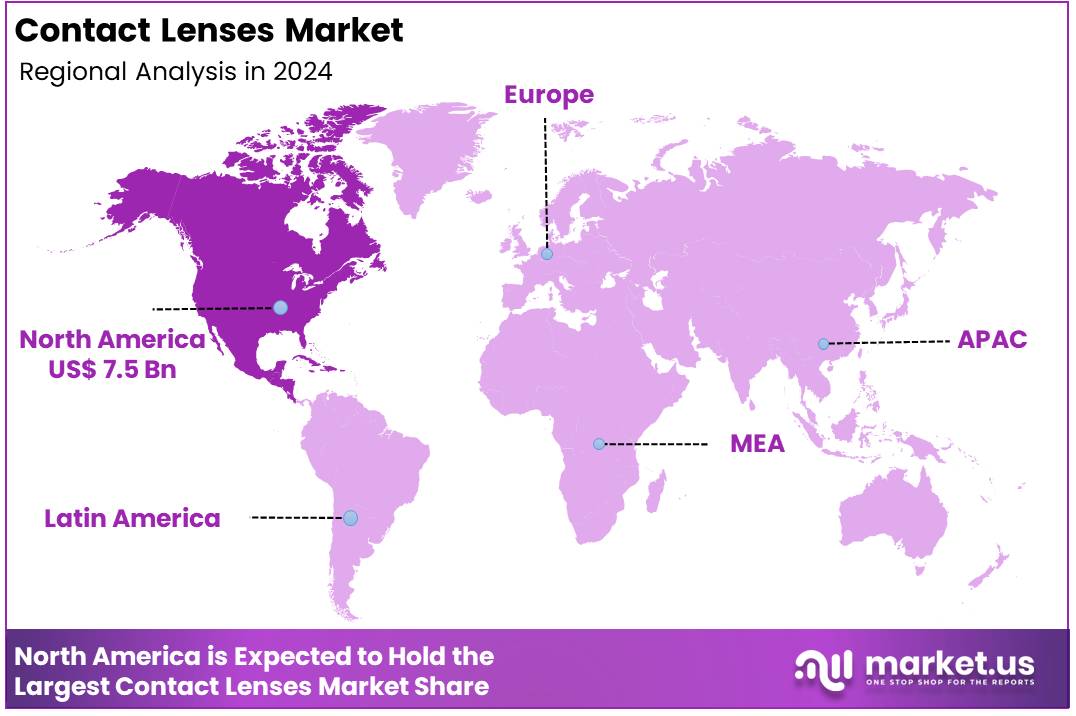

Global Contact Lenses Market size is expected to be worth around US$ 28.3 Billion by 2034 from US$ 16.7 Billion in 2024, growing at a CAGR of 5.4% during the forecast period from 2025 to 2034. In 2024, North America led the market, achieving over 45.5% share with a revenue of US$ 7.5 Billion.

Contact lenses are thin optical devices designed to be placed on the surface of the eye to correct vision. These lenses can be categorized as either rigid or soft, depending on their composition, comfort, and reusability. The increasing adoption of contact lenses in developing countries, coupled with the growing prevalence of refractive errors worldwide, is a key driver of market growth during the forecast period.

According to a report published by BMC Public Health in 2021, an estimated 116.3 million individuals suffer from moderate to severe visual impairment due to uncorrected refractive errors. This growing global burden of refractive errors, combined with increasing awareness about vision correction through contact lenses, is expected to significantly contribute to the expansion of the contact lenses market.

Furthermore, as awareness of the benefits of vision correction through contact lenses rises, more individuals are seeking alternatives to traditional glasses, particularly in regions with rapidly developing healthcare systems.

The increasing availability of advanced contact lens options, such as daily disposables, toric lenses for astigmatism, and lenses designed for presbyopia, is broadening the consumer base and driving market growth. Innovations in lens technology, including materials that offer enhanced comfort, oxygen permeability, and UV protection, are also contributing to the growing adoption of contact lenses.

In addition, the growing number of individuals who are opting for contact lenses as a preferred choice over corrective glasses is fueled by lifestyle factors, such as increased participation in sports, the desire for aesthetics, and the need for convenience. These factors are expected to continue fueling demand, particularly in emerging economies where contact lens awareness and accessibility are on the rise.

As the market evolves, the introduction of new products, such as extended-wear lenses, color contact lenses, and lenses with added therapeutic benefits, is anticipated to further stimulate the contact lenses market, providing consumers with more tailored options to meet their vision correction needs.

Key Takeaways

- Market Size: Global Contact Lenses Market size is expected to be worth around US$ 28.3 Billion by 2034 from US$ 16.7 Billion in 2024.

- Market Growth: The market growing at a CAGR of 5.4% during the forecast period from 2025 to 2034.

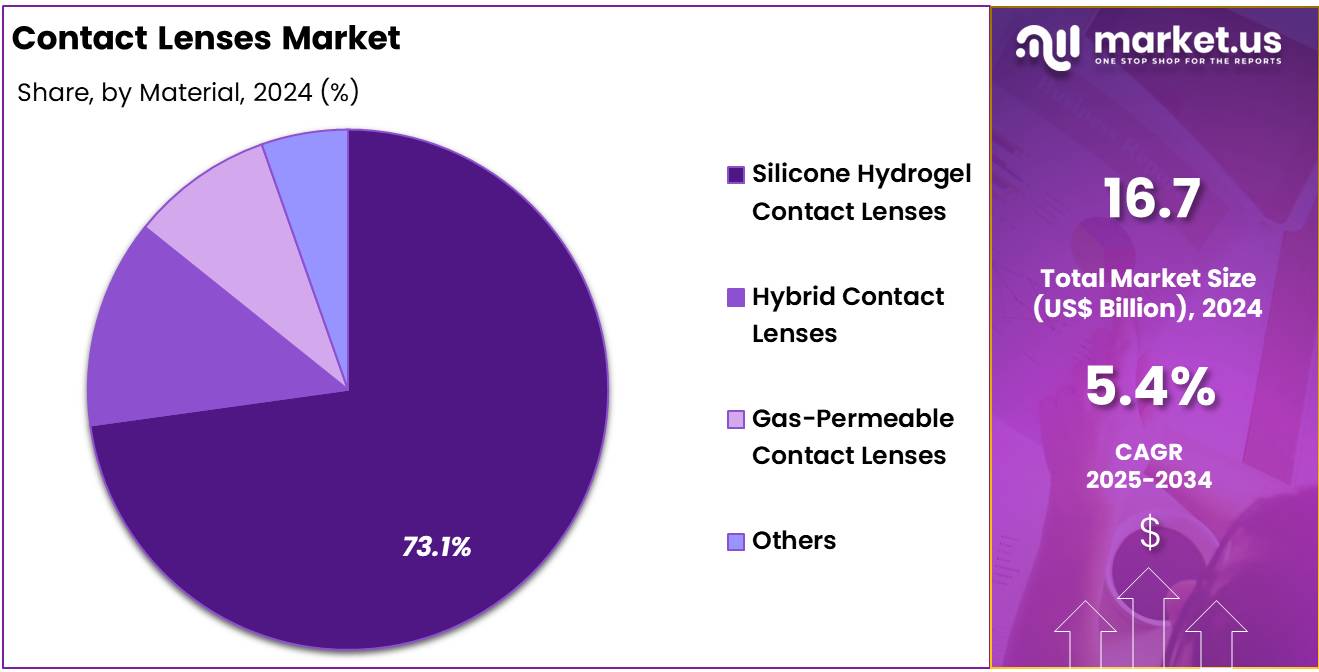

- Material Analysis: Silicone Hydrogel (SiHy) contact lenses expected to dominate, holding a significant market share of 73.2%.

- Design Analysis: In 2024, the contact lenses market is segmented by design, with Spherical Lenses expected to dominate, capturing 57.2% of the market share.

- Distribution Channel Analysis: Eye Care Professionals (ECPs) dominating the market, holding a substantial share of 58.2%.

- Usage Analysis: In 2024, the contact lenses market is segmented by usage, with Daily Wear Lenses expected to dominate, accounting for 47.5% of the market share.

- Regional Analysis: The North American contact lenses market is expected to maintain a dominant position, commanding 45.5% of the global market share in 2024.

Material Analysis

In 2024, the contact lenses market is primarily segmented by material, with Silicone Hydrogel (SiHy) contact lenses expected to dominate, holding a significant market share of 73.2%. SiHy lenses are favored for their high oxygen permeability, which contributes to better comfort and eye health, making them ideal for extended wear. The superior moisture retention and reduced risk of complications, such as dryness or irritation, further enhance their popularity among consumers.

Hybrid Contact Lenses are another key segment in the market, combining the benefits of both rigid gas permeable and soft lenses. These lenses offer the superior vision correction properties of rigid lenses with the comfort and flexibility of soft lenses. Hybrid lenses are particularly preferred by individuals with astigmatism or other irregular corneal conditions, though they represent a smaller market share compared to SiHy lenses.

Gas-Permeable Contact Lenses are also significant, providing excellent clarity of vision and oxygen flow to the eye, which is essential for long-term eye health. These lenses are particularly preferred for individuals with high refractive errors or those seeking durable, high-performance lenses. While they offer numerous benefits, they face competition from the more comfortable and convenient SiHy lenses.

Other materials, such as traditional hydrogel lenses and colored contact lenses, represent a smaller share of the market but continue to cater to specific consumer preferences. However, the dominance of Silicone Hydrogel lenses is expected to persist due to their enhanced comfort and health benefits.

Design Analysis

In 2024, the contact lenses market is segmented by design, with Spherical Lenses expected to dominate, capturing 57.2% of the market share. Spherical lenses are the most commonly used design, primarily aimed at correcting refractive errors like nearsightedness (myopia) and farsightedness (hyperopia). Their widespread adoption can be attributed to their simplicity, comfort, and effectiveness in addressing common vision problems. Spherical lenses are available in both soft and rigid variants, further contributing to their popularity.

Toric Lenses, which are designed to correct astigmatism, represent a significant segment of the market. These lenses feature different powers in different meridians of the lens to address the irregular shape of the cornea. While they are not as widely used as spherical lenses, their demand is steadily increasing due to the rising prevalence of astigmatism globally. Toric lenses offer excellent visual clarity and stability, making them a popular choice for individuals with this condition.

Multifocal Lenses are designed to correct presbyopia, allowing users to see at multiple distances. These lenses are becoming increasingly popular, particularly among the aging population. Despite their growing demand, multifocal lenses still account for a smaller market share compared to spherical and toric lenses.

Other Lenses, such as those for cosmetic or therapeutic purposes, represent a niche segment, offering specialized designs for unique needs. However, spherical lenses remain the dominant design due to their broader applicability and simplicity.

Distribution Channel Analysis

In 2024, the contact lenses market is primarily segmented by distribution channel, with Eye Care Professionals (ECPs) dominating the market, holding a substantial share of 58.2%. ECPs, including optometrists, ophthalmologists, and opticians, play a critical role in guiding consumers to the most suitable contact lenses based on their specific vision needs.

This distribution channel is favored due to the professional consultation and personalized fitting services that ECPs provide. Additionally, eye care professionals ensure that lenses are prescribed based on comprehensive eye exams, promoting eye health and reducing the risk of complications, which drives consumer trust and reliance on this channel.

E-commerce is a rapidly growing segment in the contact lenses market, offering convenience and accessibility for consumers who prefer to purchase lenses online. Online retailers often provide competitive pricing, a wide range of products, and home delivery services, attracting a significant portion of tech-savvy consumers. This channel is expected to continue expanding, particularly as digital platforms enhance their customer service and ease of purchasing, making it an attractive option for those who do not require in-person consultations.

Other Distribution Channels include retail stores, supermarkets, and optical chains, although these channels hold a smaller market share. Despite the rise of online shopping, the dominance of eye care professionals in the contact lenses market remains strong due to the value placed on professional guidance and personalized care.

Usage Analysis

In 2024, the contact lenses market is segmented by usage, with Daily Wear Lenses expected to dominate, accounting for 47.5% of the market share. Daily wear lenses are designed for single-day use, offering convenience and enhanced hygiene as they are discarded after each use.

These lenses have gained significant popularity due to their ease of use, comfort, and the reduced risk of eye infections since they do not require cleaning or maintenance. The growing awareness of the benefits of daily disposables, such as minimizing buildup of deposits and bacteria, is a key driver of their dominance in the market.

Extended Wear Lenses are another important segment in the market. These lenses are designed for longer periods of use, typically ranging from a few days to several weeks, depending on the type. Extended wear lenses provide the convenience of wearing lenses continuously, including overnight, without the need for removal. Although they offer increased convenience, they are less popular than daily wear lenses due to higher risks of eye health complications, such as dry eyes or infections, associated with prolonged wear.

Traditional Lenses, which include reusable soft lenses and rigid gas-permeable lenses, represent a smaller segment of the market. While they offer durability and long-term cost savings, their popularity is declining as consumers increasingly prefer the hygiene and comfort offered by daily wear lenses.

Key Market Segments

By Material

- Silicone Hydrogel Contact Lenses

- Hybrid Contact Lenses

- Gas-Permeable Contact Lenses

- Others

By Design

- Spherical Lens

- Toric Lens

- Multifocal Lens

- Other Lens

By Distribution Channel

- E-commerce

- Eye Care Professionals

- Others

By Usage

- Daily Wear Lenses

- Extended Lenses

- Traditional Lenses

Drivers

The predominance of Refractive Mistakes and Acquaintance with Innovatively Progressed Items with Increase Market Development

The prevalence of presbyopia and nearsightedness among both children and adults is steadily increasing. This, coupled with limited awareness and hesitance toward vision correction, particularly in emerging countries, is contributing to the growing number of individuals experiencing vision impairment.

According to data released by the WHO in 2021, approximately 2.2 billion people worldwide are affected by refractive or farsighted vision problems, with around 1 billion individuals remaining undiagnosed. A significant proportion of these cases are classified as uncorrected refractive errors and cataracts.

However, ongoing efforts by regional and national governments, along with key industry players, to raise awareness about vision correction have resulted in a growing number of people using vision correction products globally, including contact lenses.

Furthermore, the introduction of technologically advanced lenses by market leaders is a major factor driving the adoption of these products in emerging markets such as China, India, and South Korea. The increasing adoption of these advanced devices presents valuable growth opportunities for market players to expand their presence in established markets.

Restraints

Accessibility of Elective Treatment for Refractive Blunders to Control Market Development

Clinical investigations have demonstrated that contact lens wearers may experience adverse effects due to their usage patterns. These side effects range from vision impairments, which can lead to permanent visual damage or even loss of sight.

Common complications associated with contact lens use include infections, corneal edema, superficial keratitis, redness of the eye, excess mucus production, epithelial microcysts, infiltrates, giant papillary conjunctivitis (GPC), and corneal vascularization. These adverse effects are key factors limiting the widespread adoption of contact lenses.

According to data published by Harvard Health Publishing in 2021, keratitis, which can result in blindness, affects up to 20 individuals per 10,000 contact lens users. Additionally, around 1 million hospital and emergency room visits each year are related to improper use of contact lenses.

Furthermore, the availability of alternatives such as eyeglasses and LASIK surgery for the treatment of refractive errors is a significant factor hindering market growth. Additionally, the lack of insurance reimbursement for contact lenses in developed countries further limits demand for these products during the forecast period.

Opportunity

The surface disinfectant industry is experiencing growth, driven by the expanding healthcare sectors in emerging economies such as Brazil, India, South Africa, and China. Factors such as a rapidly increasing geriatric population, rising per capita incomes, high patient volumes, and growing awareness among individuals are contributing to the heightened demand for healthcare services in these regions.

In response, governments in these countries are increasing investments to enhance healthcare facilities and infrastructure. Given the widespread use of surface disinfectant products within healthcare settings, the growing investments in these sectors are expected to present significant growth opportunities for the market.

Trends

There is an increasing awareness regarding the advantages of disposable contact lenses over reusable lenses, particularly in terms of reducing the risk of adverse effects associated with cleaning solutions, such as eye staining and lid irritation. Given that the annual cost of disposable and reusable lenses is not significantly different, ophthalmologists are advocating for the use of disposable lenses due to safety concerns.

Additionally, key players in the market are actively engaged in awareness campaigns and product launches, which are expected to drive the growth of daily disposable lenses. For instance, in January 2021, Alcon launched PRECISION1 for Astigmatism, a daily disposable silicone hydrogel (SiHy) lens designed for astigmatic patients in the U.S.

Regional Analysis

The North American contact lenses market is expected to maintain a dominant position, commanding 45.5% of the global market share in 2024. This dominance can be attributed to a combination of factors, including high consumer awareness, advanced healthcare infrastructure, and the growing preference for corrective vision solutions.

The region’s significant market share is driven by increasing incidences of refractive errors such as myopia and hyperopia, which fuel the demand for corrective lenses. Additionally, the presence of major manufacturers and distributors in the U.S. and Canada, along with substantial investments in research and development, further strengthen the market’s growth.

Consumer trends also favor convenience, as contact lenses offer an alternative to glasses, particularly among younger demographics. Moreover, North America’s robust distribution channels and the growing adoption of specialized lenses, such as toric and multifocal lenses, are expected to support continued market expansion in the coming years.

Key Regions and Countries

North America

- The US

- Canada

- Mexico

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The Contact Lenses market is highly competitive, with key players focusing on product innovation, strategic partnerships, and geographic expansion to maintain market leadership. Leading companies in this sector have invested significantly in research and development, leading to the introduction of advanced lenses such as toric, multifocal, and daily disposable variants.

These players leverage cutting-edge technology to improve comfort, clarity, and eye health, thus attracting a broad consumer base. Additionally, strong distribution networks, including both online and offline channels, are essential strategies to enhance market reach.

Market leaders are also capitalizing on increasing consumer awareness of eye health, positioning themselves as trusted brands that offer reliable and high-quality solutions. Moreover, collaborations with healthcare professionals and vision care providers are common, as they help to strengthen brand credibility. The focus on sustainability, with eco-friendly materials and production processes, is also becoming a prominent trend among these major players, responding to evolving consumer preferences.

Market Key Players

- ALCON INC.

- Cooper Companies

- Contamac

- HOYA CORPORATION

- SEED Co., Ltd.

- EssilorLuxottica

- Menicon Co., Ltd.

- Euclid Vision Group

- SynergEyes

- STAAR SURGICAL

- Bausch + Lomb

Recent Developments

- In April 2021 – Cooper Organizations Inc. reported securing No7 Focal points, which plan and makes specialty focal points circulated fundamentally in the U.K.

- In April 2021 – EssilorLuxottica declared the securing of GrandVision, a corporate optical store with more than 350 stores across Europe.

- In October 2020 – Bausch and Lomb Consolidated gained an elite permit for a nearsightedness control plan for focal points created by BHVI, an Australian not-for-benefit association with a worldwide spotlight on vision research.

Report Scope

Report Features Description Market Value (2024) US$ 16.7 Billion Forecast Revenue (2034) US$ 28.3 Billion CAGR (2025-2034) 5.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material (Silicone Hydrogel Contact Lenses, Hybrid Contact Lenses, Gas-Permeable Contact Lenses, Others) By Design(Spherical Lens, Toric Lens, Multifocal Lens, Other Lens) By Distribution Channel (E-commerce, Eye Care Professionals, Others) By Usage (Daily Wear Lenses, Extended Lenses, Traditional Lenses) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape ALCON INC., Cooper Companies, Contamac, HOYA CORPORATION, SEED Co., Ltd., EssilorLuxottica, Menicon Co., Ltd., Euclid Vision Group, SynergEyes, HOYA Corporation, STAAR SURGICAL, Bausch + Lomb Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ALCON INC.

- Cooper Companies

- Contamac

- HOYA CORPORATION

- SEED Co., Ltd.

- EssilorLuxottica

- Menicon Co., Ltd.

- Euclid Vision Group

- SynergEyes

- STAAR SURGICAL

- Bausch + Lomb