Global Animal Genetics Market Analysis By Animal (Poultry, Porcine, Bovine, Canine, Other Animals), By Genetic Material (Semen, Embryos, DNA Samples, Oocytes), By Service (Genetic Disease Testing, DNA Typing, Gene Editing, Artificial Insemination, Embryo Transfer, In Vitro Fertilization (IVF)), By Application (Genetic Trait Testing, Disease Testing, Product Development, Forensic Testing, Others), By End User (Veterinary Hospitals & Clinics, Research Centers & Academic Institutes, Animal Breeding Companies, Diagnostic Laboratories, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 136416

- Number of Pages: 359

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

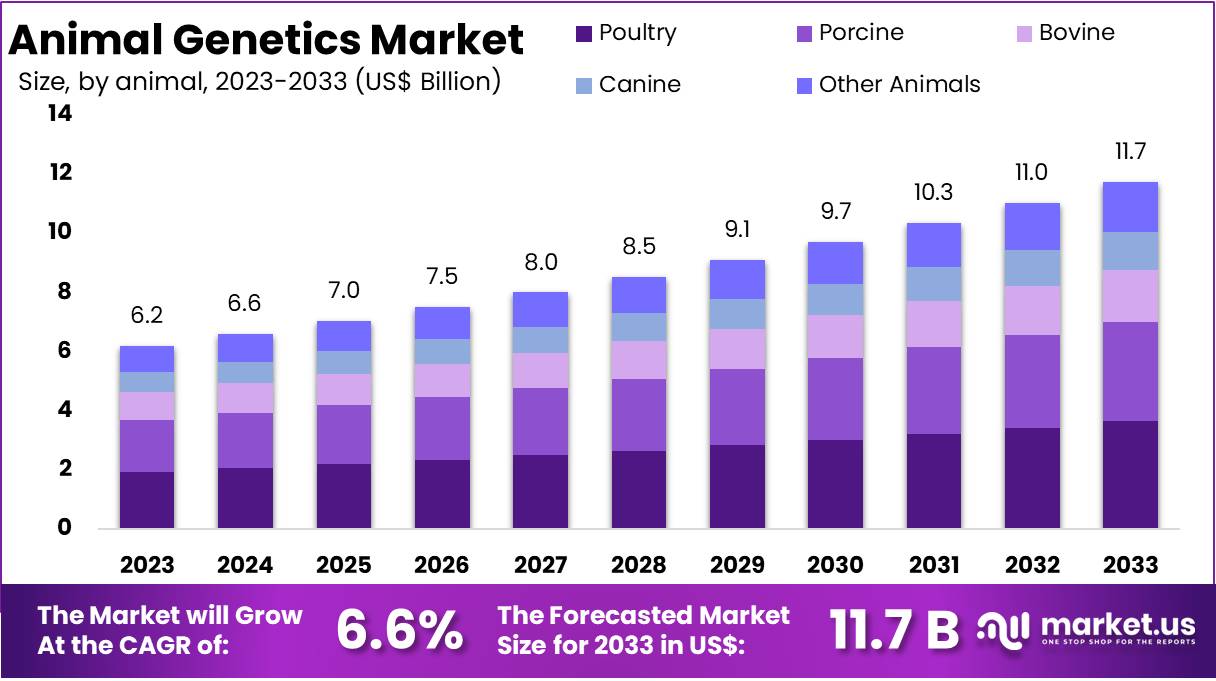

The Global Animal Genetics Market Size is expected to be worth around US$ 11.7 Billion by 2033, from US$ 6.2 Billion in 2023, growing at a CAGR of 6.6% during the forecast period from 2024 to 2033.

The animal genetics market focuses on products and services designed to enhance genetic traits in animals. This field includes genetic testing, genomic sequencing, and breeding solutions, all aimed at improving productivity, disease resistance, and physical traits in livestock and other animals. According to the USDA Economic Research Service, U.S. animal and animal products contributed $258.5 billion to total commodity cash farm receipts in 2022, highlighting the economic significance of this sector.

Genetic testing services are a core component of this market. These services include DNA typing, genetic disease testing, and marker-assisted selection. For example, genetic testing helps identify animals with desirable traits for breeding. This ensures optimal offspring and improved breed quality. With advances in biotechnological techniques, the demand for these services continues to grow, driving market expansion.

The sale of genetic materials such as semen and embryos is another critical segment. These materials play a vital role in improving livestock quality, especially in the dairy and meat industries. According to a study presented at the 12th World Congress on Genetics Applied to Livestock Production, embryo transfer (ET) in U.S. dairy cattle has seen a fivefold increase in five years. By 2021, 11% of U.S. dairy calves were born through ET. This trend underscores the growing adoption of advanced reproductive technologies.

Animal genomic services, including sequencing and analysis, provide deeper insights into genetic traits and lineage. These services are essential for managing global livestock diversity. For instance, the Food and Agriculture Organization’s (FAO) Domestic Animal Diversity Information System (DAD-IS) documents over 15,000 national breed populations. This extensive database supports initiatives like the Global Plan of Action for Animal Genetic Resources, helping countries preserve and optimize their genetic diversity.

The market also faces challenges, such as ethical considerations and regulatory compliance. According to the National Animal Health Monitoring System (NAHMS), ongoing studies on livestock health emphasize confidentiality and data protection. These measures ensure that sensitive information is used responsibly while supporting research and development. Moreover, the European Union reported using approximately 6.99 million animals in scientific procedures in 2022, with a significant portion being genetically altered. This reflects the vital role of genetically modified animals in research while also highlighting ethical concerns.

Globally, the use of genetically altered animals in research continues to grow. For example, Germany’s Max Planck Society reported 253,341 laboratory animals used in 2023, with 84.3% being genetically modified. This marks a 4.7% increase from the previous year. Similarly, in Great Britain, 45% of the 2.68 million animal procedures in 2023 involved genetically altered animals. These trends demonstrate the importance of animal genetics in advancing scientific research.

The animal genetics market plays a pivotal role in improving livestock productivity, ensuring food security, and supporting sustainable agriculture. With increasing global demand for animal-derived proteins and advancements in genetic technologies, the market’s growth trajectory remains strong. By addressing challenges and leveraging innovation, this sector is set to drive significant developments in agriculture, veterinary medicine, and biotechnology.

How Does Artificial Intelligence Help to Improve the Animal Genetics Market?

Artificial intelligence (AI) is revolutionizing the animal genetics market by enabling more precise genetic trait predictions. AI algorithms analyze extensive genetic data to identify desirable traits, such as improved milk yield or enhanced disease resistance. This predictive capability supports breeders in making informed decisions, optimizing breeding strategies to enhance animal productivity and health.

AI also plays a crucial role in genome editing and disease management. By guiding genome editing tools like CRISPR, AI ensures precise genetic modifications, targeting specific traits for improvement. Additionally, AI models predict disease outbreaks by evaluating genetic markers alongside environmental data, allowing for early interventions to prevent widespread animal health issues.

Further enhancing the animal genetics market, AI facilitates breed optimization and automates health monitoring. It suggests optimal breeding pairs to maximize genetic diversity and minimize health risks. Automation tools, powered by AI, continuously monitor animal health, detecting subtle changes that may indicate potential issues. This integration of genetic information with other data types, such as environmental and health records, provides a comprehensive view that supports better decision-making in animal management.

Key Takeaways

- The global Animal Genetics Market is projected to reach approximately US$ 11.7 billion by 2033, growing from US$ 6.2 billion in 2023 at a 6.6% CAGR.

- Bovine genetics dominated the animal segment in 2023, holding over 31.2% of the market share.

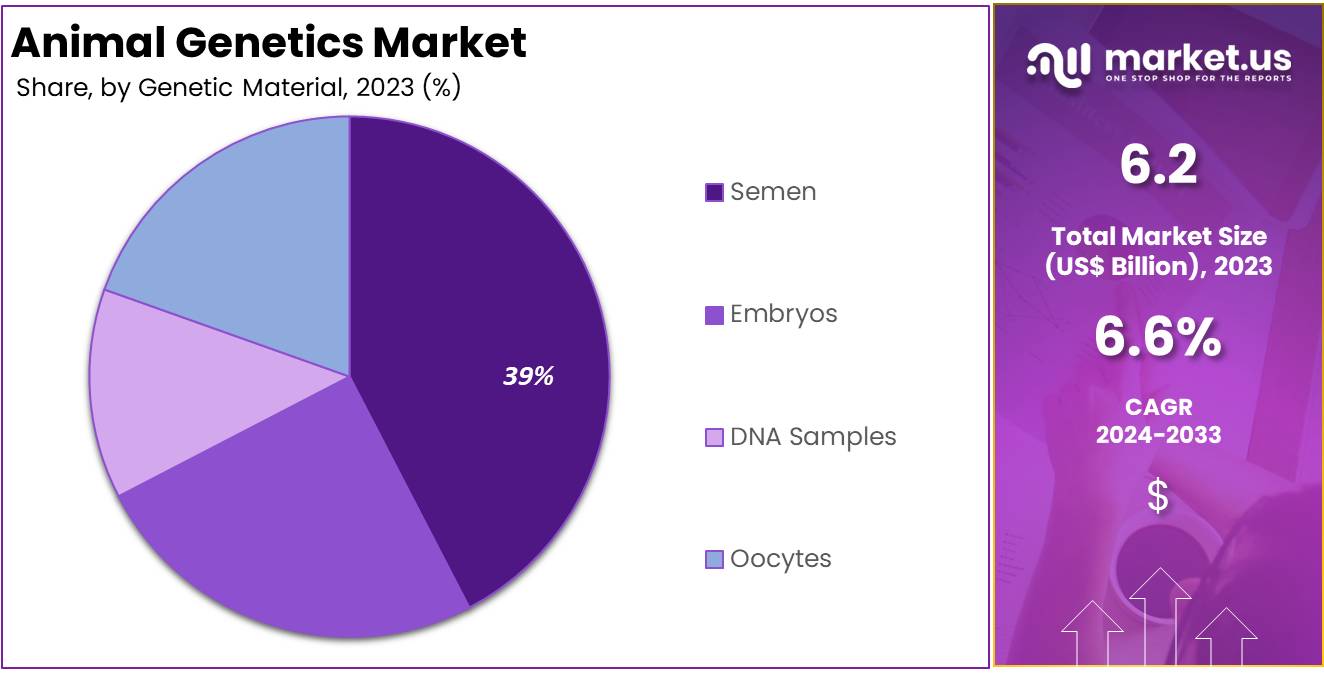

- In 2023, semen was the leading type in the genetic material segment, capturing more than 39.6% of the market.

- Artificial insemination was the predominant service in 2023, with a market share exceeding 32.7%.

- Genetic trait testing led the application segment in 2023, comprising more than 28.5% of the market.

- Animal breeding companies were the main end users in 2023, accounting for over 40.1% of the market.

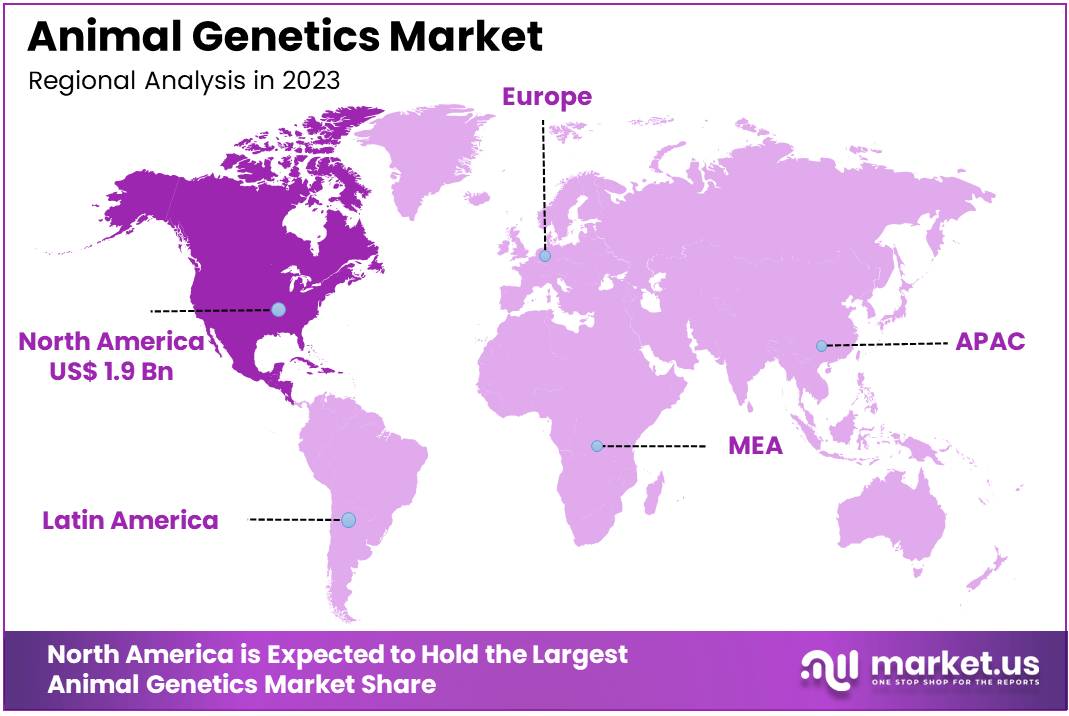

- North America was the leading region in 2023, with a market value of US$ 1.9 billion and a 31.3% share.

Animal Analysis

In 2023, Bovine held a dominant market position in the Animal Segment of the Animal Genetics Market, capturing more than a 31.2% share. This prominence is largely due to technological advancements in genetics aimed at enhancing milk and meat quality. Breeders focus on using genetic tools to increase productivity and improve resistance to diseases, factors that are critical in driving the growth of this segment.

The porcine segment is witnessing substantial growth, driven by the rising global demand for pork. Innovations in this area emphasize enhanced feed efficiency and accelerated growth rates. These improvements not only cater to increasing consumption needs but also boost investment interests within the sector, highlighting the segment’s expanding market influence.

Poultry genetics forms an essential part of the market, with research focusing on maximizing yield and boosting disease resistance. This segment addresses the growing worldwide need for poultry products, prompting ongoing development and innovation efforts. The focus here is on meeting consumer demand efficiently, ensuring a steady supply of poultry meat and eggs.

Canine genetics is gaining traction, propelled by an increase in pet ownership and interest in breed-specific traits. Genetic testing for dogs is becoming increasingly popular, helping owners and breeders identify potential health concerns and specific genetic characteristics. Additionally, smaller segments like equine and aquaculture are rapidly expanding, benefiting from genetic enhancements that cater to niche market requirements.

Genetic Material Analysis

In 2023, Semen held a dominant market position in the Animal Segment of Genetic Material Genetics Market, capturing more than a 39.6% share. This dominance is largely due to the widespread adoption of artificial insemination techniques in livestock breeding. These methods are favored for propagating elite genetic traits, significantly boosting productivity in farm animals.

The embryo segment also plays a crucial role within the market. Embryo transfer technology is highly valued for its ability to rapidly disseminate superior genetic traits across herds. This technique is particularly prevalent in developed countries, where it accelerates improvements in traits such as milk production and disease resistance.

DNA samples are increasingly important in the animal genetics market. They are essential for pinpointing genetic disorders and making informed breeding decisions. As genomic testing becomes more accessible, it provides breeders with the tools to make precise genetic selections, thereby enhancing overall animal health and productivity.

The oocytes segment is gaining attention, especially in the context of conservation and breeding programs for endangered species. Innovations in cryopreservation have simplified the storage and transport of oocytes, expanding opportunities for maintaining genetic diversity and supporting species conservation efforts.

Service Analysis

In 2023, Artificial Insemination held a dominant market position in the Service Segment of the Animal Genetics Market, capturing more than a 32.7% share. This method is crucial for enhancing reproductive efficiency and ensuring genetic diversity among livestock. Its widespread use is primarily due to its ability to enable controlled breeding programs that ensure the transmission of superior genetic qualities to the next generation.

DNA Typing is another critical service in the market. It plays a pivotal role in identifying and cataloging genetic information. This is vital for breed certification and lineage verification. By effectively managing genetic data, DNA Typing helps eradicate hereditary diseases and tailors breeding strategies to improve genetic traits.

Gene Editing is revolutionizing the Animal Genetics Market by allowing precise alterations in genetic sequences. This technology paves the way for creating disease-resistant animal breeds. As a result, it significantly enhances herd immunity and reduces the dependence on antibiotics, marking a major advancement in genetic technology.

Embryo Transfer and In Vitro Fertilization (IVF) are also key services, gaining ground especially in dairy and meat production. These techniques are essential for spreading superior genetics quickly across herds. Alongside, Genetic Disease Testing is increasingly used to prevent the propagation of inheritable diseases, ensuring the health and economic viability of future livestock generations.

Application Analysis

In 2023, Genetic Trait Testing held a dominant market position in the Application Segment of the Animal Genetics Market, capturing more than a 28.5% share. This segment supports breeders and veterinarians in selecting desirable traits through genetic insights. It contributes to enhanced productivity and health by identifying specific genetic markers. The rising demand for quality breed stocks and advanced breeding techniques drives its prominence.

Disease Testing within the Animal Genetics Market plays a crucial role by identifying genetic predispositions to diseases. This allows for early interventions and better disease management, crucial in expanding livestock industries and ensuring healthy animal populations. As the demand for disease-free livestock increases, this segment is poised for significant growth, supporting global food security and animal welfare through preventative measures.

Product Development focuses on innovating genetic testing technologies, enhancing test accuracy, and reducing costs. This application caters to the evolving needs within animal breeding and veterinary care, promoting the development of new genetic tests. Innovations in this area are vital for the widespread application of genetic testing across various animal husbandry and pet care practices.

Forensic Testing in animal genetics provides DNA profiling for legal cases involving animals, such as verifying pedigrees or resolving wildlife-related disputes. Its accuracy is crucial for enforcing laws and regulations concerning wildlife protection and animal trade. As regulations become stricter worldwide, the demand for forensic genetic testing is expected to grow, underscoring its importance in legal and conservation efforts.

End User Analysis

In 2023, Animal Breeding Companies held a dominant market position in the End User Segment of the Animal Genetics Market, capturing more than a 40.1% share. They invest significantly in genetic technologies to enhance breed qualities and productivity. Their adoption of advanced genetic selection techniques is a major driver of market growth.

In the animal genetics market, veterinary hospitals and clinics are essential. They use genetic insights to improve breeding and manage genetic disorders. This approach enhances the quality of animal care and boosts operational efficiencies within these facilities.

Research centers and academic institutes significantly contribute by advancing genetic studies. They investigate genetic markers that influence diseases and traits. This research enriches our understanding and drives innovations that impact breeding strategies and conservation efforts.

Diagnostic laboratories and other stakeholders like private breeders and conservation groups also play crucial roles. Laboratories provide testing services that identify genetic disorders, aiding in decision-making for animal care. Meanwhile, other groups use these genetic services to maintain biodiversity and manage breeding programs for endangered species, promoting sustainable practices in animal genetics.

Key Market Segments

By Animal

- Poultry

- Porcine

- Bovine

- Canine

- Other Animals

By Genetic Material

- Semen

- Embryos

- DNA Samples

- Oocytes

By Service

- Genetic Disease Testing

- DNA Typing

- Gene Editing

- Artificial Insemination

- Embryo Transfer

- In Vitro Fertilization (IVF)

By Application

- Genetic Trait Testing

- Disease Testing

- Product Development

- Forensic Testing

- Others

By End User

- Veterinary Hospitals & Clinics

- Research Centers & Academic Institutes

- Animal Breeding Companies

- Diagnostic Laboratories

- Others

Drivers

Increased global demand for animal-based products is driving advancements in animal genetics to meet consumer expectations and regulatory standards. According to the Federal Statistical Office, between 2012 and 2022, average annual global meat consumption per capita increased from 41.4 kilograms to 44.5 kilograms, reflecting a growing preference for animal-based proteins. This trend is propelled by population growth, rising incomes, and urbanization, evident in both global and Indian contexts.

Furthermore, 2022 marked a significant year in meat production. A study by the Federal Statistical Office indicates that global meat production reached approximately 361 million tonnes. Notably, poultry meat production nearly doubled over recent decades, showing an increase of about 87%. This surge underscores the intensifying demand for meat products worldwide.

In a historic shift, aquaculture production surpassed wild catch for the first time in 2022. According to AP News, aquaculture yielded 94.4 million tonnes, compared to 91 million tonnes from wild capture. This milestone highlights the pivotal role of aquaculture in meeting the global demand for aquatic animal products, showcasing its growing importance in the food supply chain.

Restraints

Ethical and Regulatory Challenges

Ethical considerations present a significant barrier in the application of genetic engineering in animal breeding. The debate centers around the morality of altering genetic structures in animals, which raises concerns about animal welfare and the natural order. These ethical issues are not only a matter of public opinion but also influence the development and deployment of genetic technologies. As societal values evolve, the acceptability of these practices remains under scrutiny, impacting the pace of technological acceptance in the field.

Regulatory challenges further complicate the advancement of genetic technologies in animal breeding. Governments impose stringent regulations to ensure safety, efficacy, and ethical compliance in genetic modifications. These regulations are designed to protect both the animals involved and the broader ecosystem from unintended consequences. However, navigating these regulatory landscapes can be a daunting task for researchers and companies, often delaying or halting projects. This regulatory rigor, while necessary, acts as a restraint on the rapid development and application of genetic engineering technologies in the industry.

Opportunities

Technological Advancements in Genetic Testing

Technological advancements in genetic testing present significant opportunities in animal breeding. Innovations like CRISPR and SNP genotyping have revolutionized the field, allowing for more precise manipulation of animal genomes. These techniques enable breeders to enhance specific traits in animals, such as increased resistance to diseases or improved productivity. As a result, the breeding process becomes not only more efficient but also more cost-effective, supporting the development of superior animal breeds.

The ability to tailor animal genetics to specific needs has wide-ranging implications for agriculture and commercial breeding. By integrating advanced genomic technologies, breeders can create animals that better meet market demands and environmental challenges. This technological leap forward not only boosts economic returns but also contributes to sustainable breeding practices. The ongoing development and application of these genetic tools continue to open new possibilities for enhancing animal breed quality and performance.

Trends

Sustainability Focus

The animal breeding industry is increasingly embracing sustainability as a core focus. Modern genetic techniques are being employed to develop breeds that are better suited to fluctuating environmental conditions. This shift not only enhances the resilience of livestock and other animals but also aligns with global sustainability efforts. By focusing on adaptability, breeders aim to ensure that animal populations can thrive in diverse climates and conditions, thus securing food supply chains and supporting ecological balance.

Simultaneously, these sustainable breeding practices are designed to minimize the environmental impact of animal farming. By selecting traits that lead to more efficient feed conversion rates and lower emissions, breeders contribute to reducing the ecological footprint of agriculture. This approach not only helps in conserving natural resources but also aligns with the increasing consumer demand for environmentally friendly and ethically produced goods. As this trend continues, it is expected to play a crucial role in shaping the future of animal agriculture towards more sustainable practices.

Regional Analysis

In 2023, North America held a dominant market position, capturing more than a 31.3% share and holds US$ 1.9 billion market value for the year. This leadership stems from its advanced agricultural practices. North American farmers and breeders employ sophisticated genetic services like DNA sequencing to enhance breeding processes and improve livestock quality.

The region also shows a high adoption rate of biotechnological tools in animal genetics. Technologies such as CRISPR are utilized extensively to boost livestock productivity and resistance to diseases. This adoption enhances the quality of outputs, including meat, milk, and eggs.

North America benefits from a robust research and development infrastructure. Significant investments from both the governmental and private sectors support innovation in animal genetics. This funding leads to new product developments and advancements in genetic testing services, maintaining the region’s competitive edge.

The presence of leading companies in the region further drives the market dynamics. These entities foster innovation through extensive research initiatives and strategic collaborations. Supported by strong regulatory frameworks that ensure ethical practices and animal welfare, North America is poised to maintain or even expand its market dominance.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Animal Genetics market is led by prominent players such as Neogen Corporation, known for its extensive product range in genetic testing and animal safety. Genetics Australia, another key player, specializes in innovative bovine genetics. Both companies demonstrate robust financial performance and strategic global expansions, though they face challenges such as market dependency and regulatory changes.

Hendrix Genetics and URUS Group LP are recognized for their multi-species genetic solutions and sustainable breeding practices. They focus on improving animal welfare and productivity through continuous investments in genetic research. These companies maintain a strong global presence and are expanding their technological advancements to stay competitive.

CRV and other smaller market players contribute significantly to the industry’s dynamism by focusing on niche markets and specialized genetic traits. While CRV excels in improving cattle health and milk production primarily in European markets, smaller entities innovate by targeting specific regional needs. This strategic diversity strengthens the overall market, providing robust competition and driving technological innovations in animal genetics.

Market Key Players

- Neogen Corporation

- Genetics Australia

- Hendrix Genetics BV

- URUS Group LP

- CRV

- Semex

- Swine Genetics International

- STgenetics

- Animal Genetics Inc.

- Generatio GmbH

- Zoetis

- Genus plc

Industrial Advantages and Opportunities For Market Players

Animal genetics offers significant business benefits for market key players. Enhanced breeding programs allow for the precise selection of livestock, improving productivity and profitability. Genetic testing aids in disease management by identifying resistant animals, reducing disease prevalence and minimizing antibiotic use. This sector also enhances product quality, meeting consumer demands for superior food products like meat, milk, and eggs. Additionally, genetic advancements enable more efficient feed utilization, reducing environmental impact and lowering production costs.

The industry gains several advantages from animal genetics. It promotes sustainable agriculture by improving the efficiency of feed conversion into protein. Integration of genetics with technologies such as AI and IoT enhances breeding strategies, providing a competitive edge. Compliance with animal welfare standards through genetic tools helps avoid legal issues, safeguarding companies. Moreover, genetic adaptation to different climates facilitates global market expansion, crucial for business growth in diverse environments.

The animal genetics market is ripe with opportunities. The development of genomic selection techniques can further enhance livestock traits like disease resistance. There’s a rising demand for customized genetic services tailored to specific regional and operational needs. Additionally, gene editing technologies like CRISPR present opportunities for precise genetic modifications, potentially revolutionizing livestock qualities. These innovations offer pathways for significant advancements in animal breeding.

Strategic partnerships and collaborations can drive innovation in animal genetics. By partnering with biotech firms and academic institutions, companies can expedite R&D, leading to new genetic solutions. There is also an opportunity in offering educational services to breeders and farmers. Informing them about the benefits of genetic technologies can open new revenue streams. These educational initiatives can enhance understanding and adoption of genetic advancements across the agricultural sector.

Recent Developments

- In December 2024: The Australian Government is investing $18.5 million to support eight startup companies in commercializing their research to develop new medical treatments and tools. Among the beneficiaries, Mirugen Pty Ltd is receiving nearly $2 million to advance a gene therapy aimed at curing certain types of blindness by regenerating eye cells to restore vision. OncoRes Medical is set to receive $2.5 million for developing a device that enhances cancer cell detection during surgeries, potentially increasing the success rate of initial surgeries and minimizing repeat procedures. Additionally, Baymatob Operations will use its $2.5 million grant to perfect software that predicts severe bleeding in pregnant women during childbirth, which could significantly reduce maternal and infant mortality and prevent labor-related emergencies.

- In December 2024: Partnership with LABOGENA DNA Hendrix Genetics has entered into a partnership with LABOGENA DNA to enhance its genotyping services. This collaboration is set to support Hendrix Genetics’ various breeding programs across multiple species, including turkeys, layers, traditional poultry, swine, trout, salmon, and shrimp. The partnership focuses on integrating advanced genotyping technology to improve genetic solutions and sustain its market leadership in the animal genetics sector.

- In July 2024: Neogen Corporation reported financial results for the fourth quarter, concluding with revenues amounting to $236.8 million. This quarter noted a slight decrease of 2.1% compared to the previous year, largely attributed to factors such as foreign currency impacts and changes in product lines. Despite the overall decline, certain areas, including the Food Safety segment, demonstrated resilience, suggesting ongoing adjustments and integration strategies within the company’s broader operational scope.

Report Scope

Report Features Description Market Value (2023) US$ 6.2 Billion Forecast Revenue (2033) US$ 11.7 Billion CAGR (2024-2033) 6.6% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Animal (Poultry, Porcine, Bovine, Canine, Other Animals), By Genetic Material (Semen, Embryos, DNA Samples, Oocytes), By Service (Genetic Disease Testing, DNA Typing, Gene Editing, Artificial Insemination, Embryo Transfer, In Vitro Fertilization (IVF)), By Application (Genetic Trait Testing, Disease Testing, Product Development, Forensic Testing, Others), By End User (Veterinary Hospitals & Clinics, Research Centers & Academic Institutes, Animal Breeding Companies, Diagnostic Laboratories, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Neogen Corporation, Genetics Australia, Hendrix Genetics BV, URUS Group LP, CRV, Semex, Swine Genetics International, STgenetics, Animal Genetics Inc., Generatio GmbH, Zoetis, Genus plc Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Neogen Corporation

- Genetics Australia

- Hendrix Genetics BV

- URUS Group LP

- CRV

- Semex

- Swine Genetics International

- STgenetics

- Animal Genetics Inc.

- Generatio GmbH

- Zoetis

- Genus plc