Global Animal Hormones Market By Animal Type (Poultry, Livestock, Porcine, Equine, Aquaculture, and Others), By Application (Performance Enhancers, Growth Promoters, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 132559

- Number of Pages: 303

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

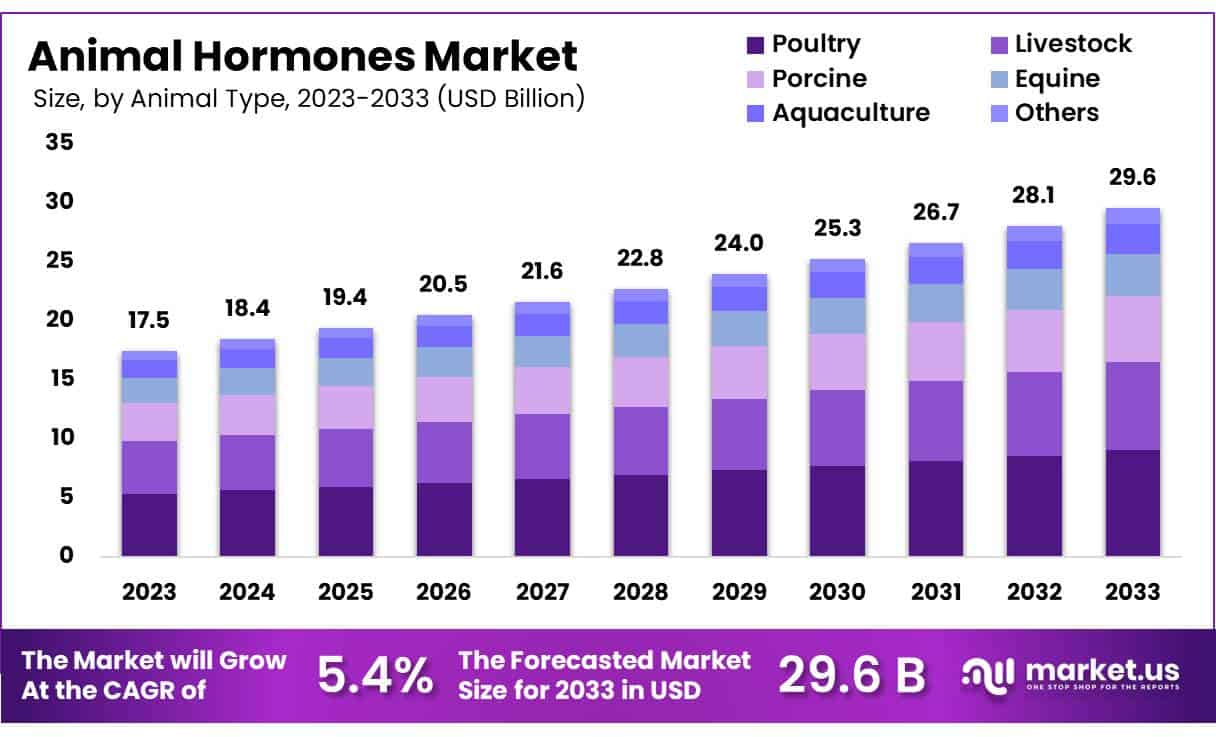

Global Animal Hormones Market size is expected to be worth around US$ 29.6 billion by 2033 from US$ 17.5 billion in 2023, growing at a CAGR of 5.4% during the forecast period 2024 to 2033.

Increasing demand for efficient livestock production drives the animal hormones market, as producers seek to enhance growth rates, reproductive efficiency, and overall animal health. Animal hormones, including bovine somatotrophin and reproductive hormones, play a critical role in accelerating growth, improving milk yield, and optimizing breeding cycles, addressing the rising global demand for meat and dairy products.

According to the National Agricultural Statistics Service, broiler production in the United States has shown steady growth over the past five decades, underscoring the need for hormonal treatments that boost production efficiency. In April 2022, the FDA approved bovine somatotrophin, a growth hormone, for enhancing milk production in dairy cows, marking a significant milestone in hormone usage within the industry.

This approval signals increasing government support for advanced hormonal interventions in animal agriculture, fostering market expansion. Recent trends indicate a shift toward precision hormone therapies tailored to improve specific health and productivity outcomes in livestock, aligning with the industry’s focus on sustainable and efficient farming practices.

Hormone innovations, such as time-release formulations and hormone delivery systems, offer significant growth opportunities by improving ease of administration and reducing side effects. The continuous efforts of regulatory bodies to streamline approval processes for hormone therapies further support the development and adoption of advanced animal hormones, helping producers meet growing consumer demands.

Key Takeaways

- In 2023, the market for animal hormones generated a revenue of US$ 5 billion, with a CAGR of 5.4%, and is expected to reach US$ 29.6 billion by the year 2033.

- The animal type segment is divided into poultry, livestock, porcine, equine, aquaculture, and others, with poultry taking the lead in 2023 with a market share of 30.5%.

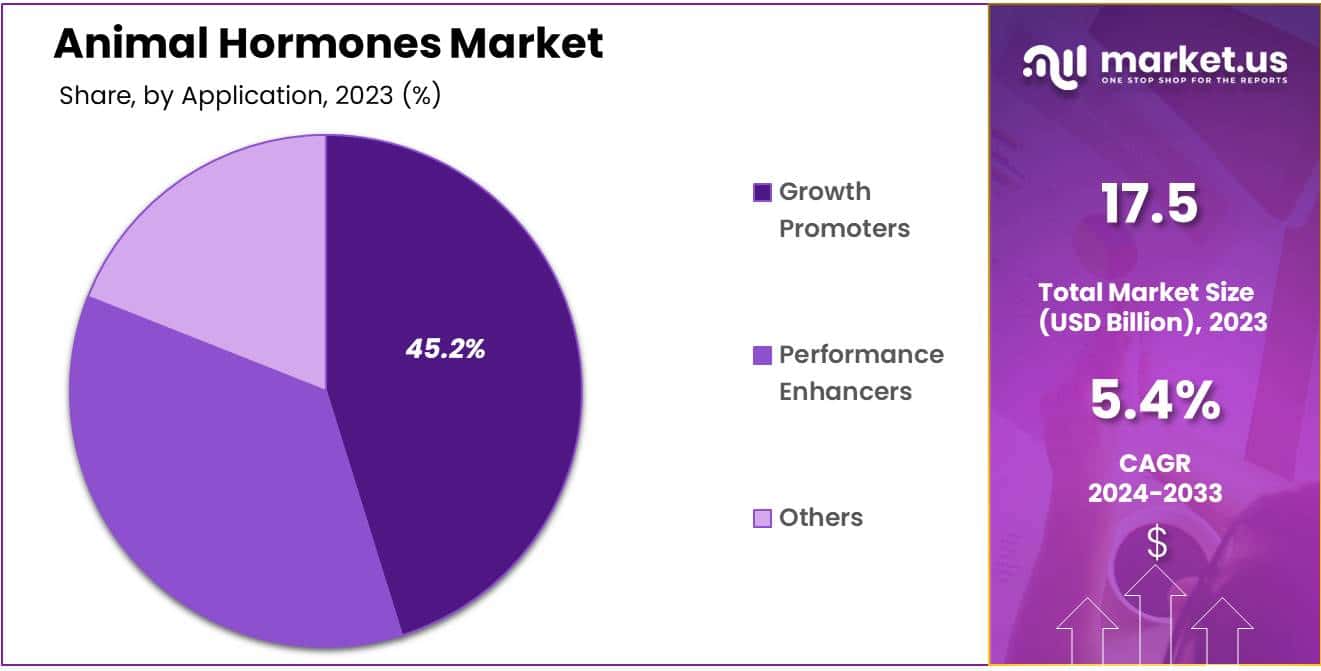

- Considering application, the market is divided into performance enhancers, growth promoters, and others. Among these, growth promoters held a significant share of 45.2%.

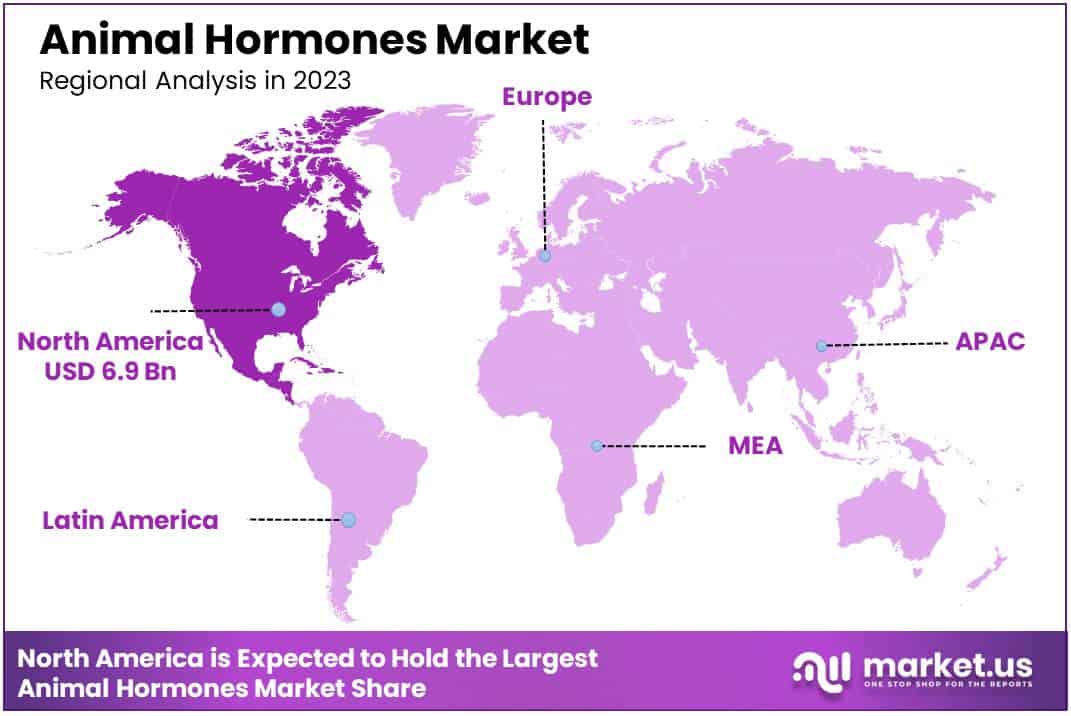

- North America led the market by securing a market share of 39.4% in 2023.

By Animal Type Analysis

The poultry segment led in 2023, claiming a market share of 30.5% owing to the rising demand for poultry products, particularly in developing regions where poultry serves as a major source of affordable protein. Increasing global consumption of chicken and eggs, fueled by population growth and changing dietary patterns, has led poultry producers to seek efficient methods for improving production rates. Hormonal solutions are expected to be widely adopted in poultry farming due to their effectiveness in enhancing growth rates and feed efficiency.

Additionally, advancements in poultry breeding and hormone administration technologies offer a streamlined approach to meeting the high production demands of the sector. As regulatory frameworks evolve to ensure safe use, the poultry segment in the animal hormones market is likely to benefit from a stable and rising demand trajectory.

By Application Analysis

The growth promoters held a significant share of 45.2% due to the need for enhanced feed efficiency and faster weight gain in animals, driven by increasing demand for meat and dairy products worldwide. Growth promoters, commonly applied in poultry and livestock, help farmers achieve quicker production cycles, which is especially valuable in regions with high meat consumption.

Rising awareness among farmers about the economic benefits of growth promoters, along with their role in optimizing feed-to-meat conversion rates, supports their adoption in commercial farming. Regulatory advancements and innovations in hormone formulations further enable the safe and effective application of growth promoters. As these factors converge, the demand for growth promoters in the animal hormones market is anticipated to expand, aligning with the broader goal of maximizing productivity in the animal agriculture sector.

Key Market Segments

By Animal Type

- Poultry

- Livestock

- Porcine

- Equine

- Aquaculture

- Others

By Application

- Performance Enhancers

- Growth Promoters

- Others

Drivers

Growing Popularity of Eggs as a Protein Source

The rising popularity of eggs as a protein source has spurred demand within the animal hormones market as poultry farmers seek to optimize egg production to meet consumer needs. As more people worldwide turn to eggs for affordable, high-quality protein, poultry producers focus on enhancing both yield and quality, often utilizing animal hormones to support reproductive efficiency in laying hens.

According to the OECD report published in 2021, poultry meat alone is projected to account for 41% of the world’s protein from meat sources by 2030, marking a 2% increase from the baseline period. This growth trajectory underscores the increasing demand for poultry products and, consequently, animal hormones to sustain large-scale egg and poultry production.

In addition, stringent regulations, such as those by the US FDA, oversee feed ingredients and medication administered to livestock, including any hormonal treatments used to boost production. As eggs continue to gain traction as a versatile and nutritious protein source, the market for animal hormones is anticipated to expand to support the growing needs of the poultry industry. This market evolution reflects both the dietary shifts favoring eggs and the agricultural focus on efficient poultry farming.

Restraints

Growing Risk of Disease Transmission

Increasing concerns about disease transmission among livestock are likely to hamper growth in the animal hormones market as producers adopt cautious approaches to mitigate health risks. The administration of hormones in animals, especially in densely populated livestock environments, can heighten susceptibility to diseases, raising concerns about potential health risks to both animals and end consumers.

Governments and regulatory bodies across the globe are intensifying scrutiny on hormone use in livestock to minimize these risks, with many countries enacting or strengthening policies that restrict hormone administration. Public health experts have warned that hormone treatments can exacerbate conditions favorable to disease outbreaks, amplifying the need for safer practices in animal husbandry.

This trend aligns with consumer demands for transparency and heightened safety standards in animal-derived products, adding pressure on producers to find alternative methods of productivity enhancement. The rising awareness of disease transmission risks is expected to act as a restraint on the animal hormones market, potentially shifting demand towards safer, hormone-free livestock management practices.

Opportunities

Increasing Demand for Meat-Based Foods

Rising demand for meat-based foods represents a significant growth opportunity for the animal hormones market, as livestock producers aim to enhance efficiency in meat production to satisfy consumer demand. In June 2021, the US Department of Agriculture highlighted a decline in beef production while noting sustained strong demand for poultry, pork, and turkey.

With meat consumption expanding globally, producers are anticipated to turn to animal hormones to boost productivity, improve feed efficiency, and ensure consistent meat quality across livestock sectors. Hormones can support optimal growth rates and yield, helping meet the needs of expanding urban populations and meat-centric diets in both developed and emerging markets.

Additionally, the global rise in animal husbandry practices underscores a growing reliance on hormones for enhanced animal health and productivity. As meat remains a dietary staple, especially in regions with increasing disposable income, the animal hormones market is likely to benefit from sustained growth as farmers seek solutions to maximize output in response to robust consumer demand.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors considerably influence the growth and sustainability of the animal hormones market. Economic stability in developed regions boosts demand for livestock products, thereby increasing the need for hormonal products to enhance animal growth and productivity. Conversely, inflationary pressures and currency fluctuations raise production costs, impacting manufacturers’ profit margins and potentially hindering affordability in emerging markets.

Trade restrictions and geopolitical tensions disrupt global supply chains, affecting the availability and pricing of key raw materials. Furthermore, strict regulatory standards, particularly in Europe and North America, create compliance challenges for producers, increasing operational costs and limiting market access in certain regions.

However, growing investments in agriculture and rising demand for animal-based protein in developing economies present positive growth prospects. These factors foster advancements in hormone formulations, promoting sustainable market growth.

Latest Trends

Impact of Rising Investments in Poultry and Meat-Based Food Production on the Animal Hormones Market

Rising investments in poultry and meat-based food production are projected to drive the animal hormones market. Increasing demand for high-quality protein sources has led to significant funding aimed at improving productivity in livestock operations.In June 2021, the U.S. Department of Agriculture (USDA) announced an investment of approximately USD 55.2 million to support mid-sized and small-scale poultry processors, expanding their capacities and boosting economic opportunities nationwide.

This focus on capacity-building strengthens the supply chain and promotes the adoption of performance-enhancing products. Additionally, high consumer expectations for efficient production methods and sustainable practices encourage ongoing innovation in hormone products. This trend aligns with a broader push for enhanced food security, positioning the market for long-term growth.

Regional Analysis

North America is leading the Animal Hormones Market

North America dominated the market with the highest revenue share of 39.4% owing to the need to enhance livestock productivity and meet rising consumer demand for animal-derived products. This growth reflects efforts to optimize cattle growth rates, milk production, and overall animal health through hormone applications, especially in cattle and poultry farming.

According to recent data from the National Agricultural Statistics Service (NASS), the United States maintained a substantial cattle population of approximately 93.6 million in 2021, underscoring the scale of livestock management in the region. Rising investments in the livestock industry, along with advancements in veterinary medicine, have contributed to the adoption of hormone-based solutions.

Furthermore, regulatory bodies such as the U.S. Food and Drug Administration (FDA) have established frameworks to ensure the safe use of growth promoters, facilitating market growth. Increased awareness of animal health and productivity standards has also led to a demand for horm

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to expanding livestock farming and rising investments in veterinary care. Rapid urbanization and population growth in countries such as India and China have fueled demand for animal products, leading farmers to adopt hormone-based treatments to boost productivity.

In March 2022, the Veterinary University Training and Research Center in Tamil Nadu’s Tripur District launched an initiative aimed at reducing the calving interval of the indigenous Kangayam cows, reflecting regional efforts to enhance livestock efficiency. Such initiatives align with government policies promoting sustainable agriculture and livestock development, further supporting market growth.

Increased awareness of advanced animal husbandry practices, coupled with a growing veterinary pharmaceutical sector, is anticipated to bolster demand for animal hormones. Additionally, collaborations between research institutions and livestock producers in the region are likely to enhance productivity and address the rising need for effective animal health management solutions..

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The major players in the animal hormones market are actively engaged in the development and introduction of innovative products, as well as implementing strategic initiatives aimed at enhancing their competitive positioning. Key players in the animal hormones market pursue growth by investing heavily in research and development to create safer and more effective hormone solutions.

Many companies aim to enhance product efficacy and safety, aligning with regulatory standards that protect both animal welfare and public health. Strategic collaborations with agricultural organizations and veterinary institutions enable them to expand their reach and improve product accessibility.

Businesses also focus on geographic expansion, targeting regions with high livestock farming activity and rising demand for efficient animal health management. Robust marketing strategies and educational programs further promote awareness and adoption among farmers and veterinary professionals.

Top Key Players

- Royal DSM N.V.

- Merck Animal Health

- Elanco Animal Health

- Danisco A/S

- Bupo Animal Health

- Boehringer Inghelheim

- Bayer Animal Health

- Alltech

- AB Vista

Recent Developments

- In September 2022, Merck Animal Health (also known as MSD Animal Health) announced it had signed a definitive agreement to acquire Vence. This acquisition enhances Merck’s capabilities in precision livestock technology, enabling more efficient animal health management through advanced monitoring systems. Such advancements contribute to the growth of the animal hormones market by providing insights that support optimized hormone-based treatments and improved livestock productivity.

- In July 2021, ADM introduced a customized antibiotic reduction program developed by Wisium Reduction. This program, which consolidates Wisium’s de-medication solutions for multiple species, aims to offer a comprehensive approach to reducing antibiotic use in livestock. The program’s emphasis on minimizing antibiotics aligns with the demand for alternative health management solutions, including hormone-based treatments, driving growth in the animal hormones market as the industry moves towards sustainable animal care practices.

Report Scope

Report Features Description Market Value (2023) US$ 17.5 billion Forecast Revenue (2033) US$ 29.6 billion CAGR (2024-2033) 5.4% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Animal Type (Poultry, Livestock, Porcine, Equine, Aquaculture, and Others), By Application (Performance Enhancers, Growth Promoters, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Royal DSM N.V., Merck Animal Health, Elanco Animal Health, Danisco A/S, Bupo Animal Health, Boehringer Inghelheim, Bayer Animal Health, Alltech, and AB Vista. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Royal DSM N.V.

- Merck Animal Health

- Elanco Animal Health

- Danisco A/S

- Bupo Animal Health

- Boehringer Inghelheim

- Bayer Animal Health

- Alltech

- AB Vista