Veterinary Diagnostic Imaging Market Analysis by Product Type (Handheld Devices and Electrosurgery Instruments), by Animal Type (Large Animal and Small Animal), by Application (Soft Tissue Surgery, Cardiovascular Surgery, Ophthalmic Surgery, Dental Surgery, Orthopedic Surgery and Others), By End-User (Veterinary Clinics, Veterinary Hospitals and Research Centers), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 21278

- Number of Pages: 319

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

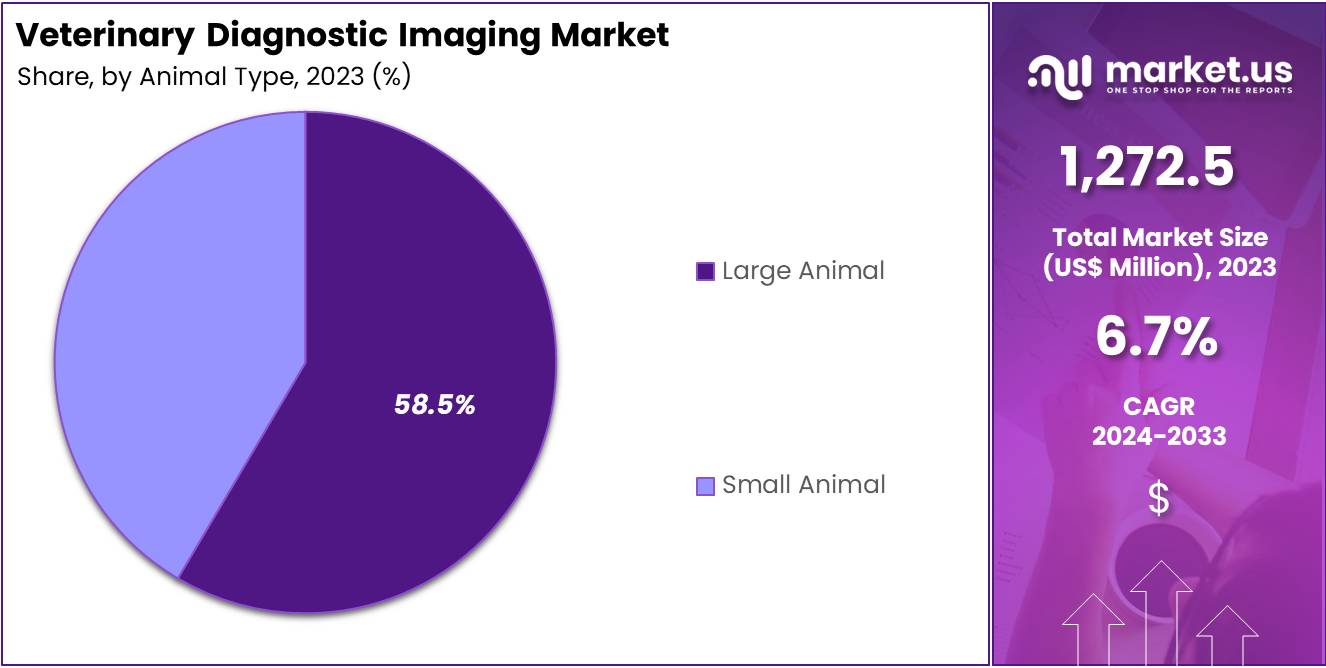

The Global Veterinary Diagnostic Imaging Market size is expected to be worth around US$ 2,386.6 Million by 2033, from US$ 1,272.5 Million in 2023, growing at a CAGR of 6.7% during the forecast period from 2024 to 2033.

The American Veterinary Dental Society (AVDS) reveals a concerning statistic: over 80% of dogs and 70% of cats exhibit signs of dental disease by age three. This high prevalence highlights the urgent need for comprehensive dental care and regular check-ups. Effective dental hygiene can prevent severe health issues and improve the quality of life for pets. Veterinary professionals emphasize early detection and treatment to manage this widespread issue effectively.

According to the American Veterinary Medical Association (AVMA), about 25% of dogs will develop cancer during their lifetime. Alarmingly, nearly half of all dogs aged over 10 are at risk of cancer. This statistic underscores the critical need for surgical interventions, including tumor removals. As such, there is a growing demand for specialized surgical instruments in veterinary care. These tools are essential for successful treatments and improving survival rates among older pets.

The growing prevalence of zoonotic diseases, which are transmitted from animals to humans, has heightened the need for effective diagnostic solutions. This demand is driven by the necessity to identify infections early, prevent outbreaks, and protect public health, thereby contributing significantly to market growth for veterinary and diagnostic services. This underscores the need for veterinary professionals to conduct thorough diagnostic evaluations in animals to prevent the transmission of zoonotic diseases to humans.

- According to 2024 data from the WHO, 60% of all infectious diseases worldwide are of zoonotic origin. Furthermore, a 2024 WHO publication highlights that 75% of the 30 new pathogens identified in humans over the past 30 years originated from animals.

Key Takeaways

- The Veterinary Diagnostic Imaging market generated a revenue of US$ 1,272.51 Million and is predicted to reach US$ 2,386.63 Million, with a CAGR of 6.7%.

- Based on the Product Type, the Handheld Devices segment generated the most revenue for the market with a market share of 54.6%.

- Based on the Animal Type, the Large Animal segment generated the most revenue for the market with a market share of 58.5%.

- By application, the Soft Tissue Surgery segment contributed the most to the market and secured a market share of 34.1%.

- In terms of end-users, the Veterinary Clinics led the market in 2023, with a market share of 56.5%.

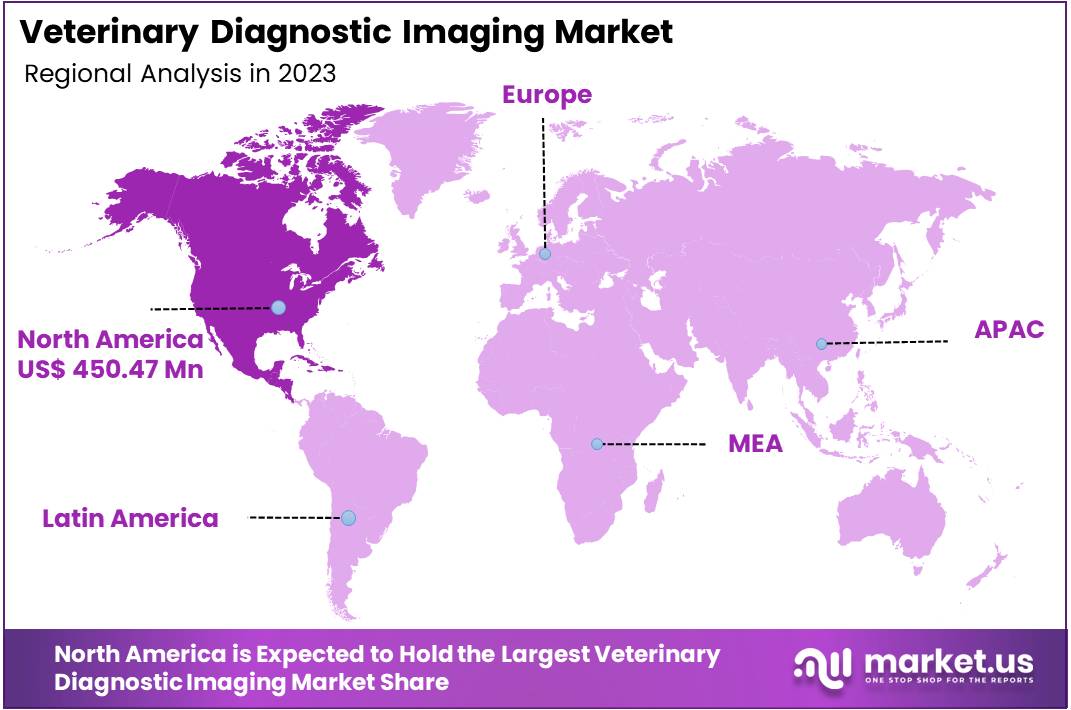

- Region-wise, North America remained the lead contributor to the market, by claiming the highest market share, amounting to 35.4%.

Product Type Analysis

Based on the type, the market is further segmented into Handheld Devices and Electrosurgery Instruments. Handheld devices dominate the veterinary diagnostic imaging market with a 54.6% share, generating $694.79 million in 2023 and projected to reach $1,255.37 million by 2033. Key components include forceps, scalpel, and surgical scissors. Forceps enable secure tissue handling, while scalpels ensure precise incisions. Notable products include Aesculap® forceps and scalpels by B. Braun and Metzenbaum scissors by Medtronic. Hooks & retractors improve visibility, and other specialized tools, like needle holders, tissue elevators, and curettes, play a vital role in enhancing surgical precision and efficiency.

Furthermore, electrosurgery instruments represent a significant segment in the veterinary diagnostic imaging market, holding a 45.4% share and generating $577.72 million in revenue in 2023. These instruments use high-frequency electric currents for cutting, coagulating, and cauterizing tissues, providing advanced solutions for diverse surgical applications. Sutures, Staplers, and Accessories dominate the segment with a 62.3% share.

These tools, including Ethicon sutures and Covidien staplers, are essential for wound closure and surgical site integrity. The others sub-segment, contributing 37.7% includes tools like electrosurgical pencils and active electrodes. Products such as Bovie and Integra™ Veterinary Electrosurgical Pencils ensure precision, while Valleylab™ active electrodes by Medtronic are vital for cutting and coagulation procedures.

Animal Type Analysis

The Large Animal segment accounted for 58.6% revenue share in the global veterinary diagnostic imaging market in 2023, with a projected CAGR of 6.5%. Equines, comprising 67.2% of this segment and generating $501.10 million, dominate due to significant investments in equine health, particularly for sports and recreational purposes. Common procedures include orthopedic, dental, and reproductive surgeries. Other large animals, including cattle, swine, and sheep, contributed 32.8%, driven by surgical interventions for disease control, injury treatment, and reproductive health.

Additionally, the Small Animal segment held 41.4% market share in 2023, growing at a 6.9% CAGR. Canines, the largest sub-segment, generated $231.27 million (43.9%), fueled by increasing pet adoption and demand for procedures like spaying, dental, and orthopedic surgeries. Felines accounted for 32.7%, followed by other small animals. Rising pet insurance adoption and preventative care further support market growth.

Application Analysis

The application segment is further bifurcated into Soft Tissue Surgery, Cardiovascular Surgery, Ophthalmic Surgery, Dental Surgery, Orthopedic Surgery and Others. The soft tissue surgery represented the largest segment in the veterinary diagnostic imaging market, accounting for 34.1% of the market share in 2023. This category encompasses a broad spectrum of procedures aimed at treating conditions affecting the skin, muscles, and internal organs.

Furthermore, dental surgery is a rapidly growing segment in the veterinary diagnostic imaging market. This segment includes procedures such as tooth extractions, root canals, and treatment of periodontal disease. The rising prevalence of dental diseases in pets, especially among older animals, is a major driver of this segment.

End-User Analysis

The Veterinary Diagnostic Imaging market is broadly segmented by end users into Veterinary Clinics, Veterinary Hospitals and Research Centers. Veterinary clinics represented the largest segment in the end-user market for veterinary diagnostic imaging, accounting for 56.5% of the market share in revenue in 2023. These clinics are the primary point of contact for pet owners seeking medical care for their animals, providing a wide range of services from routine check-ups to complex surgical procedures. The accessibility and convenience of veterinary clinics make them a preferred choice for many pet owners.

Furthermore, Veterinary hospitals constituted 32.1% of the end-user market and is anticipated to grow at the fastest CAGR over the forecast years. These hospitals typically offer more specialized and comprehensive care than veterinary clinics, equipped with advanced diagnostic and surgical facilities. Veterinary hospitals handle more complex and critical cases, often requiring sophisticated surgical instruments and highly trained veterinary professionals. The demand for surgical instruments in veterinary hospitals is driven by the need for advanced surgical procedures, including cardiovascular surgeries, orthopedic surgeries, and complex soft tissue surgeries.

Key Market Segments

By Product Type

- Handheld Devices

- Forceps

- Scalpels

- Surgical Scissors

- Hooks & Retractors

- Others

- Electrosurgery Instruments

- Sutures, Staplers, And Accessories

- Others

By Animal Type

- Large Animal

- Equines

- Other Large Animals

- Small Animal

- Canines

- Felines

- Other Small Animals

By Application

- Soft Tissue Surgery

- Cardiovascular Surgery

- Ophthalmic Surgery

- Dental Surgery

- Orthopedic Surgery

- Others

By End-User

- Veterinary Clinics

- Veterinary Hospitals

- Research Centers

Drivers

Increasing Pet Insurance Adoption

The growing adoption of pet insurance is a significant driver for the veterinary diagnostic imaging market. Pet insurance provides financial support to pet owners, enabling them to afford a wide range of veterinary services, including advanced surgical procedures. As pet ownership increases and pets are more often viewed as family members, pet owners are increasingly investing in insurance policies to ensure their pets receive comprehensive healthcare. This trend is particularly prominent in regions such as North America and Europe, where pet insurance markets are well-established and continue to expand.

In North America, pet health insurance is experiencing significant growth. By the end of 2023, nearly 6.25 million pets were insured, according to data from The North American Pet Health Insurance Association (NAPHIA). This marks a notable increase of 16.7% compared to the previous year when the number of insured pets stood at 5.3 million. This trend highlights an increasing awareness and prioritization of pet health among pet owners, reflecting a broader shift towards recognizing the value of pet insurance in managing veterinary expenses.

Pet insurance policies typically cover various medical expenses, including surgeries for injuries, illnesses, and chronic conditions. This coverage reduces the financial burden on pet owners, making them more likely to opt for necessary surgical interventions that they might otherwise forego due to cost concerns. As a result, veterinary clinics and hospitals experience increased demand for surgical services, driving the need for high-quality and specialized surgical instruments.

Furthermore, the increasing awareness of pet insurance benefits through marketing campaigns and educational efforts by insurance providers and veterinary professionals is contributing to higher adoption rates. As more pet owners recognize the value of pet insurance in managing veterinary costs, the demand for comprehensive veterinary care, including surgeries, is expected to continue rising. This trend underscores the importance of advanced surgical instruments in meeting the growing needs of insured pets, ultimately driving market growth.

Restrains

Variability in Access to Veterinarians across Markets

The significant disparity in access to veterinarians across markets is a major restraint on the veterinary diagnostic imaging market. In developed nations like the U.S., with over 100,000 active veterinarians, widespread access to veterinary care supports strong demand for advanced surgical tools. Conversely, developing nations face severe shortages; for instance, Kenya has only a few hundred veterinarians. Limited access to qualified professionals in these regions restricts the adoption of advanced instruments due to inadequate staffing, training, and resources, hampering comprehensive surgical care.

This shortage impacts animal healthcare quality, resulting in untreated diseases and injuries. Targeted initiatives to improve veterinary education, incentivize rural practice, and build international partnerships are essential to bridge this gap. Investments in infrastructure, such as veterinary clinics and hospitals, alongside support for veterinary professionals, can boost the adoption of advanced surgical tools. Addressing these challenges is critical to enhancing animal healthcare worldwide and unlocking market growth potential.

Opportunities

Growing Veterinary Care Demand in Emerging Markets

Emerging markets in Asia, Latin America, and parts of Africa offer significant growth opportunities for the veterinary diagnostic imaging market, driven by rising pet ownership, urbanization, and increasing disposable incomes. As pets are increasingly seen as family members, there is a growing willingness to invest in their health. Programs like Zoetis’ A.L.P.H.A. Plus, launched in March 2023 in partnership with the Bill & Melinda Gates Foundation, aim to improve veterinary care, livestock health, and food security in regions like Sub-Saharan Africa.

Governments are enhancing veterinary healthcare infrastructure through new clinics, improved education programs, and initiatives promoting preventive and therapeutic care. Additionally, advancements in imaging technologies, such as MRI and CT scans, allow for precise surgical planning, increasing demand for instruments compatible with modern equipment. Companies investing in innovative solutions, including minimally invasive tools, 3D printing, and imaging-integrated instruments, can capitalize on these trends and drive the evolution of veterinary care in emerging markets.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly influence the global veterinary diagnostic imaging market. Economic growth in emerging markets, rising disposable incomes, and increased pet ownership drive demand for advanced veterinary care. However, economic slowdowns, inflation, and fluctuating exchange rates can hinder market growth by reducing veterinary expenditures.

Geopolitical instability, including trade restrictions, sanctions, and conflicts, disrupts supply chains for imaging equipment and critical components, delaying deliveries and increasing costs. Regions facing political unrest often struggle with inadequate veterinary infrastructure, limiting access to diagnostic technologies.

Conversely, government investments in animal health infrastructure, particularly in developed economies, support market expansion. Programs to enhance livestock productivity and control zoonotic diseases drive adoption of imaging technologies like MRI and CT scans. Global health concerns, such as pandemics, emphasize the importance of veterinary diagnostics for disease surveillance, influencing policies and funding. Companies must navigate these macroeconomic and geopolitical challenges while leveraging opportunities in stable and growing markets to sustain long-term growth.

Trends

The global Veterinary Diagnostic Imaging Market is experiencing notable growth, primarily driven by the integration of advanced imaging technologies. These technologies, including MRI, CT scans, and digital radiography, provide veterinarians with detailed internal views that enhance surgical planning and disease detection accuracy. This advancement is particularly beneficial for precise diagnoses and improving treatment outcomes.

Another significant trend is the increasing adoption of telemedicine and remote diagnostics, especially in rural and underserved areas. Cloud-based imaging platforms are becoming essential, allowing veterinarians to collaborate with specialists easily. This shift facilitates quicker, more informed treatment decisions. Furthermore, the use of AI and machine learning is transforming veterinary imaging by enhancing image analysis, minimizing diagnostic errors, and boosting overall efficiency.

Regional Analysis

North America Dominates the Global Veterinary Diagnostic Imaging Market

North America dominates the veterinary diagnostic imaging market, holding a 35.4% share and generating US$ 450.5 million in 2023. This leadership is driven by high pet ownership, advanced veterinary infrastructure, and significant investments in veterinary technology. Pet owners’ high disposable income further fuels spending on advanced surgical care.

Leading veterinary hospitals such as Banfield Pet Hospital and VCA Animal Hospitals in the U.S. drive demand for cutting-edge surgical instruments, supported by state-of-the-art facilities. Companies like Medtronic Plc. and Ethicon US LLC play a pivotal role, offering innovative products like advanced suturing and stapling devices for procedures ranging from spaying to complex surgeries.

The rising prevalence of pet obesity, arthritis, and cancer increases demand for orthopedic and soft tissue surgeries. North America’s focus on animal welfare, stringent regulatory standards, and continuous technological advancements will sustain market growth, with a projected CAGR of 6.4% from 2024 to 2033.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global veterinary diagnostic imaging market is highly competitive, driven by innovation, technological advancements, and increasing demand for advanced imaging solutions in animal healthcare. Key players include GE Healthcare, IDEXX Laboratories, Esaote S.p.A., Siemens Healthineers, and Fujifilm Holdings Corporation, who dominate the market through robust product portfolios, global reach, and continuous R&D investments.

Companies are focusing on developing advanced imaging technologies such as digital radiography, MRI, CT scanners, and ultrasound systems tailored for veterinary use. For instance, IDEXX Laboratories offers high-performance diagnostic tools with cloud-based integration, while GE Healthcare and Siemens Healthineers provide cutting-edge imaging systems optimized for both small and large animals.

Strategic partnerships, mergers, and acquisitions are common in this competitive landscape to enhance product offerings and expand regional presence. For example, Fujifilm’s acquisition of Hitachi’s imaging division strengthened its veterinary imaging capabilities. The market also sees the entry of new players offering cost-effective solutions to cater to emerging markets, intensifying competition.

Additionally, companies are increasingly leveraging AI and machine learning to enhance diagnostic accuracy and imaging efficiency. As demand for pet care rises, the focus on innovative, portable, and cloud-integrated imaging systems will drive competitiveness, ensuring continuous market growth and technological evolution.

Top Key Players in the Veterinary Diagnostic Imaging Market

- Braun SE

- Medtronic

- Jorgen Kruuse A/S

- Surgical Holdings

- GerMedUSA

- World Precision Instruments

- Sklar Surgical Instruments

- Integra LifeSciences

- Im3 Inc.

- Johnson and Johnson (Ethicon)

- Becton, Dickinson and Company

- KARL STORZ SE & Co. KG

- Surgical Direct Inc.

- Arthrex, Inc.

Recent Developments

- In April 2024, Asteris entered a strategic partnership with VetlinkPRO. This collaboration aimed to enhance veterinary practice management by integrating advanced imaging technology into the VetlinkPRO system. The initiative focuses on improving workflow efficiency and diagnostic capabilities, streamlining processes for veterinary professionals and ensuring more accurate health assessments for animals.

- In June 2023, ESAOTE S.p.A. launched the MyLab X90VET ultrasound system. Equipped with the company’s patented Augmented Insight technology, this system is designed to provide precise and highly accurate diagnostic imaging. The MyLab X90VET is tailored to meet the specific needs of veterinary medicine, offering innovative solutions for complex diagnostic challenges.

Report Scope

Report Features Description Market Value (2023) US$ 1,272.51 Million Forecast Revenue (2033) US$ 2,386.63 Million CAGR (2024-2033) 6.7% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Product Type- Handheld Devices and Electrosurgery Instruments, by Animal Type- Large Animal and Small Animal, by Application- Soft Tissue Surgery, Cardiovascular Surgery, Ophthalmic Surgery, Dental Surgery, Orthopedic Surgery and Others, By End-User- Veterinary Clinics, Veterinary Hospitals and Research Centers. Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape B. Braun SE, Medtronic, Jorgen Kruuse A/S, Surgical Holdings, GerMedUSA, World Precision Instruments, Sklar Surgical Instruments, Integra LifeSciences, Im3 Inc., Johnson and Johnson (Ethicon), Becton, Dickinson and Company, KARL STORZ SE & Co. KG, Surgical Direct Inc. and Arthrex, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Veterinary Diagnostic Imaging MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample

Veterinary Diagnostic Imaging MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Braun SE

- Medtronic

- Jorgen Kruuse A/S

- Surgical Holdings

- GerMedUSA

- World Precision Instruments

- Sklar Surgical Instruments

- Integra LifeSciences

- Im3 Inc.

- Johnson and Johnson (Ethicon)

- Becton, Dickinson and Company

- KARL STORZ SE & Co. KG

- Surgical Direct Inc.

- Arthrex, Inc.