Veterinary Surgical Instruments Market By Product Type (Handheld Devices and Electrosurgery Instruments), By Animal Type (Large Animal and Small Animal), By Application (Soft Tissue Surgery, Cardiovascular Surgery, Ophthalmic Surgery, Dental Surgery, Orthopedic Surgery and Others) and By End-User(Veterinary Clinics, Veterinary Hospitals and Research Centers), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 118087

- Number of Pages: 316

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Product Analysis

- Animal Type Analysis

- Application Analysis

- End-User Analysis

- Key Market Segments

- Drivers

- Restrains

- Opportunities

- Impact of Macroeconomic / Geopolitical Factors

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Top Key Players in the Veterinary Surgical Instruments Market

- Recent Developments

- Report Scope

Report Overview

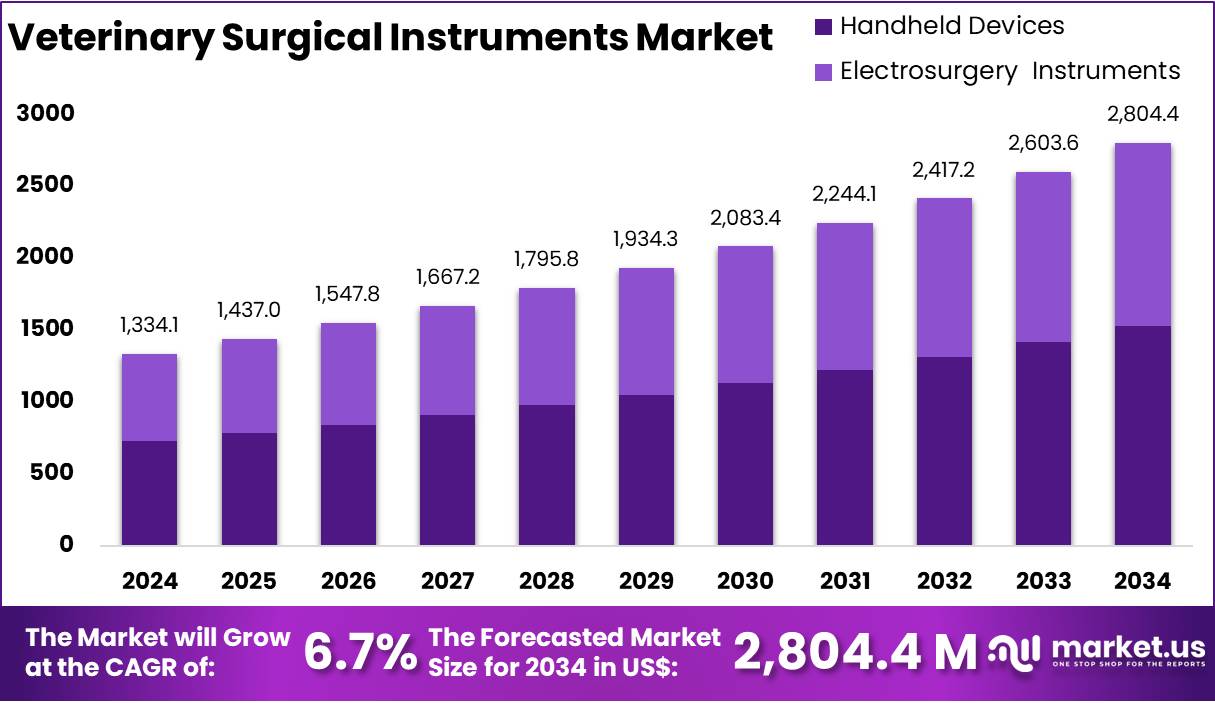

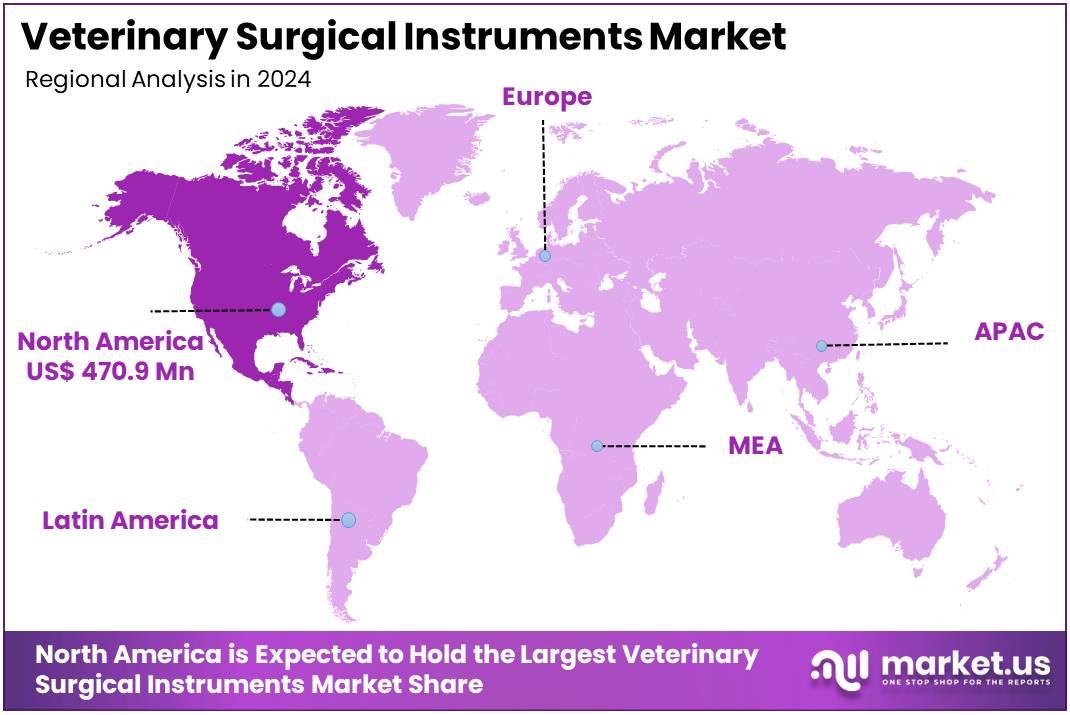

The Global Veterinary Surgical Instruments Market size is expected to be worth around US$ 2804.4 Million by 2034, from US$ 1334.1 Million in 2024, growing at a CAGR of 6.7% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 35.3% share and holds US$ 470.9 Million market value for the year.

The increasing frequency of pet surgeries in developing countries is anticipated to drive significant market growth during the forecast period. Common animal surgeries such as dental procedures, spaying or neutering, hip dysplasia, cataract surgeries, and wound repairs are contributing to the rising demand for veterinary surgical instruments.

Additionally, the expansion of veterinary surgical centers is playing a crucial role in this growth. For example, in July 2024, the VSSOC Surgery Center unveiled a 10,000 square-foot facility in the U.S., designed to provide cutting-edge surgical care. The center offers a wide range of procedures, including cardiothoracic, orthopedic, and oncology surgeries. It is equipped with advanced facilities such as five surgical suites, a 128-slice CT scanner, and dedicated recovery areas for cats and dogs. The rise in specialized surgical centers, coupled with increasing pet ownership and the demand for advanced procedures, will continue to fuel the growth of the veterinary surgical instruments market in the coming years.

The growing number of veterinary practitioners and technological advancements in veterinary surgical instruments are key drivers of market growth. As of December 2023, the American Veterinary Medical Association (AVMA) reported that there were 127,131 veterinary practitioners in the U.S., up from 124,069 in 2022. This increase reflects a rise in the number of veterinary professionals, contributing to a greater demand for surgical instruments as more practitioners offer advanced care. Additionally, the expansion of veterinary hospitals and clinics further supports market growth, as these facilities require high-quality surgical tools to perform complex procedures.

The trend of pet humanization, where pets are increasingly considered family members, coupled with rising expenditures on pet healthcare, has led to a significant increase in pet spending. Pet owners are now more inclined to invest in surgeries that improve their pets’ health and quality of life. This shift has resulted in a surge in demand for advanced veterinary surgical instruments, as owners seek the best possible care for their pets.

A significant factor fueling this trend is the growing adoption of pet insurance, such as MetLife Pet Insurance, which alleviates the financial burden associated with veterinary procedures. Pet insurance policies often cover a wide range of surgeries, including orthopedic treatments for conditions like hip and elbow dysplasia, fractures, ligament injuries, patella luxation, and osteoarthritis, provided the conditions are not pre-existing or excluded by the policy terms. This financial safety net encourages pet owners to opt for necessary surgical interventions, further driving demand for sophisticated veterinary surgical instruments.

Veterinary Surgical Instruments Market, Global Analysis, 2020-2024 (US$ Million)

Global 2020 2021 2022 2023 2024 CAGR Revenue 1,037.3 1,076.7 1,121.0 1,272.5 1,334.1 6.7% Key Takeaways

- The veterinary surgical instruments market generated a revenue of US$ 1,334.1 Million and is predicted to reach US$ 2,570.7 Million, with a CAGR of 7.7%.

- Based on the product type, the handheld devices segment generated the most revenue for the market with a market share of 54.4%.

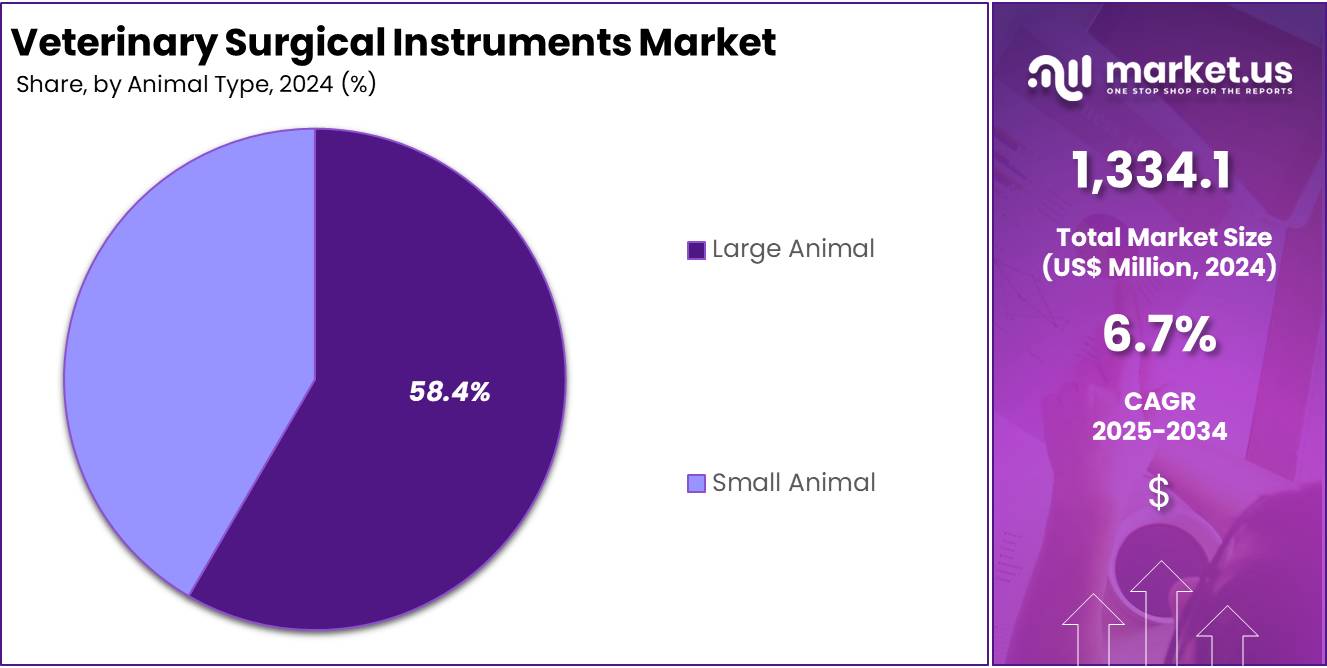

- Based on the animal type, the larger animal segment generated the most revenue for the market with a market share of 58.4%.

- Based on the application, the soft tissue surgery segment generated the most revenue for the market with a market share of 34.0%.

- Based on the end-user, the veterinary clinics segment generated the most revenue for the market with a market share of 56.4%.

- Region-wise, North America remained the lead contributor to the market, by claiming the highest market share, amounting to 35.3%.

Product Analysis

The handheld devices segment emerged as the dominant category in the product segment of the market, accounting for 54.4% of the market share in 2024. This substantial share can be attributed to several factors, including their ease of use, portability, and versatility across various medical applications. Handheld devices are designed for precision and convenience, making them indispensable tools for healthcare professionals in both clinical and surgical settings.

Their ergonomic designs and advanced features, such as wireless connectivity and real-time data display, enhance their usability and efficiency, particularly in minimally invasive procedures. Furthermore, the rising adoption of these devices in outpatient settings and their increasing utilization in emerging markets have contributed significantly to their dominance. Another factor driving the preference for handheld devices is their cost-effectiveness compared to larger, more complex equipment.

They require minimal maintenance, are easy to transport, and cater to a wide range of medical needs, from diagnostics to therapeutic interventions. Additionally, the ongoing technological advancements in handheld devices, including improved battery life, enhanced precision, and integration with digital health ecosystems, have further cemented their position as the leading choice in the market. This trend reflects a growing shift toward compact and efficient solutions in modern healthcare.

Veterinary Surgical Instruments Market, Product Analysis, 2020-2024 (US$ Million)

Product 2020 2021 2022 2023 2024 Handheld Devices 572.6 592.2 614.3 694.8 725.8 Electrosurgery Instruments 464.7 484.5 506.7 577.7 608.4 Animal Type Analysis

The large animal segment dominated the animal type category in the global veterinary surgical instruments market, driven by the growing demand for advanced surgical care for livestock, equines, and other large animals. This dominance is fueled by the increasing importance of maintaining animal health in agriculture and the equine industry, coupled with rising investments in veterinary services. Large animals often require specialized surgical instruments tailored to their anatomy, boosting the segment’s growth.

Additionally, the rising prevalence of diseases in livestock and the emphasis on improving productivity and welfare in the animal husbandry sector have further propelled this segment’s leadership in the market. Furthermore, the small animal segment is expected to grow at the fastest CAGR, driven by the increasing adoption of pets, rising awareness about pet health, and advancements in veterinary care. Growing expenditure on pet healthcare, coupled with the demand for specialized surgical procedures for companion animals, is fueling the segment’s rapid growth.

Veterinary Surgical Instruments Market, Animal Type Analysis, 2020-2024 (US$ Million)

Animal Type 2020 2021 2022 2023 2024 Large Animal 609.9 632.0 656.9 744.4 779.1 Small Animal 427.4 444.7 464.1 528.1 555.0 Application Analysis

Soft tissue surgery dominated the veterinary surgical instruments market, accounting for 34.0% of the market share. This segment’s leadership is attributed to the high prevalence of soft tissue injuries and diseases in animals, including wound repair, tumor excision, and organ surgery. The growing adoption of pets and livestock globally has increased the demand for advanced surgical procedures, boosting the segment’s prominence.

Additionally, the availability of specialized instruments designed for soft tissue procedures and advancements in surgical techniques have further supported its growth. Rising awareness among pet owners about timely medical intervention has also contributed to the dominance of this segment. Whereas, orthopedic surgery is a vital segment in the veterinary surgical instruments market, capturing 22.6% of the market share. This segment’s significance stems from the increasing prevalence of bone fractures, joint disorders, and mobility issues in both companion and farm animals.

The growing demand for advanced orthopedic procedures, such as fracture repair, joint replacement, and ligament repair, has driven the adoption of specialized surgical instruments. Technological advancements in orthopedic devices and materials, along with the rising willingness of pet owners to invest in complex surgeries, further support this segment’s growth. Additionally, the expansion of veterinary facilities globally enhances access to orthopedic care.

Veterinary Surgical Instruments Market, Application Analysis, 2020-2024 (US$ Million)

Application 2020 2021 2022 2023 2024 Soft Tissue Surgery 356.8 369.3 383.4 433.9 453.6 Cardiovascular Surgery 106.8 113.1 119.9 138.7 148.1 Ophthalmic Surgery 94.4 100.1 106.5 123.4 132.1 Dental Surgery 102.7 107.7 113.2 129.8 137.4 Orthopedic Surgery 242.7 249.8 257.8 290.1 301.5 Others 133.8 136.7 140.1 156.5 161.4 End-User Analysis

Veterinary clinics dominated the end-user market for veterinary surgical instruments in 2024, accounting for 56.4% of the market share. These clinics serve as the primary healthcare providers for pets, offering a comprehensive range of services, from routine check-ups to advanced surgical procedures. Their accessibility and convenience make them the preferred choice for many pet owners.

Technological advancements have significantly enhanced the capabilities of veterinary clinics. Tools such as digital radiography, ultrasound, and minimally invasive surgical devices like the SurgiCam® HD enable veterinarians to diagnose and treat conditions with greater precision. The increasing awareness among pet owners about regular veterinary care has led to a rise in clinic visits, further fueling the demand for surgical instruments.

With a projected compound annual growth rate (CAGR) of 6.5% from 2024 to 2033, the veterinary clinic segment is set to maintain robust growth. The expansion of veterinary services, rising clinic numbers, and continual improvements in surgical tools are key drivers of this trend. Clinics frequently perform procedures like spaying and neutering, dental surgeries, tumor removals, and minor orthopedic surgeries. For instance, iM3 dental equipment is widely used in clinics, providing reliable instruments for scaling, extractions, and polishing, ensuring high-quality care for animals.

Veterinary Surgical Instruments Market, End-User Analysis, 2020-2024 (US$ Million)

End-User 2020 2021 2022 2023 2024 Veterinary Clinics 589.2 610.5 634.5 719.0 752.4 Veterinary Hospitals 326.8 341.3 357.6 408.5 430.9 Research Centers 121.4 124.9 128.9 145.1 150.8 Key Market Segments

By Product Type

- Handheld Devices

- Forceps

- Scalpels

- Surgical Scissors

- Hooks & Retractors

- Others

- Electrosurgery Instruments

- Sutures, Staplers, And Accessories

- Others

By Animal Type

- Large Animal

- Equines

- Other Large Animals

- Small Animal

- Canines

- Felines

- Other Small Animals

By Application

- Soft Tissue Surgery

- Cardiovascular Surgery

- Ophthalmic Surgery

- Dental Surgery

- Orthopedic Surgery

- Others

By End-User

- Veterinary Clinics

- Veterinary Hospitals

- Research Centers

Drivers

Increasing Pet Ownership and Expenditure

The veterinary surgical instruments market is expanding due to increasing pet ownership and higher spending on pet care. In developed regions like North America and Europe, pets are increasingly considered family members, driving demand for advanced medical treatments. According to the American Veterinary Medical Foundation (AVMF), in 2020, 62 million U.S. households owned dogs, while 37 million owned cats. Pet care expenditures per household averaged $367 for dogs and $253 for cats. Similarly, FEDIAF EuropeanPetFood reported that 90 million European households owned pets in 2022.

Urbanization, aging populations, and higher disposable incomes are key drivers of this market. The United Nations ESCAP reported in 2022 that 670 million people in Asia and the Pacific were aged 60 or older. This number is expected to double by 2050. Older individuals are more likely to own pets for companionship, boosting pet healthcare demand. With rising awareness, pet owners seek comprehensive medical treatments, increasing demand for veterinary surgical instruments, including less invasive options like photodynamic therapy (PDT).

Technological advancements in veterinary care are further fueling market growth. Digital platforms play a crucial role in spreading pet health awareness and educating pet owners. Veterinary practices now adopt sophisticated tools to meet growing demand. Advanced surgical techniques help treat various conditions, including infected wounds, acne vulgaris, viral warts, and cutaneous leishmaniasis. This trend reflects the growing emphasis on pet well-being and high-quality healthcare services. The veterinary surgical instruments market is expected to benefit from ongoing innovation and increased investments in the global pet care industry.

Restrains

Variability in Access to Veterinarians across Markets

Access to veterinarians varies significantly across regions, posing a major challenge for the veterinary surgical instruments market. In developed nations like the United States, over 100,000 active veterinarians ensure widespread availability of veterinary care, including advanced surgical procedures. This robust presence supports consistent demand for high-quality surgical tools and technologies.

In contrast, developing nations face a critical shortage of veterinary professionals. For example, Kenya has only a few hundred veterinarians, limiting access to qualified care. This shortage significantly restricts the adoption of advanced surgical instruments, as veterinary practices in these regions often struggle with inadequate staffing, insufficient training, and limited resources. Consequently, the demand for sophisticated tools remains low, leaving the market’s potential untapped. The lack of veterinary professionals also impacts the overall quality of animal healthcare, leading to untreated diseases and injuries.

Targeted initiatives are essential to address this restraint. Enhancing veterinary education, providing incentives for rural practice, and fostering international partnerships can increase the number of trained veterinarians in underserved regions. Investments in veterinary infrastructure, such as building more clinics and hospitals, and supporting professionals can drive the adoption of advanced surgical instruments. These measures are vital to improving global animal healthcare and unlocking the market’s growth potential.

Opportunities

Growing Veterinary Care Demand in Emerging Markets

Emerging markets in regions such as Asia, Latin America, and parts of Africa offer substantial growth opportunities for the veterinary surgical instruments market. These regions are witnessing a rapid rise in pet ownership, fueled by increasing disposable incomes, urbanization, and shifting societal attitudes toward pets. As pets are increasingly viewed as family members, there is a growing willingness to invest in their health and well-being.

Programs like Zoetis’ A.L.P.H.A. Plus, launched in March 2023 in collaboration with the Bill & Melinda Gates Foundation, are advancing veterinary care and diagnostics in developing markets such as Kenya and Ivory Coast. These initiatives aim to improve livestock health, productivity, and food security in East, West, and Central Sub-Saharan Africa.

Rising awareness about animal health in emerging markets is driving demand for advanced veterinary care, including surgical procedures. Governments in these regions are actively enhancing veterinary infrastructure through investments in clinics, hospitals, and education programs. The adoption of advanced imaging technologies, such as MRI and CT scans, is transforming veterinary surgery, enabling precise planning and improved outcomes.

Manufacturers of veterinary surgical instruments can leverage these trends by developing innovative tools compatible with modern imaging technologies, focusing on minimally invasive techniques, 3D printing, and advanced imaging integration, capturing market share while advancing veterinary care globally.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly influence the global veterinary surgical instruments market. Economic fluctuations, such as recessions or economic growth, directly impact disposable incomes and healthcare spending, affecting the demand for veterinary services and, consequently, surgical instruments. In developed regions, economic stability fosters increased spending on pet healthcare, driving demand for advanced surgical tools. However, economic downturns in emerging markets can limit expenditure on veterinary care and hinder growth in those regions.

Geopolitical factors also play a crucial role. Trade restrictions, tariffs, and political instability in certain countries can disrupt the supply chain for surgical instruments, leading to higher costs and limited availability. Additionally, geopolitical tensions can affect cross-border collaborations and market access, particularly in regions with evolving healthcare infrastructures. On the other hand, initiatives in global health cooperation, like the A.L.P.H.A. Plus program, can enhance veterinary care and foster market growth in developing regions, mitigating some geopolitical challenges.

Latest Trends

The global veterinary surgical instruments market is witnessing several key trends. One of the most prominent trends is the increasing adoption of minimally invasive surgical techniques, driven by advancements in technology that reduce recovery time and improve surgical outcomes. This has led to higher demand for specialized instruments designed for such procedures. Another significant trend is the integration of advanced imaging technologies, such as MRI and CT scans, into veterinary surgeries.

These technologies allow for more precise surgical planning, fostering the development of surgical instruments compatible with these tools. The rise of pet ownership and growing awareness of animal health are also contributing to market growth, particularly in emerging regions. Additionally, the expansion of veterinary services, including specialized care for pets and livestock, is driving demand for high-quality surgical instruments. Sustainability is also gaining focus, with companies developing eco-friendly materials and manufacturing processes to meet increasing demand for environmentally responsible products in the veterinary sector.

Regional Analysis

North America Dominates the Global Veterinary Surgical Instruments Market

North America is the largest market for veterinary surgical instruments, holding 35.3% of the market share in 2024. The region’s dominance is fueled by high pet ownership, advanced veterinary healthcare infrastructure, and substantial investments in veterinary technology. Additionally, the disposable income of pet owners in North America drives increased spending on pet healthcare.

The presence of leading veterinary hospitals such as Banfield Pet Hospital and VCA Animal Hospitals in the U.S. further supports demand for surgical instruments. These hospitals are equipped with cutting-edge surgical suites and consistently invest in the latest technologies to deliver high-quality care.

The North American market for veterinary surgical instruments is expected to continue growing at a compound annual growth rate (CAGR) of 6.4% from 2025 to 2034. Advancements in veterinary technology, high care standards, and growing awareness among pet owners will continue to boost demand for advanced surgical instruments.

Major companies like Medtronic Plc. and Ethicon US LLC play a key role, offering innovative products such as Ethicon’s advanced suturing and stapling devices used in a wide range of procedures. The region’s focus on animal welfare and stringent regulatory standards ensures that veterinary practices are equipped with safe, high-quality surgical instruments, while rising cases of pet obesity and age-related conditions drive demand for orthopedic and soft tissue surgeries.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The competitive landscape in the veterinary surgical instruments market is characterized by the presence of both established players and emerging companies. Leading firms such as Medtronic Plc., Ethicon US LLC, and B. Braun Melsungen AG dominate the market by offering a wide range of advanced surgical instruments.

These companies focus on innovation, technological advancements, and high-quality products to meet the growing demand for specialized veterinary care. Additionally, regional players are also making their mark by catering to local market needs and focusing on cost-effective solutions. The market is highly competitive, with players vying for market share through product development and strategic partnerships.

Top Key Players in the Veterinary Surgical Instruments Market

- Braun SE

- Medtronic

- Jorgen Kruuse A/S

- Surgical Holdings

- GerMedUSA

- World Precision Instruments

- Sklar Surgical Instruments

- Integra LifeSciences

- Im3 Inc.

- Johnson and Johnson (Ethicon)

- Becton, Dickinson and Company

- KARL STORZ SE & Co. KG

- Surgical Direct Inc.

- Arthrex, Inc.

Recent Developments

- September 2024: Vimian Group finalized the acquisition of iM3, a globally recognized leader in veterinary dental products and equipment. This strategic move marks Vimian’s entry into the veterinary dental segment, reinforcing its presence in the veterinary MedTech sector. With this acquisition, Vimian expands its product portfolio to include dental instruments, X-ray solutions, and consumables, aligning with the increasing demand for animal dental care.

- June 2023: Movora successfully completed the integration of NGD operations into its existing facilities. As a result, the full range of NGD products became accessible through Movora’s online platforms, including its U.S. and Canadian websites. This development strengthens Movora’s position in the veterinary MedTech industry, enhancing its product offerings and improving service accessibility for veterinary clinics across North America.

Report Scope

Report Features Description Market Value (2024) US$ 1,334.1 Million Forecast Revenue (2034) US$ 2,570.7 Million CAGR (2025-2034) 7.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type: Handheld Devices and Electrosurgery Instruments, By Animal Type: Large Animal and Small Animal, By Application: Soft Tissue Surgery, Cardiovascular Surgery, Ophthalmic Surgery, Dental Surgery, Orthopedic Surgery and Others and By End-User: Veterinary Clinics, Veterinary Hospitals and Research Centers. Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape B. Braun SE, Medtronic, Jorgen Kruuse A/S, Surgical Holdings, GerMedUSA, World Precision Instruments, Sklar Surgical Instruments, Integra LifeSciences, Im3 Inc., Johnson and Johnson (Ethicon), Becton, Dickinson and Company, KARL STORZ SE & Co. KG, Surgical Direct Inc. and Arthrex, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Veterinary Surgical Instruments MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Veterinary Surgical Instruments MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Medtronic Plc

- B. Braun SE

- Neogen Corporation

- GerMedUSA

- Surgical Holdings

- Sklar Surgical Instruments

- Integra LifeSciences

- Ethicon US LLC

- Jorgen Kruuse A/S

- DRE Veterinary

- World Precision Instruments