Global Surgical Navigation Systems Market by Application (Neurosurgery, Navigation Systems, Orthopedic Navigation Systems, and Other Applications), by Technology (Electromagnetic Navigation Systems, Optical Navigation Systems, Other Technologies), by End-Users (Hospitals, Ambulatory Surgical Centers, Other End-Users), by Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2032

- Published date: June 2024

- Report ID: 12246

- Number of Pages: 316

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

The Global Surgical Navigation Systems Market size is expected to be worth around USD 1,517.0 Million by 2032 from USD 964 Million in 2023, growing at a CAGR of 6.8% during the forecast period from 2023 to 2032.

This growth is expected to be driven by the rising incidence of target disorders like osteoarthritis, brain cancer, and aging. The World Health Organization (WHO) estimates that 9.6% of people have arthritis, while 18% of those suffering from it are women. Osteoarthritis is most common in the elderly. Osteoarthritis patients often have trouble moving and are unable to perform daily activities.

The rising demand for minimally invasive surgery is another reason for the increased adoption. Because there are fewer incisions, minimally invasive surgery results in faster recovery, shorter hospital stays, and greater patient comfort, These procedures are also more cost-effective due to shorter hospital stays. Minimally invasive surgery results in less blood loss than traditional open surgeries. The market will continue to grow due to technological advancements and the introduction of new products.

The demand for hip and knee replacement surgery is expected to rise due to an unprecedented increase in the 60-year-old population. Market growth is expected to be positively influenced by this factor. A supportive regulatory framework is expected to boost the market’s growth and increase demand for surgical navigation devices. The surgeons will soon be able to adopt these systems due to the increasing reimbursement for orthopedic procedures such as knee replacement.

Key Takeaways

- Market Size: Surgical Navigation Systems Market size is expected to be worth around USD 1,517.0 Million by 2032 from USD 964 Million in 2023

- Market Growth: The market growing at a CAGR of 6.80% during the forecast period from 2023 to 2032.

- Applications Analysis: In 2022, the neurology segment accounted for 37.0% of the total revenue.

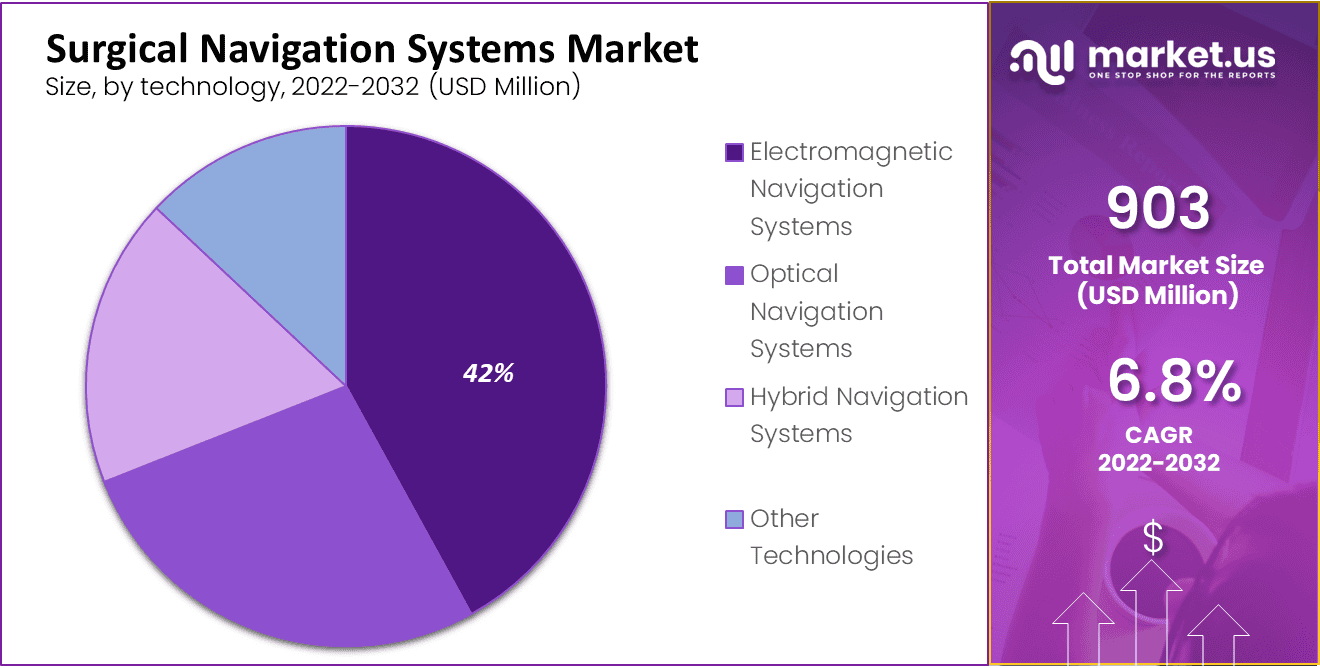

- Technology Analysis: In 2022, the Electromagnetic (EM) segment dominated surgical navigation systems and held 42.0% of the total revenue.

- End-Use Analysis: Hospitals Segment accounted for the largest market share in 2022.

- Regional Analysis: The United States had 53.340 million people aged 65 and over in 2019, projected to rise to 84.813 million by 2050.

- Technological Integration: Innovations such as augmented reality (AR) and artificial intelligence (AI) are significantly enhancing the precision and efficiency of surgical navigation systems.

- Challenges: High costs and a shortage of skilled professionals, particularly in developing regions, are significant barriers to market growth.

- Future Outlook: Continued technological advancements and increasing adoption in emerging markets are expected to drive sustained market growth.

Applications Analysis

In 2022, the neurology segment accounted for 37.0% of the total revenue. It was the first branch to integrate navigation into its clinical practice. Treating brain cancers and other Central Nervous System (CNS) disorders requires precise diagnosis and exact procedures. This is possible through the use of SNSs. There will be an increase in brain tumors and metastasis, likely leading to a greater demand for neuro-navigation systems.

Navigation allows for precise localization of vital structures such as the cranial nerves and carotid vessels, especially deep within the tumor. It also displays a real-time trackable instrument, enhancing surgeons’ anatomical appreciation and increasing their sense of safety. These benefits will contribute to steady growth in this market. Due to the increasing prevalence of ENT disorders, the Ear, Nose, and Throat (ENT) surgery segment will grow in value over the forecast period.

SNSs offer ENT surgery patients primary advantages. They are more precise, which results in less risk, less discomfort, less invasiveness, and a shorter recovery time. Most people experience an ear, nose, or throat problem at some point. Disabling hearing loss affects one in four Americans older than 65. Different malignant tumors can be found in the neck, throat, nasal sinuses, mouth, or larynx. It affects more than 63,000 Americans each year. There are an estimated 2.4 million eye injury cases in the U.S. annually. These factors indicate the potential market demand for ENT surgical Navigation Systems, which could boost the overall market growth.

Technology Analysis

In 2022, the Electromagnetic (EM) segment dominated surgical navigation systems and held 42.0% of the total revenue. This is due to the simplicity of the technology, improved line of sight, and affordability, all attributes of optical navigation. They were available before optical and hybrid SNSs, which are already well-known. This segment is expected to maintain its dominant market share over the next years. Joymax, a German-based company, announced in August 2020 that the FDA had approved its electromagnetic navigation tracking system and control system “Intracs.”

Over the forecast period, the optical segment will experience exponential growth. Optical SNSs deliver better results than electromagnetic surgical navigation systems. These systems are the industry standard in neurosurgery and can simultaneously track various tools. These systems are used in medical procedures requiring high precision and extensive access routes, such as those on the lateral skull base. They are not affected by electromagnetic fields or metallic objects in the environment. Segment growth is one of the benefits associated with this technology.

End-User Analysis

In 2022, hospitals accounted for the largest market share and will continue to dominate the market during the forecast period. To improve Point-of-Care (PoC), hospitals use various technologically advanced medical devices. These devices simplify treatment and allow for faster and more precise results. The hospital also offers a wide range of options for pain management and orthopedic procedures. These factors will continue to drive steady growth for the segment shortly.

Over the forecast period, Ambulatory Surgical Centers will experience exponential growth. The growth is expected to be boosted by the high adoption of ASCs (Ambulatory Surgical Centers) within developed countries, a shortage of hospital beds, and limited economic resources. Day-care surgery has many advantages, including a shorter wait list, faster discharge, lower procedural costs, higher efficiency, and a lower cost. These factors will continue to fuel growth.

Key Market Segments

By Application

- Neurosurgery Navigation Systems

- Orthopedic Navigation Systems

- ENT Navigation Systems

- Dental Navigation Systems

- Other Applications

By Technology

- Electromagnetic Navigation Systems

- Optical Navigation Systems

- Hybrid Navigation Systems

- Fluoroscopy-Based Navigation Systems

- CT-Based Navigation Systems

- Other Technologies

By End-User

- Hospitals

- Ambulatory Surgical Centers

- Physician Practices

- Other End-Users

Driving Factors

Growing demand for laparoscopic, endoscopic, and keyhole surgery

The market for surgical navigation systems has seen diverse growth across all segments. The key driver behind this increase in growth has always been technological advances in surgery. The medical profession has gained valuable insights into surgical navigation technologies that can help reduce blood loss and death.

There is a growing demand for laparoscopic, endoscopic, and keyhole surgery that uses surgical innovations. These surgeries are more economical and compatible because they require fewer incisions and reduce blood loss.

Restraining Factors

The slow growth of surgical navigation is due to high costs for equipment and installations.

Although the market value of surgical navigation systems has increased positively, some obstacles can hinder this growth. These are the areas surgical navigation companies must focus on to continue to drive growth upward. One of the problems that surgical companies often face is the increase in regulatory approval processes and procedural complications. Misguided decisions can cause serious health consequences and even endanger patients’ lives.

Because it takes so much time, strict approvals and procedures are a major constraint. Second, the slow growth of surgical navigation is due to high costs for equipment and installations. This problem is most common in developing countries, where there is less spending on health.

Challenges

The market for surgical navigation systems is based on technological advances and innovation. Surgical navigation technologies played an important role in driving the market and increasing revenue.

Manufacturers focused on creating technologies that would not only improve the treatment of patients but also reduce the death rate and be more economical. The surgical navigation market has seen technology as a key segment. Technology’s impact can be seen in the many upcoming laser technologies and optical navigation systems. Brain mapping techniques and electromagnetic systems have all been very useful for doctors and health professionals.

Trending Factors

Robot-assisted navigation systems-based techniques are used to perform these surgeries.

Minimally invasive procedures are becoming more popular due to their advantages over open surgery, such as less bleeding, lower postoperative infection rates, fewer complications, and shorter hospital stays. Robot-assisted navigation systems-based techniques are used to perform these surgeries. Patients are increasingly looking for minimally invasive procedures will drive demand for medical devices

The surgical navigation system has been extensively used in minimally invasive surgery for neurosurgery, orthopedics, and other procedures. These methods are faster than traditional treatments and have a quicker recovery time. They also make it easier and more precise. These will lead to the widespread acceptance and adoption of medical-surgical navigation devices in hospitals and medical centers. The global market is expected to grow due to the popularity of robotic, computer-assisted, minimally invasive surgery.

Regional Analysis

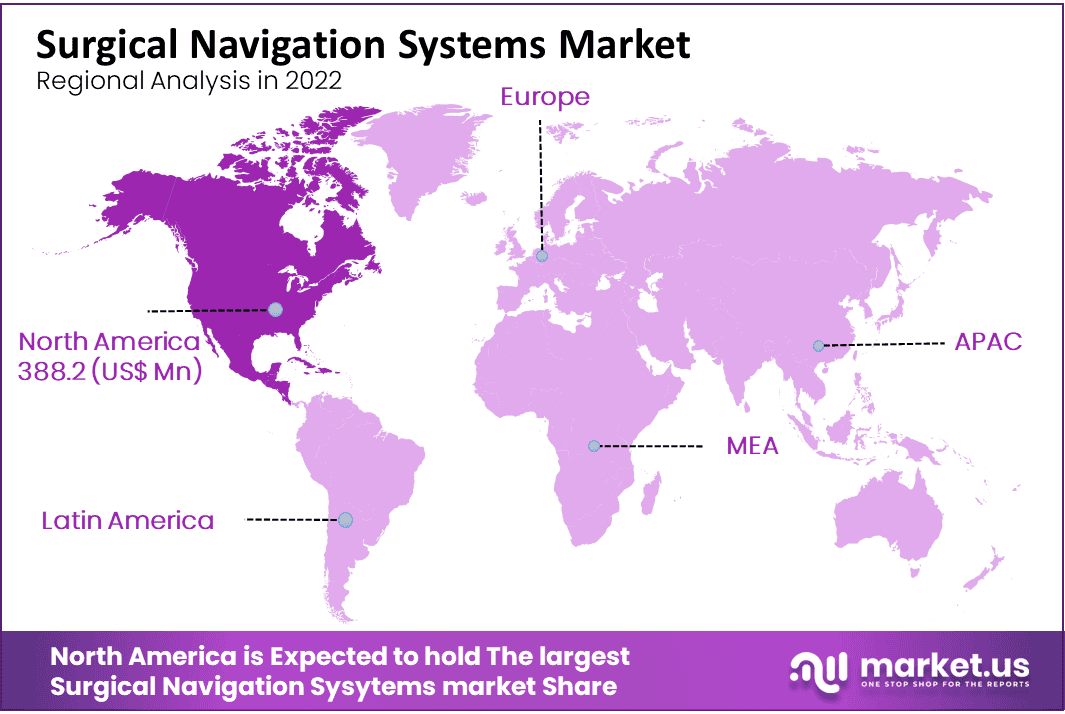

North America was responsible for 43.0% of the total revenue in 2022.

North America was responsible for 43.0% of the total revenue in 2022. Regional growth is expected to be driven by the rising incidence of neurological, ENT, and orthopedic disorders. The demand for surgical navigation systems is expected to rise due to the increased number of patients. The primary growth driver is a rising preference for ambulatory surgical centers and growing procedure volumes.

A quality-driven healthcare model and a shift to ambulatory surgery in a cost-curbing setting drive regional demand. The overall growth of the regional market is also due to factors like the growing geriatric population, well-developed reimbursement structures, and a strong reimbursement structure.

The increase in North American surgeries drives market growth. According to a January 2021 research study titled “The Effect of the COVID-19 Pandemic on Gastrointestinal Endoscopy Activities in a Tertiary Center from Northeastern Romania”, 3,608 endoscopic procedures were performed in 2019. Approximately 138 procedures per semaine will drive market growth and increase the demand for surgical navigation systems.

Due to a weaker immune system, the elderly are more susceptible to chronic diseases. World Ageing Report 2019 reported that the United States had 53.340 million people 65 and over in 2019. This number is projected to rise to 84.813 million by 2050. The expected rise in chronic diseases will likely drive the need for surgical navigation systems in diagnosis or treatment.

The market in Asia Pacific is expected to experience rapid growth during the forecast period. The fastest growth in the region’s market can be attributed primarily to developing economies, an aging population, and growing healthcare awareness. Geriatrics are more susceptible to orthotic disorders, which makes them a large target population. India, China, and Japan are major contributors to the region’s growth.

The growth is expected to be driven by high-untapped markets, increased interest from companies to expand their presence there, and ongoing R&D activities of key market players to develop better products. B. Braun, for example, opened five new manufacturing facilities in Malaysia in April 2018 to produce more pharmaceutical solutions and medical devices for infusion treatment.

Key Regions

North America

- The US

- Canada

- Mexico

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Due to their large product range and presence in the region, very few players have a substantial market share. These key players participate in various strategies, including new product development, distribution agreements, expansion, and market penetration strategies. Innovators and patients have access to Wright Medical. Stryker acquired Wright Medical in November 2020.

Johnson & Johnson’s DePuy Synthes signed a contract with JointPoint, Inc. in September 2019. DePuy Synthes purchased the navigation software of JointPoint, Inc. that enable surgeons to improve their surgical outcomes for hip arthroplasties will rise in competition in the industry.

Market Key Players

With many local and regional players’ presence, the Surgical Navigation Systems market is fragmented. Market players are subject to intense competition from top market players, particularly those with strong brand recognition and high distribution networks. Companies have gained various expansion strategies, such as partnerships and product launches, to stay on top of the market.

The following are some of the major players in the global Surgical Navigation Systems industry

- Amplitude Surgical SA

- Brainlab AG

- Braun Melsungen AG

- Intersect ENT

- Karl StorzGmBH&Co. KG

- Medtronic PLC

- ScopisGmBH

- Siemens Aktiengesellschaft

- Stryker Corporation

- Zimmer Biomet Holdings, Inc.

- GE Healthcare

- Other Key Players.

Recent Developments

- Amplitude Surgical SA: In April 2024, Amplitude Surgical SA acquired Orthomobile, a company specializing in mobile surgical navigation systems. This acquisition aims to enhance Amplitude Surgical’s product portfolio and expand its presence in the global market, particularly in mobile and versatile surgical navigation solutions.

- Brainlab AG: In January 2024, Brainlab AG launched its latest surgical navigation system, Curve® Navigation 4.0. This new product features advanced imaging capabilities and integration with augmented reality, aiming to improve surgical precision and outcomes across various specialties, including neurosurgery and orthopedic surgery.

- B. Braun Melsungen AG: In March 2024, B. Braun Melsungen AG announced a strategic merger with Aesculap AG, aiming to combine their expertise in surgical navigation and instrumentation. This merger is expected to enhance their market position and drive innovation in surgical navigation technologies.

- Intersect ENT: In February 2024, Intersect ENT introduced the Sinuva® Navigation System, a new product designed for ENT surgeries. This system integrates advanced navigation technology to improve surgical accuracy and patient outcomes, reflecting the company’s commitment to advancing ENT surgical solutions.

- Karl Storz GmbH & Co. KG: In May 2024, Karl Storz GmbH & Co. KG launched the C-MAC® FIVE, a new surgical navigation system for endoscopic procedures. This product features enhanced imaging and navigation capabilities, aiming to support surgeons in performing complex endoscopic surgeries with greater precision.

Report Scope

Report Features Description Market Value (2023) USD 964 Million Forecast Revenue (2032) USD 1,715 Million CAGR (2023-2032) 6.8% Base Year for Estimation 2022 Historic Period 2016-2021 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, Impact, Competitive Landscape, Recent Developments Segments Covered By Application – Neurosurgery Navigation Systems, Orthopedic Navigation Systems, ENT Navigation Systems, Dental Navigation Systems, and Other Applications By Technology – Electromagnetic Navigation Systems, Optical Navigation Systems, Hybrid Navigation Systems, Fluoroscopy-Based, Navigation Systems, CT-Based Navigation Systems, and Other Technologies

By End-User – Hospitals, Ambulatory Surgical Centers, Physician, Practices, Other End-Users

Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa -Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Amplitude Surgical SA, Brainlab AG, Braun Melsungen AG, Intersect ENT, Karl StorzGmBH&Co. KG, Medtronic PLC, ScopisGmBH, Siemens Aktiengesellschaft, Stryker Corporation, Zimmer Biomet Holdings, Inc., GE Healthcare, Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are surgical navigation systems?Surgical navigation systems are advanced medical devices that assist surgeons in planning and performing precise surgical procedures by providing real-time imaging and guidance.

How big is the Surgical Navigation Systems Market?The global Surgical Navigation Systems Market size was estimated at USD 964 Million in 2023 and is expected to reach USD 1,517.0 Million in 2032.

What is the Surgical Navigation Systems Market growth?The global Surgical Navigation Systems Market is expected to grow at a compound annual growth rate of 6.8%. From 2024 To 2032

Who are the key companies/players in the Surgical Navigation Systems Market?Some of the key players in the Surgical Navigation Systems Markets are Amplitude Surgical SA, Brainlab AG, Braun Melsungen AG, Intersect ENT, Karl StorzGmBH&Co. KG, Medtronic PLC, ScopisGmBH, Siemens Aktiengesellschaft, Stryker Corporation, Zimmer Biomet Holdings, Inc., GE Healthcare, Other Key Players.

How do surgical navigation systems work?These systems use various imaging modalities such as MRI, CT, and X-ray, combined with tracking technologies to guide the surgeon’s instruments accurately during the procedure.

What are the key benefits of surgical navigation systems?The main benefits include enhanced surgical precision, reduced risk of complications, shorter recovery times for patients, and improved overall surgical outcomes.

Which surgical specialties commonly use navigation systems?Surgical navigation systems are widely used in neurosurgery, orthopedic surgery, ENT surgery, spinal surgery, and certain types of cardiac and gastrointestinal surgeries.

What is driving the growth of the surgical navigation systems market?The market growth is driven by the increasing prevalence of chronic diseases, rising demand for minimally invasive surgeries, and continuous technological advancements in medical devices.

Surgical Navigation Systems MarketPublished date: June 2024add_shopping_cartBuy Now get_appDownload Sample

Surgical Navigation Systems MarketPublished date: June 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Amplitude Surgical SA

- Brainlab AG

- Braun Melsungen AG

- Intersect ENT

- Karl StorzGmBH&Co. KG

- Medtronic PLC

- ScopisGmBH

- Siemens Aktiengesellschaft

- Stryker Corporation

- Zimmer Biomet Holdings, Inc.

- GE Healthcare

- Other Key Players.