Global Surgical Sutures Market By Product Type (Absorbable, Non- Absorbable), By Filament (Monofilament, Multifilament), By Form (Natural and Synthetic) By Application (Cardiology, Gynecology, General Surgery, Orthopedics, and Others) By End- User (Hospitals, Specialty Clinics, Ambulatory Surgical Centers and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: July 2024

- Report ID: 52233

- Number of Pages: 220

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

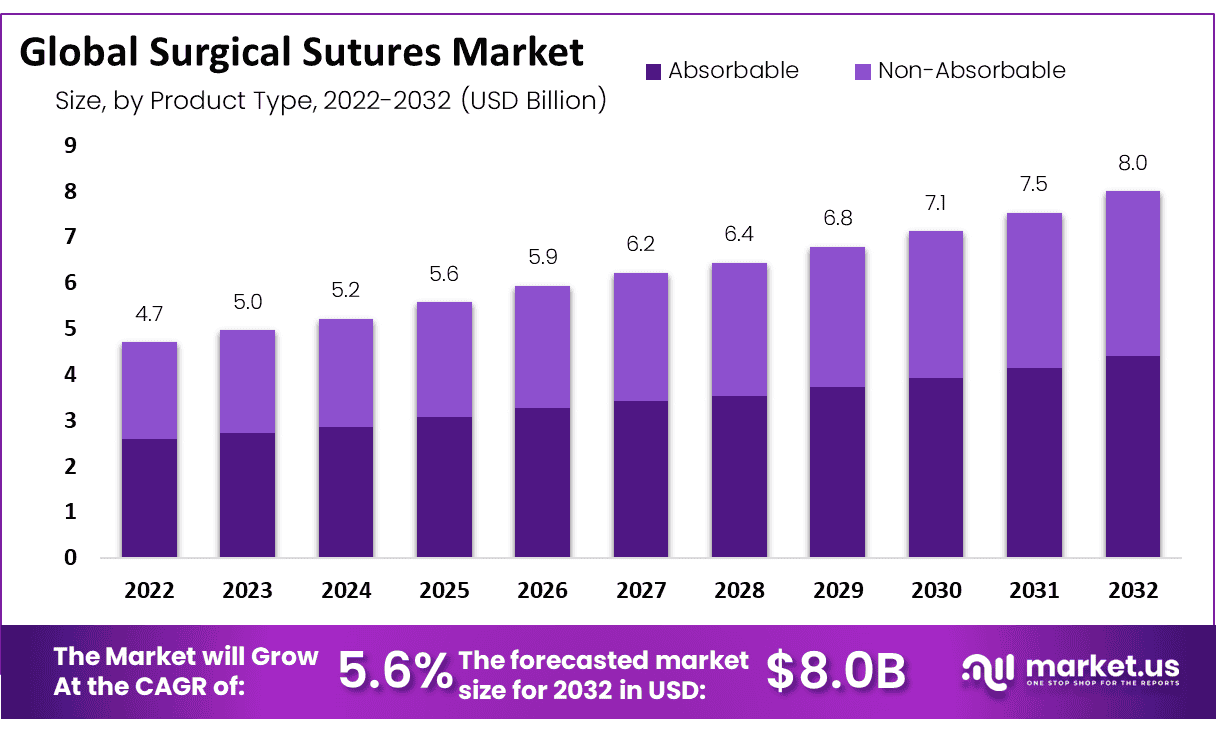

The Global Surgical Sutures Market size is expected to be worth around USD 8 Billion by 2032 from USD 4.7 Billion in 2022, growing at a CAGR of 5.6% during the forecast period from 2023 to 2032.

The surgical sutures market is significantly influenced by stringent regulatory standards, particularly from entities like the U.S. Food and Drug Administration (FDA), which classifies these products as Class II devices. These regulations mandate that surgical sutures meet rigorous performance criteria including tensile strength, knot security, and biocompatibility before they can be marketed. The FDA’s oversight ensures that these medical devices are safe for patient use and effective for various surgical procedures across domains such as cardiovascular, orthopedic, and cosmetic surgeries.

Global demand for surgical sutures is driven by the rising prevalence of conditions that require surgical intervention, alongside advancements in surgical technologies. The market is witnessing substantial growth due to the increasing use of both absorbable and non-absorbable sutures. Absorbable sutures, in particular, dominate the market because they offer convenience and reduce the need for post-operative care.

Recent developments have also focused on the innovation of suture materials to enhance surgical outcomes and patient recovery times. For instance, the introduction of synthetic sutures aims to minimize hypersensitivity reactions, and the use of antibacterial absorbable sutures helps reduce surgical site infections, offering cost savings and improved patient care.

Additionally, the market is affected by international trade dynamics, including regulatory frameworks and trade agreements that influence the import and export of these essential medical devices. The surgical sutures market is also sensitive to economic indicators such as employment rates and GDP growth, which impact healthcare spending and pricing trends.

Investments from both government and private sectors in healthcare infrastructure are crucial for market growth, supporting the rising volume of surgeries and the demand for advanced surgical technologies. For example, the World Health Federation reported in 2023 that cardiovascular diseases, which necessitate extensive use of surgical sutures, continue to affect over half a billion people globally.

Key Takeaways

- The Global Surgical Sutures Market is projected to reach USD 8.0 billion by 2032.

- Market growth is fueled by increasing surgical procedures and an aging population.

- North America commands a 34% share of the market revenue.

- Asia-Pacific is expected to grow fastest, driven by rising disease prevalence and surgeries.

- Innovations in surgical sutures, such as automated products, are propelling market expansion.

- Market constraints include alternatives like surgical staplers and surgical complications.

- Low and middle-income countries offer significant growth prospects due to favorable regulatory environments and improving healthcare infrastructure.

- Enhanced healthcare facilities and health insurance support are boosting surgical sutures adoption.

- Trends in surgical sutures feature developments in elastic, knotless, and electronic sutures.

- Absorbable sutures lead the market, comprising 55% of the market share; multifilament sutures are the fastest growing segment.

Product Type Analysis

In the global surgical sutures market, product types are categorized into absorbable and non-absorbable sutures. During the forecast period, the absorbable sutures segment emerged as the leader, capturing a significant 55% revenue share. This dominance is primarily due to the widespread application of absorbable sutures in managing delicate and deep wounds. The key advantage of these sutures lies in their high tensile strength, which supports the wound effectively, allowing for quicker healing.

Moreover, the preference for absorbable sutures is on the rise. Their ability to naturally degrade minimizes the need for post-operative suture removal, enhancing patient comfort and recovery outcomes. This characteristic contributes substantially to their increasing market demand.

Conversely, non-absorbable sutures hold a smaller market share compared to their absorbable counterparts. These sutures are designed for use in internal environments subjected to continuous stress, where absorbable sutures may not meet the necessary performance criteria. Although non-absorbable sutures do not biodegrade and typically require removal, they are indispensable in specific surgical scenarios where long-term tissue approximation is crucial. This segment’s market presence underscores the diverse needs and surgical applications addressed by different suture types within the healthcare sector.

Filament Analysis

In the global surgical suture market, sutures are classified into two categories: monofilament and multifilament. The multifilament segment dominated the market in terms of revenue and is projected to grow at the fastest rate. Multifilament sutures are preferred due to their high tensile strength, enhanced pliability, and flexibility, which contribute to their significant market share.

Conversely, monofilament sutures, although associated with a lower risk of infection, present challenges in surgical settings. These sutures are difficult to handle due to their inherent stiffness, leading to potential issues such as crimping or crushing. This can cause premature suture failure during operations. Monofilament sutures are typically made from materials like polydioxanone monocrystal, nylon, and proline. Despite their advantages, these sutures often lack knot security and are less favored due to the operational difficulties they introduce.

Overall, while both types of sutures have specific uses and benefits, the multifilament sutures’ superior handling characteristics are driving their increased adoption in surgical practices, thereby bolstering their market growth.

Form Analysis

In the surgical suture market, which is segmented into natural and synthetic types, the synthetic form dominates the industry. It holds the largest market share globally due to its widespread acceptance and effectiveness in wound closure. Unlike the natural sutures, synthetic sutures are preferred because they minimize the risk of hypersensitivity reactions, a critical factor in their widespread use.

The natural sutures, while effective, are projected to grow at a lower compound annual growth rate (CAGR) during the forecast period. This trend can be attributed to their tendency to interact with body tissues, which can sometimes complicate the healing process. Consequently, the market’s inclination towards synthetic sutures is strengthened by their reliable performance and lower risk profile.

This shift in market dynamics underscores a broader industry preference for innovations that enhance patient outcomes and procedural efficiencies. As healthcare providers increasingly prioritize safety and effectiveness, synthetic sutures are likely to continue leading the market, reflecting ongoing advancements and adaptations in medical technologies.

Application Analysis

In the diverse landscape of the global surgical suture market, the orthopedics sector emerges as a prominent leader, commanding a substantial 43% share. This segment’s dominance is underpinned by the increasing prevalence of orthopedic disorders among the aging population and a higher frequency of orthopedic surgeries globally. Following closely, the gynecology segment also shows significant market presence, bolstered by advancements in surgical practices in this field.

Looking ahead, the cardiology segment is poised for the most rapid growth. This anticipated rise is attributed to a growing incidence of arrhythmias and other coronary artery conditions, which are driving up the number of bypass surgeries and subsequently, the demand for surgical sutures. Furthermore, the general surgery segment is expected to experience notable growth, fueled by an increase in road accidents and general surgical interventions.

Conversely, the ‘other’ segment, encompassing various minor applications, is projected to grow at a moderate pace throughout the forecast period. Each segment’s growth is closely monitored to adapt strategies that align with evolving medical needs and procedural advancements.

This analysis highlights key growth drivers and emerging trends within each segment, providing stakeholders with crucial insights to navigate the complexities of the surgical suture market effectively.

End-User Analysis

The global surgical suture market segments its end-users into hospitals, ambulatory surgical centers (ASCs), specialty clinics, and others. Currently, the hospital and ASC segments dominate this market, a trend projected to continue through the forecast period. This leadership stems from the high volume of surgical procedures conducted in these facilities coupled with favorable reimbursement policies in both developing and developed nations.

Hospitals and ASCs benefit from the presence of skilled surgeons and the integration of advanced technologies for complex surgeries. These factors significantly contribute to their sustained market dominance. Moreover, the comprehensive support and infrastructure available in these settings enhance their capability to handle a diverse range of surgical needs, thereby attracting a larger patient base.

On the other hand, specialty clinics are poised for substantial growth in the coming years, expected to exhibit a significant compound annual growth rate (CAGR). The growth in this segment is driven by the personalized and specialized care these clinics offer. Specialty clinics generally have shorter wait times and are increasingly prevalent in developing regions, factors that are enhancing their appeal and accessibility to a broader demographic.

The expansion of specialty clinics, along with the steady influx of technological advancements and skilled professionals in hospitals and ASCs, underscores the dynamic nature of the surgical suture market’s end-user landscape.

Driving Factors

Rising Surgical Procedures Boost Market Growth

The global market for surgical devices is experiencing significant growth due to an increase in various surgical procedures. Specifically, the rising numbers of knee replacements, cosmetic surgeries, and bypass surgeries are enhancing the utilization of advanced devices for faster wound closure. Additionally, the expanding geriatric population contributes to the growing demand for surgical sutures.

This demographic trend is linked to a higher frequency of surgical operations, such as organ transplants, angioplasties, and joint replacements, particularly among older adults. The escalating need for these procedures underscores the growing importance of sophisticated healthcare solutions worldwide.

Technological Advancements Propel Market Expansion

Heightened awareness of surgical advancements is propelling market players to intensify research and development efforts. This focus aims to introduce innovative products that meet evolving healthcare needs. The rapid introduction of new, automated sutures featuring improved designs is shifting surgeon preferences globally.

These technological enhancements not only improve surgical outcomes but also streamline operational efficiencies in healthcare settings. The market’s inclination towards these advanced suturing devices indicates a robust trajectory in response to both medical professional demands and patient care standards.

Restraining Factors

Impact of Alternatives and Economic Barriers

The market for surgical sutures is facing growth limitations due to the availability of alternative wound healing products like surgical staplers. Technological advancements in these devices offer significant benefits; however, their adoption is curtailed by several disadvantages. Notable among these are the risks of surgical site infections and the potential for leaving cross-hatched marks, which can be cosmetically displeasing.

Moreover, the elevated costs associated with antibacterial devices further constrain surgical frequencies, subsequently impacting the adoption rates of surgical sutures. Despite the rapid application and enhanced wound healing capabilities of surgical staplers, the market’s expansion is hindered by the lack of comprehensive reimbursement policies for wound management, particularly in developing regions. This lack of financial support results in decreased surgical rates, thereby affecting the uptake of traditional surgical sutures.

These challenges underscore the need for regulatory and economic interventions that could facilitate broader acceptance and use of all wound care solutions, including surgical sutures, especially in economically constrained settings.

Growth Opportunities

Low and Middle-Income Countries

Developing economies present valuable opportunities for leading market players. These markets are characterized by low regulatory hurdles, an expanding patient base, improvements in healthcare infrastructure, and rising healthcare expenditures. Consequently, such environments are ripe for growth, particularly in sectors requiring advanced medical tests and services.

Enhanced Healthcare Facilities Supported by Governments

Governments across various nations are intensifying their efforts to augment the quality of services provided to citizens. This governmental involvement has led to the provision of superior surgical tools and materials that facilitate efficient wound healing. Furthermore, to promote the adoption of advanced suturing materials, health insurance companies are offering improved reimbursement schemes. This strategic support from both governmental and insurance sectors is crafting a conducive environment for the adoption of innovative healthcare solutions.

These factors collectively enhance the market attractiveness of low and middle-income countries for healthcare investments, particularly in technologies that advance medical care and patient outcomes. This dynamic is likely to accelerate the introduction and adoption of cutting-edge medical technologies in these regions, potentially driving significant market growth.

Trending Factors

Addressing Unmet Clinical Needs and Market Expansion

In the medical field, the evolution of suturing technology represents a significant trend, addressing previously unmet needs with innovative solutions. Elastic, knotless, and electronic sutures are increasingly preferred by healthcare providers for their superior clinical benefits compared to traditional sutures. These advanced sutures enhance patient care by integrating functionalities such as drug delivery directly at the wound site, temperature monitoring, infection detection, and therapeutic heat provision, which are crucial for effective wound management.

Furthermore, these sutures are designed for efficient stitching of large wounds, providing a more effective and patient-friendly healing process. The market for these advanced sutures is witnessing considerable expansion, attracting both new entrants and established industry players. A notable development in this sector is by Smith & Nephew, which launched the HELICOIL knotless suture in September. This innovative product leverages stem cells derived from bone marrow to accelerate the healing process, showcasing a breakthrough in suture technology.

The introduction of such advanced products not only meets the current demand for high-performance surgical tools but also opens new avenues for growth within the medical sutures market. Companies are thus not only continuing to enhance their portfolios of conventional absorbable and non-absorbable sutures but are also strategically positioning themselves to capitalize on the emerging trends of smart and multifunctional sutures. This shift indicates a promising expansion trajectory for the advanced sutures market, aligning with both technological advancements and evolving clinical needs.

Key Market Segments

By Product Type

- Absorbable

- Non- Absorbable

By Filament

- Monofilament

- Multifilament

By Form

- Natural

- Synthetic

By Application

- Cardiology

- Gynecology

- Orthopedics

- General Surgery

- Other Applications

By End-User

- Hospitals

- Specialty Clinics

- Ambulatory Surgical Centers

- Others

Regional Analysis

North America leads the surgical sutures market, holding the largest revenue share at 34%. This dominance is due to the high number of surgical procedures performed, driven by the growing geriatric population. The region also benefits from advanced medical facilities and equipment, boosting market growth.

Europe is expected to grow significantly during the forecast period. This growth is attributed to the well-developed healthcare infrastructure in European countries, which increases the demand and approval of surgical sutures. The rising number of surgeries in the region further propels market expansion.

Asia-Pacific is anticipated to record the highest CAGR during the forecast period. This growth is due to the increasing prevalence of cardiovascular and gynecological diseases, leading to more surgeries. Additionally, there is a growing awareness of advanced surgical devices and a focus on major players in developing countries, enhancing market growth in this region.

Conversely, Latin America and the Middle East & Africa (MEA) are projected to register moderate growth during the forecast period. The scarcity of trained healthcare professionals and limited access to healthcare systems are key challenges in these regions. Despite these challenges, the market is expected to grow moderately as efforts to improve healthcare access and training continue.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Prominent players like Medtronic and B. Braun Melsungen AG dominate the global surgical sutures market. They focus on inventing new technology and enhancing manufacturing capabilities to maintain their market positions. Other key players include Coloplast A/S, Boston Scientific Corporation, DemeTECH Corporation, and Endo-Surgery, Inc.

These companies leverage advanced technologies to perform complex surgical processes, ensuring they stay competitive. Their strategies revolve around continuous innovation and expansion of manufacturing capacities. This emphasis on technological advancement and production efficiency enables them to hold significant market shares in the global surgical sutures industry.

Key Market Players

- Medtronic Plc

- Braun Melsungen AG

- Smith& Nephew plc

- Coloplast A/S

- Apollo Endo-surgery, Inc.

- Boston Scientific Corporation

- DemeTECH Corporation

- TEPHA INC.

- Kono Seisakusho Co, Ltd.

- Internacional Framaceutica S.A. de C.V.

- Johnson & Johnson

- Teleflex Incorporated

- Healthium MedTech

- Mellon Medical B.V.

- GPC Medical Ltd.

- Stryker Corporation

- Integra Life Sciences Corporation

- Other Key Players

Recent Developments

- June 2024: Medtronic received a substantial investment of $337 million from Blackstone Life Sciences. This funding is designated for advancing R&D in diabetes technologies, including the development of next-generation insulin delivery systems and continuous glucose monitoring (CGM) technologies, indicating a significant boost to their Diabetes Group’s capabilities.

- June 2024: Medtronic closed a public offering of €3.0 billion in senior notes, demonstrating their strategic financial management to support ongoing and future technological advancements and market expansions. This financial maneuver supports their broad-based growth strategy across multiple healthcare sectors, including surgical technologies.

- May 2023: Medtronic announced plans to acquire EOFlow Co. Ltd., known for its wearable, tubeless insulin delivery device, EOPatch®. This move aims to broaden Medtronic’s diabetes management solutions within their ecosystem, reflecting their strategic push towards integrated healthcare technologies.

Report Scope

Report Features Description Market Value (2022) USD 4.7 Billion Forecast Revenue (2032) USD 8.0 Billion CAGR (2023-2032) 5.6% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type-Absorbable and Non- Absorbable; By Filament- Monofilament and Multifilament; By Form – Natural and Synthetic; By Application- Cardiology, Gynecology, Orthopedics, General Surgery, and Others; By End-User-Hospitals, Clinics, Ambulatory Surgical Centers, and Others Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; The Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Medtronic Plc, B. Braun Melsungen AG, Smith & Nephew plc, Coloplast A/S, Apollo Endo-surgery Inc. Boston Scientific Corporation, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Surgical Sutures market in 2022?The Surgical Sutures market size is USD 4.7 Billion in 2023.

What is the projected CAGR at which the Surgical Sutures market is expected to grow at?The Surgical Sutures market is expected to grow at a CAGR of 5.6% (2023-2032).

List the segments encompassed in this report on the Surgical Sutures market?Market.US has segmented the Surgical Sutures market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product Type the market has been segmented into Absorbable and Non- Absorbable. By Filament the market has been segmented into Monofilament and Multifilament. By Form the market has been segmented into Natural and Synthetic. By Application the market has been segmented into Cardiology, Gynecology, Orthopedics, General Surgery, and Others. By End-User the market has been segmented into Hospitals, Clinics, Ambulatory Surgical Centers, and Others.

List the key industry players of the Surgical Sutures market?Medtronic Plc, B. Braun Melsungen AG, Smith & Nephew plc, Coloplast A/S, Apollo Endo-surgery Inc. Boston Scientific Corporation, Other Key Players.

Which region is more appealing for vendors employed in the Surgical Sutures market?North America is expected to account for the highest revenue share with 34%, and boasting an impressive market value of USD 1.5 Billion. Therefore, the Surgical Sutures industry in North America is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for Surgical Sutures?The US, Canada, India, China, UK, Japan, & Germany are key areas of operation for the Surgical Sutures Market.

-

-

- Medtronic Plc

- Braun Melsungen AG

- Smith& Nephew plc

- Coloplast A/S

- Apollo Endo-surgery, Inc.

- Boston Scientific Corporation

- DemeTECH Corporation

- TEPHA INC.

- Kono Seisakusho Co, Ltd.

- Internacional Framaceutica S.A. de C.V.

- Johnson & Johnson

- Teleflex Incorporated

- Healthium MedTech

- Mellon Medical B.V.

- GPC Medical Ltd.

- Stryker Corporation

- Integra Life Sciences Corporation

- Other Key Players