Global Health Insurance Market By Provider Type (Public, Private), By Coverage Type (Term Insurance, Life time coverage), By Health insurance plan type (Point of service, Preferred provider organization, Exclusive provider organization, Health maintenance organization), By Level of Coverage type (Bronze, Silver, Gold, Platinum), By Demographics type (Minors, Adults, Seniors), By End-Users (Individuals, Corporates, Adults), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: April 2024

- Report ID: 117813

- Number of Pages: 390

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Provider Type Analysis

- By Demographics Type Analysis

- By Coverage Type Analysis

- By Level of Coverage Type Analysis

- By Health Insurance Plan Analysis

- By End User Analysis

- Key Market Segments

- Market Drivers

- Market Restraint

- Opportunities

- Trends

- Impact of Macroeconomic factors

- Regional Analysis

- Key Regions and Countries

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

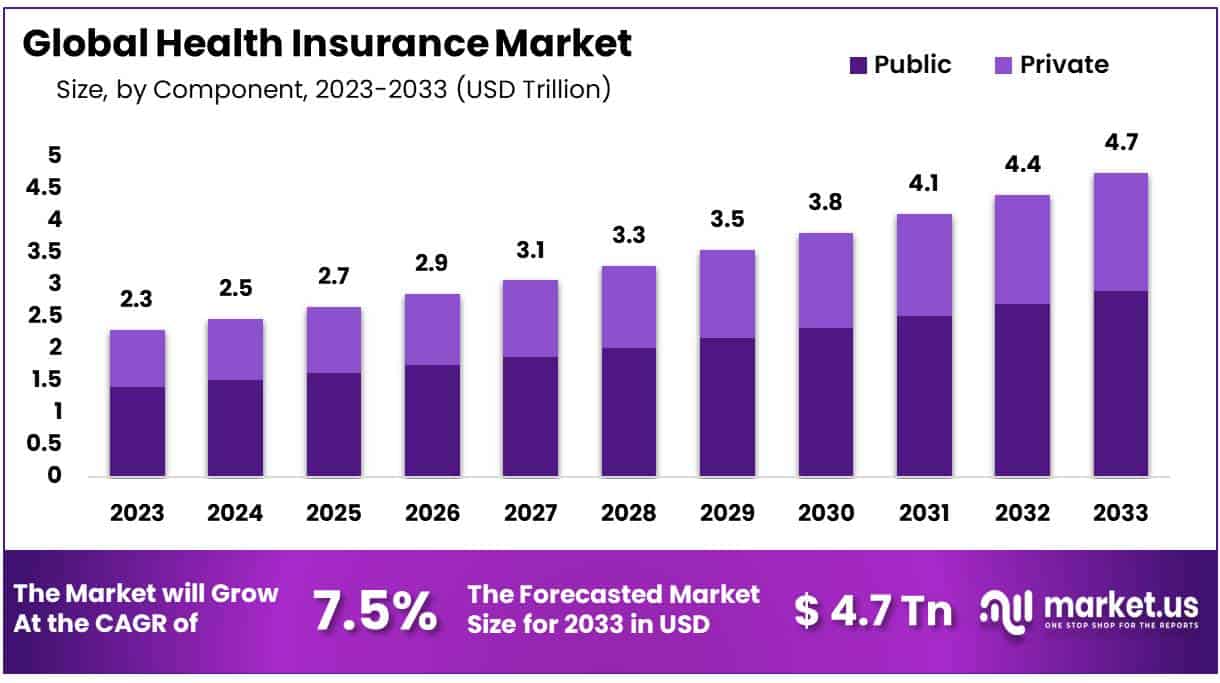

The global Health Insurance Market was valued at the USD 2.3 Trillion in 2023, and is further projected to register substantial growth of the USD 4.7 Trillion by 2033, with a 7.5% CAGR.

A coverage that pays for medical and surgical expenses incurred by the insured individual is known as health insurance. It is a contract usually made between policyholder and the insurance company, who agrees to provide financial protection by covering the costs of certain healthcare services and treatments. It pays for costs associated with receiving medical care, including ambulance fees, doctor consultation costs, hospitalization, medication, and day care procedures.

The compensation is typically based on total hospital charges reported on the original medical bills or disease diagnosis without presenting bills. Additionally, health insurance offers tax advantages for a wide range of medical disorders. Nowadays, several health insurance providers provide coverage for domiciliary care or medical supervision given at home for particular disorders.

One of the primary factor driving the global health insurance market is growing elderly population across the world, as this population is more prone to chronic illnesses. The elderly community falls under the underproductive section of the population, making it more difficult to afford extensive medical care. As a result, insurers are introducing supportive policies to cater to the geriatrics, which are expected to create lucrative opportunities. Critical illness insurance is very beneficial as they provide coverage for an array of life-threatening diseases such as cancer, stroke, heart attack, and renal failure.

These critical illnesses require extensive care with multiple hospital visits and hefty expenditure on treatment services. Thus, insurance programs for such ailments not only cover hospitalization expenses, but also aid patients pay for doctor visits, medical bills, and more, creating a favorable environment for market progress.

- According to Nation Cancer Registry Program of ICMR, cancer incidences in India surged from more than 1.3 million in 2020 to over 1.4 million in 2022.

Key Takeaways

- Based on provider type, the market is dominated by public provider type segment.

- Based on demographic types, senior citizens dominated the global health insurance market in 2023.

- Based on coverage type, a laudable market shares of 75.9% is withheld by life term insurance segment.

- Based on level of coverage type, silver segment overshadows the market occupying a valuable market share of 69.5%.

- Based on health insurance plan, preferred provider organization marks its presence as a major leader.

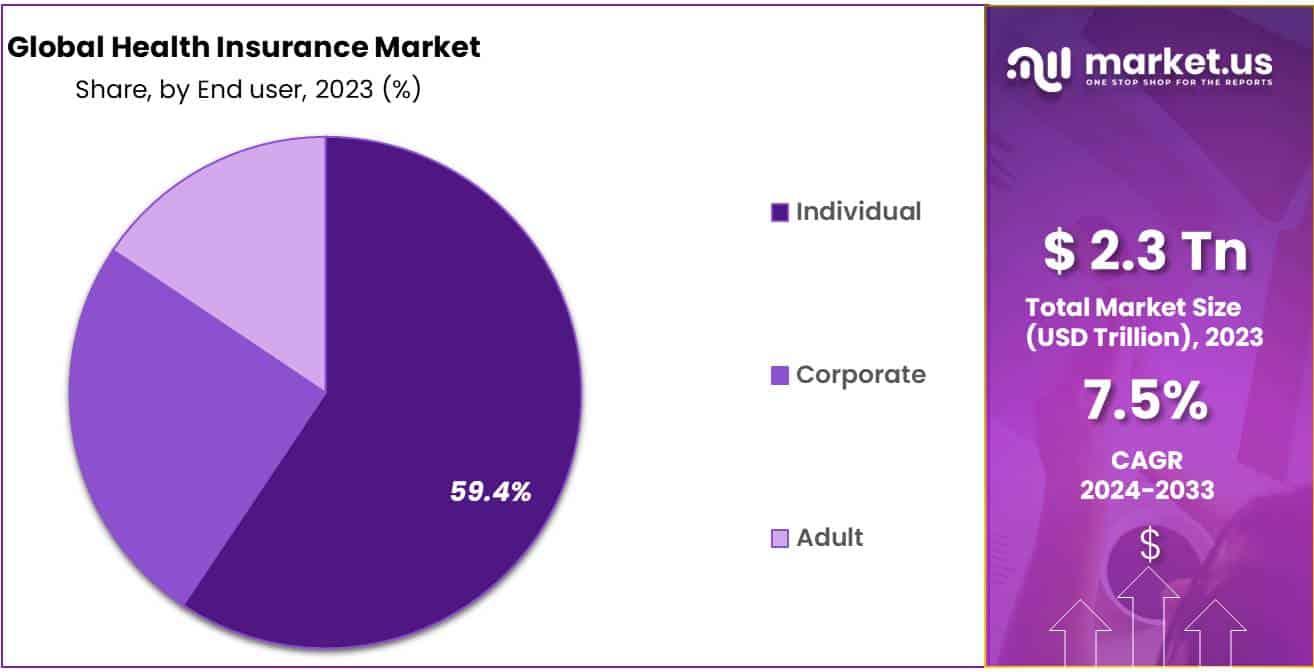

- Based on end use, individual segment occupied an impressive market portion of 59.4% in the year 2023.

By Provider Type Analysis

Public provider segment marks dominance in 2023

Based on provider type, health insurance market is broadly classified into public and private segments. Further, the public segment is categorized into Medicare and Medicaid, and the private segment into primary private health insurance, duplicate private health insurance, complementary private health insurance, and supplementary private health insurance. A notable market revenue shares of 61.2% is withheld by public provider type segment, dominating the health insurance market in the year 2023, owing to offer plans and services to all segments of population. Medicare is further subdivided into A, B, C & D, which provide inpatient, outpatient, and prescription drug coverage, respectively.

- The National Insurance Company (India) has launched Varistha Mediclaim Policy for senior citizens who are more prone to chronic ailments.

By Demographics Type Analysis

A revenue shares of 59.4% is captured by senior citizen segment

Based on demographics type, the market is bifurcated into minor, adults and senior citizen segments. In 2023, a major market revenue shares of 59.4% is captured by senior citizen segment, owing to rising prevalence of communicable and non-communicable diseases among the elder population coupled with increasing age of the world’s population.

- According to World Health Organization, in 2020, an estimate of 2.1 million people would be around aged 60 or above by 2050.

- In December 2020, health insurance for senior citizen “Respect Senior Care Rider” was launched by Bajaj Allianz (India), to provide services like emergency ambulance service, physiotherapy and nursing care at home.

By Coverage Type Analysis

Diverse advantages of life insurance segment made it a leader in health insurance market

Based on coverage type, the health insurance market is fragmented into life insurance and term insurance segments. Domination is overshadowed by life insurance segment accounting a commendable revenue share of 75.9% in the year 2023. The segmental dominance is underscored by diverse benefits offered by life policies such as permanent coverage and guaranteed death benefits. Additionally, it also aids working professionals to save taxes by investing in these types of plans.

On the other hand, fastest growth is anticipated by term insurance segment during the forecast period. This owes to the its lost cost and high coverage. It mainly includes health insurance that provides safety against the increasing cost of medical treatments and in case of health emergencies such as critical illnesses, serving as a best way to safeguard medical expenses.

By Level of Coverage Type Analysis

Silver plan segment display prominence in 2023

Based on level of coverage, the health insurance market bifurcates into bronze, silver, gold and platinum segments. Silver segment dominates the global health insurance market grabbing a valuable market share of 69.5% in the year 2023. Silver plans are most popular in the federal marketplace and state exchanges with 70.0% of the stock consumers choosing them. They are usually for those with one or two mild health conditions and require some medication.

The gold plan segment on the other hand, is anticipated to register fastest growth rate of 8.6% during the prophecy period. This is highly ascribed towards increasing prevalence of chronic diseases and the need to visit doctors very often and requires expensive medications that would be impossible to afford out of pocket.

By Health Insurance Plan Analysis

Market is ruled by preferred provider organization segment

Based on health insurance plan, the market fractionates into Point of service, Preferred provider organization, Exclusive provider organization and Health maintenance organization segment. Preferred provider organization segment led the global health insurance market accounting a remarkable market revenue share of 36.7% in the year 2023.

This is because as they are most common health plans and offer a large network of healthcare providers so that the insured person has many hospitals and doctors to choose from. In addition to this, there is little or no paper work required which creates a preference for preferred provider organization, thereby bolstering the market position.

By End User Analysis

Individual segment underscores its dominance in recent years

Based on end use, the market is broadly segmented into individuals, corporates and adult categories. Amongst these, a laudable market revenue shares of 59.4% is occupied by individual segment, dominating the market in the year 2023. This predominance owes to large number of people buying individual health plans as they are also customizable. Also, it gives more control over deductibles, co-pays, and benefits limits and is not dependent on employment status.

The corporate segment on the flip side, grows fastest owing to its low cost associated with corporate plans as compared to the individual health plans. They offer cheaper coverage for better conditions and it is easier to gain coverage for pre-existing conditions.

Key Market Segments

By Provider Type

- Public

- Private

By Demographic type

- Minor

- Adult

- Senior

By Coverage type

- Life insurance

- Term insurance

By Level of Coverage type

- Bronze

- Silver

- Gold

- Platinum

By Health insurance plan

- Point of service

- Preferred provider organization

- Exclusive provider organization

- Health maintenance organization

By End User

- Individuals

- Corporate

- Adults

Market Drivers

Growing chronic burden and rise in elderly population drive the market growth

The global health insurance market is majorly thriven by rising burden of diseases and growing geriatric population all over the world. Diverse chronic illnesses including cancer, cardiovascular diseases, respiratory diseases, neurological diseases, musculoskeletal diseases and diabetes are showcasing a steady growth. The rising obesity, physical inactivity, increased consumption of tobacco and sugar, increasing prevalence of smoking, and unhealthy food habits are the major causes behind the surging burden of chronic diseases across the globe.

In addition to this, there is rising recognition among people regarding the benefits of having health, which is robustly driving the market growth in a compact period of time.

- According to GLOBOCAN report by International agency for Research on Cancer, approximately 19.3 million new cancer cases and around 10 million cancer related deaths were reported in 2020.

- According to World Health Organization, Cardiovascular diseases are the leading cause of deaths across the globe that accounted for 32% of the global death.

- Under the government federal subsidies (US), the amount of health insurance for people under age 65 is projected to be $1.6 trillion in 2032.

Market Restraint

High premium cost to impede the market growth

The global health insurance market is expected to witness a downfall during the forecast period owing to the rise in health insurance premium costs. The rise in premium cost is because of massive claim settlement and rise in healthcare expenses such as hospital admission charges, cost of medicines, and cost of other treatments. In addition to this, the cost surged by virtue of technological advancements leading to the development of medical devices and drugs that are extremely expensive, which in turn raises the cost of treatment.

Lack of recognition among people

Another crucial factor impeding the market dimensions includes lack of awareness among people about coverages included in health insurance policy. People are unaware of diverse variety of services offered under them.

- According to survey conducted in October 2019 by Policy genius, approximately 27.2% people are unsure about health insurance policy facility in United States.

Opportunities

Rising medical treatment cost

The global health insurance market is anticipated to witness several growth opportunities owing to the increasing medical treatment cost. Technological advancements have led to the development of drugs and medical devices that are used to treat a variety of serious illnesses, injuries, or mental and physical disabilities. These advanced medical treatments being costly, surges the total cost associated with different medical procedures. In addition to this, rising ultimatum for advanced technologies among healthcare professionals to treat chronic diseases including cancer and diabetes is anticipated to foster the market during the upcoming days. Thus, an increase in medical costs robustly promotes the growth of the global market during the forecast period.

- According to National Cancer Institute, there were around 1,806,590 new cancer cases diagnoses and 606,520 cancer deaths in 2020 in United States.

Trends

Subsidized health insurance schemes: The market is boosting with provision of favorable government programs, a good regulatory environment, strong democratic factors, strong distribution channels, new product launches and new partnerships. For instance, AB PM-JAY is an entitlement based scheme funded by Indian government under Ayushman Bharat, aiming to provide INR 500,000 per family per year for secondary and tertiary care hospitalization to over 107 million vulnerable families.

Personalized policies: Personalized services improve customer experience, retain royal customers, and attract new customers.

Impact of Macroeconomic factors

The market for health insurance is profoundly impacted by government policies including healthcare reform initiatives, Medicaid expansion, and changes to insurance regulations. For instance, the insurance market in United States witnessed significant changes such as creation of health insurance exchanges and expansion of Medicaid eligibility, due to implementation of Affordable Care Act. Secondly, population demographics including age distribution, population growth rates and prevalence of chronic diseases affect the overall demand for health insurance and the types of coverage needed.

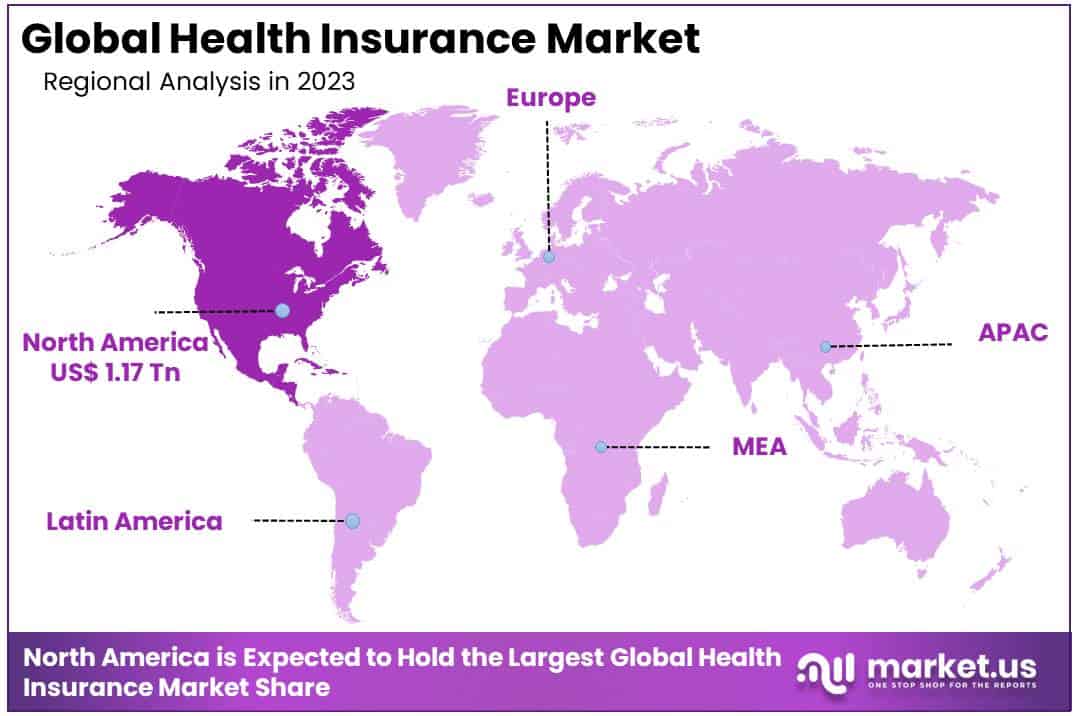

Regional Analysis

North America Holds Region Accounted Significant Share of the Global Health Insurance Market

North America leads the global health insurance market capturing an impressive market share of 51.3% in the year 2023. The dominance of the region owes to high penetration of health insurance in the region coupled with rising healthcare cost and healthcare expenditure. Most of the people rely on reimbursements for receiving the treatment. In addition to this, there is increasing prevalence of chronic illnesses in the major market like U.S., for example, approximately 60% of U.S. population is suffering from one or more chronic conditions.

Moreover, the availability of advanced healthcare infrastructure and improved access to the advanced healthcare facilities are the major benefactors behind the high healthcare cost. Thus, these factors contribute to growing success of health insurance market in North America.

Asia Pacific, on the other hand is anticipated to witness fastest growth during the prophecy period, owing to quick urbanization and growing penetration of insurance companies coupled with changing lifestyles of consumers and rising obesity leading to rising pervasiveness of chronic diseases in the region.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The global health insurance market is highly competitive in nature. This is due to the quick adoption of advanced technology for improved healthcare coupled with introduction of new products. Besides this, players are adopting various strategies such as expansion, merger and acquisition and collaboration to gain market share.

Market Key Players

The following are some of the major players in the industry

- United Healthcare

- Aetna

- Allianz

- Cigna

- Humana

- Kaiser Foundation

- Centene

- Anthem, Inc.

- Bupa

- Aviva Plc

- AIA Group Limited

Recent Developments

- In April 2023: A fully customizable, digital only health product ‘Health Edge Insurance’, was launched by SBI General to offer single comprehensive plan with nine basic indemnity coversand 18 optional covers, enabling customers to design a tailor made health insurance policy as per needed.

- In February 2023: Cigna Worldwide Insurance became the first international insurance provider to get a branch license from Saudi Central Bank, allowing the firm to operate in the kingdom of Saudi Arabia.

Report Scope

Report Features Description Market Value (2023) USD 2.3 Trillion Forecast Revenue (2033) USD 4.7 Trillion CAGR (2024-2033) 7.5% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Provider Type (Public, Private), By Coverage Type (Term Insurance, Life time coverage), By Health insurance plan type (Point of service, Preferred provider organization, Exclusive provider organization, Health maintenance organization), By Level of Coverage type (Bronze, Silver, Gold, Platinum), By Demographics type (Minors, Adults, Seniors), By End-Users (Individuals, Corporates, Adults) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape United Healthcare, Aetna, Allianz, Cigna, Humana, Kaiser Foundation, Centene, Anthem, Inc., Bupa, Aviva Plc, AIA Group Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the health insurance market?The health insurance market refers to the sector where insurance companies offer policies that provide financial coverage for medical expenses incurred by individuals or groups.

How big is the Health Insurance Market?The global Health Insurance Market size was estimated at USD 2.3 Trillion in 2023 and is expected to reach USD 4.7 Trillion in 2033.

What is the Health Insurance Market growth?The global Health Insurance Market is expected to grow at a compound annual growth rate of 7.5%. From 2024 To 2033

Who are the key companies/players in the Health Insurance Market?Some of the key players in the Health Insurance Markets are United Healthcare, Aetna, Allianz, Cigna, Humana, Kaiser Foundation, Centene, Anthem, Inc., Bupa, Aviva Plc, AIA Group Limited.

Why is health insurance important?Health insurance is essential because it helps individuals and families afford medical care, including doctor visits, medications, hospital stays, and surgeries, without facing significant financial burdens.

How does the health insurance market work?In the health insurance market, individuals or employers purchase insurance policies from insurance companies. These policies typically require regular premium payments in exchange for coverage. When policyholders need medical care, the insurance company pays a portion of the costs according to the terms of the policy.

What factors influence the health insurance market?Various factors impact the health insurance market, including government regulations, healthcare costs, medical advancements, demographic trends, consumer preferences, and economic conditions.

What are some current trends in the health insurance market?Recent trends in the health insurance market include rising healthcare costs, increasing demand for telehealth services, greater emphasis on preventive care, expansion of health savings accounts (HSAs), and the integration of technology to improve efficiency and customer experience.

-

-

- United Healthcare

- Aetna

- Allianz

- Cigna

- Humana

- Kaiser Foundation

- Centene

- Anthem, Inc.

- Bupa

- Aviva Plc

- AIA Group Limited