Global Pet Care Market By Pet Type (Dog, Cat, Fish, Bird, Others), By Type (Products, Food), By Distribution Channel (Online, Offline), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2025

- Report ID: 137749

- Number of Pages: 360

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

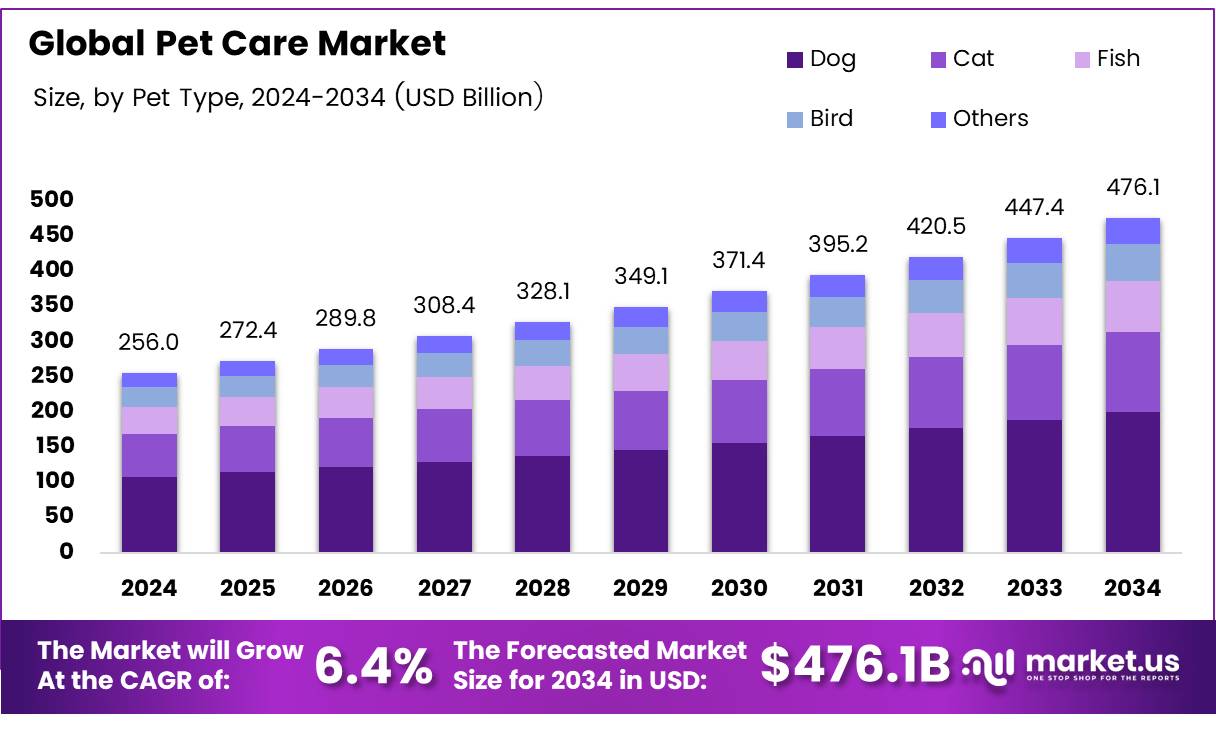

The Global Pet Care Market size is expected to be worth around USD 476.1 Billion by 2034, from USD 256.0 Billion in 2024, growing at a CAGR of 6.4% during the forecast period from 2025 to 2034.

Pet care encompasses the practices, products, and services aimed at maintaining the health, hygiene, and well-being of pets. This field includes veterinary services, grooming, nutrition, training, and the burgeoning area of pet tech, which features apps and devices for monitoring pet health and activity. The Pet Care Market represents the commercial landscape that caters to these needs, extending from traditional pet food manufacturers to innovative startups offering connected devices for pets.

The pet care industry has evolved significantly over the past decade, driven by a deeper understanding of animal health and the humanization of pets. Consumers increasingly view their pets as family members, prompting a surge in spending on premium care services and products.

According to the American Veterinary Medical Association (AVMA), while the cat population has seen steady growth, rising from 59.8 million in 1996 to 73.8 million in 2024, pet care preferences have also shifted towards more sophisticated, health-oriented products. The focus on comprehensive health solutions has bolstered the market for specialized nutrition and health monitoring systems.

The Pet Care Market is experiencing robust growth, underscored by a significant increase in consumer expenditure. In 2024, Americans spent a staggering $147 billion on pets, as reported by the American Pet Products Association via Reuters. This uptrend is facilitated by both rising pet ownership and the increased per capita spending on pets.

Insurance for pets has also seen a marked increase, with insured pets in the U.S. growing from 2.2 million in 2018 to 4.8 million in 2022, predominantly dogs, which make up 80.1% of insured pets according to Consumer Affairs. This growth in insurance uptake is indicative of pet owners’ increasing commitment to ensuring their pets’ health and well-being.

The pet care market’s growth is further catalyzed by government investments and regulatory frameworks aimed at animal welfare and product safety, which reassure consumers about the quality of pet care products.

Opportunities for expansion abound in areas such as organic and natural pet foods, advanced veterinary health services, and technological innovations for pet care. Regulations ensuring the safety and efficacy of pet care products help maintain high industry standards and consumer trust, laying a foundation for sustained growth.

Governments worldwide are enhancing their regulatory oversight on pet care products, which is pivotal in fostering market growth by ensuring product safety and efficacy. The introduction of calming products for pets is a prime example of market responsiveness to consumer needs.

According to the American Pet Products Association, the use of such products has seen a remarkable increase from 2018 to 2024, with 59% of dog owners and 52% of cat owners now using calming products, up from 22% and 19% respectively. This trend underscores not only the growth potential in the pet care market but also the industry’s agility in responding to the evolving consumer preferences and needs.

Key Takeaways

- The global pet care market is projected to reach USD 476.1 billion by 2034, growing at a CAGR of 6.4% from 2025 to 2034.

- Dogs represented the largest pet type in 2024, with a 41.2% market share due to the growing trend of pet humanization.

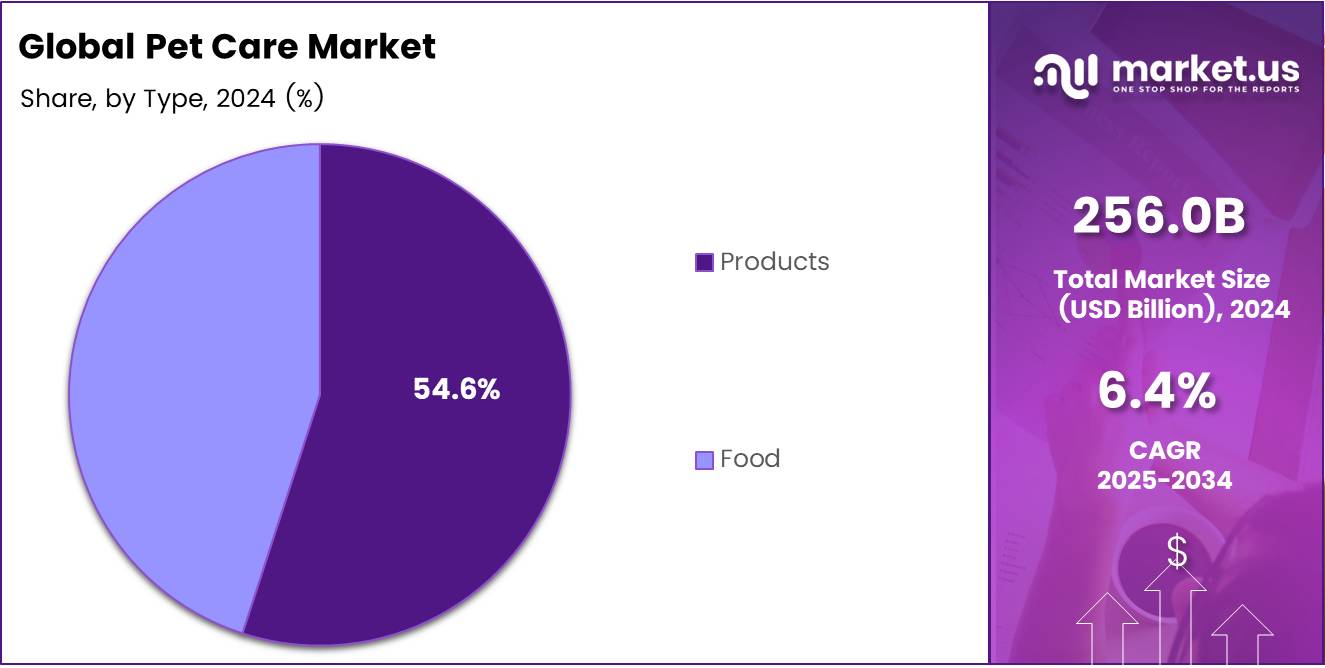

- The product segment dominated the market in 2024, holding a 54.6% share, including items like pet litter, grooming products, and accessories.

- Online channels led the distribution channel segment in 2024, driven by consumer convenience, competitive pricing, and product variety.

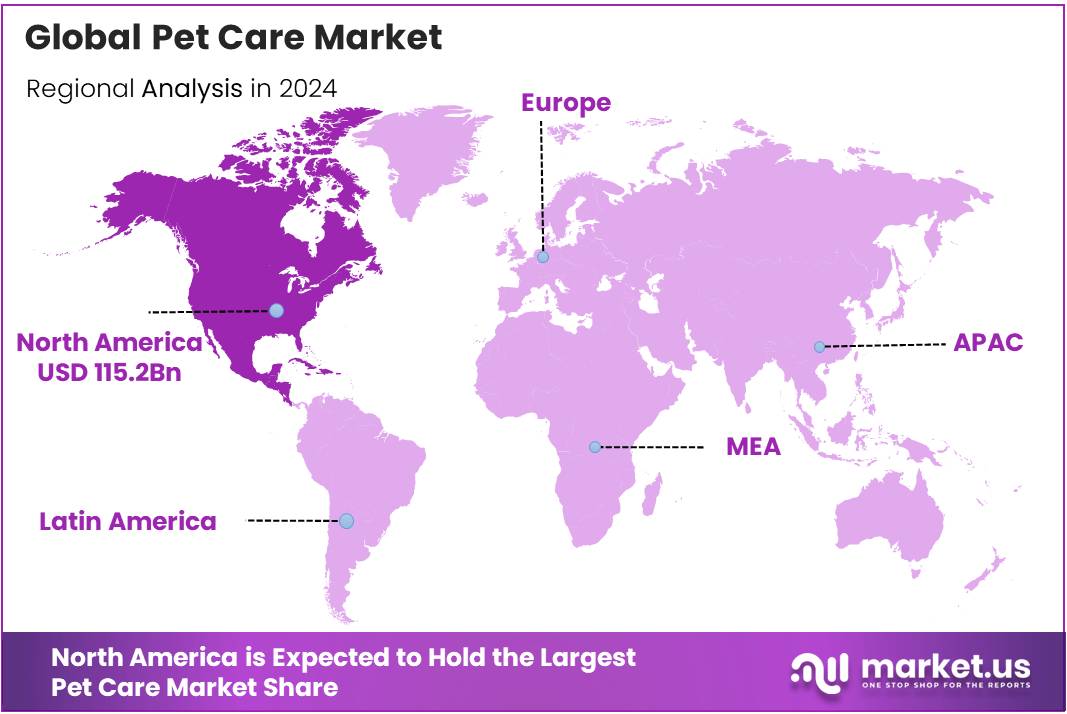

- North America is the leading region, with a 45.3% market share valued at USD 115.2 billion, fueled by high pet ownership and premium product demand.

Pet Type Analysis

In 2024, Dog Dominated the Pet Care Market with a 41.2% Share in the By Pet Type Analysis Segment

In 2024, the Pet Care Market witnessed Dogs as the leading pet type, commanding a dominant share of 41.2%. This dominance can be attributed to the increasing trend of pet humanization, where dogs are considered integral family members.

Factors such as rising disposable incomes, enhanced focus on pet health, and the growing popularity of premium pet products have bolstered the segment’s growth. As pet owners increasingly seek high-quality food, grooming, and healthcare services, the demand for dog-related pet care products has soared, reinforcing their significant market position.

Cats followed as the second-largest segment, benefiting from their lower maintenance needs and growing urban pet adoption trends. However, dogs remain the preferred choice for many families and individuals, particularly in regions like North America and Europe, where dog ownership is culturally prevalent.

The Fish and Bird segments continue to show steady growth but remain niche markets compared to dogs and cats. Fish care products have seen a surge in popularity due to the rising interest in aquariums and aquatic pets, while the Bird segment thrives on the appeal of companionship and relatively lower care requirements.

The Others category, which includes exotic pets, remains a small but growing segment, driven by increasing interest in unique pet ownership.

Type Analysis

Products Segment Dominates with 54.6% Share in By Type Analysis

In 2024, Products held a dominant market position in the By Type Analysis segment of the Pet Care Market, with a 54.6% share. This segment encompasses a wide range of pet-related offerings, including pet litter, grooming products, fashion items, toys, and accessories.

The growing demand for pet grooming and hygiene products, coupled with increasing awareness about pet well-being, has significantly contributed to the strong performance of this category. Pet fashion and accessories, which continue to gain traction, also play a key role in driving the product segment’s growth, as pet owners increasingly treat their pets as family members, investing in both functionality and aesthetics.

The Food segment, while still substantial, accounted for a smaller share in comparison, comprising products like dry food, wet/canned food, and treats/snacks. This segment caters to the essential dietary needs of pets and sees steady demand driven by pet health trends and convenience preferences among pet owners.

The balance between food and product categories highlights the shifting consumer focus on providing pets with a holistic care experience, blending nutrition and lifestyle-oriented products. However, it is the Products segment that continues to lead the way in shaping the market’s evolution.

Distribution Channel Analysis

Online Dominated the Pet Care Market’s Distribution Channel in 2024

In 2024, online channels held a dominant market position in the By Distribution Channel Analysis segment of the Pet Care Market. E-commerce platforms, fueled by consumer convenience, competitive pricing, and increased product variety, led the charge, capturing a significant share of the market.

The shift towards online shopping, accelerated by the ongoing digital transformation and changing consumer behaviors, allowed pet owners to access a wide range of products from pet food to accessories with ease. The growing popularity of subscription-based services and direct-to-consumer brands further enhanced the online market’s appeal.

Offline channels, including pet stores and supermarkets, continued to play an essential role in the market. Despite the increasing preference for online shopping, brick-and-mortar retailers remained influential, particularly for consumers seeking immediate product availability and personalized customer service.

Physical stores also maintained a steady consumer base, especially in regions where internet penetration is lower or among older demographics who prefer traditional shopping experiences.

Key Market Segments

By Pet Type

- Dog

- Cat

- Fish

- Bird

- Others

By Type

- Products

- Pet Litter

- Pet Grooming Products

- Fashion, Toys, and Accessories

- Food

- Dry Food

- Wet/ Canned

- Treats/ Snacks

By Distribution Channel

- Online

- Offline

Drivers

Increased Pet Ownership Drives Market Growth

The pet care market is experiencing significant growth, driven by several key factors. One of the main drivers is the increase in pet ownership, particularly noticeable during the COVID-19 pandemic when more people adopted pets due to lockdowns and more time spent at home. As a result, more households are investing in pet care products and services to ensure their pets are well taken care of.

Another key trend is the humanization of pets, where owners increasingly treat their pets like family members. This shift is driving demand for premium, high-quality pet food, health products, and even luxury services such as grooming and boarding. Additionally, there is a growing awareness of pet health and wellness, which is leading to an uptick in spending on veterinary care, supplements, and other health-related products.

Pet owners are now more willing to invest in advanced healthcare options for their pets, from routine check-ups to specialized treatments, which further boosts the market. These trends are expected to continue, with pet owners increasingly prioritizing the well-being and comfort of their pets, which creates a strong demand for a wide range of pet care products and services.

The combination of these factors is shaping a rapidly expanding market, with both new and established players looking to cater to the evolving needs of pet owners.

Restraints

High Cost of Pet Care Products and Services

One of the main challenges in the pet care market is the high cost of premium products and services, which can be a significant barrier for many pet owners. Many consumers are unable to afford the high prices of specialty pet foods, grooming services, or advanced health treatments, especially when considering ongoing expenses.

For instance, organic or veterinarian-recommended pet foods, as well as regular checkups, surgeries, or treatments for pets with health conditions, can quickly add up. This puts financial pressure on pet owners, especially in regions where income levels are lower or the cost of living is high. While there is a growing demand for high-quality pet care, many consumers may opt for cheaper, lower-quality alternatives, which can limit the market potential for premium products.

Additionally, some pet care businesses are forced to balance their pricing between premium and budget options, often making it difficult to cater to a wide range of consumers without sacrificing service quality.

Furthermore, regulatory constraints on pet care products, such as pet food and medicine regulations, can add costs for manufacturers, which are often passed on to the consumer. These cost barriers could slow the growth of the pet care market, especially in emerging economies or in households with limited disposable income.

Growth Factors

Expanding into Emerging Markets as Pet Ownership Grows

The pet care market is experiencing significant growth, especially in developing economies where pet ownership is rising rapidly. As more people in emerging markets adopt pets, there is a strong demand for products and services catering to this new wave of pet owners. This presents an opportunity for businesses to expand their presence in these regions, where the market is still growing and untapped.

Additionally, pet owners are becoming more conscious of their pets’ health, leading to the rise of customized pet food solutions. Tailored diets based on a pet’s specific health needs, age, and breed are becoming increasingly popular, creating opportunities for brands to offer more personalized products. This trend is expected to continue, as pet owners seek better nutritional options for their animals. Alongside this, eco-friendly and sustainable pet care products are gaining traction.

Consumers are more aware of the environmental impact of their purchases and are choosing products made from biodegradable, recyclable, or organic materials. This growing demand for eco-conscious products presents a valuable opportunity for businesses to innovate and meet these new consumer expectations.

By focusing on these trends—expansion into emerging markets, customized pet food, and eco-friendly products—companies can tap into a rapidly growing sector and position themselves as leaders in the pet care industry.

Emerging Trends

Growing Demand for Natural Products and Pet Health Tech

The pet care market is seeing several key trends, with one of the biggest being the rising demand for natural and organic products. Pet owners are becoming more conscious of the ingredients in their pets’ food and care items, preferring non-GMO, eco-friendly, and organic options. This shift is driven by a desire to keep pets healthier and avoid harmful chemicals.

Additionally, wearable technology for pets is gaining traction, as pet owners are increasingly using gadgets like GPS trackers and health monitors to keep tabs on their pets’ well-being.

These devices help track vital signs, monitor activity levels, and even prevent pets from getting lost, adding a layer of safety and convenience. Alongside this, there’s a growing focus on pet fitness and obesity management, as more pets, especially in urban environments, are becoming overweight.

Products like specialized weight-loss food, fitness equipment, and even pet gyms are emerging to help owners manage their pets’ health. As awareness around pet health grows, consumers are seeking products and services that not only improve their pets’ physical well-being but also ensure long-term happiness.

These factors are reshaping the pet care industry, with businesses adapting to meet the needs of a more health-conscious pet-owning population. The market is increasingly focused on merging technology, wellness, and sustainability, making the pet care landscape more innovative and diverse.

Regional Analysis

North America Leads the Pet Care Market with 45.3% Share and USD 115.2 Billion

North America is the leading region in the global pet care market, holding a dominant market share of 45.3%, valued at USD 115.2 billion. The growth of the pet care market in North America is driven by high pet ownership rates, particularly in the United States, where approximately 67% of households own pets. This strong demand is further fueled by an increasing focus on pet humanization, with pet owners seeking premium, specialized products for their pets.

Trends such as increased spending on pet health, grooming, and organic pet food, combined with the growing popularity of pet insurance and veterinary care, are propelling market growth in the region. Additionally, the expansion of e-commerce platforms for pet product sales and an overall rise in disposable income contribute to the steady growth of the North American market.

Regional Mentions:

Europe represents a significant portion of the global pet care market, with increasing demand for organic, sustainable, and high-quality pet products. Major markets within Europe, including Germany, the UK, and France, have seen a rise in pet adoption, particularly in urban centers. The growing trend of pet humanization and a shift towards healthier, eco-friendly pet products are notable drivers of the market in this region.

The Asia Pacific region is experiencing rapid growth in the pet care market, driven by rising pet adoption, particularly in countries such as China, Japan, and India. The growing middle class and increasing disposable income are leading consumers to invest in higher-quality pet products.

The Middle East & Africa region is witnessing steady growth in the pet care market, particularly in the UAE, Saudi Arabia, and South Africa. Pet ownership is on the rise, fueled by urbanization and changing attitudes towards pets as family members. As disposable income increases, demand for high-quality pet care products, including food, grooming services, and healthcare, is expanding.

In Latin America, Brazil and Mexico are the largest markets, with increasing rates of pet adoption and greater consumer awareness about pet health. Rising disposable incomes, urbanization, and the growing trend of humanizing pets are contributing to the region’s market growth. As pet owners increasingly seek premium products for their pets, the demand for specialized pet food, grooming products, and healthcare services is expected to continue rising.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global pet care market remains highly competitive, driven by the increasing humanization of pets, evolving consumer preferences, and a growing demand for premium and health-focused products. The key players shaping this market in 2024 include a mix of established global giants and specialized brands that continue to expand their product portfolios.

Mars, Incorporated and Nestlé Purina PetCare, as two of the largest players, dominate the global pet food and care landscape. Their vast distribution networks and strong brand equity, combined with their focus on nutritional innovation and pet health, position them as leaders in both developed and emerging markets. These companies continue to capitalize on the growing trend of premiumization, offering specialized products, such as organic, natural, and breed-specific food.

Hill’s Pet Nutrition is another major player benefiting from its focus on pet health and scientific research, particularly in therapeutic pet food. Their strategic investment in R&D has enabled them to capture the growing demand for functional, health-oriented pet products.

Companies like Champion Petfoods and Blue Buffalo Co., Ltd. are notable for their commitment to high-quality, natural ingredients, which resonate with the increasingly health-conscious consumer base. These brands are gaining traction, especially among affluent pet owners looking for premium, grain-free, and protein-rich products.

On the other hand, Petmate Holdings Co. and Ancol Pet Products Limited offer a diversified portfolio that includes pet toys, accessories, and grooming products, catering to the non-food segment of the market. Their innovation in pet care solutions and strong retail presence allow them to thrive alongside food-focused brands.

Saturn Petcare GmbH, Tail Blazers, and The Hartz Mountain Corporation maintain strong positions within specific niches, focusing on natural, eco-friendly, and affordable products, respectively. Their ability to meet specific consumer needs is essential as pet owners increasingly seek sustainability and value in pet products.

Top Key Players in the Market

- Ancol Pet Products Limited

- Champion Petfoods LP

- Hill`s Pet Nutrition, Inc.

- Blue Buffalo Co., Ltd.

- Petmate Holdings Co

- Saturn Petcare GmbH

- Mars, Incorporated

- Nestle Purina PetCare

- Tail Blazers

- The Hartz Mountain Corporation

Recent Developments

- In February 2024, Pet care startup Supertails secured $15 million in funding to strengthen its market position, focusing on expanding its private label business for pet care products.

- In March 2024, Pet care startup Sploot raised Rs 5.2 crore from Info Edge to enhance its product offerings and expand its digital platform catering to pet wellness and services.

- In February 2024, Papa Pawsome, a pet care brand, raised $400,000 in a seed round led by the Indian Angel Network (IAN) to boost its product development and brand outreach in the pet grooming space.

- In January 2024, UK-based Biscuit Pet Care raised €3.4 million in seed funding to expand its range of natural pet treats and accelerate growth in international markets.

Report Scope

Report Features Description Market Value (2024) USD 256.0 Billion Forecast Revenue (2034) USD 476.1 Billion CAGR (2025-2034) 6.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Pet Type (Dog, Cat, Fish, Bird, Others), By Type (Products, Food), By Distribution Channel (Online, Offline) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Ancol Pet Products Limited, Champion Petfoods LP, Hill`s Pet Nutrition, Inc., Blue Buffalo Co., Ltd., Petmate Holdings Co, Saturn Petcare GmbH, Mars, Incorporated, Nestle Purina PetCare, Tail Blazers, The Hartz Mountain Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Ancol Pet Products Limited

- Champion Petfoods LP

- Hill`s Pet Nutrition, Inc.

- Blue Buffalo Co., Ltd.

- Petmate Holdings Co

- Saturn Petcare GmbH

- Mars, Incorporated

- Nestle Purina PetCare

- Tail Blazers

- The Hartz Mountain Corporation