Global Pet Mobility Aids Market By Pet Type (Dogs, Cats, and Others), By Product (Wheelchairs, Splints & Braces, Ramps & Steps, Prosthetics, and Others), By Distribution Channel (Retail Stores, E-commerce, and Veterinary Hospitals & Clinics), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2025

- Report ID: 137633

- Number of Pages: 260

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Pet Type Analysis

- Product Analysis

- By Distribution Channel Analysis

- Key Segments Analysis

- Market Dynamics

- Market Restraints

- Market Opportunities

- Impact of macroeconomic factors / Geopolitical factors

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

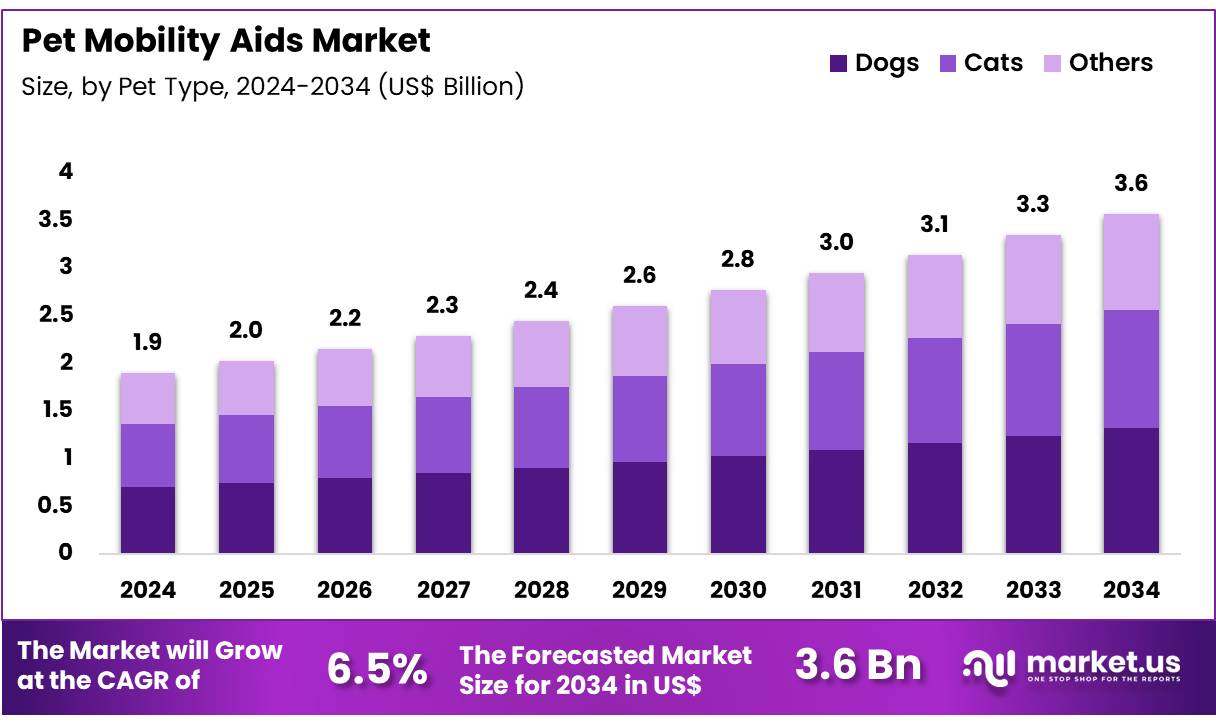

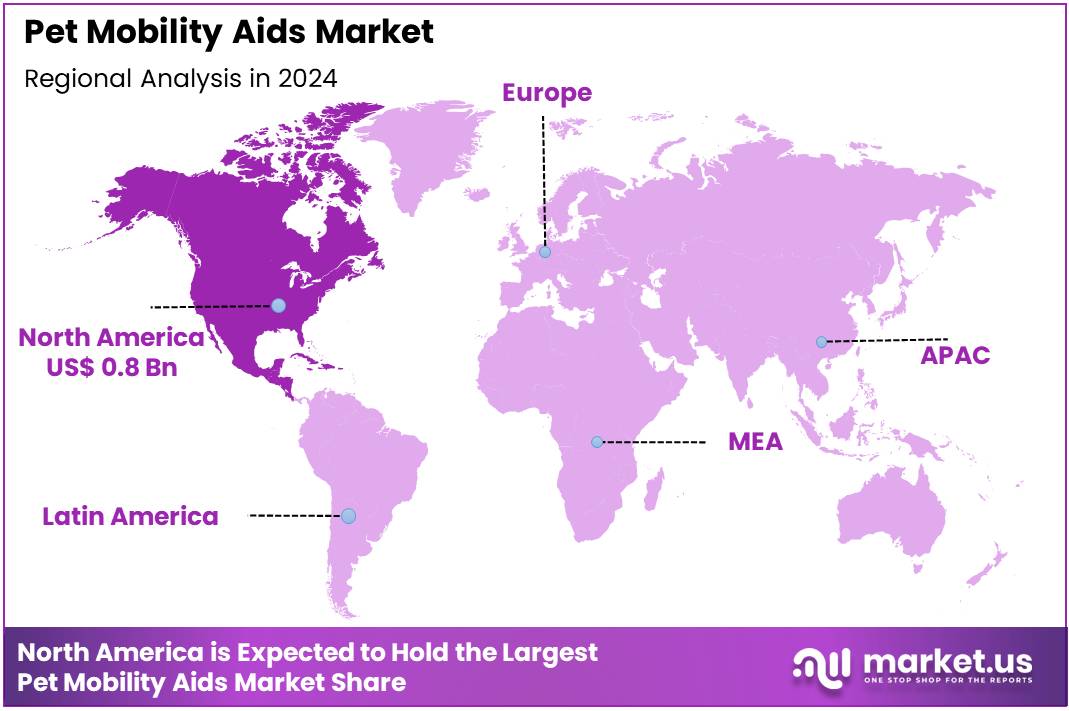

Global Pet Mobility Aids Market size is expected to be worth around US$ 3.6 Billion by 2033 from US$ 1.9 Billion in 2024, growing at a CAGR of 6.5% during the forecast period from 2024 to 2033. In 2023, North America led the market, achieving over 42% share with a revenue of US$ 0.8 Billion.

The pet mobility aids market is driven by rising pet ownership and the growing trend of pet humanization, where pets are treated as family members. Increasing awareness of pet health and advancements in veterinary care have fuelled the demand for mobility solutions like wheelchairs, harnesses, and braces. Ageing pet populations and the prevalence of joint disorders such as arthritis are significant growth factors.

Technological innovations, including lightweight and customizable designs, further enhance market appeal. However, challenges like high product costs and limited awareness in developing regions may hinder growth. The market’s competitive landscape is shaped by key players focusing on innovation, partnerships, and e-commerce expansions to cater to a growing consumer base.

Key Takeaways

- The global pet mobility aids market was valued at USD 1.9 billion in 2024 and is anticipated to register substantial growth of USD 3.6 billion by 2033, with 6.5% CAGR.

- In 2024, the dogs segment took the lead in the global market, securing 37% of the total revenue share.

- The wheelchairs segment took the lead in the global market, securing 34% of the total revenue share.

- North America maintained its leading position in the global market with a share of over 38% of the total revenue.

Pet Type Analysis

Based on pet type the market is fragmented into dogs, cats, and others. Amongst these, dogs dominated the global pet mobility aids market capturing a significant market share of 53% in 2024. Dogs dominate the global pet mobility aids market due to their widespread adoption and active lifestyles, which make mobility challenges more noticeable compared to other pets. Conditions such as arthritis, hip dysplasia, and injuries are common in dogs, particularly among ageing and large breeds, driving the demand for products like wheelchairs, braces, and harnesses.

The humanization of pets has also led dog owners to invest significantly in their pets’ health and well-being, including mobility solutions. Technological advancements have resulted in highly customizable and comfortable aids tailored to different dog sizes and conditions, further boosting adoption.

- In 2024, a survey by the American Pet Products Association revealed that 58 million U.S. households have at least one dog as a pet.

Product Analysis

The market is fragmented by product into wheelchairs, splints & braces, ramps & steps, prosthetics, and others. Wheelchairs dominated the global pet mobility aids market capturing a significant market share of 49% in 2024 due to their effectiveness in assisting pets with severe mobility impairments caused by conditions such as paralysis, arthritis, or spinal injuries. These devices provide support for pets unable to use their hind or front limbs, significantly improving their quality of life.

Wheelchairs are widely preferred due to their adaptability, with adjustable designs catering to pets of various sizes and species. Technological advancements, such as lightweight materials and foldable features, have enhanced their usability and appeal among pet owners. The increasing awareness of pet rehabilitation and the growing trend of pet humanization further drive the demand for wheelchairs. Companies are undertaking various initiatives to alleviate pain and restore mobility for pets.

- For example, in July 2023, Walkin’ Pets enabled a 12-year-old paralyzed dog to regain mobility with the use of a wheelchair.

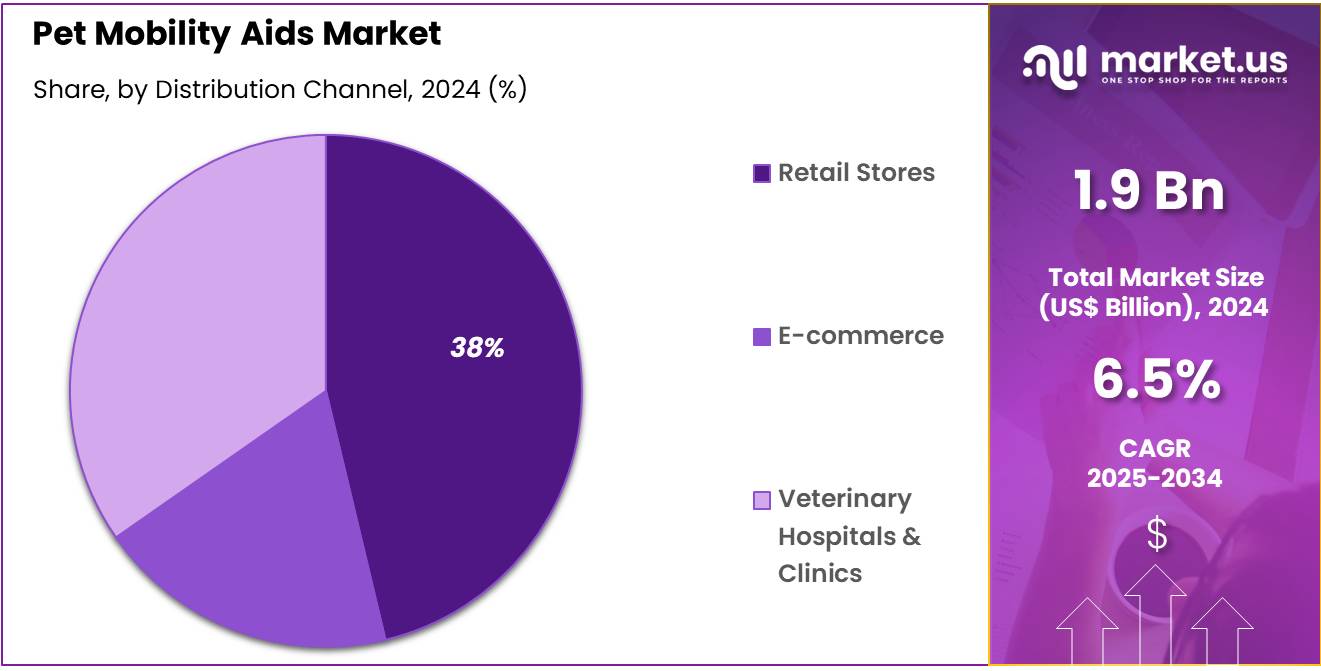

By Distribution Channel Analysis

The market is fragmented by distribution channels into retail stores, e-commerce, veterinary hospitals & clinics. Retail stores dominated the global pet mobility aids market capturing a significant market share of 56% in 2024 due to their ability to provide a hands-on shopping experience, allowing pet owners to evaluate products physically before purchase.

Many consumers prefer retail stores for their immediate product availability and the opportunity to seek personalized recommendations from store staff. Speciality pet stores and large retail chains offer a wide range of mobility aids, including wheelchairs, braces, and harnesses, catering to diverse pet needs.

The dominance of retail stores is further supported by their strategic locations, making them easily accessible to urban and suburban customers. Additionally, promotional activities, in-store discounts, and bundled offers attract a significant customer base.

Key Segments Analysis

By Pet Type

- Dogs

- Cats

- Others

By Product

- Wheelchairs

- Splints & Braces

- Ramps & Steps

- Prosthetics

- Others

By Distribution Channel

- Retail Stores

- E-commerce

- Veterinary Hospitals & Clinics

Market Dynamics

Rising Awareness about Pet Health

Rising awareness about pet health is a key driver of growth in the pet mobility aids market, as more pet owners recognize the importance of addressing mobility challenges in aging, injured, or disabled pets. Increased access to veterinary care and information has highlighted conditions such as arthritis, hip dysplasia, and paralysis, prompting demand for solutions like wheelchairs, harnesses, and braces.

Campaigns and educational initiatives by veterinary organizations and pet product companies further emphasize the benefits of mobility aids, encouraging adoption. The trend of pet humanization, where pets are treated as family members, has also contributed to a growing willingness among owners to invest in advanced mobility solutions.

Market Restraints

High Costs Associated with Advanced Pet Mobility Aids

The high costs associated with advanced pet mobility aids pose a significant restraint on the growth of the pet mobility aids market. Products such as custom-designed wheelchairs, orthopedic braces, and prosthetics often involve sophisticated materials, advanced manufacturing processes, and specialized fitting, leading to elevated prices. These costs can be prohibitive for many pet owners, especially in regions with lower disposable incomes.

While the trend of pet humanization encourages spending on pet care, affordability remains a barrier for middle-income households. Furthermore, limited insurance coverage for pet medical expenses in most countries exacerbates the financial burden on owners seeking mobility solutions for their pets.

The cost factor also impacts adoption rates in emerging markets, where awareness and access to such products are still developing. To address this challenge, market players are focusing on cost-effective innovations and offering flexible payment options, aiming to make mobility aids accessible to a broader consumer base.

Market Opportunities

New Product Launches

New product launches and approvals are driving growth opportunities in the Global Pet Mobility Aids Market by expanding the range of available treatment options and improving patient outcomes. Pharmaceutical companies are increasingly focusing on developing novel antibiotics and combination therapies to address the challenges posed by antibiotic resistance.

Recent approvals of advanced antibiotics with broader efficacy against Group A Streptococcus (GAS) are boosting the market, as these drugs offer more effective treatment for resistant strains. In addition to antibiotics, new symptomatic relief products such as pain relievers, throat sprays, and lozenges are being introduced to complement existing therapies. These products help manage symptoms while antibiotics target the infection.

- In January 2024, Walkin’ Pets introduced an innovative product line of mobility solutions for companion animals. The exclusive launch debuted at the Veterinary Meeting & Expos (VMX) held at the Orange County Convention Center in Florida.

Impact of macroeconomic factors / Geopolitical factors

Macroeconomic factors, such as rising disposable incomes, urbanization, and ageing pet populations, drive demand for pet mobility aids, while inflation and economic slowdowns can limit affordability. Exchange rate fluctuations impact import-export dynamics, influencing product costs. Geopolitical factors, including trade policies, tariffs, and regional conflicts, disrupt supply chains, increasing costs and limiting availability.

Regulatory shifts emphasizing sustainability may raise production costs, while pandemics or health crises cause supply disruptions. Stable economic and political environments foster market growth, but uncertainties highlight the need for diversified supply chains and adaptive pricing strategies to ensure resilience in the pet mobility aids market.

Latest Trends

The pet mobility aids market is witnessing trends driven by increasing pet humanization and advancements in technology. Lightweight, customizable mobility aids with improved materials, such as carbon fiber, are gaining traction. Smart mobility devices with GPS trackers and health monitoring features are emerging, enhancing functionality.

Growing awareness about pet rehabilitation and orthopaedic conditions is boosting demand for innovative solutions like adjustable wheelchairs and harnesses. Sustainable and eco-friendly products are also becoming popular, aligning with consumer preferences. Additionally, the rise of e-commerce platforms is simplifying access to these aids, expanding market reach and enabling manufacturers to offer tailored products globally.

Regional Analysis

North America held a significant 42% share of the pet mobility aids market driven by advanced veterinary infrastructure and government support for pet health innovations. The growing trend of pet humanization, where pets are treated as family members, encourages owners to invest in mobility aids that enhance pet well-being.

- According to August 2024 data from the American Pet Products Association, 31% of cat owners use leashes, and 23% use harnesses, reflecting increased adoption of mobility aids for outdoor activities. This represents a notable rise since 2018, highlighting the region’s commitment to improving pet care and driving market growth.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The competitive landscape of the pet mobility aids market is characterized by a mix of established companies and innovative startups. Key players, including Walkin’ Pets, K9 Carts, and Eddie’s Wheels, leverage strong brand presence and product customization to maintain market dominance. Smaller companies are gaining traction through niche offerings and affordability.

E-commerce platforms have intensified competition, enabling players to expand global reach and enhance accessibility. Innovation in lightweight materials, smart features, and sustainability is a major focus, with companies investing in R&D to differentiate their products. Strategic collaborations and regional expansions are also shaping the market’s competitive dynamics.

Walkin’ Pets specializes in mobility solutions for pets with disabilities or age-related challenges. Known for its innovative Walkin’ Wheels dog wheelchair, the company provides a range of adjustable and customizable products for pets of all sizes. With a focus on quality and comfort, Walkin’ Pets aims to improve pet mobility and overall quality of life.

In addition, Bionic Pets designs and manufactures custom prosthetics and orthotics for animals. Using cutting-edge technology like 3D printing, the company creates personalized solutions for pets with limb deformities or amputations. Bionic Pets is dedicated to enhancing mobility and helping animals live fuller lives.

Top Key Players in the Pet Mobility Aids Market

- Petco Animal Supplies, Inc.

- Chewy, Inc.

- Walkin’ Pets

- Bionic Pets

- Animal Ortho Care

- K-9 Orthotics & Prosthetics Inc.

- Petmate

- PetSafe

- WIMBA

- Paw Prosper

- OrthoVet LLC

Recent Developments

- In November 2024, Paw Prosper acquired K9 Mobility to enhance its presence in Europe via a dedicated e-commerce platform. This strategic move aims to improve accessibility for consumers, driving greater adoption of pet mobility aids.

- In October 2023, Sleepypod, a leading pet products company, introduced a harness designed for walking and anxiety relief, offering a dual-purpose solution for pet owners.

- In June 2023, LOVEPLUSPET, a company specializing in pet accessories, launched advanced leg braces. These braces are specifically designed to assist dogs suffering from arthritis in both the back and front legs.

Report Scope

Report Features Description Market Value (2024) US$ 1.9 billion Forecast Revenue (2033) US$ 3.6 billion CAGR (2025-2034) 6.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Pet Type (Dogs, Cats, and Others), By Product (Wheelchairs, Splints & Braces, Ramps & Steps, Prosthetics, and Others), By Distribution Channel (Retail Stores, E-commerce, and Veterinary Hospitals & Clinics) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Petco Animal Supplies, Inc., Chewy, Inc., Walkin’ Pets, Bionic Pets, Animal Ortho Care, K-9 Orthotics & Prosthetics Inc., Petmate, PetSafe, WIMBA, Paw Prosper, OrthoVet LLC and other key players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Petco Animal Supplies, Inc.

- Chewy, Inc.

- Walkin' Pets

- Bionic Pets

- Animal Ortho Care

- K-9 Orthotics & Prosthetics Inc.

- Petmate

- PetSafe

- WIMBA

- Paw Prosper

- OrthoVet LLC