Global Insulin Pump Market By Product Type (Pumps and Accessories), By Indication (Type 1 Diabetes and Type 2 Diabetes), By End-User (Hospitals & Clinics, Homecare, and Labora0tories), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 102127

- Number of Pages: 344

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

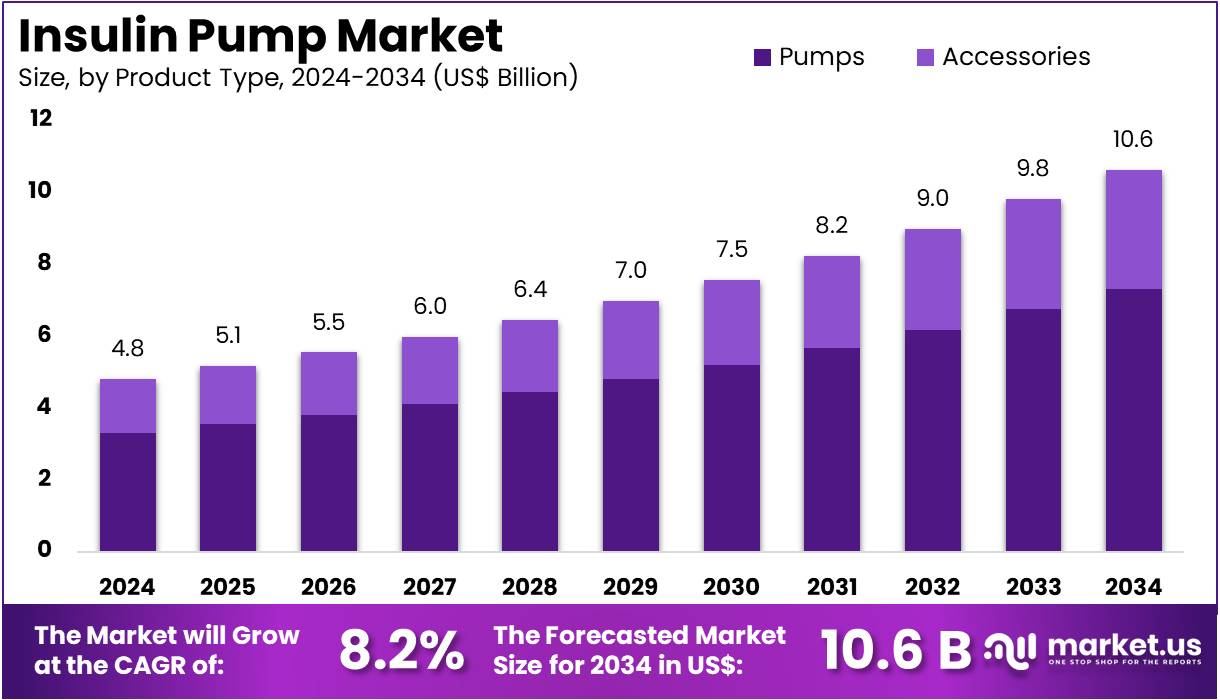

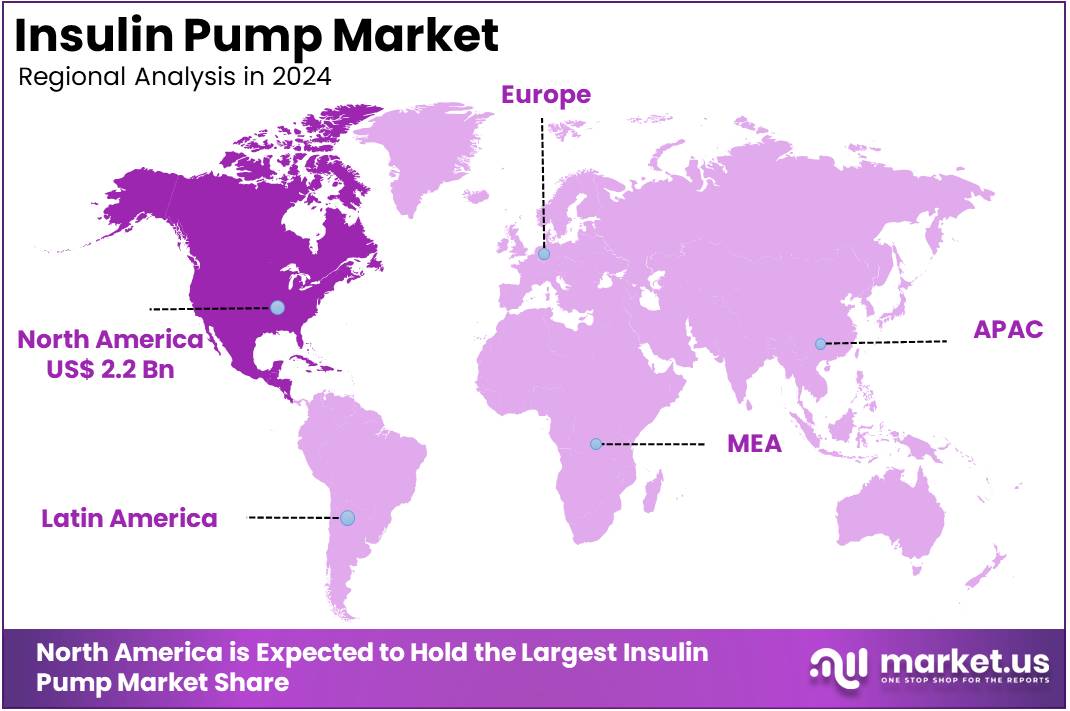

The Global Insulin Pump Market Size is expected to be worth around US$ 10.6 Billion by 2034, from US$ 4.8 Billion in 2024, growing at a CAGR of 8.2% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 47.15% share and holds US$ 2.2 Billion market value for the year.

Insulin Pump Market, Global Analysis, 2020-2024 (US$ Billion)

Global 2020 2021 2022 2023 2024 CAGR Revenue 3.0 4.0 4.2 4.5 4.8 8.2% Insulin pumps are advanced medical devices designed to provide continuous and precise insulin delivery for people with diabetes. Unlike traditional insulin injections, which are administered multiple times a day, insulin pumps deliver insulin through a small, flexible tube connected to a catheter placed under the skin. This method allows for better blood glucose control by mimicking the body’s natural insulin release patterns more closely. Users can adjust insulin delivery rates based on their needs, which is particularly beneficial for managing blood glucose levels during various activities or times of day.

Insulin pumps often have programmable features, including bolus calculators that help determine the correct insulin dose based on carbohydrate intake and current glucose levels. While they offer enhanced flexibility and control, insulin pumps require regular maintenance and monitoring, making them a more involved but effective tool for diabetes management.

The development of new products tailored to the needs of individuals and specific age groups is significantly driving growth in the insulin pumps market. As diabetes management becomes increasingly personalized, there is a growing demand for insulin delivery systems that cater to diverse patient profiles, including children, adolescents, and adults.

- For example, in May 2023, the U.S. Food and Drug Administration approved the Beta Bionics iLet ACE Pump and iLet Dosing Decision Software for use in individuals aged six and older with type 1 diabetes.

Key Takeaways

- The global insulin pump market was valued at USD 4.8 billion in 2024 and is anticipated to register substantial growth of USD 10.6 billion by 2034, with 8.2% CAGR.

- In 2024, the pump segment took the lead in the global market, securing 68.8% of the total revenue share.

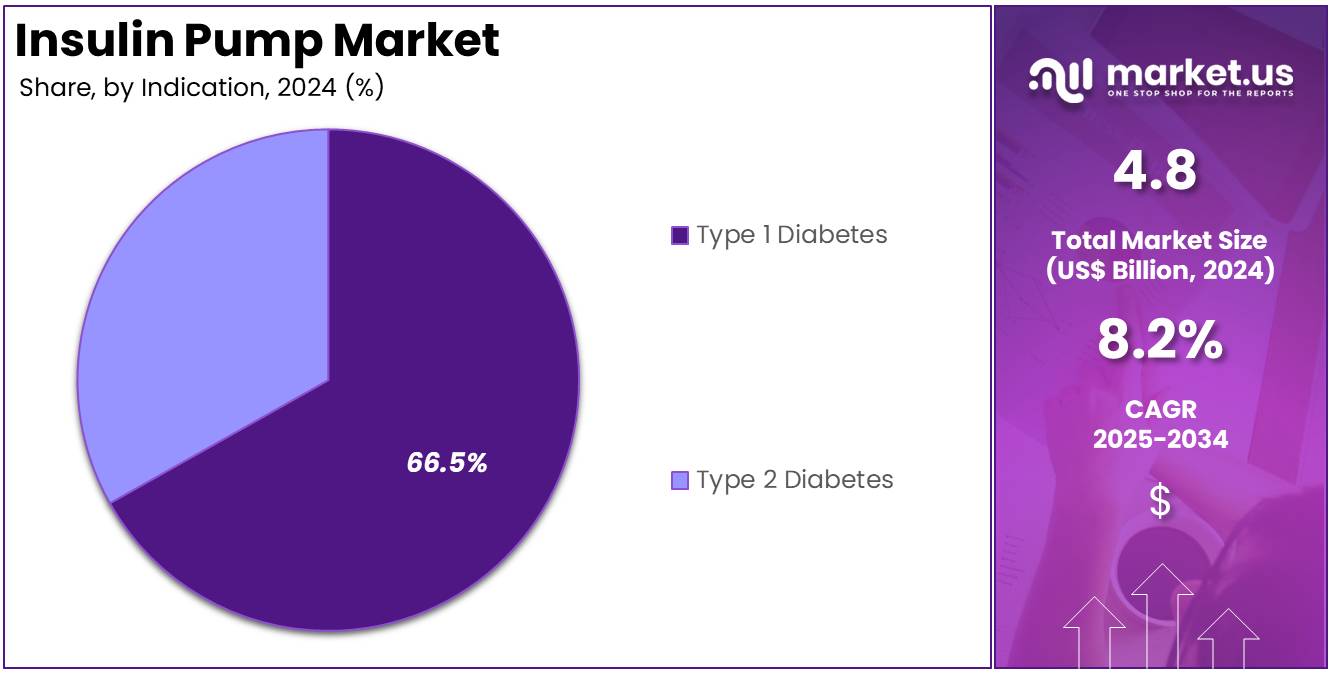

- The type 1 diabetes segment took the lead in the global market, securing 66.5% of the total revenue share.

- The hospitals & clinics segment took the lead in the global market, securing 44.1% of the total revenue share.

- North America maintained its leading position in the global market with a share of over 47.15% of the total revenue.

Product Type Analysis

Based on product type the market is fragmented into pumps and accessories. Amongst these, pump segment dominated the global insulin pump market capturing a significant market share of 68.8% in 2024. Insulin pumps are advanced medical devices designed to facilitate the management of diabetes by providing a continuous and controlled delivery of insulin. These pumps are engineered to replicate the function of a healthy pancreas, which naturally secretes insulin in response to the body’s needs.

Insulin pumps offer a significant improvement over traditional insulin injection methods by delivering insulin throughout the day and allowing for additional doses during meal times. This continuous delivery helps maintain stable blood glucose levels, which is crucial for effective diabetes management and reducing the risk of complications associated with fluctuating glucose levels.

Among the various types of insulin pumps, patch pumps represent a modern, user-friendly option. These devices are small, discreet, and worn directly on the skin, eliminating the need for external tubing. This design not only enhances comfort and freedom of movement but also simplifies daily activities, as users are less likely to experience issues with tangled or caught tubing.

Patch pumps are controlled wirelessly, often through a remote or smartphone application, allowing for easy adjustments and insulin administration. Their streamlined, tubeless design offers a degree of convenience and discreteness that is particularly appealing to many users, making them a popular choice for those seeking a less obtrusive option.

Insulin Pump Market, Product Type Analysis, 2020-2024 (US$ Billion)

Product Type 2020 2021 2022 2023 2024 Pumps 2.0 2.7 2.9 3.1 3.3 Accessories 1.0 1.3 1.3 1.4 1.5 Indication Analysis

The market is fragmented by indication into type 1 diabetes and type 2 diabetes. Type 1 diabetes dominated the global insulin pump market capturing a significant market share of 66.5% in 2024. The growing prevalence of Type 1 diabetes is a major driver of demand for insulin pumps. As awareness of the benefits of insulin pumps increases, more patients and healthcare providers are adopting these devices.

The increasing prevalence of Type 1 diabetes has significantly driven the demand for insulin pumps, a trend that is transforming diabetes management and fostering growth in the medical technology sector. Type 1 diabetes is a condition characterized by the autoimmune destruction of insulin-producing beta cells in the pancreas, leading to a lifelong dependency on external insulin for blood glucose regulation. As the number of individuals diagnosed with Type 1 diabetes rises globally, there is a corresponding need for effective, reliable, and efficient methods to manage this chronic condition.

Insulin pumps have emerged as a critical tool in this regard due to their ability to offer continuous and precise insulin delivery, which mimics the function of a healthy pancreas more accurately than traditional insulin injections. These devices provide a steady basal rate of insulin and allow for bolus doses to be administered during meals or to correct blood sugar levels, resulting in improved glycemic control and a reduction in the frequency of severe hyperglycemic and hypoglycemic episodes.

- For instance, according to the National Library of Medicine, in 2021, there were about 8·4 (95% uncertainty interval 8·1-8·8) billion individuals worldwide with type 1 diabetes. In this 1·5 billion (18%) were younger than 20 years, 5·4 billion (64%) were aged 20-59 years, and 1·6 billion (19%) were aged 60 years or older.

Insulin Pump Market, Indication Analysis, 2020-2024 (US$ Billion)

Indication 2020 2021 2022 2023 2024 Type 1 Diabetes 2.0 2.6 2.8 3.0 3.2 Type 2 Diabetes 1.0 1.3 1.4 1.5 1.6 End-User Analysis

The market is fragmented by end-user into hospitals & clinics, homecare, laboratories. Hospitals dominated the global Insulin pump market capturing a significant market share of 44.1% in 2024. The hospitals & clinics segment in the insulin pump market represents a crucial component of the overall diabetes care ecosystem, playing a significant role in the adoption, implementation, and management of insulin pump therapy.

Hospitals and clinics are primary settings where patients with diabetes, particularly those with Type 1 diabetes or advanced Type 2 diabetes, receive comprehensive care, including the initiation of insulin pump therapy. This segment encompasses a range of healthcare facilities, from large hospitals with specialized diabetes centers to smaller outpatient clinics that provide routine diabetes management.

Insulin Pump Market, End-User Analysis, 2020-2024 (US$ Billion)

End-User 2020 2021 2022 2023 2024 Hospitals & Clinics 1.3 1.8 1.9 2.0 2.1 Homecare 1.1 1.4 1.5 1.6 1.8 Laboratories 0.6 0.8 0.8 0.9 0.9 Key Segments Analysis

By Product Type

- Pumps

- Patch pumps

- Tethered pumps

- Accessories

- Infusion Set Insertion Devices

- Insulin Reservoirs/Cartridges

- Battery

By Indication

- Type 1 Diabetes

- Type 2 Diabetes

By End-User

- Hospitals & Clinics

- Homecare

- Laboratories

Drivers

Increasing Prevalence of Diabetes

The increasing prevalence of diabetes is indeed a significant catalyst for the growth of the insulin pump market. With the global incidence of diabetes on the rise due to factors such as ageing populations, sedentary lifestyles, and dietary changes, there is an escalating need for effective diabetes management solutions.

Insulin pumps offer a sophisticated and advanced approach to managing diabetes, providing patients with more precise and flexible insulin delivery in comparison to traditional methods like injections. This enhanced control plays a crucial role in maintaining optimal glucose levels and reducing the risk of complications associated with diabetes, such as cardiovascular issues and neuropathy.

- For instance, approximately 537 billion adults (20-79 years) were living with diabetes in 2021. The total number of people living with diabetes is projected to rise to 643 billion by 2030 and 783 billion by 2045. Further, 3 in 4 adults with diabetes live in low- and middle-income countries. According to the International Diabetes Federation (IDF), the global prevalence rate of diabetes stands at 6.1%, ranking it among the top 10 causes of death and disability worldwide. At the super-region level, North Africa and the Middle East have the highest prevalence rate at 9.3%, with projections indicating a rise to 16.8% by 2050. Similarly, in Latin America and the Caribbean, the diabetes rate is expected to increase to 11.3% in the coming years.

Restraints

High-Cost Associated Insulin Pump

The high cost of insulin pumps represents a significant restraint on the growth of the insulin pump market, posing a considerable obstacle to widespread adoption and market expansion. These advanced devices offer enhanced diabetes management with improved glucose control and greater convenience compared to traditional insulin delivery methods. However, their financial implications are substantial and multifaceted.

The initial purchase price of insulin pumps is often substantial, which can be a significant barrier for many individuals, particularly those from low-income or uninsured backgrounds. Additionally, the ongoing costs associated with maintaining these devices, including expenses for supplies such as infusion sets, reservoirs, and sensors, as well as the cost of insulin itself, further compound the financial burden. These recurring expenses can add up over time, making it difficult for individuals without adequate financial resources or insurance coverage to afford and sustain the use of insulin pumps.

- For instance, according to the National Institute of Health (NIH), a new insulin pump typically costs around US$ 6,500, with additional annual expenses ranging from US$ 2,000 to US$ 5,000 for ongoing supplies such as batteries and sensors. The total cost can vary based on the pump’s features, software, brand, and size.

Opportunities

Rise in Product Approvals and Launch of Innovative Products

The rise in product approvals is creating substantial growth opportunities for the insulin pumps market by driving innovation and expanding the range of available technologies. Regulatory bodies’ increasing approvals of new insulin pump devices signify a burgeoning pipeline of advanced products designed to enhance diabetes management. These approvals often reflect significant improvements in functionality, including better integration with continuous glucose monitoring (CGM) systems, which allows for real-time glucose tracking and more precise insulin adjustments.

Furthermore, newly approved devices frequently feature more user-friendly designs, making them easier to use and more accessible for a broader range of patients. Enhanced accuracy in insulin delivery, another key advancement, contributes to better overall glycemic control and improved patient outcomes. The introduction of these advanced products not only diversifies the market but also stimulates competition, encouraging ongoing technological progress and innovation. This dynamic environment is likely to attract more investments and research, further accelerating the development of next-generation insulin pumps.

- For instance, Medtronic plc recently received CE Mark approval in January 2024 for its MiniMed™ 780G system with Simplera Sync™. This new system features a disposable, all-in-one continuous glucose monitor (CGM) that eliminates the need for fingersticks and overtape, offering a more user-friendly experience with its compact design and simplified insertion process.

- In January 2024, PharmaSens, a Switzerland-based medical device company, submitted an application to seek an approval from the U.S. FDA for its new insulin pump. The company received ISO 13485 certification in November 2023.

Impact of macroeconomic factors / Geopolitical Factors

Macroeconomic and geopolitical factors significantly influence the global insulin pump market. Economic conditions such as inflation, exchange rates, and healthcare budgets affect the affordability and accessibility of insulin pumps, particularly in emerging markets where healthcare systems may be underfunded. In developed economies, economic downturns could lead to reduced spending on medical devices, impacting market growth. Geopolitical instability, trade policies, and regulatory changes also play a role in shaping the market.

Tensions between countries may disrupt the global supply chain for insulin pumps and related components, leading to shortages or price fluctuations. Additionally, variations in healthcare regulations and reimbursement policies across regions can create disparities in market access, affecting both manufacturers and consumers. These factors can hinder the widespread adoption of insulin pumps in certain markets while fostering growth in others, thereby influencing the global market dynamics.

Trends

The global insulin pump market is experiencing several key trends. There is a growing shift towards advanced insulin pumps with integrated continuous glucose monitoring (CGM) systems, offering better control and convenience for diabetes management. The rise in the adoption of hybrid closed-loop systems, which automatically adjust insulin delivery based on glucose levels, is also gaining traction. Technological advancements, such as Bluetooth connectivity and mobile app integration, are making insulin pumps more user-friendly and enabling real-time monitoring.

Additionally, there is a notable increase in the use of wearable insulin pumps, driven by a demand for more discreet and portable devices. The market is also witnessing a surge in the number of diabetes patients, particularly with the rise in Type 2 diabetes, which fuels demand for effective management solutions. Furthermore, regulatory approvals and improving reimbursement policies in various regions are expanding market access, fostering growth in both developed and emerging markets.

Regional Analysis

North America region dominated the global insulin pumps market, accounting for a substantial share due to the high prevalence of diabetes, advanced healthcare infrastructure, and increasing awareness regarding diabetes management technologies. The market’s growth in this region is fueled by factors such as a significant diabetic population, high healthcare expenditure, technological advancements, and favorable reimbursement policies. Diabetes continues to be a significant public health concern in North America, particularly in the United States.

- According to the National Diabetes Statistics Report released by the U.S. Centers for Disease Control and Prevention in 2021, an estimated 38.4 million individuals across all age groups, representing approximately 11.6% of the U.S. population, were reported to have diabetes. The data also indicated that the prevalence of diabetes increased with age, with 29.2% of adults aged 65 and older being affected.

Insulin Pumps Market, Regional Analysis, 2020-2024 (US$ Billion)

Region 2020 2021 2022 2023 2024 North America 1.5 1.9 2.0 2.1 2.3 Europe 0.7 0.9 0.9 1.0 1.0 Asia Pacific 0.6 0.8 0.9 0.9 1.0 Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global insulin pump market is highly competitive, with several key players driving innovation and market growth. Leading companies include Medtronic plc, Tandem Diabetes Care, Inc., Ypsomed AG, Insulet Corporation, and others, each offering advanced insulin pump technologies. The insulin pump market is experiencing growth driven by advancements in product development, new product launches, and regulatory approvals.

Innovations in pump technology and the introduction of more user-friendly models are expanding treatment options for diabetes patients. Additionally, regulatory approvals for new devices are enhancing market accessibility, contributing to increased adoption and market expansion.

- In February 2023, Roche Diabetes Care Inc. announced that its Accu-Chek Solo micropump system received 510(k) premarket approval. This system features interoperable technology, enhancing its integration with other diabetes management tools.

Industry leader Medtronic holds a dominant position in this market, driven by its extensive portfolio of insulin pumps and consumables designed for effective diabetes management. Medtronic’s leadership is bolstered by its continuous innovation and the frequent approval of new products by regulatory authorities, which support the company’s sustained growth and market presence.

- In September 2020, Medtronic announced the U.S. FDA’s approval of its MiniMed 770G hybrid closed-loop system. This system accesses and shares real-time Continuous Glucose Monitoring (CGM) and pump data and offers its benefits to younger children living with type 1 diabetes.

Hoffmann-La Roche AG is a global healthcare company headquartered in Basel, Switzerland, specializing in pharmaceuticals and diagnostics. It is known for its innovations in oncology, immunology, infectious diseases, and personalized medicine. Medtronic plc is a global leader in medical technology, headquartered in Dublin, Ireland. The company develops and manufactures a wide range of medical devices and therapies, including insulin pumps for diabetes management.

Top Key Players in the Insulin Pump Market

- Hoffmann-La Roche AG

- Medtronic plc

- Terumo Corporation

- Insulet Corporation

- Tandem Diabetes Care, Inc.

- Ypsomed AG

- ViCentra B.V.

- Microtec Medical Ltd

- Debiotech SA

- EOFLOW CO., LTD.

Recent Developments

- In May 2021, F. Hoffmann-La Roche Ltd. introduced the mySugr Pump Control feature within its mySugr app. This feature enables patients to manage their insulin pumps directly through their smartphones, allowing them to import data and monitor its status with ease.

- In June 2020, Tandem Diabetes Care, Inc. acquired Sugarmate, Inc., a move aimed at enhancing its technological offerings and broadening its product portfolio. The acquisition focused on developing the Sugarmate app, which provides innovative ways for individuals with diabetes to visualize and manage their therapy data. This strategic initiative not only expanded Tandem Diabetes Care’s product range but also integrated advanced digital solutions into its insulin pump systems. Such strategic actions reflect a broader trend in the market where companies seek to enhance their competitive edge through technological advancements and comprehensive product ecosystems.

Report Scope

Report Features Description Market Value (2024) US$ 4.8 billion Forecast Revenue (2034) US$ 10.6 billion CAGR (2025-2034) 8.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Pumps and Accessories), By Indication (Type 1 Diabetes and Type 2 Diabetes), By End-User (Hospitals & Clinics, Homecare, and Laboratories). Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Hoffmann-La Roche AG, Medtronic plc, Terumo Corporation, Insulet Corporation, Tandem Diabetes Care, Inc. , Ypsomed AG, ViCentra B.V., Microtec Medical Ltd, Debiotech SA, and EOFLOW CO., LTD. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Hoffmann-La Roche AG

- Medtronic plc

- Terumo Corporation

- Insulet Corporation

- Tandem Diabetes Care, Inc.

- Ypsomed AG

- ViCentra B.V.

- Microtec Medical Ltd

- Debiotech SA

- EOFLOW CO., LTD.