Global Medical Tubing Market By Product Type (Single-Lumen, Multi-Lumen, Coiled Tubing, Extruded Tubing, Other Product Types), By Material Type (Polyvinyl Chloride Silicone, Polyolefins, Polytetrafluoroethylene (PTFE), Polycarbonates, Fluoropolymers, and Polyimide), By Application (Bulk Disposable Tubing Peristaltic Pump Tubing, Catheters, Drug Delivery Systems, and Other Applications), By Distribution Channel (Offline and Online), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 13298

- Number of Pages: 351

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

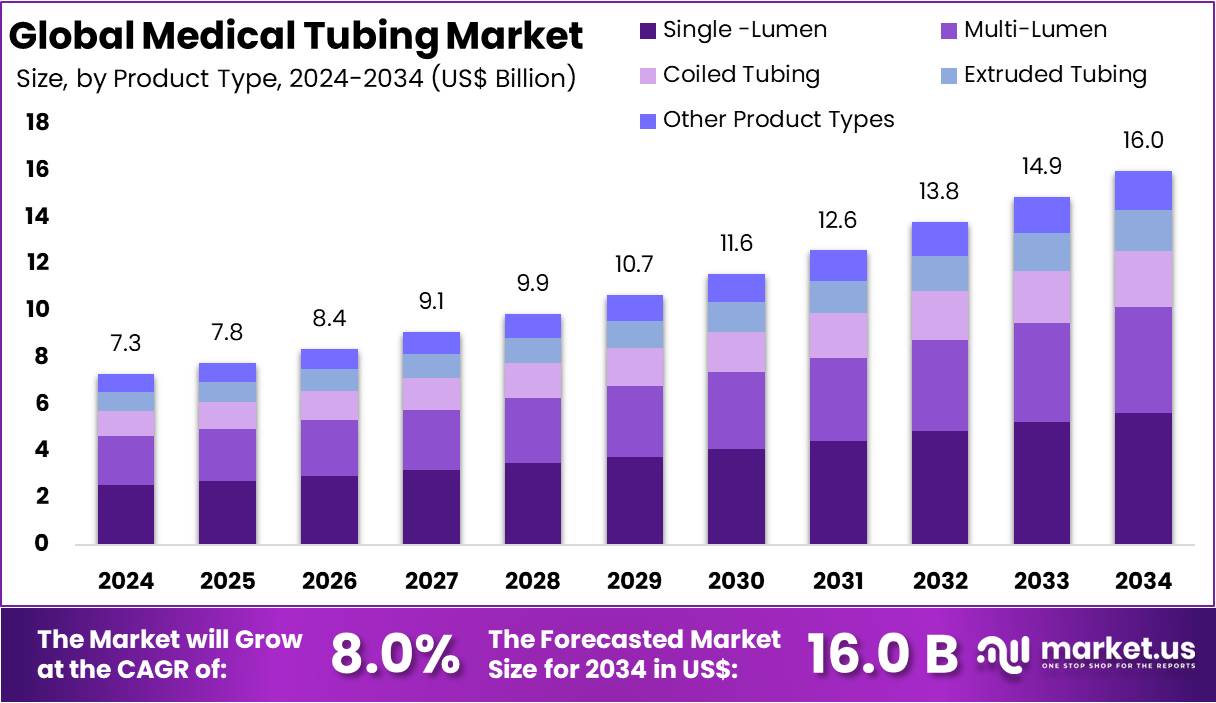

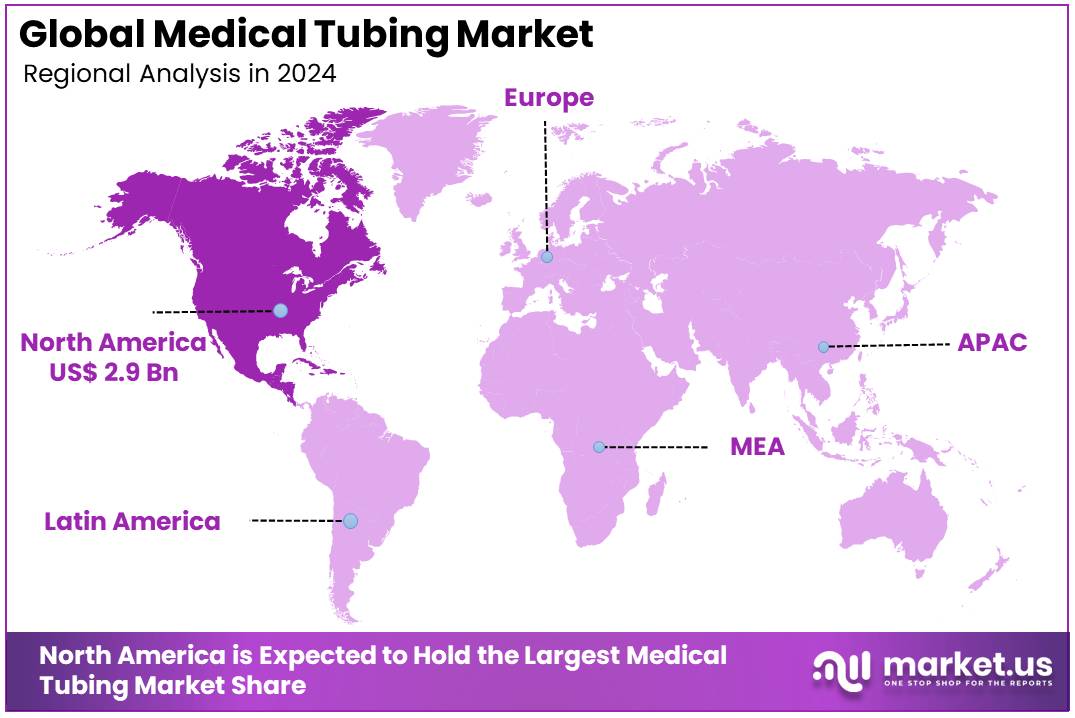

The Global Medical Tubing Market Size is expected to be worth around US$ 16 Billion by 2034, from US$ 7.3 Billion in 2024, growing at a CAGR of 8% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 39.5% share and holds US$ 2.9 Billion market value for the year.

Medical Tubing Market, Global Analysis, 2020-2024 (US$ Billion)

Global 2020 2021 2022 2023 2024 CAGR Revenue 5.9 6.2 6.5 6.9 7.3 8.0% Medical tubing is an important component in healthcare industry that provides safe and sterile transport of fluids and gases within the body. Comprising various materials like PVC, silicone, or polyurethane, it is made for different applications such as peristaltic pump tubing, bulk disposable tubing, catheters, drug delivery systems, and other applications. Medical tubing’s flexibility, biocompatibility, and resistance to bend ensure efficient delivery of medications, nutrients, and oxygen. Its diverse sizes and designs comply specific medical needs.

Medical tubes are designed with precision to meet stringent medical standards, ensuring compatibility with different medical applications and minimizing risks of contamination, leakage, and allergic reactions. Regulatory compliance and quality assurance remain integral to the medical tubing market. Stringent standards, such as ISO 13485 and FDA regulations necessitate manufacturers to adhere to rigorous quality control processes to ensure patient safety and product efficacy.

- For instance, according to National Health Expenditure Accounts (NHEA), U.S. health care spending grew 2.7 percent in 2021, reaching US$4.3 trillion or US$12,914 per person.

- According to the article published by National Center for Biotechnology Information, in a comprehensive analysis of major operating room procedures, the year 2017 saw a total of 9.8 million inpatient surgeries. Out of these, 11.1% were conducted using Minimally Invasive Surgery (MIS) techniques, while 2.5% utilized robotic-assisted methods. In contrast, the year 2018 featured 9.6 million inpatient surgeries, with 11.2% of them being MIS and 2.9% being robotic-assisted.

Key Takeaways

- The global medical tubing market was valued at USD 7.3 billion in 2024 and is anticipated to register substantial growth of USD 16.0 billion by 2034, with 8.0% CAGR.

- In 2024, the single-lumen segment took the lead in the global market, securing 35.8% of the total revenue share.

- The polyvinyl chloride segment took the lead in the global market, securing 31.0% of the total revenue share.

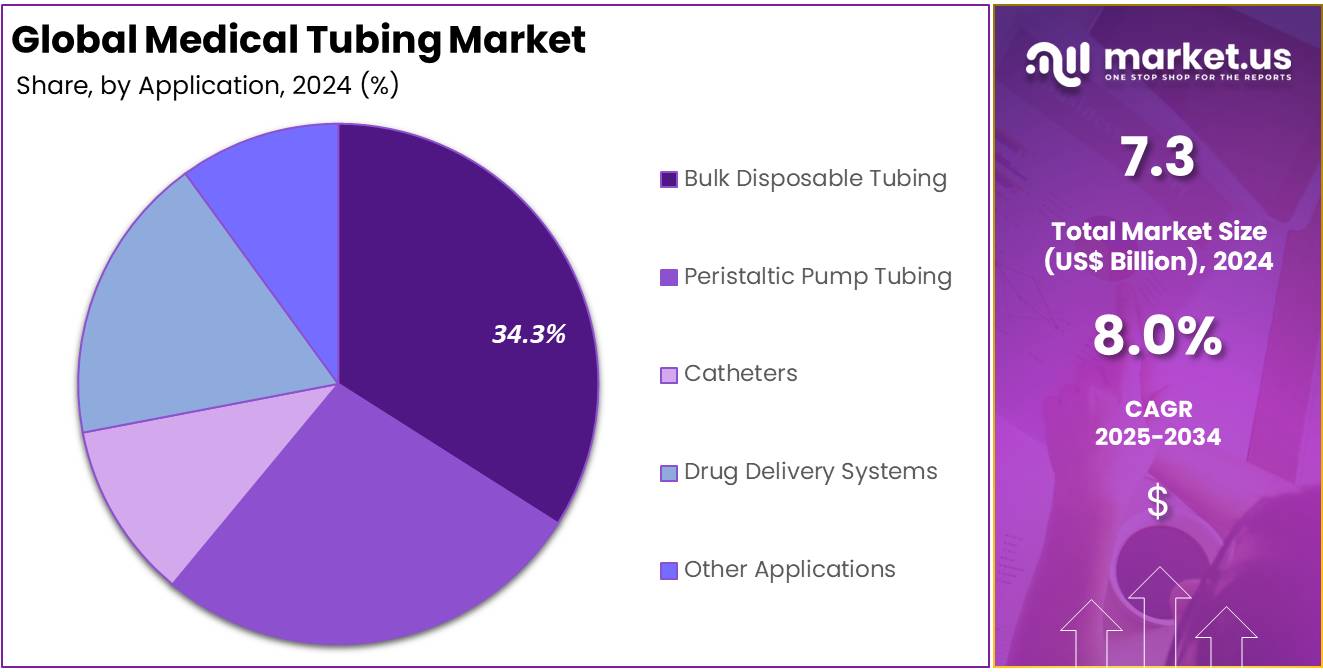

- The bulk disposable tubing segment took the lead in the global market, securing 34.3% of the total revenue share.

- The offline segment took the lead in the global market, securing 64.1% of the total revenue share.

- North America maintained its leading position in the global market with a share of over 39.5% of the total revenue.

Product Type Analysis

Based on product type the market is fragmented into single-lumen, multi-lumen, coiled tubing, extruded tubing, and other product types. Amongst these, single-lumen segment dominated the global medical tubing market capturing a significant market share of 35.8% in 2024. The single-lumen segment has dominated the global medical tubing market due to its widespread use in a variety of medical applications that require simple, efficient, and cost-effective solutions.

Single-lumen tubing, characterized by its single internal passage, is commonly used for the delivery of fluids, gases, or medications in medical devices such as catheters, respiratory tubes, and IV lines. The simplicity of the design, combined with its reliability, makes it a preferred choice for many medical applications, including drug delivery systems, diagnostic equipment, and surgical instruments.

The segment’s dominance can also be attributed to the increasing demand for minimally invasive procedures, where single-lumen tubes are essential for catheter-based interventions, such as angioplasty or endoscopy. These procedures often require flexible, precise, and lightweight tubing that can be easily inserted into the body. Furthermore, the rising prevalence of chronic diseases, such as diabetes and cardiovascular conditions, drives the need for long-term medical interventions, which often rely on single-lumen tubing for continuous fluid or medication administration.

Medical Tubing Market, Product Type Analysis, 2020-2024 (US$ Billion)

Product Type 2020 2021 2022 2023 2024 Single -Lumen 2.1 2.2 2.3 2.4 2.6 Multi-Lumen 1.7 1.8 1.8 2.0 2.1 Coiled Tubing 1.1 1.2 1.2 1.3 1.4 Extruded Tubing 0.7 0.7 0.7 0.8 0.8 Other Product Types 0.4 0.4 0.4 0.4 0.5 Material Type Analysis

The market is fragmented by material type into polyvinyl chloride silicone, polyolefins, polytetrafluoroethylene (PTFE), polycarbonates, fluoropolymers, and polyimide. Polyvinyl chloride dominated the global medical tubing market capturing a significant market share of 31.0% in 2024. Polyvinyl chloride (PVC) has dominated the global medical tubing market due to its versatile properties, cost-effectiveness, and wide range of applications in the healthcare industry.

PVC is a preferred material for medical tubing because it is durable, flexible, and biocompatible, making it suitable for a variety of medical devices such as catheters, IV lines, and respiratory tubes. Its ability to be easily molded into different shapes and sizes allows manufacturers to create custom tubing solutions tailored to specific medical applications.

One of the key factors driving PVC’s dominance is its flexibility and strength, which are essential for medical tubing used in minimally invasive procedures. PVC can be formulated to meet specific requirements, such as varying degrees of stiffness or flexibility, depending on the device’s intended use. Additionally, PVC is resistant to kinking and has a high tolerance for pressure, making it ideal for critical care applications like blood transfusions, drug delivery systems, and dialysis.

Medical Tubing Market, Material Type Analysis, 2020-2024 (US$ Billion)

Material Type 2020 2021 2022 2023 2024 Silicone 1.1 1.1 1.2 1.2 1.3 Polyolefins 1.0 1.0 1.1 1.2 1.3 Polytetrafluoroethylene (PTFE) 0.7 0.8 0.8 0.9 0.9 Polyvinyl Chloride 1.7 1.8 1.9 2.1 2.3 Polycarbonates 0.6 0.7 0.7 0.7 0.8 Fluoropolymers 0.5 0.5 0.5 0.6 0.6 Polyimide 0.2 0.2 0.2 0.2 0.2 Application Analysis

The market is fragmented by application into bulk disposable tubing peristaltic pump tubing, catheters, drug delivery systems, and other applications. Bulk disposable tubing dominated the global medical tubing market capturing a significant market share of 34.3% in 2024.

Bulk disposable tubing has dominated the global medical tubing market due to its wide-ranging applications in hospitals, clinics, and other healthcare settings. This type of tubing is used primarily in single-use medical devices, such as IV lines, catheters, blood bags, and respiratory equipment, making it essential for ensuring hygiene and preventing cross-contamination. The demand for disposable medical products has surged in recent years, largely driven by an emphasis on infection control and patient safety, especially in response to the ongoing challenges posed by healthcare-associated infections (HAIs).

The increasing demand for disposable tubing in healthcare is driven by its cost-effectiveness, convenience, and safety benefits. These single-use solutions help minimize the risk of infection transmission between patients while eliminating the need for extensive and expensive sterilization procedures. Moreover, disposable medical devices improve inventory management by being easily accessible and simple to discard after use, reducing contamination risks.

Medical Tubing Market, Application Analysis, 2020-2024 (US$ Billion)

Application 2020 2021 2022 2023 2024 Peristaltic Pump Tubing 0.6 0.6 0.6 0.6 0.7 Bulk Disposable Tubing 2.0 2.1 2.2 2.3 2.5 Catheters 1.4 1.5 1.5 1.6 1.8 Drug Delivery Systems 1.2 1.2 1.3 1.4 1.4 Other Applications 0.8 0.8 0.9 0.9 1.0 Distribution Channel Analysis

The market is fragmented by distribution channel into offline, and online. Offline dominated the global medical tubing market capturing a significant market share of 64.1% in 2024. The offline segment has traditionally dominated the global medical tubing market, primarily due to the widespread reliance on established distribution channels, local suppliers, and direct purchasing by healthcare institutions such as hospitals, clinics, and medical device manufacturers. In this context, “offline” refers to the traditional methods of acquiring medical tubing, where buyers engage directly with suppliers, attend trade shows, or rely on local distributors for their procurement needs.

One of the key reasons for the dominance of offline sales is the critical nature of medical tubing in healthcare applications. Given the highly regulated and safety-sensitive environment, healthcare providers prefer to source tubing from trusted suppliers through direct, face-to-face interactions, where they can ensure quality, discuss customization options, and receive tailored service. Additionally, quality assurance and regulatory compliance are essential in the medical industry, and many healthcare organizations feel more secure with offline procurement, where they can validate certifications and inspect product specifications in person.

Medical Tubing Market, Distribution Channel Analysis, 2020-2024 (US$ Billion)

Distribution Channel 2020 2021 2022 2023 2024 Online 2.0 2.1 2.3 2.4 2.6 Offline 3.9 4.1 4.2 4.4 4.7 Key Segments Analysis

By Product Type

- Single-Lumen

- Multi-Lumen

- Coiled Tubing

- Extruded Tubing

- Other Product Types

By Material Type

- Polyvinyl Chloride

- Silicone

- Polyolefins

- Polytetrafluoroethylene (PTFE)

- Polycarbonates

- Fluoropolymers

- Polyimide

By Application

- Bulk Disposable Tubing

- Peristaltic Pump Tubing

- Catheters

- Drug Delivery Systems

- Other Applications

By Distribution Channel

- Offline

- Online

Drivers

Aging Population and Chronic Diseases

The global medical tubing market is experiencing significant growth, largely driven by the aging population and the rising prevalence of chronic diseases. As the global population continues to age, there is an increased demand for healthcare services, particularly for treatments associated with age-related conditions. Elderly individuals often require more frequent medical interventions, such as catheterization, respiratory support, and other life-sustaining treatments, all of which rely heavily on medical tubing.

Chronic diseases, such as cardiovascular conditions, diabetes, and respiratory diseases, are becoming more common worldwide. These conditions often necessitate ongoing medical care, including the use of medical devices that incorporate tubing for drug delivery, blood pressure monitoring, and respiratory therapy. The growing number of patients with such long-term health issues creates a steady demand for specialized medical tubing solutions that can support these treatments effectively and safely.

- According to the United Nations, the global population aged 60 years or over was estimated at 1 billion in 2020, and it is projected to reach 1.4 billion by 2030. By 2050, it is expected that 1 in 6 people in the world will be aged 60 years or older.

- The World Health Organization (WHO) reports that 80% of people aged 65 and over are living with at least one chronic condition, with 50% having two or more. This includes conditions like heart disease, diabetes, and respiratory issues.

Restraints

Stringent Regulatory Requirements

Stringent regulatory requirements are a significant restraint on the growth of the global medical tubing market, as manufacturers must adhere to strict standards set by health authorities like the U.S. Food and Drug Administration (FDA), the European Medicines Agency (EMA), and other global regulatory bodies. These regulations ensure that medical tubing meets the necessary safety, biocompatibility, and performance standards, but they also increase the complexity and cost of production.

Meeting regulatory standards for medical tubing can be a complex and time-consuming process. Manufacturers must conduct extensive testing, maintain detailed documentation, and obtain certifications before their products can enter the market. The tubing must undergo rigorous assessments to evaluate its resistance to factors like chemical leaching, durability, and cytotoxicity to ensure it is safe for patients. Additionally, compliance with specific ISO standards, such as ISO 10993 for biological evaluation, further increases the complexity and costs involved in the development process.

Opportunities

Advancements in Medical Technologies

Advancements in medical technologies are creating significant growth opportunities for the global medical tubing market. As the healthcare industry evolves, there is an increasing demand for innovative medical devices that require specialized tubing solutions. Medical tubing plays a crucial role in a wide range of modern technologies, including minimally invasive surgeries, drug delivery systems, diagnostic equipment, and implantable devices.

The development of sophisticated medical technologies, such as robotic surgeries and precision medicine, has necessitated the creation of specialized, high-performance medical tubing. These advancements demand materials that are not only biocompatible but also highly durable, flexible, and capable of withstanding high-pressure environments. For example, medical devices used in minimally invasive procedures, such as catheters and endoscopes, require tubing that is both flexible and strong to navigate complex body pathways while delivering optimal performance.

The continuous advancements in medical technologies, such as robotics, imaging, and remote monitoring, have led to a higher demand for medical tubing. These technologies often require intricate tubing solutions to facilitate precise delivery of fluids, gases, or other substances within the human body.

- For instance, in October 2022, the FDA approved modifications to Fresenius Medical’s 2008T hemodialysis machines, involving the utilization of platinum catalyst silicone tubing in the machine’s hydraulics. The manufacturer’s data indicated the absence of non-dioxin-like (NDL) polychlorinated biphenyl acids (PCBAs) and NDL polychlorinated biphenyls (PCBs) in machines featuring the updated silicone tubing.

Impact of Macroeconomic Factors / Geopolitical Factors

Economic conditions, such as inflation, recession, or economic growth, affect consumer spending and healthcare budgets. During economic downturns, healthcare organizations may face budget constraints, leading to reduced demand for non-essential medical devices or delayed procurement of high-cost medical products. Conversely, in periods of economic growth, healthcare spending tends to rise, increasing demand for medical devices, including those that rely on medical tubing.

Geopolitical tensions, trade disputes, and regulatory changes can disrupt global supply chains. The medical tubing market is heavily dependent on the availability of raw materials such as polymers and plastics, which may be sourced from various countries. Trade restrictions, tariffs, or political instability in key regions can lead to supply chain disruptions, affecting production timelines and costs. For example, the U.S.-China trade war had a notable impact on global manufacturing, with increased costs for raw materials and manufacturing delays.

Additionally, geopolitical uncertainty can lead to regulatory changes or shifts in healthcare policies that may affect the approval or demand for medical devices in certain regions. Companies in the medical tubing market must navigate these risks, which could affect pricing, supply, and market access, ultimately impacting growth opportunities.

Trends

The medical tubing market is evolving with several notable trends driven by advancements in technology and growing healthcare needs. A key trend is the innovation in materials, with a focus on biocompatible, durable, and eco-friendly options like thermoplastic elastomers and bioresorbable polymers. These materials enhance the performance and safety of medical devices, while meeting increasing demand for sustainable solutions.

Another significant trend is the rise of minimally invasive procedures, which require highly flexible, precise, and smaller-diameter tubing for applications such as catheterization, endoscopy, and laparoscopy. As a result, manufacturers are designing more adaptable and robust tubing solutions to support these advanced surgeries. Customization and co-extrusion techniques are also gaining traction, enabling the production of multi-layered, specialized tubing tailored to specific medical applications, such as drug delivery or resistance to kinking.

Additionally, the growing healthcare infrastructure in emerging markets is fuelling demand for medical devices, offering new opportunities for the market. As a result, companies are expanding their presence in these regions to meet the rising demand for advanced medical tubing. These trends collectively reflect the market’s shift toward more specialized, high-performance, and sustainable solutions, which are crucial for meeting the evolving demands of modern healthcare.

Regional Analysis

North America boasts a dynamic and expanding medical tubing market, driven by several key factors, including technological advancements, improved healthcare infrastructure, and the increasing aging population. Technological innovations are central to the region’s market growth, with manufacturers focusing on developing advanced materials such as thermoplastic elastomers, bioresorbable polymers, and multi-layered tubing. These innovations improve the performance, safety, and biocompatibility of medical tubing, which is essential for applications ranging from drug delivery and catheterization to minimally invasive surgeries.

In addition, ongoing research and development efforts are yielding new manufacturing processes, such as co-extrusion and extrusion molding, which allow for the production of more flexible, durable, and customized tubing solutions. These advancements not only enhance the functionality of medical tubing but also enable the development of more specialized products tailored to specific medical needs.

Furthermore, North America’s robust healthcare infrastructure, particularly in the U.S. and Canada, provides a strong foundation for market growth, with increased demand for medical devices driven by an aging population that requires more healthcare interventions. The combination of innovation, a mature healthcare system, and demographic shifts positions North America as a key market for the medical tubing industry, fostering further growth and technological evolution in this sector.

- For instance, according to National Health Expenditure Accounts (NHEA), U.S. health care spending grew 2.7 percent in 2021, reaching US$4.3 trillion or US$12,914 per person.

- The U.S. government allocated $8.5 billion in funding to support healthcare infrastructure improvements, including funding for rural healthcare facilities, health IT upgrades, and telemedicine.

Medical Tubing Market, Regional Analysis, 2020-2024 (US$ Billion)

Region 2020 2021 2022 2023 2024 North America 2.4 2.5 2.6 2.7 2.9 Europe 1.7 1.8 1.9 2.0 2.1 Asia Pacific 1.2 1.3 1.4 1.5 1.6 Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global medical tubing market is highly competitive, characterized by the presence of both established multinational corporations and emerging players, each focusing on innovation, material development, and expansion into new markets. Key players in this market include Lubrizol Corporation, Saint-Gobain, Medtronic, PolyOne Corporation, Tekni-Plex, and Freudenberg Medical.

These companies are actively investing in advanced manufacturing technologies, such as co-extrusion and multi-layer tubing, to enhance the functionality and biocompatibility of medical devices. They also focus on developing specialized materials like thermoplastic elastomers (TPE), bioresorbable polymers, and silicone, which cater to the growing demand for high-performance, sustainable, and safe medical products.

To maintain a competitive edge, these companies are leveraging strategic partnerships, mergers, and acquisitions. For instance, in recent years, several firms have acquired smaller companies to diversify their product portfolios and strengthen their market presence in emerging regions. Additionally, companies are increasingly focused on customization to meet the specific needs of medical applications, ranging from drug delivery systems to minimally invasive surgeries.

Teleflex Incorporated is a global provider of medical technologies focused on improving patient outcomes. The company offers a wide range of innovative products, including medical tubing, respiratory devices, anesthesia products, and cardiovascular solutions. Teleflex serves a diverse array of healthcare sectors, including hospitals, surgery centers, and outpatient clinics.

In addition to this, MDC Industries is a leading manufacturer of medical tubing and custom components, specializing in high-quality polymer extrusion solutions for the healthcare industry. The company provides a wide range of tubing products used in medical devices, including drug delivery, catheterization, and diagnostic equipment. MDC Industries focuses on delivering custom-engineered tubing solutions tailored to specific medical applications, ensuring compliance with stringent regulatory standards.

Top Key Players in the Medical Tubing Market

- Teleflex Incorporated

- MDC Industries

- Nordson Corporation

- W.L.Gore and Associates Inc.

- TE Connectivity

- Freudenberg & Co. KG

- Dupont de Nemours Inc.

- Zeus Industrial Products Inc.

- Raumedic AG

- Tekni-Plex Inc.

Recent Developments

- In June 2020, Nordson Corporation finalized its acquisition of Fluortek, Inc., a company based in Easton, Pennsylvania, that specializes in precision plastic extrusion. Fluortek is known for manufacturing custom-sized tubing specifically designed for use in the medical device industry.

- In November 2021: Freudenberg Medical, an international provider of medical device components and biopharma tubing manufacturing services, is set to present its top-tier silicone tubing, hoses, and assemblies at the prominent CPhi & PMEC India 2021 expo, located at Booth 15.D25. This marks Freudenberg Medical’s official entry into the Indian market with its exceptional range of fluid handling products. Freudenberg has a rich history of producing high-purity tubing since 1989, operating from specialized facilities in both the United States and Europe.

- In June 2020: Freudenberg Medical, a worldwide contract manufacturer specializing in medical device components and pharmaceutical tubing, has disclosed the successful conclusion of extractables testing for PharmaFocus® Premium silicone tubing, which is employed in biopharma fluid processing and single-use applications. Freudenberg collaborated with Eurofins Lancaster Laboratories to perform independent extractables testing in accordance with the BPOG and USP 665 standards. These two protocols encompassed the examination of 8 different solvents over a period of 21 days.

Report Scope

Report Features Description Market Value (2024) US$ 7.3 billion Forecast Revenue (2034) US$ 16.0 billion CAGR (2025-2034) 8.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Single-Lumen, Multi-Lumen, Coiled Tubing, Extruded Tubing, Other Product Types), By Material Type (Polyvinyl Chloride Silicone, Polyolefins, Polytetrafluoroethylene (PTFE), Polycarbonates, Fluoropolymers, and Polyimide), By Application (Bulk Disposable Tubing Peristaltic Pump Tubing, Catheters, Drug Delivery Systems, and Other Applications), By Distribution Channel (Offline and Online). Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Teleflex Incorporated, MDC Industries, Nordson Corporation, W.L.Gore and Associates Inc., TE Connectivity, Freudenberg & Co. KG, Dupont de Nemours, Inc., Zeus Industrial Products, Inc., Raumedic AG, and Tekni-Plex, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Teleflex Incorporated

- MDC Industries

- Nordson Corporation

- W.L.Gore and Associates Inc.

- TE Connectivity

- Freudenberg & Co. KG

- Dupont de Nemours Inc.

- Zeus Industrial Products Inc.

- Raumedic AG

- Tekni-Plex Inc.