Global Disposable Medical Devices Sensors Market By Product Type (Biosensors, Temperature Sensors, Pressure Sensors, Accelerometers, and Others), By Application (Diagnostic, Therapeutic, and Patient Monitoring), By Type (Strip Sensors, Wearable Sensors, Invasive Sensors, Ingestible Sensors, and Implantable Sensors), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 142324

- Number of Pages: 202

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

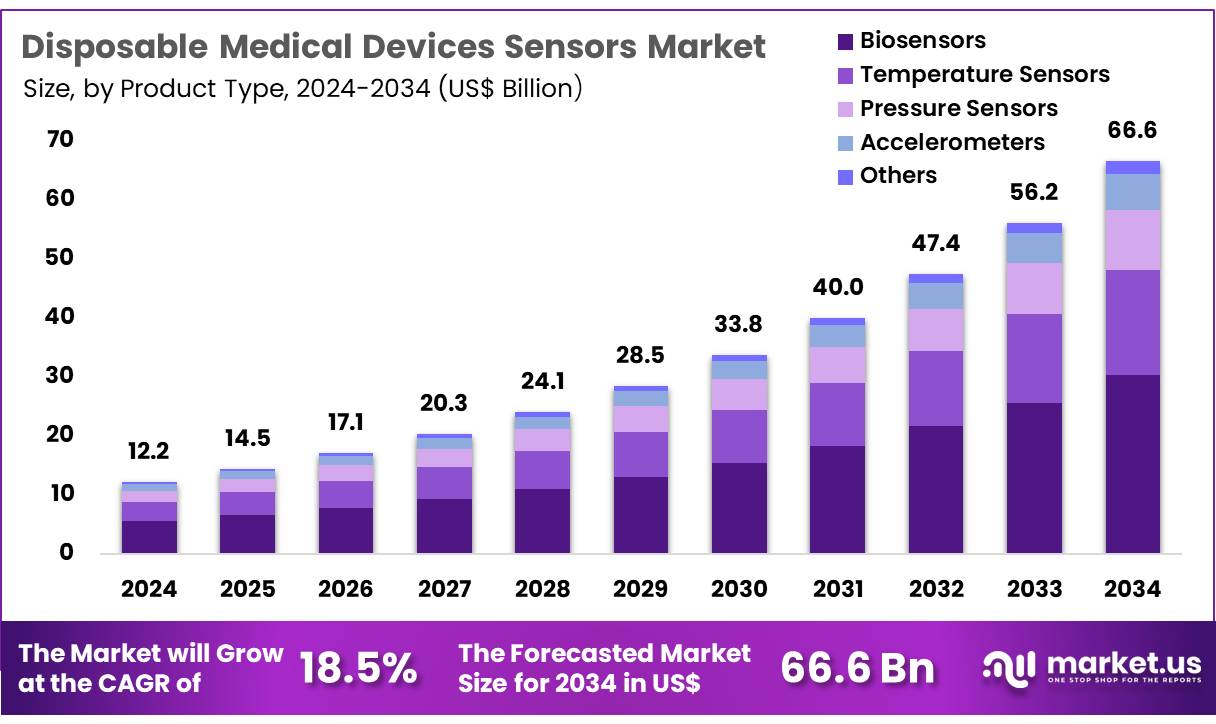

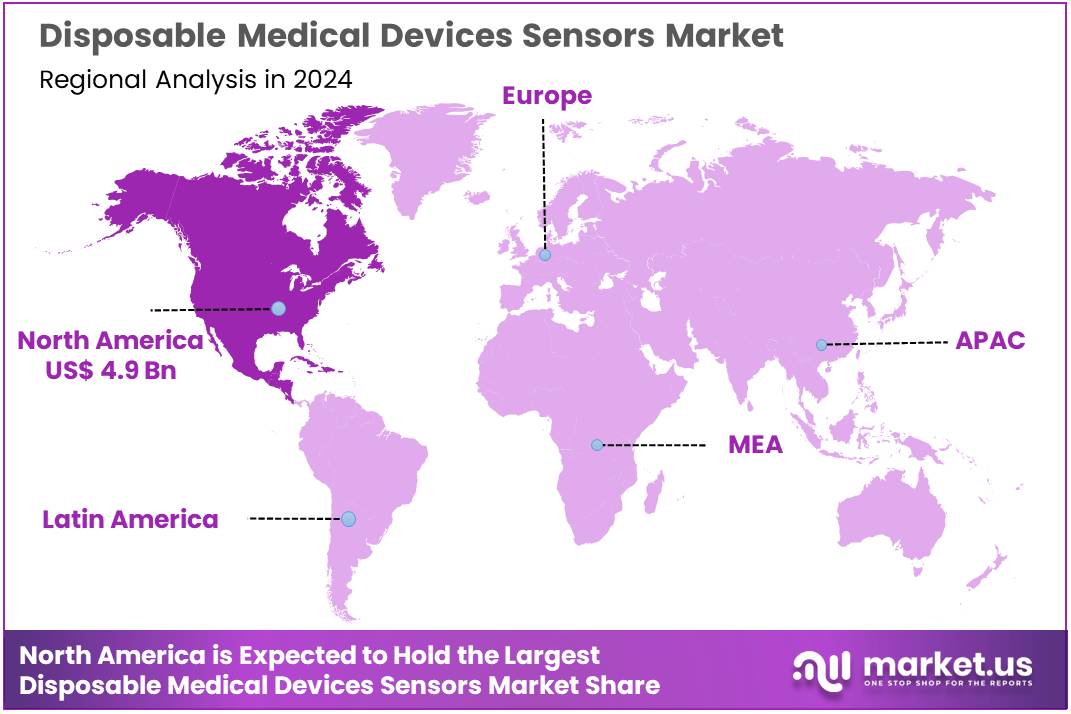

Global Disposable Medical Devices Sensors Market size is expected to be worth around US$ 66.6 billion by 2034 from US$ 12.2 billion in 2024, growing at a CAGR of 18.5% during the forecast period 2025 to 2034. In 2023, North America led the market, achieving over 40.3% share with a revenue of US$ 4.9 Billion.

Rising demand for advanced healthcare solutions and the increasing need for patient monitoring are driving significant growth in the disposable medical devices sensors market. Healthcare providers increasingly rely on sensors for real-time, accurate data, enabling improved decision-making and patient outcomes. The rising prevalence of chronic diseases, along with a growing geriatric population, is contributing to the need for continuous monitoring devices.

These sensors are integral to various medical applications, including diagnostics, patient monitoring, and surgical procedures. As healthcare providers aim to enhance treatment precision, disposable sensors play a crucial role by offering high accuracy while minimizing infection risks associated with reusable devices. The adoption of wearable devices is also gaining momentum, providing patients with personalized care through continuous data collection.

In April 2022, Variohm EuroSensor introduced a next-generation NTC thermistor designed to detect subtle temperature variations within the human body and surrounding medical environments. This innovation enhances the precision of patient monitoring and supports improved diagnostics in healthcare applications. Such technological advancements are expected to expand the scope of disposable sensors, driving growth in the market.

Key Takeaways

- In 2024, the market for Disposable Medical Devices Sensors generated a revenue of US$ 12.2 billion, with a CAGR of 18.5%, and is expected to reach US$ 66.6 billion by the year 2033.

- The product type segment is divided into biosensors, temperature sensors, pressure sensors, accelerometers, and others, with biosensors taking the lead in 2023 with a market share of 45.6%.

- Considering application, the market is divided into diagnostic, therapeutic, and patient monitoring. Among these, diagnostic held a significant share of 52.6%.

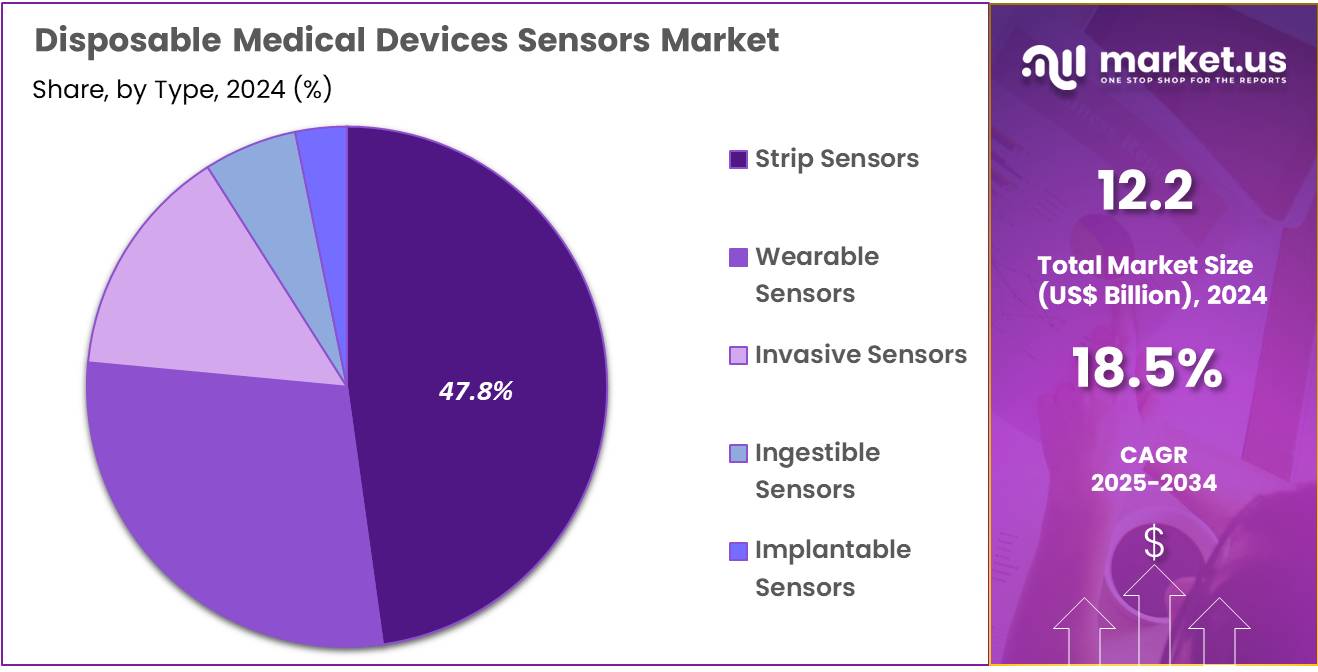

- Furthermore, concerning the type segment, the market is segregated into strip sensors, wearable sensors, invasive sensors, ingestible sensors, and implantable sensors. The strip sensors sector stands out as the dominant player, holding the largest revenue share of 47.8% in the Disposable Medical Devices Sensors market.

- North America led the market by securing a market share of 40.3% in 2023.

Product Type Analysis

The biosensors segment led in 2023, claiming a market share of 45.6% owing to the increasing demand for advanced diagnostic and monitoring tools. The growth is anticipated to be driven by the rising prevalence of chronic diseases, such as diabetes, cardiovascular disorders, and infections, which require continuous monitoring. Biosensors are projected to gain popularity as they offer rapid, cost-effective, and non-invasive methods of detecting biomarkers and physiological parameters.

Technological advancements in biosensor design, such as the integration of miniaturization, sensitivity, and portability, are likely to enhance their utility in both home care and clinical settings. The increasing emphasis on personalized healthcare and the growing trend of remote patient monitoring are also expected to contribute to the expansion of the biosensors market.

Application Analysis

The diagnostic held a significant share of 52.6%. The rising global demand for early disease detection and preventive care is anticipated to drive the growth of diagnostic applications. As healthcare systems continue to prioritize early intervention, disposable sensors are expected to gain traction for their convenience and affordability in diagnostic procedures. Advances in sensor technology, allowing for more accurate and rapid diagnosis, are likely to support the segment’s growth.

Additionally, the increasing need for continuous monitoring and the growing adoption of telemedicine are projected to expand the use of disposable sensors in diagnostic applications. As healthcare providers focus on improving patient outcomes through timely and precise diagnostics, the demand for such sensors is expected to rise significantly.

Type Analysis

The strip sensors segment had a tremendous growth rate, with a revenue share of 47.8% owing to the increasing use of diagnostic tests for home care and point-of-care settings. Strip sensors are projected to see a rise in demand due to their affordability, ease of use, and ability to provide quick results for a wide range of applications, such as glucose monitoring in diabetic patients.

The growing prevalence of chronic conditions that require regular monitoring, such as diabetes and cardiovascular diseases, is likely to propel the growth of strip sensors. Technological advancements in sensor materials, as well as the development of more sophisticated, disposable test strips, are expected to make them even more effective and accessible. The convenience and portability of strip sensors make them an attractive choice for both patients and healthcare providers, further supporting their growth in the market.

Key Market Segments

Product Type

- Biosensors

- Temperature Sensors

- Pressure Sensors

- Accelerometers

- Others

Application

- Diagnostic

- Therapeutic

- Patient Monitoring

Type

- Strip Sensors

- Wearable Sensors

- Invasive Sensors

- Ingestible Sensors

- Implantable Sensors

Drivers

Rising Concerns for Hospital-Acquired Infections Driving the Disposable Medical Devices Sensors Market

High concerns regarding hospital-acquired infections (HAIs) are significantly driving the disposable medical devices sensors market. In 2023, the Centers for Disease Control and Prevention (CDC) reported that around 3.2% of hospitalized patients experienced at least one healthcare-associated infection (HAI) during their stay. As the incidence of these infections continues to rise, healthcare providers are increasing their focus on infection control measures.

Disposable sensors embedded in medical devices can significantly reduce the risk of cross-contamination, as they help to monitor and prevent the spread of infections. With the increasing prevalence of HAIs, there is a growing need for advanced, disposable, single-use sensors that provide real-time monitoring of patient conditions while minimizing the risk of infection. The demand for these technologies is expected to rise as hospitals and healthcare facilities implement more stringent protocols to enhance patient safety and ensure sterile environments.

Consequently, healthcare institutions are investing more in technologies that can help detect infections early, improve clinical outcomes, and reduce healthcare costs associated with HAIs. This trend is likely to continue as hospitals worldwide prioritize infection prevention and patient protection.

Restraints

High Cost of Disposable Medical Devices Sensors

High costs associated with disposable medical device sensors act as a significant restraint on market growth. The production and maintenance of these advanced sensors require high-quality materials and technology, which can drive up the cost per unit. For many healthcare facilities, particularly smaller practices and those in developing regions, the cost of adopting disposable sensors may be prohibitive. While these devices offer infection control and monitoring benefits, their high prices can limit widespread adoption.

Additionally, the recurring cost of purchasing disposable sensors for each procedure or patient encounter could strain healthcare budgets. Smaller or less-funded healthcare institutions may be forced to forgo these advanced technologies, opting for more cost-effective, reusable alternatives.

Furthermore, insurance reimbursement policies may not cover the cost of these specialized sensors, creating an additional barrier to their adoption. As a result, despite the clear advantages, the high cost of disposable medical devices sensors remains a challenge for expanding their use in healthcare settings globally.

Opportunities

Increasing Innovation in Medical Imaging Creating Opportunities for Disposable Medical Devices Sensors Market

High levels of innovation in medical imaging are creating substantial opportunities for the disposable medical devices sensors market. In June 2021, OMNIVISION Technologies, Inc. introduced an 8-megapixel resolution imaging sensor, specifically designed for both disposable and reusable endoscopes. This innovation enhances the quality of medical imaging, facilitating higher precision in minimally invasive procedures and improving diagnostic accuracy.

As medical imaging technologies continue to advance, the integration of disposable sensors into imaging devices will likely expand, making procedures more efficient and accurate. The rising demand for minimally invasive techniques, which rely on real-time, high-definition imaging, is expected to drive the need for more advanced disposable sensors.

Additionally, the growing focus on personalized healthcare will further fuel the adoption of such devices, as tailored, accurate diagnostics become increasingly important. These innovations allow for better patient outcomes and greater procedural efficiency, presenting significant growth opportunities for the disposable medical device sensors market in the medical imaging sector.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly impact the disposable medical device sensors market. On the positive side, increasing healthcare spending in both developed and emerging economies drives the demand for advanced healthcare solutions, including sensors in medical devices. The ongoing global health challenges, such as the COVID-19 pandemic, have heightened the need for more efficient and accessible monitoring solutions, further fueling market growth.

However, economic downturns and geopolitical instability can result in budget cuts to healthcare expenditures and delays in product approvals, affecting market dynamics. Regulatory changes, trade tariffs, and international policy shifts can either pose challenges or open up new opportunities for market players. Despite these challenges, the growing adoption of advanced medical technologies ensures continued market expansion, driven by innovations that improve patient outcomes and healthcare efficiency.

Latest Trends

Rising Demand for Biomarker Sensing Technology Driving the Disposable Medical Devices Sensors Market:

Rising demand for biomarker sensing technology is expected to drive substantial growth in the disposable medical devices sensors market. High advancements in biomarker sensing systems enable healthcare providers to monitor patient conditions more accurately in real-time, improving diagnosis and treatment outcomes. These technologies are anticipated to revolutionize patient care by facilitating the early detection of diseases and monitoring chronic conditions.

As healthcare systems strive for more cost-effective and efficient solutions, biomarker sensors are projected to become integral to personalized medicine. In March 2022, Rockley Photonics Holdings Limited partnered with Medtronic to integrate its Bioptx biomarker sensing technology into Medtronic’s medical solutions. This collaboration highlights the growing use of optical biosensing platforms in healthcare, enhancing real-time health monitoring and driving the demand for disposable sensors in medical devices.

Regional Analysis

North America is leading the Disposable Medical Devices Sensors Market

North America dominated the market with the highest revenue share of 40.3% owing to increased demand for minimally invasive procedures and the rising need for real-time patient monitoring. The expansion of telemedicine and remote healthcare services also contributed to the demand for sensors that provide continuous health data without the need for extended hospital stays.

In November 2022, OmniVision unveiled the OH02B CameraCubeChip, the first square 2-megapixel CMOS image sensor with a 1500×1500 resolution. Designed for disposable medical devices like endoscopes, catheters, and guidewires, this sensor delivers high-quality imaging while maintaining a compact form factor. The introduction of such advanced technologies has enabled healthcare providers to improve diagnostic accuracy and patient outcomes.

Additionally, advancements in sensor technology, such as wireless connectivity and integration with electronic health records (EHRs), have further accelerated the adoption of disposable sensors. Rising healthcare costs and the push for cost-effective solutions have also driven the market, as disposable devices reduce the need for expensive reprocessing and maintenance.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to increasing healthcare investments, an aging population, and rising incidences of chronic diseases. The region’s growing focus on advanced healthcare technologies and the expansion of healthcare infrastructure are likely to drive demand for sensors in various medical applications, including diagnostics, monitoring, and treatment.

In March 2024, researchers at Tokyo University of Science (TUS) introduced a flexible, paper-based AI health sensor utilizing nanocellulose and zinc oxide (ZnO) nanoparticles. This innovative sensor, which captures real-time optical inputs, is expected to support the development of lightweight, biodegradable, and efficient solutions for wearable health monitoring devices.

As disposable sensors become more affordable and accessible, their integration into wearable health tech and point-of-care testing is projected to increase significantly. The anticipated rise in demand for continuous monitoring solutions, particularly in emerging markets, will further boost market growth in Asia Pacific, along with increasing adoption of advanced technologies like AI and nanotechnology.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the disposable medical devices sensors market focus on developing cost-effective, high-performance sensors that improve patient monitoring and diagnostic accuracy. Companies invest in miniaturization, wireless connectivity, and integration with mobile health applications to enhance patient care in real-time.

Strategic partnerships with hospitals, diagnostic centers, and wearable device manufacturers help expand market reach and drive adoption. Many players prioritize regulatory compliance and certifications to ensure product safety and build consumer trust. Additionally, companies expand geographically to tap into emerging markets with growing healthcare infrastructure.

Medtronic is a leading company in this market, offering a wide range of disposable sensors, including those used in cardiac monitoring and respiratory care. The company emphasizes innovation in sensor technology, particularly in non-invasive monitoring systems that integrate with mobile health platforms. Medtronic’s commitment to improving patient outcomes and expanding global accessibility establishes it as a key player in the sensor market for medical devices.

Top Key Players

- TE Connectivity

- SSI Electronics

- Smith’s Medical

- Sensirion AG Switzerland

- Medtronic

- GE Healthcare

- EnSilica

- ACE Medical Devices

Recent Developments

- In January 2024, Medtronic plc obtained CE (Conformite Europeenne) Mark certification for the MiniMed 780G system, featuring the Simplera Sync, a next-generation disposable continuous glucose monitor (CGM). This upgraded device eliminates the need for fingerstick calibration, incorporates a simplified two-step insertion process, and is significantly more compact than its previous iteration, offering an improved patient experience.

- In February 2022, EnSilica introduced the ENS62020, a power-efficient sensor interface IC designed for integration into wearable health devices such as pulse oximeters and fitness monitors. The chip enables real-time health tracking, accelerates product development, and allows for customized solutions through its adaptable architecture, supporting the expanding demand for smart medical wearables.

Report Scope

Report Features Description Market Value (2024) US$ 12.2 billion Forecast Revenue (2034) US$ 66.6 billion CAGR (2025-2034) 18.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Biosensors, Temperature Sensors, Pressure Sensors, Accelerometers, and Others), By Application (Diagnostic, Therapeutic, and Patient Monitoring), By Type (Strip Sensors, Wearable Sensors, Invasive Sensors, Ingestible Sensors, and Implantable Sensors) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape TE Connectivity, SSI Electronics, Smith’s Medical , Sensirion AG Switzerland, Medtronic, GE Healthcare, EnSilica, and ACE Medical Devices. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Disposable Medical Devices Sensors MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Disposable Medical Devices Sensors MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- TE Connectivity

- SSI Electronics

- Smith’s Medical

- Sensirion AG Switzerland

- Medtronic

- GE Healthcare

- EnSilica

- ACE Medical Devices