Global Non-PVC IV Bags Market By Product (Single chamber, Multi Chamber) By Material Type (Polypropylene IV Bag, Polyethylene IV Bag, Ethylene Vinyl Acetate, Others) By Content Type (Frozen Mixture, Liquid Mixture) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: March 2024

- Report ID: 16486

- Number of Pages: 206

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

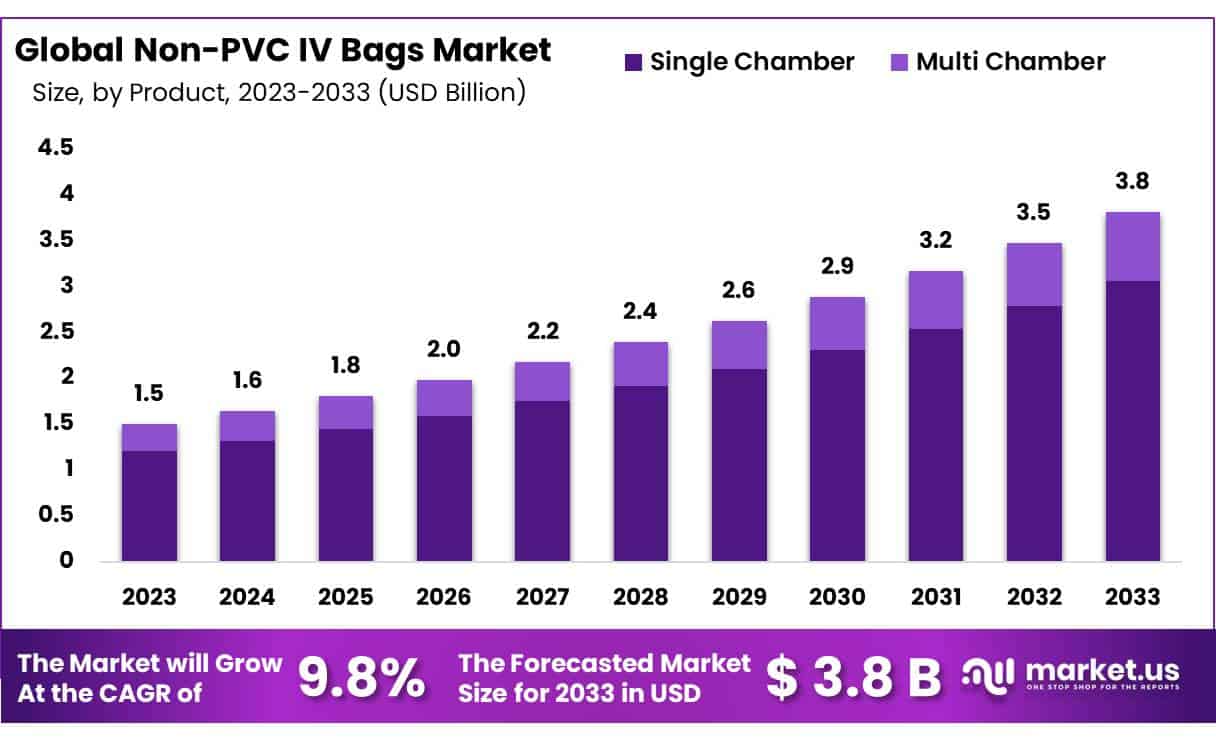

The Global Non-PVC IV Bags Market size is expected to be worth around USD 3.8 Billion by 2033 from USD 1.5 Billion in 2023, growing at a CAGR of 9.8% during the forecast period 2024 to 2033.

Increased patient traffic within healthcare settings has been identified as one of the primary drivers for growth in the non-PVC IV bag market. This trend is propelled by an increasing demand for preventative measures against errors such as improper dosage delivery and stringent regulations regarding hospital-acquired diseases that necessitate advanced IV containers.

Furthermore, rising demand for oncology treatments such as chemotherapy and targeted drug delivery combined with rising cancer incidence is contributing significantly to market expansion. Expanding hospitals and ambulatory centers, infrastructure development within healthcare sectors, favorable reimbursement policies, and government initiatives all positively influence the non-PVC IV bags market. Furthermore, their availability in various designs presents lucrative market players during 2024-2033 forecast period.

As more individuals seek oncology treatments, more therapeutic agents can interact with plasticizers and become hazardous substances. To reduce risks associated with this process, non-PVC containers made from materials like ethylene-vinyl acetate or polypropylene are increasingly being utilized – companies like B. Braun have invested significantly over five years, allocating USD 500.00 million towards developing innovative PVC and DEHP-free product lines; once obsolete materials such as glass containers have been replaced by modern alternatives, demand for non-PVC IV bags will increase significantly.

Cancer was responsible for an estimated 9.6 million deaths globally in 2018, as per World Health Organization (WHO). In 2019, American Cancer Society reported over 1.75 million new cancer cases just within the United States. Cancer Research U.K. recorded 36,700 new cancer cases annually within U.K. This data illustrates IV solutions industry growth potential owing to increasing cancer prevalence rates.

Key Takeaways

- Market Size: Non-PVC IV Bags Market size is expected to be worth around USD 3.8 Billion by 2033 from USD 1.5 Billion in 2023.

- Market Growth: The market growing at a CAGR of 9.8% during the forecast period 2024 to 2033.

- Product Analysis: In 2023, the single-chamber segment dominated the market, comprising 64.7% of the total share.

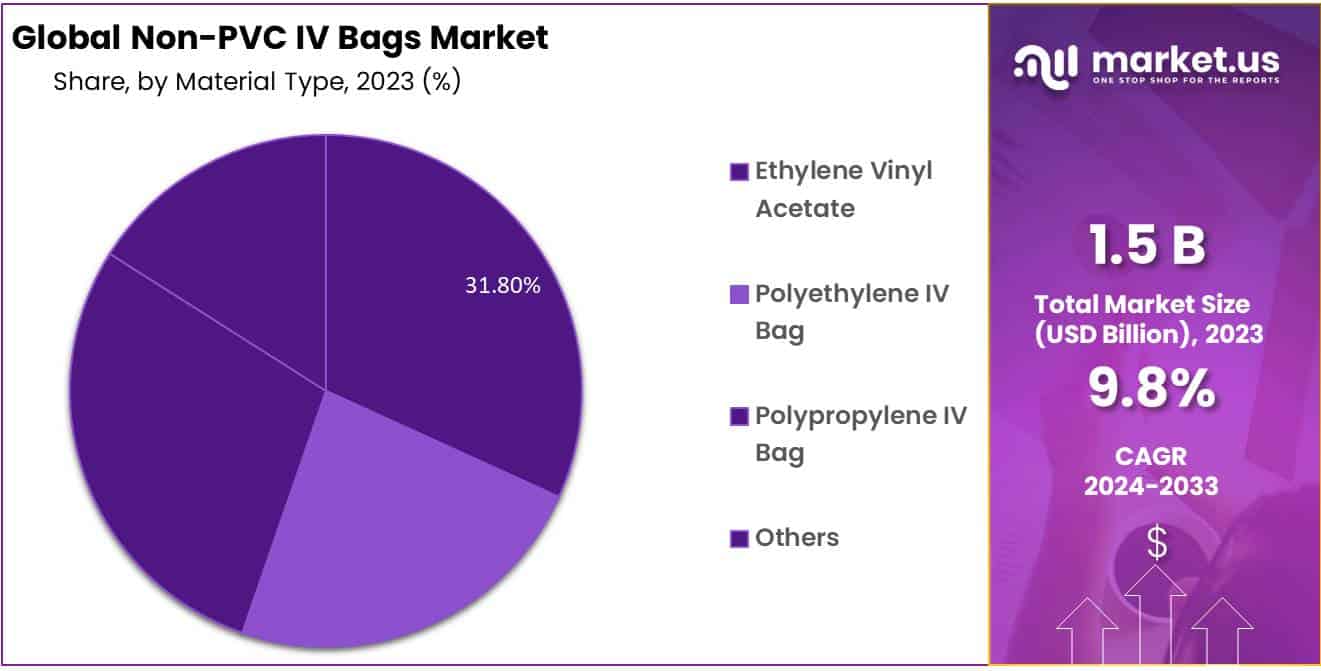

- Application Analysis: The Ethylene Vinyl Acetate (EVA) held approximately 31.8% market share in 2023.

- Content Analysis: In 2023, the largest segment of liquid mixtures accounted for approximately 80.2% of the market share.

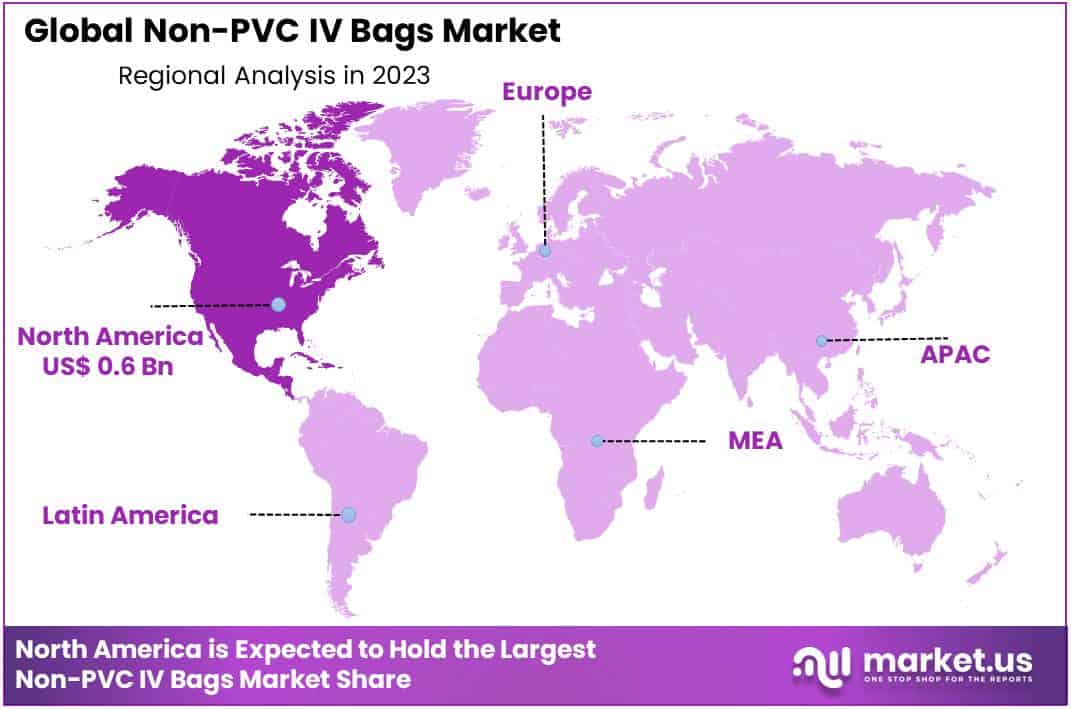

- Regional Analysis: North America held the largest market share dominate by 41.6% in 2023.

Product Type Analysis

In 2023, the single-chamber segment dominated the market, comprising 64.7% of the total share. Single-chamber IV bags remain immensely popular and are poised to maintain their prominence in the future, particularly as they gradually replace other IV containers. The adoption of non-PVC materials has spurred the transition from glass containers to plastic bags, offering advantages such as ease of transportation and disposal. These versatile bags accommodate intravenous solutions like drip bags, irrigation fluids, and sterile water, further driving their demand and ensuring continued growth throughout the forecast period.

Forecasts anticipate the multi-chambered segment to exhibit the most rapid growth. Multi-chambered IV bags are preferred for intravenous treatment scenarios requiring multiple medications. Constructed from non-PVC film with rapid sealing properties, these bags find extensive use in emergency healthcare settings. Their quick accessibility compared to other IV bags streamlines pharmaceutical operations.

Multi-chamber IV bags, renowned for their stability, pressure resistance, transparency, toughness, thermal sealing capabilities, and reusability, are widely embraced in the pharmaceutical sector. The surge in their utilization across diverse applications, including parenteral nutrition, drug reconstitution, and customized product offerings, underscores the burgeoning multi-chambered market.

Material Analysis

The largest market share, comprising approximately 31.8%, was held by Ethylene Vinyl Acetate (EVA). This key segment is poised for significant growth throughout the forecast period. EVA, the predominant alternative to PVC, emerged as the market leader in 2020 and is anticipated to witness extensive utilization, particularly in blood banks and for the storage of frozen mixtures. The projected increase in segment share during the forecast period is attributed to heightened recognition and escalating demand for blood and blood component storage. Furthermore, the rising popularity of parenteral nutrition therapy, coupled with the increasing prevalence of chronic kidney diseases, is expected to fuel demand for EVA bags.

The segment of co-polyester ether is forecasted to exhibit the swiftest growth during the study period. Co-polyester ether boasts several advantages, including durability, transparency, and chemical resistance. It is capable of withstanding radiation and autoclave sterilization. When combined with other materials such as polypropylene, polyolefin, and other resins, co-polyester ether demonstrates enhanced strength. The emergence of Excel Epoxymer represents a significant future trend in the evolution of co-polyester ether’s utilization in pharmaceutical packaging. Key players involved in the development and production of these combinations include Eastman Chemical Company, Sealed Air Corporation, B. Braun Melsungen AG, and Sealed Air Corporation.

Content Analysis

In 2023, the largest segment of liquid mixtures accounted for approximately 80.2% of the market share. This significant portion was primarily driven by factors such as the widespread utilization of IV drips and the introduction of innovative designs. The escalating demand for IV containers with enhanced resistance to low temperatures and heightened security, particularly within blood banks, has further propelled this segment’s growth trajectory.

Major industry players are actively engaged in augmenting their production capacities to capitalize on this burgeoning demand and expand their market presence. Notably, Grifols, a key player in this domain, initiated operations at its state-of-the-art blood-collection facility in Brazil in 2019. With an annual production capacity exceeding 10 million blood-collection bags, this strategic move underscores the company’s commitment to catering to evolving market needs and solidifying its position in the industry.

Кеу Маrkеt Ѕеgmеntѕ

Product

- Single chamber

- Multi Chamber

Material Type

- Polypropylene IV Bag

- Polyethylene IV Bag

- Ethylene Vinyl Acetate

- Others

Content Type

- Frozen Mixture

- Liquid Mixture

Driver

Increasing Regulatory Scrutiny and Healthcare Standards

The intensification of regulatory scrutiny and escalating healthcare standards globally serve as a primary driver for the Non-PVC IV bags market. Regulatory bodies, including the European Union and the U.S. Food and Drug Administration (FDA), are actively imposing restrictions on the use of DEHP, a common plasticizer in PVC, due to its associated health risks. For example, the European Union’s directive 2015/863/EU amends Annex II to Directive 2011/65/EU, adding DEHP to the list of substances restricted under RoHS (the Restriction of Hazardous Substances in electrical and electronic equipment), reflecting the serious stance on minimizing DEHP exposure.

Similarly, the FDA has highlighted the need to reduce DEHP usage, particularly among vulnerable populations like neonates and pregnant women, through its guidelines. These regulatory measures are pushing manufacturers towards adopting Non-PVC materials for IV bags, viewed as safer alternatives that comply with the new standards for patient care. As a result, the market for Non-PVC IV bags is witnessing robust growth, underscored by a commitment to enhance patient safety and adhere to stringent healthcare regulations.

Restraint

Compatibility and Stability Issues

Compatibility and stability issues associated with non-PVC materials present a substantial barrier in the non-PVC IV bag market. Non-PVC IV bags offer many benefits in terms of safety and environmental sustainability; however, certain pharmaceutical substances may be incompatible with them, which could pose chemical compatibility challenges that don’t exhibit as much stability in PVC bags. Problems associated with drug degradation or absorption could diminish its efficacy and safety. Furthermore, non-PVC materials contain physical characteristics which could reduce shelf life and potency of pharmaceutical contents such as oxygen and light permeability differences, thus diminishing their effectiveness as packaging materials.

Industry testing and validation procedures must ensure that these materials can safely and effectively store various medicinal products. Compatibility testing could impede market expansion, according to research published by the International Journal of Pharmaceutics which estimates that up to 30% of new pharmaceuticals encounter stability issues when packaged using non-traditional materials such as non-PVC IV bags. This poses a considerable hurdle to greater acceptance.

Opportunity

Growing Demand for Biologics and Specialty Pharmaceuticals

The global Non-PVC IV bags market is presented with substantial opportunities due to the rising demand for biologics and specialty pharmaceuticals, which require specialized packaging solutions. Biologics, including vaccines, blood components, and advanced therapeutic medicinal products, often necessitate storage and delivery in containers that maintain their stability, potency, and safety.

Non-PVC IV bags, with their inert and non-reactive nature, are well-suited to these requirements, offering a viable packaging option that minimizes the risk of interaction with the product. As the biopharmaceutical sector continues to expand, driven by advancements in drug development and an increasing focus on personalized medicine, the demand for compatible and safe packaging solutions like Non-PVC IV bags is expected to surge, providing a significant growth avenue for the market.

Trend

Shift Towards Sustainable Healthcare Solutions

A prevailing trend in the global Non-PVC IV bags market is the healthcare industry’s shift towards sustainable and eco-friendly practices. There is a growing awareness of the environmental impact of medical waste, particularly the issues associated with the disposal of PVC, which can release harmful dioxins when incinerated and contribute to landfill pollution due to its non-biodegradable nature. This environmental consciousness is prompting healthcare facilities and medical product manufacturers to adopt greener alternatives.

Non-PVC IV bags, being more environmentally friendly than their PVC counterparts, are gaining traction as part of this broader trend towards sustainability in healthcare. They are viewed as a step forward in reducing the ecological footprint of healthcare operations, aligning with global initiatives for environmental protection and sustainable development within the medical sector.

Regional Market Analysis

North America held the largest market share dominate by 41.6% in 2023. There are strict regulations in America that aim to improve patient safety. This has led to increased demand for non-PVC IV containers. These containers provide safe, effective patient care without exposing patients to harm. As stomach cancer is more common, IV bags are in high demand.

The American Cancer Society has estimated that approximately 27,600 cases of will be diagnosed in the U.S. with stomach cancer in 2020. In addition, 11,010 would be affected by the disease. Because stomach cancer patients cannot eat food through their mouths, they must rely on complete parenteral care for their survival and dietary needs. This could lead to a rise in demand for ethylene-vinyl alcohol (EVA) IV bags. In return, market growth is expected. In this region, there is also the possibility of a rise in the use of innovative drug delivery systems as well as technological innovations.

Asia Pacific is expected to have the highest CAGR for the forecasted duration. The competitive landscape of local manufacturers is promoting international demand by selling products at affordable prices, increasing foreign direct investments, and rapid improvement to healthcare industry infrastructures, such as a rising number of hospitals and clinics, all have a significant impact on the industry’s growth.

Key Regions and Countries

North America

- The US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The market’s key players play a role in developing strategies, such as partnerships, mergers and acquisitions, and the launch of new products. Baxter was granted FDA approval in July 2019 for Myxredlin. It is the only ready-to-use insulin for IV Infusion.

In order to produce the most advanced products possible, major players are investing heavily in research and development. China’s first “non-PVC solid fluid double chamber bag for ceftazidime/sodium chloride injection” certification has been granted to the Group. There are several prominent market players in this global market for non-PVC IV bags are:

Маrkеt Kеу Рlауеrѕ

- MEDI PHARMA PLAN Co.,Ltd

- Fagron Sterile Services US

- Technoflex

- ICU Medical Inc.

- Fresenius SE and Co. KGaA

Recent Developments

- MEDI PHARMA PLAN Co., Ltd has undertaken various research and development initiatives aimed at increasing the performance and eco-friendliness of their non-PVC IV bags. New manufacturing processes and materials were implemented in order to boost product quality while decreasing environmental impacts; and its distribution network expanded worldwide to reach even more healthcare facilities.

- Fagron Sterile Services US has made strides to expand their product portfolio with non-PVC IV bag formulations designed specifically to meet individual patient needs, through research efforts that have produced innovative solutions with enhanced compatibility, stability, and safety profiles. Furthermore, this company has invested in state-of-the-art manufacturing facilities for maximum quality assurance as well as regulatory standards compliance.

- Technoflex has established itself as a top provider of sustainable packaging solutions for healthcare industries. They have introduced non-PVC IV bags made of biocompatible materials sourced from renewable sources, which offer comparable performance while significantly reducing their environmental footprint. Technoflex continues to collaborate with healthcare providers and regulatory agencies to encourage sustainable practices within healthcare providers’ operations.

Report Scope

Report Features Description Market Value (2023) USD 1.5 Billion Forecast Revenue (2033) USD 3.8 Billion CAGR (2024-2033) 9.8% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Single chamber, Multi Chamber) By Material Type (Polypropylene IV Bag, Polyethylene IV Bag, Ethylene Vinyl Acetate, Others) By Content Type (Frozen Mixture, Liquid Mixture) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape MEDI PHARMA PLAN Co.,Ltd, Fagron Sterile Services US, Technoflex, ICU Medical, Inc., Fresenius SE and Co. KGaA Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are Non-PVC IV Bags?Non-PVC IV bags are intravenous fluid containers made from materials other than polyvinyl chloride (PVC). These alternatives are often preferred for their reduced environmental impact and potential health benefits.

How big is the Non-PVC IV Bags Market?The global Non-PVC IV Bags Market size was estimated at USD 1.5 Billion in 2023 and is expected to reach USD 3.8 Billion in 2033.

What is the Non-PVC IV Bags Market growth?The global Non-PVC IV Bags Market is expected to grow at a compound annual growth rate of 9.8%. From 2024 To 2033

Who are the key companies/players in the Non-PVC IV Bags Market?Some of the key players in the Non-PVC IV Bags Markets are MEDI PHARMA PLAN Co.,Ltd, Fagron Sterile Services US, Technoflex, ICU Medical, Inc., Fresenius SE and Co. KGaA.

What are the Key Drivers for Non-PVC IV Bags Market Growth?Factors driving the growth of the Non-PVC IV Bags market include increasing awareness about the harmful effects of PVC, rising demand for eco-friendly healthcare products, and stringent regulations promoting the use of safer materials in medical devices.

What are the Advantages of Non-PVC IV Bags?Non-PVC IV bags offer several advantages, including reduced risk of leaching harmful chemicals into intravenous fluids, enhanced biocompatibility, improved recyclability, and lower environmental footprint compared to traditional PVC bags.

How is Sustainability Driving Innovation in the Non-PVC IV Bags Market?Sustainability concerns are prompting companies to invest in research and development efforts aimed at developing biocompatible materials, optimizing manufacturing processes, and reducing environmental impact throughout the lifecycle of Non-PVC IV bags.

-

-

- Angiplast Pvt. Ltd.

- Alfa Laboratories

- Baxter International

- Braun Melsungen AG

- B. Braun Medical Inc.

- Huaren Pharmaceutical Co.,

- Pfizer, Inc. (Hospira)

- Fresenius Kabi AG

- Gen Eco-Technologies Co., Ltd

- JW Life Science

- Jiangxi Sanxin Medtec Co., Ltd.

- Kraton Corporation

- Otsuka Holdings Co., Ltd.

- Renolit SE

- Sartorius AG

- Shanghai Solve Care Co., Ltd.

- Shanghai Xin Gen Eco-Technologies Co.

- PolyCine GmbH

- Technoflex

- Sippex

- Pharmaceutical Solutions

- Vioser

- ICU Medical

- Well Pharma

- Other Key Players