Global Medical Device Cleaning Market By Device (Non-Critical, Semi-Critical, and Critical), By Process (Sterilization, Disinfection, Ethylene Dioxide), By EPA (High Level, Low Level, and Intermediate Level), By Application, By End-User, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2032

- Published date: Oct 2023

- Report ID: 14344

- Number of Pages: 211

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

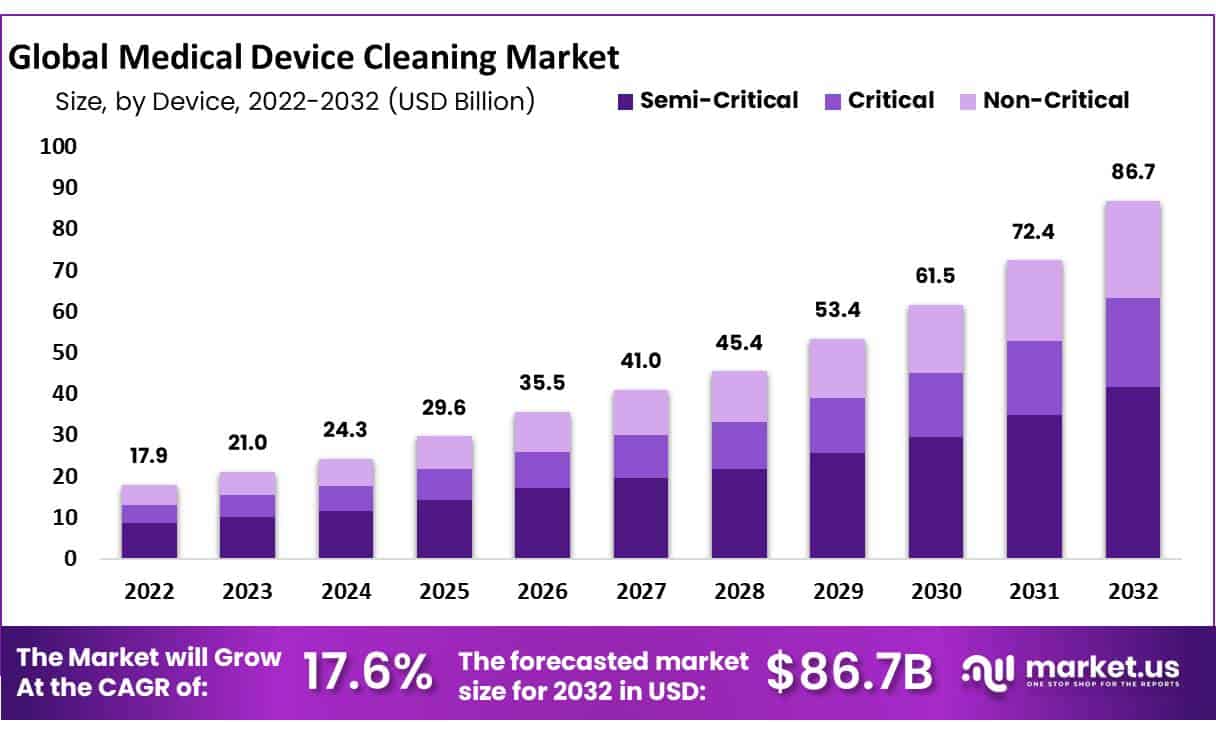

Global Medical Device Cleaning Market size is expected to be worth around USD 86.7 billion by 2032 from USD 21.0 billion in 2023, growing at a CAGR of 17.60% during the forecast period from 2024 to 2032.

Medical device cleaning is a procedure to evade contamination to a healthy individual. Cleaning medical devices can be done through disinfection or sanitization with numerous reagents and chemicals.

Some generally used cleaners include washer-sterilizers, disinfectors, and ultrasonic. Presently, the requirement for these cleaners is increasing worldwide for diagnostics applications and to prevent the indirect transmission of diseases.

In addition, medical device cleaning is necessary to avoid the transmission of any kind of viral or bacterial infection. Various products are available in the market through offline and online modes of distribution that help maintain the medical devices’ cleanliness.

Device Analysis

The Semi-Critical Segment to Witness Significant Growth

Based on the device, the global medical device cleaning market is segmented into non-critical, semi-critical, and critical. The semi-critical segment accounted for the largest market share of 48 % in 2022. Semi-critical devices are those that are shown the mucosal membranes.

Endoscopes and dental equipment are some of the surgical instruments of this type. Disposable devices are rising due to their decreasing prices, high competition, and strict regulatory guidelines. As per the Central for Disease Control and Prevention, these devices must be sterilized before any procedure using chemical or heat sterilization methods.

The critical segment is projected to witness the highest growth during the forecast period. These devices are sterilized in earlier packaging, most of which are single-use. Ethylene oxide and heat sterilization are the most widely used processes for these devices.

Key Takeaways

- Market Size: Global Medical Device Cleaning Market size is expected to be worth around USD 86.7 billion by 2032 from USD 21.0 billion in 2023.

- Market Growth: The market growing at a CAGR of 17.60% during the forecast period from 2024 to 2032.

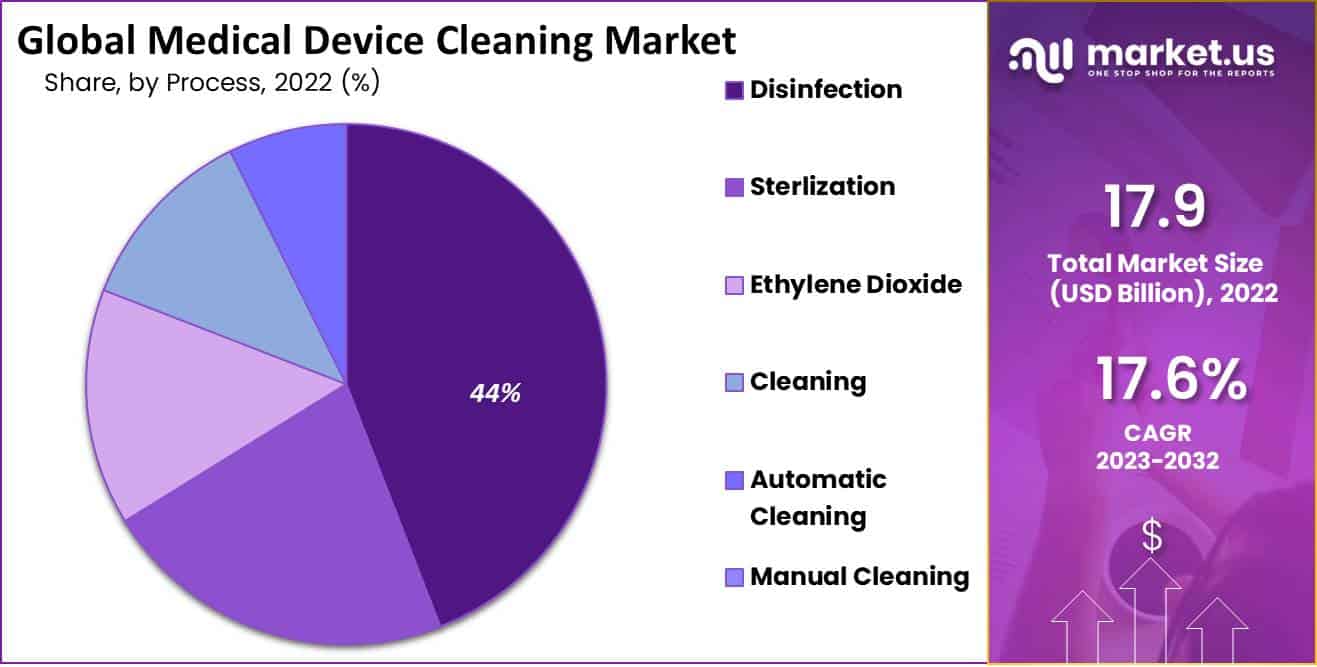

- Process Analysis: The disinfection segment dominated the market and held the highest revenue share of 44% in 2022.

- EPA Analysis: The intermediate-level segment dominated the medical device cleaning market and held a lucrative market share of 52% in 2022.

- Application Analysis: The Surgical Instruments Segment Held the Largest Revenue Share in 2022.

- End-Use Analysis: Hospitals & Clinics Segment Estimated to Contribute Significantly to the Market Growth

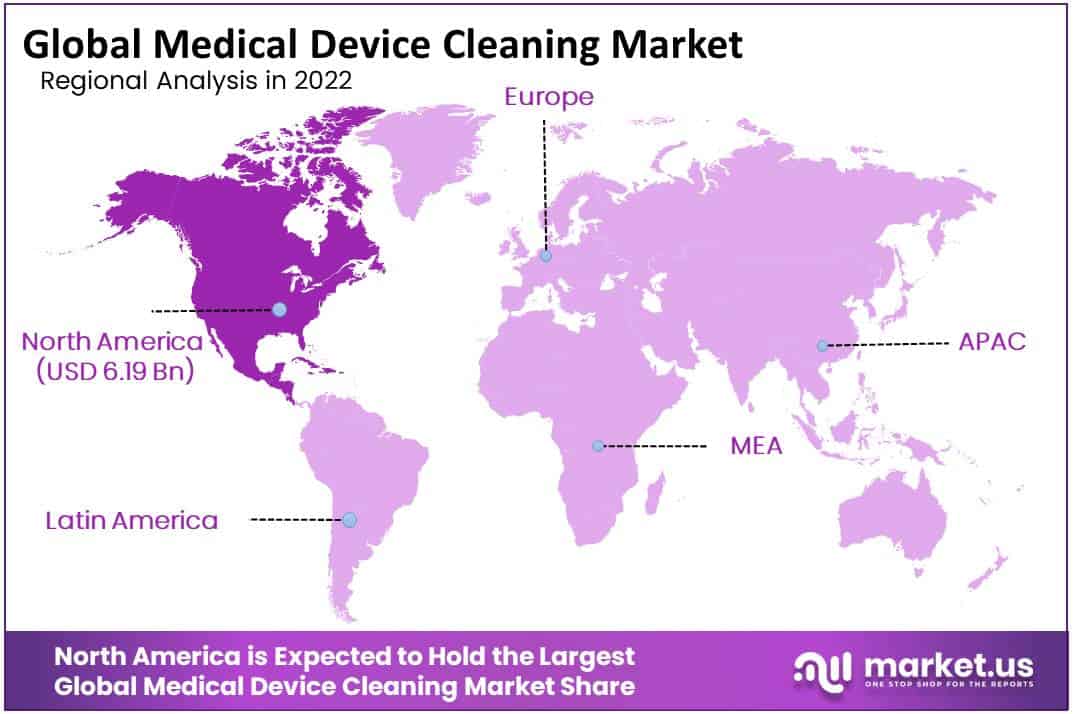

- Regional Analysis: North America accounted for a significant medical device cleaning market revenue share of 34.6%.

- Environmental Sustainability: There has been an increased focus on environmentally sustainable cleaning solutions that reduce harm to the environment while remaining eco-friendly.

By Process Analysis

The Disinfection Segment Dominated the Medical Device Cleaning Market

Based on the process, the medical device cleaning market is classified into sterilization, disinfection, ethylene dioxide, cleaning, automatic cleaning, and manual cleaning. Among these processes, the disinfection segment dominated the market and held the highest revenue share of 44% in 2022. Disinfection is a significant step in the processing of critical and semi-critical medical devices.

The disinfectant is mainly divided into fungicidal, virucidal, and bactericidal. The selection of this material is mostly based on the type of medical device. Disinfection in association with detergents is mostly used in developing countries where healthcare establishments have insufficient economic resources.

The sterilization market segment is anticipated to witness the highest market growth rate. Sterilization includes the removal of microorganisms present on medical devices. EtO and steam sterilization are the most usually employed sterilization procedures in hospitals.

By EPA

Intermediate Segment is Expected to Show the Lucrative Growth During the Forecast Period

Based on the EPA, the global medical device cleaning market is segmented into high-level, intermediate-level, and low-level. The intermediate-level segment dominated the medical device cleaning market and held a lucrative market share of 52% in 2022.

Intermediate-level disinfectants are chemical agents that kill the diseases producing microorganisms. Some of the main types of intermediate-level disinfectants are bleach, hydrogen-based phenolic, and water-based phenolic. The rising incidence of HAIs and the spread of infectious diseases are contributing to market growth. On the other hand, the high-level segment is anticipated to grow at the highest CAGR during the forecast period.

High-level disinfectants do treatments of medical devices and dental instruments. Some of the most commonly used high-level disinfectants are special peracetic acid, glutaraldehyde, and special hydrogen peroxide.

By Application Analysis

The Surgical Instruments Segment Held the Largest Revenue Share in 2022

Based on the application, the medical device market is divided into surgical instruments, endoscopes, ultrasound probes, dental instruments, and other applications. The surgical instruments segment is expected to register the highest market revenue share during the forecast period.

Surgical instrument cleaning is done using neutral or near-neutral pH detergent solution; such solutions generally provide the best material compatibility profile. In addition, to keep patients, doctors, and the environment safe, they need to use medical equipment safely.

Medical device cleaning market share has seen remarkable expansion over the last several years due to increased awareness about its importance within healthcare settings and hospitals’ investments in advanced cleaning solutions and technologies to safeguard patients and healthcare staff alike.

By End-user Analysis

Hospitals & Clinics Segment Estimated to Contribute Significantly to the Market Growth

Based on end-user, the market is divided into hospitals & clinics, diagnostic centers, dental clinics, ambulatory surgical centers, and others. The hospitals & clinics segment dominated the market with the highest revenue share in 2022.

Due to the increasing prevalence of cardiovascular diseases such as cardiomyopathy, heart failure, etc., has augmented the utilization of medical devices in hospitals and clinics across the world. According to the World Health Organization, a large world population is suffering from cardiovascular diseases.

On the other hand, the ambulatory surgical center segment accounted for the highest market growth rate during the forecast period. This is because ambulatory surgical centers provide preventive and diagnostic services.

Key Market Segments

By Device

- Non-Critical

- Semi-Critical

- Critical

By Process

- Sterilization

- Disinfection

- Ethylene Dioxide

- Cleaning

- Automatic Cleaning

- Manual Cleaning

By EPA

- High Level

- Intermediate Level

- Low Level

By Application

- Surgical Instruments

- Endoscopes

- Ultrasound Probes

- Dental Instruments

- Other Applications

By End-User

- Hospitals & Clinics

- Diagnostic Centers

- Dental Clinics

- Ambulatory Surgical Centers

- Other End-users

Drivers

Increasing Demand for Surgical Methods

The market development is being directly influenced by the increase in surgical operations due to various factors, such as accidents, surgeries, and aging-related aesthetic enhancements. In addition to the market’s rising accessibility of cutting-edge surgical goods is the way for expansion. This has increased the demand for different medical devices and surgical equipment.

Research and Development Abilities

Increasing government investment in research & development, mainly in developing and developed nations, will open up new market opportunities. In addition, the medical device cleaning market growth rate is also being driven by biopharmaceutical and pharmaceutical organization’s R & D abilities for the acquisition of cutting-edge technology in healthcare facilities.

Restraints

Concerns regarding the safety of reprocessed instruments

There are concerns about the performance and safety of reprocessed devices. Healthcare suppliers reprocess medical devices to reduce waste and save money. However, the lack of cleaning instruments and skilled professionals results in the retention of tissue and blood in medical devices.

These factors are restraining the acceptance of reprocessed medical devices amongst hospital administrators and physicians. Some of the difficulties in reprocessing and cleaning are that they are delicate and have characteristics such as narrow lumens, special coatings, and obtuse angles.

Revealing these instruments to high pressure and temperature during the sterilization and disinfection procedures may also damage the original properties of their construction material or causes them to degrade.

Opportunity

Rising Healthcare Expenditure and Medical Tourism in Developing Countries

During the forecast period, participants in the market may expect a vast range of growth possibilities from developing countries such as India and China. The escalating cost of HAIs to the healthcare systems, increasing number of hospitals and clinics, emergence of multidrug-resistant microorganisms, and rising government initiatives contribute to the market growth.

Government investments in healthcare infrastructure

The government increased support for accelerating market expansion in addition to improving and expanding the healthcare sector by private and public sectors. Mostly, emerging countries will provide significant market opportunities. In addition, the market value is also increasing owing to the rising use of preventative strategies to decrease hospital-acquired illness.

Trends

Growing Demand for Diagnosis Equipment in the Healthcare Industry

With the Increasing cases of Coronavirus disease, the usage of endoscopes, infusion equipment and stethoscopes, pulse oximeter, ventilators, and other medical devices is increasing across the globe.

Medical device cleaning market trends have recently seen an exponential surge. Amid rising healthcare-associated infections and their accompanying concerns about patient hygiene, hospitals and healthcare facilities are placing increased focus on maintaining clean environments for their patients.

This represents one of the major factors that positively impact the requirement for medical device cleaning solutions to decrease the risk of contamination. Additionally, the increasing geriatric population and the rising surgery rates due to the growing occurrence of chronic disease contribute to market growth.

Regional Analysis

North America Region Accounted for a Significant Revenue Share of the Global Medical Device Cleaning Market

North America accounted for a significant medical device cleaning market revenue share of 34.6%. A constant number of collaborations adopted by the market players to widen their product portfolio and infection control abilities are anticipated to be responsible for this region’s greater market revenue share.

Additionally, strict government regulations regarding the cleaning and disinfection of medical devices and favorable reimbursement policies are projected to propel the regional market growth during the forecast period. A major factor contributing to the rising adoption for sterile practices is the growing use of non-disposable medical devices.

Asia-Pacific is anticipated to witness lucrative growth over the forecast period. Owing to the rise in government initiatives to promote awareness, increase regional research activities, and increase medical tourism demand for healthcare in the region.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The key players are entering into acquisitions and mergers to raise their market share and consumers globally. In addition, developments in the healthcare industry, increasing technological advancements, and Increasing R&D make the market lucrative.

Market Key Players

- Steris plc.

- Rhuof Corporation

- Oro Clean Chemie AG

- Cantel Medical Corporation

- Ecolab Inc.

- Sklar Corporation

- Getinge AB

- 3 M Company

- Integra Lifesciences Holdings Corporation

- Metrex Research, LLC

- Other Key Players

Recent Development

- Steris plc – Acquisition In June 2023, Steris plc acquired Becton, Dickinson and Company’s surgical instrumentation assets for $540 million. This acquisition is set to enhance Steris’s capabilities in sterilization and disinfection solutions, particularly in the healthcare and life sciences sectors.

- Cantel Medical Corporation (by Steris) – Merger Steris completed its $4.6 billion merger with Cantel Medical in June 2021. This merger has expanded Steris’s portfolio in infection prevention products and services, particularly in endoscopy and dental sterilization.

- Ecolab Inc. – New Product Launch In February 2023, Ecolab launched a new advanced cleaning system designed for healthcare settings. This system aims to improve the efficiency and reliability of medical device sterilization, thus enhancing patient safety.

Report Scope

Report Features Description Market Value (2023) USD 21.0 Billion Forecast Revenue (2032) USD 86.7 Billion CAGR (2023-2032) 17.6% Base Year for Estimation 2023 Historic Period 2016-2022 Forecast Period 2024-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Device-Non-Critical, Semi-Critical, and Critical; By Process- Disinfection, Sterilization, Ethylene Dioxide, Cleaning, Automatic Cleaning, Manual Cleaning; By EPA-High Level, Intermediate Level, and Low Level; By Application-Surgical Instruments, Endoscopes, Ultrasound Probes, Dental Instruments, and other applications; By End-user- Hospitals & clinics, Diagnostic centers, Dental Clinics, Ambulatory Surgical Centers, and Other End-users Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; The Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Steris plc. Rhuof Corporation, Oro Clean Chemie AG, Cantel Medical Corporation, Ecolab Inc., Sklar Corporation, Getinge AB,3 M Company, Integra Lifesciences Holdings Corporation, Metrex Research, LLC, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Medical Device Cleaning MarketPublished date: Oct 2023add_shopping_cartBuy Now get_appDownload Sample

Medical Device Cleaning MarketPublished date: Oct 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Steris plc.

- Rhuof Corporation

- Oro Clean Chemie AG

- Cantel Medical Corporation

- Ecolab Inc.

- Sklar Corporation

- Getinge AB

- 3 M Company

- Integra Lifesciences Holdings Corporation

- Metrex Research, LLC

- Other Key Players