Global E-Commerce Apparel Market By Type (Womens Apparel, Mens Apparel, Children Apparel), By Gender (Women, Men, Children), By Pricing Model (Discounted, Premium), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 134890

- Number of Pages: 302

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

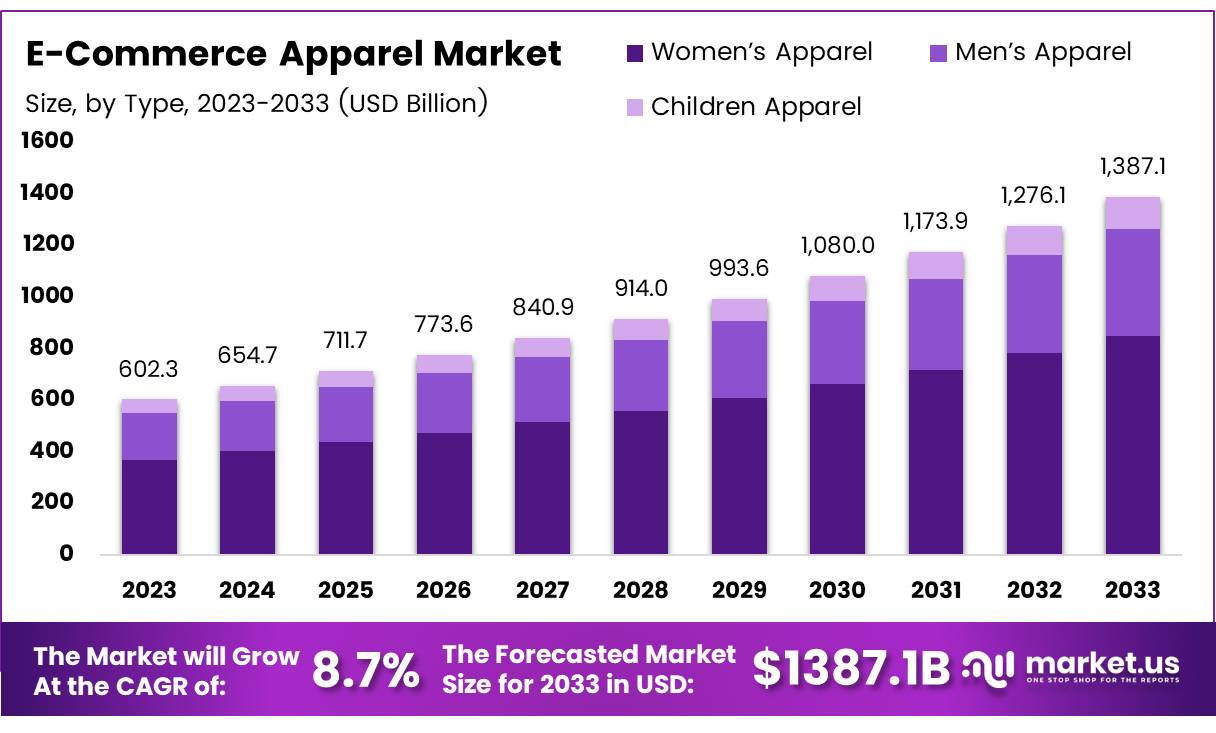

The Global E-Commerce Apparel Market size is expected to be worth around USD 1387.1 Billion by 2033, from USD 602.3 Billion in 2023, growing at a CAGR of 8.7% during the forecast period from 2024 to 2033.

E-commerce apparel refers to the sale of clothing, footwear, and accessories through online platforms. This mode of retail leverages the internet to showcase products, manage transactions, and facilitate the exchange of goods between sellers and buyers without the need for a traditional brick-and-mortar presence.

The digital nature of e-commerce allows for a broader reach to customers, enabling retailers to operate on a global scale, optimize inventory management, and enhance customer engagement through personalized marketing strategies.

The e-commerce apparel market encompasses all activities related to the buying and selling of apparel goods over the internet. This market segment is part of a larger e-commerce industry, distinguished by its focus on fashion and clothing items.

The market’s dynamics are influenced by consumer trends, technological advancements, and the evolving landscape of global retail. It serves a diverse demographic, offering a wide range of products from luxury garments to everyday wear, catering to varying tastes, budgets, and shopping preferences.

The e-commerce apparel sector has demonstrated remarkable resilience and adaptability amidst changing fashion trends and consumer behaviors. As an industry analyst with a decade of experience, it is observed that innovation in digital marketing and the integration of advanced technologies like AI for personalized shopping experiences significantly boost consumer engagement and satisfaction.

The e-commerce apparel market is poised for significant growth, driven by increasing internet penetration and the rising comfort of consumers with online shopping. The integration of immersive technologies such as augmented reality and virtual fitting rooms is enhancing the online shopping experience, thereby reducing the return rates and increasing consumer confidence in purchasing apparel online.

Furthermore, the market’s expansion is supported by robust E-commerce logistics and supply chain frameworks that enable efficient worldwide shipping, thus broadening the potential consumer base for e-commerce apparel retailers.

The e-commerce apparel market is witnessing substantial growth, underpinned by a surge in online consumer base and technological advancements in e-commerce platforms.

According to recent data, nearly 40% of Asian fashion sales are now conducted online, highlighting the region’s rapid adoption of e-commerce solutions. Globally, the number of online shoppers is projected to reach 2.71 billion by 2024, representing 33% of the world’s population, which indicates a significant market expansion potential.

Opportunities within this sector are abundant, particularly in harnessing emerging technologies to create more personalized and engaging user experiences. Additionally, the market is expected to reach a monumental $1 trillion in 2024 and is projected to grow to $1.2 trillion by 2025, evidencing robust economic prospects.

Governments worldwide are also playing a crucial role by investing in digital infrastructure, ensuring cybersecurity, and framing e-commerce-friendly policies, which facilitate the growth of the online apparel market. However, they are also imposing regulations that mandate transparency, data protection, and consumer rights, which companies must navigate to harness the full potential of the market.

In the United States, consumer spending on online shopping has overtaken in-store purchases with a distribution of 63% to 37%, signifying a shift in consumer preference towards online platforms. This trend is further supported by the growing number of online shoppers in the United States, set to increase from 268 million in 2022 to nearly 285 million by 2025, thereby solidifying the market’s expansion trajectory.

Key Takeaways

- The global e-commerce apparel market is projected to grow from USD 602.3 billion in 2023 to USD 1387.1 billion by 2033, at a CAGR of 8.7%.

- Women’s apparel dominates the e-commerce apparel market with a 68.7% share in 2023, driven by the preference for online shopping and availability of more style and size options.

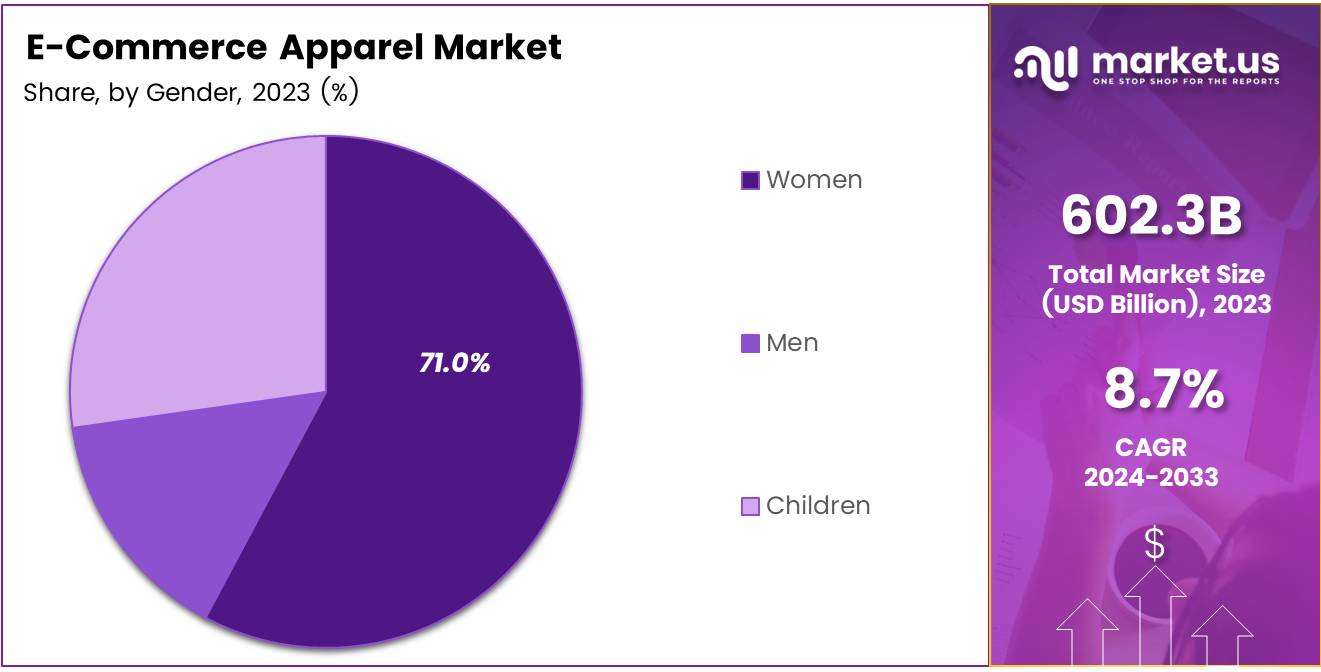

- Women hold a 71% share in the gender analysis of the e-commerce apparel market in 2023, influenced by diverse product offerings and frequent purchasing habits.

- The discounted pricing model leads the market due to consumer demand for affordability, accounting for a significant market share in 2023.

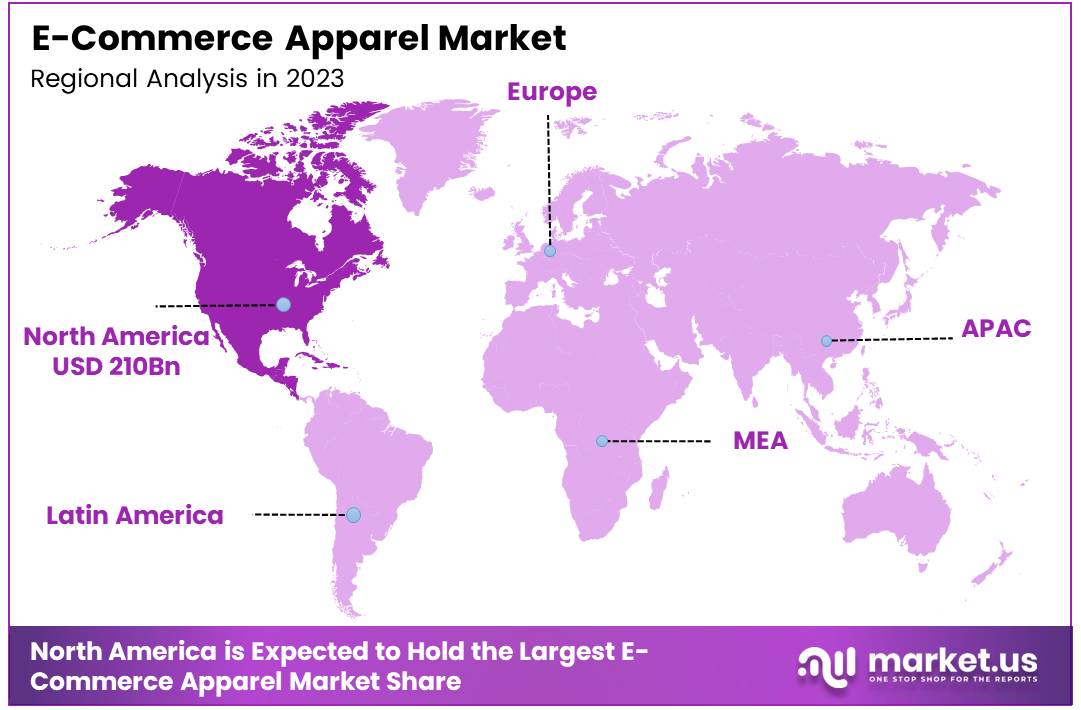

- North America holds a commanding 35% market share in the e-commerce apparel sector, propelled by strong digital infrastructure and high consumer spending.

Type Analysis

Women’s Apparel Leads the Charge in E-Commerce, Capturing Nearly 70% of the Market in 2023

In 2023, Women’s Apparel held a dominant market position in the By Type Analysis segment of the E-Commerce Apparel Market, with a 68.7% share. This substantial market share is attributed to the increasing preference for online shopping among women, coupled with a wider variety of styles and sizes offered by e-commerce platforms compared to traditional retail outlets. The convenience of trying clothes at home and easy return policies have further fueled the growth of women’s apparel online.

Men’s Apparel, while still significant, commands a smaller segment of the market. Trends indicate a steady increase in online purchases among men, driven by the availability of targeted marketing and expanded product offerings that cater to male consumers. However, this segment has not grown at the same pace as women’s apparel, indicating potential areas for strategic expansion and increased market penetration.

Children’s Apparel in the e-commerce space has seen an upsurge in demand, primarily due to the convenience factor that appeals to busy parents. This sector is expected to grow as retailers continue to enhance their online presence with appealing, kid-friendly interfaces and more robust selections of children’s clothing.

Gender Analysis

Gender-Based Dynamics in the E-Commerce Apparel Market

In 2023, women held a dominant market position in the By Gender Analysis segment of the E-Commerce Apparel Market, with a 71% share. This dominance is largely driven by the diverse product offerings available to female consumers and the influence of fashion trends.

The engagement of women with online shopping platforms is further amplified by targeted marketing campaigns that leverage digital and social media channels, capitalizing on the tendency of women to make more frequent purchases.

The men’s segment, while smaller, reflects a growing interest in fashion, though purchasing patterns differ significantly. Men tend to make less frequent purchases, focusing on essentials and investment pieces. This segment’s growth potential lies in expanding the variety of offerings and enhancing the online shopping experience to encourage more frequent transactions.

Children’s apparel holds the smallest share, influenced by the practical considerations of parents or guardians. Purchases in this category are driven by need, based on growth and seasonal changes, rather than fashion trends.

However, there is an emerging trend towards more fashion-forward, child-centric designs that appeal to both children and their parents, indicating a potential area for expansion.

Pricing Model Analysis

Balancing Affordability and Quality in E-Commerce Apparel Trends

In 2023, Discounted held a dominant market position in the By Pricing Model Analysis segment of the E-Commerce Apparel Market. This trend can be attributed to the increased consumer preference for affordability amidst economic uncertainties.

The discounted segment capitalized on this shift, garnering substantial market share by offering value-driven choices to price-sensitive consumers. This strategic positioning allowed companies within this segment to enhance their market penetration and customer base, contributing to volume-driven growth.

Conversely, the Premium segment, characterized by higher-priced offerings, targeted a niche market focused on quality and exclusivity.

Despite a smaller market share, this segment maintained stable revenue streams, supported by brand loyalty and consumer segments less sensitive to price fluctuations. The resilience of premium brands, especially in developed markets, underscored the continued demand for specialty and high-quality apparel products.

The dynamics between these two pricing models underscore significant insights for stakeholders in the E-Commerce Apparel Market, highlighting the importance of tailored market strategies to effectively engage different consumer segments.

Key Market Segments

By Type

- Women’s Apparel

- Men’s Apparel

- Children Apparel

By Gender

- Women

- Men

- Children

By Pricing Model

- Discounted

- Premium

Drivers

Internet Access Opens the Door for Online Apparel Shopping

The expansion of the e-commerce apparel market can be attributed to several key drivers. Firstly, increased internet penetration has significantly contributed to the growth of this sector. With a larger base of internet users and widespread smartphone adoption, accessing online platforms for apparel shopping has become more convenient than ever. This accessibility allows consumers to browse and purchase clothing at any time, enhancing the appeal of online shopping.

Furthermore, there has been a noticeable shift in consumer behavior, with a growing preference for the ease and flexibility offered by online shopping environments. This shift is supported by the 24/7 availability of e-commerce stores, which contrasts sharply with the fixed hours of traditional retail outlets.

Additionally, many established brick-and-mortar apparel retailers are extending their operations online, thus broadening their product offerings and reaching a wider audience. The integration of personalization and recommendation algorithms, powered by advanced artificial intelligence and data analytics, further enriches the consumer experience.

These technologies help in tailoring the shopping experience to individual preferences, suggesting apparel choices that are more aligned with consumer tastes and previous shopping behaviors. This combination of technological advancement and shifting consumer preferences continues to drive robust growth in the e-commerce apparel market.

Restraints

Size and Fit Challenges Hinder Online Apparel Shopping

One of the primary restraints facing the e-commerce apparel market is the difficulty customers experience in assessing the size, fit, and feel of clothing when shopping online. This uncertainty often leads to higher return rates, as items may not meet expectations once received.

Additionally, the absence of a physical shopping experience poses a significant barrier. The tactile element of feeling fabrics and trying on garments, which is integral to the traditional shopping experience, is missing in the online environment. This lack of physical interaction can deter potential buyers, who prefer to see and feel products firsthand to make confident purchasing decisions.

These factors collectively impact consumer satisfaction and loyalty, as well as potentially increase operational costs for retailers due to returns processing and reshipping of exchanged goods. These challenges emphasize the need for innovative solutions in virtual fitting technologies and enhanced online customer service to mitigate the inherent limitations of the e-commerce model for apparel.

Growth Factors

Expansion into Emerging Markets

Tapping into the potential of emerging markets offers a robust growth opportunity for the e-commerce apparel sector. The expanding middle-class population in regions like India, Southeast Asia, and Africa is becoming increasingly accessible thanks to widespread internet penetration and mobile technology.

This demographic shift is creating a fertile ground for e-commerce platforms, as more consumers are turning to online shopping for their apparel needs. The integration of augmented reality (AR) and virtual reality (VR) technology enhances this appeal by providing customers with a virtual try-on experience, thus increasing confidence in their purchases.

Furthermore, strategic collaborations with influencers and celebrities can significantly amplify brand visibility and trust, driving higher traffic and conversion rates on these platforms. By leveraging these technological and marketing innovations, companies can unlock new customer segments and achieve sustained growth in these dynamic markets.

Emerging Trends

Social Commerce Transforms Apparel Shopping

In the dynamic landscape of the e-commerce apparel market, several trending factors are shaping consumer behaviors and business strategies.

The proliferation of social commerce has revolutionized how apparel is marketed and sold, enabling direct purchases through social media platforms like Instagram and TikTok. This trend harnesses the power of visual content and influencer endorsements, making shopping an interactive and seamless experience.

Additionally, there is a growing demand for sustainable and ethical fashion, driven by consumer awareness and preference for eco-friendly practices. Brands are responding by integrating sustainable sourcing and recycling initiatives into their operations.

Moreover, influencers continue to wield significant impact, dictating trends and influencing consumer choices through digital platforms. The market is also seeing an increase in smart clothing, with advancements in technology leading to the development of apparel that incorporates smart fabrics and wearable technology. These trends collectively emphasize the evolving nature of consumer engagement and the continuous adaptation required within the apparel industry.

Regional Analysis

North American Dominance in the E-Commerce Apparel Market with 35% Share, USD 210 Billion

The e-commerce apparel market exhibits significant regional diversity, characterized by varying growth rates and market dynamics across North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America.

Dominating this sector, North America commands a substantial 35% market share, valued at approximately USD 210 billion. This dominance can be attributed to the region’s robust digital infrastructure, high consumer spending power, and the pervasive culture of online shopping, which have collectively fostered an environment conducive to the growth of e-commerce apparel ventures.

Regional Mentions:

Europe follows, marked by a highly developed e-commerce ecosystem and the increasing preference for sustainable and ethically produced garments. The region’s market is driven by fashion-forward consumers and the presence of numerous legacy fashion brands pivoting to online retail models.

The Asia Pacific region is witnessing the fastest growth in this market, spurred by increasing internet penetration, rising middle-class affluence, and expanding smartphone usage, which are making online apparel shopping more accessible and desirable.

Conversely, the Middle East & Africa, and Latin America regions are emerging markets in the e-commerce apparel sector. These regions show promising growth potential due to rapidly improving internet infrastructure and a young, tech-savvy population. The Middle East, in particular, is experiencing a luxury apparels fashion boom online, facilitated by a wealthy consumer base and increasing digital connectivity.

In Latin America, the growth is primarily driven by increasing consumer confidence in online transactions and the expanding presence of local and international e-commerce retailers.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the global e-commerce apparel market witnessed significant contributions from key players, each exhibiting distinct strategic footprints. Walmart Inc. leveraged its extensive physical infrastructure to enhance its online platform, effectively integrating omnichannel retail strategies that cater to a broad consumer base. The company’s emphasis on cost-effective pricing and expansive reach has strengthened its position in various regional markets.

EBay Inc. continued to capitalize on its marketplace model, fostering a unique environment for both new and used apparel. Its consumer-to-consumer (C2C) platform enabled personalized transactions and potentially increased buyer retention by offering niche clothing items not typically available in mainstream retail channels.

Shopify Inc., predominantly serving as an enabler for small to medium-sized enterprises, has substantially influenced the market by democratizing e-commerce. Its platform allows independent fashion brands to craft distinctive online identities, thereby diversifying the market landscape and enhancing consumer choices.

Amazon Inc. remained a dominant force, driving innovations in logistics and customer experience. Its Prime service and robust distribution network provide unparalleled convenience, setting high industry standards for delivery speed and service quality.

JD, Inc., primarily operating in China, has effectively used its logistics capabilities to guarantee swift deliveries, even in the less accessible regions. Its integration with social media platforms has also helped capture a significant share of the youth market.

Alibaba Group Holding Limited has maintained its leadership in Asia, pioneering fast fashion e-commerce through technological advancements like AI and data analytics for trend forecasting and personalized shopping experiences.

Rakuten Group, Inc., while smaller in scale compared to its counterparts, has effectively utilized partnerships and loyalty programs to enhance customer value propositions and reinforce its market presence in Japan.

Top Key Players in the Market

- Wal-Mart Inc

- EBay Inc

- Shopify Inc

- Amazon, Inc

- JDcom, Inc

- Alibaba Group Holding Limited

- Rakuten Group, Inc

Recent Developments

- In July 2024, the fast fashion brand Newme successfully secured $18 million in Series A funding to enhance its market presence and accelerate growth strategies.

- In July 2024, Fashion-Tech startup unspun raised $32 million to expand its innovative zero-waste and emissions-reducing apparel solutions, aiming to revolutionize the fashion industry with sustainable practices.

- In November 2024, apparel brand Vuori increased its market valuation to an impressive US$5.5 billion, reflecting strong investor confidence and significant growth in its sector.

Report Scope

Report Features Description Market Value (2023) USD 602.3 Billion Forecast Revenue (2033) USD 1387.1 Billion CAGR (2024-2033) 8.7% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Womens Apparel, Mens Apparel, Children Apparel), By Gender (Women, Men, Children), By Pricing Model (Discounted, Premium) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Wal-Mart Inc, EBay Inc, Shopify Inc, Amazon Inc, JDcom Inc, Alibaba Group Holding Limited, Rakuten Group Inc Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Wal-Mart Inc

- EBay Inc

- Shopify Inc

- Amazon, Inc

- JDcom, Inc

- Alibaba Group Holding Limited

- Rakuten Group, Inc