Global Decorated Apparel Market Report By Product Type (Embroidery, Screen Printing, Dye Sublimation, Digital Printing, Other Product Types), By End-User (Men, Women, Children), By Distribution Channel (Online, Offline), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: October 2024

- Report ID: 59558

- Number of Pages: 250

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

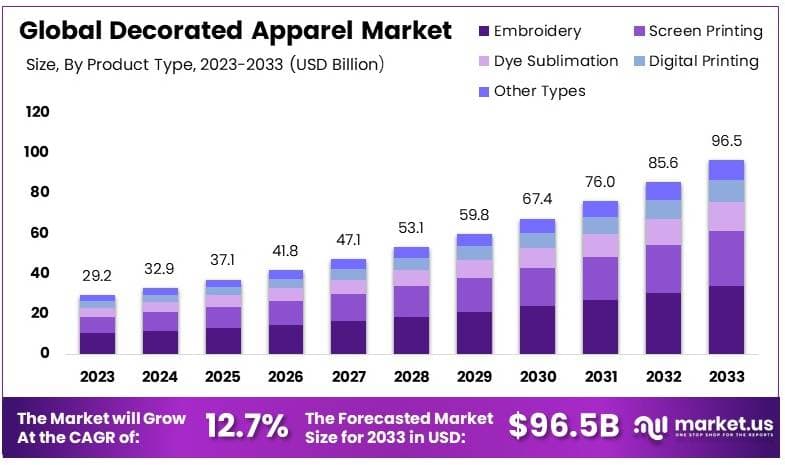

The Global Decorated Apparel Market size is expected to be worth around USD 96.5 Billion by 2033, from USD 29.2 Billion in 2023, growing at a CAGR of 12.7% during the forecast period from 2024 to 2033.

Decorated apparel refers to clothing that is customized with various design techniques, including embroidery, screen printing, and digital printing. It is commonly used for branding, promotional wear, sportswear, and personalized clothing. The growing trend of customization and personalization is key in driving the demand for decorated apparel.

The decorated apparel market encompasses the production, customization, and sale of apparel with added design elements. This market is expanding rapidly due to increasing demand from businesses, sports teams, and individuals seeking customized clothing. Advances in printing technologies and the rise of e-commerce platforms have made it easier to offer affordable and high-quality decorated apparel to a global audience.

The decorated apparel market is driven by several factors. The increasing demand for personalized fashion, corporate branding, and promotional items is a major growth driver. Additionally, technological advancements in printing and embroidery have made customization more accessible and cost-effective. The rise of social media marketing and online stores is further fueling the demand for decorated apparel.

Demand for decorated apparel is rising across multiple segments, including corporate uniforms, promotional wear, and fashion retail. The ability to customize clothing for events, brand recognition, and personal use makes it attractive to businesses and individuals alike. The growing trend of athleisure and personalized sports apparel also contributes to increasing demand.

The decorated apparel sector has significant growth opportunities in the development of eco-friendly printing technologies and sustainable fabrics. There is also potential in emerging markets where personalization is gaining popularity. Brands that focus on fast customization and efficient delivery are well-positioned to capture a larger share of the market.

The environmental challenges associated with fast fashion also present an opportunity for innovation. Fast fashion items, which are typically worn fewer than five times and kept for around 35 days, contribute significantly to carbon emissions.

In contrast, garments that are worn 50 times and kept for a full year produce 400% fewer emissions per item annually. This highlights the importance of durable, high-quality decorated apparel, offering long-term value to consumers and reducing environmental impact.

The growth of e-commerce, which will account for 20.1% of all retail sales globally in 2024, is a significant driver of demand for decorated apparel. As e-commerce is projected to rise to 23% by 2027, the online availability of customizable clothing options presents a substantial growth opportunity.

The rise in disposable incomes is another growth factor. In 2024, the average per capita disposable income in the U.S. reached $51,147, one of the highest globally. This increase in consumer spending power supports the demand for customized apparel, as consumers are more willing to invest in personalized and high-quality items.

Globally, disposable personal income has grown, with the U.S. seeing a 4.2% rise in disposable income in the fourth quarter of 2023, translating to a 2.5% real increase when adjusted for inflation. This positive trend in consumer purchasing power boosts the market for decorated apparel, particularly in premium and bespoke categories.

Governments are increasingly focused on regulating the environmental impacts of the fashion industry. The industry is responsible for 4% of total global greenhouse gas emissions, producing 2.1 billion tonnes of carbon emissions annually. Additionally, 20% of global freshwater pollution is linked to textile dyeing and treatment. As governments enforce stricter environmental regulations, there is growing pressure on manufacturers to adopt eco-friendly practices.

Key Takeaways

- The Decorated Apparel Market was valued at USD 29.2 Billion in 2023, and is expected to reach USD 96.5 Billion by 2033, with a CAGR of 12.7%.

- In 2023, Embroidery dominated the product type segment with 42%, due to its popularity in personalized and promotional apparel.

- In 2023, Women accounted for 68% of the end-user segment, reflecting the growing demand for fashion-forward decorated clothing.

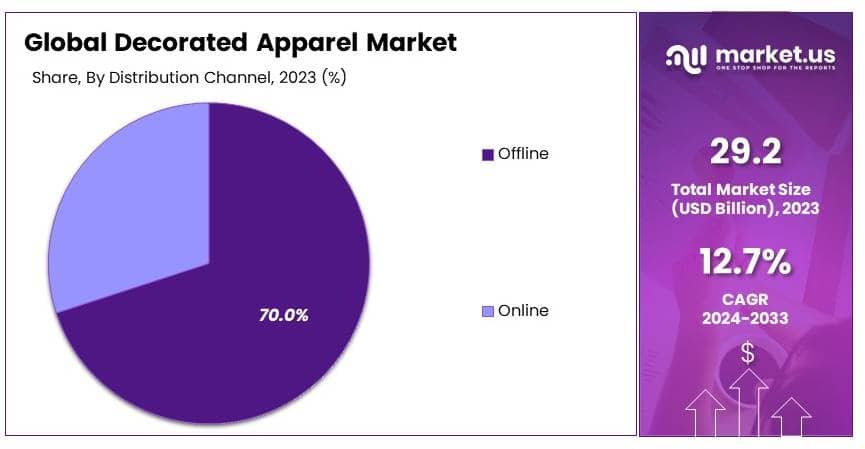

- In 2023, Offline channels led the distribution segment with 70%, as physical stores remain a preferred shopping option.

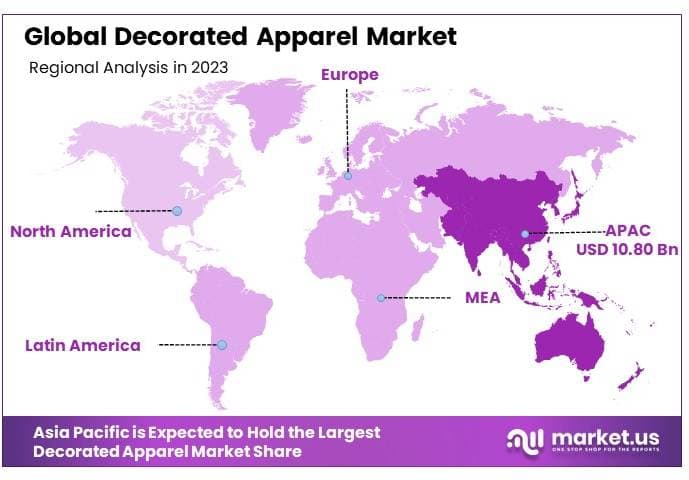

- In 2023, Asia-Pacific held 37% of the regional market, driven by large-scale production and consumption of apparel.

Product Type Analysis

Embroidery dominates with 42% due to its perceived value of craftsmanship and long-lasting quality.

In the Decorated Apparel Market, the “By Product Type” segment is essential, as it highlights the various methods used to add decorative details to clothing. Embroidery, as the leading sub-segment, commands a significant 42% of the market share.

This prevalence is attributed to its traditional appeal and the durability it lends to garments, which are highly valued in both casual and formal wear. The intricate and personalized touch that embroidery adds to apparel is a key factor in its dominance, as consumers often perceive embroidered goods as higher quality and more durable.

The market also includes other product types such as Screen Printing, Dye Sublimation, Digital Printing, and others. Each of these techniques offers unique benefits and serves different market needs. For instance, Screen Printing is favored for large batch production and vibrant colors, making it ideal for promotional wear.

Dye Sublimation excels in producing vivid and detailed images on synthetic fabrics, often used in sportswear. Digital Printing, on the other hand, provides excellent options for customization with detailed graphics, suitable for small batch orders and designer fashion.

Embroidery’s lead in the market is further reinforced by its widespread use in corporate branding, uniforms, and luxury fashion, where the quality and elegance of embroidered logos and designs are unmatched. As fashion trends continue to emphasize personalized and unique clothing, embroidery’s role in the decorated apparel market is expected to remain strong, supported by advancements in embroidery technology that reduce production costs and time.

End-User Analysis

Women dominate the market with 68% due to a wide range of preferences and higher purchasing frequency in decorated apparel.

The “By End-User” segment of the Decorated Apparel Market is critically defined by the target demographics, with Women as the dominant sub-segment, making up 68% of the market. This dominance is driven by the broad spectrum of styles and the frequent updates in women’s fashion, which demand a variety of decorated apparel.

Women tend to purchase clothing more often and are more likely to seek out unique and customized pieces, which aligns well with the offerings in the decorated apparel market.

Other key segments within the End-User category include Men and Children. Men’s decorated apparel tends to focus more on subtlety and functionality, often with branding and casual prints, while children’s decorated apparel is characterized by vibrant colors and playful patterns.

Although these segments represent smaller portions of the market compared to women, they contribute significantly to the industry by catering to specific needs and preferences.

The prominence of women in the market is bolstered by their extensive engagement with fashion trends and new apparel releases, making them pivotal customers in the decorated apparel industry. The ongoing growth in women’s fashion is likely to continue propelling the demand for new decorating techniques and designs, thus maintaining the segment’s significant share in the market.

Distribution Channel Analysis

Offline channels dominate with 70% due to consumer preference for trying on apparel before purchasing and the tactile shopping experience.

Within the Decorated Apparel Market, the “By Distribution Channel” segment is vital, with Offline distribution holding a dominant 70% share. This segment’s prominence is largely due to the tangible nature of shopping for apparel, where consumers prefer to see, feel, and try on clothing before making a purchase.

The importance of physical stores in providing a direct consumer experience, particularly when selecting luxury apparel, where the feel of the fabric and the quality of the decoration are best assessed in person, cannot be understated.

The Online segment, though smaller, is rapidly growing as technology improves and e-commerce becomes more integrated into consumer habits.

Online stores offer the convenience of shopping from home and often provide a wider range of products than is available in physical stores. However, the tactile gap and concerns over fit and appearance continue to limit its market share relative to offline channels.

The dominance of offline channels is supported by the consumer’s ongoing preference for a hands-on shopping experience, especially in the fashion industry where the fit and feel of the product are crucial. Despite the growth of online shopping, the offline segment is expected to maintain a significant share of the market, supported by the experiential benefits it offers to consumers.

As technology evolves, however, the gap between these channels may narrow, with augmented reality and improved online fitting tools potentially enhancing the online shopping experience for decorated apparel.

Key Market Segments

By Product Type

- Embroidery

- Screen Printing

- Dye Sublimation

- Digital Printing

- Other Product Types

By End-User

- Men

- Women

- Children

By Distribution Channel

- Online

- Offline

Driver

Increasing Popularity of Customized Clothing Drives Market Growth

The decorated apparel market is driven by the growing demand for customized clothing. Consumers increasingly seek personalized designs, which allows them to express their individuality through unique apparel choices. This trend is particularly prevalent among younger generations who prefer tailored and distinctive fashion items.

The rising demand for sports and athletic wear is also contributing to market growth. Sports teams, fitness enthusiasts, and active individuals are looking for high-quality, decorated clothing, such as jerseys, workout gear, and branded sportswear.

The growth of fashion and apparel e-commerce platforms further drives market expansion. Online platforms allow consumers easy access to a wide variety of decorated apparel, fostering a competitive landscape where brands can directly reach their target audience. E-commerce also facilitates the customization process, offering a seamless experience for customers to design and purchase personalized items.

Moreover, the adoption of advanced printing technologies, such as screen printing and digital printing, is accelerating market growth. These technologies enable high-quality designs at lower costs and faster turnaround times, meeting the rising demand for decorated apparel across various segments.

Restraint

High Production Costs Restraints Market Growth

Despite the growing demand, several restraining factors hinder the growth of the decorated apparel market. High production costs, particularly for small-scale and customized orders, pose a significant challenge. Customization often requires specialized equipment and materials, which increases the overall cost of production and limits the affordability of these products for consumers.

Stringent environmental regulations are another restraining factor, as the apparel industry faces increased scrutiny over its environmental impact. Many decorated apparel manufacturers are required to comply with regulations governing the use of chemicals and waste management, adding to operational costs.

Fluctuating raw material prices further impact the market. Unpredictable changes in the cost of fabrics, dyes and pigments, and other inputs make it difficult for manufacturers to maintain stable pricing. Additionally, limited access to skilled labor, particularly in regions where garment manufacturing is prominent, can slow production processes and reduce overall efficiency, restraining market growth.

Opportunity

Expansion in Emerging Markets Provides Opportunities

There are several growth opportunities in the decorated apparel market, particularly in emerging markets. As disposable incomes rise in regions like Asia-Pacific, Latin America, and Africa, consumers are increasingly spending on personalized and high-quality apparel. This presents a valuable opportunity for companies to expand their reach and tap into these growing markets.

The increasing demand for sustainable and eco-friendly apparel also provides an opportunity for market players. Consumers are becoming more conscious of the environmental impact of their purchases, leading to a rise in demand for garments made from organic or recycled materials. Brands that focus on sustainability and ethical production can differentiate themselves and capture this expanding customer base.

Collaboration with fashion influencers offers another growth opportunity. Influencers play a significant role in shaping consumer preferences, especially in the fashion industry. Partnering with influencers for exclusive collections or limited-edition designs can boost brand visibility and drive sales.

The rising demand for limited edition and exclusive collections also creates opportunities for companies to offer high-margin products that cater to niche markets. These exclusive collections generate a sense of urgency and uniqueness, attracting customers willing to pay premium prices.

Challenge

Intense Competition in the Apparel Industry Challenges Market Growth

The decorated apparel market faces several challenges that may limit its growth. Intense competition within the apparel industry is one of the major challenges. Both established brands and new entrants are vying for market share, making it difficult for businesses to stand out in a crowded market. This competition drives down prices and puts pressure on profit margins.

Rapid changes in fashion trends also pose a challenge. The fast-paced nature of the fashion industry means that apparel companies must continually innovate and adapt their designs to stay relevant. This constant need to follow trends can be costly and risky, particularly if a new design fails to resonate with consumers.

Supply chain disruptions, such as those caused by geopolitical issues or natural disasters, present additional challenges. Interruptions in the availability of materials or manufacturing delays can hinder production and affect delivery times, leading to dissatisfied customers and lost revenue.

Lastly, the high cost of technological upgrades, such as adopting advanced printing or automation systems, is a significant challenge for many companies. While these technologies offer efficiency gains and better quality, the upfront investment required may be prohibitive for small to medium-sized enterprises.

Growth Factors

Increasing Demand for Casual Wear and Streetwear Is Growth Factor

Several growth factors are contributing to the expansion of the decorated apparel market. The increasing demand for casual wear and streetwear is one such factor. As consumers prioritize comfort and style in their everyday clothing choices, decorated casual apparel, including graphic t-shirts and hoodies, continues to grow in popularity.

The growth in corporate branding apparel is another important factor. Companies are increasingly investing in customized uniforms and branded clothing for their employees, creating a steady demand for decorated apparel that promotes brand identity and corporate culture.

The rise in fitness and athleisure trends is also driving growth. Consumers are looking for fashionable yet functional athletic wear, which presents opportunities for companies to offer decorated sports apparel that combines performance with style.

Lastly, the expanding fast fashion industry contributes to the growth of the decorated apparel market. Fast fashion brands, known for their rapid production cycles and trend-driven designs, are incorporating decorated apparel into their collections, meeting consumer demand for affordable, stylish clothing with unique prints and embellishments.

Emerging Trends

Personalization and On-demand Production Is Latest Trending Factor

Several trends are shaping the decorated apparel market. Personalization and on-demand production are becoming increasingly popular. Consumers are looking for unique, custom-designed clothing, and companies are meeting this demand by offering products that can be made to order. This trend is supported by advancements in digital printing and other technologies that allow for efficient, small-batch production.

The rise of digital printing technologies is another key trend. Digital printing offers greater flexibility and precision compared to traditional methods, allowing businesses to produce detailed, high-quality designs at a faster pace. This technology also supports customization, making it a crucial driver of market growth.

The growing emphasis on sustainable and ethical fashion is another significant trend. Consumers are increasingly looking for apparel that aligns with their values, such as clothing made from organic or recycled materials. This trend is driving companies to adopt more sustainable practices throughout their production processes.

Finally, the increasing use of social media marketing is transforming how brands engage with customers. Social media platforms provide a powerful tool for promoting decorated apparel, particularly through influencer collaborations and user-generated content. This trend allows brands to reach a wider audience and build a loyal customer base through direct interaction and engagement.

Regional Analysis

Asia-Pacific Dominates with 37% Market Share

Asia-Pacific leads the Decorated Apparel Market with a 37% share, valued at USD 10.80 billion. This dominance is driven by the region’s large-scale textile manufacturing, low production costs, and increasing demand for custom apparel. Countries like China, India, and Bangladesh play a key role in the production and export of decorated apparel, making Asia-Pacific the leading hub for global apparel production.

The region benefits from its strong manufacturing infrastructure, a large workforce, and favorable trade policies. Additionally, the rising popularity of fashion trends, coupled with growing e-commerce platforms, further boosts market performance in the decorated apparel industry.

Asia-Pacific’s market share is expected to grow as demand for customized, sustainable, and affordable apparel continues to rise. The expansion of digital printing technologies and a growing middle class will further support the region’s dominance in the coming years.

Regional Mentions:

- North America: North America holds a strong position in the Decorated Apparel Market, driven by increasing demand for personalized apparel and the growth of e-commerce. The region also benefits from technological advancements in printing and embroidery.

- Europe: Europe is characterized by its focus on sustainable and high-quality apparel. The region’s strict environmental regulations and strong fashion industry support the growth of the decorated apparel market.

- Middle East & Africa: The Middle East and Africa are gradually expanding in the market, driven by growing demand for premium fashion and branded apparel. Increased urbanization and rising disposable incomes fuel the market in this region.

- Latin America: Latin America is emerging in the Decorated Apparel Market, with increasing demand for sports and casual wear. Growth in digital printing technologies and local production capabilities are contributing to market development.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the Decorated Apparel Market, Gildan, Hanesbrands Inc., and Fruit of the Loom, Inc. are the key players that lead in market influence, driven by their extensive product offerings and global presence.

Gildan is a dominant force in the market, recognized for its vast range of customizable apparel. Gildan’s strong manufacturing capabilities and cost-efficient production processes allow it to cater to large-scale orders, making it a preferred partner for businesses seeking decorated apparel. The company’s global reach and its focus on sustainability further enhance its competitive edge.

Hanesbrands Inc. is another major player, leveraging its well-established brand reputation to offer high-quality, decorated apparel. Hanesbrands is known for its diverse product line, from casual wear to activewear, making it a versatile option for consumers and businesses alike. Its strong presence in both retail and wholesale markets solidifies its position as a key market leader.

Fruit of the Loom, Inc. also plays a significant role, offering a wide array of decorated apparel with a focus on affordability and quality. The company’s long-standing presence and extensive distribution networks contribute to its influence in the market. Its dedication to innovation, including the use of new printing technologies, allows it to stay competitive.

These top companies drive market growth through their focus on affordability, customization, and sustainability. Their ability to adapt to changing consumer preferences and their strong manufacturing capabilities position them as leaders in the decorated apparel industry.

Top Key Players in the Market

- Gildan

- Fruit of Loom, Inc.

- Downtown Custom Printwear

- Hanesbrands Inc.

- Master Printwear

- Delta Apparel, Inc.

- Target Decorated Apparel

- Advance Printwear Limited

- Lynka

- New England Printwear

- Other Key Players

Recent Developments

- In January 2024, Epson recently introduced the SureColor F1070, a new entry-level direct-to-garment (DTG) and direct-to-film (DTFilm) printer, designed for small businesses and Etsy stores, offering cost-effective, compact, and versatile printing solutions for customized apparel.

- In January 2024, Roland DGA Corporation expanded its VersaSTUDIO line with the BD-8 UV flatbed printer and the BY-20 direct-to-film printer, introducing advanced personalization and garment decoration solutions for small businesses.

- In 2023, Roxy and Quiksilver, in partnership with Lizee, launched Boardriders Rental in France, an online service for renting men’s, women’s, and children’s surf and snow sports apparel starting October 23.

Report Scope

Report Features Description Market Value (2023) USD 29.2 Billion Forecast Revenue (2033) USD 96.5 Billion CAGR (2024-2033) 12.7% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Embroidery, Screen Printing, Dye Sublimation, Digital Printing, Other Product Types), By End-User (Men, Women, Children), By Distribution Channel (Online, Offline) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Gildan, Fruit of Loom, Inc., Downtown Custom Printwear, Hanesbrands Inc., Master Printwear, Delta Apparel, Inc., Target Decorated Apparel, Advance Printwear Limited, Lynka, New England Printwear, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

Which region is more appealing for vendors employed in the Decorated Apparel market?APAC accounted for the highest revenue share of 37%. Therefore, the Decorated Apparel industry in APAC is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for Decorated Apparel?China, India, U.K., Germany, The U.S., Brazil, South Africa, are key areas of operation for Decorated Apparel Market.

List the segments encompassed in this report on the Decorated Apparel market?Market.US has segmented the Decorated Apparel market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product Type(Embroidery,Screen Printing,Dye Sublimation,Digital Printing,Other Product Types), By End-User(Men, Women, Children), By Distribution Channel(Online, Offline)

What is the projected size of the Global Decorated Apparel Market by 2033?The Global Decorated Apparel Market size is expected to be worth around USD 96.4 Billion by 2033, from USD 29.2 Billion in 2023, growing at a CAGR of 12.7% during the forecast period from 2024 to 2033.

List the key industry players of the Decorated Apparel market?Gildan, Fruit of Loom, Inc., Downtown Custom Printwear, Hanesbrands Inc., Master Printwear, Delta Apparel, Inc., Target Decorated Apparel, Advance Printwear Limited, Lynka, New England Printwear, Other Key Players. Decorated Apparel MarketPublished date: October 2024add_shopping_cartBuy Now get_appDownload Sample

Decorated Apparel MarketPublished date: October 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Gildan

- Fruit of Loom, Inc.

- Downtown Custom Printwear

- Hanesbrands Inc.

- Master Printwear

- Delta Apparel, Inc.

- Target Decorated Apparel

- Advance Printwear Limited

- Lynka

- New England Printwear

- Other Key Players