Global Sportswear Market By Product(Footwear, Apparel), By End-user(Men, Women, Children), By Distribution Channel(Online, Offline(Sporting Goods Retailers, Supermarkets & Hypermarkets, Exclusive Brand Outlets, Others)), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: October 2024

- Report ID: 41081

- Number of Pages: 297

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

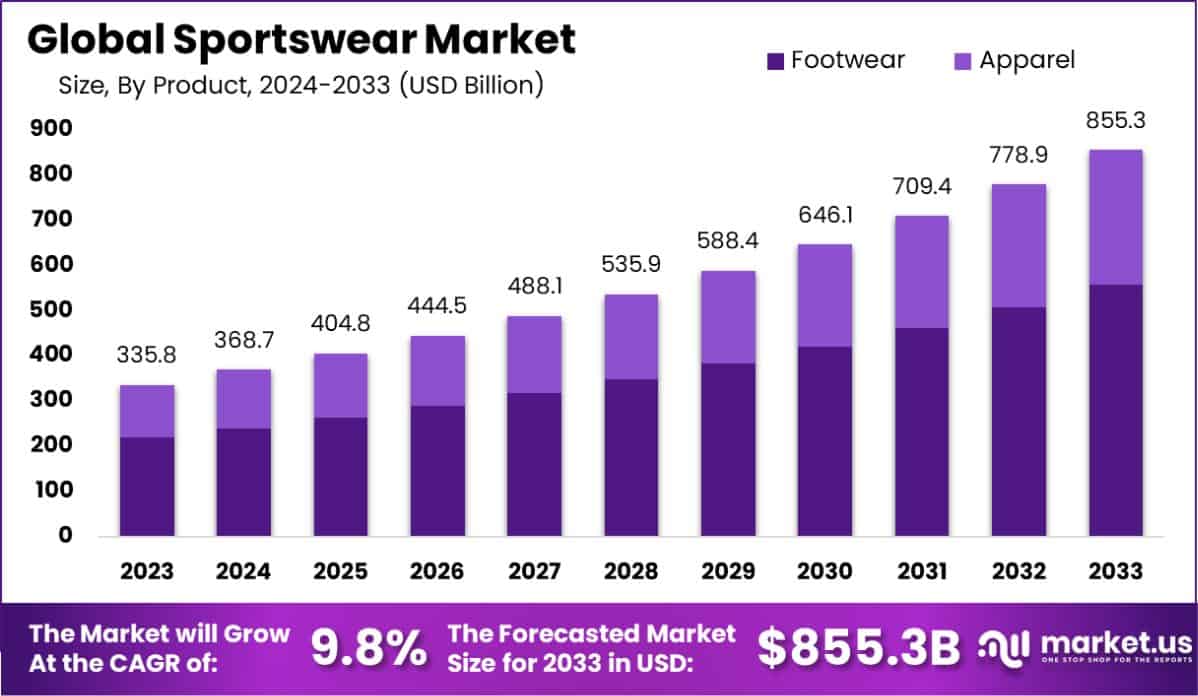

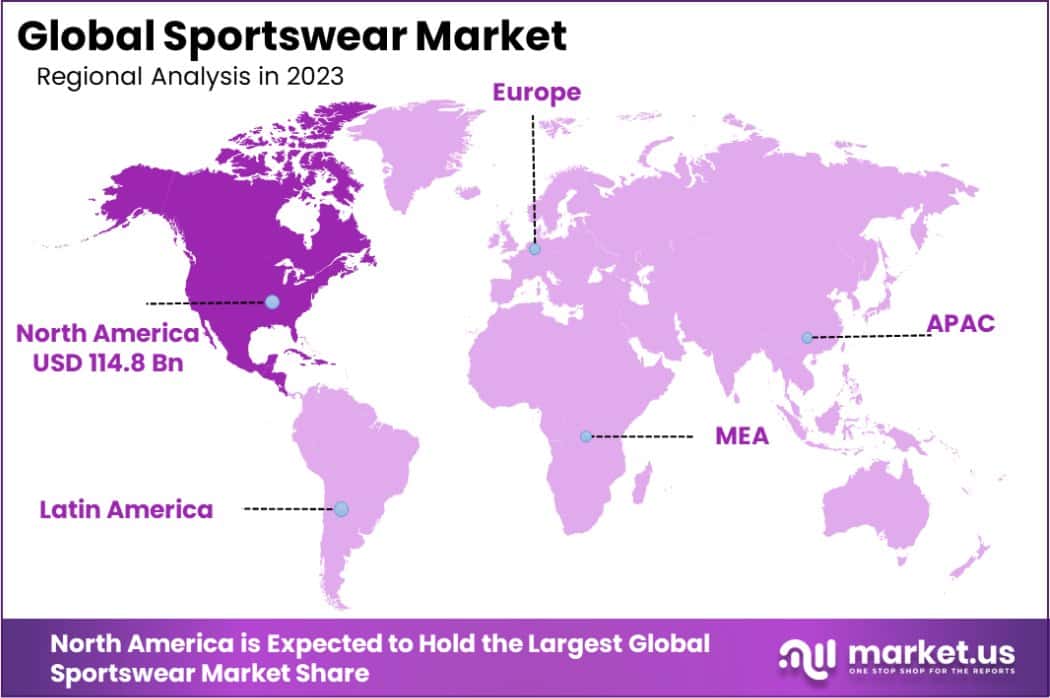

The Global Sportswear Market size is expected to be worth around USD 855.3 Billion by 2033, from USD 335.8 Billion in 2023, growing at a CAGR of 9.8% during the forecast period from 2024 to 2033. North America dominated a 34.2% market share in 2023 and held USD 114.8 Billion in revenue from the Sportswear Market.

Sportswear refers to clothing designed specifically for sports and physical activities. These garments are typically made from materials that offer comfort, enhanced performance, and durability, such as moisture-wicking fabrics and compression materials. The design and technology of sportswear focus on supporting athletic performance while providing safety and improving the efficiency of movements.

The sportswear market encompasses the sale of apparel and luxury footwear optimized for sports and exercise. This market’s growth is propelled by increasing health awareness, the popularity of fitness activities, and a growing emphasis on active lifestyles across various demographics. Rising disposable incomes and the influence of sports fashion trends also contribute significantly to demand.

Technological advancements in materials and the expansion of e-commerce platforms are major growth drivers for the sportswear market. Driven by a surge in participation in sports activities and a global shift towards health and virtual fitness consciousness. Emerging markets present significant opportunities due to rising incomes and increasing health awareness among consumers.

The sportswear market is poised for substantial growth, fueled by a combination of factors that synergistically enhance its trajectory. Increasing global interest in health and wellness, coupled with the rise of athleisure as a fashion trend, underpins a robust demand for sportswear.

Technological innovations in fabric and design, which improve comfort and performance, are enticing a broader demographic to adopt sportswear not only for sports but for everyday use.

Additionally, the influence of social media and celebrity endorsements continuously propels the popularity of sportswear brands. Government initiatives in various countries further bolster this sector by investing in sports infrastructure and training, reflecting a commitment to fostering a sports culture that directly benefits the sportswear market.

For instance, as reported by yas. nic.in, India has invested ₹64.88 crore for the customized training of 389 sportspersons and ₹111.71 crore in infrastructure development and equipment procurement as of November 2019.

Similarly, the preparation for upcoming international events like the Paris Olympics has seen allocations such as ₹96.08 crore specifically for athletics, with a total of nearly ₹470 crore invested across 16 disciplines. These investments not only prepare athletes but also stimulate market growth by highlighting the importance of quality sportswear.

Key Takeaways

- The Global Sportswear Market size is expected to be worth around USD 855.3 Billion by 2033, from USD 335.8 Billion in 2023, growing at a CAGR of 9.8% during the forecast period from 2024 to 2033.

- In 2023, Footwear held a dominant market position in the by-product segment of the Sportswear Market, with a 65.2% share.

- In 2023, Men held a dominant market position in the end-user segment of the Sportswear Market, with a 56.3% share.

- In 2023, Offline held a dominant market position in the By Distribution Channel segment of the Sportswear Market, with a 33.1% share.

- North America dominated a 34.2% market share in 2023 and held USD 114.8 Billion in revenue from the Sportswear Market.

By Product Analysis

In 2023, Footwear held a dominant market position in the by-product segment of the Sportswear Market, capturing a 65.2% share. Apparel followed, accounting for the remaining percentage of the market.

The robust performance of the footwear segment can be primarily attributed to escalating consumer interest in athletic and leisure activities, coupled with rising awareness of the health benefits associated with an active lifestyle. This trend has been further bolstered by technological advancements in footwear manufacturing, which have enhanced product comfort, functionality, and appeal.

The growth of this segment is also supported by strategic marketing campaigns by leading market players that effectively resonate with the health-conscious consumer. Moreover, the integration of fashion elements into sportswear has broadened the consumer base, attracting individuals seeking both style and functionality in their footwear. This blend of practicality and aesthetic appeal has significantly driven the market’s expansion.

Despite the prominence of footwear, the apparel segment remains substantial, fueled by innovations in fabric technology and the global movement toward sustainable fashion. These factors are anticipated to maintain a steady growth trajectory for the apparel sector within the sportswear market, ensuring sustained market interest and investment in the coming years.

By End-user Analysis

In 2023, Men held a dominant market position in the By End-user segment of the Sportswear Market, with a 56.3% share. Women and children accounted for the remainder, indicating significant market participation but trailing behind men’s segment dominance.

The leading position of the men’s segment can be attributed to heightened participation rates in sports and physical activities among males. This demographic has demonstrated considerable engagement in both amateur and professional sports, which has driven demand for men’s sportswear.

The sportswear market for men has also benefited from extensive product offerings, including specialized apparel and footwear designed to meet specific athletic requirements. This has been complemented by aggressive marketing strategies and endorsements by male sports icons, which have effectively tapped into the male consumer psyche, fostering brand loyalty and recurrent purchases.

While men continue to represent the largest market share, the women’s segment is experiencing rapid growth, driven by an increasing focus on fitness and wellness among females.

The children’s segment, though smaller, is also expanding as more young consumers participate in organized sports from an early age. This trend is supported by growing parental recognition of the importance of physical activity for children, contributing to a steady demand in the children’s sportswear market.

By Distribution Channel Analysis

In 2023, Offline channels held a dominant market position in the By Distribution Channel segment of the Sportswear Market, with a 33.1% share. This segment encompasses Sporting Goods Retailers, Supermarkets & Hypermarkets, Exclusive Brand Outlets, and Others, with each sub-segment contributing to the robust performance of offline sales.

Despite the rapid growth of online commerce, offline channels maintained prominence, benefiting from the tangible shopping experience they offer, allowing customers to physically assess the fit, comfort, and quality of sportswear.

Sporting Goods Retailers emerged as the leading offline sub-segment, driven by their specialized focus and expertise in sports-related products, which attract a dedicated customer base.

Exclusive Brand Outlets also played a crucial role, offering branded experiences and loyalty programs that resonate well with brand-conscious consumers. Meanwhile, Supermarkets & Hypermarkets expanded their sportswear offerings, providing convenience and accessibility to a broader audience.

The preference for offline shopping in the sportswear market can be attributed to consumer desire for immediate product access and the experiential aspects of in-store shopping, such as personalized service and the ability to try before buying.

These factors have significantly influenced consumer behavior, supporting the sustained relevance of offline channels in the sportswear market landscape.

Key Market Segments

By Product

- Footwear

- Apparel

By End-user

- Men

- Women

- Children

By Distribution Channel

- Online

- Offline

- Sporting Goods Retailers

- Supermarkets & Hypermarkets

- Exclusive Brand Outlets

- Others

Drivers

Sportswear Market Growth Factors

The sportswear market is experiencing significant growth due to several key drivers. Firstly, there is an increasing awareness of health and fitness across the globe, encouraging more people to engage in physical activities and, consequently, boosting the demand for sportswear.

Innovations in fabric technology have also played a crucial role, with advancements leading to more comfortable, durable, and attractive products that meet the diverse needs of active consumers. Furthermore, the influence of social media and celebrity endorsements continues to propel the popularity of sportswear as both functional attire and a fashion statement.

This trend is supported by the growing adoption of sportswear in daily wear, known as the athleisure trend, which combines style with practicality. These factors collectively drive the sustained expansion of the sportswear market, appealing to a broad demographic and encouraging frequent purchases.

Restraint

Challenges Facing the Sportswear Market

One significant restraint in the sportswear market is the high cost of premium products, which can limit accessibility for a large segment of potential consumers. Quality sportswear often incorporates advanced technologies and materials, which raise production costs and, consequently, retail prices.

This pricing strategy can deter budget-conscious buyers, particularly in economically sensitive regions where spending power is lower. Additionally, the sportswear market is highly competitive, with numerous brands vying for consumer attention. This competition necessitates continuous investment in marketing and product development, straining the resources of smaller players and potentially stifling innovation.

These factors combined can hinder market growth by narrowing the consumer base to predominantly affluent segments, leaving significant untapped potential in more price-sensitive demographics.

Opportunities

Expanding Opportunities in Sportswear Market

The sportswear market presents substantial opportunities, particularly through the increasing trend towards sustainable and eco-friendly products. Consumers are becoming more environmentally conscious, seeking items that not only serve their fitness needs but also have a minimal ecological impact.

This shift in consumer preferences opens a lucrative avenue for brands that prioritize sustainability in their production processes and materials. Additionally, the growing penetration of e-commerce offers sportswear brands an expansive platform to reach a global audience, significantly enhancing their market presence.

Emerging markets, with their rising middle-class populations and increasing health awareness, also offer new regions for expansion. Brands that successfully adapt to these trends by innovating in product design and sustainability while enhancing online sales channels are well-positioned to capitalize on these emerging opportunities in the sportswear industry.

Challenges

Navigating Sportswear Market Challenges

The sportswear market faces several challenges that could impede its growth. One of the main issues is the saturation of the market, with numerous brands competing fiercely for customer attention, which can dilute brand loyalty and reduce profitability for individual companies.

This saturation also leads to intense price competition, which can force companies to cut costs, potentially compromising product quality. Another significant challenge is the rapid change in consumer preferences and trends, requiring brands to quickly adapt their product lines and marketing strategies to stay relevant.

Additionally, global supply chain disruptions, influenced by geopolitical tensions and economic instabilities, pose a continual risk, affecting the timely production and distribution of goods. These factors create a complex environment for sportswear companies, requiring agile business strategies and robust risk management to navigate successfully.

Growth Factors

Key Drivers Boosting Sportswear Market

The sportswear market is thriving due to several compelling growth factors. A major driver is the increasing global focus on health and fitness, which spurs demand for athletic apparel and footwear as more people adopt active lifestyles.

Technological advancements in materials and design also significantly contribute, offering consumers more durable, comfortable, and stylish options. The rise of athleisure wear—clothing that blends sportswear with casual, everyday fashion—further boosts market growth as consumers seek versatile apparel suitable for both exercise and social settings.

Additionally, the expansion of online retail platforms allows sportswear brands to reach a wider audience, making it easier for consumers to access a broader range of products. This combination of health trends, technological innovation, and retail evolution presents robust opportunities for the sportswear market’s continued expansion.

Emerging Trends

Emerging Trends Shaping Sportswear Market

The sportswear market is being shaped by several emerging trends that are redefining consumer expectations and industry standards. Notably, the integration of technology in sportswear, such as smart wearables and smart fabrics that monitor health metrics and enhance athletic performance, is gaining traction.

The push towards personalization and customization is also significant, with consumers increasingly seeking products tailored to their specific needs and preferences. Furthermore, the adoption of sustainable practices is on the rise, with both new and established brands investing in eco-friendly materials and production methods to appeal to environmentally conscious consumers.

Additionally, the blurring lines between sportswear and fashion wear are creating new opportunities for brands to innovate in their designs and expand their market reach. These trends are setting the stage for a dynamic evolution of the sportswear market, making it an exciting time for both consumers and companies.

Regional Analysis

The sportswear market presents a varied landscape across different regions, reflecting diverse consumer preferences, climatic conditions, and economic factors. In North America, the market dominates with a substantial 34.2% share, valued at USD 114.8 billion, driven by a culture that emphasizes fitness and an array of professional and amateur sports activities.

Europe follows closely, benefiting from well-established sports infrastructures and increasing health awareness among its populace, which sustains demand for innovative and sustainable sportswear products.

Asia Pacific is witnessing rapid growth in the sportswear sector, catalyzed by increasing disposable incomes and the burgeoning middle class, alongside a growing trend towards fitness and wellness in countries like China and India. This region is poised to challenge the dominance of Western markets in the coming years due to its massive consumer base and rising urbanization.

Conversely, the Middle East & Africa, and Latin America exhibit smaller market shares but are expected to grow steadily due to increasing sports participation and a rising young population interested in health and fitness trends. These emerging markets offer significant growth potential for sportswear brands seeking new geographic territories and consumer segments.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the global sportswear market has been significantly shaped by the strategic maneuvers of its leading players: Nike Inc., Adidas, and Puma SE. Each company has uniquely positioned itself to capitalize on emerging market trends and consumer preferences, enhancing its competitive edges.

Nike Inc. continues to dominate the sportswear arena through its relentless innovation and strong brand equity. The company has effectively harnessed cutting-edge technology to develop high-performance apparel and footwear, that resonate with both professional athletes and fitness enthusiasts.

Nike’s commitment to sustainability, with initiatives such as the use of recycled materials in manufacturing, has also bolstered its market position and aligned with the growing consumer demand for environmentally responsible products.

Adidas has made significant inroads by diversifying its product offerings and strengthening its digital presence. The company’s focus on inclusivity and diversity, along with its collaborations with celebrities and designers, has broadened its appeal beyond traditional sports segments.

Adidas’ investments in digital transformation and direct-to-consumer channels have streamlined operations and improved customer engagement, driving substantial revenue growth.

Puma SE has exhibited robust growth by targeting niche markets and expanding its geographical footprint. With a strategy focused on agility and quick response to market trends, Puma has successfully captured the youth demographic with trendy designs and affordable pricing. Strategic partnerships in various sports disciplines, along with effective marketing campaigns, have enhanced Puma’s visibility and appeal globally.

As these industry giants continue to innovate and adapt, their strategies and market positions are critical in shaping the dynamics of the global sportswear market. Their ongoing developments and adjustments to consumer demands and global economic conditions will likely dictate their trajectories in the coming years.

Top Key Players in the Market

- Nike Inc.

- Adidas

- Puma SE

- Lululemon Athletica Inc.

- Under Armour Inc.

- Umbro

- Columbia Sportswear Company

- Anta Sports

- Li Ning Group

- Other Key Players

Recent Developments

- In August 2023, Umbro secured a significant partnership with a major European football league to supply team kits, reinforcing its presence in global football sportswear.

- In July 2023, Under Armour expanded into the digital fitness space by acquiring a fitness app startup, aiming to integrate workout tracking with their sportswear.

- In May 2023, Lululemon launched a new line of high-performance yoga wear, enhancing its product range with innovative fabric technology.

Report Scope

Report Features Description Market Value (2023) USD 335.8 Billion Forecast Revenue (2033) USD 855.3 Billion CAGR (2024-2033) 9.8% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product(Footwear, Apparel), By End-user(Men, Women, Children), By Distribution Channel(Online, Offline(Sporting Goods Retailers, Supermarkets & Hypermarkets, Exclusive Brand Outlets, Others)) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Nike Inc., Adidas, Puma SE, Lululemon Athletica Inc., Under Armour Inc., Umbro, Columbia Sportswear Company, Anta Sports, Li Ning Group, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Nike Inc.

- Adidas

- Puma SE

- Lululemon Athletica Inc.

- Under Armour Inc.

- Umbro

- Columbia Sportswear Company

- Anta Sports

- Li Ning Group

- Other Key Players