Global Pickleball Market Size, Share, Research By Product Type (Apparel, Footwear, Paddles, Balls, Other Product Types), By End User, By Sales Channel, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 106213

- Number of Pages: 246

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Business Environment Analysis

- Pickleball Industry Statistics

- Regional Analysis

- Product Type Analysis

- End User Analysis

- Sales Channel Analysis

- Key Market Segments

- Driving Factors

- Restraining Factors

- Major Growth Opportunities

- Emerging Trending Factors

- Competitive Landscape

- Recent Advancements

- Report Scope

Report Overview

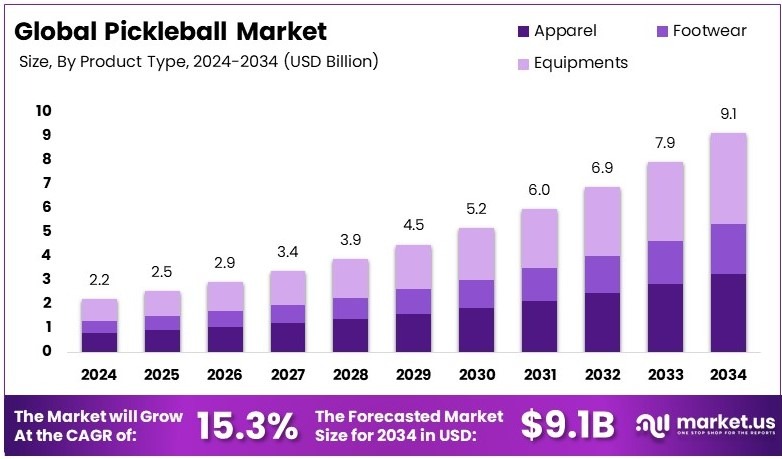

The Global Pickleball Market is projected to reach USD 9.1 Billion by 2034, up from USD 2.2 Billion in 2024, growing at a CAGR of 15.3% during the forecast period from 2025 to 2034.

Pickleball is a paddle sport that combines elements of tennis, badminton, and table tennis. It is played on a smaller court with paddles and a perforated plastic ball. The game is simple, inclusive, and accessible, making it suitable for people of all ages and skill levels.

The Pickleball Market includes products like paddles, balls, nets, and apparel, as well as services such as court construction, tournaments, and training. The market supports growing player participation and demand for equipment and facilities worldwide, reflecting the sport’s increasing popularity.

The pickleball market size has seen a significant surge in recent years, with strong projections indicating continued growth. The increasing number of recreational players and investments in infrastructure contribute to a dynamic and expanding market. Ongoing market research suggests that pickleball’s rapid expansion is set to transform it into a mainstream sport, with considerable economic impact in the coming years.

Pickleball is experiencing rapid growth worldwide due to its accessibility and health benefits. In Australia, interest in the sport doubled in 2023, with memberships increasing from 4,000 to 9,000, according to the Pickleball Australia Association. An estimated 25,000 people play nationwide, with predictions suggesting a rise to one million in three years.

In the U.S., it’s recognized as one of the “fastest-growing sports,” boasting 4.8 million active players and nearly 8,500 locations. Legislative support, such as Washington State naming pickleball its official sport, reflects its rising popularity.

Meanwhile, emerging markets such as Australia and Canada show promise. In Canada, pickleball participation rose from 1 million in 2022 to 1.37 million in 2023, reflecting strong demand among women and young people.

Several growth factors are propelling pickleball’s expansion. The Apple Heart and Movement Study highlights the sport’s health benefits, as participants averaged a peak heart rate of 143 beats per minute during pickleball sessions, making it an appealing fitness activity.

The market presents numerous opportunities for growth, particularly in facility development, equipment sales, and organized leagues. With the International Federation of Pickleball now overseeing 58 member countries, there is a pathway for global expansion.

Key Takeaways

- The Pickleball Market was valued at USD 2.2 Billion in 2024, and is expected to reach USD 9.1 Billion by 2034, with a CAGR of 15.3%.

- In 2023, Equipment dominated the product type segment with 41.5%, driven by the increasing demand for paddles and balls.

- In 2023, Men led the end-user segment with 51.7%, owing to higher participation rates in the sport.

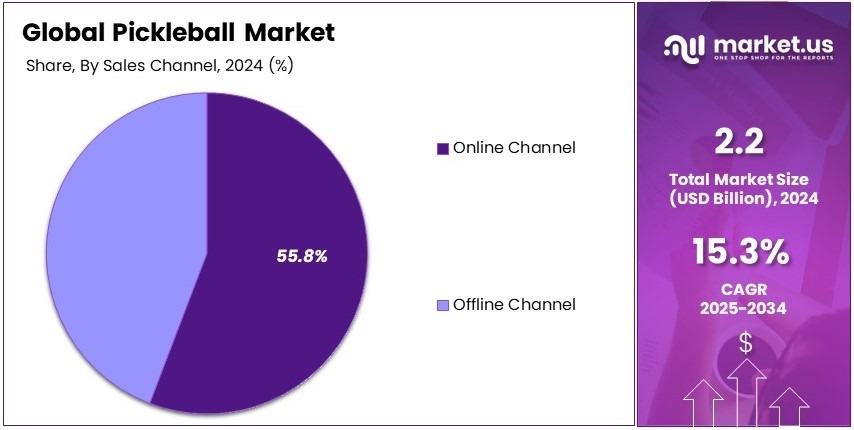

- In 2023, Online Channel dominated the sales channel with 55.8%, due to the convenience of e-commerce platforms.

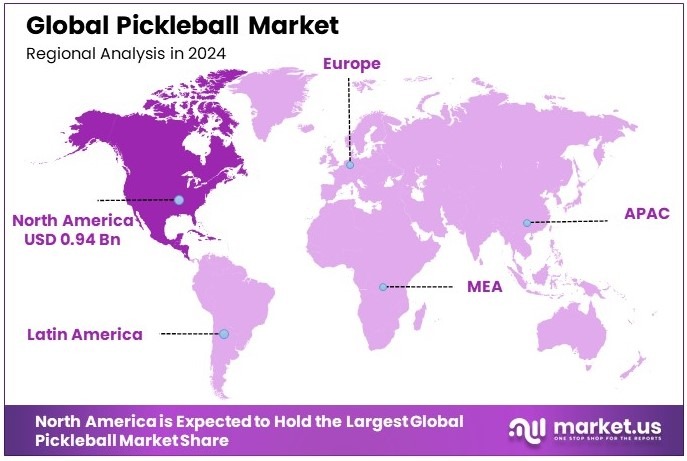

- In 2023, North America accounted for 42.9% of the market, valued at USD 0.94 Billion, owing to the rising popularity of pickleball in the region.

Business Environment Analysis

The pickleball market is expanding globally, being played in over 70 countries with 63 national organizations. However, this rapid growth may lead to increased competition, necessitating strategic positioning and innovation to maintain market share.

Additionally, pickleball appeals to a diverse age range. According to The Pickleball Player it has 8.9 million players in the US. Core players average 47.5 years, while 27.8% are aged 18-34, and 33% of core players are over 65, highlighting its broad demographic appeal. Males make up 60.5% of pickleball players, while females represent 39.5%.

Moreover, product differentiation is evident through innovations like AI-powered tracking by The Picklr and performance gear from Skechers. Interest doubled in 2023, with memberships rising from 4,000 to 9,000, demonstrating the effectiveness of unique features and strategic partnerships in enhancing competitive advantage.

Furthermore, the value chain includes pickleball equipment manufacturers, distributors, retailers, and service providers. Key players such as Wingfield provide advanced technology, while collaborations with brands like Skechers enhance product offerings, ensuring efficient coordination and customer satisfaction.

Investment opportunities are significant, as shown by innovative initiatives like mini pickleball on flights in December 2024, and partnerships such as AIPA’s five-year deal with Skechers in May 2024. Additionally, The Picklr’s agreement with Wingfield in October 2024 introduces advanced technologies, presenting lucrative prospects for investors.

In terms of export and import dynamics, the global trade of badminton and similar rackets like tennis reached $811 million in 2022. China led exports with $488 million (60.2%), while Spain was the top importer with $111 million (13.7%), supporting robust international trade and market expansion.

Finally, adjacent markets like badminton and other racket sports offer growth opportunities, sharing a global trade value of $811 million. Expansion into indoor facilities, technology integration, and apparel can further penetrate related segments.

Pickleball Industry Statistics

Participation and Growth

- An estimated 48.3 million pickleball players were in the U.S. as of 2023 (APP).

- Pickleball participation has grown by an average of 223.5% over the last three years (SFIA).

- 14% of Americans have played pickleball at least once.

- 8.5 million people played pickleball eight or more times.

- Over 13.6 million players were reported in 2023, reflecting a 65% increase from the prior year.

Events and Facilities

- In 2023, 195 USA Pickleball-sanctioned tournaments were held.

- The 2023 National Championships in Texas attracted 3,500 players and 50,000 attendees.

- The 2023 Diamond Amateur Championship in Florida featured 1,082 players and awarded 675 medals.

- $43,550 was awarded through 69 Community, 4 Collegiate, and 92 Youth Grants.

- Over $300 million was invested in new facilities, including 35+ regional venues.

Fun Facts

- Pickleball was invented in 1965 on Bainbridge Island, Washington.

- The sport is named after a dog called “Pickles” or a reference to a “pickle boat”.

- The court measures 20′ x 44′ with a net height of 34” at the center.

- The average age of pickleball players is 38.1 years.

- An average pickleball match lasts 15-25 minutes.

Regional Analysis

North America Dominates with 42.9% Market Share

North America leads the Pickleball Market with a significant 42.9% share, amassing USD 0.94 billion in revenue, driven by the sport’s surging popularity and extensive community engagement. This stronghold is fueled by the sport’s immense popularity in the United States, which had over 8.9 million players in 2023. For three consecutive years—2021, 2022, and 2023—pickleball was recognized as the fastest-growing sport in the U.S. by the Sports and Fitness Industry Association.

The region’s dominance is further supported by a well-established network of pickleball organizations, such as USA Pickleball, which actively promotes the sport and organizes tournaments. The presence of international federations like the International Pickleball Federation (IPF) and the World Pickleball Federation (WPF) adds credibility and structure to the sport.

These organizations initiated merger talks in 2023, indicating efforts to consolidate and strengthen global representation. Additionally, USA Pickleball announced the Global Pickleball Foundation (GPF) in 2023 to expand the sport internationally through educational resources and tournament support, with ambitions to gain Olympic recognition.

North America’s market strength is also influenced by widespread infrastructure, including numerous pickleball courts and facilities, which enhance accessibility and encourage participation. The sport’s appeal spans various age groups, from younger players to seniors, making it inclusive and driving continuous growth.

Regional Mentions:

- Europe: Europe is gradually embracing pickleball, with growing participation in countries like Spain and the UK. The region’s market is expanding due to increasing awareness and the rising popularity of racket sports.

- Asia Pacific: Asia Pacific shows potential in the Pickleball Market, driven by its robust sports culture and increasing interest in adopting new recreational activities. Countries like Australia are witnessing a rise in pickleball clubs and communities.

- Middle East & Africa: The Middle East and Africa are nascent in their adoption of pickleball. However, interest is growing, particularly in tourist and expat communities, which could lead to more significant market development in the future.

- Latin America: Latin America is on the cusp of discovering pickleball, with some countries beginning to introduce the sport through community events and sports festivals. The region holds untapped potential for market growth as awareness and accessibility improve.

Product Type Analysis

Equipment dominates with 41.5% due to its essential role in playing the sport.

In the rapidly growing market of pickleball, Equipment emerges as the leading product type, holding a significant 41.5% share. This dominance is largely due to the fundamental necessity of quality paddles and balls in playing the sport, which players from all levels invest in to enhance their game experience and performance. Paddles, designed with advanced materials and technology, cater to various play styles and skill levels, thereby driving growth in this sub-segment.

Pickleball apparel, which comprises shirts, tops, pants, shorts, and skorts, accounts for 35.8% of the market, with each sportswear designed for comfort and mobility which is crucial during a game.

According to The Dink, the entry of high-performance brands like MUEV is transforming the market. MUEV, backed by 35 Capital, has introduced thermoregulated fabrics and technical designs tailored specifically for pickleball players, emphasizing both style and functionality.

Footwear is another vital segment, making up 22.7% of the market, with pickleball shoes specifically designed to support the quick lateral movements typical in pickleball. Each of these segments contributes uniquely to the sport’s accessibility and enjoyment, fueling ongoing growth in the overall market.

End User Analysis

Men lead the market with 51.7% due to higher participation rates in the sport.

Among end users, Men constitute the largest segment of the pickleball market at 51.7%, reflecting higher participation rates and a strong interest in the sport among male players. This demographic tends to invest heavily in pickleball equipment, apparel, and footwear, seeking products that offer performance and durability to enhance their game.

Women represent a substantial 33.2% of the market, with increasing numbers joining the sport, which is mirrored by a growing range of women-specific products that cater to their needs and preferences. Kids, holding a 15.1% market share, are an emerging segment, with more young players taking up pickleball, indicating potential for growth as schools and community centers increasingly include the sport in their programs.

Sales Channel Analysis

Online Channel leads with 55.8% due to convenience and the growing trend of digital shopping.

Sales channels for pickleball equipment and apparel are dominated by the Online Channel, which accounts for 55.8% of sales. This trend is driven by the convenience of shopping from home, the ability to compare products and prices, and the direct-to-consumer marketing strategies that many brands are adopting.

E-commerce websites offer a wide range of sports equipment, making it easy for consumers to find exactly what they need, while brand websites provide detailed product insights and exclusive merchandise.

The National Sporting Goods Association (NSGA) also notes that online purchases are gaining traction, particularly among younger consumers and those seeking quick, efficient transactions without visiting physical locations.

The Offline Channel, capturing 44.2% of the market, remains vital due to customer preference for testing equipment before purchase. Sporting goods stores, hypermarkets, and exclusive brand outlets provide tangible experiences where players can feel the weight of a paddle, try on apparel, and interact with experts, which can be crucial for those new to the sport or looking to upgrade their equipment.

Key Market Segments

By Product Type

- Apparel

- Shirts & Tops

- Pants

- Shorts & Skorts

- Others

- Footwear

- Equipments

- Paddles

- Balls

- Others

By End User

- Men

- Women

- Kids

By Sales Channel

- Online Channel

- E-commerce Websites

- Brand Websites

- Offline Channel

- Sporting Goods Stores

- Hypermarkets & Supermarkets

- Exclusive Brand Outlets

By Regions

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driving Factors

Growing Popularity Among All Age Groups Drives Market Growth

The Pickleball Market is experiencing substantial growth driven by its increasing popularity across all age demographics. This inclusive sport appeals to both younger and older individuals, fostering a diverse player base that enhances its reach and sustainability.

The game’s simple rules and low-impact nature make it accessible to beginners while still offering competitive play for seasoned athletes. Additionally, the rise in health and wellness awareness contributes significantly to this trend, as Pickleball provides an excellent form of cardiovascular exercise and improves agility and coordination.

Increased accessibility and the availability of courts in community centers, parks, and recreational facilities further support market expansion by making the sport more reachable to a broader audience. Supportive communities and social engagement also play a crucial role, as the social aspect of Pickleball encourages regular participation and fosters a sense of belonging among players.

Restraining Factors

Limited Awareness in Certain Regions Restraints Market Growth

Despite its growing popularity, the Pickleball Market faces several restraining factors that hinder its expansion. Limited awareness in certain regions remains a significant barrier, as potential players in these areas may be unfamiliar with the sport’s rules, benefits, and opportunities. This lack of knowledge can result in lower participation rates and slow market penetration.

Additionally, the high initial investment required for quality equipment, such as paddles, balls, and appropriate footwear, can deter new players from trying the sport. The cost associated with setting up and maintaining Pickleball courts also poses a financial challenge for recreational facilities and community centers, limiting the sport’s availability.

Moreover, Pickleball faces stiff competition from other established sports like tennis, badminton, and squash, which have well-established player bases and infrastructure. USA Pickleball has also expanded its efforts to professionalize and regulate the sport. The organization now has over 830 credentialed referees, showing a 20.2% growth in its officiating program in 2024.

Major Growth Opportunities

Expansion into International Markets Provides Opportunities

The Pickleball Market is well-positioned to capitalize on several growth opportunities that can drive its global expansion. One of the primary opportunities lies in the expansion into international markets, where the sport is still in its nascent stages. Regions such as Europe, Asia, and South America present substantial growth potential due to increasing interest in diverse recreational activities and the rising middle-class population with disposable income for sports participation. This expansion aligns with the overall pickleball industry growth, as seen in recent pickleball market research, which highlights the promising outlook for the sport’s adoption in emerging markets.

Developing professional leagues and tournaments internationally can also enhance the sport’s visibility and appeal, attracting sponsorships and media coverage that further boost its profile. Integration with digital platforms and technology offers another significant opportunity, enabling virtual fitness, online communities, and enhanced player engagement through apps and social media.

Additionally, partnerships with local sports organizations can facilitate the adoption of standardized rules and training programs, ensuring consistent quality and competitiveness across different regions. Private companies and franchises are also capitalizing on pickleball’s popularity. For example, Life Time Fitness has built over 350 pickleball courts and reported an 338% increase in unique participants in 2022.

Emerging Trending Factors

Increasing Social Media Presence and Health Trends Are Latest Trending Factors

The pickleball market is benefiting from several trending factors, including increasing social media presence, health and wellness trends, recreational sports tourism, and cross-generational appeal. These trends collectively drive the sport’s popularity and market growth.

The increasing social media presence is a major trend contributing to the sport’s growth. Influencers, athletes, and enthusiasts are sharing content related to pickleball on platforms like Instagram, TikTok, and YouTube.

Health and wellness trends also play a significant role. With a growing focus on maintaining an active lifestyle, more individuals are choosing sports that offer both physical and social benefits. Pickleball fits this demand as it combines cardiovascular exercise with social interaction, making it a popular option for people of all ages.

Recreational sports tourism is another trend positively impacting the pickleball market. Travel enthusiasts are increasingly seeking sports-related activities during vacations, and pickleball events and facilities are being integrated into resort and recreational destinations. This not only boosts participation but also expands the market for equipment and training services.

Competitive Landscape

In the Pickleball Market, the foremost companies include Amazin’ Aces, Engage Pickleball, LLC, Franklin Sports, Inc., and Gamma Sports (Gamma Sports LLC), each playing a significant role in the sport’s equipment sector.

Amazin’ Aces offers a range of pickleball paddles that are known for their quality and affordability, making the sport accessible to beginners and intermediate players alike. The company’s focus on customer satisfaction and value is central to its market strategy.

Engage Pickleball, LLC is a specialist in high-performance pickleball paddles and gear, catering to professional and serious players. Their products are designed with advanced materials and technology to enhance playability and performance, solidifying their position at the premium end of the market.

Franklin Sports, Inc. provides a wide array of sports equipment, including pickleball paddles and balls. Known for its innovation and versatility, Franklin Sports serves both casual and competitive players, making it a key player in expanding the sport’s reach.

Gamma Sports (Gamma Sports LLC) stands out for its pioneering technologies in pickleball paddles and accessories. The company’s commitment to quality and enhancement of player performance through superior equipment technology appeals to a broad segment of the market.

These companies drive growth in the Pickleball Market through their focused product development strategies, commitment to quality, and engagement with the sport’s community. They play crucial roles in popularizing pickleball and enhancing player experiences at all levels.

Major Companies in the Market

- Amazin’ Aces

- Engage Pickleball, LLC

- Franklin Sports, Inc.

- Gamma Sports (Gamma Sports LLC)

- Gearbox Sports

- HEAD USA, Inc. (HEAD Pickleball)

- Manta World Sport

- Onix Sports, Inc.

- Paddle Tek

- Paddletek, LLC

- Pickleball central

- Pickleball Depot.

- Pickle-Ball Inc.

- Prince Global Sports, LLC (Prince Pickleball)

- ProLite Sports, LLC

- Selkirk Sport

- Vulcan Sporting Goods

- Wilson Sporting Goods Co.

Recent Advancements

- Los Alamos County: In October 2024, Los Alamos County included pickleball sessions in its Open Gym Program, available on Tuesday and Thursday evenings at Los Alamos High School. This collaboration with the Pajarito Pickleball Club aims to foster physical and social well-being by promoting the sport for all ages and skill levels.

- Chaifetz Group: In October 2024, the Chaifetz Group invested in The Picklr, expanding its pickleball investment portfolio, which already includes the St. Louis Shock Major League Pickleball team. This investment is part of a larger strategy to capitalize on pickleball’s growing popularity and drive brand growth.

- QVC: In October 2024, QVC entered the professional pickleball broadcasting sector, integrating live match coverage with merchandise sales. This initiative aims to leverage the sport’s increasing popularity by merging entertainment and shopping experiences.

Report Scope

Report Features Description Market Value (2024) USD 2.2 Billion Forecast Revenue (2034) USD 9.1 Billion CAGR (2024-2033) 15.3% Base Year for Estimation 2024 Historic Period 2019-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Apparel, Footwear, Paddles, Balls, Other Product Types), By End User (Men, Women, Kids), By Sales Channel (Online Channel, Offline Channel) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Amazin’ Aces, Engage Pickleball, LLC, Franklin Sports, Inc., Gamma Sports (Gamma Sports LLC), Gearbox Sports, HEAD USA, Inc. (HEAD Pickleball), Manta World Sport, Onix Sports, Inc., Paddle Tek, Paddletek, LLC, Pickleball central, Pickleball Depot., Pickle-Ball Inc., Prince Global Sports, LLC (Prince Pickleball), ProLite Sports, LLC, Selkirk Sport, Vulcan Sporting Goods, Wilson Sporting Goods Co. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Amazin’ Aces

- Engage Pickleball, LLC

- Franklin Sports, Inc.

- Gamma Sports (Gamma Sports LLC)

- Gearbox Sports

- HEAD USA, Inc. (HEAD Pickleball)

- Manta World Sport

- Onix Sports, Inc.

- Paddle Tek

- Paddletek, LLC

- Pickleball central

- Pickleball Depot.

- Pickle-Ball Inc.

- Prince Global Sports, LLC (Prince Pickleball)

- ProLite Sports, LLC

- Selkirk Sport

- Vulcan Sporting Goods

- Wilson Sporting Goods Co.