Global Tennis Racquet Market By Material (Graphite, Titanium, Carbon Fiber), By Product Type (Power Racquets, Control Racquets, Tweener Racquets), By String Pattern (Open String Pattern, Tight or Closed String Pattern), By End User (Adults, Kids), By Distribution Channel (Independent Sport Outlets, Specialty and Sports Shops, Franchised Sport Outlets, Online Retail, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 22240

- Number of Pages: 244

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

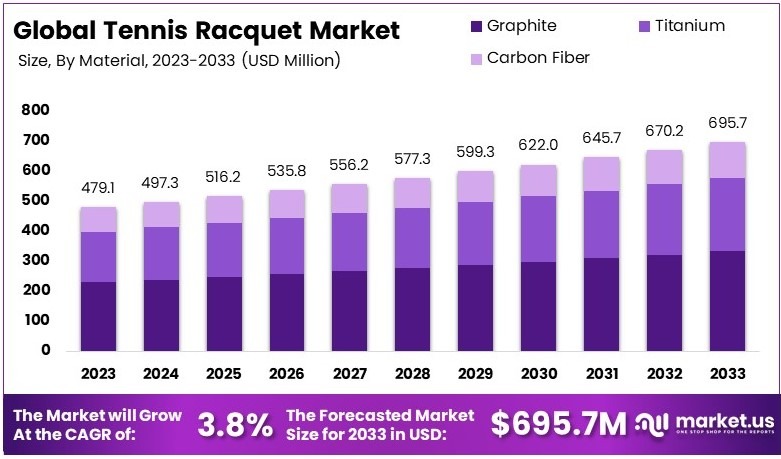

The Global Tennis Racquet Market size is expected to be worth around USD 695.7 Million by 2033, from USD 479.1 Million in 2023, growing at a CAGR of 3.8% during the forecast period from 2024 to 2033.

A tennis racquet is a sports equipment used to hit the tennis ball during play. It consists of a frame with a tightly strung open hoop, providing precision and power. Different racquets cater to varying player levels, ensuring comfort and control.

The tennis racquet market includes the production, distribution, and sales of tennis racquets worldwide. It serves recreational and professional players. The market focuses on innovation in materials, design, and customization to meet players’ needs. It is supported by increasing participation in tennis globally.

The Tennis Racquet Market continues to grow, driven by increasing global participation. In 2023, 23.8 million Americans played tennis, reflecting a growth of six million since 2019 as per USTA, 2024. Globally, 106 million people engage in tennis, with Asia accounting for 35.3 million players or 33.4% of the global total, as per ITF Global Tennis.

The rise in tennis participation fuels racquet demand, especially in emerging markets. Asia leads this trend due to its large player base and increasing disposable incomes. Moreover, partnerships, such as the WTA-PIF collaboration, highlight growth opportunities in premium equipment and sponsorships, further boosting the tennis ecosystem globally.

The market faces saturation in developed regions where tennis is mature. Consequently, competition intensifies among established brands, pushing innovation in sportswear and performance. However, in regions like Asia and the Middle East, untapped potential creates room for new players, making market entry attractive for manufacturers.

Tennis equipment growth impacts both global and local scales. Internationally, events like the WTA Finals in Riyadh (2024) enhance market visibility. Locally, government investments in sports facilities stimulate tennis popularity. Additionally, regulatory bodies ensure product standards, promoting safety and sustainability while supporting long-term market stability.

Key Takeaways

- The Tennis Racquet Market was valued at USD 479.1 million in 2023 and is expected to reach USD 695.7 million by 2033, with a CAGR of 3.8%.

- In 2023, Graphite material led the material segment with 47.3%, valued for its lightweight and durability, enhancing player performance.

- In 2023, Power Racquets dominated the product type segment with 39.2%, preferred for their ability to maximize shot power.

- In 2023, Open String Pattern led with 64.3%, offering better spin and power, appealing to aggressive play styles.

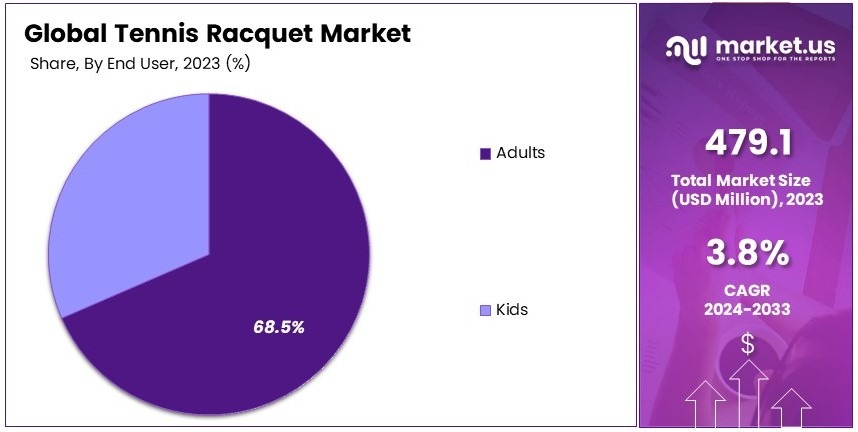

- In 2023, Adults dominated the end-user segment with 68.5%, driven by growing participation in recreational and competitive tennis.

- In 2023, Specialty and Sports Shops held 34.5% of the distribution channel segment due to their targeted product offerings and expertise.

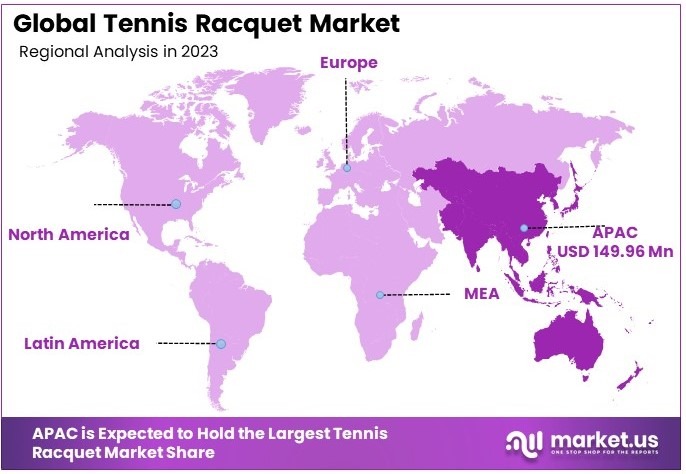

- In 2023, APAC was the dominant region with 31.3%, driven by growing tennis participation and increasing disposable incomes across emerging markets.

Material Analysis

Graphite dominates with 47.3% due to its superior strength and lightweight characteristics.

The Tennis Racquet Market, when analyzed by material, prominently features graphite as the dominant sub-segment, capturing 47.3% of the market share. The preference for graphite in tennis racquets stems from its ability to provide an excellent balance between strength and lightness.

This significantly enhances player performance by allowing for faster swings and greater control. This material’s durability also plays a critical role in its popularity, as it can withstand the physical demands of the sport without compromising the racquet’s integrity.

Other materials used in tennis racquets include titanium and carbon fiber. Titanium, while not as prevalent as graphite, is valued for its shock absorption qualities, contributing to comfort and control during play, thereby supporting the market’s growth.

Carbon fiber, known for its stiffness and power, offers a different playstyle, appealing to players who prioritize force over maneuverability. Both materials are integral to diversifying the choices available to players, ensuring that various playing preferences and needs are met.

Product Type Analysis

Power Racquets dominate with 39.2% due to their enhancement of play for beginners and intermediate players.

In the product type segment of the Tennis Racquet Market, power racquets lead with a 39.2% market share. These racquets are engineered to maximize power output, which is particularly advantageous for beginners and intermediate players who might not yet possess the technique to generate powerful shots independently.

The design typically features a larger head size and a lighter weight, which increases the sweet spot and reduces the effort needed to hit a strong, accurate shot.

Control racquets and tweener racquets are other significant sub-segments. Control racquets appeal to advanced players who prioritize precision over power, allowing for more strategic gameplay. Tweener racquets, positioned between power and control racquets, offer a balanced option for players seeking a mix of speed, power, and control.

String Pattern Analysis

Open String Pattern dominates with 64.3% due to its ability to impart more spin and power.

Within the string pattern segment, open string patterns hold a commanding lead with 64.3% of the market. This design allows for more movement of the strings, which generates additional spin and power on the ball—a preferred feature among modern players who utilize topspin as a crucial element of their game.

The open string pattern also tends to enhance the ‘feel’ of the ball on contact, providing better feedback to the player, which is critical for improving stroke mechanics.

Conversely, tight or closed string patterns offer enhanced control and are suited to players who value precision and have a flatter hitting style. Although less dominant, this sub-segment fulfills the need for a racquet that supports a playstyle focused on accuracy and consistency, thereby maintaining its relevance in the market.

End User Analysis

Adults dominate with 68.5% due to the larger consumer base actively participating in tennis.

The end user segment of the Tennis Racquet Market is predominantly comprised of adults, who constitute 68.5% of the market. This dominance is largely due to the extensive involvement of adults in tennis, both recreationally and competitively. Adults typically have the financial resources to invest in high-quality equipment, which drives continuous innovation and sales in this sub-segment.

Kids’ tennis racquets, though a smaller portion of the market, are crucial for the sport’s growth as they cater to young players entering the sport. These racquets are designed to be lighter and more manageable for younger players, helping cultivate skills and passion for tennis at an early age. This segment’s role in developing future generations of players highlights its importance to the overall market dynamics.

Distribution Channel Analysis

Specialty and Sports Shops dominate with 34.5% due to personalized customer service and product variety.

The distribution channel of the Tennis Racquet Market sees specialty and sports shops as the leading sub-segment, holding 34.5% of the market. These outlets are preferred by consumers seeking expert advice and a wide range of products, which allows for hands-on testing and comparison.

The personalized customer service offered at these shops significantly influences purchasing decisions, as consumers appreciate the guidance from knowledgeable staff.

Other channels include independent sport outlets, franchised sport outlets, and online retail. Independent sport outlets provide local access to tennis equipment, contributing to regional market growth. Franchised sport outlets, with their standardized product offerings, ensure availability across wider regions. Online retail has grown notably, offering convenience and competitive pricing, which appeals to a digitally-savvy consumer base.

Key Market Segments

By Material

- Graphite

- Titanium

- Carbon Fiber

By Product Type

- Power Racquets

- Control Racquets

- Tweener Racquets

By String Pattern

- Open String Pattern

- Tight or Closed String Pattern

By End User

- Adults

- Kids

By Distribution Channel

- Independent Sport Outlets

- Specialty and Sports Shops

- Franchised Sport Outlets

- Online Retail

- Others

Drivers

Driving Factors Propel Tennis Racquet Market Growth

The Tennis Racquet Market benefits significantly from the rising popularity of sports as a recreational activity. This factor has been fueled by the increasing awareness of the health benefits associated with tennis, such as improved cardiovascular health and stress reduction.

Additionally, the growing influence of international tournaments and celebrity endorsements has made tennis more appealing to younger demographics, encouraging participation globally. Furthermore, government initiatives promoting sports activities have encouraged participation, creating a robust demand for racquets.

Innovations in materials and design also contribute to market growth, with manufacturers producing racquets that enhance performance through advanced features. These combined factors collectively drive the growth of the Tennis Racquet Market by fostering a broader and more engaged consumer base.

Restraints

Restraining Factors Impede Tennis Racquet Market Expansion

Economic instability in emerging markets creates affordability concerns for consumers, limiting the adoption of premium racquets that offer better performance. Additionally, the high cost of advanced materials and technologies used in modern racquets further restricts accessibility for budget-conscious buyers.

The seasonal nature of tennis as a sport also impacts sales consistency, with manufacturers and retailers facing significant downtime during off-peak seasons. Moreover, the growing popularity of alternative sports such as pickleball and padel tennis is diverting attention from traditional tennis, reducing its market share.

These factors together challenge the market by reducing consumer purchasing power, narrowing the target audience, and intensifying competition from substitute activities.

Opportunity

Emerging Factors Provide Opportunities for Tennis Racquet Market

The Tennis Racquet Market is poised to capitalize on expanding online retail channels, which offer global accessibility and competitive pricing to a diverse customer base. E-commerce platforms provide customers the convenience of comparing features and prices, leading to higher sales and broader reach.

In addition, the rising adoption of customized racquets for specific playing styles represents a significant growth opportunity, allowing players to enhance performance and enjoy a personalized experience. Technological advancements such as connected racquets with sensors to track performance create a niche segment with high growth potential among tech-savvy consumers.

Furthermore, initiatives targeting younger players through school programs and youth leagues are likely to foster a new generation of tennis enthusiasts and long-term market sustainability.

Challenges

Challenging Factors Slow Tennis Racquet Market Growth

Stringent regulations regarding material sourcing, such as environmental compliance for carbon fiber, pose operational challenges for manufacturers, increasing production complexity.

Additionally, fluctuating raw material prices affect production costs and profit margins, creating financial unpredictability for industry players. The limited availability of skilled labor for designing and manufacturing specialized racquets further hampers growth, especially for high-performance products.

Retailers face challenges in balancing inventory, particularly with seasonal demand fluctuations that leave stock either surplus or insufficient. These challenges collectively create hurdles, requiring market players to innovate and adapt to sustain growth in a competitive landscape.

Growth Factors

Technological Advancements Are Latest Trending Factor

The integration of smart technologies into tennis racquets is one of the latest trends driving market interest, especially among professionals seeking performance analytics. Connected racquets with performance-tracking features are gaining popularity among professionals and enthusiasts, enabling users to improve their game strategically.

Furthermore, the use of sustainable materials such as recycled composites aligns with environmental awareness trends, appealing to eco-conscious consumers. Lightweight racquets with improved aerodynamics are also trending, offering enhanced playability and reducing player fatigue.

Additionally, augmented reality applications for virtual racquet fitting and training are being introduced, creating a tech-driven appeal that resonates with younger audiences.

Emerging Trends

Health Awareness and Active Lifestyles Are Growth Factors

Growing awareness of health benefits associated with tennis is a significant growth factor as consumers increasingly view tennis as a holistic means of maintaining physical fitness and reducing stress. The activity not only improves cardiovascular health but also promotes social interaction, adding to its appeal.

The trend toward active lifestyles, particularly among urban populations, supports demand for tennis equipment as part of a fitness-oriented routine. Furthermore, rising disposable incomes in developing economies enable more consumers to invest in quality racquets, driving market expansion.

The expansion of tennis clubs and recreational facilities globally has also bolstered market growth, offering accessible platforms for new players to take up the sport. These factors, collectively, underscore the enduring appeal and potential of the Tennis Racquet Market.

Regional Analysis

Asia Pacific Dominates with 31.3% Market Share

Asia Pacific leads the Tennis Racquet Market with a commanding 31.3% share, translating to USD 149.96 billion. This dominant position is driven by high population density, increasing disposable incomes, and a growing passion for sports, particularly tennis, across the region. The flourishing sports culture in countries like China, Japan, and India significantly supports market growth.

The region’s dominance is further attributed to rising investments in sports infrastructure and training facilities, making tennis more accessible to amateur and professional players alike. Additionally, the strong presence of racquet manufacturers and distributors ensures the availability of high-quality and affordable products, fostering increased consumer adoption.

Asia Pacific is projected to maintain its leadership in the tennis racquet market, with growth driven by the increasing popularity of tennis among the youth and women. The surge in tennis tournaments and government support for sports activities further enhance the region’s influence in the global market.

Regional Mentions:

- North America: North America boasts a significant share of the tennis racquet market, driven by high participation rates in sports and a well-established infrastructure. The professional tennis scene and strong retail network contribute to its robust market presence.

- Europe: Europe remains a strong contender in the market, supported by the popularity of tennis as a mainstream sport and its established culture of professional tournaments. The region benefits from a mature consumer base and high-quality product demand.

- Middle East & Africa: Tennis is gaining traction in the Middle East & Africa, fueled by rising interest in international sports and investment in premium racquet brands. The market is emerging, with gradual adoption among urban populations.

- Latin America: Latin America shows potential in the tennis racquet market, driven by increasing interest in sports as a leisure activity. The region’s focus on improving sports infrastructure could boost future market opportunities.

Key Regions and Countries covered in the report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The tennis racquet market is led by a few global players who dominate through innovation, brand recognition, and a strong distribution network. These companies focus on advanced materials, ergonomic designs, and professional endorsements to maintain their competitive edge.

Wilson Sporting Goods is a key leader in the market. Its strong brand heritage, extensive product portfolio, and sponsorship of top players position it prominently. Wilson emphasizes innovation, such as racquets with enhanced control and power, appealing to professional and amateur players.

Yonex Co., Ltd. is renowned for its precision engineering and cutting-edge technology. Its products cater to competitive players, offering racquets designed with advanced carbon materials for durability and performance. The company has a robust presence in both Asian and international markets.

Head combines innovative technology with a global marketing strategy. The company’s racquets feature unique technologies, such as Graphene-enhanced frames, ensuring high performance. Head also benefits from endorsements by leading players and wide distribution networks.

Babolat specializes in high-performance racquets with innovative stringing systems. The company is well-regarded for its focus on players’ needs and collaborations with professionals. Its emphasis on product customization enhances its appeal among various skill levels.

These top companies differentiate themselves through a mix of technology, player endorsements, and global presence, driving the growth of the tennis racquet market.

Top Key Players in the Market

- Amer Sport ASI LLC

- ASICS Asia Pte. Ltd

- Babolat

- Dunlop Sports Group Americas

- Gamma Sports

- Head N.V.

- KC Kinetic Solutions, LLC

- Pacific Europe GmbH

- PowerAngle LLC

- Prince Sports

- Slazenger

- Tecnifibre

- Völkl – Global

- Wilson Sporting Goods

- YONEX Co., Ltd

Recent Developments

- Wilson Sporting Goods Co. and Roger Federer: In August 2024, Wilson Sporting Goods Co., in collaboration with Roger Federer, introduced the RF Collection—a new line of tennis equipment. This collection includes three racket models, all designed and tested by Federer, as well as performance bags and accessories. The RF Collection aims to honor Federer’s legacy while incorporating innovative features for future players.

- Yonex: In July 2024, Yonex announced the addition of a ‘Sand Beige’ design to its 7th-generation VCORE tennis racket series. This new colorway is intended to help players focus and perform confidently under pressure. The VCORE series is recognized for its enhanced spin capabilities, featuring an enlarged sweet spot and advanced string technology to support aggressive gameplay.

- Aperol: In August 2024, Aperol, the Italian aperitif brand, launched a tennis-inspired capsule collection to mark its second year as an official partner of the US Open. The collection, modeled by actress Ashley Park, features apparel in Aperol’s signature orange hue, embracing the ‘tenniscore’ aesthetic. Items range from graphic T-shirts to tennis skirts.

Report Scope

Report Features Description Market Value (2023) USD 479.1 Million Forecast Revenue (2033) USD 695.7 Million CAGR (2024-2033) 3.8% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material (Graphite, Titanium, Carbon Fiber), By Product Type (Power Racquets, Control Racquets, Tweener Racquets), By String Pattern (Open String Pattern, Tight or Closed String Pattern), By End User (Adults, Kids), By Distribution Channel (Independent Sport Outlets, Specialty and Sports Shops, Franchised Sport Outlets, Online Retail, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Amer Sports ASI LLC, ASICS Asia Pte. Ltd., Babolat, Dunlop Sports Group Americas, GAMMA Sports, Head, KC KINETIC SOLUTIONS LLC, PACIFIC Europe GmbH, PowerAngle LLC, PRINCE SPORTS, Slazenger, Tecnifibre, Völkl – Global, Wilson Sporting Goods, YONEX Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Amer Sport ASI LLC

- ASICS Asia Pte. Ltd

- Babolat

- Dunlop Sports Group Americas

- Gamma Sports

- Head N.V.

- KC Kinetic Solutions, LLC

- Pacific Europe GmbH

- PowerAngle LLC

- Prince Sports

- Slazenger

- Tecnifibre

- Völkl - Global

- Wilson Sporting Goods

- YONEX Co., Ltd