Global Shopping App Market Size, Share, Statistics Analysis Report By Platform Type (Apple iOS Store, Google Play Store), By Product Category (Grocery, Electronics, Fashion and Apparel, Health and Beauty, Home Goods and Furniture, Other Product Categories), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov. 2024

- Report ID: 133994

- Number of Pages: 352

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- North America Shopping App Market Size

- Platform Type Analysis

- Product Category Analysis

- 5 Best Shopping Apps

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Growth Factors

- Emerging Trends

- Business Benefits of Shopping Apps

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

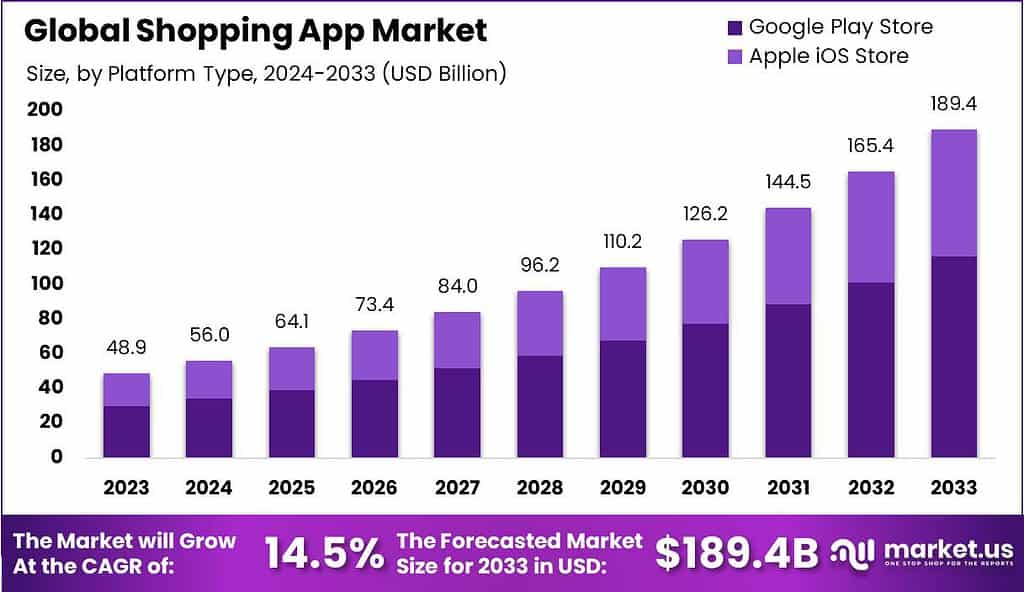

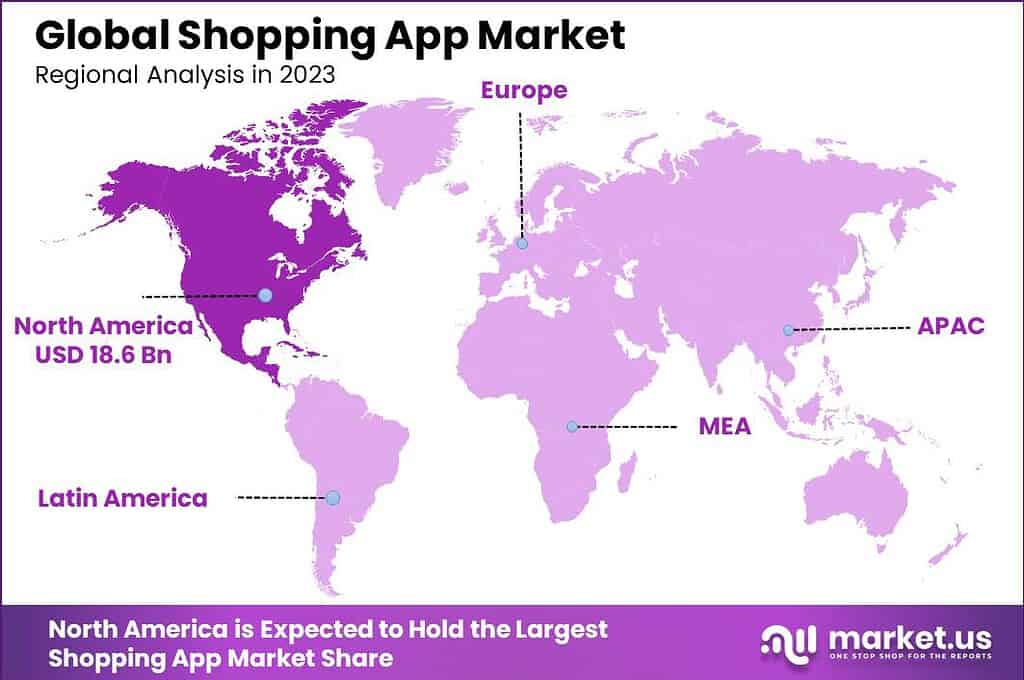

The Global Shopping App Market size is expected to be worth around USD 189.4 Billion by 2033, from USD 48.9 Billion in 2023, growing at a CAGR of 14.5% during the forecast period from 2024 to 2033. In 2023, North America held a dominant market position, capturing more than a 38.1% share, holding USD 18.6 Billion revenue.

A shopping app is a mobile application specifically designed to facilitate the purchasing of goods and services through smartphones and tablets. These apps allow users to browse products, compare prices, and complete transactions directly from their mobile devices, offering a convenient and personalized shopping experience. They often include features such as push notifications for promotions, enhanced payment options, and user-friendly navigation.

The shopping app market is a segment of e-commerce that has seen significant growth, driven by the increasing use of mobile devices for online shopping. This market includes a variety of apps that cater to different shopping needs and preferences, providing platforms where users can engage with brands, discover products, and make purchases with ease.

Key factors propelling the growth of the shopping app market include the widespread adoption of smartphones and the internet. As digital connectivity improves, more consumers are turning to their mobile devices for shopping due to the convenience and speed it offers. Retailers are also increasingly adopting mobile technologies to create more engaging shopping experiences, integrating features such as AI, AR, and personalized shopping assistance, which further stimulates market growth.

Market demand for shopping apps is robust, driven by the consumer’s growing preference for the ease and flexibility of shopping on mobile devices. With features like push notifications for deals, loyalty rewards, and one-tap purchase options, these apps are becoming a preferred shopping method for millions globally. This trend is supported by data showing that shopping app installations and usage continue to rise, indicating a strong consumer shift towards mobile-first commerce.

The shopping app market is ripe with opportunities, particularly in integrating emerging technologies like AR, AI, and voice search, which can significantly enhance the user experience. For instance, AR can allow users to visualize products in their own space before buying, and AI can offer personalized shopping experiences based on user behavior. Voice search capabilities are also becoming popular, providing a hands-free way of shopping which is predicted to grow substantially in revenue in the upcoming years.

Technological innovations are continuously shaping the shopping app market. The use of AI for personalized recommendations, AR for product visualization, and seamless payment technologies are some of the advancements that are enhancing the functionality of shopping apps. Moreover, the integration of voice-activated tools has opened a new avenue for consumer interaction, making shopping more accessible and convenient than ever.

Based on data from Business of Apps, mobile retail in the United States accounts for less than 10% of total retail sales. This is significantly lower than China, where nearly 30% of retail happens through mobile, with Alibaba, JD.com, and Pinduoduo driving the market.

Globally, the shopping app market saw an 8% growth in 2023, reaching close to $4 trillion, with China leading the way in terms of consumer spending. This highlights the massive potential in mobile shopping, especially in markets where mobile-first behaviors are ingrained.

In the U.S., Amazon dominates with over 35% market share, which is a huge lead of 30% points over its nearest competitor, Walmart. However, despite the growing popularity of mobile shopping, there’s a major hurdle: over 80% of mobile shopping carts are abandoned.

Key Takeaways

- The global shopping app market is projected to grow from USD 48.9 billion in 2023 to a staggering USD 189.4 billion by 2033, driven by increasing smartphone penetration and a shift towards online retail. This represents a CAGR of 14.5% over the forecast period.

- Google Play Store emerged as the leading platform in the shopping app market in 2023, capturing a dominant 61.3% market share, reflecting its expansive user base and app ecosystem.

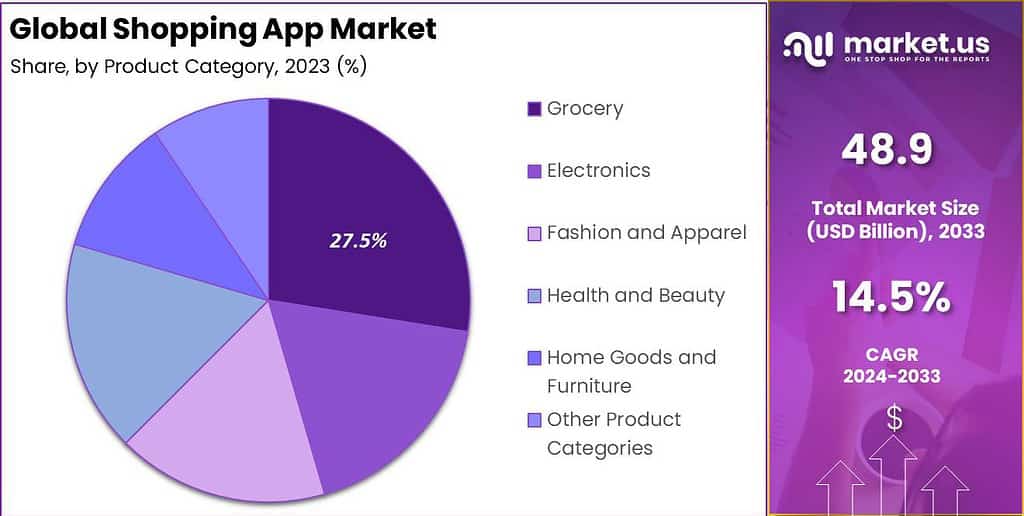

- Among app categories, the grocery segment dominated in 2023, holding a 27.5% share of the global shopping app market. This growth highlights the rising demand for convenient grocery delivery services worldwide.

- North America led the market regionally, commanding a 38.1% share in 2023. Factors such as advanced digital infrastructure, high adoption rates of mobile apps, and significant consumer spending contributed to this dominance.

North America Shopping App Market Size

In 2023, North America maintained its dominance in the shopping app market, capturing a substantial market share of over 38.1%, equating to revenue of approximately USD 18.6 billion. This leading position can be attributed to several key factors that uniquely position North America at the forefront of the mobile commerce revolution.

Firstly, the high penetration of smartphones and the widespread availability of high-speed internet provide a solid foundation for mobile shopping. Consumers in this region have embraced mobile technology at one of the highest rates globally, facilitating their frequent engagement with shopping apps. The cultural propensity towards embracing new technologies has led to consumers in North America being more likely to adopt shopping apps for everyday purchases, ranging from groceries to luxury goods.

Moreover, the region is home to several tech giants and pioneering startups that continually push the boundaries of what shopping apps can offer. Innovations in app functionalities, such as augmented reality (AR) and personalized AI-driven recommendations, have significantly enhanced the user experience, making online shopping more engaging and convenient.

These technological advancements are not only attracting a larger number of users but are also setting the standard for what consumers expect from mobile shopping experiences. Additionally, the business environment in North America supports substantial investments in digital and mobile marketing strategies by retailers.

This investment is driven by the need to compete in a highly saturated market, leading to the development of sophisticated shopping apps that offer seamless and integrated shopping experiences. Companies are leveraging data analytics extensively to understand consumer behavior and tailor their offerings accordingly, thereby increasing user engagement and customer retention.

Platform Type Analysis

In 2023, the Google Play Store segment held a dominant position in the shopping app market, capturing a significant 61.3% market share. This dominance is largely attributable to the extensive reach of the Android operating system, which powers a vast array of devices across different market segments globally.

Google Play’s widespread accessibility in emerging markets, coupled with the variety and volume of applications it hosts, significantly contributes to its market share. One of the key reasons for the Google Play Store’s dominance is its appeal to a wide demographic, which includes users in developing countries where Android devices are more economically accessible than their iOS counterparts.

This has allowed the Google Play Store to maintain a substantial lead in app downloads and user engagement compared to other platforms. Additionally, the platform’s less restrictive app approval process compared to Apple’s iOS Store has encouraged a larger number of developers to choose Google Play for hosting their apps, further boosting its market presence.

According to Go-Globe, In the year 2024, the amount of people using smartphones has exceeded 3. 8 Billion. Its integration with Android ensures pre-installed access, providing unparalleled market reach and convenience for users.

Technologically, Google has made significant strides in enhancing the Google Play Store experience, integrating advanced features such as AI-driven recommendations, better security measures, and a more user-friendly interface. These improvements not only enhance user engagement by making app discovery easier and safer but also encourage developers to innovate further, knowing that the platform continuously evolves to support better user experiences.

Moreover, the economic model of the Google Play Store, which supports a variety of monetization options such as in-app purchases, advertisements, and subscriptions, has been advantageous both for app developers and Google. This flexibility in monetization strategies attracts more developers to the platform, contributing to its vast app ecosystem and, consequently, its dominance in the market.

The future of the Google Play Store looks promising with ongoing advancements in mobile technology and increasing global internet penetration, which are expected to drive further growth and market share expansion

Product Category Analysis

In 2023, the grocery segment secured a dominant market position within the shopping app landscape, accounting for over 27.5% of the market share. This substantial share is largely driven by the increased consumer preference for convenience and immediacy in their shopping habits, trends that were amplified by the global shift towards digital platforms following the COVID-19 pandemic.

The integration of shopping apps into everyday grocery procurement has been further facilitated by enhancements in app functionalities, including real-time inventory updates, personalized shopping recommendations, and streamlined checkout processes, making it easier for consumers to manage their purchases from the comfort of their homes.

The rise of the grocery segment can also be attributed to the growing consumer awareness and sensitivity towards health and wellness, which has spurred the demand for organic and health-oriented food products available through these platforms. As shopping apps expand their grocery offerings, they also cater to a wider range of dietary preferences and restrictions, broadening their market appeal.

Moreover, the evolution of supply chain capabilities has played a crucial role in this segment’s growth. Advanced logistics and delivery systems have enabled faster and more reliable delivery options, enhancing customer satisfaction and trust in online grocery shopping. The integration of AI and machine learning technologies has also improved demand forecasting and inventory management, reducing waste and ensuring a better match between supply and consumer demand.

Finally, strategic partnerships between shopping app companies and major grocery chains have bolstered the market presence of these apps, providing them access to a wider product range and fostering customer loyalty through seamless service experiences. These collaborations have been pivotal in expanding market reach and enhancing the overall user experience, securing the grocery segment’s robust position in the shopping app market.

5 Best Shopping Apps

The top five shopping apps that are leading in popularity and utility across both iOS and Google Play platforms are:

- Temu: Emerging as a frontrunner in the online marketplace, Temu offers a wide range of products at competitive prices. Its rapid rise in popularity can be attributed to its affordable pricing and broad selection, appealing to a diverse customer base.

- SHEIN: This app specializes in trendy and affordable fashion, gaining significant traction among consumers who appreciate fast fashion at low costs. SHEIN is particularly noted for its vast collection of clothing and accessories, updated frequently to keep up with the latest trends.

- Amazon Shopping: A long-standing leader in the e-commerce space, Amazon continues to dominate due to its extensive product range, reliable customer service, and efficient logistics. It remains a preferred choice for a seamless shopping experience offering everything from everyday essentials to electronics and apparel.

- Walmart: Known for its grocery and household items, Walmart’s app integrates online shopping with physical store benefits, such as pickup and delivery options, making it a convenient choice for routine purchases.

- AliExpress: This app provides access to a wide array of low-cost products directly from manufacturers, primarily based in China. AliExpress is favored for its affordable pricing and diverse product categories, ranging from electronics to fashion and home goods.

Key Market Segments

By Platform Type

- Google Play Store

- Apple iOS Store

By Product Category

- Grocery

- Electronics

- Fashion and Apparel

- Health and Beauty

- Home Goods and Furniture

- Other Product Categories

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- UK

- Spain

- Austria

- Rest of Europe

- Asia-Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Rest of Asia-Pacific

- Latin America

- Brazil

- Middle East & Africa

- South Africa

- Saudi Arabia

- United Arab Emirates

Driver

Increased Internet Connectivity and Mobile Device Penetration

One of the primary drivers propelling the growth of the shopping apps market is the significant increase in internet connectivity alongside the rapid penetration of mobile devices globally. The widespread availability of high-speed internet has transformed consumer behavior, making mobile apps a preferred platform for shopping due to the convenience and immediacy they offer.

The expansion of 4G and the emerging rollout of 5G networks further boost the capabilities of mobile devices, allowing for smoother and quicker app functionalities, which in turn enhances user engagement and increases the frequency of app usage for shopping. These technological advancements not only improve the user experience but also expand the reach of shopping apps to new users who are now coming online for the first time.

Restraint

Security Concerns and Data Privacy Issues

Security concerns and data privacy issues present significant restraints in the adoption and growth of shopping apps. With increasing incidences of data breaches and cyber-attacks, consumers are becoming more cautious about sharing personal information online, especially on platforms requiring financial transactions. The apprehension about the misuse of personal and payment data can deter potential users from adopting shopping apps, impacting market growth.

Moreover, the regulatory landscape around data security is becoming more stringent, with laws such as GDPR in Europe and various local regulations in other regions imposing strict guidelines on data handling and user privacy. Compliance with these regulations adds an additional layer of complexity and cost for shopping app developers, potentially slowing down their go-to-market strategies and innovation cycles.

Opportunity

Integration of Advanced Technologies

The integration of advanced technologies such as augmented reality (AR), virtual reality (VR), and artificial intelligence (AI) presents a substantial opportunity for the evolution of shopping apps. These technologies can significantly enhance the user experience by providing more interactive and personalized shopping experiences. For example, AR can allow users to visualize products in their home environment before purchasing, while AI can offer personalized shopping suggestions based on user behavior and preferences.

Furthermore, as technology evolves, there is an opportunity for shopping apps to become more integrated into the everyday lives of consumers, potentially shifting from being purely transactional platforms to becoming part of a larger ecosystem of services that offer added value such as social interaction, entertainment, and personalized content.

Challenge

Maintaining User Engagement and Loyalty

Maintaining user engagement and loyalty is a significant challenge in the highly competitive shopping app market. With a plethora of options available, user retention becomes critical. Shopping apps need to continually innovate and improve the user experience to keep users interested and engaged. This involves regular updates, incorporating new features that meet evolving consumer expectations, and ensuring a seamless and bug-free experience.

Additionally, developing a loyalty program that rewards users for their continuous engagement can be effective. However, these programs must be compelling enough to deter users from switching to competitor apps offering potentially better deals or experiences. As market saturation grows, differentiating one’s offering and maintaining a loyal customer base will require not just technological innovation but also strategic marketing and excellent customer service.

Growth Factors

The growth of the shopping app market is significantly propelled by a combination of technological advancements and shifts in consumer behavior. Increased smartphone penetration across the globe provides a solid foundation for the expansion of mobile commerce. Consumers now have constant access to online stores via their phones, facilitating spur-of-the-moment purchases and regular engagement with brands.

The ubiquity of high-speed internet further enhances this trend, enabling a seamless shopping experience without the lag or load times that once hindered mobile shopping. E-commerce businesses are increasingly leveraging advanced technologies such as artificial intelligence (AI) to personalize the shopping experience, offering recommendations based on user behavior and preferences. This personalized approach not only improves customer satisfaction but also increases the likelihood of purchases.

Moreover, augmented reality (AR) has begun to play a crucial role in the market, particularly in the fashion and home decor sectors, where it allows consumers to visualize products in their own space before making a purchase decision. The integration of mobile payments solutions has also been a critical growth driver. As security in mobile transactions has improved, consumer trust in using apps for purchases has increased.

Emerging Trends

Emerging trends in the shopping app market revolve around enhancing user engagement and integrating more comprehensive services into single platforms. Live commerce, or the fusion of live streaming and shopping, is gaining traction. This trend allows consumers to view products in real time, engage directly with sellers through Q&A sessions, and make purchases during the broadcast, which mimics a physical shopping experience in a digital format.

Social commerce is another growing trend, with shopping apps integrating directly with social media platforms to tap into the vast user base and harness the persuasive power of social interactions. These platforms make use of influencer partnerships and user-generated content to foster trust and streamline the path to purchase, making shopping a more social and interactive experience.

Subscription models within apps are evolving to offer more than just products; they now provide tailored experiences and exclusive content, enhancing value and customer loyalty. These models ensure predictable revenue streams for businesses and help maintain continuous engagement with users.

Business Benefits of Shopping Apps

Shopping apps offer numerous benefits for businesses by opening up new avenues for growth and customer connection. They enable a broader reach, breaking geographical barriers and allowing brands to engage with a global audience. The data collected through these apps provide invaluable insights into consumer behavior, preferences, and purchasing patterns, which can be leveraged to tailor marketing strategies and optimize product offerings.

Furthermore, shopping apps enhance customer loyalty through personalized experiences and rewards programs, which encourage repeat business. The ability to send push notifications and alerts about new products, sales, and special events helps keep the brand at the forefront of consumers’ minds, thereby increasing the frequency of interactions and purchases.

The competitive advantage gained through shopping apps is significant in today’s digital landscape. Brands that provide a seamless, engaging, and secure shopping experience can differentiate themselves from competitors and build a strong, loyal customer base.

Key Players Analysis

One of the leading players in the market is Amazon which dominates the e-commerce landscape, offering a wide range of products through its mobile app. Amazon focuses on customer experience, fast delivery, and extensive product categories. Another prominent player operating in the market is Walmart which leverages its vast physical store network and mobile app for seamless online to offline shopping experiences.

Top Opportunities Awaiting for market Players

The shopping app market presents several promising opportunities for players looking to expand and innovate. Here are some key areas of opportunity:

- Expansion into Emerging Markets: Rapid growth in regions like the Philippines and other Asian markets presents a significant opportunity for market expansion and increased revenue. With substantial increases in e-commerce traffic, businesses should consider these regions for their growth strategies, particularly as some Western markets are experiencing a decline in web traffic share.

- Leveraging AI and AR: Artificial Intelligence (AI) and Augmented Reality (AR) technologies are transforming the e-commerce landscape, offering enhanced personalization, improved customer service, and optimized marketing strategies. Companies should invest in these technologies to provide personalized recommendations, automate customer interactions, and analyze data more effectively.

- Social Commerce: The integration of e-commerce and social media platforms, particularly TikTok, has opened up new avenues for social selling. This approach leverages the vast user base and the engagement potential of social media, making it a fertile ground for direct product marketing and sales.

- Robust Security Measures: As mobile shopping grows, so does the importance of securing consumer data. Implementing robust security measures can help build trust and protect against breaches, which is crucial for maintaining customer loyalty and safeguarding transaction integrity.

- Phygital Experiences: Creating seamless omnichannel experiences that blend physical and digital shopping can enhance customer engagement. Employing mobile apps in physical stores to facilitate payments, access loyalty rewards, and more, can significantly enhance the customer shopping experience.

Top Key Players in the Market

- Amazon.com, Inc.

- eBay Inc.

- Walmart Inc.

- Alibaba Group Holding Limited

- JD.com, Inc.

- Rakuten Group, Inc.

- Target Corporation

- Etsy, Inc.

- Best Buy

- Zalando SE

- Other Key Players

Recent Developments

- In November 2024, U.S. beta launches today in the Amazon Shopping app, featuring fashion, home, lifestyle, electronics, and other products, all backed by Amazon’s A-to-Z Guarantee, with delivery times of one to two weeks.

- In August 2024, Food aggregator Zomato is launching a new app, District, to expand its services beyond its core food delivery and quick commerce business. The new platform aims to consolidate various ‘going-out’ services such as dining, movies, sports ticketing, live performances, shopping, and staycations, creating a one-stop destination for customers.

Report Scope

Report Features Description Market Value (2023) USD 48.9 Bn Forecast Revenue (2033) USD 189.4 Bn CAGR (2024-2033) 14.5% Largest Market North America Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Platform Type (Apple iOS Store, Google Play Store), By Product Category (Grocery, Electronics, Fashion and Apparel, Health and Beauty, Home Goods and Furniture, Other Product Categories) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Amazon.com, Inc., eBay Inc., Walmart Inc., Alibaba Group Holding Limited, JD.com, Inc., Rakuten Group, Inc., Target Corporation, Etsy, Inc., Best Buy, Zalando SE, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Amazon.com, Inc.

- eBay Inc.

- Walmart Inc.

- Alibaba Group Holding Limited

- JD.com, Inc.

- Rakuten Group, Inc.

- Target Corporation

- Etsy, Inc.

- Best Buy

- Zalando SE

- Other Key Players