Global Pro AV (Audio Visual) Market Size, Share, Statistics Analysis Report By Type (Products, Services), By Application (Entertainment, Hospitality, Corporate, Transportation, Other), By Distribution Channel (Direct sales, Distributors), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

- Published date: Nov. 2024

- Report ID: 133906

- Number of Pages: 242

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

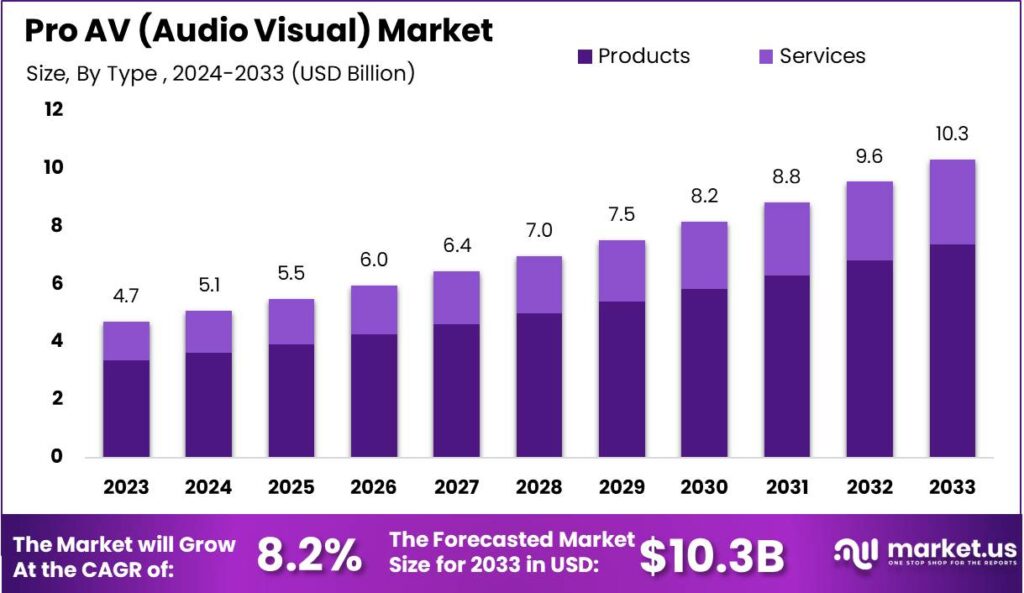

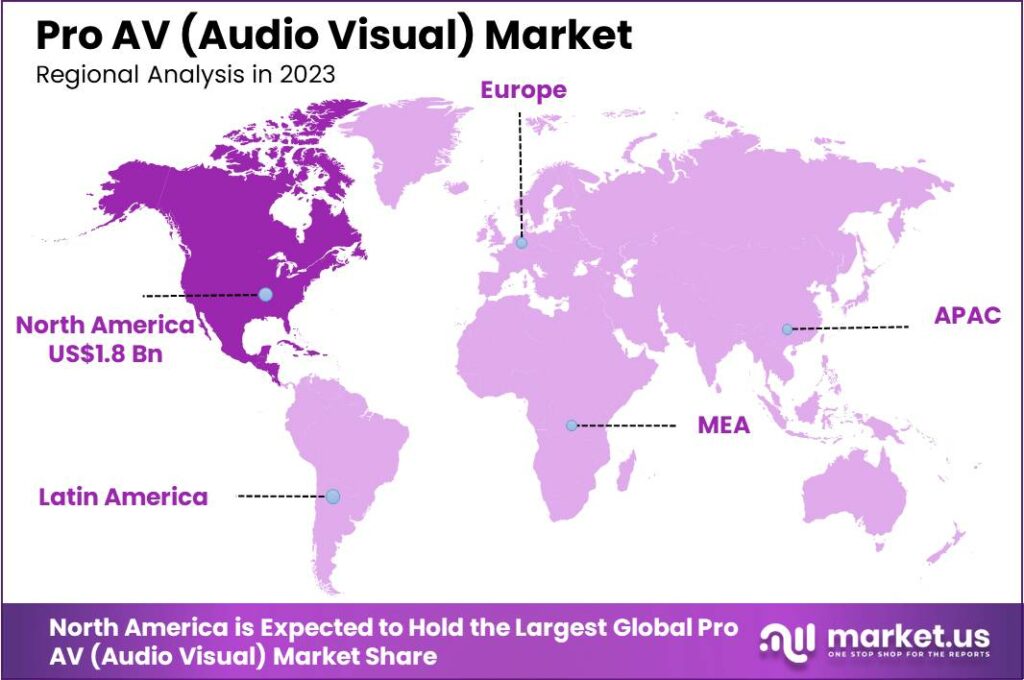

The Global Pro Av (Audio Visual) Market size is expected to be worth around USD 10.3 Billion By 2033, from USD 4.7 billion in 2023, growing at a CAGR of 8.2% during the forecast period from 2024 to 2033. In 2023, North America held a dominant market position, capturing more than a 40.3% share, holding USD 1.8 Billion revenue.

Pro AV, or Professional Audio Visual, refers to the integration and use of audio and video equipment to enhance communication and interactive experiences in various environments. This sector encompasses a broad array of technologies, including displays, sound systems, video conferencing, lighting, and control systems, all designed to facilitate effective and engaging audiovisual presentations.

The Pro AV market is a dynamic field within the technology sector that is expanding due to increasing demand for advanced communication tools and digital media. This market encompasses the sale, distribution, and installation of audiovisual systems that are used in professional and commercial settings.

The scope of the market includes a variety of products and services, ranging from video displays and projectors to sound systems and collaborative technologies, which are applied in diverse sectors including business, education, healthcare, and entertainment. The Pro AV market’s growth is primarily driven by the increasing adoption of digital signage across various industries.

Businesses are leveraging electronic signage to engage customers with interactive and content-rich media. Additionally, the educational sector’s shift towards more digital and interactive learning formats has significantly boosted the demand for advanced AV solutions. These factors are complemented by the rising need for effective communication and presentation tools in corporate and government settings..

Market demand in the Pro AV sector is heavily influenced by the need for efficient, high-quality communication and presentation solutions across various industries. With the rise of hybrid work environments and e-learning, organizations are investing in AV technologies to create more engaging and interactive experiences. This demand is complemented by the consumer expectation for seamless and integrated audiovisual experiences, whether in public, corporate, or private spaces.

Additionally, the ongoing shift towards cloud-based solutions presents opportunities for service providers to offer scalable and flexible AV services that can be customized to varying customer needs. Technological advancements are pivotal in shaping the Pro AV market. The development of 4K, 8K, and even higher resolution displays ensures clearer and more immersive visual presentations.

Advances in wireless technology, including 5G, enhance the speed and reliability of AV transmissions, facilitating better connectivity and performance. Moreover, innovations in AI are transforming AV equipment into smarter systems capable of voice recognition and automated environmental adjustments, which greatly enhance user interaction and operational efficiency.

Key Takeaways

- In 2023, the market was valued at USD 4.7 billion and is projected to reach USD 10.3 billion by 2033, growing at a compound annual growth rate (CAGR) of 8.2% from 2024 to 2033.

- In 2023, North America dominated the Pro AV market, holding a revenue share of more than 40.3%, equivalent to USD 1.8 billion.

- The Products segment accounted for a 71.5% share of the Pro AV market in 2023, making it the largest contributor.

- The Entertainment sector emerged as the largest application area for Pro AV solutions, holding over 35% of the market share in 2023.

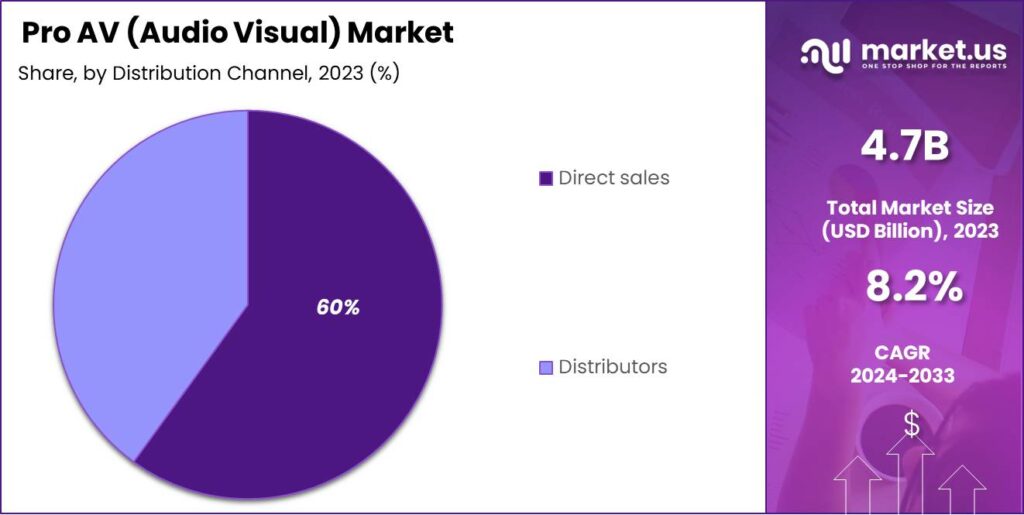

- Direct sales accounted for the majority of the market, with a 60% share in 2023.

North America Pro AV Market Size

In 2023, North America held a dominant market position in the Pro AV market, capturing more than a 40.3% share with revenues amounting to USD 1.8 billion. This significant market share can be attributed to a robust ecosystem of technological innovation and a high rate of adoption of advanced audiovisual technologies across various sectors including corporate, education, and entertainment.

The region’s leadership in the Pro AV market is further bolstered by the presence of key industry players and a strong focus on research and development activities that drive technological advancements in audiovisual solutions. The growth of the Pro AV market in North America is also supported by substantial investments in IT infrastructure and the rapid integration of digital technologies within business operations.

The educational sector, in particular, has seen a significant increase in the deployment of audiovisual technologies to facilitate remote learning and immersive classroom experiences, reflecting a broader trend toward digital transformation influenced by the recent global shifts in educational delivery methods.

Moreover, the entertainment industry in North America, especially in the United States, plays a pivotal role in the expansion of the Pro AV market. The surge in live events, concerts, and sports after the easing of pandemic restrictions has led to increased demand for high-quality audiovisual systems to enhance viewer experiences.

Type Insights

In 2023, the Products segment held a dominant market position within the Pro AV (Audio Visual) market, capturing more than a 71.5% share. This substantial market share can primarily be attributed to the increasing demand for advanced audiovisual technologies across various sectors, including corporate, education, entertainment, and healthcare.

The integration of AV products such as digital signage, projectors, display systems, and sound reinforcement systems has been crucial in driving the segment’s growth. These products are essential for facilitating effective communication and enhancing user engagement through high-quality audio and visuals.

The surge in the adoption of AV products is further bolstered by the rapid advancements in technology. Innovations such as 4K, 8K, and higher resolution displays, as well as immersive audio systems, have significantly improved the quality and capabilities of AV solutions, making them more appealing to consumers and businesses alike.

Additionally, the expansion of wireless technologies and the Internet of Things (IoT) has simplified the integration and operation of AV systems, thereby increasing their accessibility and utility in both public and private spaces. Moreover, the shift towards hybrid working models and virtual learning environments has propelled the demand for robust AV products that can support remote interaction and collaboration.

Organizations are investing in AV products to create dynamic and flexible environments capable of supporting a range of communication needs, from virtual meetings and conferences to live streaming and content creation. This trend is expected to continue, as the boundaries between physical and digital spaces become increasingly blurred, necessitating more sophisticated and versatile AV solutions.

Overall, the Products segment’s dominance in the Pro AV market is expected to persist, driven by continuous technological innovations and growing requirements for high-quality communication tools across all industries. The ongoing development of more advanced and user-friendly AV products will likely further enhance this segment’s growth trajectory, solidifying its position as a cornerstone of the Pro AV industry.

Application Insights

In 2023, the Entertainment segment held a dominant market position within the Pro AV (Audio Visual) market, capturing more than a 35% share. This leadership is largely due to the increasing consumer demand for immersive and high-quality entertainment experiences.

Advanced AV technologies, including high-definition video walls, 3D projection systems, and augmented reality (AR) installations, have become integral in transforming audience experiences at concerts, cinemas, theme parks, and other entertainment venues. The integration of these technologies enhances visual and auditory experiences, making them more engaging and memorable for the audience.

The proliferation of live events and the expanding scope of digital installations across entertainment hubs have further fueled the growth of this segment. As venues strive to differentiate themselves and attract larger audiences, investment in state-of-the-art AV systems has risen. These systems are critical in delivering spectacular shows and events that leverage sophisticated sound and visual effects to create captivating environments.

Furthermore, the rapid growth of the e-sports industry and the increasing popularity of interactive gaming have opened new avenues for AV technologies. E-sports arenas are adopting professional-grade audiovisual systems to deliver a seamless and immersive experience to both players and spectators.

The ability of AV technology to integrate with other digital platforms and provide a cohesive experience across various forms of media also supports the expansion of the entertainment segment in the AV market. Given these factors, the Entertainment segment’s prominence in the Pro AV market is expected to continue.

The ongoing technological advancements and the ever-growing consumer expectations for high-quality and interactive entertainment options will likely drive further growth and innovation in this sector, reinforcing its leading position in the market.

Distribution Channel Insights

In 2023, the Direct sales segment held a dominant market position in the Pro AV (Audio Visual) market, capturing more than a 60% share. This considerable market share can be attributed to the increasing preference among businesses and end-users for customized AV solutions tailored to specific operational requirements and environments.

Direct sales channels enable manufacturers to engage directly with their customers, providing a more personalized approach that facilitates the integration of bespoke AV systems designed according to precise customer specifications. The direct sales approach also allows for better control over brand management and customer service.

By dealing directly with their clients, companies can ensure higher levels of customer satisfaction through immediate feedback and swift resolution of any issues. This close interaction fosters stronger relationships and often results in higher customer loyalty and repeat business.

Additionally, the elimination of intermediaries in the direct sales model can lead to cost savings for both the provider and the consumer, making it an attractive option for large-scale deployments where budget considerations are paramount. Moreover, the direct sales model benefits from the rapid advancement of digital technologies, including e-commerce platforms and digital marketing strategies, which have made it easier for companies to reach a global audience more efficiently.

The ability to market and sell products directly through online channels has significantly expanded the reach of AV companies, enabling them to tap into new markets and demographics with minimal physical presence required. The dominance of the direct sales segment in the Pro AV market is likely to continue, driven by the ongoing digital transformation and the increasing demand for customized AV solutions across various industries.

Key Market Segments

By Type

- Products

- Services

By Application

- Entertainment

- Hospitality

- Corporate

- Transportation

- Other Applications

By Distribution Channel

- Direct sales

- Distributors

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- UK

- Spain

- Austria

- Rest of Europe

- Asia-Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Rest of Asia-Pacific

- Latin America

- Brazil

- Middle East & Africa

- South Africa

- Saudi Arabia

- United Arab Emirates

Driver

Increasing Demand for Immersive Experiences

In the professional audio-visual (Pro AV) market, one of the primary drivers is the escalating demand for immersive experiences. As businesses and organizations strive to elevate customer engagement and improve employee training, there is a substantial investment in advanced AV solutions.

These include interactive displays, augmented reality (AR) applications, and virtual reality (VR) simulations, which significantly enhance user interactions by making them more engaging and personalized.

For instance, retail environments are leveraging interactive displays to provide customers with unique, personalized shopping experiences, while companies are using VR simulations for more effective and hands-on employee training. This trend is not only driving innovation but also fostering competitiveness across various industries.

Restraint

High Implementation Costs

Despite the growing demand, the Pro AV market faces significant constraints due to the high costs associated with implementing advanced AV technologies. The initial investment required for state-of-the-art AV equipment, software, and installation is substantial, posing a formidable barrier, particularly for small businesses with limited financial resources.

This financial challenge restricts market entry for smaller players and slows down the adoption of new technologies, ultimately hampering the market’s growth and the spread of innovative AV solutions.

Opportunity

Expansion in Healthcare and Education Sectors

The Pro AV market is witnessing considerable opportunities in the healthcare and education sectors, driven by the integration of AV technologies into telemedicine, remote learning, and interactive classroom solutions. These technologies are proving essential for modernizing these sectors and improving accessibility to quality education and healthcare services.

For instance, telemedicine uses AV technology to enhance patient care by facilitating remote consultations, while educational institutions are employing interactive learning tools to provide more engaging and effective learning experiences. The ongoing advancements in these sectors represent a significant growth opportunity for the Pro AV market.

Challenge

Security Risks

Security remains a major challenge in the Pro AV market, particularly with the increasing integration of networked devices and systems. The vulnerabilities associated with these networked AV systems include risks of data breaches, malware attacks, and unauthorized access, all of which require robust security measures to mitigate.

The necessity for improved security protocols and systems to protect sensitive information and maintain user confidence is becoming ever more critical. Failing to address these security concerns could significantly hinder market growth and adoption rates of networked AV solutions.

Growth Factors

Technological Advancements and Demand for Enhanced Experiences

The Pro AV market is currently witnessing significant growth, driven largely by technological advancements and a rising demand for enhanced audiovisual experiences. Innovations such as ultra-high-definition (UHD) displays and advancements in audio technology, like spatial audio and beamforming microphones, are transforming the way audiovisual content is delivered, offering clearer and more immersive experiences.

This technological push is complemented by a growing demand for high-quality communication and collaboration tools, especially in corporate environments where the need for effective connectivity in hybrid work settings is crucial.

Furthermore, the entertainment and events sectors are increasingly utilizing advanced Pro AV solutions to create engaging and memorable experiences for audiences, thus driving market growth.

Emerging Trends

Integration of AI and Embracing Virtual Environments

Emerging trends in the Pro AV market include the integration of Artificial Intelligence (AI) and the adoption of Virtual (VR) and Augmented Reality (AR) technologies. AI is being used to enhance user interaction with AV systems through features like automated camera tracking and smart audio systems that adapt to the acoustics of the environment.

Meanwhile, VR and AR are being increasingly employed not just in entertainment, but also in sectors like education and healthcare, to create immersive and interactive experiences that go beyond traditional AV capabilities. These technologies are not only expanding the application areas for Pro AV solutions but are also setting new standards for engagement and interactivity.

Business Benefits

Enhanced Communication and Operational Efficiency

Pro AV solutions provide substantial business benefits by enhancing communication and operational efficiency. In corporate settings, these systems are integral for video conferencing and presentations, enabling seamless interaction among teams and with clients globally.

Educational institutions benefit from interactive displays that support dynamic teaching methods, thus enhancing learning outcomes. In the realm of entertainment, Pro AV systems deliver high-quality audio and visual experiences that are crucial for audience engagement.

The overall impact includes better communication, increased productivity, and the ability to create compelling, immersive environments that drive customer and stakeholder satisfaction.

Key Player Analysis

The competitive landscape of the market highlights key details about major players, offering insights into their operations and strategies. This includes an overview of each company, financial performance, revenue contributions, and their potential in the market. It also covers investments in research and development, efforts to explore new markets, and the extent of their global presence.

Wesco International recently enhanced its market position by merging with Anixter International. This strategic move not only expanded their global reach but also combined their extensive product lines and customer bases, creating a powerhouse in the distribution sector. The merger has positioned Wesco to leverage Anixter’s strong market presence and technological capabilities to enhance service offerings and drive innovation.

AVI-SPL, a major player in the AV solutions sector, has consistently driven its market expansion through strategic acquisitions. These acquisitions have not only broadened its service capabilities but also strengthened its position in new and existing markets, enhancing its ability to offer comprehensive AV and collaboration technology solutions across a diverse clientele. This strategy of growth through acquisition has enabled AVI-SPL to maintain a competitive edge in the rapidly evolving AV landscape.

Biamp, known for its high-quality audio systems, has been actively launching new products that emphasize innovation in audiovisual technology. Their recent launches have focused on enhancing user experience and functionality, catering to the sophisticated needs of modern AV environments. By prioritizing research and development, Biamp has successfully introduced products that are both technologically advanced and aligned with current market demands, thereby reinforcing its reputation as a leader in audio solutions.

Top Key Players in the Market

- Anixter Inc. (U.S.)

- Wesco (U.S.)

- AVI Systems (U.S.)

- AVI-SPL, LLC (U.S.)

- Biamp (U.S.)

- CCS Presentation Systems (U.S.)

- Ford Audio-Video, LLC (U.S.)

- New Era Technology (India)

- Pro AV (U.S.)

- Solutionz Inc. (U.S.)

- Telerent Leasing Corp (U.S.)

- ITOCHU Corporation (China)

- Vistacom Inc. (India)

Recent Developments

- In October 2024, Acuity Brands announced an agreement to acquire QSC, LLC, a prominent audio, video, and control systems manufacturer, for $1.215 billion. This acquisition is expected to strengthen Acuity’s Intelligent Spaces Group.

- In March 2024, Nikon acquired Red Digital Cinema, a company known for high-end video cameras. This acquisition signifies Nikon’s expansion into the professional video market.

- In July 2024, Harman introduced new JBL Modern Audio receivers and Stage 2 Loudspeakers, designed for high-performance home theater systems, at the Audio Advice Live 2024 event.

Report Scope

Report Features Description Market Value (2023) USD 4.7 Bn Forecast Revenue (2033) USD 10.3 Bn CAGR (2024-2033) 8.2% Largest Market North America Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Products, Services), By Application (Entertainment, Hospitality, Corporate, Transportation, Other), By Distribution Channel (Direct sales, Distributors) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Anixter Inc. (U.S.), Wesco (U.S.), AVI Systems (U.S.), AVI-SPL, LLC (U.S.), Biamp (U.S.), CCS Presentation Systems (U.S.), Ford Audio-Video, LLC (U.S.), New Era Technology (India), Pro AV (U.S.), Solutionz Inc. (U.S.), Telerent Leasing Corp (U.S.), ITOCHU Corporation (China), Vistacom Inc. (India) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Pro AV (Audio Visual) MarketPublished date: Nov. 2024add_shopping_cartBuy Now get_appDownload Sample

Pro AV (Audio Visual) MarketPublished date: Nov. 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Anixter Inc. (U.S.)

- Wesco (U.S.)

- AVI Systems (U.S.)

- AVI-SPL, LLC (U.S.)

- Biamp (U.S.)

- CCS Presentation Systems (U.S.)

- Ford Audio-Video, LLC (U.S.)

- New Era Technology (India)

- Pro AV (U.S.)

- Solutionz Inc. (U.S.)

- Telerent Leasing Corp (U.S.)

- ITOCHU Corporation (China)

- Vistacom Inc. (India)