Global Liquid Egg Market By Product Type (Whole Egg, Egg white, Egg Yolk, Scrambled Mix), By Form (Frozen, Refrigerated), By Source (Conventional, Organic, Cage-free), By End-use (Food Industry, Biotechnology, Cosmetic Industry, Pharmaceutical and Dietary Supplement, Animal Nutrition, Others), By Packaging (Plastic Pouches, Carton Boxes, PET Bottles, Others), By Sales Channel (B2B, Ho-Re-Ca, B2C), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

- Published date: November 2024

- Report ID: 133788

- Number of Pages: 270

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Product Type Analysis

- By Form Analysis

- By Source Analysis

- By End-use Analysis

- By Packaging Analysis

- By Sales Channel Analysis

- Key Market Segments

- Driving factors

- Restraining Factors

- Growth Opportunity

- Trending Factors

- Regional Analysis

- Key Players Analysis

- Recent Development

- Report Scope

Report Overview

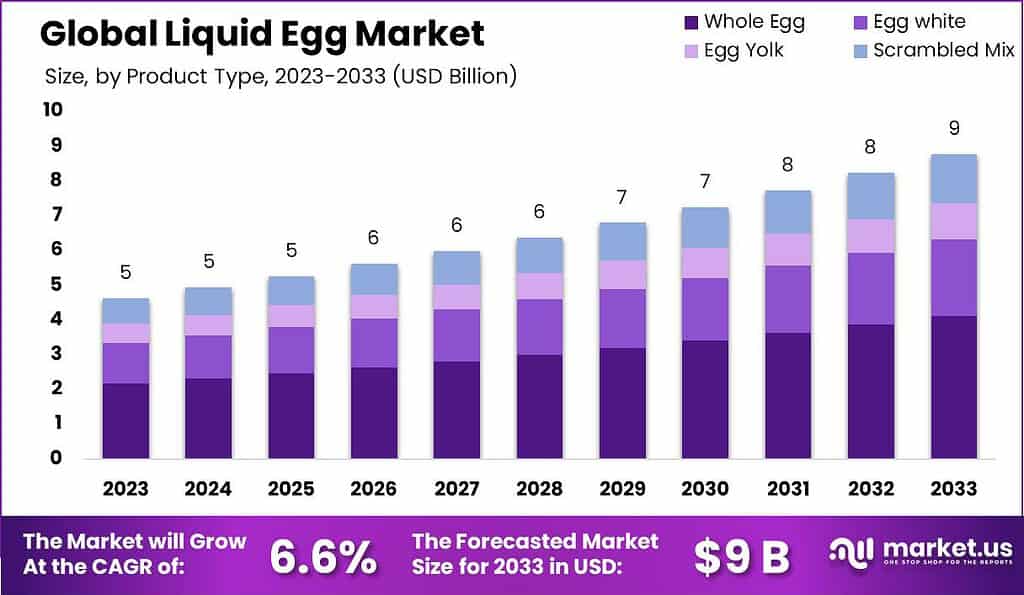

The Global Liquid Egg Market size is expected to be worth around USD 9.0 Billion by 2033, from USD 4.6 Billion in 2023, growing at a CAGR of 6.6% during the forecast period from 2024 to 2033.

The liquid egg market involves eggs that have been processed into a liquid form, making them easier to use in cooking and food production. These eggs come in different types, such as whole-liquid eggs, egg whites, and egg yolks. The market has seen growth due to the increasing demand for convenience and healthier food options.

As of 2023, the global liquid egg market is growing at an annual rate of approximately 5-6%, driven by the increasing popularity of protein-rich diets and the demand for convenience in food preparation. Liquid eggs are commonly used in ready-to-eat meals, bakery products, salads, and breakfast items, meeting the needs of both consumers and food manufacturers.

One of the main drivers of this demand is the growing preference for protein-based foods. Eggs are seen as a high-quality protein source, and their inclusion in a variety of processed foods is expanding. The food service industry is also a key contributor to this growth, as more restaurants, fast food chains, and catering services prefer liquid eggs for their consistency and ease of use. This demand is particularly evident in North America and Europe, where the food service and processed food sectors dominate.

The liquid egg industry is highly regulated to ensure safety and quality. In the U.S., the Food and Drug Administration (FDA) and the U.S. Department of Agriculture (USDA) have set guidelines for egg products, including pasteurization standards to prevent Salmonella. The compliance rate for pasteurization in the U.S. was over 98% as of 2023. Similarly, the European Food Safety Authority (EFSA) enforces regulations on egg products in Europe, ensuring strict monitoring and inspection.

Global trade of liquid eggs is significant, with global exports of egg products, including liquid eggs, valued at approximately $3.8 billion in 2022. Major exporting countries include the U.S., the Netherlands, and Germany, while the largest importers are Japan, South Korea, and the European Union. The U.S. exported around 240 million kilograms of liquid eggs in 2022, worth $450 million. North America and Europe account for over 60% of global consumption.

In terms of market size, the global egg product market, including liquid eggs, was valued at about $11.3 billion in 2023. The liquid egg segment is growing at a compound annual growth rate (CAGR) of 5.2% from 2023 to 2030, and the market is expected to reach $15.8 billion by 2030. Governments globally are supporting the egg industry through programs that promote biosecurity, sustainability, and modernization of egg production. The U.S. Department of Agriculture’s Egg Products Inspection Act (EPIA) and the European Union’s Horizon 2020 initiative are examples of such efforts.

Investments in the liquid egg sector are also on the rise. In 2023, the U.S. egg industry invested around $500 million in improving processing technologies, while European companies like Eurovo Group invested over €100 million to modernize their plants. Furthermore, innovations in the market, such as plant-based liquid egg alternatives, are gaining traction, with companies like Eat Just receiving substantial funding to expand their production capacity.

Corporate activity in the market is also noteworthy, with mergers and acquisitions driving consolidation. In 2023, Michael Foods acquired the liquid egg business of Moark, increasing its market share. Additionally, companies like Rembrandt Foods have formed long-term partnerships with fast-food giants, such as McDonald’s and Burger King, securing a steady demand for liquid eggs.

Key Takeaways

- The Global Liquid Egg Market size is expected to be worth around USD 9.0 Billion by 2033, from USD 4.6 Billion in 2023, growing at a CAGR of 6.6% during the forecast period from 2024 to 2033.

- Whole Egg dominated the “By Product Type” segment of the Liquid Egg Market with a 47.2% share.

- Frozen dominated the Liquid Egg Market By Form with a 56.2% share.

- The Conventional eggs dominated the Liquid Egg Market with a 62.1% share.

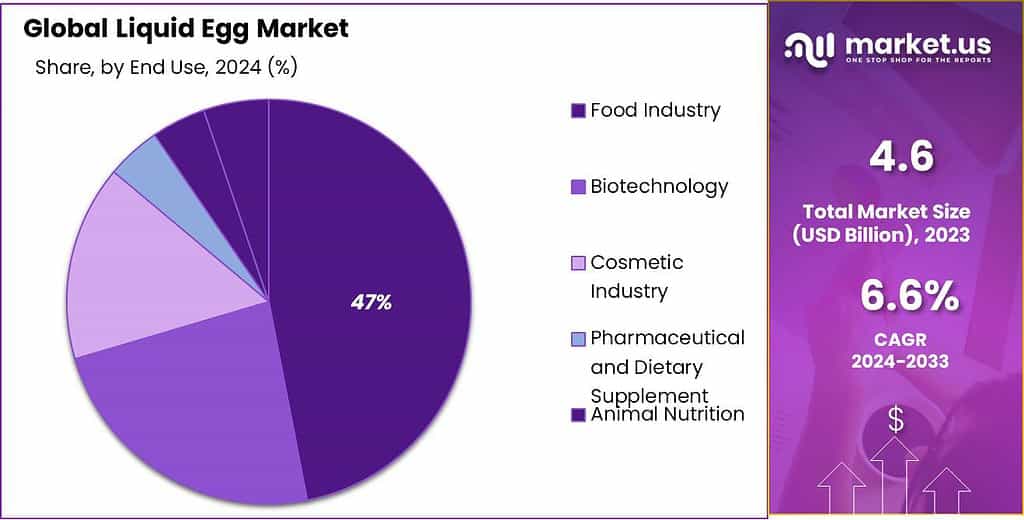

- The Food Industry led the “By End-Use” segment of the Liquid Egg Market with a 53.2% share.

- Plastic Pouches led the Liquid Egg Market By Packaging with a 34.4% share.

- B2B led the Liquid Egg Market By Sales Channel with a 57.5% share.

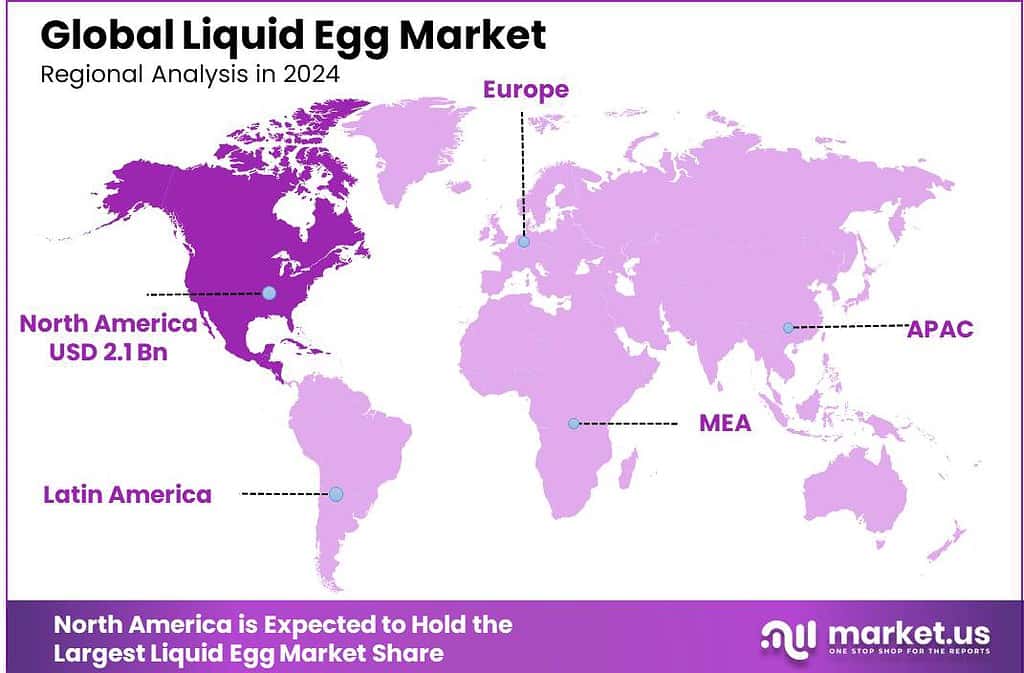

- North America leads the liquid egg market with a 43.4% share, valued at $2.1 billion.

By Product Type Analysis

Whole Egg dominated the “By Product Type” segment of the Liquid Egg Market with a 47.2% share.

In 2023, Whole Egg held a dominant market position in the By Product Type segment of the Liquid Egg Market, capturing more than a 47.2% share. This segment’s strength is primarily due to the versatility and widespread use of whole eggs in various culinary and industrial applications. Whole egg products are indispensable in baking, cooking, and processed food manufacturing, offering convenience and consistency for food service operators and food manufacturers.

Egg White followed, appealing particularly to the health-conscious demographic and fitness enthusiasts due to its high protein and low-fat content. Used extensively in protein supplements and health foods, egg white products have carved out a significant niche. They cater not only to culinary needs but also to biotechnological applications where high-protein, low-fat ingredients are crucial.

Egg Yolk products, known for their rich flavor and nutritional value, are extensively used in sauces, dressings, and bakery items. Their ability to emulsify fats makes them indispensable in the production of mayonnaise and creamy sauces, driving their demand in both home cooking and industrial food preparation.

The Scrambled Mix segment caters primarily to convenience food sectors, including fast food chains and ready-to-eat meal manufacturers. This pre-mixed solution simplifies the cooking process, ensuring consistency in taste and quality, which is highly valued in the hospitality and food service industry. The demand in this segment reflects the growing trend towards convenient and quick meal options.

By Form Analysis

Frozen dominated the Liquid Egg Market By Form with a 56.2% share.

In 2023, Frozen held a dominant market position in the By Form segment of the Liquid Egg Market, capturing more than a 56.2% share. This segment benefits from the extended shelf life and ease of storage that frozen egg products offer, making them highly preferred in commercial food service and manufacturing sectors. Frozen eggs maintain their quality over time, providing a consistent product for baking, cooking, and processed food applications, which is crucial for maintaining standardization across various culinary outputs.

The Refrigerated segment also plays a critical role in the market, particularly appealing to consumers and businesses looking for ready-to-use options with a fresher taste. Refrigerated liquid eggs are essential for immediate use scenarios in restaurants and cafes, where quick preparation and fresh ingredients are key. This form is particularly favored for its convenience and reduced preparation time, catering to the fast-paced nature of modern culinary operations.

By Source Analysis

The Conventional eggs dominated the Liquid Egg Market with a 62.1% share.

In 2023, Conventional eggs held a dominant market position in the By Source segment of the Liquid Egg Market, capturing more than a 62.1% share. This dominance is attributed to their widespread availability and cost-effectiveness, which makes them a preferred choice for large-scale food manufacturers and consumers looking for budget-friendly options. Conventional eggs are extensively used in various food products due to their versatility and functional properties.

Organic eggs, on the other hand, cater to a niche market focused on sustainability and animal welfare. Despite their higher price point, the demand for organic eggs is driven by a growing consumer base that prioritizes environmentally friendly and ethically produced foods. These eggs are becoming increasingly popular in urban areas and among health-conscious consumers.

Cage-free eggs represent another segment that appeals to ethically minded consumers. The demand for cage-free eggs has been growing due to the shifting consumer preferences towards more humane conditions for poultry. This segment is supported by various animal welfare organizations and legislative changes, pushing more producers to adopt cage-free practices.

By End-use Analysis

The Food Industry led the “By End-Use” segment of the Liquid Egg Market with a 53.2% share.

In 2023, The Food Industry held a dominant market position in the By End-Use segment of the Liquid Egg Market, capturing more than a 53.2% share. This segment’s prominence is largely due to the integral role that liquid eggs play in culinary applications, ranging from baking and cooking to processed food manufacturing. The convenience and consistent quality of liquid eggs make them a staple in professional kitchens and food production lines.

Following the Food Industry, the Biotechnology segment utilizes liquid eggs primarily for research and development purposes. The unique properties of egg components, particularly proteins and enzymes, are valuable in various biotechnological applications, including the development of vaccines and diagnostics.

The Cosmetic Industry also leverages liquid eggs, particularly egg whites, for their skin-tightening and pore-reducing properties. Egg-based products are increasingly popular in natural cosmetic formulations, catering to the growing demand for organic and cruelty-free beauty products.

Pharmaceutical and Dietary Supplement industries use liquid eggs as a source of high-quality protein and other essential nutrients in nutritional supplements and functional foods. This segment values the high bioavailability of egg-derived compounds, which are crucial for various health supplements.

Animal Nutrition is another significant segment where liquid eggs are used as a high-protein ingredient in feeds for various animals, particularly in specialized feeds for young and breeding animals, enhancing their growth and overall health.

By Packaging Analysis

Plastic Pouches led the Liquid Egg Market By Packaging with a 34.4% share.

In 2023, Plastic Pouches held a dominant market position in the by-packaging segment of the Liquid Egg Market, capturing more than a 34.4% share. This preference is largely due to the cost-effectiveness, flexibility, and lightweight nature of plastic pouches, which reduce shipping costs and are convenient for both retailers and consumers. They are also highly customizable, allowing for enhanced branding opportunities and visibility on store shelves.

Following closely, Carton Boxes are favored for their eco-friendliness and biodegradability, appealing to environmentally conscious consumers and companies aiming to reduce their carbon footprint. These boxes provide excellent protection for liquid eggs, ensuring they reach consumers in optimal condition.

PET Bottles also play a significant role in the market, prized for their clarity, which allows consumers to see the product inside. They are durable, resealable, and recyclable, making them a popular choice for premium liquid egg products.

By Sales Channel Analysis

B2B led the Liquid Egg Market By Sales Channel with a 57.5% share.

In 2023, B2B held a dominant market position in the By Sales Channel segment of the Liquid Egg Market, capturing more than a 57.5% share. This segment primarily includes sales directly to businesses such as food manufacturers and bakeries that use liquid eggs as a key ingredient in large-scale production. The B2B channel benefits from volume-based pricing and long-term contracts, which help ensure steady demand and supply continuity.

The Ho-Re-Ca (Hotels, Restaurants, and Cafés) sector also plays a significant role, utilizing liquid eggs for their convenience and consistency in food preparation. This channel focuses on quality and freshness, catering to businesses that require ready-to-use egg products for quick and efficient kitchen operations.

Lastly, the B2C segment, though smaller, is growing due to the increasing consumer interest in convenient cooking options. Retail sales of liquid eggs through supermarkets, online stores, and specialty food shops allow consumers to access professional-grade ingredients for home use, broadening the market’s reach beyond commercial users to everyday cooks seeking quality and convenience.

Key Market Segments

By Product Type

- Whole Egg

- Egg white

- Egg Yolk

- Scrambled Mix

By Form

- Frozen

- Refrigerated

By Source

- Conventional

- Organic

- Cage-free

By End-use

- Food Industry

- Biotechnology

- Cosmetic Industry

- Pharmaceutical and Dietary Supplement

- Animal Nutrition

- Others

By Packaging

- Plastic Pouches

- Carton Boxes

- PET Bottles

- Others

By Sales Channel

- B2B

- Ho-Re-Ca

- B2C

Driving factors

Increasing Demand for Convenience Foods

The growing preference for convenience foods plays a pivotal role in driving the expansion of the liquid egg market. As consumer lifestyles become increasingly fast-paced, there is a marked shift toward products that offer ease of preparation without compromising on nutritional value. Liquid eggs, which can be used in a variety of ready-to-eat and quick-to-prepare meals, align with the demand for convenience. They significantly reduce preparation time compared to traditional whole eggs, providing a ready-to-use solution for both consumers and food service businesses.

The demand for convenience is further fueled by the rise in single-person households and the increasing number of working professionals, both of which are contributing to a surge in demand for time-saving products. The shift towards processed, ready-to-cook foods such as breakfast products, baked goods, and meal kits, which often use liquid eggs as an ingredient, directly influences the market’s expansion.

Technological Advancements in Egg Processing

Technological innovation in egg processing has significantly enhanced the appeal and versatility of liquid eggs, contributing to market growth. Advances in pasteurization, filtration, and packaging technologies have improved the safety, shelf-life, and quality of liquid eggs, making them a more viable option for both domestic and industrial use. These developments ensure that liquid eggs maintain their nutritional integrity while reducing the risk of foodborne illnesses, which is critical for consumer confidence.

For example, the adoption of high-tech pasteurization methods has enabled liquid eggs to be stored for longer periods without the need for refrigeration, increasing their availability and convenience. Furthermore, innovations in egg processing equipment, such as automated egg-breaking and separation systems, have significantly lowered production costs, enhancing the cost-efficiency of liquid egg production. These factors, in turn, make liquid eggs a more attractive option for food manufacturers, restaurants, and caterers, contributing to a broader market adoption.

Increasing Demand for Protein-Rich Diets

The global shift toward health-conscious eating, including the increasing preference for protein-rich diets, is another major driver of the liquid egg market. Eggs, particularly liquid eggs, are a rich and cost-effective source of high-quality protein, making them an attractive option for individuals seeking to meet their daily protein requirements. The growing awareness of the benefits of protein in muscle building, weight management, and overall health has led to a surge in demand for protein-enhanced foods.

This trend is particularly prominent among health-conscious consumers, athletes, fitness enthusiasts, and the aging population, all of whom seek convenient, protein-rich options. Liquid eggs, being versatile and easy to incorporate into a wide range of meals, from smoothies to baked goods, are increasingly seen as a key component in protein-centric diets.

The increasing consumer inclination towards plant-based diets, which often necessitate alternative protein sources, also complements this trend. Liquid eggs are considered a superior protein alternative to many plant-based options, offering complete amino acid profiles.

Restraining Factors

Consumer Perception of Processed Foods

Consumer perception of processed foods remains a significant restraint on the growth of the liquid egg market. Many consumers associate processed products with lower nutritional quality and potential health risks, preferring fresh, minimally processed alternatives. This skepticism is particularly strong among health-conscious individuals who prioritize natural, organic foods and avoid products perceived as overly industrialized. The liquid egg market, as a processed product, faces this challenge, despite the nutritional benefits and convenience it offers.

However, efforts to educate consumers about the safety and quality improvements in liquid egg processing, particularly in pasteurization and food safety, are helping to mitigate some of these concerns. While this perception may slow growth in certain consumer segments, particularly those focused on “clean eating,” it remains balanced by other market factors, such as rising demand for convenience and protein-rich diets.

Health and Safety Concerns

Health and safety concerns related to liquid eggs specifically the risk of salmonella contamination are another significant restraint. Despite advancements in pasteurization technologies, some consumers remain wary of consuming processed egg products due to fears of foodborne illness. These concerns are particularly prominent in regions with strict food safety regulations and among particularly vulnerable consumers, such as pregnant women and the elderly.

The implementation of stricter food safety regulations and continuous technological improvements in egg processing, such as ultra-pasteurization and HACCP (Hazard Analysis Critical Control Point) compliance, have helped alleviate some of these concerns. However, as food safety remains a high priority, companies must continue to invest in technologies that ensure the highest levels of safety and transparency to maintain consumer trust and confidence.

Packaging and Transportation Challenges

Packaging and transportation challenges also present a barrier to the growth of the liquid egg market. Liquid eggs require specialized packaging to maintain freshness and prevent contamination, and the logistics of transporting these products, especially in bulk can be costly and complex. Stringent refrigeration requirements during transportation add to operational costs and limit the product’s shelf life, which can deter some potential buyers in regions with less robust cold chain infrastructure.

Despite advancements in packaging technologies that extend shelf life and reduce spoilage, the cost and logistical complexities of liquid egg distribution remain key obstacles. The need for continued innovation in packaging solutions and transportation infrastructure is critical to overcoming these challenges and expanding the market’s reach.

Growth Opportunity

Rising Demand for Bakery and Confectionery Products

The demand for bakery and confectionery products, including bread, cakes, pastries, and cookies, is a significant growth driver for the liquid egg market. Eggs, particularly liquid eggs, are essential ingredients in many bakery products due to their ability to enhance texture, moisture retention, and overall product consistency.

With the global bakery market projected to grow at a CAGR of 4.8% from 2024 to 2029, liquid eggs are increasingly seen as a time-saving, cost-effective alternative to whole eggs, especially in large-scale production. This trend is amplified by the growing popularity of artisanal and premium baked goods, where liquid eggs offer consistency and high-quality standards.

Strategic Partnerships with Foodservice Chains

Strategic partnerships with food service chains present another significant opportunity for the liquid egg market. As the food service industry grows fueled by the rising popularity of quick-service restaurants (QSRs), casual dining, and fast-casual formats demand for consistent, high-quality ingredients like liquid eggs is expected to rise.

Partnerships with major food service chains can provide liquid egg manufacturers with steady demand, larger market access, and long-term growth prospects. Notably, the global food service industry is projected to grow at a CAGR of 6.2% over the next five years, enhancing prospects for liquid egg adoption in commercial kitchens and food processing.

Growing Adoption of Egg Substitutes in Vegan Cooking

The rising adoption of plant-based diets and vegan cooking offers a unique opportunity for the liquid egg market to expand into egg substitute solutions. As consumers become more health-conscious and environmentally aware, the demand for egg substitutes in vegan and plant-based recipes is increasing.

Liquid egg alternatives that mimic the functionality of traditional eggs whether for baking, cooking, or in ready-to-eat products are finding traction in this segment. With the plant-based food market expected to grow at a CAGR of 9.1% from 2024 to 2030, the liquid egg industry can explore innovation in plant-based egg products and increase market penetration among vegan consumers.

Trending Factors

Non-GMO and Organic Egg Products

As consumer demand for clean-label and sustainable food options intensifies, the trend toward non-GMO and organic egg products is gaining traction. Organic and non-GMO certifications are becoming increasingly important to consumers who prioritize transparency, sustainability, and health-conscious choices. Liquid egg manufacturers are responding to this demand by expanding their portfolios to include organic and non-GMO egg products, tapping into the rising market for premium, environmentally friendly foods.

According to recent reports, the organic food market is projected to grow at a CAGR of 9.8% from 2024 to 2029, highlighting the broader shift toward organic consumption. This trend is expected to increase the market share of organic liquid eggs, especially in regions like North America and Europe.

Ready-to-Eat Egg-Based Snacks

The growing demand for convenient, on-the-go snacks is fueling the rise of ready-to-eat egg-based snack products. Liquid eggs are integral to the production of protein-rich, convenient snacks such as egg muffins, breakfast bowls, and other ready-to-eat products. As busy lifestyles and health-conscious eating habits continue to dominate, consumers are seeking protein-packed snacks that offer nutritional benefits without the preparation time.

This trend is poised to drive further innovation in the snack category, with liquid eggs providing a versatile base for high-protein, low-calorie products that align with current dietary preferences.

Increased Focus on Functional Foods

Consumers are increasingly seeking foods that provide additional health benefits beyond basic nutrition, a trend that is influencing the liquid egg market. Functional foods, which include ingredients designed to enhance specific aspects of health, such as gut health, immunity, and brain function, are gaining popularity.

Liquid eggs, known for their high protein and nutrient density, are being integrated into functional food products aimed at health-conscious consumers. With growing interest in fortified foods and nutritional enhancement, liquid eggs are well-positioned to be used in a variety of functional applications, such as protein shakes, meal replacements, and functional breakfast foods.

Regional Analysis

North America leads the liquid egg market with a 43.4% share, valued at $2.1 billion.

The global liquid egg market is experiencing varied growth across regions, with North America emerging as the dominant market, accounting for 43.4% of the global market share, valued at approximately $2.1 billion in 2024. The region benefits from a strong demand for liquid egg products, driven by the increasing popularity of convenience foods, protein-rich diets, and advancements in food processing technologies. The U.S. is a major contributor, with both the food service and retail sectors showing robust growth in the consumption of liquid egg products.

Europe holds a significant share of the market, driven by the increasing consumer demand for organic and non-GMO food products. The region is witnessing a rise in health-conscious eating habits, with liquid eggs being favored in bakery and confectionery products. The European market is also benefitting from expanding regulations and food safety standards that enhance consumer confidence in processed egg products.

The Asia Pacific region is expected to witness rapid growth, particularly in emerging markets like China and India. Increasing urbanization, a growing middle-class population, and rising disposable incomes are fueling demand for processed and ready-to-eat food products, including liquid eggs.

In the Middle East & Africa, liquid egg consumption is rising due to the expanding food service industry and growing demand for protein-rich foods. Latin America is seeing moderate growth, driven by the increasing adoption of Western eating habits and the growing food processing sector.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

In the highly competitive global Liquid Egg Market of 2024, several key players are shaping industry trends with innovative strategies and expansive product offerings. Among them, CalMaine Foods, Cargill Incorporated, Michael Foods, and Rose Acre Farms stand out due to their significant market influence and strategic initiatives.

CalMaine Foods continues to lead with its extensive distribution network and emphasis on sustainable practices. As the largest producer of shell eggs in the U.S., their pivot towards liquid egg products caters to the rising demand for convenient, ready-to-use egg formulations in both the retail and industrial sectors. Their commitment to animal welfare and environmental sustainability remains a key component of their market strategy, appealing to a more conscientious consumer base.

Cargill Incorporated leverages its global presence to distribute a diverse range of liquid egg products that meet stringent quality and safety standards. Known for its innovation in food technology, Cargill invests heavily in research and development to enhance product shelf-life and safety, which are critical in maintaining their competitive edge in both domestic and international markets.

Michael Foods, a subsidiary of Post Holdings, is recognized for its specialized products tailored to the food service industry. Their custom solutions address specific needs such as low-fat and high-protein egg products, making them a preferred partner for restaurants and fast-food chains looking to enhance their menu offerings.

Rose Acre Farms focuses on vertical integration to control every aspect of production, from feed to finished product. This control ensures a consistent supply of high-quality liquid eggs, crucial for their business clientele. Their ongoing expansion into organic and cage-free products also aligns with growing market trends towards ethical and healthy food choices.

These companies exemplify strong adaptability and strategic foresight, positioning them favorably in the evolving landscape of the Liquid Egg Market.

Market Key Players

- American Egg Board

- Bumble Hole Foods Limited

- CalMaine Foods

- Cargill Incorporated

- D Wise Ltd.

- Eggland

- Global Food Group BV

- Imperial Egg Products

- Michael Foods

- Moy Park

- Neogen Corporation

- Nest Fresh Eggs Inc.

- Newburg Egg Cor

- Noble Foods

- Ovostar Union NV

- Provitec

- Ready Egg Products Ltd

- Rembrandt Enterprises

- Rose Acre Farms

- Vanderpol’s Eggs Ltd.

- Versova Holdings Pty Ltd

Recent Development

- In April 2024, Eurovo Group, a leading European egg producer, announced an investment in state-of-the-art pasteurization technology at its liquid egg production facility in Italy. This technology aims to enhance the safety, shelf life, and nutritional quality of its liquid egg products, aligning with the company’s strategy to meet the increasing demand for safe, high-quality egg products across Europe and beyond.

- In March 2024, Suntava, a leading provider of organic and non-GMO food products, launched a new line of non-GMO liquid eggs. This development comes in response to increasing consumer demand for clean-label, sustainable food options. The product line is aimed at the growing market of health-conscious and environmentally aware consumers, with a focus on both retail and food service channels.

- In January 2024, Cal-Maine Foods, the largest producer of eggs in the U.S., announced the expansion of its liquid egg production facilities to meet rising demand in both domestic and international markets. The investment in new processing equipment is expected to increase production capacity by 15% to support the growing demand for liquid egg products in the food service and retail sectors.

Report Scope

Report Features Description Market Value (2023) USD 4.6 Billion Forecast Revenue (2033) USD 9.0 Billion CAGR (2024-2032) 6.6% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Whole Egg, Egg white, Egg Yolk, Scrambled Mix), By Form (Frozen, Refrigerated), By Source (Conventional, Organic, Cage-free), By End-use (Food Industry, Biotechnology, Cosmetic Industry, Pharmaceutical, and Dietary Supplement, Animal Nutrition, Others), By Packaging (Plastic Pouches, Carton Boxes, PET Bottles, Others), By Sales Channel (B2B, Ho-Re-Ca, B2C) Regional Analysis North America – The US, Canada, Rest of North America, Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America – Brazil, Mexico, Rest of Latin America, Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape American Egg Board, Bumble Hole Foods Limited, CalMaine Foods, Cargill Incorporated, D Wise Ltd., Eggland, Global Food Group BV, Imperial Egg Products, Michael Foods, Moy Park, Neogen Corporation, Nest Fresh Eggs Inc., Newburg Egg Corp, Noble Foods, Ovostar Union NV, Provitec, Ready Egg Products Ltd, Rembrandt Enterprises, Rose Acre Farms, Vanderpol’s Eggs Ltd., Versova Holdings Pty Ltd Customization Scope We will provide customization for segments and at the region/country level. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- American Egg Board

- Bumble Hole Foods Limited

- CalMaine Foods

- Cargill Incorporated

- D Wise Ltd.

- Eggland

- Global Food Group BV

- Imperial Egg Products

- Michael Foods

- Moy Park

- Neogen Corporation

- Nest Fresh Eggs Inc.

- Newburg Egg Cor

- Noble Foods

- Ovostar Union NV

- Provitec

- Ready Egg Products Ltd

- Rembrandt Enterprises

- Rose Acre Farms

- Vanderpol's Eggs Ltd.

- Versova Holdings Pty Ltd