Global High Oleic Soybean Market By Grade(Food, Industrial), By Type(GMO, Non-GMO), By Nature(Organic, Conventional), By Application(Cooking Oils, Processed Foods, Salad Dressings and Sauces, Biofuels, Others), By End-use(Food Processing Industry, Restaurants and Hotels Industry, Petrochemicals Industry, Others), By Distribution Channel(Hypermarkets/Supermarkets, Convenience Stores, Specialty Stores, Online Retail), By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024–2033

- Published date: April 2024

- Report ID: 28117

- Number of Pages: 232

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

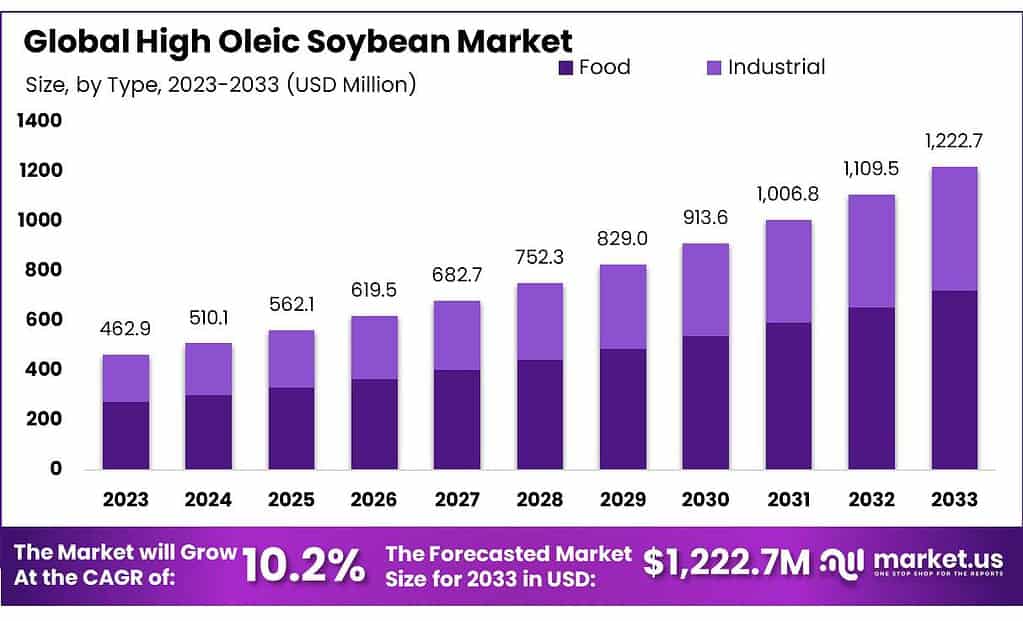

The global High Oleic Soybean Market size is expected to be worth around USD 1222.7 Million by 2033, from USD 462.9 Million in 2023, growing at a CAGR of 10.2% during the forecast period from 2023 to 2033.

The High Oleic Soybean Market refers to the segment within the agricultural and food industry focused on the cultivation, processing, and sale of high oleic soybeans. These soybeans are genetically modified or traditionally bred to contain higher levels of oleic acid compared to conventional soybean varieties. Oleic acid is a monounsaturated fatty acid known for its stability at high temperatures and its potential health benefits, including lowering bad cholesterol levels.

High oleic soybeans are engineered to meet the specific needs of the food industry and industrial applications. In the food industry, oils derived from these soybeans are used for cooking and in processed foods because they offer extended shelf life, improved nutritional profile, and better frying quality without creating trans fats. For industrial applications, high oleic soybean oil is valued for its stability, making it suitable for use in lubricants, biofuels, and other non-food products.

The development of high oleic soybeans represents a response to consumer demand for healthier cooking oils and industrial demands for high-performance, plant-based oils. The market for high oleic soybean and its derivatives is growing as industries and consumers alike seek sustainable, healthy, and versatile oil options. This growth is supported by advancements in agricultural biotechnology, which enable the production of soybean varieties with desired fatty acid profiles, and by regulatory approvals that facilitate their cultivation and use.

As health concerns and sustainability continue to drive consumer choices, the High Oleic Soybean Market is expected to expand, reflecting broader trends towards healthier diets and environmentally friendly agricultural practices.

Key Takeaways

- Market Projection: High Oleic Soybean Market expected to reach USD 1222.7 Million by 2033, growing at CAGR of 10.2% from 2023.

- Segments Dominance: Food grade high oleic soybeans lead with over 59.3% market share in 2023.

- Type Preference: GMO high oleic soybeans hold 65.2% market share in 2023, driven by advanced traits and higher yields.

- Nature Preference: Organic high oleic soybeans capture 72.3% market share in 2023, reflecting consumer demand for organic products.

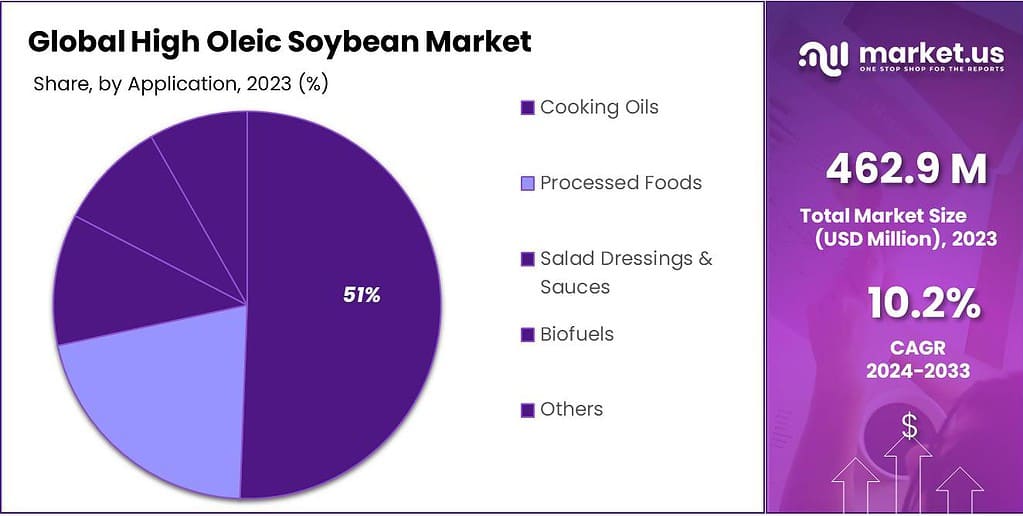

- Application Demand: Cooking oils dominate with 55.4% market share in 2023, driven by demand for healthier options.

- End-use Focus: Food processing industry holds 58.5% market share in 2023, adopting high oleic soybean oil for health benefits.

- Distribution Channel: Hypermarkets/Supermarkets capture 43.5% market share in 2023, followed by convenience stores and online retail.

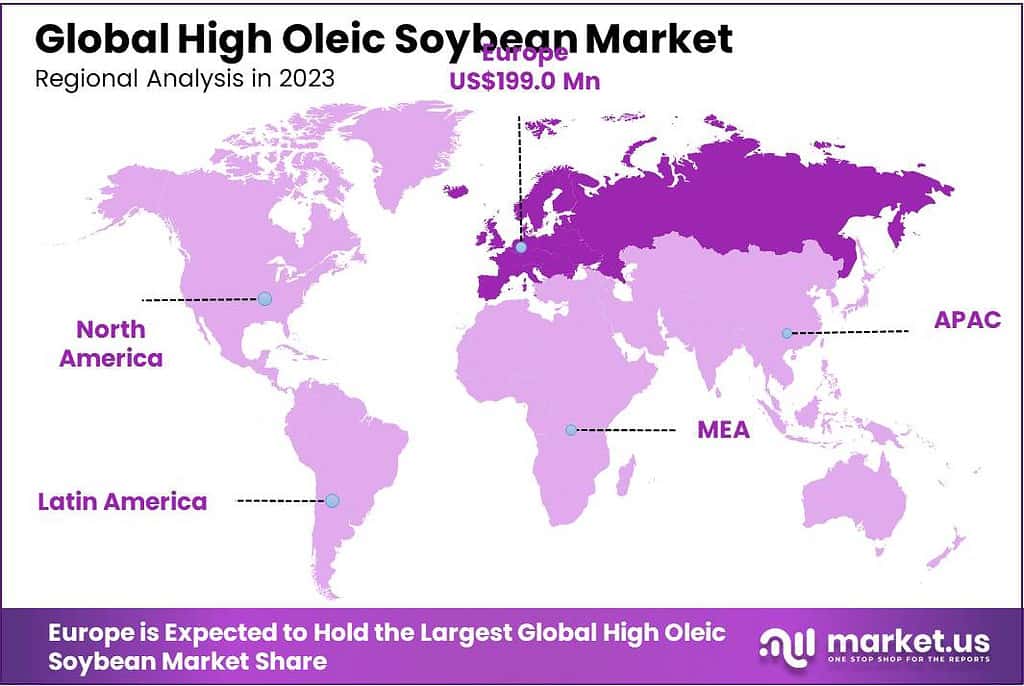

- Europe is poised to maintain its leading position in the global High Oleic Soybean Market, holding an impressive market share of 42.4%.

By Grade

In 2023, Food grade high oleic soybeans held a dominant market position, capturing more than a 59.3% share. This segment’s prominence is attributed to the growing consumer demand for healthier cooking oils that contribute to cardiovascular health and offer better cooking properties, including a higher smoke point and longer shelf life.

Food-grade high oleic soybean oil is increasingly preferred by both home cooks and the food processing industry for its nutritional benefits, such as lower saturated fat levels and the absence of trans fats, making it an ideal choice for frying, baking, and salad dressings. The trend towards cleaner eating and the demand for non-GMO and organic options have further fueled the growth of this segment, with manufacturers and suppliers focusing on meeting these consumer preferences.

On the other hand, the Industrial grade high oleic soybeans also represent a significant part of the market, driven by the oil’s superior oxidative stability and extended shelf life. This makes it a valuable ingredient in industrial applications such as lubricants, biofuels, and biodegradable plastics.

The demand in this segment is spurred by the push towards more sustainable and environmentally friendly industrial products, with high oleic soybean oil offering a plant-based alternative to petroleum-derived products. The versatility and sustainability of high oleic soybean oil in various industrial applications underscore the potential for growth in this segment, as industries continue to seek renewable and less environmentally impactful resources.

Both segments of the High Oleic Soybean Market are poised for continued expansion, driven by evolving consumer preferences, technological advancements in agriculture and processing, and the growing emphasis on sustainability in food production and industrial practices.

By Type

In 2023, GMO high oleic soybeans held a dominant market position, capturing more than a 65.2% share. This segment’s lead is largely due to the advanced traits engineered into these soybeans, allowing for higher oleic acid content and improved oil stability, which are crucial for both food and industrial applications.

The adoption of GMO high oleic soybeans by farmers is driven by their ability to provide higher yields and better resistance to pests and diseases, making them a more viable and economically beneficial option. The widespread acceptance of GMO varieties in major soybean-producing countries contributes to their dominance in the market, supported by the food industry’s demand for oils that offer longer shelf life and better cooking qualities without trans fats.

Conversely, Non-GMO high oleic soybeans are gaining traction, reflecting a growing segment of consumers and manufacturers prioritizing non-genetically modified ingredients due to health, environmental, and ethical considerations. Although currently holding a smaller share of the market, non-GMO high oleic soybeans appeal to niche markets that value organic and natural food production practices.

This segment benefits from the premium prices that non-GMO products can command, alongside the increasing consumer demand for transparency and sustainability in food sourcing. The growth of the non-GMO segment is bolstered by advancements in traditional breeding techniques and the expanding availability of non-GMO high oleic soybean varieties, offering promising potential for market expansion as consumer preferences continue to evolve.

Both GMO and Non-GMO segments of the High Oleic Soybean Market are critical to meeting the diverse needs of the global food and industrial sectors. As consumer preferences shift and technology advances, the landscape of the market continues to evolve, highlighting the importance of innovation and sustainability in the cultivation and utilization of high oleic soybeans.

By Nature

In 2023, the Organic segment of the High Oleic Soybean Market held a dominant position, capturing more than a 72.3% share. This impressive dominance is primarily attributed to the growing consumer preference for organic products, driven by concerns over health, the environment, and sustainable farming practices.

Organic high oleic soybeans are produced without the use of synthetic pesticides, fertilizers, or genetically modified organisms (GMOs), appealing to consumers looking for pure and environmentally friendly food options. The demand for organic high oleic soybean oil, in particular, has surged in the food industry for its use in healthier cooking oils and processed foods that align with the clean eating trends.

Despite the challenges of lower yields and higher production costs associated with organic farming, the premium price and growing consumer demand for organic products have made this segment a lucrative market for producers and suppliers.

On the other hand, the Conventional segment, while currently holding a smaller share of the market, continues to play a significant role in meeting the global demand for high oleic soybeans. Conventional high oleic soybeans are widely used in both food and industrial applications, valued for their enhanced oil stability and extended shelf life properties.

This segment benefits from more established farming practices and higher crop yields, making it a vital component of the overall market. However, the growing consumer awareness and preference for organic and non-GMO products are likely to influence future trends in this segment, pushing for more sustainable and environmentally friendly conventional farming practices.

Both the Organic and Conventional segments of the High Oleic Soybean Market are pivotal in catering to the diverse needs and preferences of consumers and industries worldwide. As the market evolves, the balance between these segments will continue to shift, reflecting broader consumer trends towards health, sustainability, and natural ingredients.

By Application

In 2023, Cooking Oils held a dominant market position in the High Oleic Soybean Market, capturing more than a 55.4% share. This dominance stems from the high demand for healthier cooking oil options that offer stability at high temperatures and a better nutritional profile, including lower saturated fats and no trans fats.

High oleic soybean oil is particularly prized for its extended shelf life and its ability to maintain quality under the stress of frying and baking, making it a preferred choice for both home kitchens and commercial food services. The shift towards healthier diets and the global trend for clean eating have significantly contributed to the sustained growth of this segment.

Processed Foods follow closely, with high oleic soybean oil being increasingly used by the food manufacturing industry to enhance the nutritional content and shelf stability of a wide range of products. This application benefits from the oil’s neutral flavor and high oxidative stability, making it suitable for snacks, baked goods, and ready-to-eat meals that require extended shelf life without the use of artificial preservatives.

Salad Dressings & Sauces is another key application area, where the mild flavor and healthful profile of high oleic soybean oil are highly valued. Its ability to blend well with a variety of flavors while contributing to the product’s overall healthfulness boosts its use in this segment, catering to consumers seeking healthier options for their meals.

Biofuels represent a growing application for high oleic soybean oil, driven by the demand for renewable energy sources and the oil’s favorable properties for biodiesel production. The high oxidative stability and cold weather performance of high oleic soybean oil make it an excellent feedstock for biofuel, supporting efforts to reduce greenhouse gas emissions and reliance on fossil fuels.

By End-use

In 2023, the Food Processing Industry held a dominant market position in the High Oleic Soybean Market, capturing more than a 58.5% share. This segment’s leadership is primarily due to the widespread adoption of high oleic soybean oil as a key ingredient in various food products, valued for its health benefits, including a lower content of saturated fats and no trans fats.

The industry’s shift towards cleaner, more natural ingredients has made high oleic soybean oil a preferred choice for manufacturers looking to improve the nutritional profile and shelf life of processed foods, snacks, and ready-to-eat meals. The demand for healthier food options among consumers has significantly contributed to the growth of this segment, driving innovation and the development of new products that leverage the qualities of high oleic soybean oil.

The Restaurants & Hotels Industry also represents a significant portion of the market, utilizing high oleic soybean oil for its superior cooking performance, including higher smoke points and better fry life. This makes it an ideal choice for commercial kitchens aiming to offer healthier menu options without compromising on taste or quality. The segment benefits from the growing consumer demand for healthier dining out options, prompting many establishments to switch to high oleic soybean oil for frying, baking, and salad dressings.

In the Petrochemicals Industry, high oleic soybean oil is gaining traction as a sustainable alternative to traditional petrochemicals in products like lubricants, plastics, and biofuels. The oil’s high stability and renewable nature align with the industry’s shift towards more environmentally friendly production processes and materials, marking it as an emerging but growing market segment.

By Distribution Channel

In 2023, the Hypermarkets/Supermarkets channel held a dominant market position in the distribution of High Oleic Soybean Market products, capturing more than a 43.5% share. This dominance is attributed to the extensive range of high oleic soybean oil products that these outlets offer, catering to the diverse needs of consumers under one roof.

Hypermarkets and supermarkets are preferred by consumers for their convenience, accessibility, and the ability to compare different brands and prices. The visibility and availability of high oleic soybean oil in these retail spaces have significantly contributed to consumer awareness and adoption, supported by the trend towards healthier cooking oils.

Convenience Stores also play a crucial role in the market, offering easy access to high oleic soybean oil products for consumers looking for quick shopping options. Although capturing a smaller share of the market, convenience stores serve important urban and densely populated areas, making high oleic soybean oil products more accessible to a wide audience.

Specialty Stores, focusing on health and organic food products, represent another important distribution channel. These stores cater to health-conscious consumers seeking high-quality, niche products like non-GMO or organic high oleic soybean oil. Specialty stores provide an environment where consumers can find detailed product information and guidance, enhancing the shopping experience for those with specific health or dietary preferences.

Online Retail is an emerging and rapidly growing distribution channel for high oleic soybean oil products. The convenience of online shopping, combined with the increasing consumer preference for doorstep delivery, has made online retail a significant player in the market. This channel benefits from the ability to reach a wider audience, including consumers in areas not served by physical retail outlets, and offers potential for direct-to-consumer marketing strategies by producers.

Key Market Segments

By Grade

- Food

- Industrial

By Type

- GMO

- Non-GMO

By Nature

- Organic

- Conventional

By Application

- Cooking Oils

- Processed Foods

- Salad Dressings & Sauces

- Biofuels

- Others

By End-use

- Food Processing Industry

- Restaurants & Hotels Industry

- Petrochemicals Industry

- Others

By Distribution Channel

- Hypermarkets/Supermarkets

- Convenience Stores

- Specialty Stores

- Online Retail

Drivers

Growing Demand for Healthier Cooking Oils and Industrial Applications

A major driver propelling the High Oleic Soybean Market is the escalating demand for healthier cooking oils coupled with the versatile industrial applications of high oleic soybean oil. This trend is rooted in the growing global awareness of the health implications associated with dietary fats, particularly the negative effects of saturated and trans fats on cardiovascular health.

High oleic soybean oil, with its high content of monounsaturated fats and lower levels of saturated fats, offers a healthier alternative to traditional cooking oils. Its ability to withstand high temperatures without breaking down or forming harmful trans fats makes it an ideal choice for frying, baking, and other cooking methods, aligning with the consumer shift towards healthier eating habits.

In addition to its culinary appeal, the industrial sector’s growing interest in sustainable and biodegradable materials has further fueled the demand for high oleic soybean oil. Its stability and oxidative resistance make it a valuable ingredient in the production of biofuels, biolubricants, and bioplastics. These applications not only contribute to reducing dependency on fossil fuels but also align with global sustainability goals, driving interest in plant-based alternatives across various industries.

The advancements in agricultural biotechnology have played a crucial role in meeting this demand, enabling the development of high oleic soybean varieties that combine high yield potential with the desired oil profile. These technological advancements have made it economically viable to produce high oleic soybean oil at a scale sufficient to meet both food industry requirements and industrial demands.

Moreover, the regulatory environment, particularly in developed markets, is increasingly favoring the use of healthier fats in food products. This regulatory push, combined with consumer demand for cleaner labels and more natural ingredients, has led food manufacturers to reformulate products with high oleic soybean oil. The transparency in production practices and the potential for organic certification of high oleic soybeans further enhance their appeal to health-conscious consumers and those concerned about environmental sustainability.

Restraints

Premium Pricing and Production Challenges

A significant restraint impacting the growth of the High Oleic Soybean Market is the premium pricing associated with high oleic soybean products, coupled with the production challenges faced by farmers. High oleic soybeans, designed to produce oil with a healthier fatty acid composition and better cooking and industrial properties, require specific breeding, cultivation, and processing methods. These specialized requirements often lead to increased production costs compared to conventional soybeans.

For farmers, the adoption of high oleic soybean varieties involves considerations such as the need for segregated handling to maintain purity, potential yield differences, and the requirement for specific agronomic practices. These factors contribute to higher costs of production, which, in turn, are passed down the supply chain, culminating in higher retail prices for high oleic soybean oil and related products.

From the perspective of food manufacturers and consumers, while the health benefits and superior performance of high oleic soybean oil are recognized, the premium price can be a barrier to widespread adoption, especially in price-sensitive markets or among consumers with limited disposable income. The decision to switch to high oleic soybean oil involves balancing the cost with the perceived value, which can limit the market’s growth potential.

Additionally, the production of high oleic soybeans faces challenges such as the need for continued research and development to enhance yield parity with conventional soybeans and to ensure the stability of oleic acid content across different environmental conditions. These agronomic and genetic improvement efforts require substantial investment in research and development, further contributing to the costs associated with high oleic soybean production.

Moreover, the market for high oleic soybeans is also influenced by regulatory and certification processes, which can vary by region and add another layer of complexity and cost to production and market entry. Ensuring compliance with both domestic and international standards for genetically modified organisms (GMOs), where applicable, and organic certification, where relevant, can be challenging and costly for producers.

Opportunity

Expansion into Emerging Markets and Non-Food Industries

A significant opportunity for the High Oleic Soybean Market lies in its potential expansion into emerging markets and non-food industries. As global awareness of health and sustainability increases, the demand for high oleic soybean oil is not limited to traditional food processing applications but extends to various non-food industries seeking sustainable and biodegradable alternatives to petrochemical-based products. These industries include biofuels, biolubricants, and bioplastics, where high oleic soybean oil’s stability, oxidative resistance, and renewable nature offer considerable advantages.

Emerging markets represent untapped potential for high oleic soybean products. Countries experiencing economic growth, along with a burgeoning middle class, are witnessing a shift in consumer preferences towards healthier and more sustainable products. This demographic shift presents a valuable opportunity for the introduction and growth of high oleic soybean oil in these regions.

As diets evolve and awareness of the health implications associated with fat consumption increases, the demand for cooking oils that offer better health benefits, such as those made from high oleic soybeans, is expected to rise.

Additionally, the biofuels sector, driven by the global push for cleaner energy sources, offers a substantial growth avenue for high oleic soybean oil. Its use as a feedstock for biodiesel production, particularly in regions with stringent environmental regulations, is expanding.

High oleic soybean oil’s favorable properties, such as a lower cloud point and improved cold flow performance, make it an ideal candidate for biofuel applications, aligning with global efforts to reduce carbon emissions and dependency on fossil fuels.

The biolubricants and bioplastics industries also present opportunities for high oleic soybean oil. Its biodegradability and non-toxicity are key attributes for applications in environmentally sensitive areas, such as marine and agricultural settings, where the leakage or disposal of lubricants can pose significant environmental risks. Similarly, the demand for bioplastics, driven by consumer and regulatory pressure to reduce plastic waste, opens up new markets for high oleic soybean oil as a renewable resource for plastic production.

Trends

Increasing Integration of Biotechnology in Crop Development

A major trend influencing the High Oleic Soybean Market is the increasing integration of biotechnology in crop development. This trend reflects the agricultural sector’s ongoing efforts to meet the growing demand for high oleic soybean oil, driven by its health benefits and industrial applications. Advances in genetic engineering and plant breeding technologies are enabling the development of high oleic soybean varieties with enhanced nutritional profiles, higher yields, and greater resistance to pests and diseases.

Biotechnology plays a crucial role in addressing the production challenges associated with high oleic soybeans, such as ensuring consistency in oleic acid levels across different environmental conditions and improving the crop’s adaptability to various climates. Through precise genetic modifications or advanced breeding techniques, scientists are able to enhance the desirable traits of high oleic soybeans while minimizing less favorable characteristics, such as susceptibility to specific pests or environmental stresses.

This trend is also facilitating the expansion of high oleic soybean cultivation beyond traditional growing areas, opening up new markets and opportunities for farmers and producers. By developing varieties that are tailored to the conditions of different regions, biotechnology is helping to diversify the geographical footprint of high oleic soybean production, making it more resilient to climatic fluctuations and reducing dependency on specific locales.

Furthermore, the integration of biotechnology in crop development is leading to more sustainable farming practices. High oleic soybean varieties engineered for pest resistance can reduce the need for chemical pesticides, lowering the environmental impact of cultivation and aligning with consumer demand for more natural and sustainable agricultural products. Similarly, improvements in crop efficiency and yield contribute to better land use and resource management, further enhancing the sustainability credentials of high oleic soybeans.

The trend towards leveraging biotechnology in crop development is not without its challenges, including regulatory hurdles, public perceptions of genetically modified organisms (GMOs), and the need for continuous research and investment. However, the potential benefits in terms of health, sustainability, and market growth opportunities are driving continued innovation in this area.

Regional Analysis

As of 2023, Europe is poised to maintain its leading position in the global High Oleic Soybean Market, holding an impressive market share of 42.4%. This dominance is largely due to Europe’s proactive stance on environmental sustainability and its rigorous implementation of environmental regulations within the agricultural sector.

European countries have been at the forefront of adopting and promoting sustainable farming practices, which include the cultivation of high oleic soybeans. Such initiatives not only aim to minimize the environmental impact of agriculture but also to enhance the nutritional value and application versatility of soybean oil. The strong regulatory framework and support from European governments have significantly boosted the demand for high oleic soybeans, positioning them as a cornerstone in the region’s pursuit of sustainable agricultural practices.

The integration of high oleic soybeans into European agriculture represents a strategic move towards blending traditional farming techniques with modern, eco-friendly innovations. This approach ensures the agricultural sector’s evolution without compromising environmental integrity. It highlights the adaptability and importance of high oleic soybeans in driving forward sustainable farming practices.

Europe’s dedication to sustainability has also fueled notable progress in research and development within the High Oleic Soybean Market. These advancements have led to the production of high oleic soybean varieties that are not only more efficient and safe but also environmentally beneficial. As a result, Europe solidifies its role as a beacon of innovation and a global exemplar for sustainable agricultural practices. The region’s pioneering work not only enhances the performance and environmental credentials of high oleic soybeans but also cements Europe as a key player in shaping the future of sustainable agriculture worldwide.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Market Share Analysis of the High Oleic Soybean Market reveals a dynamic and rapidly evolving landscape, marked by the increasing demand for healthier edible oils and sustainable industrial products. As of 2023, this market has seen significant growth, driven by consumer health awareness, industrial needs for bio-based materials, and global sustainability initiatives.

Key Market Players

- Adams Group Inc.

- Ag Processing Inc

- Archer Daniels Midland Company

- Archer-Daniels-Midland

- Aston Food and Food Ingredients

- Bayer AG.

- Borges Agricultural & Industrial Oils, S.A.U.

- Bunge limited

- Bunge Limited

- Cargill, Incorporated

- Cellectis S.A

- CHS Inc.

- Colorado Mills

- DowDuPont Inc.

- Gustav Heess Oleochemische Erzeugnisse GmbH

- James Richardson & Sons, Limited

- Jivo Wellness Pvt. Ltd.

- Macjerry Sunflower Company

- Marbacher Ölmühle GmbH

- Oilseed International, Ltd.

- PPB Berhad Group

Recent Developments

In 2023, Archer Daniels Midland Company (ADM) continued to strengthen its position in the High Oleic Soybean sector, underscoring its commitment to innovation and sustainability in agricultural practices.

In 2023, Bayer AG has made notable strides within the High Oleic Soybean sector, marking its commitment to agricultural innovation and sustainability.

Report Scope

Report Features Description Market Value (2023) USD 462.9 Mn Forecast Revenue (2033) USD 1222.7 Mn CAGR (2024-2033) 10.2% Base Year for Estimation 2023 Historic Period 2020-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Grade(Food, Industrial), By Type(GMO, Non-GMO), By Nature(Organic, Conventional), By Application(Cooking Oils, Processed Foods, Salad Dressings and Sauces, Biofuels, Others), By End-use(Food Processing Industry, Restaurants and Hotels Industry, Petrochemicals Industry, Others), By Distribution Channel(Hypermarkets/Supermarkets, Convenience Stores, Specialty Stores, Online Retail) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Adams Group Inc., Ag Processing Inc, Archer Daniels Midland Company, Archer-Daniels-Midland, Aston Food and Food Ingredients, Bayer AG., Borges Agricultural & Industrial Oils, S.A.U., Bunge limited, Bunge Limited, Cargill, Incorporated, Cellectis S.A, CHS Inc., Colorado Mills, DowDuPont Inc., Gustav Heess Oleochemische Erzeugnisse GmbH, James Richardson & Sons, Limited, Jivo Wellness Pvt. Ltd., Macjerry Sunflower Company, Marbacher Ölmühle GmbH, Oilseed International, Ltd., PPB Berhad Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of High Oleic Soybean Market?High Oleic Soybean Market size is expected to be worth around USD 1222.7 Million by 2033, from USD 462.9 Million in 2023

What CAGR is projected for the High Oleic Soybean Market?The High Oleic Soybean Market is expected to grow at 10.2% CAGR (2023-2032).Name the major industry players in the High Oleic Soybean Market?Adams Group Inc., Ag Processing Inc, Archer Daniels Midland Company, Archer-Daniels-Midland , Aston Food and Food Ingredients, Bayer AG. , Borges Agricultural & Industrial Oils, S.A.U., Bunge limited, Bunge Limited, Cargill, Incorporated, Cellectis S.A , CHS Inc., Colorado Mills, DowDuPont Inc., Gustav Heess Oleochemische Erzeugnisse GmbH , James Richardson & Sons, Limited, Jivo Wellness Pvt. Ltd., Macjerry Sunflower Company, Marbacher Ölmühle GmbH, Oilseed International, Ltd., PPB Berhad Group

High Oleic Soybean MarketPublished date: April 2024add_shopping_cartBuy Now get_appDownload Sample

High Oleic Soybean MarketPublished date: April 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Adams Group Inc.

- Ag Processing Inc

- Archer Daniels Midland Company

- Archer-Daniels-Midland

- Aston Food and Food Ingredients

- Bayer AG.

- Borges Agricultural & Industrial Oils, S.A.U.

- Bunge limited

- Bunge Limited

- Cargill, Incorporated

- Cellectis S.A

- CHS Inc.

- Colorado Mills

- DowDuPont Inc.

- Gustav Heess Oleochemische Erzeugnisse GmbH

- James Richardson & Sons, Limited

- Jivo Wellness Pvt. Ltd.

- Macjerry Sunflower Company

- Marbacher Ölmühle GmbH

- Oilseed International, Ltd.

- PPB Berhad Group