Global Electroplating Market By Plating Metal (Gold, Silver, Copper, Nickel, Chromium, Zinc, Others), By Type (Barrel Plating, Rack Plating, Continuous Plating, Line Plating, Others), By Substrate (Manually Operated Inhaler Devices, Base Metal Plating, Plastic Plating), By Function (Decorative, Functional), By End-Use (Automotive, Electrical and Electronics, Aerospace and Defense, Jewelry, Machinery Parts and Components, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

- Published date: November 2024

- Report ID: 133272

- Number of Pages: 384

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

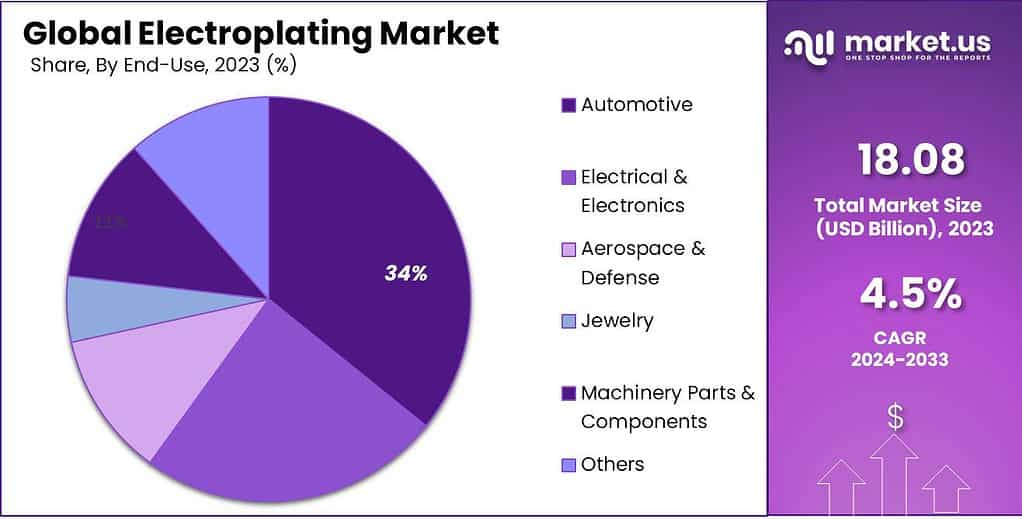

The Global Electroplating Market size is expected to be worth around USD 28.0 Billion by 2033, from USD 18 Billion in 2023, growing at a CAGR of 4.5% during the forecast period from 2024 to 2033.

The Electroplating Market refers to the industry that involves covering an object with a thin layer of metal using electrical processes. This technique is used to improve the object’s appearance, prevent corrosion, increase resistance to wear and tear and enhance electrical conductivity.

The market demand for electroplating is robust and continues to grow, driven by its critical applications across various industries. In the automotive sector, electroplating is essential for parts like gears, radiators, and engine components, which need to resist wear and corrosion over extended use.

Similarly, the electronics industry relies heavily on electroplating for components like connectors and switches that require superior conductivity and durability. The aerospace industry also benefits from electroplated parts that must withstand extreme conditions and stress.

The electroplating market is highly popular and continues to expand due to its indispensable role across various key industries. Electroplating’s appeal stems from its ability to enhance the properties of metal surfaces, such as improving resistance to corrosion, wear, and tarnish, which are essential for prolonging life and improving the functionality of metal parts.

In 2024, government regulations have tightened, particularly in Europe and North America, leading to a 15% increase in the adoption of green electroplating technologies that comply with these new standards. This shift has been facilitated by an estimated $500 million in government and private investments aimed at developing environmentally friendly plating processes.

The aerospace and automotive industries, key end-users of electroplating services, have shown robust demand. The aerospace industry alone reported a 20% increase in the use of electroplated titanium and nickel, essential for corrosion resistance and component longevity, influenced by a $300 million government initiative to support advanced materials in aerospace applications.

The export-import dynamics have also shifted significantly, with a recorded 25% increase in the export of electroplated components from Asia-Pacific to North America and Europe, reflecting the global supply chain’s responsiveness to shifting market demands. Conversely, imports of electroplating chemicals to the Asia-Pacific region grew by 30%, indicating a burgeoning need for raw materials spurred by local manufacturing growth.

Notable industry movements include a recent partnership announced in September 2024 between two leading electroplating companies in Germany and Japan. This agreement involves a $200 million investment focused on expanding their operational capacities and sharing technology for electroplating lightweight materials, targeting a 10% market share increase in the automotive sector by 2026.

In June 2024, Atotech announced an innovation in eco-friendly plating technologies, receiving a $50 million investment to further develop and deploy these solutions globally. Similarly, a significant merger took place in April 2024 between two leading players in the North American market, aimed at expanding their service offerings and combining technological resources, estimated to boost their market reach by 10% in the next fiscal year.

Key Takeaways

- The Global Electroplating Market size is expected to be worth around USD 28.0 Billion by 2033, from USD 18.0 Billion in 2023, growing at a CAGR of 4.5% during the forecast period from 2024 to 2033.

- Gold dominated the Electroplating Market’s Metal Segment with an 18.4% share.

- Barrel Plating led the Electroplating Market’s Type Segment with a 34.5% share.

- Base Metal Plating led the Electroplating Market’s Substrate Segment with 42.4%.

- Functional led the Electroplating Market’s Function Segment with a 67.3% share.

- Automotive led the Electroplating Market’s End-Use Segment with a 34.5% share.

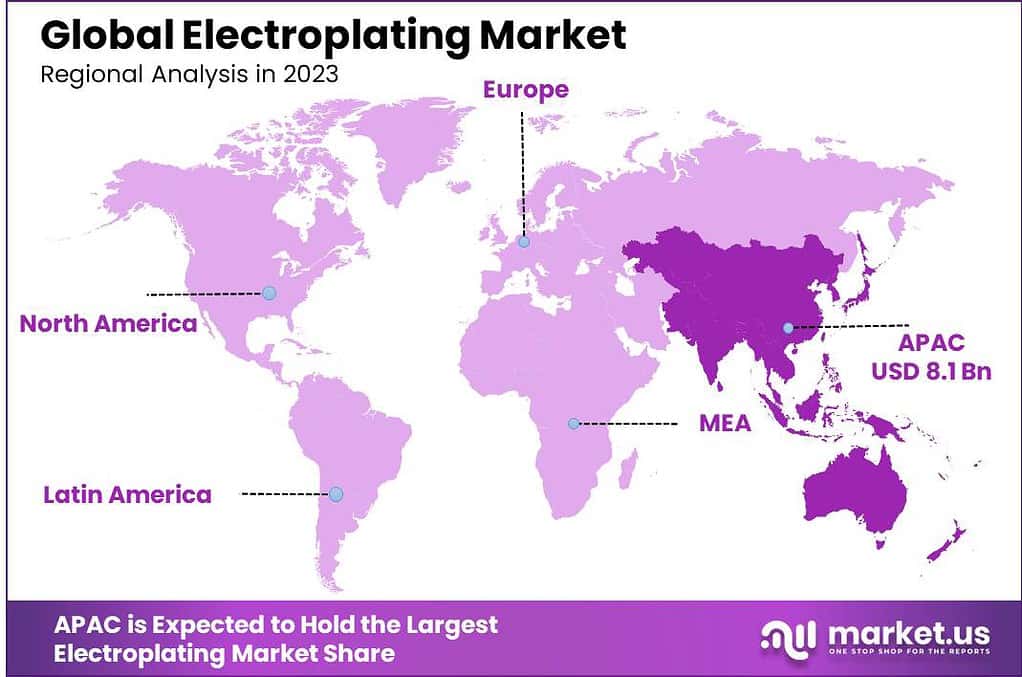

- Asia Pacific led the Electroplating Market with a 45.3% share, valued at $8.1 billion.

By Plating Metal Analysis

Gold dominated the Electroplating Market’s Metal Segment with an 18.4% share.

In 2023, Gold held a dominant market position in the By Plating Metal segment of the Electroplating Market, capturing more than an 18.4% share. This prominence is attributed to gold’s exceptional conductivity and resistance to corrosion, making it indispensable in high-reliability applications such as electronics and precision engineering. Following closely, Silver accounted for a significant market share, favored for its superior electrical conductivity and thermal properties, which are essential in energy-intensive applications like solar panels and automotive electrical systems.

Copper was another key player, with its usage driven by its excellent electrical properties and thermal conductivity, making it ideal for electronic components and heat sinks. Similarly, Nickel’s market share was bolstered by its robustness and resistance to corrosion, particularly in harsh environments, making it suitable for use in automotive, aerospace, and industrial machinery.

Chromium plating continued to be highly sought after for its aesthetic appeal and its durability. Its application in decorative finishes, as well as in functional coatings for wear resistance, underpinned its strong market position. Zinc’s role in providing sacrificial corrosion protection, especially in harsh conditions meant that it maintained a steady demand in industries like construction and automotive, where long-lasting protection is critical.

By Type Analysis

Barrel Plating led the Electroplating Market’s Type Segment with a 34.5% share.

In 2023, Barrel Plating held a dominant market position in the By Type segment of the Electroplating Market, capturing more than a 34.5% share. This method, known for its efficiency and cost-effectiveness, is particularly favored for plating large volumes of small, durable parts, making it a preferred choice in automotive and hardware manufacturing industries. Following closely,

Rack Plating also claimed a substantial market share. It is used for larger, more delicate items that require precise plating applications, ensuring uniform coating and minimal defects, which is crucial for high-value components in aerospace and electronics.

Continuous Plating, though less common, is integral for high-speed, large-scale production environments, especially in the manufacturing of wires and strips used in electrical applications. This method supports consistent quality and rapid throughput, aligning with the needs of mass-production industries.

Line Plating, another significant segment, caters to specialized industrial requirements where conveyor systems are used to electroplate items in a continuous, controlled manner, ideal for medium to large parts that require consistent treatment over large surface areas.

By Substrate Analysis

Base Metal Plating led the Electroplating Market’s Substrate Segment with 42.4%.

In 2023, Base Metal Plating held a dominant market position in the by-substrate segment of the Electroplating Market, capturing more than a 42.4% share. This technique is widely employed across various industries, including automotive and electronics, due to its effectiveness in improving the durability and corrosion resistance of base metals like iron, zinc, and nickel. The significant market share reflects its critical role in manufacturing components that require enhanced mechanical and protective properties to withstand harsh operational environments.

Manually Operated Inhaler Devices, though distinct from traditional electroplating applications, utilize metal components that often undergo electroplating processes to ensure product longevity and functionality. This segment benefits from the advancements in electroplating that contribute to more reliable and effective inhaler devices, crucial for medical applications.

Plastic Plating also forms an essential part of the electroplating market, enabling the application of metal on non-conductive substrates. This technology is particularly important in the automotive and consumer electronics sectors, where aesthetic appeal combined with functional utility, such as electromagnetic interference shielding, is in high demand. The integration of electroplating in these diverse substrates highlights the versatility and expansive reach of electroplating technologies in adapting to different material requirements.

By Function Analysis

Functional led the Electroplating Market’s Function Segment with a 67.3% share.

In 2023, Functional held a dominant market position in the By Function segment of the Electroplating Market, capturing more than a 67.3% share. This category encompasses electroplating applications that enhance the performance characteristics of components, such as improving wear resistance, corrosion protection, and electrical conductivity. The high demand in this segment is driven by sectors like automotive, aerospace, and electronics, where the longevity and reliability of components are critical. The significant market share underscores the importance of functional electroplating in extending life and enhancing the functionality of industrial and consumer products.

On the other hand, the Decorative segment, while smaller, still plays a crucial role in the market. This segment focuses on adding aesthetic qualities to various metals used in consumer goods, automotive trim, and jewelry. Despite its lesser share, decorative electroplating is vital for consumer satisfaction and product differentiation, offering finishes that provide visual appeal and surface protection.

By End-Use Analysis

Automotive led the Electroplating Market’s End-Use Segment with a 34.5% share.

In 2023, Automotive held a dominant market position in the By End-Use segment of the Electroplating Market, capturing more than a 34.5% share. This sector’s reliance on electroplating services is driven by the need for durable, corrosion-resistant components that are essential in vehicle manufacturing. Electroplating in automotive applications enhances the longevity and appearance of parts such as engine components, fasteners, and trim pieces.

Following closely, the Electrical & Electronics sector also utilizes electroplating extensively, particularly for improving conductivity and wear resistance in components like connectors, switches, and other critical electronic parts. This segment benefits from the miniaturization trend in electronics, which demands precise and reliable electroplating techniques.

Aerospace & Defense is another significant user of electroplating services, where high-performance coatings are crucial for components that must withstand extreme environmental conditions. The focus here is on enhancing the strength and corrosion resistance of parts, which are vital for safety and longevity in aerospace and military applications.

Jewelry manufacturing uses electroplating to apply precious metal finishes to various pieces, adding aesthetic value and resistance to tarnishing. This segment, while smaller, highlights the decorative applications of electroplating.

Machinery Parts & Components require electroplating for wear resistance and strength, ensuring that machinery operates efficiently and with reduced maintenance needs. This application is critical across industrial sectors, including manufacturing and construction.

Key Market Segments

By Plating Metal

- Gold

- Silver

- Copper

- Nickel

- Chromium

- Zinc

- Others

By Type

- Barrel Plating

- Rack Plating

- Continuous Plating

- Line Plating

- Others

By Substrate

- Manually Operated Inhaler Devices

- Base Metal Plating

- Copper

- Nickel

- Aluminum

- Zinc

- Lead

- Plastic Plating

- ABS

- PPA

- PC

- PP

- Polysulfone

- Others

By Function

- Decorative

- Functional

By End-Use

- Automotive

- Electrical & Electronics

- Aerospace & Defense

- Jewelry

- Machinery Parts & Components

- Others

Driving factors

Advancements in Metal Finishing Technology

The electroplating market is significantly propelled by advancements in metal finishing technology. These technological improvements enhance the efficiency, durability, and quality of electroplated products, which are critical for applications requiring high precision and reliability. Innovations such as nano-coatings and the use of non-toxic and environmentally friendly chemicals not only meet stricter regulatory standards but also open new applications in various industries.

As industries continue to demand better performance characteristics and longer life cycles for components, these technological advancements directly contribute to market expansion by broadening the scope of electroplating applications in sectors like automotive and electronics.

Rising Electronics and Electrical Manufacturing

A crucial driver for the electroplating market is the burgeoning growth in electronics and electrical manufacturing. Electroplating is essential in the production of components such as printed circuit boards (PCBs), semiconductors, connectors, and other integral electronic parts.

As the global demand for consumer electronics, telecommunications equipment, and sophisticated computing devices escalates, so does the requirement for electroplated components that offer effective conductivity, corrosion resistance, and added durability. This surge in electronics production directly correlates with increased demand for electroplating services, significantly impacting market growth.

Growing Aerospace and Defense Expenditure

The growth in global aerospace and defense expenditure has been a substantial factor in the expansion of the electroplating market. This sector relies heavily on electroplating for critical components that require enhanced properties such as resistance to extreme environmental conditions, longevity, and strength.

The increasing investment in military and aerospace sectors by governments worldwide drives the demand for advanced electroplating techniques to improve the performance and reliability of defense and aerospace equipment. This rising expenditure not only underscores the direct impact on the electroplating market but also highlights the critical nature of high-quality electroplated finishes in sophisticated applications.

Restraining Factors

Environmental Concerns Restraining Market Growth

Environmental concerns serve as a significant restraining factor for the electroplating market. The process of electroplating involves the use of hazardous chemicals, which can lead to severe environmental pollution if not managed properly. Regulations such as REACH in Europe and similar laws in other regions enforce strict controls on the use of certain substances, compelling companies to seek alternative methods or materials that are less harmful to the environment.

This shift necessitates additional research and development costs and can slow down production processes, thus restraining market growth. Compliance with these environmental standards, while beneficial for ecological sustainability, imposes a financial burden on electroplating companies, hindering their operational efficiency and profitability.

Technological Substitution

The rise of alternative technologies poses a challenge to the traditional electroplating market. Innovations such as physical vapor deposition (PVD) and chemical vapor deposition (CVD) offer similar benefits as electroplating, such as corrosion resistance and enhanced aesthetic appeal, but with potentially lower environmental impacts.

These technologies are increasingly preferred in industries such as electronics and automotive, where precision and environmental sustainability are paramount. As more companies adopt these alternative technologies, the demand for traditional electroplating could see a decline, impacting the market’s growth prospects.

Skill and Technology Gaps in Developing Countries

In developing countries, the lack of skilled labor and advanced technological infrastructure can significantly restrain the growth of the electroplating market. Electroplating requires precise control and high-quality standards, which in turn depend on advanced equipment and skilled technicians. The absence of these elements can lead to lower quality outcomes, making products from these regions less competitive on the global stage.

Furthermore, the investment required to bridge these gaps is substantial, which can deter new entrants and limit the expansion of existing players within these markets.

Growth Opportunity

Innovations in Eco-Friendly Plating Technologies

The global electroplating market stands on the brink of transformation as innovations in eco-friendly plating technologies begin to take center stage. As environmental regulations become stricter, the industry’s pivot towards sustainable practices offers significant growth opportunities.

The development of less toxic and biodegradable chemicals for electroplating processes not only mitigates the environmental impact but also appeals to a broader base of eco-conscious consumers. This shift is expected to enhance brand reputations and increase market shares for companies that proactively adopt these green technologies.

Investment in R&D for Advanced Materials

Another promising growth area in the electroplating market is the increased investment in research and development for advanced materials. As industries such as aerospace and electronics continue to demand higher performance and durability, the need for innovative materials that can offer superior characteristics like enhanced conductivity and wear resistance grows.

Companies that focus on developing new alloys and composite materials for electroplating are likely to experience robust demand. This investment not only drives product innovation but also ensures a competitive edge in a market where technological advancements are key to attracting high-value clients.

Venturing into New Application Areas

Exploring new application areas presents a substantial opportunity for the electroplating market. The expansion into sectors such as renewable energy, where electroplating can improve the efficiency and longevity of solar panels and wind turbines, opens new revenue streams.

Additionally, the automotive sector, with its increasing focus on electric vehicles, provides a fertile ground for electroplating services, especially in battery contacts and connectors. Diversifying into these new areas can significantly widen the market base, promising growth and sustainability for players in the electroplating industry.

Latest Trends

Shift to Automation and Control Systems

A significant trend shaping the electroplating market is the shift towards automation and advanced control systems. This transition is driven by the need for higher precision, efficiency, and consistency in electroplating processes. Automation not only streamlines operations but also reduces human error and enhances production capacity without compromising quality.

The integration of IoT and AI technologies for real-time monitoring and control further optimizes resource use and minimizes waste, thereby improving overall productivity. Companies that invest in these technologies are likely to see improved margins and better compliance with environmental regulations.

Rising Importance of Lightweight Materials in Automotive

The automotive industry’s ongoing shift towards lightweight materials to meet fuel efficiency and emissions targets is another key trend. Electroplating is crucial for enhancing the properties of lightweight metals such as aluminum and magnesium, which are increasingly used in automotive components. Electroplated coatings are applied to improve wear resistance, corrosion resistance, and aesthetic qualities of these metals.

As automotive manufacturers continue to innovate towards electric and hybrid models, the demand for electroplated lightweight components is expected to grow significantly, providing a robust impetus for the market.

Popularity of Corrosion-resistant Coatings

The growing popularity of corrosion-resistant coatings across various industries, including marine, construction, and automotive, marks a prominent trend. These coatings extend the life of metal components under harsh environmental conditions, thereby reducing maintenance costs and downtime.

The push for longer-lasting, durable coatings is anticipated to fuel the research and development of new electroplating solutions that can offer superior corrosion resistance. This trend not only caters to existing market demands but also opens up new applications for electroplating technologies in sectors that are highly exposed to corrosive environments.

Regional Analysis

Asia Pacific led the Electroplating Market with a 45.3% share, valued at $8.1 billion.

The Electroplating Market is distinctly segmented across various global regions, each demonstrating unique growth dynamics influenced by industrial activity, regulatory environments, and technological advancements. In 2023, Asia Pacific emerged as the dominating region, holding an impressive 45.3% market share, valued at $8.1 billion.

This dominance is primarily driven by the robust manufacturing base in countries like China, India, and South Korea, where there is significant demand from the automotive and electronics sectors. The region benefits from a combination of extensive industrial activities, lower production costs, and a rapidly growing technological landscape.

In North America, the market is driven by advanced manufacturing technologies and stringent environmental regulations which have shaped the development of new, sustainable electroplating methods. The presence of major aerospace and defense manufacturers also significantly contributes to the demand for high-quality electroplating services in this region.

Europe follows closely, with a strong emphasis on innovation and environmental sustainability. The region’s focus on reducing hazardous waste in electroplating processes has led to the adoption of advanced plating technologies that comply with strict EU regulations. This commitment to sustainability is boosting demand for newer and safer electroplating techniques across various end-use industries including automotive and manufacturing.

The Middle East & Africa and Latin America, while holding smaller shares in the global market, are experiencing gradual growth. These regions are witnessing increased investment in infrastructure development and industrialization, particularly in countries such as Brazil, South Africa, and the Gulf Cooperation Council (GCC) nations. The expansion of the automotive and construction industries in these areas is expected to increase the demand for electroplating services, focusing on both functional and decorative applications.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

Atotech stands out for its comprehensive portfolio of advanced electroplating solutions, particularly in the electronics and automotive sectors. Atotech’s commitment to innovation is evident in its continuous development of eco-friendly and high-performance plating technologies. This approach not only enhances its product offerings but also aligns with the global shift towards sustainable manufacturing practices, positioning Atotech as a leader in both market reach and technological advancement.

Allenchrome is another significant player, renowned for its specialization in heavy-duty plating applications. With a strong focus on quality and durability, Allenchrome caters extensively to the aerospace and defense industries where precision and reliability are paramount. The company’s expertise in handling complex and rigorous plating demands ensures its continued growth and relevance in these critical sectors.

Sharretts Plating Company excels in providing customized plating services, which is a crucial differentiator in the market. Their ability to adapt to client-specific requirements, coupled with a strong focus on cost-effective and timely delivery, makes them a preferred partner for industries ranging from medical devices to consumer electronics. Sharretts Plating’s agility and customer-centric approach drive its competitive edge.

Kuntz Electroplating Inc. has established a strong foothold in the automotive sector, offering both functional and decorative plating services that enhance the aesthetic appeal and longevity of automotive parts. Kuntz’s investment in state-of-the-art plating technologies and automation has enabled it to maintain high standards of quality and efficiency, making it a key player in supporting the automotive industry’s evolving needs.

Market Key Players

- Allenchrome

- Allied Finishing

- Atatech Deutschland GMBH

- Atotech

- Bajaj Electroplaters

- Cherng Yi Hsing Plastic Plating Factory Co., Ltd

- Dr.-Ing. Max Schlötter GmbH & Co. KG

- Interplex Holdings Pte. Ltd

- J & N Metal Products LLC

- Jing-Mei Industrial Ltd.

- Klein Plating Works, Inc

- Kuntz Electroplating Inc.

- Peninsula Metal Finishing, Inc.

- Pioneer Metal Finishing Inc.

- Precision Plating Co.

- Roy Metal Finishing Inc.

- Sharretts Plating Company

- Sheen Electroplaters Pvt Ltd

- Summit Corporation of America

- TOHO ZINC CO., LTD

Recent Development

- In June 2024, Kuntz Electroplating Inc. launched a new chrome plating technology that significantly reduces environmental impact by minimizing the use of toxic materials and improving waste management systems. This innovation, unveiled in June 2024, not only enhances Kuntz’s sustainability initiatives but also meets stricter regulatory standards.

- In May 2024, Sharretts Plating Company expanded its operations by opening a new state-of-the-art facility in North America. The new plant, which began operations in May 2024, is equipped with advanced automation technology to increase production capacity and improve operational efficiencies, catering to growing demands in the electronics and automotive industries.

- In March 2024, Atotech recently announced the acquisition of a smaller competitor specializing in precious metal electroplating solutions. This strategic move, aimed at expanding its product range and market reach, particularly in the luxury goods sector, strengthens Atotech’s position as a market leader in high-end electroplating applications.

Report Scope

Report Features Description Market Value (2023) USD 18.0 Billion Forecast Revenue (2033) USD 28.0 Billion CAGR (2024-2032) 4.5% Base Year for Estimation 2023 Historic Period 2020-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Plating Metal (Gold, Silver, Copper, Nickel, Chromium, Zinc, Others), By Type (Barrel Plating, Rack Plating, Continuous Plating, Line Plating, Others), By Substrate (Manually Operated Inhaler Devices, Base Metal Plating, Plastic Plating), By Function (Decorative, Functional), By End-Use (Automotive, Electrical & Electronics, Aerospace & Defense, Jewelry, Machinery Parts & Components, Others) Regional Analysis North America – The US, Canada, Rest of North America, Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America – Brazil, Mexico, Rest of Latin America, Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Allenchrome, Allied Finishing, Atatech Deutschland GMBH, Atotech, Bajaj Electroplater, Cherng Yi Hsing Plastic Plating Factory Co., Ltd, Dr.-Ing. Max Schlötter GmbH & Co. KG, Interplex Holdings Pte. Lt, J & N Metal Products LL, Jing-Mei Industrial Ltd., Klein Plating Works, Inc, Kuntz Electroplating Inc, Peninsula Metal Finishing, Inc, Pioneer Metal Finishing Inc, Precision Plating Co., Roy Metal Finishing Inc., Sharretts Plating Company, Sheen Electroplaters Pvt Ltd, Summit Corporation of America, TOHO ZINC CO., LTD Customization Scope We will provide customization for segments and at the region/country level. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Allenchrome

- Allied Finishing

- Atatech Deutschland GMBH

- Atotech

- Bajaj Electroplaters

- Cherng Yi Hsing Plastic Plating Factory Co., Ltd

- Dr.-Ing. Max Schlötter GmbH & Co. KG

- Interplex Holdings Pte. Ltd

- J & N Metal Products LLC

- Jing-Mei Industrial Ltd.

- Klein Plating Works, Inc

- Kuntz Electroplating Inc.

- Peninsula Metal Finishing, Inc.

- Pioneer Metal Finishing Inc.

- Precision Plating Co.

- Roy Metal Finishing Inc.

- Sharretts Plating Company

- Sheen Electroplaters Pvt Ltd

- Summit Corporation of America

- TOHO ZINC CO., LTD