Global Antifreeze Market Report Size, Share, Upcoming Investments Report By Product Type (Ethylene Glycol, Propylene Glycol, Glycerin, Methanol), By Type (Diluted, Concentrate), By Technology (Inorganic Acid Technology (IAT), Organic Acid Technology (OAT), Hybrid Organic Acid Technology (HOAT)), By Distribution Channel(OEM, Aftermarket), By End-use (Automotive, Passenger Vehicles, Commercial Vehicles, Aerospace, Industrial, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2025

- Report ID: 122767

- Number of Pages: 210

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

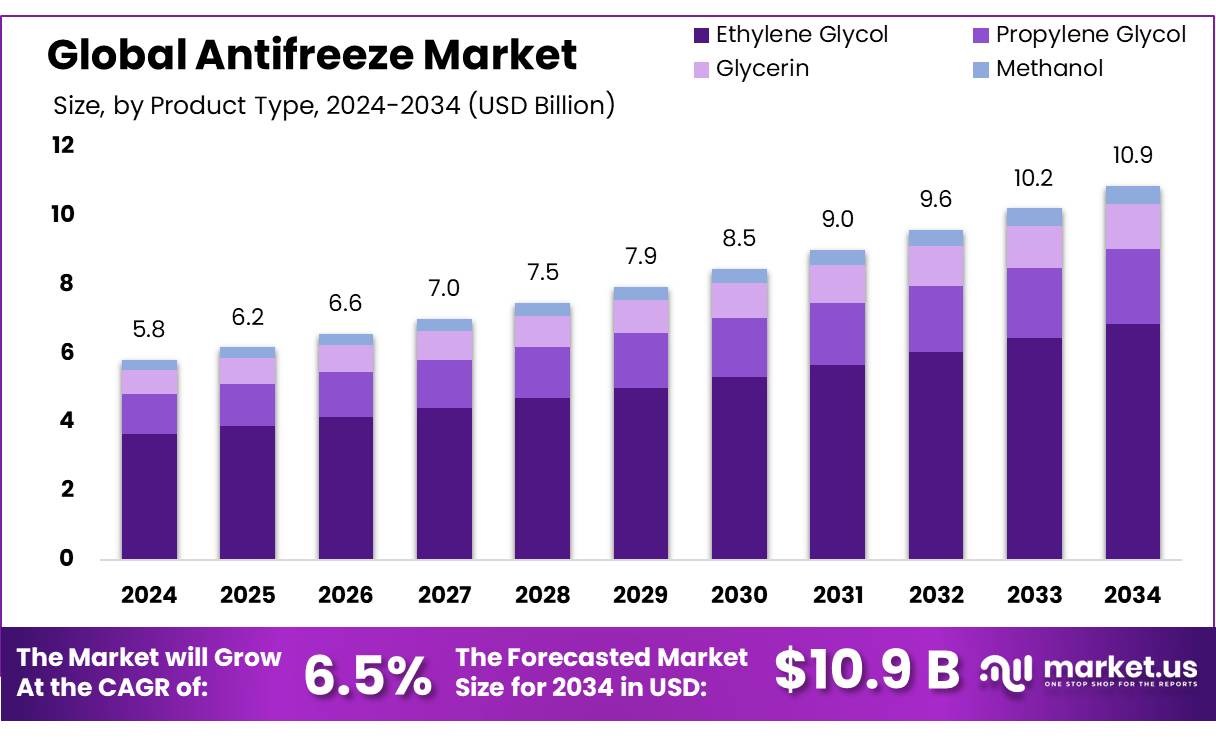

The Global Antifreeze Market size is expected to be worth around USD 10.9 Billion by 2034, from USD 5.8 Billion in 2024, growing at a CAGR of 6.5% during the forecast period from 2025 to 2034.

The global antifreeze market is a crucial segment of the automotive, industrial, and aerospace industries, primarily driven by the need for effective engine and machinery cooling solutions. Antifreeze, mainly composed of ethylene glycol, propylene glycol, and glycerin, helps regulate engine temperatures, prevents freezing in cold weather, and inhibits corrosion within cooling systems. With the growing global vehicle fleet and expanding industrial applications, the demand for antifreeze has increased significantly.

The antifreeze market is heavily influenced by the automotive sector, which accounts for over 60% of global antifreeze consumption. Passenger and commercial vehicle manufacturers require advanced coolant solutions to improve engine performance and comply with strict emissions standards. Additionally, antifreeze plays a significant role in industrial applications such as HVAC systems, manufacturing equipment, and marine vessels, expanding its market footprint.

Several driving factors are contributing to the rising demand for antifreeze. The global automotive industry continues to grow, with annual vehicle sales exceeding 80 million units. As internal combustion engine (ICE) vehicles remain dominant, efficient cooling systems are essential to prevent overheating and extend engine life. The increasing shift toward environmentally friendly antifreeze solutions, such as biodegradable and non-toxic propylene glycol-based coolants, is also gaining momentum.

This trend is particularly prominent in regions with stringent environmental policies, where the focus is on reducing the environmental impact of industrial activities. Furthermore, electric vehicles, which require specialized cooling systems for their batteries and power electronics, are driving innovation in coolant formulations. The EV market, expected to surpass 40 million unit sales by 2030, presents new opportunities for advanced thermal management fluids in automotive applications.

Future growth opportunities in the antifreeze market are linked to advancements in coolant technology and sustainability initiatives. Manufacturers are focusing on developing long-life, low-maintenance coolants that offer extended service intervals, reducing maintenance costs for consumers. These coolants promise to enhance operational efficiency, reduce waste, and improve overall system reliability.

The demand for bio-based antifreeze solutions, which minimize environmental impact, is expected to reshape the market landscape. Additionally, innovations in nanofluid-based coolants, which improve thermal conductivity and heat dissipation, are gaining attention, especially in high-performance automotive and industrial applications. Governments worldwide are promoting circular economy principles, encouraging the recycling and reusing of coolant fluids to minimize waste.

Key Takeaways

- Antifreeze Market size is expected to be worth around USD 10.9 Billion by 2034, from USD 5.8 Billion in 2024, growing at a CAGR of 6.5%

- Ethylene Glycol held a dominant market position, capturing more than a 62.30% share of the global antifreeze market.

- Diluted antifreeze held a dominant market position, capturing more than a 67.40% share of the global market.

- Organic Acid Technology (OAT) held a dominant market position, capturing more than a 56.40% share

- OEM held a dominant market position, capturing more than a 56.70% share of the global antifreeze market.

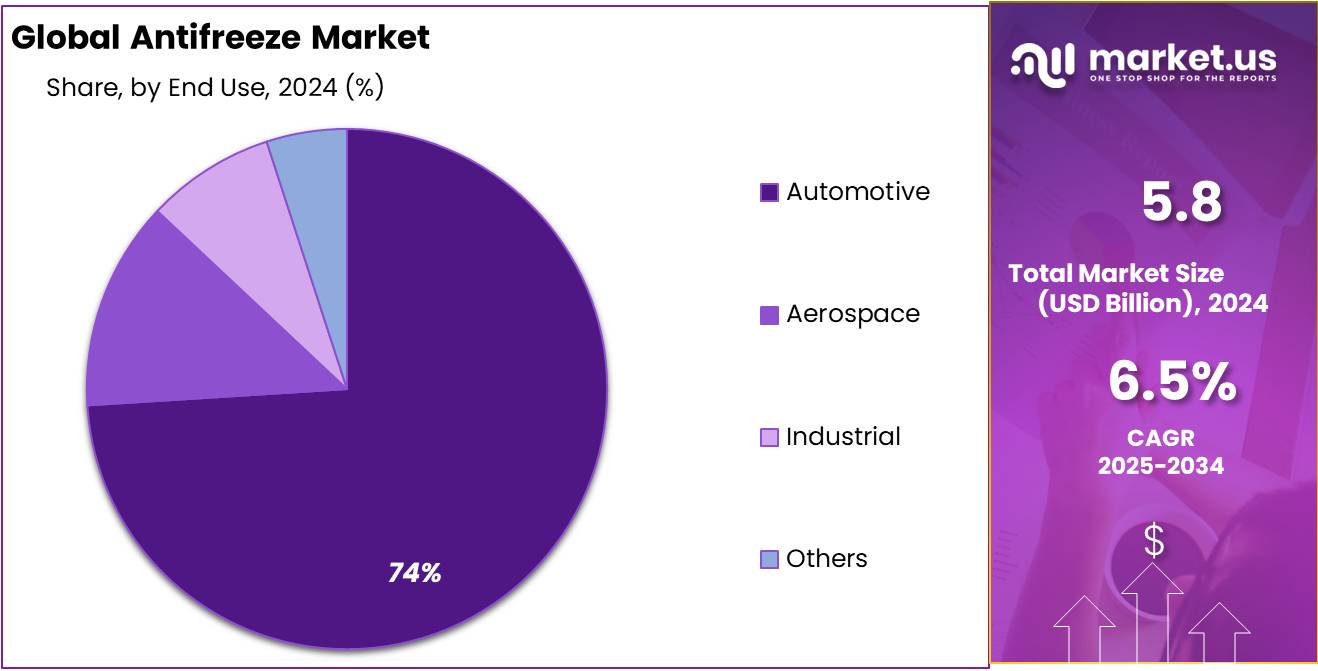

- Automotive held a dominant market position, capturing more than a 74.50% share of the global antifreeze market.

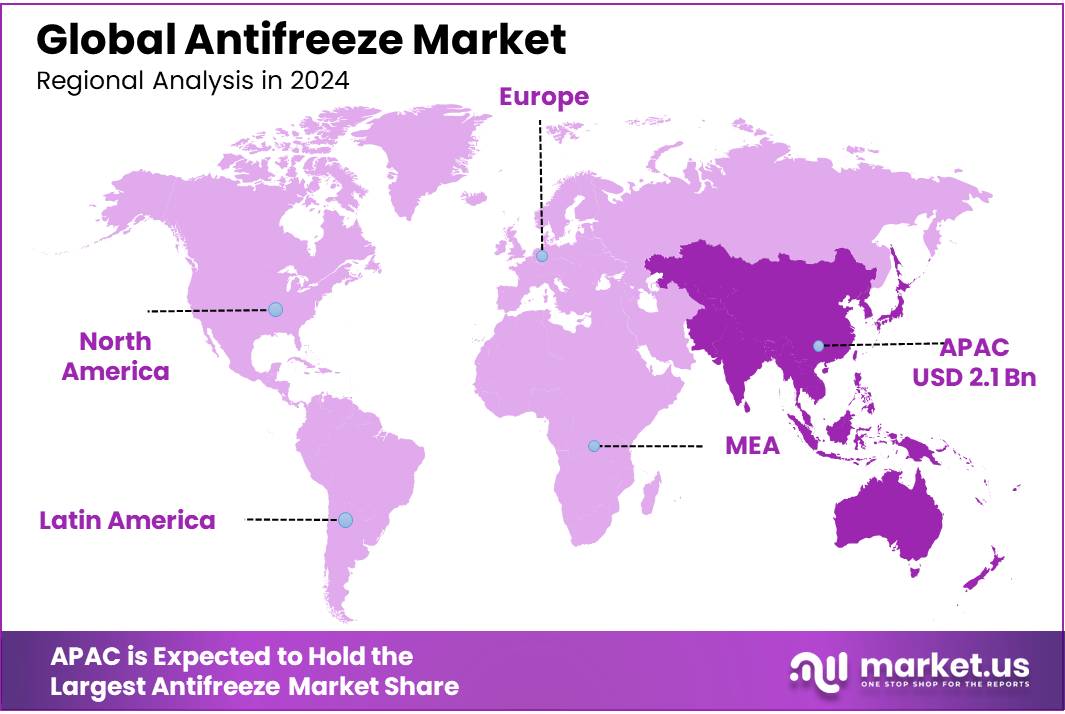

- Asia Pacific (APAC) region is expected to hold the dominant market position in the antifreeze market, capturing more than 36.80% of the global share, valued at approximately $2.1 billion.

By Product Type

In 2024, Ethylene Glycol held a dominant market position, capturing more than a 62.30% share of the global antifreeze market. Ethylene Glycol is widely used in automotive and industrial applications due to its excellent heat transfer properties and relatively low cost. It is primarily used in the production of antifreeze formulations, where its ability to lower the freezing point and raise the boiling point of engine coolant makes it highly effective.

In comparison, Propylene Glycol held a smaller market share but is still a key player in the antifreeze sector, accounting for a significant portion of the market in 2024. Propylene Glycol is often preferred for applications that require a less toxic alternative to Ethylene Glycol, such as in food-grade antifreeze and in areas where environmental and health concerns are paramount.

Glycerin, which is used in niche antifreeze products, accounted for a smaller portion of the market. Glycerin’s use is mostly limited to specific industrial applications and where environmental sustainability is a priority.

By Type

In 2024, Diluted antifreeze held a dominant market position, capturing more than a 67.40% share of the global market. The popularity of diluted antifreeze stems from its ready-to-use nature, which makes it convenient for consumers, especially in automotive and industrial applications. These products are pre-mixed with water, making them ideal for direct application without the need for additional mixing. The widespread use of diluted antifreeze is also driven by its cost-effectiveness and ease of use, as well as its strong demand in regions with moderate climate conditions where consumers prefer the convenience of pre-diluted solutions.

The Concentrate segment, while accounting for a smaller share of the market, continues to see steady growth. Concentrated antifreeze solutions are typically mixed with water before use, offering consumers the flexibility to adjust the concentration according to specific requirements. This segment appeals to both commercial and industrial users who require more control over the antifreeze mixture, as well as those in colder regions who may need stronger concentrations for extreme weather conditions.

By Technology

In 2024, Organic Acid Technology (OAT) held a dominant market position, capturing more than a 56.40% share of the global antifreeze market. OAT-based antifreeze products are known for their extended service life and superior corrosion protection, which makes them highly popular in both automotive and industrial applications. These antifreeze solutions are free from inorganic additives, offering better protection for modern engines and reducing the environmental impact.

Inorganic Acid Technology (IAT) antifreeze, while holding a smaller share of the market, continues to serve a significant portion of the automotive industry, especially in older vehicles and regions with a high proportion of older car models. IAT antifreeze is known for its relatively low cost and effectiveness in traditional engines.

Hybrid Organic Acid Technology (HOAT) holds an intermediate position in the market, offering a blend of the benefits of both OAT and IAT. HOAT antifreeze is increasingly being used in vehicles that require a combination of extended protection and cost efficiency. This technology typically combines organic acid inhibitors with traditional inorganic inhibitors, providing both corrosion protection and extended service intervals.

By Distribution Channel

In 2024, OEM held a dominant market position, capturing more than a 56.70% share of the global antifreeze market. Original Equipment Manufacturers (OEMs) play a significant role in driving demand for antifreeze, as they supply pre-filled antifreeze solutions directly to consumers at the time of vehicle purchase. The OEM segment benefits from its strong relationship with automotive manufacturers, who often include antifreeze as part of their vehicles’ cooling systems.

The Aftermarket segment, while smaller than the OEM segment, is also an important part of the antifreeze market. In 2024, the Aftermarket is expected to capture the remaining market share, driven by consumers needing replacement antifreeze for their vehicles after the initial coolant has reached the end of its service life. The Aftermarket provides a variety of antifreeze options, including those for older vehicles or specific engine types, with a growing preference for environmentally friendly and high-performance products.

By End-Use

In 2024, Automotive held a dominant market position, capturing more than a 74.50% share of the global antifreeze market. The automotive sector remains the largest consumer of antifreeze, as vehicles require efficient cooling systems to maintain optimal engine performance. The demand for antifreeze in this segment is primarily driven by the growing global car fleet, advancements in automotive technologies, and the increasing production of passenger vehicles.

Passenger Vehicles, a sub-segment of the automotive category, is the largest contributor to the overall automotive antifreeze demand, due to the sheer volume of vehicles in this category. In 2024, it is expected to capture the largest portion of the automotive antifreeze market.

Commercial Vehicles, which include trucks, buses, and vans, also play a significant role in the antifreeze market, although they account for a smaller share compared to passenger vehicles. These vehicles generally require more durable antifreeze solutions due to their higher engine loads and longer operational hours.

The Light Duty and Heavy Duty segments, which fall under commercial vehicles, each have distinct antifreeze needs. Light-duty vehicles, such as delivery vans and small trucks, rely on antifreeze that offers a balance of performance and cost-efficiency. Heavy-duty vehicles, on the other hand, need antifreeze solutions that offer longer service life and enhanced protection against extreme temperatures, due to their larger engines and more demanding operational environments.

In the Aerospace and Industrial sectors, antifreeze consumption is significantly lower compared to automotive applications. In 2024, the Aerospace sector is expected to capture a smaller portion of the overall antifreeze market. Antifreeze in aerospace applications is used for specific systems like de-icing aircraft, and it tends to be highly specialized.

Key Market Segments

By Product Type

- Ethylene Glycol

- Propylene Glycol

- Glycerin

- Methanol

By Type

- Diluted

- Concentrate

By Technology

- Inorganic Acid Technology (IAT)

- Organic Acid Technology (OAT)

- Hybrid Organic Acid Technology (HOAT)

By Distribution Channel

- OEM

- Aftermarket

By End-use

- Automotive

- Passenger Vehicles

- Commercial Vehicles

- Light Duty

- Heavy Duty

- Aerospace

- Industrial

- Others

Driving Factors

Increased Demand for Automotive Maintenance and Performance

In 2024, the global vehicle fleet is estimated to grow by approximately 3% year-on-year, with a significant increase in passenger vehicles, especially in emerging markets. For example, according to the International Organization of Motor Vehicle Manufacturers (OICA), more than 80 million vehicles were produced worldwide in 2023, with a projected growth rate of 3-4% in 2024. This rapid expansion in the automotive sector directly boosts the demand for antifreeze, as manufacturers and vehicle owners alike require high-performance solutions to protect engines from extreme temperatures and reduce wear and tear.

Government regulations around vehicle maintenance and emissions are also driving the demand for advanced antifreeze products. Governments across the globe are enforcing stricter regulations to improve fuel efficiency and reduce vehicle emissions. These regulations require that automotive cooling systems meet specific performance standards, leading to an increased demand for high-performance antifreeze that can sustain engine temperatures under more challenging conditions. For instance, the European Union’s regulations, which mandate that all vehicles meet strict emissions standards, are contributing to the shift towards more durable and efficient antifreeze solutions in Europe.

Furthermore, the growing awareness among consumers about the importance of vehicle maintenance has led to a steady increase in demand for antifreeze products. A report from the U.S. Department of Transportation estimates that nearly 75% of vehicle owners in the country follow regular maintenance schedules, which includes checking and replacing antifreeze. This trend is reflected globally, as consumers become more aware of the long-term benefits of proper engine maintenance, including improved fuel efficiency and reduced repair costs.

According to a report from the U.S. Energy Information Administration (EIA), approximately 40% of the U.S. vehicle fleet is located in states where temperatures regularly drop below freezing, further increasing the need for antifreeze products. Similarly, countries in northern Europe, such as Sweden and Finland, also experience a surge in antifreeze demand during the colder months.

Restraining Factors

Environmental Concerns and Regulatory Challenges

Ethylene glycol-based antifreeze, the most commonly used type in the automotive industry, is highly toxic and poses significant environmental risks. If spilled, it can contaminate water sources, harming aquatic life. Additionally, its ingestion by animals can lead to serious health consequences, including death. According to the U.S. Environmental Protection Agency (EPA), antifreeze is one of the most common causes of pet poisoning in the U.S., with more than 10,000 cases of animal poisoning reported annually. This has prompted government authorities to enforce tighter regulations on the sale and disposal of traditional antifreeze products.

In response to these concerns, the European Union has implemented stringent rules under the REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulation, which limits the use of hazardous chemicals in antifreeze products. The European Commission has encouraged the development of “green” antifreeze solutions based on propylene glycol, which is less toxic and more biodegradable. In fact, many countries in Europe are gradually phasing out ethylene glycol-based antifreeze in favor of propylene glycol, which is considered safer for the environment.

Similarly, in the U.S., several states, including California, have adopted regulations to reduce the environmental impact of automotive chemicals. California’s Proposition 65, for example, requires businesses to warn consumers about potential exposure to harmful chemicals, including those found in some traditional antifreeze products. Such regulations have led to increased research and development of eco-friendly alternatives, although transitioning to these alternatives can be costly for manufacturers, limiting their growth potential in the short term.

The cost of developing and producing eco-friendly antifreeze also poses a challenge. While propylene glycol-based antifreeze is a safer alternative, it is typically more expensive to produce than traditional ethylene glycol antifreeze. For manufacturers, the higher production costs may result in price hikes for consumers, potentially impacting demand.

According to a report by the U.S. Department of Energy, the cost of environmentally friendly antifreeze solutions is approximately 20% higher than traditional options. This price disparity could hinder the widespread adoption of green antifreeze products, especially in price-sensitive markets or among consumers who prioritize cost over environmental impact.

Growth Opportunities

Growing Demand for Eco-Friendly and Sustainable Antifreeze Solutions

The U.S. Environmental Protection Agency (EPA) reports that antifreeze-related accidents, especially from spills or leaks, are a significant environmental concern. As a result, the market is seeing a rise in demand for biodegradable and less toxic alternatives like propylene glycol-based antifreeze, which offers similar performance but is far less harmful to the environment.

The European Union (EU) has been at the forefront of promoting more sustainable solutions. Under the REACH regulation, the EU has set strict standards for chemicals, pushing manufacturers to develop products that are both safer and more environmentally friendly. This regulatory pressure is encouraging companies to shift towards the development of greener antifreeze solutions, presenting a growth opportunity for manufacturers focused on sustainability. In fact, the EU’s “Green Deal,” which aims to make Europe the world’s first climate-neutral continent by 2050, has been a catalyst for growth in the green chemical sector.

Additionally, the increasing adoption of electric vehicles (EVs) is creating new opportunities for the antifreeze market. While electric vehicles do not use antifreeze in the same way as internal combustion engine (ICE) vehicles, they still require cooling systems to regulate battery temperatures. As EV adoption continues to grow globally, with sales of electric cars expected to exceed 14 million units annually by 2025 according to the International Energy Agency (IEA), the demand for specialized antifreeze products designed for electric vehicle batteries and cooling systems will increase.

Another key opportunity for growth is in the emerging markets, where the automotive sector is experiencing rapid expansion. As countries in Asia Pacific, Latin America, and Africa continue to increase vehicle production and sales, the demand for antifreeze is expected to rise. For instance, China’s automotive market, which is the largest in the world, is projected to produce over 30 million vehicles annually by 2025, according to the China Association of Automobile Manufacturers (CAAM).

Trending Factors

Rising Adoption of Green Antifreeze Technologies

Ethylene glycol-based antifreeze is highly toxic to animals and aquatic life, which can lead to widespread contamination in the event of spills or improper disposal. According to the U.S. Environmental Protection Agency (EPA), antifreeze-related accidents are among the leading causes of water contamination in the country. As a result, there has been a significant push for the development and use of safer, more sustainable antifreeze options, such as those based on propylene glycol or glycerin. These alternatives are less toxic and more biodegradable, making them safer for the environment and non-toxic to animals.

Governments have been pivotal in driving this trend, particularly in regions like the European Union and North America, where regulatory frameworks are encouraging the use of environmentally friendly antifreeze. The European Union, for example, has implemented policies under its REACH regulation that mandate manufacturers to use safer chemicals in consumer products, including automotive fluids. This has encouraged the development of “green” antifreeze formulations that are based on renewable resources and are biodegradable. In addition to this, several EU countries have introduced incentive programs to encourage the use of sustainable automotive products, which is further boosting the demand for eco-friendly antifreeze.

The adoption of “green” antifreeze is also being driven by consumers who are becoming increasingly conscious of the environmental impact of their purchasing decisions. The shift towards more eco-friendly products is especially pronounced among younger consumers who prioritize sustainability and environmental protection. As these consumers represent a growing segment of the automotive market, their preferences are influencing the types of antifreeze products being developed and sold.

The rise in electric vehicle (EV) adoption is another factor contributing to the growing trend of green antifreeze. EVs, which require a different type of coolant due to their unique thermal management needs, are becoming more mainstream, particularly in Europe and North America. In 2023, global electric vehicle sales surpassed 10 million units, with the International Energy Agency (IEA) projecting further growth in the coming years. Although electric vehicles do not use traditional antifreeze in the same way as internal combustion engine (ICE) vehicles, they still require cooling fluids for regulating battery temperatures. These systems increasingly rely on sustainable coolants, further driving the demand for green antifreeze solutions.

Regional Analysis

In 2024, the Asia Pacific (APAC) region is expected to hold the dominant market position in the antifreeze market, capturing more than 36.80% of the global share, valued at approximately $2.1 billion. The region’s growth is driven by the rapid expansion of the automotive industry, particularly in China and India, which are two of the largest car markets globally. The increasing demand for both passenger and commercial vehicles in these countries is significantly boosting the need for antifreeze products.

Europe is another key player in the global antifreeze market, accounting for a substantial share in 2024. The European market is driven by strict government regulations aimed at reducing environmental impact, which is encouraging the adoption of eco-friendly antifreeze formulations, such as those based on propylene glycol. The shift toward electric vehicles (EVs) in the region also presents opportunities for growth, as EVs require specialized cooling solutions. As the European Union pushes for greener standards, the demand for sustainable antifreeze options continues to rise.

North America holds a significant share of the antifreeze market as well, with strong demand stemming from both the U.S. and Canada. The region’s automotive sector continues to grow, and consumer preference for high-quality, reliable products boosts antifreeze sales. The presence of major antifreeze manufacturers, along with government incentives for eco-friendly automotive products, further supports market growth.

Latin America and the Middle East & Africa are expected to have slower growth compared to APAC, Europe, and North America, but the increasing demand for vehicles in these regions will gradually drive the need for antifreeze solutions in the coming years.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The antifreeze market is highly competitive, with major global players such as Shell Plc, Chevron Corporation, ExxonMobil, and TotalEnergies dominating the landscape. These companies benefit from strong brand recognition and extensive distribution networks, providing a wide range of antifreeze products catering to various applications in the automotive and industrial sectors.

For instance, Shell and ExxonMobil are known for their advanced formulations and high-quality antifreeze products, which are widely used in passenger vehicles and commercial fleets. BP Plc and Saudi Aramco Group are also key players, leveraging their extensive global reach and strong positions in the energy sector to offer antifreeze products that meet evolving industry standards, particularly in terms of environmental sustainability and performance.

Indian Oil Corporation Ltd and Prestone Products Corporation also hold significant market shares, with a strong presence in their respective regions. Indian Oil Corporation is a major supplier in India, providing cost-effective antifreeze solutions for the growing automotive market in the region. Similarly, Prestone, a leader in the North American market, is known for its innovative antifreeze products that cater to both consumer and commercial vehicle needs.

The ongoing shift toward more sustainable and eco-friendly antifreeze products has created a competitive advantage for companies that prioritize environmental impact, like Lukoil, PETRONAS, and Valvoline Inc. These companies are investing in research and development to offer alternatives such as propylene glycol-based antifreeze, which is biodegradable and less toxic. With the global push for greener technologies, these players are well-positioned to capitalize on emerging opportunities in the antifreeze market while addressing growing consumer and regulatory demands.

Market Key Players

- Shell Plc

- Chevron Corporation

- ExxonMobil

- TotalEnergies

- Saudi Aramco Group

- BP Plc

- Indian Oil Corporation Ltd

- Amsoil

- Prestone Products Corporation

- Lukoil

- PETRONAS

- RelaDyne

- BASF SE

- Valvoline Inc.

- Cummins Inc.

- Other Key Players

Recent Developments

- In 2024, Shell continues to strengthen its position with its advanced antifreeze formulations, including both ethylene glycol and environmentally friendly alternatives, such as propylene glycol-based coolants.

- In 2024, Chevron’s antifreeze products are recognized for their advanced formulations that provide effective engine protection against extreme temperatures and corrosion.

- ExxonMobil’s antifreeze products are recognized for their advanced formulations that provide effective engine protection against extreme temperatures and corrosion

Report Scope

Report Features Description Market Value (2024) USD 5.8 Billion Forecast Revenue (2034) USD 10.9 Billion CAGR (2025-2034) 6.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Ethylene Glycol, Propylene Glycol, Glycerin, Methanol), By Type (Diluted, Concentrate), By Technology (Inorganic Acid Technology (IAT), Organic Acid Technology (OAT), Hybrid Organic Acid Technology (HOAT)), By Distribution Channel (OEM, Aftermarket), By End-use (Automotive, Passenger Vehicles, Commercial Vehicles, Aerospace, Industrial, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Shell Plc, Chevron Corporation, ExxonMobil, TotalEnergies, Saudi Aramco Group, BP Plc, Indian Oil Corporation Ltd, Amsoil, Prestone Products Corporation, Lukoil, PETRONAS, RelaDyne, BASF SE, Valvoline Inc., Cummins Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Shell Plc

- Chevron Corporation

- ExxonMobil

- TotalEnergies

- Saudi Aramco Group

- BP Plc

- Indian Oil Corporation Ltd

- Amsoil

- Prestone Products Corporation

- Lukoil

- PETRONAS

- RelaDyne

- BASF SE

- Valvoline Inc.

- Cummins Inc.

- Other Key Players