Global Sodium Diacetate Market Report By Grade (Food Grade, Feed Grade), By Application (Food and Beverages, Cosmetics and Personal Care, Animal Feed, Agrochemicals, Others), By Distribution Channel (Offline, Online), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: June 2024

- Report ID: 122164

- Number of Pages: 212

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

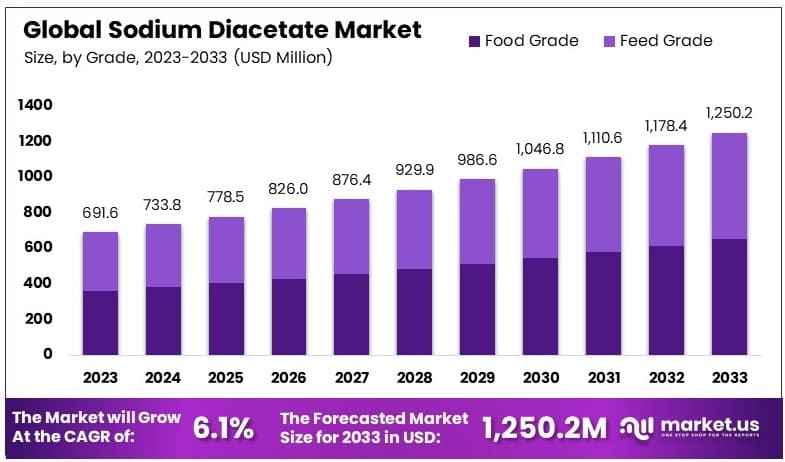

The Global Sodium Diacetate Market size is expected to be worth around USD 1,250.2 Million by 2033, from USD 691.6 Million in 2023, growing at a CAGR of 6.1% during the forecast period from 2024 to 2033.

The Sodium Diacetate market focuses on the production and supply of sodium diacetate, a versatile food additive used as a preservative and flavoring agent. It is commonly used in snacks, bakery products, and meat processing to enhance taste and extend shelf life. The market is propelled by the growing demand for processed and convenience foods.

Additionally, sodium diacetate’s role in maintaining food safety standards boosts its usage. Key market participants include food ingredient manufacturers and suppliers. Trends show an upward trajectory due to rising consumer preference for packaged foods and stringent food safety regulations.

The sodium diacetate market is experiencing notable growth, driven by its increasing use as a food preservative. Sodium diacetate, known for its antimicrobial properties, is widely used to enhance the shelf life of various food products, including baked goods, snacks, and meats. This market expansion is closely tied to the rising consumer demand for fresh and safe food products.

Extending the shelf life of bread by just one day, a 20% increase, can reduce food waste by 5-6%. This reduction has significant environmental benefits, lowering CO2 emissions and water usage by hundreds of kilograms and thousands of liters per 1000 kg of product. These environmental benefits are a key driver for the adoption of sodium diacetate, as manufacturers seek sustainable solutions.

The sodium diacetate market is also benefiting from its effectiveness in controlling mold and bacteria in food, which ensures product quality and safety. This is particularly important in the current market where consumers are more health-conscious and demand transparency regarding food ingredients.

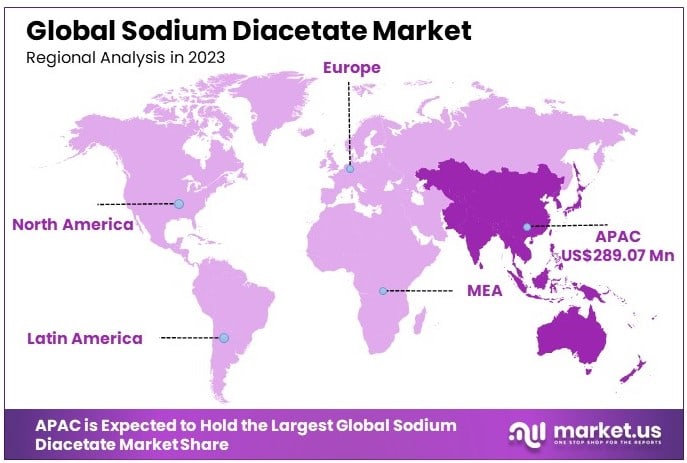

Regionally, North America and Europe dominate the market due to stringent food safety regulations and high consumer awareness. However, the Asia-Pacific region is expected to witness the fastest growth, fueled by rising disposable incomes and changing dietary habits.

The sodium diacetate market is set to grow, supported by its role in extending food shelf life and reducing waste. The environmental and health benefits associated with sodium diacetate make it an attractive option for food manufacturers worldwide. This growth trajectory is expected to continue as the demand for sustainable and safe food preservatives increases.

Key Takeaways

- Market Value: The Sodium Diacetate Market was valued at USD 691.6 million in 2023, and is expected to reach USD 1,250.2 million by 2033, with a CAGR of 6.1%.

- Grade Analysis: Food Grade dominated with 52.5%; vital for its widespread use in food preservation.

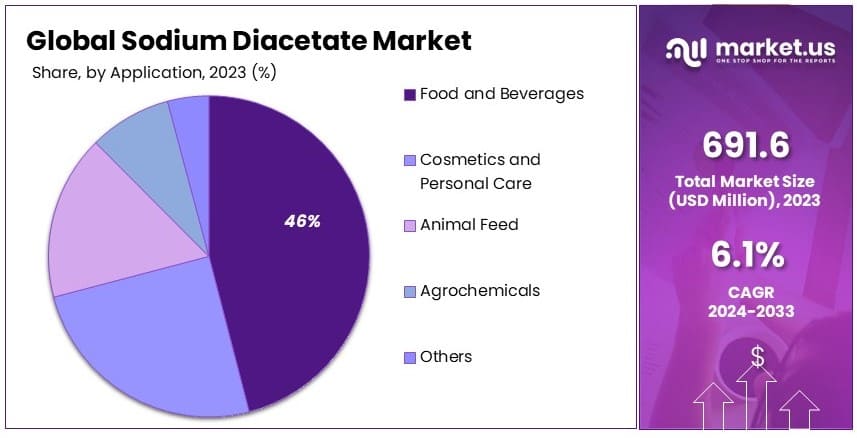

- Application Analysis: Food and Beverages led with 46%; critical for its preservative properties enhancing shelf life.

- Distribution Channel Analysis: Offline channels dominated with 75.4%; important for direct sales to food manufacturers.

- Dominant Region: Asia Pacific held 41.8%; significant due to high demand in the food industry.

- Analyst Viewpoint: The sodium diacetate market is highly competitive with significant potential for growth in food preservation. Future trends indicate increased adoption in various food applications.

- Growth Opportunities: Players can capitalize on rising demand for food preservatives and expand their footprint in emerging markets.

Driving Factors

Increasing Demand in the Food Industry Drives Market Growth

The sodium diacetate market is significantly propelled by the increasing demand within the food industry, primarily due to the growing emphasis on food safety and the desire for extended shelf life of food products. Sodium diacetate serves as a critical component, functioning as a preservative and pH regulator across various food segments, including bakery products, meat and poultry, and dairy items.

The application of sodium diacetate in meat processing, for instance, is not only crucial for controlling microbial growth but also enhances product safety. Major industry players like Cargill have reported a heightened use of this compound in their processing facilities, indicating a direct correlation between food safety requirements and the surge in sodium diacetate usage. This trend reflects broader market dynamics where food safety regulations and consumer preferences for longer-lasting products drive demand for effective preservative solutions, thus fostering market growth for sodium diacetate.

Growth in the Animal Feed Sector Drives Market Growth

The expansion of the sodium diacetate market is robustly supported by its growing use in the animal feed sector. As livestock producers seek more efficient and healthier feeding solutions, sodium diacetate has become a popular choice for its properties as a animal feed additive. This compound enhances gut health, improves nutrient absorption, and boosts growth performance in animals, making it a staple in feed formulations, especially for poultry and swine.

Companies like Nutreco are leading this trend by integrating sodium diacetate into their products, which they report leads to enhanced feed efficiency and reduced mortality rates among livestock. The strategic use of sodium diacetate in animal nutrition not only underscores its importance in modern agricultural practices but also highlights its role in meeting the increasing demand for optimized animal health and productivity, thereby driving market growth.

Rising Applications in Personal Care Products Drives Market Growth

The personal care industry’s burgeoning growth presents another avenue for the expansion of the sodium diacetate market. Known for its pH-balancing properties and serving as a buffering agent, sodium diacetate is increasingly being incorporated into cosmetics and skincare products.

Notable companies like L’Oréal have leveraged this compound to maintain optimal pH levels in their formulations, ensuring product stability and enhancing skin compatibility. This application reflects a broader trend within the personal care sector, where ingredient safety and product efficacy are paramount. As consumer awareness and regulatory standards around product safety continue to rise, the use of sodium diacetate in personal care products is expected to grow, contributing significantly to the overall market expansion.

Restraining Factors

Regulatory Constraints Restrain Market Growth

Stringent regulations on food additives significantly hinder the expansion of the sodium diacetate market. Various regions impose limits on the permissible levels of sodium diacetate in food products, with entities like the European Food Safety Authority (EFSA) enforcing specific restrictions across different food categories.

These regulatory measures require food manufacturers to adhere strictly to set thresholds, which often leads to costly product reformulations and operational adjustments. Such constraints not only limit the scope of market growth by reducing the potential usage of sodium diacetate but also increase compliance costs for producers, thereby impeding broader adoption in the food industry.

Competition from Natural Preservatives Restrains Market Growth

The rising consumer preference for natural and clean-label products presents a substantial challenge to the sodium diacetate market. As awareness and demand for healthier, more natural food options grow, food manufacturers are increasingly substituting synthetic preservatives with natural alternatives such as vinegar, citrus extracts, and rosemary oil.

This shift is exemplified by companies like Nestle, which has committed to eliminating artificial preservatives in favor of natural options. This trend reduces reliance on synthetic additives like sodium diacetate, curtailing its market penetration and growth potential. The consumer-driven demand for natural ingredients directly impacts the competitive landscape, positioning natural preservatives as formidable rivals to sodium diacetate.

Grade Analysis

Food Grade dominates with 52.5% due to its widespread use across multiple industries.

The sodium diacetate market is distinctly segmented by grade, with Food Grade emerging as the dominant sub-segment, accounting for 52.5% of the market. This prevalence is largely attributed to sodium diacetate’s extensive utility in the food industry as a preservative and pH regulator. Its effectiveness in inhibiting microbial growth and extending the shelf life of food products makes it a preferred choice in bakery items, dairy products, and processed meats. The robust demand within the food sector ensures steady growth in this segment, underpinned by rising global consumption and stricter food safety regulations which demand reliable and effective preservation solutions.

Conversely, the Feed Grade segment, while smaller, plays a critical role in the animal nutrition sector. Sodium diacetate is valued in animal feed for its acidifying properties, which help improve gut health and nutrient absorption in livestock. This segment benefits from the growing global demand for enhanced animal feed quality to boost livestock productivity and health, reflecting broader agricultural trends towards optimized feed formulations. Although smaller in market share, Feed Grade’s impact on the sodium diacetate market is bolstered by ongoing research and development aimed at enhancing animal feed efficacy and safety.

Application Analysis

Food and Beverages leads with 46% due to its critical role in food safety and quality.

In the application segment of the sodium diacetate market, Food and Beverages hold the largest share at 46%. The dominance of this segment is driven by the crucial role sodium diacetate plays in food preservation, taste enhancement, and safety. Its ability to manage microbial growth effectively makes it indispensable in processed foods, bakery products, and dairy, aligning with industry needs for longer shelf life and improved food safety standards. The ongoing expansion of the global food industry, coupled with increasing consumer expectations for quality and longevity of food products, continues to fuel growth in this segment.

Other application segments, such as Cosmetics and Personal Care, Animal Feed, Agrochemicals, and others, though smaller, contribute significantly to the market’s diversity and expansion. In cosmetics, sodium diacetate is used for its pH-balancing properties, enhancing product stability and skin compatibility, which is becoming increasingly important as consumer awareness of product safety grows. In the animal feed and agrochemical sectors, its use as an acidifier and preservative supports overall market growth by meeting the rising demand for high-efficiency and safe agricultural and animal products.

Distribution Channel Analysis

Offline distribution leads with 75.4% due to its established trust and accessibility.

The distribution channel of the sodium diacetate market is overwhelmingly led by Offline methods, accounting for 75.4% of the market. This dominance is primarily due to the established infrastructure, trust, and accessibility that offline channels offer, including direct sales and distributor networks. These channels are particularly effective in delivering chemical compounds like sodium diacetate, where handling and storage conditions are crucial, and client relationships are built on longstanding trust and reliability.

On the other hand, the Online segment, though currently smaller, is rapidly growing. This growth is driven by the increasing digitalization of sales channels and the convenience of online ordering systems. E-commerce platforms and online B2B transactions are becoming more prevalent, catering to a global clientele seeking efficient, scalable, and quick procurement options. As digital platforms continue to evolve and integrate more deeply into business operations, the online distribution of sodium diacetate is expected to increase, complementing the dominant offline channels and enhancing overall market accessibility and reach.

Key Market Segments

By Grade

- Food Grade

- Feed Grade

By Application

- Food and Beverages

- Cosmetics and Personal Care

- Animal Feed

- Agrochemicals

- Others

By Distribution Channel

- Offline

- Online

Growth Opportunities

Emerging Economies in Asia-Pacific Offer Growth Opportunity

The rapid urbanization and evolving dietary habits in Asia-Pacific, particularly in countries like India and China, present substantial growth opportunities for the sodium diacetate market. The increasing demand for processed and convenience foods in these regions, driven by a growing middle class and busier lifestyles, underpins the rising need for effective preservatives like sodium diacetate.

For instance, Hindustan Unilever Limited’s expansion of its ready meals range in India exemplifies this trend, highlighting a potential surge in the usage of sodium diacetate to ensure product safety and extend shelf life. This market dynamic is poised to drive substantial growth as companies capitalize on the expanding consumer base and their shifting preferences towards convenience food options.

Advancements in Controlled-Release Technologies Offer Growth Opportunity

Innovations in controlled-release technologies create lucrative growth avenues within the sodium diacetate market. This advancement is particularly impactful in the animal feed sector, where prolonged antimicrobial activity is crucial. For example, DSM, a global science-based company, has developed slow-release acidifiers that utilize sodium diacetate.

Such technologies enhance the effectiveness of sodium diacetate, allowing for more controlled and extended release, which improves overall feed efficacy. The adoption of such innovative technologies not only meets the demand for higher performance products but also opens new market segments by enhancing the applicability and desirability of sodium diacetate in various industrial applications.

Trending Factors

Clean-Label Reformulations Are Trending Factors

The clean-label trend is reshaping the sodium diacetate market by encouraging manufacturers to pursue reformulations that align with consumer demands for natural and transparent labeling. Companies like Kerry Group are leading the way by investing in natural fermentation processes to produce preservatives, including sodium diacetate, derived from natural sources.

This shift not only meets the preservation needs of food products but also caters to the growing consumer preference for clean-label ingredients. As the trend towards healthier and more natural food choices continues to gain momentum, the demand for naturally-derived sodium diacetate is expected to rise, marking a significant trend in the market.

E-commerce Boom in Food Retail Are Trending Factors

The e-commerce boom in food retail, significantly accelerated by the COVID-19 pandemic, has become a key trend influencing the sodium diacetate market. This shift has heightened the need for robust preservative solutions to ensure food safety across longer supply chains. Platforms like Amazon Fresh, which have stringent requirements for shelf life and food safety, exemplify the growing need for effective preservatives like sodium diacetate in online food retail.

As e-commerce continues to expand, the demand for sodium diacetate is expected to increase, driven by the need to maintain product quality and safety during extended storage and transport, reinforcing its status as a trending factor in the market.

Regional Analysis

Asia Pacific Dominates with 41.8% Market Share

Asia Pacific holds a dominant position in the sodium diacetate market with a 41.8% market share, largely due to its robust food processing sector and rapid urbanization. The region’s growing middle class is increasingly demanding more processed and convenience foods, which require effective preservatives like sodium diacetate. Furthermore, the local governments’ focus on food safety regulations has enforced the use of food-grade chemicals to ensure product longevity and safety, further driving the demand.

The regional characteristics of Asia Pacific, including high population growth, urbanization, and an expanding economy, significantly influence the sodium diacetate market. These factors contribute to increased food production and consumption, which directly correlates with the need for preservatives. Additionally, the rising awareness and acceptance of packaged foods among consumers amplify the use of sodium diacetate in this region.

The future influence of Asia Pacific in the sodium diacetate market is predicted to grow even stronger. As the region continues to develop economically, coupled with rising consumer spending and ongoing urbanization, the demand for processed foods and hence, sodium diacetate, is expected to increase. The ongoing investments in food technology and safety regulations will also support the sustained growth of this market.

Regional Market Shares and Dynamics:

- North America: Holds approximately 25.4% of the market share. The region’s mature food industry and stringent food safety regulations drive the demand for sodium diacetate. The presence of major food processing companies also contributes to steady market growth.

- Europe: Commands around 22.3% market share. Europe’s strict regulations on food additives and a growing preference for clean-label products shape the market dynamics, with a steady demand for sodium diacetate in food applications.

- Middle East & Africa: With a smaller market share of 5.2%, this region is experiencing gradual growth. The increasing urbanization and development in food industries in select countries are beginning to drive demand for food preservatives, including sodium diacetate.

- Latin America: Holds a market share of 5.3%. The region shows potential for growth driven by expanding food processing sectors and increasing economic stability, which could increase consumer spending on processed foods.

These statistics and dynamics underscore the varied growth patterns and market potentials across different regions, highlighting the global reach and application of sodium diacetate.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the Sodium Diacetate Market, the influence and strategic positioning of key players are crucial for understanding the competitive landscape and market dynamics. Henan Honghui Biotechnology Co., Ltd. and Mitsubishi Chemicals Corporation are significant due to their extensive production capacities and innovation in product quality, which allow them to meet the rising global demand effectively. ULRICH GmbH and Macco Organiques Inc. strengthen their market positions through their focus on sustainable and compliant manufacturing practices, catering to the European markets with stringent regulatory standards.

Niacet and Kerry Company leverage their strong R&D capabilities to innovate in preservative solutions, often leading the way in developing clean-label and natural preservatives that appeal to the current market trend towards healthier food options. Corbion stands out for its strategic focus on bio-based products, aligning with global sustainability trends and enhancing its appeal among environmentally conscious consumers.

Vinipul Inorganics Pvt Ltd. and Fooding Group Limited target niche markets by offering specialized blends and formulations of sodium diacetate, providing tailored solutions to meet specific customer needs in food safety and preservation. These companies, through their diverse strategies and broad product portfolios, collectively drive competition, innovation, and growth in the Sodium Diacetate Market.

Market Key Players

- Henan Honghui Biotechnology Co., Ltd.

- Mitsubishi Chemicals Corporation

- ULRICH GmbH

- Macco Organiques Inc.

- Niacet

- Kerry Company

- Corbion

- Vinipul Inorganics Pvt Ltd.

- Fooding Group Limited

Recent Developments

- In June 2021, Kerry Group acquired Niacet’s sodium diacetate business for approximately $1 billion. This acquisition is a significant step in Kerry’s strategic initiatives aimed at enhancing its product offerings in the food preservation sector. Sodium diacetate is a vital ingredient in food preservation, particularly for savory flavor applications and shelf-life extension systems.

- Earlier, Niacet Corporation expanded its market presence by acquiring the sodium diacetate business from Jungbunzlauer. This move aligned well with Niacet’s core business strategy, leveraging their longstanding experience in the acetate market to enhance their capabilities in food ingredients.

Report Scope

Report Features Description Market Value (2023) USD 691.6 Million Forecast Revenue (2033) USD 1,250.2 Million CAGR (2024-2033) 6.1% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Grade (Food Grade, Feed Grade), By Application (Food and Beverages, Cosmetics and Personal Care, Animal Feed, Agrochemicals, Others), By Distribution Channel (Offline, Online) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Henan Honghui Biotechnology Co., Ltd., Mitsubishi Chemicals Corporation, ULRICH GmbH, Macco Organiques Inc., Niacet, Kerry Company, Corbion, Vinipul Inorganics Pvt Ltd., Fooding Group Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the current size of the global sodium diacetate market?The global sodium diacetate market was valued at USD 691.6 million in 2023.

What is the compound annual growth rate (CAGR) of the sodium diacetate market during the forecast period 2024-2033?The market is expected to grow at a CAGR of 6.1% during this period.

What are the main driving factors for the growth of the sodium diacetate market?Key drivers include increasing demand in the food industry, growth in the animal feed sector, and rising applications in personal care products.

Which region holds the largest market share in the sodium diacetate market?Asia Pacific holds the largest market share at 41.8%.

Who are the key players in the sodium diacetate market?Key players include Henan Honghui Biotechnology Co., Ltd., Mitsubishi Chemicals Corporation, ULRICH GmbH, Macco Organiques Inc., Niacet, Kerry Company, Corbion, Vinipul Inorganics Pvt Ltd., and Fooding Group Limited.

-

-

- Henan Honghui Biotechnology Co., Ltd.

- Mitsubishi Chemicals Corporation

- ULRICH GmbH

- Macco Organiques Inc.

- Niacet

- Kerry Company

- Corbion

- Vinipul Inorganics Pvt Ltd.

- Fooding Group Limited