Global Pickleball Shoes Market Size, Share, Growth Analysis By Type (Indoor, Outdoor), By User Demographics (Men, Women, Children), By Distribution Channel (Online Retailers, Specialty Stores, Sporting Goods Stores, Other Channels), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 143178

- Number of Pages: 263

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

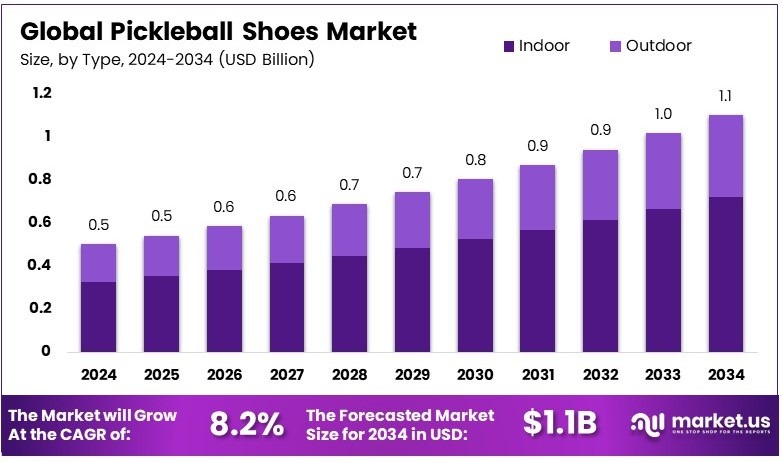

The Global Pickleball Shoes Market size is expected to be worth around USD 1.1 Billion by 2034, from USD 0.5 Billion in 2024, growing at a CAGR of 8.2% during the forecast period from 2025 to 2034.

Pickleball shoes are specialized footwear designed to enhance performance and safety during pickleball play. They feature supportive soles and tread patterns tailored to the unique movements and court surfaces associated with pickleball, maximizing grip and comfort.

The pickleball shoes market refers to the industry sector focused on the production, distribution, and sale of pickleball-specific footwear. This market segment caters to the growing number of pickleball enthusiasts, addressing their needs for footwear that combines durability, support, and style.

As per Market.us, the global pickleball market is projected to reach a significant milestone, climbing to USD 9.1 billion by 2034 from USD 2.2 billion in 2024. This robust growth, at a compound annual growth rate (CAGR) of 15.3%, highlights the increasing appeal of pickleball as an accessible and beneficial form of exercise. The sport’s simplicity and health advantages are attracting a diverse group of players, contributing to its rapid rise in global popularity.

Alongside the sport itself, the market for pickleball shoes is experiencing a parallel increase in demand, driven by the sport’s expansion in established markets like the United States and burgeoning interest in countries such as Australia and Canada.

In the U.S., pickleball boasts 4.8 million active players and nearly 8,500 playing locations, indicating a thriving market with potential for further expansion. The sport’s infrastructure, supported by state endorsements like Washington State’s recognition of pickleball as its official sport, plays a crucial role in promoting the game and, by extension, the market for related pickleball equipment.

Moreover, emerging markets such as Australia, where pickleball membership doubled in just one year, and Canada, where player numbers grew from 1 million in 2022 to 1.37 million in 2023, are showing impressive growth. This surge in participation is particularly noticeable among women and young people, underscoring the inclusive nature of the sport. The increase in players directly translates into a higher demand for pickleball shoes, which are essential for playing the game safely and effectively.

These market dynamics are further supported by minimal government regulations, which facilitates easier market entry for new brands and continuous innovation by existing ones. The global spread of pickleball, coupled with the sport’s low barriers to entry and health benefits, makes it a promising area for investment and development within the sports equipment industry.

As pickleball continues to gain recognition and formalization globally, the market for specialized sports shoes is expected to grow correspondingly, offering substantial opportunities for manufacturers and retailers alike.

Key Takeaways

- Pickleball Shoes Market was valued at USD 0.5 Million in 2024 and is expected to reach USD 1.1 Billion by 2034, with a CAGR of 8.2%.

- In 2024, Indoor shoes dominated the type segment with 65.3%, driven by their high demand in controlled playing environments.

- In 2024, Men accounted for 50.4% of the user demographics due to higher participation in pickleball.

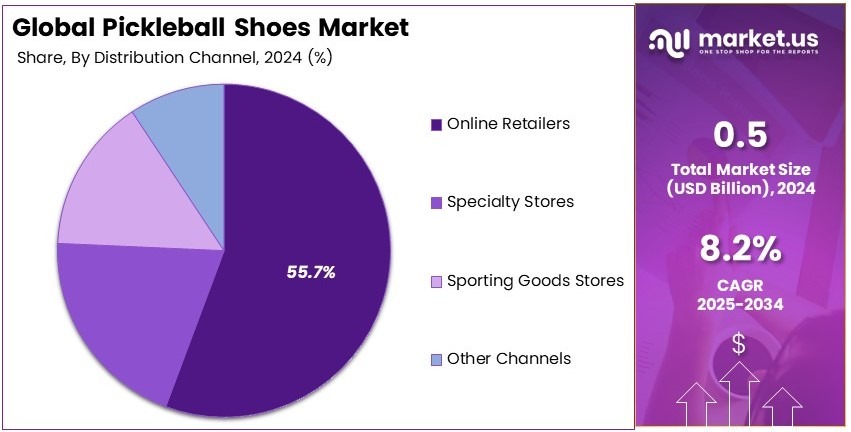

- In 2024, Online Retailers led the distribution channel with 55.7%, benefiting from convenience and a wider range of product availability.

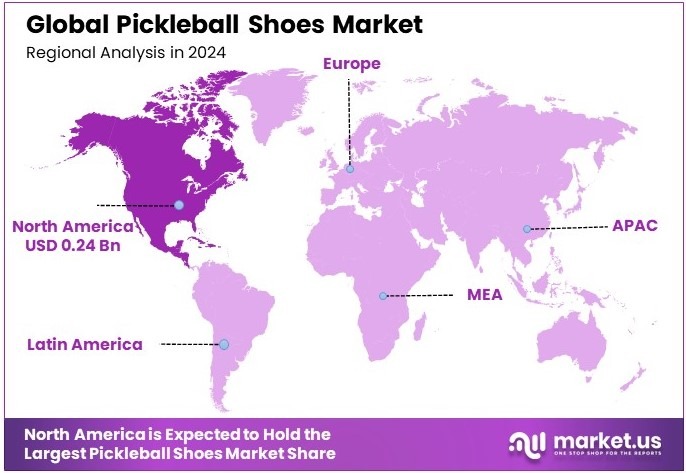

- In 2024, North America dominated the market with 48.6% and a value of USD 0.24 Mn, driven by increasing adoption of the sport.

Type Analysis

Indoor sub-segment dominates with 65.3% due to its adaptability to various play environments and year-round usability.

The Pickleball Shoes Market, by type, is segmented into indoor and outdoor shoes. The dominant sub-segment, Indoor, comprises 65.3% of the market. This preference can be attributed to the controlled climate conditions of indoor courts, which reduce wear and tear on shoes, thus enhancing durability and player performance. Additionally, the growing availability of indoor pickleball facilities encourages more consistent play regardless of weather conditions, further driving demand for indoor-specific shoes.

The Outdoor sub-segment, while less dominant, still plays a crucial role in the market’s growth. Outdoor pickleball shoes are designed to offer increased resistance to weather elements and rougher surfaces. As such, they are critical for players who prefer outdoor courts, supporting the overall market expansion by meeting diverse player needs.

User Demographics Analysis

Men’s sub-segment dominates with 50.4% due to higher participation rates and targeted marketing campaigns.

Within the Pickleball Shoes Market, the User Demographics segment is crucial. Men’s pickleball shoes lead with a 50.4% market share. This dominance is largely due to higher participation rates among men and marketing strategies that specifically target this demographic with features like enhanced support and durability, which are highly valued by competitive players.

Women’s sub-segment, though not as large, is significant, driven by increasing female participation in sports and demand for women-specific athletic wear. Children’s shoes contribute minimally to the segment but are expected to grow as pickleball gains popularity among younger demographics, thereby supporting the broader market growth.

Distribution Channel Analysis

Online Retailers sub-segment dominates with 55.7% due to convenience and a wider range of product offerings.

The Distribution Channel for pickleball shoes shows a clear preference for Online Retailers, which hold a dominant market share of 55.7%. This dominance is driven by the convenience of online shopping and the broader array of choices available, allowing consumers to find the best prices, latest models, and ample reviews, which influence purchasing decisions.

Specialty Stores are important for offering expert advice and specialized products, which are essential for new players needing guidance. Sporting Goods Stores also contribute to the market by providing immediate product availability and the opportunity to try shoes before purchasing, which remains a preferred choice for some consumers. Other channels, including department stores and small retailers, while smaller, round out the market’s distribution landscape, ensuring product access across different consumer segments.

Key Market Segments

By Type

- Indoor

- Outdoor

By User Demographics

- Men

- Women

- Children

By Distribution Channel

- Online Retailers

- Specialty Stores

- Sporting Goods Stores

- Other Channels

Driving Factors

High-Performance Features Drive Market Growth

The growing demand for high-traction and ankle-supportive shoes is fueling the expansion of the pickleball shoe market. Players need footwear that offers excellent grip on the court to prevent slipping and injuries. Shoes with reinforced ankle support help reduce the risk of sprains, especially for older players.

Additionally, more athletes are switching to court-specific shoes designed for pickleball, as these provide better stability and comfort. Unlike running shoes, which lack lateral support, pickleball shoes are built for side-to-side movement, reducing strain on the feet.

Another factor boosting the market is the increasing number of senior players. Older participants prioritize comfort, cushioning, and shock absorption to protect their joints during play. Manufacturers are responding by integrating advanced cushioning technologies, making shoes more durable and responsive.

These innovations enhance player performance while ensuring long-term foot health. As a result, demand for specialized pickleball shoes is rising across different age groups.

Restraining Factors

Cost and Competition Restrain Market Growth

The high cost of manufacturing performance-focused pickleball shoes is a key barrier to market expansion. Advanced materials and technology add to production costs, making premium shoes expensive for casual players. As a result, many consumers opt for general athletic shoes instead.

Furthermore, competition from well-established sports shoe brands limits the growth of pickleball-specific companies. Larger brands with strong distribution networks dominate the market, making it challenging for new or niche players to gain recognition.

Another issue is the lack of customization in shoe designs. Players have different foot shapes and playing styles, yet most shoes come in standard sizes and fits. This limitation discourages some buyers from investing in court-specific footwear.

Additionally, sizing inconsistencies across brands make it difficult for consumers to find the right fit. Without a standardized system, many players experience discomfort, leading them to choose non-specialized alternatives. These challenges hinder widespread adoption, slowing the growth of the pickleball shoe market.

Growth Opportunities

Innovative Materials and Digital Expansion Provide Opportunities

The introduction of lightweight and breathable materials is opening new opportunities in the pickleball shoe market. Players seek shoes that keep their feet cool and reduce fatigue during long matches. Manufacturers are experimenting with mesh fabrics and flexible soles to improve comfort without sacrificing durability.

Another growth avenue is the expansion of online sales and direct-to-consumer strategies. E-commerce platforms allow brands to reach more customers while reducing costs associated with physical retail stores.

Companies are also forming partnerships with professional pickleball players to launch signature shoe lines. Athlete endorsements boost credibility and attract loyal buyers, helping brands establish a strong presence in the market.

Additionally, smart shoe technology is gaining traction. Some brands are integrating sensors into footwear to track player performance and reduce the risk of injuries. These features appeal to competitive players who want real-time feedback on their movements.

Emerging Trends

Fashion Trends and Sustainability Are Latest Trending Factors

The rising popularity of stylish and colorful court shoes is shaping consumer preferences in the pickleball shoe market. Players want footwear that performs well but also looks attractive on the court. Bright designs and unique patterns are becoming key selling points, especially among younger buyers.

In addition, sustainability is gaining importance. More consumers prefer shoes made from recycled materials, reducing their environmental impact. Brands that focus on eco-friendly production gain a competitive edge by appealing to environmentally conscious shoppers.

Another trend is the emergence of pickleball-specific brands. Instead of relying on general sports shoe manufacturers, players are turning to niche companies that specialize in court footwear. These brands offer better design innovations tailored to the sport’s unique needs.

Additionally, 3D printing is making its way into the market. This technology allows for customized shoe designs, ensuring a perfect fit for different foot shapes. With these trends shaping demand, the pickleball shoe market is evolving to meet modern consumer expectations.

Regional Analysis

North America Dominates with 48.6% Market Share

North America commands the Pickleball Shoes Market with a 48.6% share with a valuation of USD 0.24 billion, primarily driven by the growing popularity of pickleball as a lifestyle sport among all age groups. The region’s high participation rates and the establishment of numerous pickleball courts are significant contributors.

The robust retail infrastructure and the rapid adoption of e-commerce platforms facilitate easy access to a wide variety of pickleball equipment. Furthermore, local manufacturers and international brands actively promote their products through aggressive marketing campaigns and sponsorships, increasing their visibility and appeal.

Looking forward, North America is expected to maintain its dominance in the Pickleball Shoes Market. The ongoing expansion of pickleball facilities and programs, coupled with rising health awareness and leisure activities, will continue to drive market growth. The region’s influence may increase as new players enter the sport and existing players upgrade their equipment.

Regional Mentions:

- Europe: Europe, with a focused development in sports infrastructure and increasing health consciousness, is quickly adopting pickleball. The market there benefits from community-based sports programs and local government support in sports activities.

- Asia Pacific: Asia Pacific shows promising growth in the Pickleball Shoes Market, supported by rising disposable incomes and increasing urbanization. Countries like Japan and South Korea are experiencing a surge in popularity for racket sports, which boosts the market.

- Middle East & Africa: The Middle East & Africa are gradually recognizing pickleball, with the market driven by expatriate communities and increasing investments in sports facilities. However, market growth is still nascent compared to other regions.

- Latin America: Latin America’s interest in pickleball is budding, with increased exposure through sports programs and community activities. The region shows potential for market expansion as awareness and accessibility to the sport improve.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

In the competitive Pickleball Shoes Market, four key players dominate: Adidas, Nike, ASICS, and New Balance. These companies are recognized for their strong brand presence and robust product offerings of pickleball clothing and shoes that cater to a wide range of player needs, from amateurs to professionals.

Adidas and Nike are industry giants with extensive experience in sports footwear. They leverage their innovative technologies and vast marketing resources to deliver high-performance pickleball shoes that offer durability, comfort, and style. Their global distribution networks ensure widespread availability of their products, enhancing their market penetration.

ASICS stands out for its focus on specialized sports shoes that provide exceptional support and agility, making them a favorite among pickleball players who value comfort during fast-paced games. New Balance, with its commitment to quality and fit, offers customized options that appeal to players looking for shoes that meet specific foot types or playing styles.

Together, these companies drive the market through continuous product development and strategic marketing campaigns. They not only support the growth of the sport but also set trends in footwear that influence consumer preferences and expectations in the pickleball community.

Major Companies in the Market

- Adidas

- Nike

- ASICS

- New Balance

- K-Swiss

- Wilson Sporting Goods

- Mizuno

- HEAD

- Puma

- Babolat

- Under Armour

- Skechers

- Salming

Recent Developments

- Skechers: On March 2025, Skechers officially entered the pickleball market by launching a new collection of footwear, apparel, and equipment in collaboration with professional players Tyson McGuffin and Catherine Parenteau, aiming to blend style, comfort, and performance for players of all skill levels.

- P448: On March 2025, P448 introduced a new line of performance court shoes in response to the growing popularity of racket sports such as tennis, pickleball, and padel, signifying its commitment to combining fashion-forward designs with functional athletic footwear.

Report Scope

Report Features Description Market Value (2024) USD 0.5 Billion Forecast Revenue (2034) USD 1.1 Billion CAGR (2025-2034) 8.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Indoor, Outdoor), By User Demographics (Men, Women, Children), By Distribution Channel (Online Retailers, Specialty Stores, Sporting Goods Stores, Other Channels) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Adidas, Nike, ASICS, New Balance, K-Swiss, Wilson Sporting Goods, Mizuno, HEAD, Puma, Babolat, Under Armour, Skechers, Salming Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Adidas

- Nike

- ASICS

- New Balance

- K-Swiss

- Wilson Sporting Goods

- Mizuno

- HEAD

- Puma

- Babolat

- Under Armour

- Skechers

- Salming