Global Trampoline Market By Type( Indoor, Outdoor), By Product Type (Round, Rectangular, Square, Spring free, Rebounder), By Size (Large, Medium, Mini), By Consumer Orientation (Children, Adults), By Application (Residential, Commercial, Play Schools, School Ground, Trampoline Parks, Gym, Others), By Distribution Channel (Specialty Stores, Hypermarkets, E-Commerce, Others), By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024–2033

- Published date: Dec 2024

- Report ID: 18401

- Number of Pages: 339

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

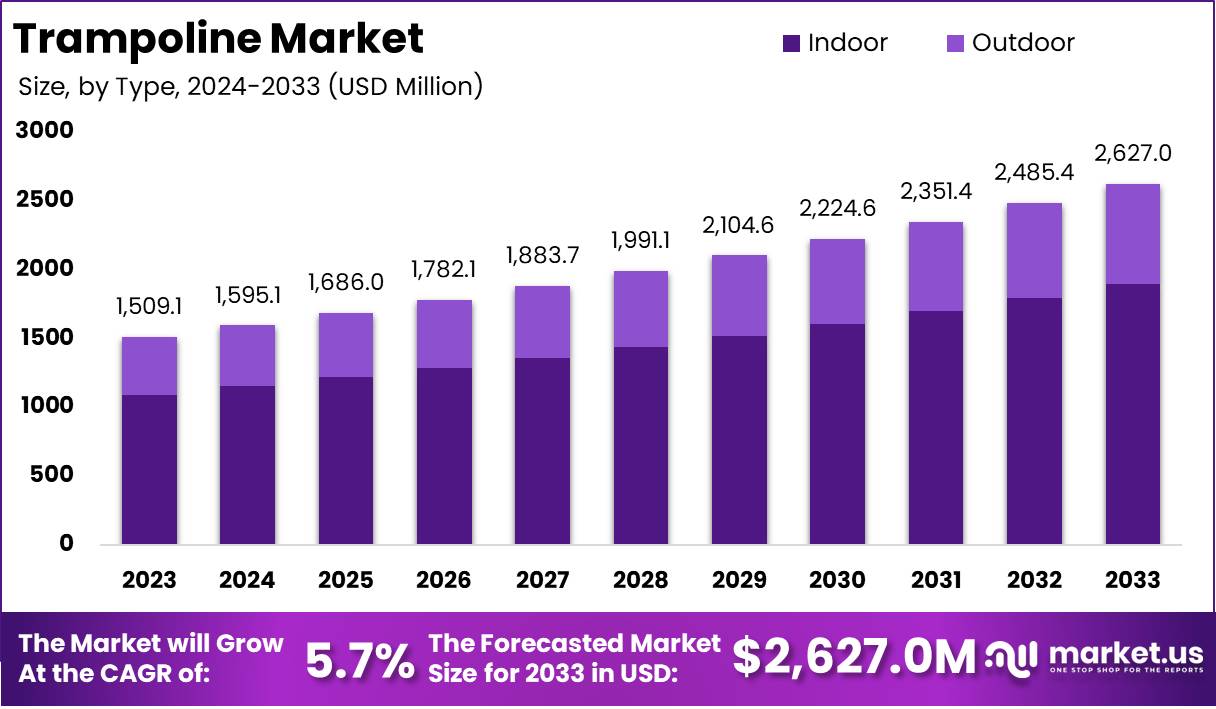

The Global Trampoline Market size is expected to be worth around USD 2,627.0 Million by 2033, from USD 1509.1 Million in 2023, growing at a CAGR of 5.7% during the forecast period from 2024 to 2033.

A trampoline is a recreational or fitness device designed with a taut, durable fabric stretched over a metal frame, supported by coiled springs or elastic bands. It enables users to bounce or perform acrobatic movements due to its elastic surface.

Originally popularized as a leisure activity, trampolines now serve a variety of purposes, including athletic training, rehabilitation, and fitness programs. Their usage spans multiple sectors, from home settings to gyms, schools, and professional sporting environments, underscoring their versatility.

The trampoline market encompasses the production, distribution, and sale of trampolines for recreational, fitness, and professional applications. This market includes a wide array of product types, such as round trampolines, rectangular trampolines, mini trampolines (rebounders), and springless trampolines, tailored to meet diverse user needs.

The trampoline market is witnessing significant growth, driven by multiple factors. Increasing awareness of health and wellness has positioned trampolines as an effective fitness tool, spurring demand among individuals seeking low-impact exercise solutions.

The demand for trampolines is fueled by their multifunctional appeal. On one hand, families view trampolines as a source of entertainment and physical activity for children, while on the other, fitness enthusiasts value them as an effective cardiovascular exercise tool.

According to Springfree Trampoline, the highest trampoline bounce ever recorded reached 22 ft, 1 in., highlighting both the performance potential of modern trampolines and their appeal as a recreational product. NASA research underscores the health benefits of trampolining, finding that 10 minutes of jumping burns more calories than 30 minutes of running, driving demand for trampolines in fitness-oriented segments.

However, safety concerns remain significant, with over 100,000 trampoline-related injuries reported annually in the U.S., 90% of which involve children aged 5-15. Notably, 34% of injuries occur at trampoline parks, where 55% result in fractures or dislocations, affecting primarily the lower extremities (36%), upper extremities (31.8%), head (14.5%), trunk (9.8%), and neck (7.9%).

Trampoline innovations also reflect rising consumer preferences for premium, permanent setups. For example, in-ground trampolines, costing over $5,000 to install, resemble backyard swimming pools in expense and installation complexity. Additionally, trampoline-related records, including 3,333 consecutive somersaults and 376 participants jumping simultaneously, emphasize their cultural relevance. As these trends converge, safety, product innovation, and health benefits are shaping future market dynamics.

According to Roller, the trampoline market demonstrates significant engagement among younger demographics, with 77% of all jumpers being 17 or younger, most requiring parental supervision. The 6-10 age group leads participation, accounting for 35%, followed by 11-15-year-olds at 26%. Toddlers aged 1-5 contribute 13%, while adults aged 21-40 represent 15%, indicating growing cross-generational appeal.

Key Takeaways

- The global trampoline market is set to grow from USD 1,509.1 million in 2023 to USD 2,627.0 million by 2033, at a CAGR of 5.7%.

- Outdoor trampolines led with 72.2% market share in 2023, driven by backyard recreation and enhanced safety features.

- Large trampolines dominated with 54.3% share, favored for group use and sturdy construction.

- Children’s trampolines held 64.3% share, reflecting high demand for youth-oriented recreational products.

- Residential trampolines captured 72.3% share, fueled by affordability and home-based usage.

- APAC led with 37.2% share in 2023, driven by rising disposable incomes and urbanization.

By Type Analysis

Outdoor Trampolines Dominating the Market with a 72.2% Share in 2023

In 2023, outdoor trampolines held a dominant market position in the By Type segment, capturing over 72.2% of the market share. This substantial share is attributed to the growing consumer preference for outdoor recreational activities, particularly in residential spaces such as backyards. The durability and larger size of outdoor trampolines make them a popular choice among families, contributing to their widespread adoption. Additionally, advancements in safety features, such as reinforced enclosures and weather-resistant materials, have further boosted demand in this segment.

Indoor trampolines accounted for a smaller yet steadily growing share of the market in 2023. Their compact size and suitability for limited spaces make them particularly appealing to urban households, schools, and fitness centers. These trampolines are often used for fitness routines, children’s play areas, and therapy purposes. While their market share remains secondary to outdoor trampolines, rising health awareness and innovative indoor trampoline designs are expected to drive future growth in this segment.

By Product Type Analysis

Round Trampolines Dominating the Market with a 47.2% Share in 2023

In 2023, round trampolines secured a dominant market position in the by product type segment, capturing over 47.2% of the market share. Their widespread popularity stems from their affordability, ease of use, and suitability for recreational purposes, particularly in residential settings.

Round trampolines are designed to evenly distribute force, ensuring enhanced safety, making them a preferred choice for families with children. This segment continues to benefit from high consumer demand and robust availability across various price ranges.

Rectangular trampolines held the second-largest share in 2023, favored by athletes and gymnasts for their superior bounce quality and larger jumping surface. This segment is particularly prominent in training centers, schools, and professional sports environments, where performance and precision are key.

Square trampolines captured a moderate share in the market, appealing to consumers seeking a balance between the spacious design of rectangular models and the compact efficiency of round ones. Their versatile application for both recreational and fitness activities positions them as a growing niche in the market.

Spring-free trampolines are emerging as an innovative solution, offering enhanced safety by replacing traditional springs with flexible rods. While their market share remains relatively small, the growing emphasis on injury prevention and premium features is expected to support steady growth in this segment.

Rebounder trampolines, designed specifically for low-impact fitness routines, represent a niche yet growing market segment. Their compact size and rising use in home-based fitness regimens are driving demand. As health and wellness trends gain momentum, rebounder trampolines are poised for further adoption among fitness enthusiasts and health-conscious consumers.

By Size Analysis

Large Trampolines Dominating the Market with a 54.3% Share in 2023

In 2023, large trampolines held a dominant market position in the by size segment, capturing more than 54.3% of the market share. Their popularity is driven by their ability to accommodate multiple users, making them an ideal choice for families and group recreational activities. Large trampolines are commonly used in outdoor settings such as backyards, and their sturdy construction and enhanced safety features further contribute to their widespread demand.

Medium trampolines accounted for a significant share of the market in 2023, appealing to consumers looking for a balance between size and functionality. These trampolines are well-suited for both children and adults, offering flexibility for recreational and fitness purposes, particularly in households with limited outdoor space.

Mini trampolines captured a smaller yet growing market share in 2023. Designed for personal fitness routines, these trampolines are particularly popular in urban areas where space constraints are a concern. Their affordability, portability, and rising use in low-impact exercise programs position them as a niche but promising segment in the trampoline market.

By Consumer Orientation Analysis

Children Trampolines Dominating the Market with a 64.3% Share in 2023

In 2023, children trampolines secured a dominant market position in the by consumer orientation segment, capturing more than 64.3% of the market share. Their popularity is driven by the strong demand for recreational and physical activity equipment tailored to younger users.

Enhanced safety features, such as enclosures and padded edges, coupled with vibrant designs, make these trampolines highly appealing to families. The increasing emphasis on outdoor play and exercise for children has further fueled growth in this segment.

Adult trampolines held a smaller but steadily expanding share of the market in 2023. These trampolines cater to fitness enthusiasts and recreational users, offering a robust design to support higher weight capacities and intense use. The growing popularity of trampoline-based exercise routines, such as rebound workouts, is expected to drive further demand in this segment.

By Application Analysis

Residential Trampolines Dominating the Market with a 72.3% Share in 2023

In 2023, residential trampolines held a dominant market position in the by application segment, capturing more than 72.3% of the market share. The high demand for residential trampolines is fueled by their widespread use in backyards, offering families an affordable and convenient way to promote outdoor recreation and exercise. Safety advancements and availability in a variety of sizes and designs have further solidified their popularity among homeowners, particularly those with children.

Commercial trampolines accounted for a notable share in 2023, driven by their use in trampoline parks, recreational centers, and fitness studios. These trampolines are designed for durability and frequent use, making them a key feature in commercial spaces catering to group activities.

Play schools and school grounds represent an important segment, leveraging trampolines for physical development and recreational purposes. Trampolines in these settings focus on safety and child-friendly designs, driving moderate yet steady demand.

Trampoline parks are emerging as a lucrative market segment, particularly in urban areas where entertainment-driven recreational activities are popular. Their role in group events, parties, and fitness sessions is boosting adoption in this category.

Trampolines in gyms represent a smaller but growing segment, driven by the rising popularity of trampoline-based fitness routines such as rebound workouts. Their compact size and health benefits make them increasingly appealing to fitness enthusiasts.

The Others segment includes trampolines used in professional training, therapy, and specialized recreational activities. Although this segment holds a relatively small share, it caters to specific consumer groups with unique requirements.

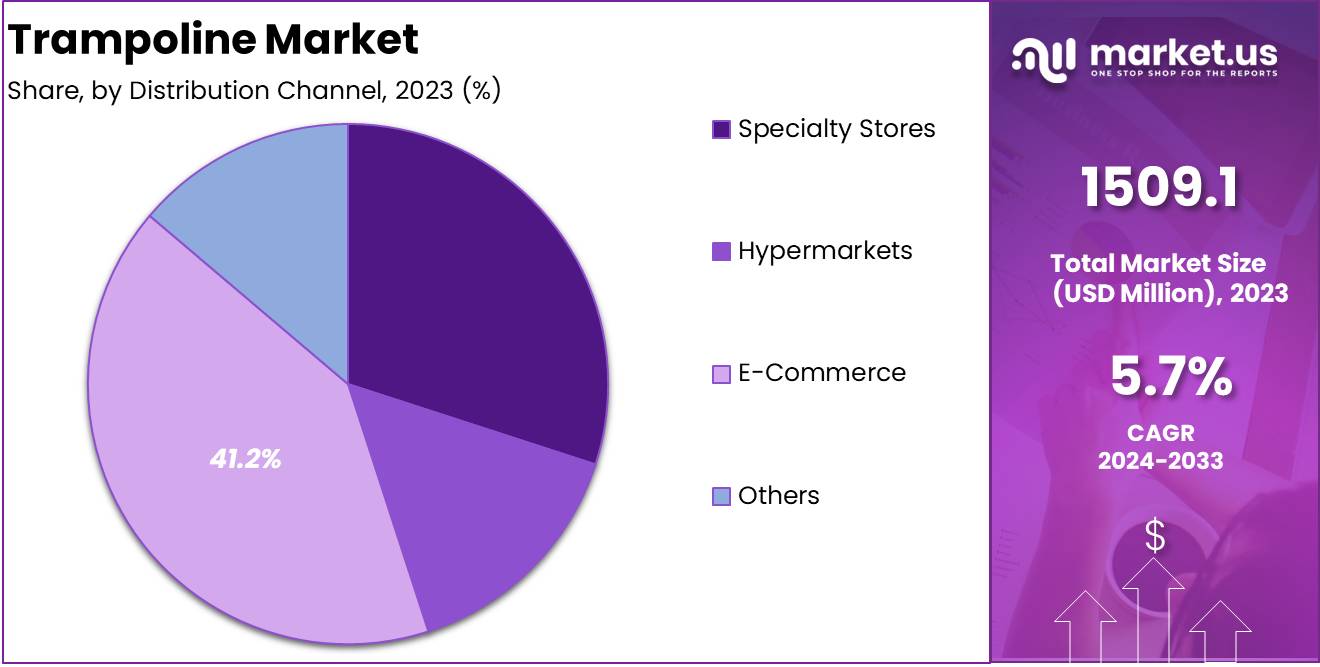

By Distribution Channel Analysis

E-Commerce Dominating the Market with a 41.2% Share in 2023

In 2023, e-commerce held a dominant market position in the by distribution channel segment, capturing more than 41.2% of the market share. The growing preference for online shopping, driven by convenience, competitive pricing, and a wide variety of options, has made e-commerce the leading channel for trampoline sales.

Additionally, the availability of detailed product descriptions, customer reviews, and doorstep delivery services has significantly boosted consumer confidence in purchasing trampolines online.

Specialty stores accounted for a significant share in 2023, offering customers expert guidance and access to premium-quality trampolines. These stores remain a preferred choice for buyers seeking personalized recommendations and professional support during their purchase.

Hypermarkets captured a moderate share in the market, benefiting from their ability to provide trampolines alongside a range of other household goods. Their convenient location and in-store promotions continue to attract consumers seeking instant purchases.

The Others category, including small-scale retailers and rental services, represents a smaller share of the market. These channels cater to niche consumer groups with specific needs, such as temporary usage or localized purchasing options.

Key Market Segments

By Type

- Indoor

- Outdoor

By Product Type

- Round

- Rectangular

- Square

- Spring free

- Rebounder

By Size

- Large

- Medium

- Mini

By Consumer Orientation

- Children

- Adults

By Application

- Residential

- Commercial

- Play Schools

- School Ground

- Trampoline Parks

- Gym

- Others

By Distribution Channel

- Specialty Stores

- Hypermarkets

- E-Commerce

- Others

Driver

Increasing Popularity of Fitness-Oriented Activities

The growing global emphasis on fitness and health has significantly boosted the demand for trampolines, positioning them as a fun, effective, and engaging workout tool. The trampoline’s ability to combine cardiovascular exercise with strength-building activities has made it particularly appealing to health-conscious individuals and families seeking home-based fitness solutions.

As awareness grows about the benefits of trampoline exercises, such as improving balance, coordination, and core strength, consumers increasingly see trampolines as an alternative to traditional workout equipment.

Moreover, the rise of social media platforms has amplified this trend, with fitness influencers showcasing trampoline workouts, further enhancing the product’s visibility and desirability. This expanding customer base, spanning adults, fitness enthusiasts, and children, has been a key growth driver for the trampoline market in 2024.

The fitness industry’s promotion of trampoline-based workouts as low-impact, joint-friendly alternatives to running or jumping on hard surfaces has also contributed to this trend. In an era where consumers are increasingly cautious about long-term health implications, trampolines are perceived as a safer way to maintain an active lifestyle.

Additionally, as remote work and hybrid work models become the norm, more people are investing in at-home fitness equipment, including trampolines.

These developments collectively position trampolines as a versatile solution catering to both recreational and fitness needs, fueling their adoption across diverse demographics. Consequently, the alignment of trampolines with the global health and wellness movement is driving sustained growth in the market.

Restraint

Safety Concerns and Associated Risks

Despite their growing popularity, trampolines face significant challenges due to safety concerns, which can limit their adoption, especially among parents and guardians. Trampoline-related injuries, such as sprains, fractures, and head trauma, have been frequently reported, raising apprehensions about their use, particularly for young children.

Studies highlight that improper use or lack of safety measures, such as inadequate padding or missing enclosure nets, significantly increases the risk of accidents. This concern has prompted healthcare professionals and safety organizations to issue warnings about the potential dangers of trampolines, influencing consumer purchasing decisions.

As a result, the perception of trampolines as potentially hazardous has hindered their widespread acceptance in certain regions, particularly in households with safety-conscious individuals.

These concerns are further exacerbated by insurance restrictions, with some homeowner insurance policies excluding coverage for trampoline-related injuries. This adds an additional layer of deterrence for potential buyers.

Manufacturers are attempting to address these issues by introducing safety-enhancing features, such as reinforced frames, improved spring systems, and protective enclosure nets. However, while these advancements aim to mitigate risks, they often lead to increased product costs, potentially discouraging price-sensitive customers.

Additionally, negative publicity around trampoline-related injuries can undermine consumer trust, requiring manufacturers and retailers to invest more heavily in educational campaigns about safe usage practices. Unless safety concerns are effectively addressed, they will continue to act as a restraint, limiting the market’s growth potential.

Opportunity

Expansion into Urban and Compact Spaces

The growing trend of urbanization and smaller living spaces is creating a significant opportunity for the trampoline market through the development of compact, foldable, and portable trampoline designs. Traditional trampolines, often perceived as requiring substantial space, have historically been unsuitable for urban dwellers with limited outdoor or indoor areas.

However, innovations in design and technology are making trampolines more adaptable to modern lifestyles. Mini-trampolines, also known as rebounders, are gaining popularity due to their compact size and versatility. These products cater to urban consumers who want to enjoy the benefits of trampoline workouts without the need for large backyards or dedicated spaces.

Furthermore, manufacturers are exploring creative ways to integrate trampolines into multifunctional spaces, such as home gyms or community fitness centers, enabling urban populations to access the product conveniently. The increased focus on portability has also opened opportunities in rental and sharing models, where consumers can access trampolines on-demand without committing to ownership.

With urban populations continuing to grow and fitness trends persisting in densely populated areas, these innovations position trampolines as an attractive solution for space-constrained environments. As a result, the trampoline market is poised to benefit from the increasing alignment of product features with the needs of urban consumers, driving growth in untapped demographic segments.

Trends

Rising Adoption of Smart Trampolines

In 2024, the trampoline market is witnessing a strong shift towards digitization and technology integration with the rise of smart trampolines. These innovative products are equipped with sensors, connected apps, and gamification features that elevate the user experience by merging physical activity with digital interactivity.

Smart trampolines appeal to tech-savvy consumers, especially parents seeking engaging ways to keep their children active and entertained. These trampolines can monitor jumping patterns, track calories burned, and provide real-time feedback, offering a gamified approach to fitness. Such features enhance their value proposition, making them appealing to both recreational users and fitness enthusiasts.

The gamification aspect has proven particularly effective in attracting younger users, as it combines physical activity with interactive challenges, rewards, and virtual competitions. Moreover, the inclusion of fitness tracking tools has made smart trampolines a sought-after option for adults aiming to achieve their fitness goals in an engaging manner.

The rise in wearable fitness devices has further complemented this trend, as smart trampolines seamlessly integrate with existing ecosystems, including smartphones and fitness bands.

As consumers increasingly demand personalized and interactive fitness experiences, smart trampolines are expected to become a significant driver of market growth, establishing a new standard in trampoline innovation. These advancements underscore the trampoline market’s responsiveness to evolving consumer preferences, paving the way for sustained expansion.

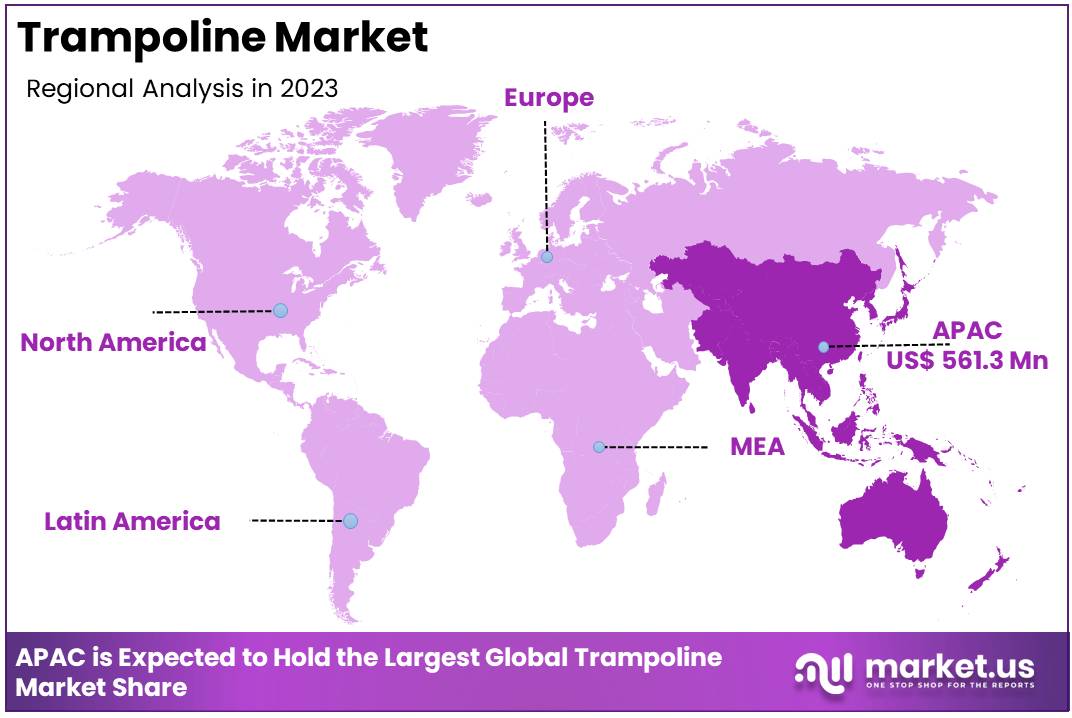

Regional Analysis

Asia Pacific Leads the Trampoline Market with Largest Market Share of 37.2% in 2023

The global trampoline market exhibits significant regional variations, with the Asia Pacific (APAC) region emerging as the dominant player, holding the largest market share of 37.2% in 2023. This leadership position is underpinned by robust consumer demand, fueled by increasing disposable incomes, urbanization, and a rising interest in fitness and recreational activities.

The APAC trampoline market is valued at USD 561.3 million, driven by high population densities and the growing popularity of outdoor activities among families, particularly in countries like China, India, and Japan. These nations are witnessing increased investments in sports infrastructure, along with a surge in trampoline parks and fitness centers, further bolstering regional growth.

In North America, the trampoline market demonstrates steady growth, underpinned by strong recreational trends and a well-established culture of backyard sports. The region is characterized by widespread adoption of trampolines as a family-oriented activity, with a significant focus on safety standards and innovative product designs. The rising awareness of trampolines as fitness equipment has also contributed to demand, particularly in the U.S. and Canada.

Europe follows closely as a prominent region for trampoline adoption, driven by increasing health consciousness and government initiatives promoting physical activity among children and adults. Key markets such as Germany, the U.K., and France exhibit substantial demand, particularly in urban centers where residential gardens and recreational facilities integrate trampoline installations.

The Middle East & Africa (MEA) region presents a developing yet promising market for trampolines. Rising disposable incomes, coupled with the expanding middle-class population, are driving the demand for outdoor recreational equipment.

Countries such as the United Arab Emirates and South Africa are witnessing growing popularity for trampolines in both residential and commercial settings, including schools, parks, and fitness centers. While infrastructural limitations in certain areas may pose challenges, the market potential remains significant, with increased adoption anticipated over the coming years.

Latin America, though comparatively smaller in market share, reflects gradual growth fueled by urbanization and a rising inclination toward recreational activities. Key countries such as Brazil, Mexico, and Argentina are witnessing increasing adoption of trampolines as part of family leisure and fitness routines. The region also benefits from a youthful population, which drives demand for innovative and affordable trampoline products.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

The global trampoline market in 2024 is poised for dynamic competition, driven by a diverse array of key players ranging from established global brands to specialized niche manufacturers. Leading companies like Airmaster Trampoline, Eurotramp Trampoline Kurt Hack GmbH, and Springfree Trampoline Inc.

continue to dominate through their focus on innovative designs, safety-enhanced features, and robust manufacturing standards, appealing to both recreational and professional users. Skywalker Holdings LLC and Jump King maintain strong market positions by leveraging wide product portfolios and effective pricing strategies, catering to a broad demographic spanning families and fitness enthusiasts.

On the premium end, brands such as Vuly Trampolines Pty Ltd. and Jumpflex differentiate themselves with cutting-edge materials and advanced engineering that emphasize durability and user experience. Meanwhile, companies like Plum Products Ltd. and Stamina Products Inc. are capitalizing on the rising demand for fitness-centric trampolines, blending functionality with affordability.

Emerging players, including Domi Jump Inc. and Luna, are gaining traction in cost-sensitive markets by offering competitive pricing and customization options. Multiplay International Ltd. and Sino Fourstar Group Co. Ltd. stand out in the commercial and wholesale segments, leveraging extensive distribution networks to reach schools, gyms, and entertainment parks.

Furthermore, sustainability and eco-friendly production are becoming critical differentiators, with players such as Pure Global Brands Inc. incorporating recyclable materials to appeal to environmentally conscious consumers. This competitive landscape highlights the critical role of innovation, brand differentiation, and targeted strategies in driving growth in the trampoline market.

Top Key Players in the Market

- Airmaster Trampoline

- Domi Jump Inc.

- Eurotramp Trampoline Kurt Hack GmbH

- Fourstar

- Jump King

- Jumpflex

- Multiplay International Ltd.

- Plum Products Ltd.

- Pure Global Brands Inc.

- Sino Fourstar Group Co. Ltd.

- Skywalker Holdings LLC

- Springfree Trampoline Inc.

- Stamina Products Inc.

- Upper Bounce

- Vuly Trampolines Pty Ltd.

- Y J Corporation

- Luna

- Sportspower

Recent Developments

- In 2024, Sky Zone announced plans to expand its footprint with 10 new parks across high-demand cities, including Austin, Seattle, Henderson, and Atlanta. The new parks, part of single and multi-park franchise agreements, are scheduled to open by early 2026, aiming to bring more family-friendly entertainment to growing markets.

- In 2024, Trampoline, a rising B2B home décor brand, secured $5 million in seed funding, led by Matrix Partners India and WaterBridge Ventures, with Alteria Capital contributing $2 million in venture debt. This funding will enhance Trampoline’s supply chain, product development, and team-building efforts, accelerating its growth in the competitive home décor space.

- In 2023, Vuly Play donated an Ultra Medium Trampoline, valued at over $1,049, as part of a sponsorship initiative. Known as Australia’s leading outdoor play equipment manufacturer, Vuly Play designs products with advanced safety features tailored to diverse outdoor conditions, promoting safe and active play for children nationwide.

- In 2023, Bounce India introduced its 40,000 sq. ft. indoor adventure park, featuring over 100 interconnected trampolines and freestyle zones. The park includes thrilling activities like X-Park, Slam Dunk, and Big Bag, fostering physical activity, creativity, and confidence in a vibrant, inclusive setting.

Report Scope

Report Features Description Market Value (2023) US$ 1509.1 Mn Forecast Revenue (2033) US$ 2,627.0 Mn CAGR (2024-2033) 5.7% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type( Indoor, Outdoor), By Product Type (Round, Rectangular, Square, Spring free, Rebounder), By Size (Large, Medium, Mini), By Consumer Orientation (Children, Adults), By Application (Residential, Commercial, Play Schools, School Ground, Trampoline Parks, Gym, Others), By Distribution Channel (Specialty Stores, Hypermarkets, E-Commerce, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Airmaster Trampoline, Domi Jump Inc., Eurotramp Trampoline Kurt Hack GmbH, Fourstar, Jump King, Jumpflex, Multiplay International Ltd., Plum Products Ltd., Pure Global Brands Inc., Sino Fourstar Group Co. Ltd., Skywalker Holdings LLC, Springfree Trampoline Inc., Stamina Products Inc., Upper Bounce, Vuly Trampolines Pty Ltd., Y J Corporation, Luna, Sportspower Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Airmaster Trampoline

- Domi Jump Inc.

- Eurotramp Trampoline Kurt Hack GmbH

- Fourstar

- Jump King

- Jumpflex

- Multiplay International Ltd.

- Plum Products Ltd.

- Pure Global Brands Inc.

- Sino Fourstar Group Co. Ltd.

- Skywalker Holdings LLC

- Springfree Trampoline Inc.

- Stamina Products Inc.

- Upper Bounce

- Vuly Trampolines Pty Ltd.

- Y J Corporation

- Luna

- Sportspower