Global Home Entertainment Systems Market By Device (Video Devices, Audio Devices, Gaming Consoles), By Distribution Channel (Offline, Online), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 133721

- Number of Pages: 355

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

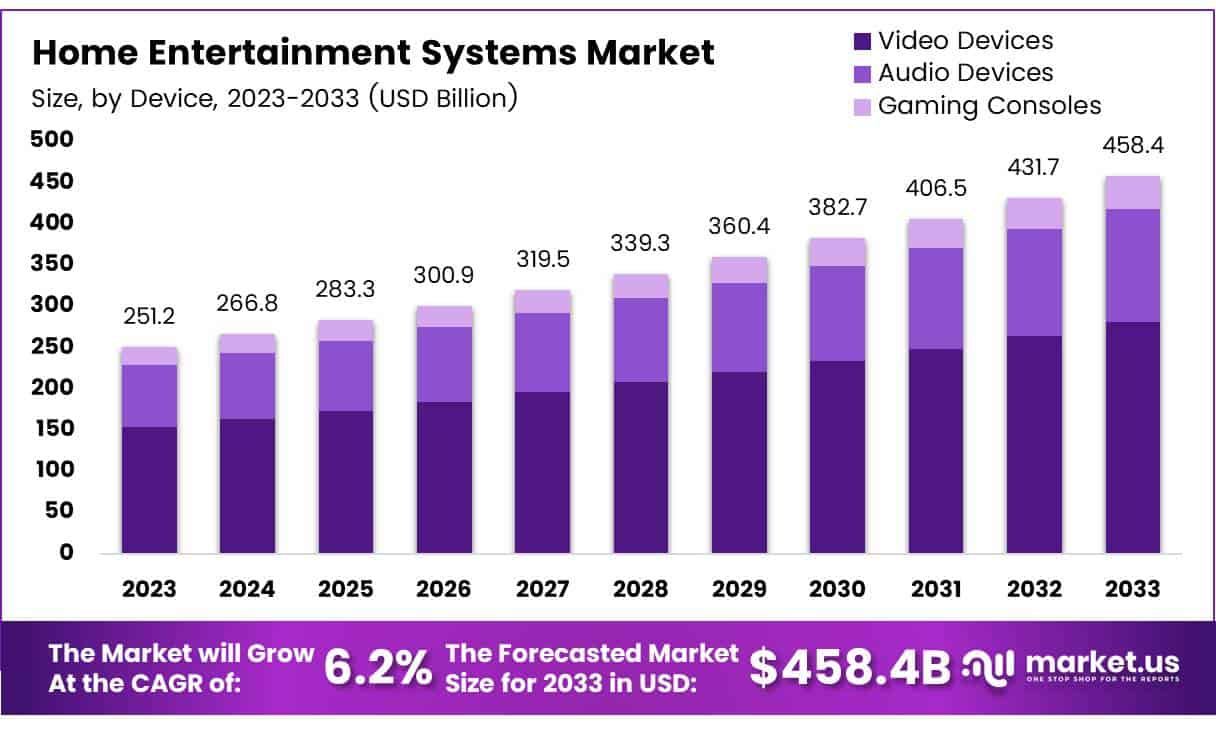

The Global Home Entertainment Systems Market size is expected to be worth around USD 458.4 Billion by 2033, from USD 251.2 Billion in 2023, growing at a CAGR of 6.2% during the forecast period from 2024 to 2033.

Home entertainment systems include a variety of electronic devices like televisions, gaming consoles, and smart home technologies that deliver audio, video, and interactive media content.

These systems are becoming more interconnected and smarter, incorporating technologies such as the Internet of Things (IoT) to enhance user experience and connectivity.

The market is experiencing significant growth, fueled by technological evolution and changing consumer habits towards home-based entertainment. The integration of smart technologies, including voice-activated systems and smart TVs, along with the spread of high-speed internet, drives this expansion. Additionally, the increasing demand for immersive experiences through virtual reality (VR) and augmented reality (AR) is creating new opportunities for market players.

Government actions also significantly impact this market. Regulations on data privacy, energy consumption, and device compatibility ensure the safety, efficiency, and environmental friendliness of new devices.

The landscape of home entertainment is robust, with smart TVs leading the charge. According to Hub Entertainment Research, a staggering 79% of U.S. homes now own a smart TV, illustrating the significant penetration of advanced viewing technologies in everyday life.

Furthermore, the adoption of smart home devices is on the rise, indicating a broader integration of technology in the home environment. Electroiq reports that in the United States, 23% of broadband consumers own three or more smart home devices, while 50% of households own at least one.

Voice-assistant devices have become a crucial element of the smart home ecosystem, with Amazon Alexa dominating the market at a usage rate of 79%, followed by Google Home at 11%, and Siri at 7%.

The entertainment consumption behaviors are also evolving, with Nielsen noting a 3.7% rise in TV viewing in January, primarily fueled by events like the NFL playoffs and colder weather conditions. This seasonal fluctuation highlights the importance of content and events in driving the usage of home entertainment systems.

Lastly, the gaming console market continues to thrive as a core component of home entertainment systems, with the PlayStation 5 console exemplifying success in this arena. With nearly 22 million devices sold in 2023 alone, the gaming sector remains a potent force in driving the market’s growth and innovation, appealing to a broad demographic of users from casual viewers to avid gamers.

Key Takeaways

- The Global Home Entertainment Systems Market is projected to grow from USD 251.2 billion in 2023 to USD 458.4 billion by 2033, with a CAGR of 6.2%.

- Video devices dominated the device segment of the market in 2023, holding a 60.2% share due to increasing consumer demand for high-definition viewing experiences.

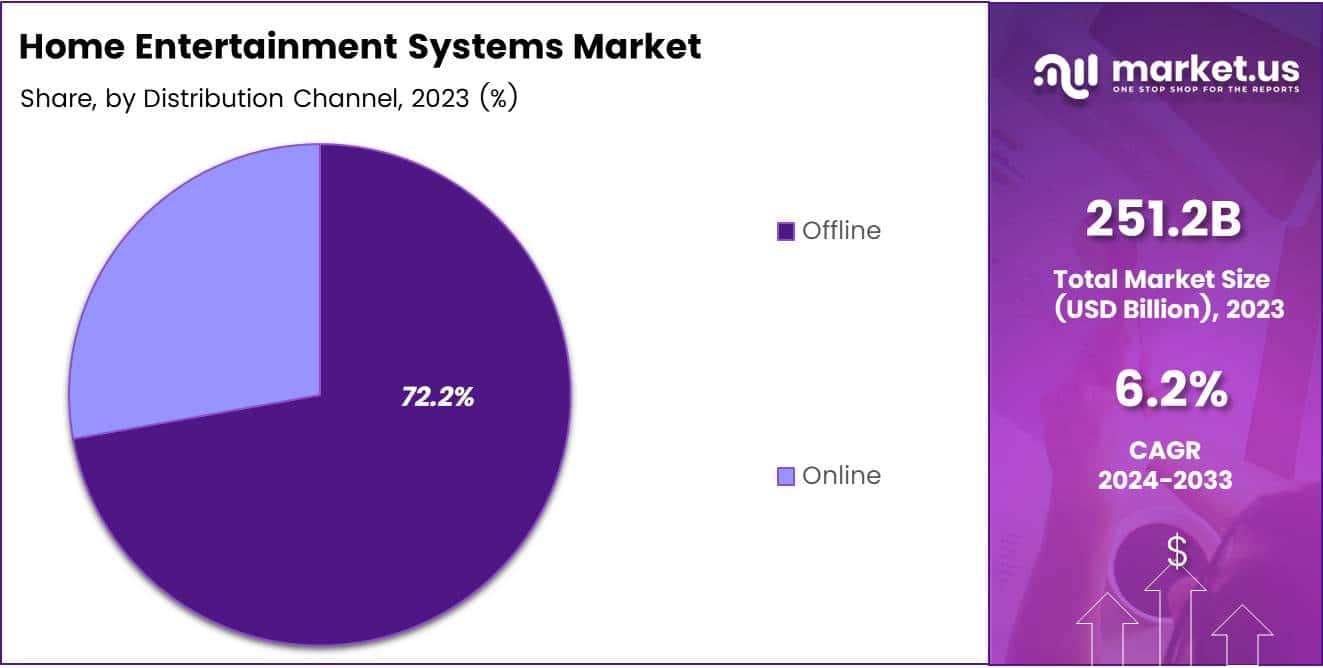

- Offline sales channels led the distribution market in 2023, capturing a 72.2% share, highlighting consumer preference for experiencing products in person.

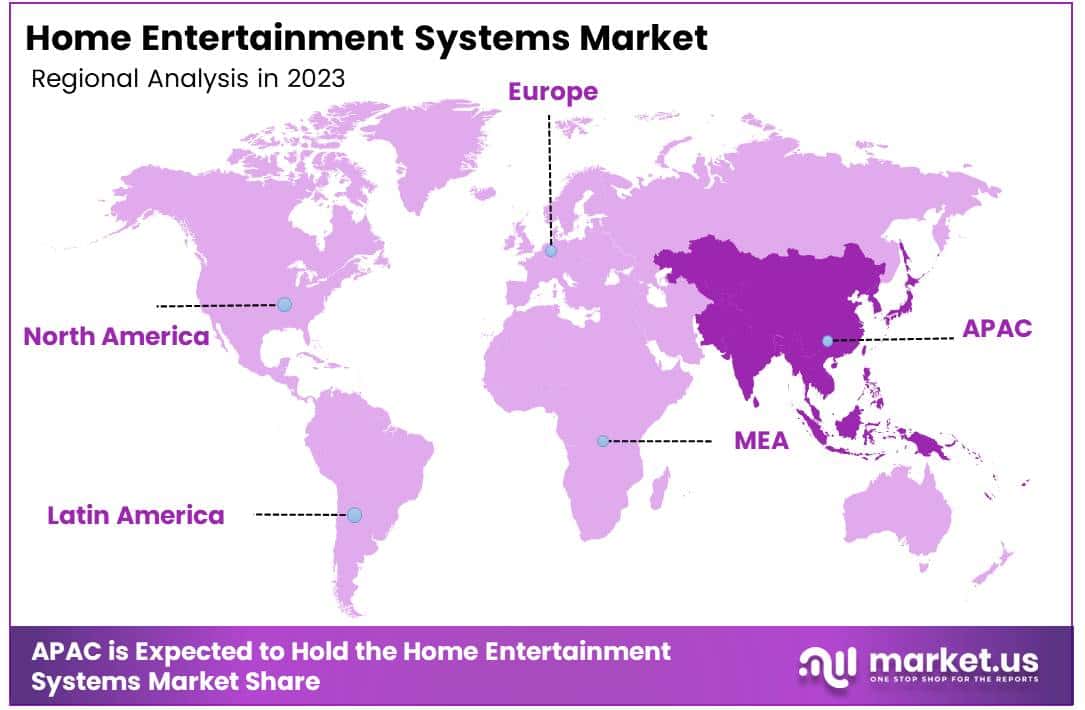

- Asia Pacific is the leading region in the home entertainment systems market due to rapid urbanization and rising incomes, suggesting continued growth and market dominance.

Device Analysis

Video Devices Lead with 60.2% Market Share in 2023 Home Entertainment Systems

In 2023, Video Devices held a dominant market position in the By Device Analysis segment of the Home Entertainment Systems Market, with a 60.2% share. This substantial market share underscores the growing consumer preference for high-definition televisions, projectors, and streaming devices, reflecting a significant shift towards visual-based entertainment.

The proliferation of streaming services and advancements in display technologies have further bolstered the demand for video devices, making them a central component of modern home entertainment setups.

Audio Devices also played a pivotal role in the market, enhancing the audio-visual experience essential for a comprehensive home entertainment system. High-quality speakers, soundbars, and home theater systems have seen consistent growth, driven by innovations in sound technology and the increasing importance of immersive audio experiences in home entertainment.

Gaming Consoles continued to carve a niche in the market, driven by the rising popularity of interactive and virtual gaming. These devices benefit from ongoing technological advancements and a strong ecosystem of games and online services, appealing to a broad demographic from casual gamers to dedicated enthusiasts.

Distribution Channel Analysis

Offline Dominates Home Entertainment Systems Market with 72.2% Share in 2023

In 2023, Offline held a dominant market position in the By Distribution Channel Analysis segment of the Home Entertainment Systems Market, boasting a substantial 72.2% share. This segment’s success is largely attributed to consumer preferences for a tactile buying experience, where they can test and evaluate the audio and visual quality of systems before purchase.

Retail stores also offer the advantage of immediate possession, avoiding the wait times associated with online orders, which is a significant deciding factor for many consumers looking to enhance their home entertainment setups immediately.

Conversely, the Online segment, while growing, caters to a different consumer behavior, focused on convenience and often more competitive pricing. However, the sensory limitations of not being able to experience the product firsthand, coupled with concerns over damage during shipping, have slowed its adoption rate compared to offline sales.

As digital platforms evolve and consumer trust in online purchases strengthens, it is expected that the online share will gradually increase, fueled by enhanced e-commerce technologies and improved consumer engagement strategies.

Key Market Segments

By Device

- Video Devices

- Audio Devices

- Gaming Consoles

By Distribution Channel

- Offline

- Online

Drivers

Demand for Smart Devices Fuels Home Entertainment Systems Market

The home entertainment systems market is experiencing robust growth primarily driven by the rising demand for smart devices. Consumers are increasingly integrating smart TVs, speakers, and home automation systems into their living spaces, which is propelling market growth. These smart devices offer enhanced connectivity and can be easily controlled via smartphones or voice commands, making them highly attractive to tech-savvy users.

Additionally, advancements in technology such as 4K, 8K, and OLED display innovations are significantly improving user experiences by delivering superior image quality and vibrant displays. The market is also benefiting from the growing popularity of streaming services like Netflix, Hulu, and Disney+.

These platforms provide a wide range of content, prompting users to invest in advanced home entertainment systems that can support high-quality audio and video streaming, thereby enriching the overall viewing and listening experience at home.

Restraints

Challenges of High Initial Costs and Space Constraints

The home entertainment systems market faces notable challenges that could slow its growth. Firstly, the high initial costs associated with premium entertainment systems present a significant barrier, particularly for middle-income households. These systems often come with advanced features and high-quality components, making them expensive and less accessible to a broader audience.

Additionally, as urban living spaces become increasingly compact, many consumers find it difficult to accommodate elaborate home entertainment setups. This limitation is especially prevalent in apartments and smaller homes where space is at a premium. Together, these factors restrict the potential customer base, as not everyone can afford or physically fit these systems into their living spaces.

Growth Factors

Expanding Wireless Technology Adoption

The home entertainment systems market is seeing exciting growth opportunities, especially with the rising popularity of wireless technologies. Consumers are increasingly drawn to wireless soundbars and speakers due to their convenience and the clutter-free setup they offer, fueling demand in this sector.

Additionally, the integration of artificial intelligence (AI) in home entertainment systems is transforming how users interact with their devices, offering personalized experiences and enhanced functionalities. For example, AI can optimize sound quality based on room acoustics or viewer location, making it a significant draw for tech-savvy consumers.

Furthermore, there’s potential for market expansion through partnerships with streaming services, where companies can offer subscription bundles that include advanced audio systems, attracting a broader customer base seeking comprehensive entertainment solutions. These factors collectively create a vibrant landscape for growth in the home entertainment systems market.

Emerging Trends

Voice Control Features Enhance User Convenience

Voice control features are increasingly defining the home entertainment systems market, as consumers show a strong preference for convenience and seamless interaction with their devices.

The integration of voice assistants like Alexa and Google Assistant allows users to control their media setups, adjust settings, and access content through simple voice commands, eliminating the need for remote controls or manual inputs. This trend is further driven by the compatibility of these systems with various smart home devices, making them central to creating interconnected, user-friendly home environments.

Furthermore, advancements in AI and machine learning are continuously improving voice recognition capabilities, making these systems more appealing by offering a more intuitive and responsive user experience. This shift towards voice-enabled home entertainment options is redefining how consumers interact with technology in their leisure time, prioritizing ease and accessibility.

Regional Analysis

Asia Pacific Dominates Home Entertainment Systems Market

Asia Pacific dominates the global landscape, holding the largest market share in terms of revenue. This region’s dominance, driven by rapid urbanization, increasing disposable incomes, and the growing popularity of home entertainment solutions among a vast population base, is expected to continue.

The market in Asia Pacific is particularly propelled by emerging economies like China and India, where the adoption of connected devices and internet penetration is surging.

Regional Mentions:

North America is a significant player in the Home Entertainment Systems market, driven by high consumer spending power and a robust presence of leading technology companies. Innovations in smart home technologies and high adoption rates of devices such as smart TVs and sound systems contribute to the growth in this region. The market is also supported by a well-established digital infrastructure that facilitates the latest home entertainment solutions.

Europe follows closely, with a strong focus on high-quality audio equipment and advanced gaming systems. European consumers’ preference for high-end aesthetics and sound quality fuels the demand for premium home entertainment systems. The region benefits from the presence of several key global players and a sophisticated consumer base that prioritizes immersive audiovisual experiences.

In Latin America, the market is growing steadily, thanks to improving economic conditions and the expansion of middle-class populations who are increasingly investing in home entertainment. The region shows a keen interest in new technologies, with a significant uptick in smart home devices.

Middle East & Africa also shows promising growth, attributed mainly to the luxury segment in countries like the UAE and Saudi Arabia, where there is high demand for state-of-the-art home entertainment systems.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the global Home Entertainment Systems market witnessed significant contributions from several key players, each bringing unique advancements and strategic developments to the sector.

Samsung Electronics Co. Ltd. continues to lead with its innovative product launches that integrate cutting-edge technology and user-centric designs. Samsung’s emphasis on high-resolution screens and connected devices has helped it maintain a competitive edge in the market.

Koninklijke Philips N.V. focuses on delivering personalized experiences through its range of smart home theater systems, which are designed to integrate seamlessly with the Internet of Things (IoT), enhancing user engagement and comfort.

Haier Inc. has expanded its market presence by leveraging its capabilities in smart appliances to introduce entertainment systems that are compatible with various smart home products, focusing on convenience and energy efficiency.

Microsoft Corporation has made impactful strides with its Xbox series, which has transcended traditional gaming to become a central hub for home entertainment, incorporating streaming services, social media, and more.

Mitsubishi Electric Corporation is noted for its high-quality display technology, which includes cutting-edge projectors and display systems that offer exceptional clarity and are suited for both home cinema enthusiasts and a broader consumer base looking for superior viewing experiences.

Sennheiser electronic GmbH & Co. KG and Bose Corporation are pivotal in enhancing audio experiences in home entertainment systems. Their dedication to sound innovation ensures immersive audio that complements visual advancements from other key players.

Panasonic Corporation and Sony Corporation remain vital in shaping the market through their continual innovation in both visual and audio electronics. Sony, particularly, has been a frontrunner in integrating artificial intelligence with its devices to improve user interactivity and content delivery.

Lastly, LG Electronics Inc. stands out with its commitment to user-friendly interfaces and pioneering technologies like OLED, which are essential for the high-definition viewing experience that today’s consumers demand.

Top Key Players in the Market

- Samsung Electronics Co. Ltd.

- Koninklijke Philips N.V.

- Haier Inc.

- Microsoft Corporation

- Mitsubishi Electric Corporation

- Sennheiser electronic GmbH & Co. KG

- Bose Corporation

- Panasonic Corporation

- Sony Corporation

- LG Electronics Inc.

Recent Developments

- In July 2024, Circuit House Technologies successfully raised $4.3 million in a funding round aimed at accelerating their technology development and expanding market reach.

- In October 2023, Imbue secured an additional $12 million in combined funding from the Alexa Fund and Eric Schmidt, former CEO of Google and Executive Chairman of Alphabet, to enhance their product offerings and boost their operational capabilities.

- In April 2024, gaming start-up LightFury secured $8.5 million in funding to support their innovative gaming projects and expand their team to meet growing demand.

- In October 2023, Harmony Games secured $3 million in seed round funding, led by Griffin Gaming Partners, to further develop their gaming platforms and increase their presence in the competitive gaming market.

Report Scope

Report Features Description Market Value (2023) USD 251.2 Billion Forecast Revenue (2033) USD 458.4 Billion CAGR (2024-2033) 6.2% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Device (Video Devices, Audio Devices, Gaming Consoles), By Distribution Channel (Offline, Online) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Samsung Electronics Co. Ltd., Koninklijke Philips N.V., Haier Inc., Microsoft Corporation, Mitsubishi Electric Corporation, Sennheiser electronic GmbH & Co. KG, Bose Corporation, Panasonic Corporation, Sony Corporation, LG Electronics Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Home Entertainment Systems MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample

Home Entertainment Systems MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Samsung Electronics Co. Ltd.

- Koninklijke Philips N.V.

- Haier Inc.

- Microsoft Corporation

- Mitsubishi Electric Corporation

- Sennheiser electronic GmbH & Co. KG

- Bose Corporation

- Panasonic Corporation

- Sony Corporation

- LG Electronics Inc.