Global Smart Speaker Market By Virtual Personal Assistant (Siri, Alexa, Google Assistant, DuerOS, Cortana, Ali Genie, Others), By Component (Hardware, Software), By Application (Smart Home, Smart Office, Consumers), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 51895

- Number of Pages: 331

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

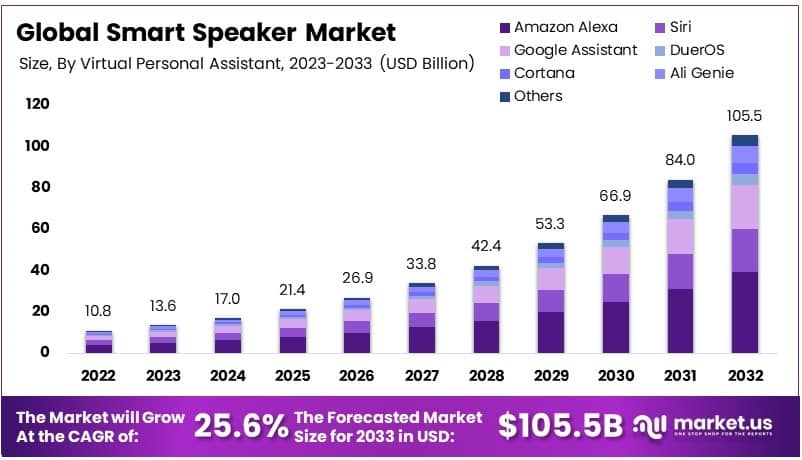

The Global Smart Speaker Market size is expected to be worth around USD 105.5 Billion by 2033, from USD 10.8 Billion in 2023, growing at a CAGR of 25.6% during the forecast period from 2024 to 2033.

A smart speaker is a voice-activated device that uses artificial intelligence to play music, answer questions, and control smart home devices. Integrated with virtual assistants, these speakers provide a hands-free way for users to interact with technology and enhance convenience in daily tasks.

The smart speaker market includes the production, sale, and development of voice-activated devices with AI capabilities. This market caters to consumers seeking enhanced connectivity and convenience. It covers a range of devices from basic speakers to advanced models that control entire smart home ecosystems.

The smart speaker market is experiencing steady growth, driven by rising adoption of smart home technology and increasing integration of AI features. According to NRP, 35% of U.S. adults now own a smart speaker, indicating strong consumer acceptance.

Amazon reports that global sales of Alexa-enabled devices exceeded 500 million units by May 2023, highlighting substantial demand and market penetration. Innovations in AI are reshaping the market landscape, with companies like Amazon and Apple enhancing their devices’ capabilities through partnerships and technology upgrades.

Moreover, Amazon’s partnership with Anthropic, announced in August 2024, aims to integrate Claude AI models into Alexa, while Apple plans to incorporate OpenAI’s ChatGPT into Siri. These advancements indicate a shift toward more intuitive and responsive voice assistants.

The demand for smart speakers is closely linked to the expansion of smart home technology. In 2024, about 69.91 million U.S. households are projected to use smart home devices, a 10.2% increase from 63.43 million in 2023, according to OBERLO.

The smart speaker industry benefits from this trend, as these devices serve as central hubs for managing various smart home functions. Market saturation is rising in regions like North America, where high ownership rates indicate mature demand, yet emerging markets present growth potential as urbanization and tech adoption increase. Competition remains high, with established players and new entrants vying to differentiate through improved AI features and ecosystem integration.

Key Takeaways

- The Smart Speaker Market was valued at USD 10.8 Billion in 2023 and is expected to reach USD 105.5 Billion by 2033, with a CAGR of 25.6%.

- In 2023, Amazon Alexa leads the virtual personal assistant segment with 37.1%, owing to its high user engagement.

- In 2023, Software is the dominant component, emphasizing the role of digital solutions in the smart home ecosystem.

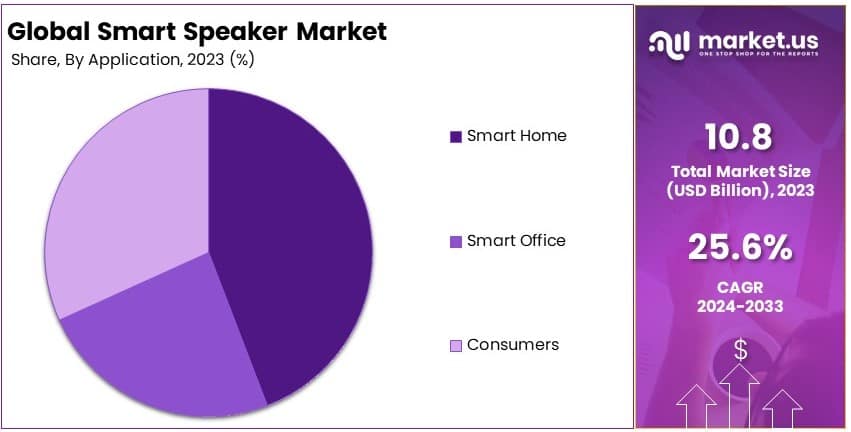

- In 2023, Smart Home is the leading application, driven by the increasing demand for home automation.

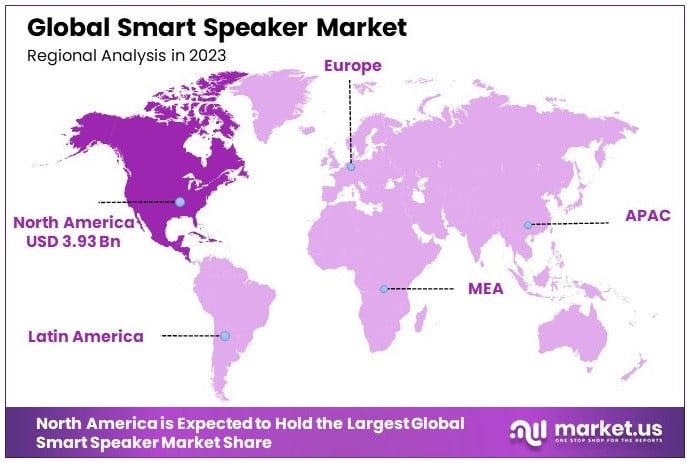

- In 2023, North America leads with 36.4% market share, underscoring its technological advancement and adoption rate.

Virtual Personal Assistant Analysis

Amazon Alexa dominates with 37.1% due to its extensive ecosystem and user-friendly features.

Amazon Alexa leads the Virtual Personal Assistant segment in the smart speaker market, holding a substantial 37.1% market share. This dominance is primarily driven by Alexa’s robust ecosystem, which integrates seamlessly with a wide range of smart home devices, making it a preferred choice for consumers seeking comprehensive home automation solutions.

Additionally, Alexa’s continuous updates and improvements in natural language processing enhance user experience, allowing for more accurate and intuitive voice interactions. Amazon’s strategic partnerships with various manufacturers have also expanded Alexa’s presence across different smart speaker models, further solidifying its market position.

Siri, Apple’s Virtual Personal Assistant, maintains a significant presence in the market, leveraging Apple’s loyal customer base and seamless integration with iOS devices. Google Assistant continues to grow rapidly, benefiting from Google’s advanced search capabilities and integration with Google services.

DuerOS, developed by Baidu, caters primarily to the Chinese market, offering localized features and language support. Cortana, Microsoft’s Virtual Personal Assistant, has seen limited adoption due to strategic shifts away from consumer-facing products.

Ali Genie, Alibaba’s virtual assistant, is gaining traction in the Chinese market with its focus on e-commerce integration. Other Virtual Personal Assistants, although holding smaller market shares, contribute to the competitive landscape by offering unique features and catering to niche segments.

Component Analysis

Software dominates the component segment due to advancements in AI and seamless integration capabilities.

In the smart speaker market, the software component holds a leading position, driven by significant advancements in artificial intelligence (AI) and machine learning technologies. Software developments enhance the functionality and intelligence of smart speakers, enabling more accurate voice recognition, personalized responses, and seamless integration with various smart home devices and services.

The continuous improvement of natural language processing allows smart speakers to understand and execute complex commands, thereby enhancing user satisfaction and engagement. Additionally, software updates and the introduction of new features keep the devices relevant and capable of meeting evolving consumer demands.

The rise of cloud computing and data analytics further supports the software component by providing the necessary infrastructure for real-time processing and data management, essential for delivering efficient and responsive user experiences.

Hardware remains a crucial sub-segment, focusing on the physical aspects of smart speakers such as design, audio quality, and connectivity options. While hardware innovations contribute to the overall appeal and functionality of smart speakers, the rapid pace of software advancements often takes precedence in driving market growth.

Manufacturers continue to invest in high-quality materials and advanced audio technologies to differentiate their products in a competitive market. However, without robust software capabilities, the full potential of smart speakers cannot be realized, underscoring the dominance of the software component in the overall market landscape.

Application Analysis

Smart Home is the dominant application segment due to the increasing adoption of home automation technologies.

The Smart Home application segment leads the smart speaker market, propelled by the growing trend of home automation and the desire for connected living environments. Smart speakers serve as central hubs for managing various smart devices such as lighting, smart thermostats, security systems, and entertainment systems, providing users with convenient and centralized control.

The integration of smart speakers with popular home automation platforms like Amazon Alexa, Google Assistant, and Apple HomeKit facilitates seamless interactions and enhances the overall user experience. Additionally, the rising awareness of energy efficiency and security among consumers drives the adoption of smart home technologies, further boosting the demand for smart speakers.

Smart Office applications represent a growing segment, with businesses leveraging smart speakers to enhance productivity and streamline operations. Smart speakers in office environments can facilitate tasks such as scheduling meetings, managing communications, and controlling office equipment, contributing to more efficient workflows.

Consumers also form a significant segment, using smart speakers for personal entertainment, information access, and daily task management. While the Smart Home segment remains dominant, the expansion into smart office and consumer applications highlights the versatility and broad appeal of smart speakers across different use cases and environments.

Key Market Segments

By Virtual Personal Assistant

- Siri

- Alexa

- Google Assistant

- DuerOS

- Cortana

- Ali Genie

- Others

By Component

- Hardware

- Software

By Application

- Smart Home

- Smart Office

- Consumers

Drivers

Rising Adoption of Smart Home Devices Drives Market Growth

The growing adoption of smart home devices significantly drives the Smart Speaker Market. Consumers increasingly prefer connected devices that enhance convenience and efficiency at home.

The integration of voice assistants with smart speakers boosts their appeal. Voice commands enable hands-free control of various tasks, increasing consumer interest in such devices.

The demand for connected living environments also supports market growth. Smart speakers act as central hubs in smart homes, controlling lighting, security, and entertainment systems.

Technological advancements in AI enhance the capabilities of smart speakers. AI-driven features like personalized recommendations and voice recognition make these devices more attractive, expanding their user base.

Restraints

Privacy and Security Concerns Restraints Market Growth

Privacy and security concerns limit the adoption of smart speakers. Consumers worry about data privacy, as these devices often collect voice data for functionality.

High initial costs of advanced smart speakers also restrict market growth. Premium models with advanced features are expensive, making them less accessible to budget-conscious consumers.

Limited language and regional support affect user adoption. Consumers in non-English-speaking regions may find limited support for local languages, reducing product appeal.

Compatibility issues with older devices hinder broader integration. Some smart speakers may not work well with outdated systems, creating barriers to seamless connectivity in homes.

Opportunity

Expansion in Emerging Markets Provides Opportunities

Emerging markets offer significant growth opportunities for smart speakers. Increasing urbanization and rising disposable incomes drive demand for smart home technologies in regions like Asia-Pacific and Latin America.

Integration with IoT ecosystems presents growth potential. Smart speakers can connect with other IoT devices, enabling seamless control and enhanced user experiences.

Development of multi-lingual support further expands market reach. Adding support for more languages can attract a wider audience, increasing adoption rates globally.

Growing demand for smart speakers in commercial spaces, such as hotels and offices, provides additional growth avenues. Businesses use these devices to enhance customer service and operational efficiency.

Challenges

Rapid Technological Changes Challenges Market Growth

Rapid technological changes pose challenges for smart speaker manufacturers. Constant innovation requires significant investment in research and development, impacting profit margins.

Intense competition among key players also affects the market. Leading brands frequently launch new models, making it difficult for smaller players to maintain market presence.

Economic instability in certain regions limits consumer spending. In economically unstable areas, consumers may delay purchasing non-essential devices like smart speakers.

Dependence on internet connectivity further challenges growth. In areas with poor internet infrastructure, the functionality of smart speakers is limited, reducing their attractiveness.

Growth Factors

Government Initiatives for Smart City Projects Are Growth Factors

Government initiatives for smart city projects boost the demand for smart speakers. These projects focus on building connected urban infrastructures, supporting the adoption of smart devices.

The growing popularity of smart entertainment systems drives smart speaker demand. Consumers seek integrated audio solutions, making smart speakers an essential part of home entertainment setups.

Rising disposable income in urban areas supports market growth. Higher income levels enable more consumers to invest in advanced smart home devices, including smart speakers.

Expansion of e-commerce sales channels also fuels growth. Online platforms make it easy for consumers to explore, compare, and purchase smart speakers, increasing overall market penetration.

Emerging Trends

Voice-Activated Smart Assistants Are Latest Trending Factor

Voice-activated smart assistants have become a major trend in the Smart Speaker Market. These assistants offer seamless control over various functions, making daily tasks easier.

Integration with streaming services is another key trend. Consumers enjoy accessing music, podcasts, and audiobooks directly through their smart speakers, driving demand.

Personalized user experiences are increasingly popular. AI-powered features enable smart speakers to deliver tailored recommendations based on user preferences, enhancing satisfaction.

Adoption of AI-powered analytics is on the rise. These analytics provide insights into user behavior, helping manufacturers improve product functionality and target marketing efforts more effectively.

Regional Analysis

North America Dominates with 36.4% Market Share

North America leads the Smart Speaker Market with a 36.4% share, totaling USD 3.93 billion. This dominance is driven by high consumer tech adoption, strong internet connectivity, and widespread use of voice assistants like Alexa and Google Assistant. The U.S. is the largest contributor, with Canada also showing significant growth.

The region benefits from a tech-savvy population, robust R&D, and heavy investments by major tech companies. Smart home integration and frequent product innovations further boost market performance. Additionally, rising demand for entertainment and connected living drives consumer preference for smart speakers.

North America’s influence in the global smart speaker market is expected to remain strong. Ongoing advancements in AI, smart home compatibility, and personalized voice services will enhance the region’s market position.

Regional Mentions:

- Europe: Europe maintains a significant market presence, driven by high awareness of smart home devices and increasing interest in multi-language support for voice assistants. Strong demand for home automation drives growth.

- Asia Pacific: APAC is rapidly expanding in the Smart Speaker Market, fueled by massive urbanization and increasing adoption of connected devices in countries like China, Japan, and South Korea.

- Middle East & Africa: The region shows steady growth, supported by rising smart home initiatives and demand for Arabic-compatible voice assistants, boosting consumer interest in smart speakers.

- Latin America: Latin America is gradually embracing smart speakers, supported by growing digital infrastructure and increasing awareness of connected devices, particularly in Brazil and Mexico.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The smart speaker market is highly competitive, driven by innovation, technological advancements, and diverse product offerings. The top four companies dominating this market are Amazon Inc., Apple Inc., Alphabet Inc., and Tmall Genie. These companies maintain strong market positions through extensive R&D, wide distribution networks, and strategic investments in AI and voice recognition technologies.

Apple Inc. stands out with its HomePod series, which emphasizes sound quality, seamless integration with Apple’s ecosystem, and privacy features. The company targets premium users who value quality and data security. Apple’s focus on design, premium materials, and superior sound quality strengthens its position in the high-end segment of the smart speaker market.

Alphabet Inc. holds a significant share with its Google Nest series. These devices are known for their superior voice recognition, compatibility with Google’s ecosystem, and extensive language support. Google’s expertise in AI and continuous updates to improve the user experience enhance its competitiveness in this sector.

Tmall Genie, backed by Alibaba, is a strong player in China. It offers affordable smart speakers that cater to local needs, focusing on seamless integration with Alibaba’s e-commerce platforms. Its dominance in the Chinese market is fueled by aggressive marketing, partnerships, and a deep understanding of local consumer behavior.

These companies drive growth by prioritizing product development, AI capabilities, and strong ecosystem integration, making them the leaders in the global smart speaker market.

Top Key Players in the Market

- Amazon Inc.

- Apple Inc.

- Alphabet Inc.

- Tmall Genie

- Lenovo Group Ltd.

- Sonos One

- Bose Corporation

- Xiaomi Inc.

- Sonos Beam

- AliGenie

- DuerOS

- Others

Recent Developments

- Sonos: In September 2024, Sonos introduced the Era 100 and Era 300 smart speakers, engineered for high-fidelity audio with multi-room capabilities. The Era 300 offers Dolby Atmos support, catering to music enthusiasts and home theater users.

- Google Nest Audio: In October 2024, Google enhanced its Nest Audio smart speakers with advanced AI features, enabling more natural voice interactions and improved audio quality. These upgrades aim to enhance the user experience, appealing to tech enthusiasts and smart home adopters.

- Apple HomePod Mini: By November 2024, Apple’s HomePod Mini experienced growth in market share, especially among students and music fans. Its compact size, seamless integration with Apple services, and competitive price contributed to its rising popularity in the smart speaker market.

Report Scope

Report Features Description Market Value (2023) USD 10.8 Billion Forecast Revenue (2033) USD 105.5 Billion CAGR (2024-2033) 25.6% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Virtual Personal Assistant (Siri, Alexa, Google Assistant, DuerOS, Cortana, Ali Genie, Others), By Component (Hardware, Software), By Application (Smart Home, Smart Office, Consumers) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Amazon Inc., Apple Inc., Alphabet Inc., Tmall Genie, Lenovo Group Ltd., Sonos one, Bose Corporation, Xiaomi Inc., Sonas Beam, AliGenie, DuerOS, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Amazon Inc.

- Apple Inc.

- Alphabet Inc.

- Tmall Genie

- Lenovo Group Ltd.

- Sonos one

- Bose Corporation

- Xiaomi Inc.

- Sonas Beam

- AliGenie

- DuerOS

- Others