Global Power Purchase Agreement Market Size, Share, Upcoming Investments Report By Type (Physical Delivery PPA, Virtual PPA, Portfolio PPA, Block Delivery PPA, and Others), By Location (On-site and Off-site), By Category (Corporate, Government, and Others), By Deal Type (Wholesale, Retail, and Others), By Capacity (Up to 20 MW, 20-50 MW, 50-100 MW, and Above 100 MW), By Application, By End-Use, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 107225

- Number of Pages: 226

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Type Analysis

- By Location Analysis

- By Category Analysis

- By Deal Type Analysis

- By Capacity Analysis

- By Application Analysis

- By End-Use Analysis

- Market Key Segmentation

- Driving Factors

- Restraining Factors

- Growth Opportunities

- Latest Trends

- Geopolitics and Recession Impact Analysis

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

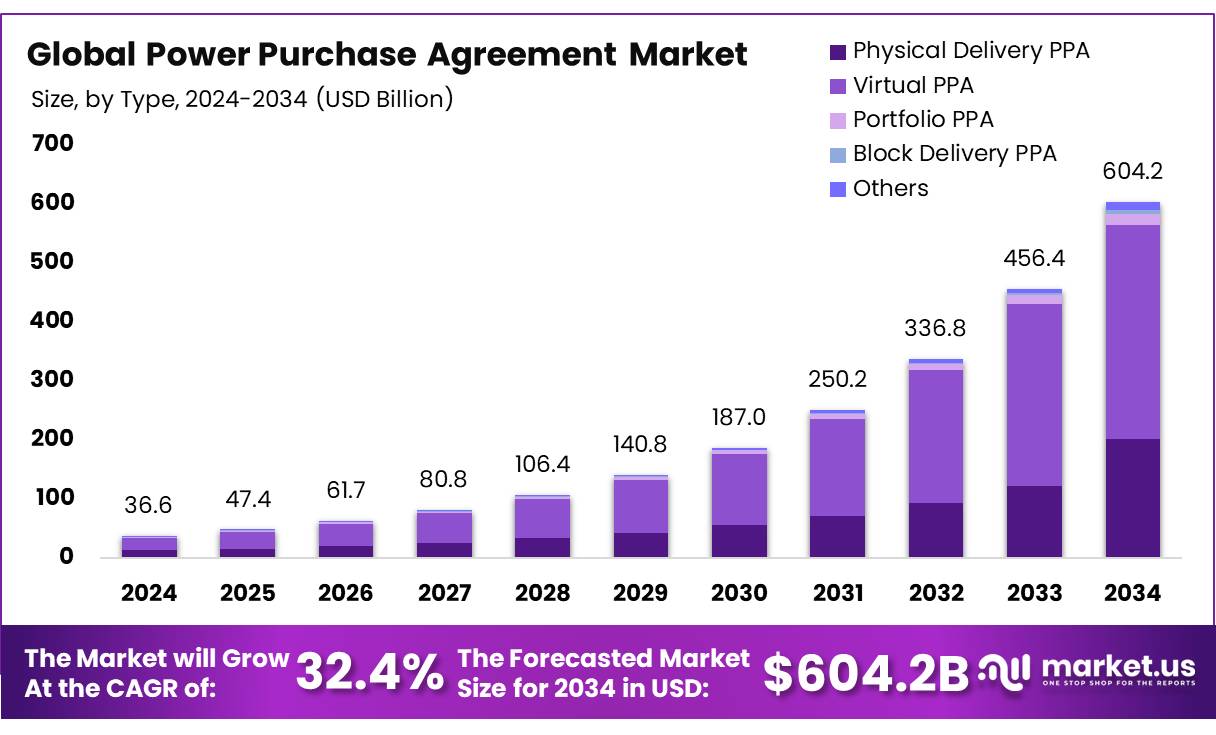

The Global Power Purchase Agreement Market size is expected to be worth around USD 604.2 Bn by 2034, from USD 36.6 Bn in 2024, growing at a CAGR of 32.4% during the forecast period from 2025 to 2034.

A Power Purchase Agreement (PPA) is a contractual agreement where a third-party developer installs, owns, and operates an energy system on a customer’s premises. The customer commits to purchasing the electric output generated by the system for a predetermined duration. PPAs are commonly used for renewable energy systems, such as solar or wind installations, allowing customers to access stable and cost-effective electricity without upfront expenses. The system owner benefits from tax credits and revenue generated through the sale of electricity.

PPAs extend to other energy technologies like combined heat and power, providing a flexible and mutually advantageous framework for energy development and consumption. The customer acquires the electric output generated by the energy system at a rate typically below the utility’s retail rate, resulting in immediate cost savings. The PPA rate often includes an annual escalation factor, accommodating factors such as system efficiency declines, rising operational and maintenance costs, and increases in the retail rate of electricity. PPAs are typically long-term agreements spanning 10 to 25 years.

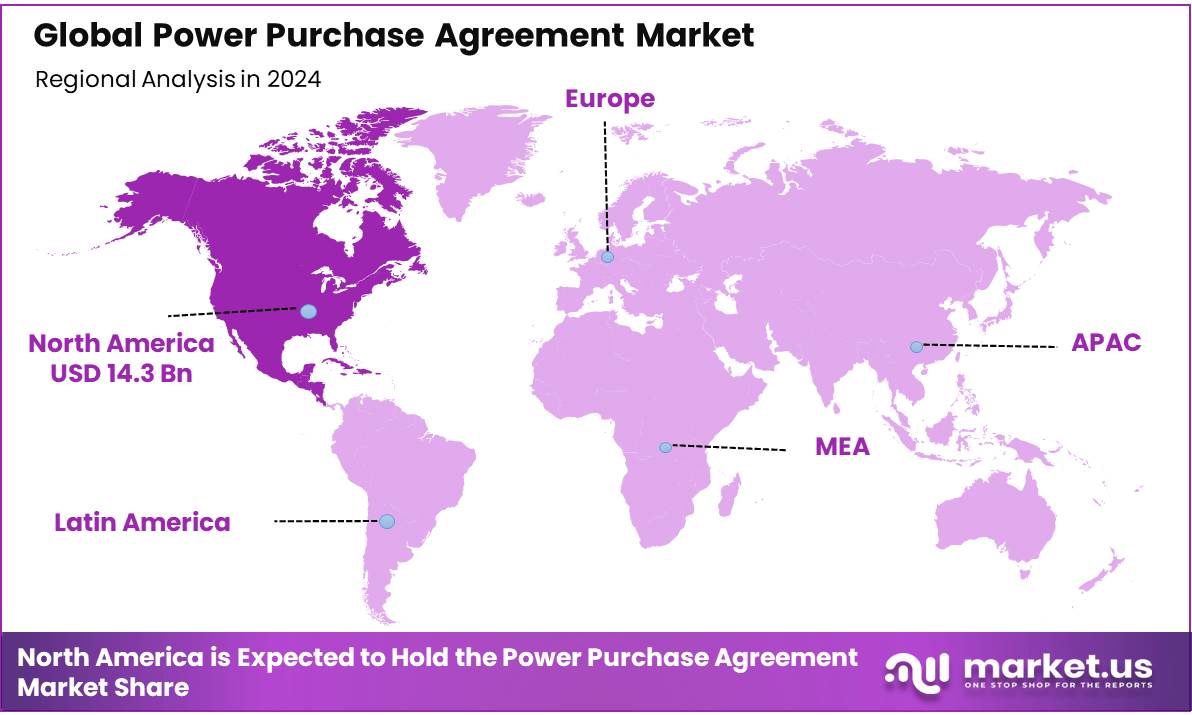

The Global Power Purchase Agreement (PPA) market is a vibrant sector, driven by regulatory frameworks, renewable energy targets, and evolving market dynamics. North America, particularly the US, is expanding due to government policies, technological advancements, and corporate sustainability goals. Europe is showing significant growth potential, with countries like Germany, Spain, and the UK leading the adoption of PPAs.

Key Takeaways

- In 2024, the global power purchase agreement market was valued at US$ 36.6 Billion.

- The global power purchase agreement market is projected to grow at a CAGR of 32.4% between 2024 and 2034.

- By type, the virtual PPAs held a major market share of 59.9% in 2024.

- By location, the off-site segment dominated the global market with 83.9% market share in 2024.

- By category, the corporate segment accounted for 87.1% of the global market.

- Based on the deal type, the wholesale segment led the market with a 61.9% market share in 2024.

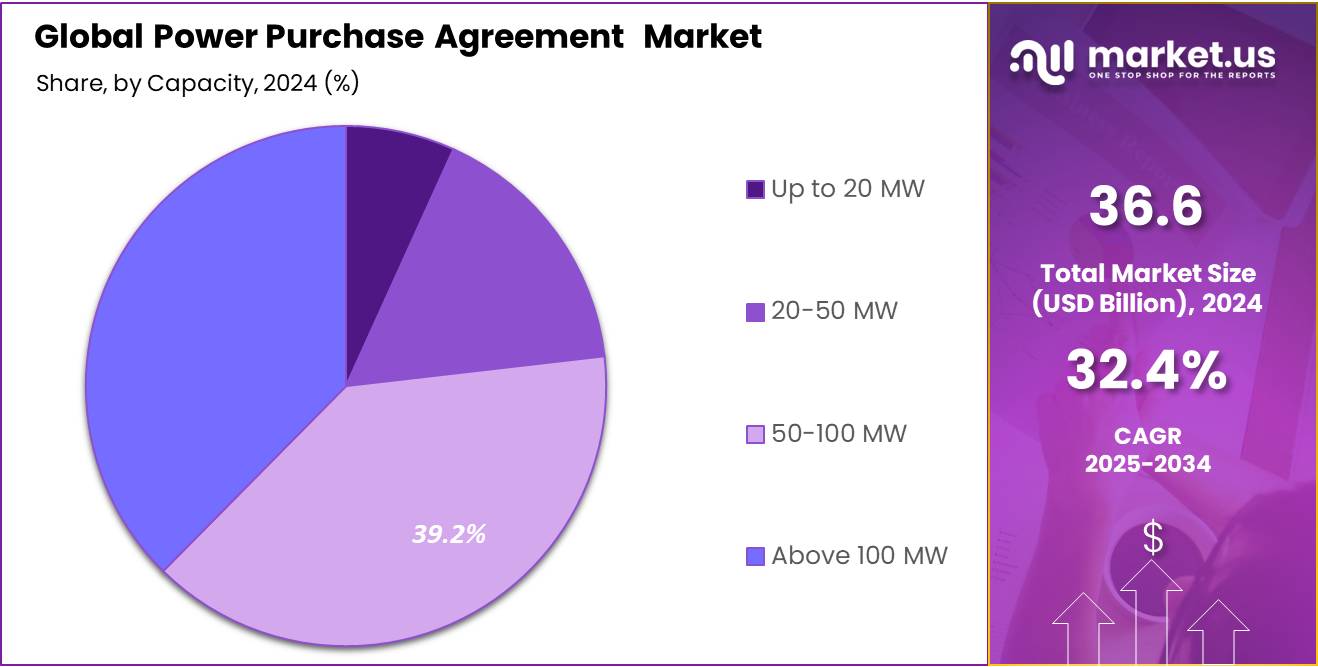

- By capacity, the 50-100 MW segment dominated the market in 2024, accounting for over 39.2% market share.

- By application, the wind segment accounted for the fastest growth, accounting for 37.3% CAGR during the forecasted period.

- Based on the end-use, the commercial segment dominated the market with 49.1% market share in 2024.

- In 2024, North America dominated the market with the highest revenue share of 39.2%.

- In 2022, According to the American Public Power Association, 36.7 gigawatts (GW) of offsite projects were supported by power purchase agreements signed by more than 167 companies.

- Australia’s Renewable Energy Target (RET) influences PPAs by setting targets for electricity generation from renewable sources. For instance, the country has set a national renewable electricity target of 82% by 2030.

By Type Analysis

The Physical Delivery PPA segment held the largest market share in 2024 owing to its tangible supply of electricity, providing a sense of security and reliability for buyers

Based on type, the Power Purchase Agreement market is segmented into physical delivery PPA, virtual PPA, portfolio PPA, block delivery PPA, and others. Among these types, the virtual PPA segment was the most lucrative in the global Power Purchase Agreement market, with a market share of 59.9% in 2024. Virtual Power Purchase Agreements (PPAs) are becoming increasingly popular due to their flexibility, scalability, and competitive pricing.

These agreements allow companies to procure renewable energy from off-site projects without the need for physical proximity to the generation source, making them suitable for businesses with limited on-site space. They also provide stability in volatile energy markets through long-term contracts. The scalability of virtual PPAs allows for the integration of large renewable energy projects into corporate energy portfolios, supporting sustainability goals and reducing carbon emissions. These advantages make virtual PPAs a preferred choice for businesses seeking environmental stewardship and energy cost optimization.

The physical delivery PPA segment, which accounted for 33.5% of the renewable energy market in 2024, Its transparency and reliability allow buyers to directly purchase electricity from renewable projects, ensuring a stable energy supply. Additionally, long-term contracts provide price stability in volatile energy markets. The straightforward nature of PPAs simplifies transaction processes and mitigates risks, making them a preferred choice for many renewable energy stakeholders.

Global Power Purchase Agreement Market, By Type, 2020-2024 (USD Mn)

Type 2020 2021 2022 2023 2024 Physical Delivery PPA 4,791.9 6,034.7 7,614.9 9,642.5 12,245.0 Virtual PPA 7,821.8 10,034.9 12,945.0 16,784.6 21,904.4 Portfolio PPA 433.6 552.7 707.3 907.9 1,172.1 Block Delivery PPA 160.7 196.1 240.5 295.8 366.0 Others 392.3 477.6 583.9 716.5 884.6 By Location Analysis

Off-site Market Dominates Market Owing to Its Flexibility and Scalability

By location, the global Power Purchase Agreement can be further categorized into on-site and off-site. Off-site segment dominated the market with a significant share of 83.9% in 2024. Off-site PPAs provide businesses and utilities with the flexibility to obtain renewable energy from sources with favorable conditions for generation, usually on a large scale and at a lower cost This approach is exhausting under the challenges associated with on-site renewable energy, such as space constraints, infrastructure, and necessity. Additionally, off-site PPAs enable organizations to tap into the renewable energy available in ecologically rich areas, further enhancing, and potentially, their sustainability programs reduced operating costs. The dominance of the off-site segment underscores its attractiveness and viability in facilitating the transition toward a cleaner and more resilient energy landscape.

Global Power Purchase Agreement Market, By Location, 2020-2024 (USD Mn)

Location 2020 2021 2022 2023 2024 On-site 2,660.0 3,230.8 3,931.5 4,800.9 5,880.0 Off-site 10,940.3 14,065.1 18,160.0 23,546.3 30,692.2 By Category Analysis

Corporate Dominance in Power Purchase Agreement Market Fueled by Sustainability Goals and Cost Savings

By category, the market is further segmented as, corporate, government, and others. The corporate segment dominated the Power Purchase Agreement market with a major revenue share of 87.1%, and it is projected to register a CAGR of 32.8% during the estimated period. The dominance of the corporate segment is attributed to the increasing adoption of renewable energy sources by businesses aiming to reduce carbon footprints and secure long-term energy costs. Corporations are leveraging PPAs as a strategic tool to hedge against volatile energy prices, while also committing to sustainability goals.

- For instance, In October 2024, 9 GW of clean power contracts were signed in Europe through corporate power purchase agreements, indicating a considerable rise year on year in several industries.

This trend is further bolstered by supportive governmental policies, technological advancements in renewable energy, and an increasing societal push toward environmental responsibility. Together, these factors catalyze the corporate sector’s investment in and commitment to renewable energy PPAs.

Global Power Purchase Agreement Market, By Category, 2020-2024 (USD Mn)

Category 2020 2021 2022 2023 2024 Corporate 11,389.8 14,639.0 18,885.7 24,465.1 31,844.2 Government 588.0 704.6 846.1 1,019.8 1,232.9 Others 1,622.5 1,952.3 2,359.7 2,862.4 3,495.0 By Deal Type Analysis

Scalability and Regulatory Backing Drive Dominance of Wholesale Power Purchase Agreements (PPAs)

By deal type, the PPA market is divided into wholesale, retail, and others. Among these, the wholesale segment dominates the market with a 61.9% market share in 2024. The scalability of wholesale PPAs appeals to large energy purchasers and utilities seeking to secure substantial volumes of electricity at predictable rates. These agreements facilitate the direct procurement of renewable energy from large-scale projects, thus offering economies of scale. Moreover, wholesale PPAs are instrumental in enabling energy producers to guarantee revenue streams for their projects, thereby enhancing project viability and attracting investment. This segment’s dominance is further bolstered by regulatory support and the growing corporate commitment to sustainability, driving the demand for renewable energy sourced through wholesale PPAs.

Global Power Purchase Agreement Market, By Deal Type, 2020-2024 (USD Mn)

Deal Type 2020 2021 2022 2023 2024 Wholesale 8,592.5 10,909.4 13,879.0 17,704.2 22,647.4 Retail 3,096.6 4,113.4 5,496.9 7,386.6 9,993.6 Others 1,911.3 2,273.0 2,715.6 3,256.4 3,931.3 By Capacity Analysis

50-100 MW Segment Dominates Power Purchase Agreement Market Deu to Scalability and Easiness in Integration

Based on the capacity the market is further separated into Up to 20 MW, 20-50 MW, 50-100 MW, and Above 100 MW. Among these 50-100 MW segment led the market with a 39.2% market share in 2024. This capacity range strikes an optimal balance between scalability and manageability, making it highly suitable for a broad spectrum of applications. It is large enough to achieve economies of scale, thereby reducing the cost per megawatt and making projects more financially viable.

- Evonik, for instance, and EnBW signed a second PPA in February 2024 for the purchase of 50 MW of offshore wind energy from the proposed “He Dreiht” offshore wind farm over 15 years. This is in addition to the 100 MW of offshore wind energy already acquired from EnBW under a prior PPA.

Additionally, installations within this capacity range are often more readily integrated into existing power grids, avoiding the infrastructural challenges and regulatory hurdles that larger projects may encounter.

Global Power Purchase Agreement Market, By Capacity, 2020-2024 (USD Mn)

Capacity 2020 2021 2022 2023 2024 Up to 20 MW 1,248.3 1,467.0 1,734.7 2,065.1 2,479.0 20-50 MW 2,425.6 3,023.0 3,782.6 4,748.2 5,996.0 50-100 MW 5,481.3 6,931.8 8,766.1 11,098.3 14,055.7 Above 100 MW 4,445.1 5,874.1 7,808.1 10,435.6 14,041.5 By Application Analysis

Solar Power Purchase Agreements (PPAs) Shine Bright, Driven by Stability, Accessibility, and Cost-Effectiveness

The market for PPA is further divided based on the application into solar, wind, geothermal, hydropower, carbon capture and storage, and others. Among these, the solar segment dominates the market with more than 50.9% market share in 2024. Solar PPAs offer a predictable and stable pricing model, which is particularly attractive for commercial and industrial entities looking to hedge against volatile energy prices. Furthermore, solar energy’s scalability and rapidly declining installation costs have made it increasingly accessible and economically viable for a broad range of applications. Additionally, technological advancements in photovoltaic (PV) cells have significantly enhanced efficiency, further driving adoption.

Additionally, the cost-effectiveness of solar PPAs significantly contributes to their attractiveness. For instance, in the second quarter of 2024, the average price for solar power purchase agreements in North America witnessed a slight decrease of 1%, settling at $49.09 per megawatt-hour. This price reduction enhances the financial viability of solar projects for buyers, promoting wider adoption.

Global Power Purchase Agreement Market, By Application, 2020-2024 (USD Mn)

Application 2020 2021 2022 2023 2024 Solar 7,389.4 9,277.9 11,669.1 14,712.5 18,601.7 Wind 4,224.0 5,619.3 7,510.6 10,081.5 13,601.4 Geothermal 255.1 297.6 348.9 410.4 485.9 Hydropower 604.6 715.8 851.1 1,015.5 1,219.5 Carbon Capture & Storage 162.5 196.6 238.9 291.2 357.3 Others 964.7 1,188.7 1,472.9 1,836.2 2,306.4 By End-Use Analysis

Commercial Sector Dominates PPA Market Owing to Stable Energy Procurement and Sustainability

Based on the end-uses the market is further into residential, commercial, and industrial. The commercial segment led the market with 49.1% market share in 2024. Commercial enterprises often have higher energy demands compared to residential users, driving the need for stable, long-term energy procurement strategies. Additionally, PPAs offer commercial entities the opportunity to lock in predictable energy costs, mitigating the risk of price volatility in the energy markets. This financial predictability is crucial for businesses in planning their long-term operational costs. Moreover, PPAs enable commercial organizations to meet sustainability goals by sourcing renewable energy directly.

- For instance, On April 3, 2024, Ørsted and Google announced their first power purchase agreement (PPA), Google will purchase renewable energy from Helena Wind Farm, a 268 MW wind farm located in Bee County, Texas. This collaboration supports Google’s aim to operate all its data centers, cloud regions, and offices on 24/7 carbon-free energy by 2030.

Global Power Purchase Agreement Market, By Deal Type, 2020-2024 (USD Mn)

Deal Type 2020 2021 2022 2023 2024 Residential 591.9 701.8 835.7 998.6 1,201.1 Commercial 7,423.7 9,212.3 11,463.7 14,323.2 17,951.1 Industrial 5,584.7 7,381.8 9,792.1 13,025.4 17,420.0 Market Key Segmentation

Based on Type

- Physical Delivery PPA

- Virtual PPA

- Portfolio PPA

- Block Delivery PPA

- Others

Based on Location

- On-site

- Off-site

Based on Category

- Corporate

- Government

- Others

Based on Deal Type

- Wholesale

- Retail

- Others

Based on Capacity

- Up to 20 MW

- 20 50 MW

- 50 100 MW

- Above 100 MW

Based on Application

- Solar

- Wind

- Geothermal

- Hydropower

- Carbon Capture and

- Storage

- Others

Based on End-Use

- Residential

- Commercial

- Industrial

Driving Factors

Increasing Demand for Renewable Energy Is Expected to Drive the Market

The escalation in demand for renewable energy sources is anticipated to serve as a significant driver for the global Power Purchase Agreements (PPA) market. This trend can be attributed to the growing global emphasis on sustainability and the shift towards cleaner, more sustainable energy solutions. The expansion of the renewable energy sector, encompassing solar, wind, hydroelectric, and biomass energy, necessitates robust financial and contractual frameworks to ensure the viability and stability of energy projects. Power Purchase Agreements (PPAs) are instrumental in this context, providing a mechanism for securing long-term energy sales between energy producers and purchasers, thus mitigating the risk associated with the development of renewable energy projects.

- In the US, corporates have procured more than 70 GW of project-specific renewable capacity since 2014, and the market share of renewable capacity contracted by the corporate sector surpassed 50% of the total PPA market in 2022.

The Risk Of Electricity Price Fluctuations Driving the Global Power Purchase Agreements Market

Rising prosperity and expanding commercial activity lead to an increase of about 15% in energy demand. Furthermore, rising population and rapid industrialization lead to the development of manufacturing and processing industries. The global energy demand is growing; this is facilitated by the industrialization of new energy facilities.

- Global electricity demand is growing at 1.8% per year and will grow to almost 50% in this sector by 2050, as the electricity demand increases, it will give rise to an increase in the price of electricity.

The prices of traditional energy sources are notoriously sensitive to market fluctuations, and power purchase agreements protect companies from such fluctuations. Because wind and solar generation require minimal maintenance costs after installation, buyers benefit from consistent and predictable costs that are pre-defined in the option power purchase agreement. Committing to lower prices for renewable energy through a PPA reduces the risk of future electricity price increases, creating a beneficial advantage for companies.

Power purchase agreements offer a fixed and predictable electricity price for the life of the agreement and in structured form and PPA is also cost competitive for the end user because the full price of electricity is lower than the retail price of electricity.

Restraining Factors

Limited Availability and Contract Complexity of Power Purchase Agreements

One of the primary factors restraining the global power purchase agreements market is the limited availability of power purchase agreements. Power purchase agreement laws vary from state to state. Some states have prohibited power purchase agreements.

The changes in the legal provisions of power purchase contracts vary to varying degrees around the world. Some power purchase agreements do not recognize the risk at all, and some power purchase agreements partially address the risk. A strong law change clause makes the PPA bankrupt, resolving lenders’ concerns about which party is responsible for costs arising from law changes and funding such costs required for the PPA. Power purchase agreements are complex contracts and have higher transaction costs than purchasing the system. Power purchase agreements comply with a complex legislative and regulatory framework at both federal and regional levels and often require a lot of time and negotiation before PPA is concluded. The long-term nature of power purchase contracts has proven unfavorable the price development is negative for the customer or seller.

The competitive nature of the energy market contributes to the scarcity of PPA. There is a mismatch between supply and demand for these agreements as more renewable projects seek off-takers, limiting the availability of suitable PPA for developers. The expansion of renewable energy initiatives is hampered by this circumstance, slowing down the transition to a cleaner energy landscape.

Growth Opportunities

Rise in Virtual Power Purchase Agreements Opportunities in the Power Purchase Agreements Market

Virtual power purchase agreements (VPPAs) are gaining popularity as a way for businesses and commercial entities to achieve sustainability goals. These agreements facilitate producer-owned partnerships, allowing for more PPA options and higher success rates. Organizations can gain significant financial benefits by entering into a VPPA and locking in a low fixed energy price. Additionally, VPPAs provide Renewable Energy Certificates (RECs), allowing organizations to make valid claims about clean energy use and carbon reduction.

- According to the Public Power Association, more than 80% of PPA contracts executed in the US in 2019 were virtual PPA. The introduction of VPPA has accelerated the transition to eco-friendlier power options. Furthermore, this presents an excellent opportunity to initiate virtual PPA for renewable energy initiatives in more recent developing nations, such as India.

VPPAs are increasingly being used by various businesses, including tech companies, healthcare, media, manufacturing, retail, pharmaceutical, food and beverage, agriculture, and oil and gas. These power purchase agreements are ideal for connecting large buildings with renewable energy, such as data centers and factories, as well as smaller buildings that use less energy. Retail stores and service businesses can also connect to renewable energy through a VPPA, ensuring consistent energy usage across their locations.

Adoption of Power Purchase Agreements in Developing Nation Anticipated to Create Opportunities

Increasing investment in renewable energy sources and favorable government policies encourage market expansion in developing nations. In addition, several governments have enacted laws to promote the development and use of renewable energy sources, hence increase in renewable energy will give rise to power purchase agreements in developing nations.

Power purchase agreements are crucial for funding renewable energy infrastructure in developing nations such as India. Making them transparent will make the power supply more reliable and affordable. Economies such as India and China are expected to drive demand for the geothermal energy sector. Significant growth in energy demand as a result of explosive investments in renewable energy projects has occurred in India, China, and others.

The growth in the number of renewable power plants on-site and off-site will soon create a lucrative market for power purchase agreements in developing nations. The solar company owns all the costs associated with the solar system’s setup or upkeep in the PPA. Electricity generated by the system is paid for by consumers. the cost of electricity purchased through PPA will rise at a certain rate, usually between 2% and 5% per year, which is generally lower than the rate of increase of utility. The price of the PPA will be lower than the electricity purchased from the utility.

Latest Trends

Rise Demand for Hybrid Power Purchase Agreement

The hybrid power purchase agreement involves the usual agreement for the power plant and a separate agreement for the storage unit. Things work independently and follow different rules. They also benefit from being in the same place because they are technically and financially good. The whole project is managed by using sophisticated computer programs that help save money on bills.

They also use incentives from the market and programs such as demand response. The use of hybrid PPAs is a new way of buying renewable energy. These new ways of buying energy combine transparency, teamwork, and customized cost-effective solutions. As hybrid PPAs keep changing the energy industry, a smart market will help create a future that is more sustainable, efficient, and able to change with the changing needs of renewable energy.

Rise in Demand for Aggregated Power Purchase Agreement

Aggregated PPA often follows a 3-tiered approach, consisting of one large buyer, several medium-to-large buyers, and many smaller-sized corporates. Aggregated PPAs provide a solution that allows small and medium enterprises to gain economies of scale by working together on renewable procurement. This increases small-and-medium enterprise’s buying power, enabling them to access long-term renewables to reduce their greenhouse emissions. This increases suppliers to decarbonize through aggregated PPA, the convening organization gets the benefit of reduced emissions throughout the supply chain. Hence, PPA demand and developer investment in new renewable projects are expected to increase shortly.

Geopolitics and Recession Impact Analysis

Owing to the Rapid Growth Of Chemical Industries Across The Region, The Asia Pacific Dominates The Global Market.

The increasing geopolitical tensions, trade disputes, and most notably, the Russia-Ukraine conflict have introduced significant volatility and uncertainty into global energy markets. The conflict between Russia and Ukraine had a considerable impact on the renewable energy market, causing disruptions in global energy markets, and leading to price volatility, supply shortages, and security concerns. This conflict has slowed down the renewable energy transition in Europe and impacted the expansion of the PPA market, with several projects being put on hold or delayed.

- 40% of Europe’s natural gas supply comes from Russia.

In addition, the power purchase agreement market has faced challenges due to disruptions in the supply chain for renewable energy technology. These disruptions can lead to delays in the deployment of new renewable energy projects and may affect the fulfillment of existing power purchase agreements. Moreover, the geopolitical unrest, especially in energy-rich regions, has led to fluctuations in fossil fuel prices. While this can make renewables more competitive in the short term, it also complicates the financial modeling underpinning power purchase agreements, as the long-term cost benefits of renewable projects become harder to predict.

Geopolitical shifts can lead to changes in national energy policies and regulations, which may affect the stability and attractiveness of PPAs. For instance, changes in subsidies, tariffs, or tax incentives can significantly impact the feasibility and profitability of renewable energy projects.

Owing to geopolitical risks, investors and corporations may seek to diversify their energy portfolios, which could benefit the PPA market. Companies might be more inclined to invest in PPAs as a way to ensure energy security and hedge against price risks associated with geopolitical instability. Geopolitical tensions can lead to currency fluctuations that impact the financials of power purchase agreements, which often involve cross-border payments. Currency risks need to be managed to protect both the power producers and the off-takers.

Countries may focus more on energy independence in light of geopolitical risks, which could drive an increase in domestic PPAs, especially for renewable energy projects. The power purchase agreements market is showing resilience by adapting to the changing geopolitical landscape.

- During the initial ten months of 2022, Europe witnessed the signing of corporate renewable power purchase agreements amounting to 3,491 megawatts (MW). This figure stands in contrast to the more substantial total of over 8,000 MW recorded throughout the entirety of 2021.

Regional Analysis

In 2024, North America led the PPA market, with a 39.2% market share. North America’s strong regulatory support for renewable energy initiatives has made it a significant player in the Power Purchase Agreement (PPA) market. Governments, particularly in the US and Canada, have introduced incentives and policies that encourage the adoption of renewable energy sources, making PPAs attractive for both producers and consumers.

- According to data from the American Clean Power Association (ACP), commercial and industrial (C&I) companies in the US signed nearly 20 GW of clean power purchase agreements (PPAs) in 2022, reaching a record high in domestic corporate power purchasing activity.

The mature and technologically advanced renewable energy sector in North America has also facilitated large-scale renewable projects, further bolstering the PPA market. Corporations in North America are increasingly entering PPAs to secure long-term, cost-effective renewable energy supplies, fueled by growing societal demand for green energy. Europe accounted for the fastest growth rate in the Power purchase agreement PPA market, with 37.3% CAGR during the forecasted period, and it is anticipated that Europe will Overtake North America in terms of market share in upcoming years. This rapid growth can be attributed to stringent environmental regulations and ambitious renewable energy targets set by the European Union have catalyzed the adoption of renewable energy sources, making PPAs an attractive option for securing long-term energy supplies.

- According to recent reports, 2024 was a record-breaking year for the European Power Purchase Agreement (PPA) market, with over 16.2 GW of contracted renewable power volumes. The European PPA market is projected to surpass 20 GW in 2024.

Additionally, the increasing corporate commitment towards sustainability in Europe has driven the demand for renewable PPAs, as companies aim to reduce their carbon footprint and ensure a sustainable energy future.

Global Power Purchase Agreement Market, By Region, 2020-2024 (USD Mn)

Region 2020 2021 2022 2023 2024 North America 6,092.9 7,518.5 9,301.3 11,534.1 14,350.8 Europe 4,719.3 6,247.2 8,300.5 11,076.2 14,851.8 Asia Pacific 1,686.4 2,211.6 2,907.9 3,834.9 5,074.9 Middle East & Africa 394.4 470.5 561.9 672.1 805.9 Latin America 707.2 848.1 1,020.0 1,230.0 1,488.8 Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- India

- Japan

- South Korea

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Key Players Analysis

The global Power Purchase Agreement (PPA) market is characterized by the presence of key industry players, including General Electric, Siemens AG, Shell Plc, Statkraft, and several others, each contributing significantly to market dynamics through their diverse range of renewable energy solutions and services. These companies play a pivotal role in shaping the renewable energy landscape by facilitating the development, financing, and operationalization of renewable energy projects worldwide. The market share among these entities is distributed based on their geographical presence, technological expertise, and the capacity to forge strategic partnerships and agreements.

Companies like Iberdrola, S.A., Ørsted A/S, and Enel Global Trading have been particularly instrumental in advancing the PPA market through their extensive renewable energy portfolios and global reach. The competitive landscape is further enriched by specialized firms like Ameresco and Ecohz, which offer tailored energy solutions to meet the growing demand for sustainable energy sources. As the market evolves, these key players are expected to drive innovation, expand renewable energy capacities, and thus, play a crucial role in the transition towards a more sustainable energy future.

Market Key Players

- General Electric

- Siemens AG

- Shell Plc

- Statkraft

- Fairdeal Greentech India Pvt. Ltd.

- Ameresco

- RWE AG

- Enel Global Trading

- Ecohz

- Greensphere Cleantech Services Private Limited

- Iberdrola, S.A.

- Ørsted A/S

- Renew Energy Global PLC

- Drax Energy Solutions Limited

- Other Key Players

Recent Developments

- In Oct 2024, Statkraft and Chiesi Group signed a 10-year renewable power purchase agreement to supply more than 30 gigawatt-hours per year of renewable energy. This agreement will help Chiesi Group stabilize its electricity costs in the long term and reduce CO2 emissions, equivalent to the annual electricity needs of more than 12,500 households.

- In Oct 2024, RWE signed its first power purchase agreement in the US with the state of New York. The agreement involves the supply of electricity from 1300 MW of offshore wind capacity. The company’s joint venture with grid operator National Grid Ventures was awarded the contract.

- In Sept 2024, Shell Energy Europe signed a 15-year power purchase agreement (PPA) with HANSAINVEST Real Assets to secure 600 megawatts (MW) of capacity at Germany’s largest solar project, the Witznitz Energy Park. The project is being developed by MOVE ON Energy. As part of the agreement, Shell will sell the power generated by 323MW of the solar capacity to Microsoft.

Report Scope

Report Features Description Market Value (2024) US$ 36.6 Bn Forecast Revenue (2034) US$ 604.2 Bn CAGR (2024-2034) 32.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Physical Delivery PPA, Virtual PPA, Portfolio PPA, Block Delivery PPA, and Others), By Location (On-site and Off-site), By Category (Corporate, Government, and Others), By Deal Type (Wholesale, Retail, and Others), By Capacity (Up to 20 MW, 20-50 MW, 50-100 MW, and Above 100 MW), By Application (Solar, Wind, Geothermal, Hydropower, Carbon Capture and Storage, and Others), By End-Use (Residential, Commercial, and Industrial) Regional Analysis North America: The US and Canada; Europe: Germany, France, The UK, Italy, Spain, Russia & CIS, and the Rest of Europe; APAC: China, India, Japan, South Korea, ASEAN, and the Rest of APAC; Latin America: Brazil, Mexico, and Rest of Latin America; Middle East & Africa: GCC, South Africa, and Rest of Middle East & Africa. Competitive Landscape General Electric, Siemens AG, Shell Plc, Statkraft, Fairdeal Greentech India Pvt. Ltd., Ameresco, RWE AG, Enel Global Trading, Ecohz, Greensphere Cleantech Services Private Limited, Iberdrola S.A., Ørsted A/S, Renew Energy Global PLC, Drax Energy Solutions Limited and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Power Purchase Agreement MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Power Purchase Agreement MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- General Electric

- Siemens AG

- Shell Plc

- Statkraft

- Fairdeal Greentech India Pvt. Ltd.

- Ameresco

- RWE AG

- Enel Global Trading

- Ecohz

- Greensphere Cleantech Services Private Limited

- Iberdrola, S.A.

- Ørsted A/S

- Renew Energy Global PLC

- Drax Energy Solutions Limited

- Other Key Players