Global Sulfuric Acid Market By Raw Material (Base Metal Smelters, Elemental Sulfur, Pyrite Ores, and Other Raw Materials), By Concentration (Below 50%, 50-70%, 70-93%, and 93-99%), By Application (Fertilizers, Metal Processing, Petroleum Refining, Textile, and Other Applications), By Region and Companies- Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: Dec 2023

- Report ID: 34760

- Number of Pages: 315

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

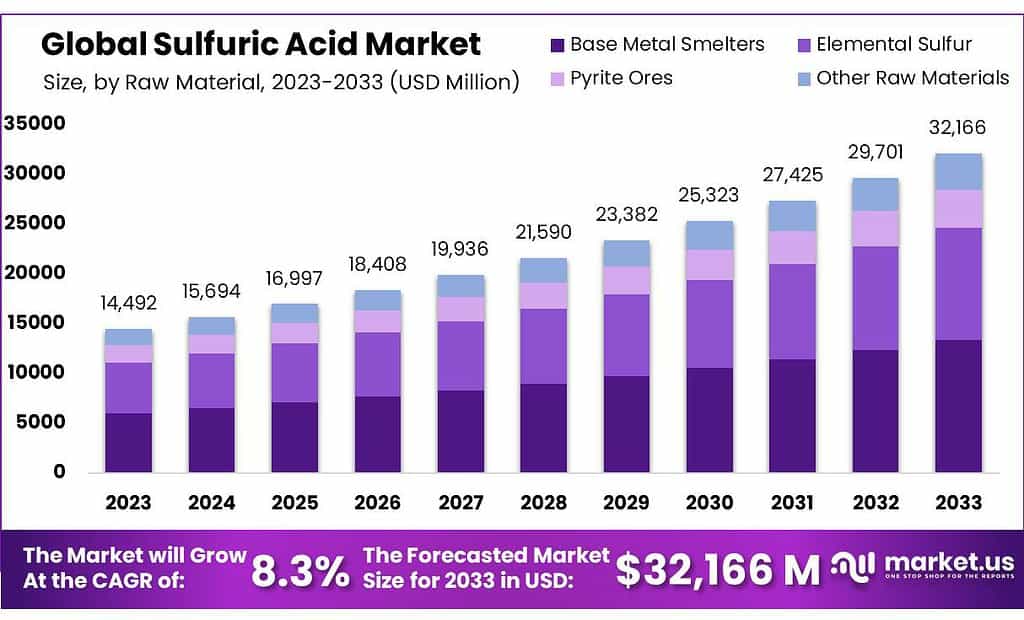

The Sulfuric Acid Market was valued at USD 14,491.6 Million in 2023. It is expected to experience an 8.3% CAGR over the forecast period of 2023-2032 and has a value of USD 32,166 Million in 2033.

The increasing use of sulfuric acid in the agriculture and automobile sectors is responsible for the rising demand. Because of its direct & indirect use in the manufacturing of many chemicals, including fertilizers, sulfuric acid has been called “the king” of acids.

Sulfuric acid, a mineral composed of sulfur, hydrogen, and oxygen, has the molecular formula H2SO4. It is an insoluble chemical that is colorless and odorless. It is a strong acidic chemical with dehydrating and oxygenizing properties.

This makes it useful in many industries, including agricultural, transportation, and consumer goods. It’s made from sulfur dioxide and some ferrous sulfate wastewater solutions. It’s produced by two major processes, the contact process and the lean chamber.

The sulfuric acid market growth has been driven by stringent government regulations and stricter emission control rules. The market is expected to grow over the forecast period due to increased product demand for a catalyst, dehydrating, and reactant in fertilizers and paper & pulp, as well as chemical manufacturing, metal processing, and petroleum refinery.

Industry growth has been aided by higher demands for sulfate, nitric, hydrochloric, synthetic detergents and dyes & colors, as well as other drugs.

Key Takeaways

- The global sulfuric acid market was valued at US$ 14,491.6 Million in 2023.

- The global sulfuric acid market is projected to reach US$ 32,166 Million by 2033.

- Among other raw materials, elemental sulfur accounted for the largest market share of 9%.

- Among concentrations, the 93-99% concentrated sulfuric acid accounted for the majority of the market share with 9%.

- Based on applications fertilizers accounted for the largest market share in 2023 with 7%.

- In the U.S., sulfur production reached 6 million metric tons in 2022, with roughly 93% being recovered elemental sulfur.

- Elemental sulfur production was estimated to be 5 million tons, with Louisiana and Texas accounting for about 55% of domestic production in the US.

- A report by the International Resource Panel (IRP) indicates that legal restrictions on pyrite mining in a major sulfuric acid-producing country have led to a 10% decline in sulfuric acid production over the past two years.

- In the U.S., about 90% of sulfur consumed was in the form of sulfuric acid.

Raw Material Analysis

Elemental Sulfur Accounted for The Largest Market Share Owing to Sulfuric Acid, produced It Has A Diverse Range Of Applications Across Various Industries.

The sulfuric acid market is segmented based on raw materials into base metal smelters, elemental sulfur, pyrite ores, and other raw materials. Among these, elemental sulfur held the majority of revenue share in 2023. Elemental sulfur accounted for the market share of 63.9% among other raw materials. Elemental sulfur is a primary raw material in the production of sulfuric acid. Moreover, elemental sulfur is widely available as a byproduct from petroleum refining and natural gas processing, where it is removed from fossil fuels to reduce sulfur dioxide emissions when these fuels are used. Its abundant availability and relatively low cost make it an attractive raw material for sulfuric acid production.

- Sulfur is the 10th most abundant element in the universe and the 5th most common on Earth. It’s found in both its elemental state and in mineral compounds. Sulfur is also released from volcanoes as sulfur dioxide.

Concentration Analysis

Owing to Their High Purity, 93-99% Concentrated Sulfuric Acid is Preferred Over Other Concentrations for Specific Applications; it Dominate the Market

The market is segmented into below 50%, 50-70%, 70-93%, and 93-99% based on a concentration. Among these concentrations, 93-99% sulfuric acid accounted for the majority of the market share with 48.9%.

Owing to their high purity level, 93-99% concentrated sulfuric acid is preferred for specific applications such as in petroleum refining, fertilizers, particularly phosphates, metal processing, chemical synthesis, and wastewater treatment. Sulfuric acid in this concentration range offers an optimal balance between reactivity and safety.

While higher concentrations (above 98%) are more reactive and potentially more efficient in certain applications, they are also more corrosive and hazardous to handle. The 93-99% range offers high efficiency with a comparatively manageable safety profile. Hence, the 93-99% concentration range of sulfuric acid is favored in the global market due to its effectiveness, versatility, and cost-efficiency.

Application Analysis

The Increasing Global Agricultural Demand Has Boosted the Demand for Sulfuric Acid Based Fertilizer

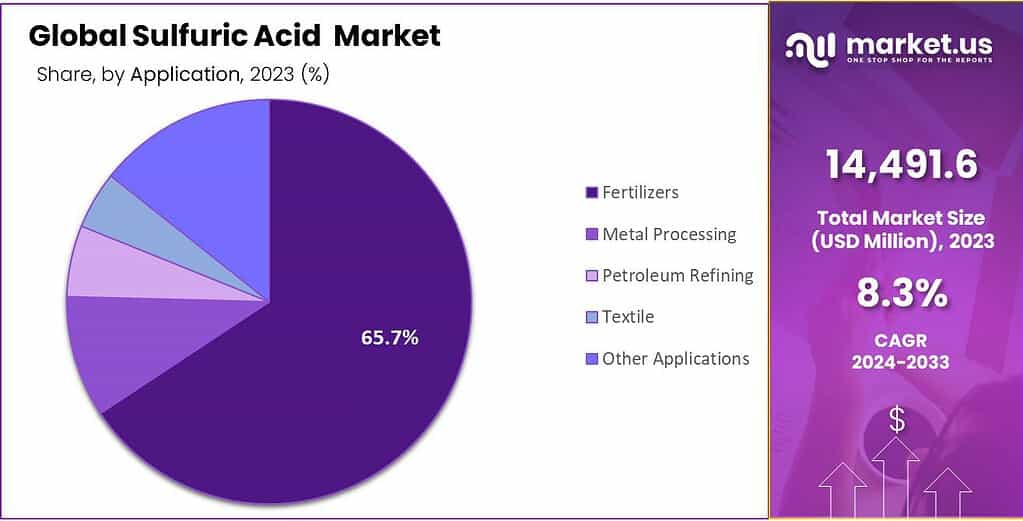

Based on applications, the market is further divided into fertilizers, metal processing, petroleum refining, textile, and other applications. Among these applications, fertilizers accounted for the largest market share in 2023 with 65.7%. With the growing global population and the increasing need for food production, there has been a significant rise in demand for fertilizers to enhance crop yields.

This surge in demand directly translates to increased consumption of sulfuric acid for fertilizer production. Sulfur is an essential nutrient for plant growth, playing a crucial role in the synthesis of amino acids, proteins, enzymes, and vitamins. The depletion of sulfur in the soil due to intensive farming practices has led to an increased requirement for sulfur-containing fertilizers.

In several countries, government policies and subsidies aimed at boosting agricultural productivity and sustainability have led to increased use of fertilizers, consequently driving the demand for sulfuric acid.

Key Market Segments

Based on Raw Material

- Base Metal Smelters

- Elemental Sulfur

- Pyrite Ores

- Others

By Concentration

- Below 50%

- 50-70%

- 70-93%

- 93-99%

Based on Application

- Fertilizers

- Chemical Manufacturing

- Metal Processing

- Refining

- Textile

- Automotive

- Others

Driving Factors

Rising Usage of Sulfuric Acid in Agricultural Industry Is the Major Driving Factor for the Market

Farmers worldwide utilize fertilizers containing three essential nutrients – nitrogen, phosphorus, and potassium – to enhance the quality and yield of their fruit and vegetable crops. Among these fertilizers, certain types, such as mono ammonium phosphate (MAP) and di-ammonium phosphate (DAP), prove highly efficient in delivering both nitrogen and phosphorus to the soil.

Sulfuric acid plays a critical initial role in both MAP and DAP production, as it is combined with phosphate rock to create phosphoric acid. This rise in demand can be linked to factors such as the increasing global population, which demands higher food production, as well as changing dietary preferences that have led to an escalation in the cultivation of specific crops.

Additionally, the depletion of soil nutrients due to intensive agricultural practices necessitates using sulfuric acid-based fertilizers to restore soil fertility and ensure sustainable farming. Furthermore, advancements in agricultural technologies, such as precision farming techniques, have further promoted the targeted application of fertilizers, driving the adoption of sulfuric acid in farming practices. Consequently, sulfuric acid has become indispensable in modern agriculture, positively impacting crop growth and overall food production.

Increasing Focus on Sustainable Manufacturing of Sulfuric Acid

The growing emphasis on sustainable sulfuric acid manufacturing is a significant driving force in the sulfuric acid market. With mounting environmental concerns, industries actively seek ways to minimize their environmental impact and adopt eco-friendly practices.

The increasing global demand for sulfuric acid, combined with stricter regulations on sulfur oxide (SOx) emissions and a corporate shift towards environmental responsibility, has made spent acid regeneration an appealing alternative to traditional disposal methods such as neutralization.

- For instance, Ecovyst Inc. exemplifies the commitment to sustainability by regenerating spent acid, converting it into reusable sulfuric acid. This approach prevents millions of tons of used acid from becoming waste while simultaneously increasing the availability of sulfuric acid in the market. The company operates multiple sulfuric acid regeneration sites, catering to various chemical spent acids.

Regeneration presents a win-win opportunity for sustainable development, allowing sulfuric acid users to contribute to the circular economy while simultaneously reducing the costs and hazards associated with hazardous waste disposal. This trend highlights the industry’s commitment to environmental preservation and adopting greener practices to ensure a more sustainable future.

Restraining Factors

Environmental Concerns Associated with Sulfuric Acid May Hinder the Growth

Environmental and regulatory concerns pose significant restraints on the sulfuric acid market due to its potential environmental impact during production and use. Sulfuric acid, a highly corrosive and reactive substance, is manufactured by combusting sulfur or sulfur-containing compounds, leading to sulfur dioxide (SO2) emissions and other pollutants into the atmosphere. These emissions contribute to air pollution, acid rain formation, and adverse effects on human health and ecosystems.

Several countries have strict regulations governing SO2 emissions from sulfuric acid production facilities to mitigate environmental and public health risks. Producers must comply with emission limits and invest in pollution control technologies to minimize their environmental footprint. However, meeting these stringent requirements can lead to additional compliance costs, potentially impacting the profit margins of sulfuric acid producers.

- For instance, according to the United States Environmental Protection Agency (EPA), sulfuric acid manufacturing is subject to emission limits. The allowed rate of sulfur dioxide (SO2) emissions must not exceed 4 pounds per ton of 100% sulfuric acid produced. In comparison, acid mist emissions should not exceed 0.5 pounds of sulfuric acid per ton of 100% acid produced. These regulations are implemented to control and minimize the environmental impact of sulfuric acid production in the United States

Growth Opportunities

Rising Focus on Wastewater Treatment Among Various End-Use Industries

The rising focus on wastewater treatment among various end-use industries presents a significant opportunity for the sulfuric acid market. Wastewater treatment processes often involve the use of sulfuric acid due to its strong acidic properties and ability to neutralize alkaline waste streams effectively.

This chemical’s unique characteristics make it a valuable tool in pH control and wastewater treatment applications. Industries such as metal processing, chemical manufacturing, and petroleum refining generate wastewater containing contaminants and pollutants that require proper treatment before discharge. Sulfuric acid serves as a pH adjuster and neutralizing agent in these treatment processes, ensuring the wastewater reaches an optimal pH level for safe disposal or further treatment.

Furthermore, sulfuric acid finds application in wastewater treatment for removing heavy metals and other harmful substances through precipitation or chemical reactions. Its ability to facilitate the formation of metal sulfides aids in removing toxic elements, supporting environmental protection and regulatory compliance.

With growing awareness of environmental sustainability and stringent wastewater discharge regulations worldwide, there is an increasing demand for effective treatment solutions. As industries strive to meet these requirements, the demand for sulfuric acid in wastewater treatment is expected to rise.

Trends

Integration of Sulfuric Acid Production with Oil Refining

Integrating sulfuric acid production with oil refining is a notable trend observed in the chemical industry. In this process, sulfur dioxide (SO2) generated as a byproduct during oil refining is utilized as a raw material for sulfuric acid production. Oil refineries can mitigate environmental concerns by converting harmful emissions into valuable sulfuric acid through this integration.

This approach optimizes resource utilization and reduces the environmental impact of both oil refining and sulfuric acid production. It creates a symbiotic relationship between the two industries, promoting sustainability and cost-effectiveness. This trend has gained traction as industries seek greener and more sustainable practices, making it a significant development in the global sulfuric acid market.

Geopolitical Impact Analysis

Geopolitical Tensions Significantly Impact the Growth of the Sulfuric Acid Market Due to The Halt in Production and Supply Chain Activities

The production of sulfuric acid is often linked to the availability of raw materials such as sulfur and base metals, which are unevenly distributed around the world. Geopolitical tensions or policies in resource-rich countries can impact the global supply chain. For instance, trade embargoes or tariffs on these raw materials can lead to fluctuations in sulfuric acid prices.

The production of sulfuric acid is energy-intensive. Therefore, global energy prices and policies significantly influence production costs. Geopolitical events that affect oil and gas supply, such as conflicts in the Middle East or policy shifts in major energy-producing nations, can have a ripple effect on the sulfuric acid market.

International environmental agreements and policies can impact the sulfuric acid market. Stricter environmental regulations in response to global initiatives for pollution control and sustainable practices can increase production costs or lead to the development of cleaner, but more expensive, technologies. Since sulfuric acid is a key input in fertilizer production, geopolitical decisions related to agriculture and food security can influence its demand.

For example, policies aimed at boosting domestic agricultural production in populous countries such as China and India can lead to increased demand for sulfuric acid. The impact of geopolitical scenarios on the sulfuric acid market is evident in the fluctuating prices and demand trends across different regions.

- For instance, in Asia, the sulfuric acid market experienced declining prices due to factors such as falling prices of oleum and fertilizers, while in Europe and North America, poor market sentiments in the chemicals and fertilizers sectors contributed to the downward movement of sulfuric acid prices.

Regional Analysis

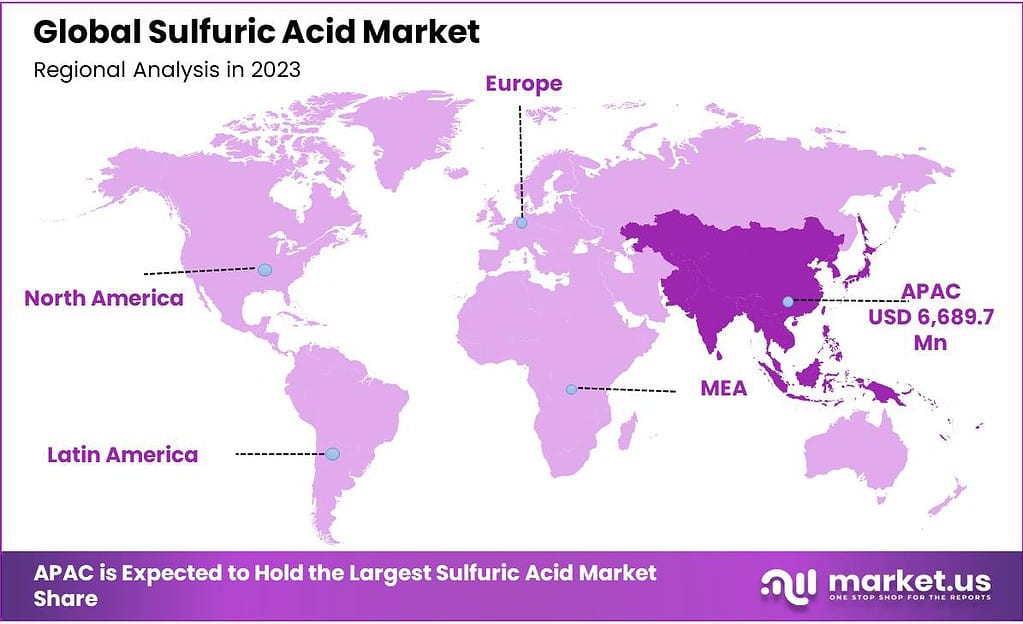

APAC is estimated to be the Most Lucrative Market in the Global Sulfuric Acid Market

Asia-Pacific held the largest market share, with 42% in Sulfuric Acid in 2022. APAC is home to some of the fastest-growing economies in the world. Countries like China, India, and Southeast Asian nations have seen significant industrial growth. This industrial expansion fuels the demand for sulfuric acid in various sectors, including manufacturing, metal processing, and chemical synthesis.

The region has a large agricultural base, with countries such as India and China being among the world’s top agricultural producers. Sulfuric acid is a critical ingredient in the production of phosphate fertilizers. The growing population in these countries demands increased agricultural output, which in turn drives the demand for fertilizers and, consequently, sulfuric acid.

APAC countries, particularly China, are rich in raw materials required for sulfuric acid production, such as sulfur and base metals. This abundance facilitates local production, reducing reliance on imports and enhancing market growth. The combination of rapid industrial and agricultural growth, abundant raw material supply, supportive government policies, technological advancements, and strategic geographical position makes the APAC region a highly lucrative market for sulfuric acid.

Кеу Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Strong Focus On Product Portfolio Expansion Through Various Strategies Maintain the Dominance of Industry Leaders

Mergers and acquisitions are common strategies for rapid expansion in this market. By acquiring or merging with other companies, businesses can quickly increase their market share, access new markets, or integrate vertically or horizontally.

For instance, acquiring a company with a strong presence in a particular region or a complementary product line can significantly boost a company’s market position. Entering new geographical markets is a key strategy for growth. This might involve exporting to new countries or setting up production facilities in regions with high demand or strategic advantages.

Geographical expansion helps companies to diversify their market risk and tap into emerging markets with high growth potential. Each of these strategies requires careful planning and execution, considering the specific dynamics of the sulfuric acid market, including customer needs, regulatory environment, competition, and global economic conditions.

Top Key Players

- BASF S.E.

- The Mosaic Company

- Nutrien

- Honeywell International Inc.

- Linde plc (Asia Union Electronic Chemical Corporation)

- Aurubis AG

- OCP Group

- Nouryon

- Solvay S.A.

- Boliden AB

- Hubei Xingfa Chemicals Group Co. Ltd

- Chemtrade Logistics Income Fund (Chemtrade Logistics Inc.)

- Trident Group

- Other Key Players

Recent Key Developments

- Chemtrade Logistics Income Fund announced in July 2022 that Kanto Group and Chemtrade Logistics Income Fund would form a joint venture for the greenfield construction of a high-purity sulfuric acid plant. They will jointly build a sulfuric acids plant in Arizona, with an anticipated start-up date of 2024.

- In May 2022, WeylChem International GmbH completed the acquisition of INEOS Sulfur Chemicals Spain SLU. This is the most important Spanish arm of INEOS businesses. The newly acquired business includes a 350,000-ton annual production facility for sulfuric acid in Bilbao. The new integrated sulfur business is now known as WeylChem Bilbao.

- BroadPeak Global LP, Asia Green Fund, and the Saudi Arabian Industrial Investments Company (Dussur) completed the transaction to buy Clean Technologies from DuPont de Nemours, Inc. Elessent Clean Technologies, Inc. has been established as the newly independent company.

Report Scope

Report Features Description Market Value (2023) US$ 14,491.6 Mn Forecast Revenue (2033) US$ 32,166 Mn CAGR (2023-2032) 8.3% Base Year for Estimation 2023 Historic Period 2020-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Raw Material (Base Metal Smelters, Elemental Sulfur, Pyrite Ores, and Other Raw Materials), By Concentration (Below 50%, 50-70%, 70-93%, and 93-99%), By Application (Fertilizers, Metal Processing, Petroleum Refining, Textile, and Other Applications) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC- China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- GCC, South Africa, & Rest of MEA Competitive Landscape BASF SE, The Mosaic Company, Nutrien, Honeywell International Inc., Linde plc (Asia Union Electronic Chemical Corporation), Aurubis AG, OCP Group, Nouryon, Solvay S.A., Boliden AB, Hubei Xingfa Chemicals Group Co. Ltd, Chemtrade Logistics Income Fund (Chemtrade Logistics Inc.), Trident Group, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What will be the market size for Sulfuric Acid Market in 2032?In 2032, the Sulfuric Acid Market will reach USD 29.4 billion.

What CAGR is projected for the Sulfuric Acid Market?The Sulfuric Acid Market is expected to grow at 8.3% CAGR (2023-2032).

List the segments encompassed in this report on the Sulfuric Acid Market?Market.US has segmented the Sulfuric Acid Market by geographic (North America, Europe, APAC, South America, and MEA). By Raw Material, market has been segmented into Base Metal Smelters, Elemental Sulfur and Pyrite Ores. By Application, the market has been further divided into, Fertilizers, Chemical Manufacturing, Metal Processing and Other.

What are the main business areas for the Sulfuric Acid Market?APAC and North America are the largest market share in Sulfuric Acid Market.

-

-

- BASF S.E.

- The Mosaic Company

- Nutrien

- Honeywell International Inc.

- Linde plc (Asia Union Electronic Chemical Corporation)

- Aurubis AG

- OCP Group

- Nouryon

- Solvay S.A.

- Boliden AB

- Hubei Xingfa Chemicals Group Co. Ltd

- Chemtrade Logistics Income Fund (Chemtrade Logistics Inc.)

- Trident Group

- Other Key Players