Global Smart TV Market By Operating System (Android, Tizen O.S., WebOS, Roku, Firefox, Fire TV, Others), By Resolution (4K UHD TV, HDTV, Full HD TV, 8K TV), By Screen Size (Below 32 inches, 32 to 45 inches, 46 to 55 inches, 56 to 65 inches, Above 65 inches), By Screen Shape (Flat, Curved), By Technology (OLED, QLED, LED, Others), By Application (Residential, Commercial), By Distribution Channel (Online, Offline), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec. 2024

- Report ID: 16251

- Number of Pages: 295

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Operating System Analysis

- By Resolution Analysis

- By Screen Size Analysis

- By Screen Shape Analysis

- By Technology Analysis

- By Application Analysis

- By Distribution Channel Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

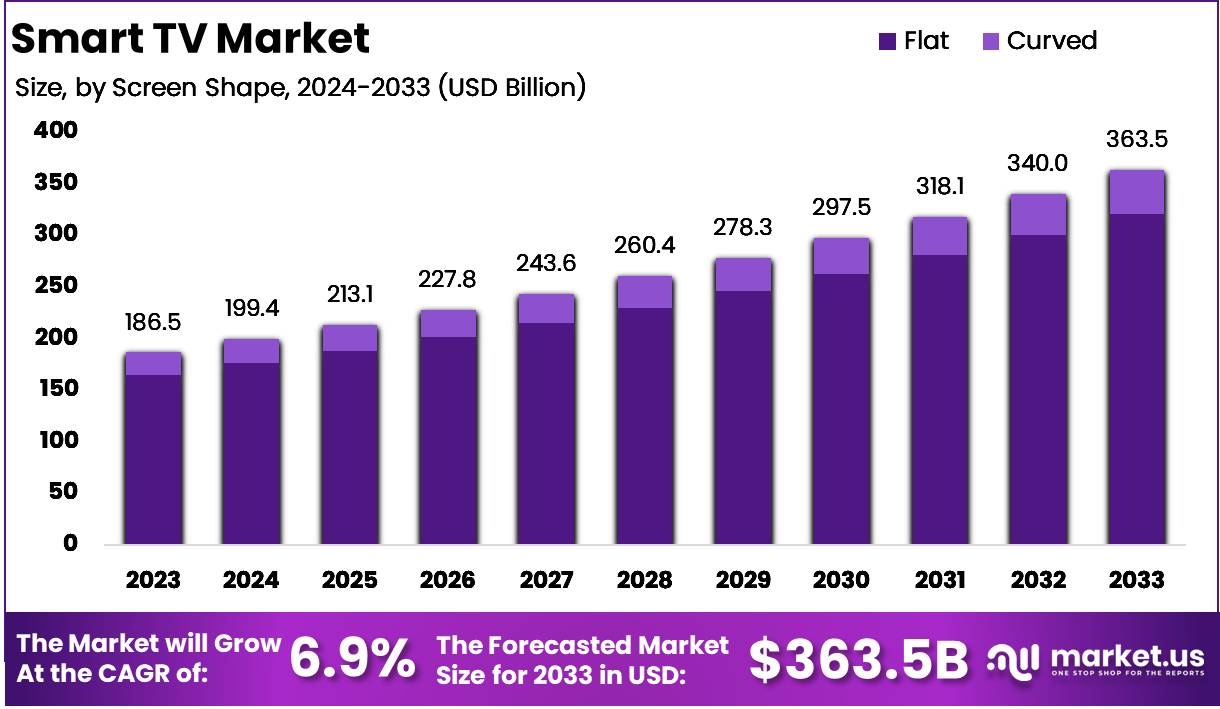

The Global Smart TV Market size is expected to be worth around USD 363.5 Billion by 2033, from USD 186.5 Billion in 2023, growing at a CAGR of 6.9% during the forecast period from 2024 to 2033.

A Smart TV is an internet-enabled television that offers more than just traditional broadcasting. It integrates various digital services and apps, enabling users to stream content from platforms like Netflix, YouTube, and Hulu, access social media, browse the web, and even connect with other smart devices within the home.

By combining traditional TV functions with advanced computing capabilities, Smart TVs offer an enhanced viewing experience that is highly interactive, customizable, and app-driven. These devices often feature built-in operating systems such as Android TV, Tizen, or webOS, which enable seamless integration with other smart home ecosystems and provide over-the-top (OTT) content directly to the television.

The Smart TV market encompasses the global industry involved in the manufacturing, distribution, and sale of internet-connected television sets. This market has evolved significantly, driven by both consumer demand for enhanced home entertainment experiences and technological advancements in display quality, processing power, and connectivity.

The Smart TV market includes various product categories, ranging from entry-level models with basic streaming capabilities to high-end models with 4K, OLED, and QLED displays.

Additionally, the market also includes the development of complementary software, apps, and services that enhance the functionality of these devices. As of recent years, Smart TVs have moved beyond being simple consumer electronics to become central hubs for home entertainment and digital lifestyles.

The growth of the Smart TV market is propelled by several key factors. First, the ongoing global shift toward digital content consumption, particularly via OTT platforms like Netflix, Disney+, and Amazon Prime Video, has substantially increased the demand for internet-enabled televisions.

As consumers increasingly prioritize convenience, customization, and high-quality streaming, the appeal of Smart TVs, which integrate these services seamlessly, has surged.

Second, technological advancements in display technology such as 4K and 8K resolution, OLED, and QLED screens are driving the adoption of more premium models. The rise of voice-controlled smart assistants and the growing integration of Smart TVs with other IoT devices in the home further contribute to this growth, enhancing the overall value proposition of owning a Smart TV.

Additionally, the rapid penetration of broadband internet, particularly in emerging markets, has created new avenues for market expansion.

The demand for Smart TVs is increasingly driven by a combination of consumer preference for seamless streaming experiences and the growing trend of cord-cutting, where viewers are opting for internet-based television services over traditional cable. As more households gain access to high-speed internet, the adoption rate of Smart TVs has risen across various regions, particularly in developed markets.

Furthermore, demand is being fueled by affordability improvements in Smart TV models, as manufacturers introduce budget-friendly options without sacrificing essential features like HD or 4K resolution.

The demand is also being shaped by shifting consumer habits, with younger generations, in particular, viewing Smart TVs as integral to their digital lifestyle. The flexibility to customize the TV’s functionality through apps, streaming services, and even gaming options has made Smart TVs a central element of modern entertainment ecosystems.

The Smart TV market presents significant opportunities, particularly in emerging economies where internet access is expanding rapidly. As broadband infrastructure improves and disposable incomes rise, there is a clear opportunity for manufacturers to capture new market segments by offering affordable yet feature-rich Smart TVs tailored to local preferences.

Additionally, the integration of next-generation technologies, such as artificial intelligence (AI) and augmented reality (AR), opens up opportunities for product differentiation, offering enhanced user experiences through personalized content recommendations, voice interactions, and immersive viewing.

For companies operating in the consumer electronics or digital content sectors, strategic partnerships with OTT service providers or telecom operators can further drive growth, creating a more integrated entertainment ecosystem that attracts and retains consumers.

According to Techreport, smart TV adoption is increasingly shaped by generational shifts in media consumption. Over 60% of Americans under 30 prefer streaming content online over traditional TV, reflecting a broader trend where younger demographics are less inclined to subscribe to cable or satellite services.

In fact, over 60% of adults under 30 have never had such subscriptions. This shift is further supported by the fact that 70% of video streaming users are between 18-44 years old, with 28.5% of this group aged 28-34.

Moreover, 35% of Americans earning over $75K annually lean toward streaming services, indicating a clear preference for flexible, on-demand viewing options. Interestingly, 41% of American viewers would engage more with ads if they were tailored to their preferences, underscoring the potential for personalized advertising strategies in the smart TV landscape.

According to Finder, the UK’s Smart TV market is experiencing robust growth, with 27.3 million households owning a TV as of 2022, accounting for almost 97% of households. With an average of 28 hours and 18 minutes spent on TV and streaming content weekly, UK consumers are increasingly investing in devices that offer seamless connectivity.

In fact, as of March 2023, there were 24.4 million active TV licenses, while 19.3 million households (67.3%) subscribed to services like Netflix or Amazon Prime. Additionally, BBC channels remain dominant, reaching 51.9 million viewers in October 2023, highlighting the continued demand for advanced, smart broadcasting solutions.

Key Takeaways

- The global Smart TV market is projected to grow from USD 186.5 billion in 2023 to USD 363.5 billion by 2033, driven by a robust 6.9% CAGR during the forecast period.

- Android OS dominates the Smart TV operating system segment, capturing over 43.2% of the global market share in 2023.

- 4K UHD TV leads the Smart TV resolution market with a commanding 48.3% market share in 2023.

- The 46 to 55 inches screen size segment dominates, holding more than 35.6% of the Smart TV market share in 2023.

- LED technology remains the market leader, accounting for more than 54.3% of the Smart TV market share in 2023.

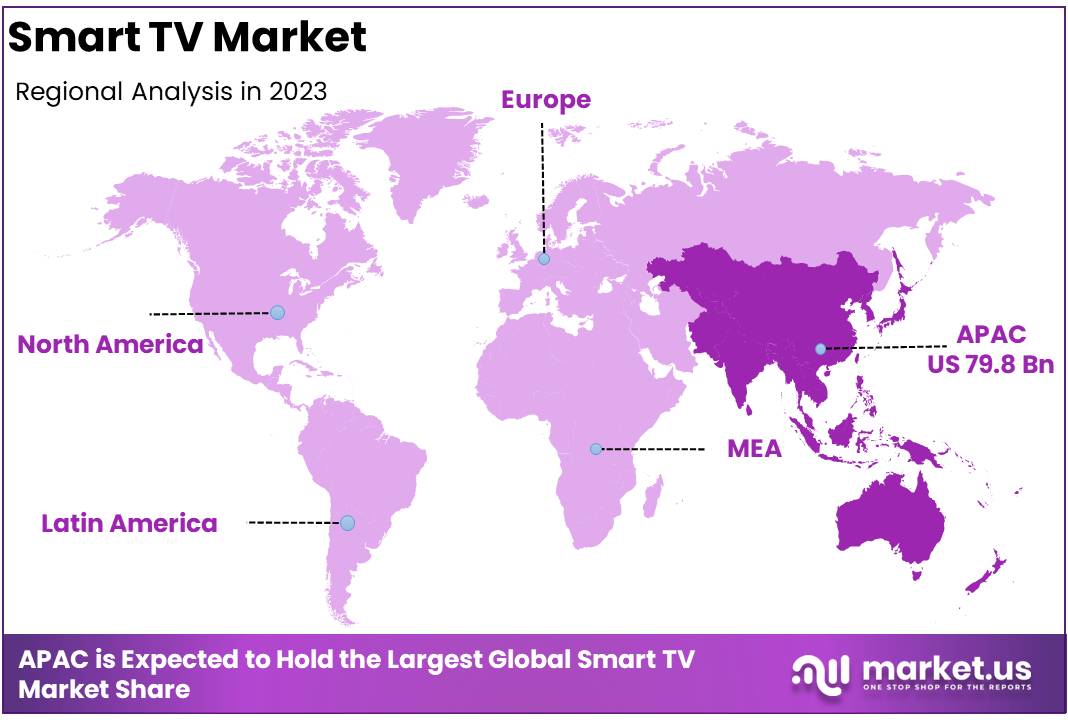

- Asia Pacific holds the largest market share in the Smart TV market, with 42.8% of the global market share in 2023, driven by rapid technological advancements and rising disposable incomes.

By Operating System Analysis

In 2023, Android Holds a Dominant Market Position in the Smart TV Operating System Segment, Capturing More than 43.2% Share

The Smart TV operating system market continues to experience dynamic growth, driven by technological advancements and evolving consumer preferences. As of 2023, Android OS stands as the leading platform, commanding over 43.2% of the global market share. This dominance is largely attributed to Android’s expansive ecosystem, wide compatibility across diverse brands, and its user-friendly interface.

The operating system is integrated into a variety of Smart TV models, ranging from premium to budget-friendly options, making it accessible to a broad consumer base. Furthermore, the integration of Google services and a robust app store ecosystem further strengthens Android’s position in the market.

Tizen OS, developed by Samsung, holds the second-largest share of the Smart TV operating system market, with a 21.3% share in 2023. Tizen’s success is largely driven by its exclusive use in Samsung’s Smart TV lineup, the world’s leading TV brand by volume.

Known for its sleek interface, ease of navigation, and consistent updates, Tizen OS continues to enhance the user experience. Additionally, Tizen supports a variety of apps, streaming services, and smart home integration, making it a strong contender in the global market.

WebOS, the operating system from LG Electronics, commands a 14.5% share of the Smart TV operating system market as of 2023. WebOS is recognized for its intuitive, card-style interface, which facilitates easy navigation through apps, channels, and settings.

It is widely used in LG’s premium OLED and LED TV models, and its emphasis on simplicity and speed has contributed to its increasing popularity. WebOS also offers robust support for streaming services, voice control, and smart home devices, adding to its appeal.

Roku continues to hold a 9.7% share of the Smart TV operating system market in 2023. Known for its simple and affordable streaming solutions, Roku is integrated into a variety of low-cost TV models, making it a popular choice in the budget segment.

Roku’s proprietary operating system offers a user-friendly interface and access to a vast library of content, making it an attractive choice for consumers primarily interested in streaming. The company’s strong relationships with content providers and ongoing efforts to expand its ecosystem further solidify Roku’s market position.

Firefox OS, though less widespread than other platforms, has captured a 4.8% share of the Smart TV operating system market in 2023. Initially developed by Mozilla, Firefox OS is known for its open-source nature and lightweight design, which is ideal for cost-effective Smart TV models.

Although its market share is relatively small, Firefox OS continues to serve as a viable alternative for brands seeking a non-proprietary OS with flexibility and customization potential.

Amazon’s Fire TV OS has made significant inroads in the Smart TV operating system market, securing 3.5% of the global market share in 2023. Primarily integrated into Amazon’s own TV offerings, as well as third-party devices, Fire TV OS stands out with its seamless integration with Amazon’s ecosystem, including Alexa, Amazon Prime Video, and other smart home features.

The OS is particularly appealing to consumers already invested in Amazon’s product ecosystem, offering a highly integrated and personalized user experience.

TheOthers category, which includes smaller or regional operating systems, holds an aggregate 3.0% share of the Smart TV OS market in 2023. This segment is comprised of a mix of niche and regional platforms that cater to specific markets or brands.

While the market share of Others remains relatively small, the segment plays an important role in diversifying the landscape of Smart TV operating systems. Some of these OS platforms include proprietary systems developed by brands like Sony, Hisense, and TCL, as well as newer entrants looking to carve out a niche in the industry.

By Resolution Analysis

In 2023, 4K UHD TV Holds a Dominant Market Position in the Smart TV Resolution Segment, Capturing More Than 48.3% Share

The Smart TV resolution market is characterized by rapid technological advancements, as consumers demand increasingly higher picture quality. In 2023, 4K UHD TV leads the segment, commanding a dominant 48.3% share of the market.

This significant share is reflective of the growing consumer preference for 4K resolution, driven by its superior image clarity, affordability, and widespread availability.

The increasing adoption of 4K content from streaming services, sports broadcasts, and video games has further fueled the growth of 4K UHD TVs. Additionally, the broad compatibility of 4K TVs with smart features and high-definition content makes them an attractive choice for a wide range of consumers, from budget-conscious to premium buyers.

HDTV (High Definition Television) remains a key segment in the Smart TV resolution market, accounting for 30.1% of the global market share in 2023. While older than 4K UHD, HDTV still appeals to consumers who prioritize affordability over the latest advancements in resolution.

HDTVs offer a decent viewing experience at a lower price point, making them a popular choice in developing markets or for consumers looking for budget-friendly options.

Although the demand for HDTVs is gradually declining due to the widespread adoption of higher-resolution models, they continue to account for a significant portion of the market, especially in the entry-level segment.

Full HD TV, with a resolution of 1080p, holds a 16.2% share of the Smart TV resolution market in 2023. Full HD TVs are positioned between HDTV and 4K UHD in terms of price and image quality. They remain popular in mid-range models and offer a good balance of performance and cost.

While Full HD resolution has been largely overshadowed by the rise of 4K UHD, it still appeals to price-sensitive consumers who want better resolution than standard HDTV but are not yet ready to invest in 4K models. Full HD TVs continue to be widely available, with many mid-tier TV brands offering Full HD models as their primary resolution option.

8K TV, with its ultra-high resolution of 7680 x 4320 pixels, has made significant strides but remains a niche segment in the Smart TV resolution market, capturing 5.4% of the market share in 2023.

The 8K market is still in its infancy, with limited content available to fully leverage the resolution. However, the appeal of 8K TVs lies in their ability to provide an unparalleled viewing experience, especially with large screen sizes.

Leading brands like Samsung, LG, and Sony are driving the adoption of 8K TVs, which are increasingly being marketed as premium products for tech enthusiasts, home theater aficionados, and consumers seeking the ultimate in future-proof technology.

As content availability grows and prices become more accessible, 8K TVs are expected to gradually gain a larger market share.

By Screen Size Analysis

In 2023, 46 to 55 Inches Dominates the Smart TV Market by Screen Size, Capturing More than 35.6% Share

In 2023, the 46 to 55 inches segment of the smart TV market by screen size emerged as the dominant category, securing more than 35.6% of the total market share. This size range has been particularly popular due to its balance between screen size and affordability, appealing to a broad consumer base, from urban dwellers to suburban households looking for larger screens that fit comfortably in most living spaces.

As consumer preferences continue to shift toward larger viewing experiences without excessive pricing, this segment remains a key driver of market growth.

The 46 to 55 inches screen size segment holds the largest market share within the smart TV category. This size is considered ideal for the average living room or entertainment space, striking the right balance between visual impact and compatibility with standard room sizes.

Moreover, advancements in smart TV technology, such as enhanced picture quality (e.g., 4K and OLED), as well as streaming services and gaming compatibility, have further bolstered demand for TVs in this range. The segment is expected to maintain its leading position as consumer preferences for mid-sized smart TVs continue to evolve.

The Below 32 inches segment continues to represent a smaller portion of the smart TV market, contributing around 10% of the total market share in 2023. This size category appeals primarily to consumers in smaller living spaces, such as apartments or dorm rooms, where compact form factors are essential.

While its share is comparatively lower, the segment is seeing steady growth, particularly in regions with high population density and limited space. As prices for smaller smart TVs continue to decline and manufacturers offer increasingly advanced features in this size, demand is likely to see incremental growth.

The 32 to 45 inches segment represents a mid-range option that captures around 22% of the smart TV market share. These sizes are popular for consumers seeking a balance between size and cost, offering a substantial viewing experience without overwhelming the room.

As smart TVs in this category continue to integrate cutting-edge technologies such as 4K resolution, AI-driven picture enhancement, and better connectivity options, this segment is positioned for continued relevance, especially among consumers upgrading from older, non-smart televisions.

The 56 to 65 inches segment is becoming increasingly important as consumers seek larger, more immersive viewing experiences, capturing approximately 18% of the total market share in 2023. This size range is popular in mid-to-high-end markets where consumers prioritize quality entertainment and smart features like advanced AI for optimized viewing and streaming capabilities.

The segment is expected to grow as more consumers opt for smart TVs that are larger, with enhanced picture quality (such as 4K and 8K) and smart home integration. The popularity of streaming services, online gaming, and live sports is further driving growth in this category.

The Above 65 inches segment, which represents approximately 14% of the smart TV market share, is driven by consumers seeking premium viewing experiences, typically in larger living rooms or home theaters. These ultra-large screen TVs are favored for their immersive, cinematic feel, offering 4K and 8K resolution options and top-tier smart capabilities.

Though the segment commands a smaller share compared to mid-sized TVs, it is growing steadily as technological advancements reduce production costs, making large, high-quality smart TVs more accessible to a broader range of consumers. With demand for superior home entertainment increasing, this segment is poised for future growth, particularly in regions with higher disposable incomes and larger living spaces.

By Screen Shape Analysis

In 2023, Flat Screen Smart TVs Capture More Than 88.3% Market Share by Screen Shape

In 2023, the Flat screen segment maintained a dominant position in the smart TV market by screen shape, capturing more than 88.3% of the total market share. Flat screen smart TVs have consistently been the preferred choice for the majority of consumers, driven by their versatility, ease of installation, and wide availability.

The dominance of flat screens is attributed to their more affordable pricing, familiar design, and the growing demand for large, high-quality screens that fit seamlessly into various room configurations.

The Flat screen segment continues to lead the smart TV market, accounting for over 88% of the market share in 2023. The appeal of flat screen TVs lies in their practicality and universal compatibility with wall mounts, furniture, and home setups. Additionally, flat screens are widely available in a range of sizes, from compact models to ultra-large TVs, catering to a broad spectrum of consumer preferences.

The vast majority of smart TV features, such as 4K resolution, smart connectivity, and enhanced sound systems, are also primarily available in flat screen models. As a result, this segment remains the most popular and is expected to continue dominating the market for the foreseeable future.

The Curved screen segment, though smaller, represents a niche but growing portion of the smart TV market, capturing about 11.7% of the total market share in 2023. Curved screens are favored by a subset of consumers who seek a more immersive viewing experience, particularly in large-screen models.

The curvature of the display is designed to create a more cinematic feel by providing a wider field of view and reducing image distortion at the edges. While the demand for curved TVs has not reached the same scale as flat screens, their appeal remains strong in premium segments and home theater setups, where larger screen sizes and advanced viewing technologies are prioritized.

By Technology Analysis

In 2023, LED Dominated the Smart TV Market by Technology, Capturing More Than 54.3% Market Share

The Smart TV market has continued to evolve with advancements in display technologies, and by 2023, LED technology emerged as the dominant segment in terms of market share, capturing more than 54.3% of the global market.

LED technology remains the leading choice for Smart TVs, contributing over 54.3% of the market share in 2023. This dominance can be attributed to the widespread affordability and availability of LED-based Smart TVs, along with their energy efficiency, superior brightness, and relatively low production costs compared to other advanced display technologies.

LED TVs are highly popular in both entry-level and mid-range segments, making them a go-to option for consumers seeking a balance between performance and price.

OLED technology, while still commanding a smaller share of the market at approximately 22.1%, has been gaining significant traction among high-end Smart TV consumers.

OLED panels offer superior contrast ratios, deeper blacks, and a wider color gamut, which makes them ideal for premium and luxury segments. As consumer demand for ultra-high-definition displays and cinematic viewing experiences grows, OLED is becoming an increasingly popular choice for those prioritizing picture quality and advanced features, despite their higher price point.

QLED (Quantum Dot LED) TVs, which use quantum dot technology to enhance brightness and color, have continued to perform well in the premium segment of the Smart TV market, holding a market share of around 18.5% in 2023.

While QLED does not match OLED in terms of black levels and contrast, it delivers impressive brightness and color accuracy, making it a top choice for well-lit environments. The backing of major brands like Samsung has helped QLED establish a strong presence in the high-end TV market, with ongoing improvements in technology enhancing its appeal.

The remaining 5.1% of the market is composed of various other technologies, including microLED, mini-LED, and other niche variants. These technologies are primarily found in the premium and innovative segments, offering cutting-edge features such as even brighter displays, more precise local dimming, and thinner form factors. However, these technologies are still in their nas

By Application Analysis

In 2023, Residential Dominated the Smart TV Market by Application, Capturing More Than 78.5% Market Share

The Smart TV market has witnessed significant growth across various application segments, with Residential usage continuing to dominate. In 2023, the Residential segment captured more than 78.5% of the total market share.

The Residential segment remains the largest application area for Smart TVs, accounting for over 78.5% of the global market share in 2023. This dominance is driven by the increasing consumer demand for connected home entertainment solutions, with Smart TVs becoming an integral part of everyday life in households worldwide.

The trend towards streaming services, gaming, and smart home integration has propelled residential sales, as consumers seek advanced features like voice control, app integration, and personalized viewing experiences. As more homes adopt 4K and 8K TVs, as well as features such as HDR (High Dynamic Range) and AI-enhanced displays, the residential sector will continue to lead the market, fueled by technological advancements and evolving consumer preferences.

While the Commercial segment holds a smaller share at approximately 21.5%, it has been steadily growing as businesses and institutions increasingly adopt Smart TVs for various purposes. In commercial settings such as hotels, retail stores, corporate offices, and public spaces, Smart TVs are used not only for entertainment but also for digital signage, advertising, and presentations.

The increasing demand for interactive displays and video conferencing capabilities in business environments is driving growth in this segment. Additionally, the rise of hybrid work models has led to greater demand for high-tech Smart TVs in meeting rooms and collaborative spaces, where functionality and versatility are key.

While still trailing behind the residential segment, the commercial market for Smart TVs is expected to expand as businesses continue to embrace digital transformation and interactive technologies.

By Distribution Channel Analysis

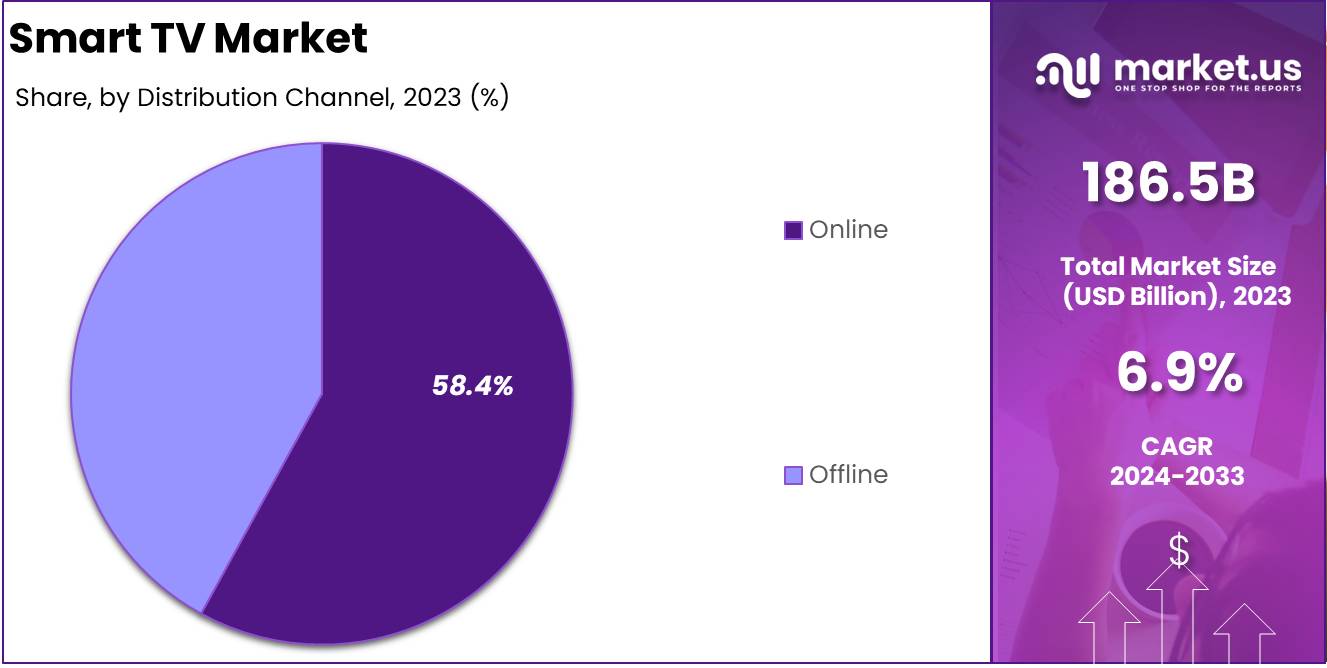

In 2023, Online Dominated the Smart TV Market by Distribution Channel, Capturing More Than 58.4% Market Share

The Smart TV market has seen a significant shift in the way consumers purchase their devices, with Online channels taking a dominant position in 2023. The Online distribution channel captured more than 58.4% of the global Smart TV market share, reflecting changing consumer behaviors and preferences.

The Online distribution channel is the clear leader in the Smart TV market, commanding over 58.4% of the total market share in 2023. The growing preference for online shopping, driven by convenience, competitive pricing, and a wide range of product choices, has significantly contributed to the growth of online sales in the Smart TV segment.

E-commerce platforms such as Amazon, Best Buy, Walmart, and various regional online retailers have become essential channels for consumers to research, compare, and purchase Smart TVs. Additionally, online sales are often accompanied by attractive discounts, promotions, and direct-to-door delivery, making it the most convenient option for tech-savvy consumers.

The ability to easily access customer reviews, detailed product specifications, and the latest models has further boosted the appeal of buying Smart TVs online. This trend is expected to continue, with more consumers opting for the convenience and flexibility of online purchasing.

While Offline retail channels have seen a relative decline in market share, they still hold a significant portion of the Smart TV market at around 41.6% in 2023. Offline retail outlets, including electronic stores, department stores, and specialty retailers, remain popular for consumers who prefer a more hands-on shopping experience.

In-store visits allow customers to physically compare models, assess display quality, and receive guidance from sales associates. Offline channels also provide the benefit of immediate product availability, avoiding wait times for delivery. Furthermore, in regions where online shopping penetration is lower, traditional brick-and-mortar stores continue to be a critical distribution channel.

Despite the growing shift toward online purchasing, offline retailers are evolving by integrating omni-channel strategies, such as offering in-store pickup for online orders, and enhancing customer service to maintain their market share.

Key Market Segments

By Operating System

- Android

- Tizen O.S.

- WebOS

- Roku

- Firefox

- Fire TV

- Others

By Resolution

- 4K UHD TV

- HDTV

- Full HD TV

- 8K TV

By Screen Size

- Below 32 inches

- 32 to 45 inches

- 46 to 55 inches

- 56 to 65 inches

- Above 65 inches

By Screen Shape

- Flat

- Curved

By Technology

- OLED

- QLED

- LED

- Others

By Application

- Residential

- Commercial

By Distribution Channel

- Online

- Offline

Driver

Increasing Consumer Demand for Smart Home Integration

The rapid expansion of the smart home ecosystem is a major driver for the growth of the global Smart TV market. As consumers increasingly invest in interconnected devices to enhance convenience, entertainment, and home automation, Smart TVs have become a central hub in the smart home experience.

The desire for seamless integration with voice assistants, smart speakers, lighting systems, and security devices has propelled the adoption of smart televisions.

Consumers no longer view TVs as standalone devices but as integral components of a broader, connected home network. With features like voice control, smart assistant compatibility (e.g., Alexa, Google Assistant), and IoT integration, Smart TVs are now seen as multifunctional appliances that add value to daily living.

This surge in demand is also supported by the expanding availability of streaming services and content.

As more people opt for services like Netflix, Disney+, and Hulu, the expectation for smart-enabled TVs grows stronger. Enhanced user experience features such as easy app navigation, voice recognition, and personalized content recommendations further increase the appeal of Smart TVs.

In 2024, it is expected that smart home adoption will continue to rise, with more consumers embracing smart TVs not only for entertainment but also for controlling other smart devices within their homes.

The evolving consumer mindset towards home automation, combined with the need for interconnected devices, will remain a strong growth driver for the Smart TV market in the coming years.

Restraint

High Initial Costs for Advanced Features

Despite the growing popularity of Smart TVs, one of the key challenges facing their widespread adoption is the relatively high upfront cost associated with advanced features.

Premium models that offer cutting-edge technologies, such as 4K resolution, OLED displays, and advanced voice-control capabilities, come at a significantly higher price point compared to traditional or non-smart TVs.

This price disparity can deter budget-conscious consumers, particularly in emerging markets where the purchasing power of the population is lower. Even as prices gradually decrease, the cost of incorporating advanced hardware and software into Smart TVs can still be a substantial barrier, preventing many from upgrading to the latest models.

Furthermore, this price sensitivity can slow the rate of replacement in mature markets where consumers may be less inclined to purchase a new Smart TV unless their current models are outdated or malfunctioning. In these regions, the reluctance to spend on high-end models, especially during times of economic uncertainty, can act as a drag on overall market growth.

Although the long-term cost benefits of owning a Smart TV (such as reduced need for external devices like streaming boxes or gaming consoles) can offset the initial expenditure, many consumers still perceive Smart TVs as expensive relative to non-smart alternatives. Until manufacturers can further drive down costs while maintaining quality, the high initial cost of advanced Smart TVs remains a significant restraint on market expansion.

Opportunity

Rising Popularity of Streaming Services and On-Demand Content

The ever-expanding landscape of streaming services presents a considerable opportunity for the Smart TV market. As traditional cable and satellite TV subscriptions continue to decline, more consumers are shifting toward digital streaming platforms, which offer on-demand content, flexibility, and more affordable pricing structures.

With the proliferation of services like Netflix, Amazon Prime Video, YouTube, and niche platforms catering to specific genres or interests, the demand for devices that can access these services is on the rise.

Smart TVs, which come with built-in streaming capabilities, offer an all-in-one solution, making them the device of choice for consumers who are looking to cut the cord and embrace a more personalized viewing experience.

This shift towards streaming content is not just confined to developed regions; emerging markets are also seeing increasing numbers of consumers adopting streaming services, driven by improvements in internet infrastructure and mobile connectivity.

As the affordability of broadband increases globally, streaming platforms have become more accessible to a broader audience. Smart TVs, which offer native integration with these services, are uniquely positioned to benefit from this trend.

The ongoing expansion of content libraries, including original programming, localized content, and interactive features, further enhances the appeal of Smart TVs as the primary medium for accessing a diverse array of entertainment options.

This presents a significant growth opportunity for the global Smart TV market as more consumers choose smart-enabled televisions to complement their streaming habits.

Trends

Advancements in Display Technology (OLED, MicroLED, 8K)

In 2024, advancements in display technology are poised to continue driving innovation in the Smart TV market. OLED (Organic Light Emitting Diode) and MicroLED technologies are rapidly gaining traction, offering consumers a premium viewing experience with superior picture quality, deeper blacks, and vibrant colors.

OLED displays, known for their thin form factor and energy efficiency, are already a popular choice in high-end Smart TVs, while MicroLED technology is emerging as a groundbreaking option that offers even higher resolution, greater brightness, and improved color accuracy without the limitations of traditional LCD screens.

Additionally, 8K resolution, although still in its infancy, is becoming a sought-after feature for consumers who want the highest level of image clarity and detail, particularly for large-screen displays.

These advancements in display technology are driving demand for premium Smart TVs, as consumers are increasingly willing to pay a premium for top-tier visual experiences. As these technologies become more widely available and cost-effective, they are expected to trickle down to mid-range Smart TV models, broadening their appeal.

The integration of these cutting-edge technologies into Smart TVs is not only a response to growing consumer expectations for better picture quality but also an attempt to differentiate products in a highly competitive market.

As TV manufacturers continue to innovate, the focus on improving display quality through advancements like OLED, MicroLED, and 8K resolution will remain a key trend shaping the future of the Smart TV industry. This will drive continued consumer interest and, ultimately, market growth.

Regional Analysis

Asia Pacific Dominates the Smart TV Market with Largest Market Share of 42.8%

The global smart TV market is experiencing substantial growth across different regions, with notable trends and varying degrees of market penetration. Among these, the Asia Pacific region is clearly the dominant force, capturing the largest share of the market in 2023, holding a substantial 42.8% of the global market.

Valued at approximately USD 79.8 billion, Asia Pacific’s growth can be attributed to a combination of factors, including the rapid technological advancements in consumer electronics, a large base of tech-savvy consumers, and increasing disposable incomes in countries like China, India, and Japan.

The growing preference for home entertainment solutions and the shift toward digital content consumption also contribute to the region’s market leadership.

In contrast, North America and Europe, while significant markets, are witnessing relatively slower growth compared to Asia Pacific. North America, with its mature consumer electronics market, continues to represent a strong share of global sales, benefiting from high penetration rates of smart TV adoption, especially in the United States.

However, the region faces market saturation as a challenge, limiting further rapid expansion. North America remains an important market, particularly in terms of high-end smart TV models and technological innovations, but it does not exhibit the same explosive growth dynamics seen in Asia Pacific.

Europe, similarly, holds a considerable portion of the global market, but growth is tempered by economic conditions, as well as increased competition from local manufacturers. Western Europe, in particular, is seeing stable demand for smart TVs, driven by consumer demand for larger screen sizes, 4K resolution, and integration with streaming services.

However, Eastern Europe remains a less penetrated market where affordability and access to newer technologies could drive future growth in the coming years.

The Middle East & Africa (MEA) region, while still emerging, is gradually experiencing increased demand for smart TVs, particularly in the Gulf Cooperation Council (GCC) countries, where high disposable incomes and a preference for advanced home entertainment systems are strong market drivers.

However, the broader MEA region remains fragmented, with economic disparities and varied levels of infrastructure development posing challenges to market growth. The region’s demand is expected to grow steadily, driven by a rising middle class and increased adoption of smart technologies.

Latin America presents a mixed picture, with growth potential in countries such as Brazil and Mexico, where the adoption of smart TV technology is gaining traction. However, economic instability, high tariffs on imported goods, and limited access to premium content pose significant barriers to rapid market expansion.

Nevertheless, as digital infrastructure improves and the middle class expands, Latin America is expected to see increased adoption of smart TVs over the next few years.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

The global Smart TV market in 2024 is marked by intense competition and innovation, with several key players vying for market share across various regions. Haier Inc., a major Chinese consumer electronics company, continues to build its presence through competitive pricing and expanding product lines that cater to the budget-conscious segment while incorporating smart functionalities.

Similarly, Hisense International is positioning itself as a significant challenger with its technologically advanced yet affordable smart TV models, capitalizing on strong market penetration in both emerging and developed markets.

Intex Technologies, while more prominent in India, is focusing on affordability and localized features, making its smart TVs appealing to price-sensitive consumers in South Asia.

Koninklijke Philips N.V., now under the TP Vision brand, remains a strong player in Europe with its focus on high-quality displays and user-centric interfaces, aiming to capture the mid-to-premium market segment.

LG Electronics Inc. and Samsung Electronics Co. Ltd., the two dominant forces in the global smart TV market, maintain their leadership through constant innovation, particularly in OLED and QLED technologies, offering unparalleled picture quality, smart integrations, and ecosystem synergy across their home appliances.

Panasonic Corporation remains a reliable player in the premium segment with its focus on high-end technology and long-lasting durability.

TCL Electronics Holdings Limited and Sony Corporation continue to expand their global footprints, with TCL leveraging cost-effective manufacturing strategies and Sony focusing on high-end features and superior image processing capabilities.

Finally, Sansui Electric Co. Ltd. and Toshiba Visual Solutions (TVS Regza) offer competitive alternatives, relying on strong brand legacy and consistent innovation to appeal to diverse consumer needs across various price ranges. The continued evolution of these companies is poised to drive significant growth and transformation in the Smart TV sector.

Top Key Players in the Market

- Haier Inc.

- Hisense International

- Intex Technologies

- Koninklijke Philips N.V

- LG Electronics Inc

- Panasonic Corporation

- Samsung Electronics Co. Ltd

- Sansui Electric Co. Ltd

- Sony Corporation

- TCL Electronics Holdings Limited

- Toshiba Visual Solutions (TVS Regza Corporation)

Recent Developments

- In February 2024, Walmart confirmed its decision to acquire VIZIO for $11.50 per share in cash, valued at approximately $2.3 billion in total equity. This strategic move aims to enhance Walmart’s connection with consumers through VIZIO’s SmartCast OS, which will bolster the retailer’s presence in the television, home entertainment, and media sectors, offering innovative in-home experiences.

- On March 19, 2024, Xiaomi Corporation released its audited results for the year ending December 31, 2023. The company reported total revenue of RMB 271 billion, a 10.9% year-over-year growth in the fourth quarter, with adjusted net profits increasing by 126.3% to RMB 19.3 billion. This surge in profitability was primarily driven by the company’s expanding smart EV business and other emerging initiatives, signaling strong future prospects despite rising costs.

Report Scope

Report Features Description Market Value (2023) USD 186.5 Billion Forecast Revenue (2033) USD 363.5 Billion CAGR (2024-2033) 6.9% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Operating System (Android, Tizen O.S., WebOS, Roku, Firefox, Fire TV, Others), By Resolution (4K UHD TV, HDTV, Full HD TV, 8K TV), By Screen Size (Below 32 inches, 32 to 45 inches, 46 to 55 inches, 56 to 65 inches, Above 65 inches), By Screen Shape (Flat, Curved), By Technology (OLED, QLED, LED, Others), By Application (Residential, Commercial), By Distribution Channel (Online, Offline) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Haier Inc., Hisense International, Intex Technologies, Koninklijke Philips N.V, LG Electronics Inc, Panasonic Corporation, Samsung Electronics Co. Ltd, Sansui Electric Co. Ltd, Sony Corporation, TCL Electronics Holdings Limited, Toshiba Visual Solutions (TVS Regza Corporation) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Haier Inc.

- Hisense International

- Intex Technologies

- Koninklijke Philips N.V

- LG Electronics Inc

- Panasonic Corporation

- Samsung Electronics Co. Ltd

- Sansui Electric Co. Ltd

- Sony Corporation

- TCL Electronics Holdings Limited

- Toshiba Visual Solutions (TVS Regza Corporation)