Global Smart Home Hub Market By Connectivity (Wi-Fi, Bluetooth, Others), By Application (Home Security and Automation, Entertainment, Energy Management, Healthcare), By Distrubution Channel (Specialty Retailers, Electronic Stores, Online Stores, Others), By Region And Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends And Forecast 2025–2034

- Published date: Feb 2025

- Report ID: 26795

- Number of Pages: 225

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Connectivity Analysis

- By Application Analysis

- By Distribution Channel Analysis

- Key Market Segments

- Driver

- Technological Advancements Fueling Market Growth

- Restraint

- Security Concerns and Privacy Issues

- Opportunity

- Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

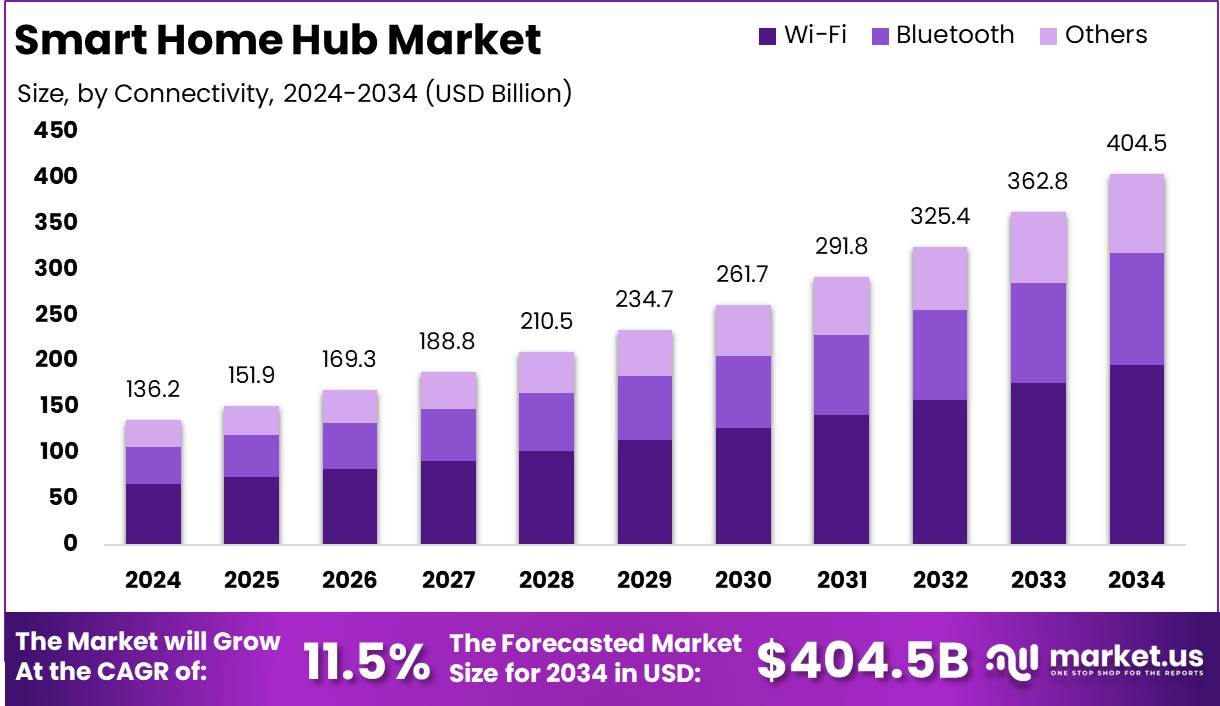

The Global Smart Home Hub Market size is expected to be worth around USD 404.5 Billion by 2034 from USD 136.2 Billion in 2024, growing at a CAGR of 11.5% during the forecast period from 2025 to 2034.

A Smart Home Hub is a centralized device that connects and manages various smart home products and systems, enabling seamless communication and control. It serves as the interface for controlling lighting, heating, security systems, and appliances via voice commands, mobile apps, or automation, enhancing home efficiency and convenience.

The Smart Home Hub Market refers to the commercial ecosystem surrounding these devices, encompassing product development, distribution, and technological innovations. It includes a wide array of interconnected solutions designed to optimize home automation. This market is driven by the increasing demand for smart homes and integrated, user-friendly solutions.

The growth of the Smart Home Hub market is primarily driven by technological advancements, such as improved connectivity (e.g., 5G), AI-driven automation, and consumer interest in energy efficiency. Additionally, rising disposable income, an increasing focus on home security, and the growing trend of sustainable living are contributing to sustained market expansion.

Demand for Smart Home Hubs is increasing due to the growing adoption of smart home devices and the desire for streamlined, centralized control. Consumers are increasingly prioritizing convenience, energy efficiency, and enhanced security, fueling the demand for integrated home automation solutions. This trend is also supported by widespread adoption of voice assistants.

The Smart Home Hub market presents significant opportunities for innovation and expansion, particularly in developing regions. Companies can capitalize on increasing demand for integrated home ecosystems, energy-efficient solutions, and enhanced user experiences. Additionally, partnerships with IoT, AI, and 5G providers can enhance product functionality, driving further market growth.

According to Exploding Topics, the Smart Home Hub market is experiencing robust growth, driven by consumer demand for connected devices. Notably, 78% of potential home buyers express a willingness to pay a premium for a smart home. Approximately 75% of smart home consumers are under the age of 55, with 40% of smart home devices owned by individuals aged 18-34, despite this age group constituting only 30% of the population.

Additionally, 97% of smart home device owners report satisfaction with their products, though nearly two-thirds remain concerned about data security. In terms of market geography, North America leads the smart home market, accounting for the largest share, followed by Asia-Pacific (29%) and Western Europe (18%). Smart home security systems are a key driver of growth in the U.S., where the average household has 8 connected devices.

According to Techjury, the Smart Home Hub market is experiencing significant growth, driven by increasing household adoption of smart devices. In the U.S., 69% of households now have at least one smart home gadget, with 75% of buyers incorporating these devices into their homes. Additionally, 53.9% of U.S. homes will be automated by 2023, further fueling market demand.

Globally, over 400 million smart homes are projected by 2024, highlighting a robust expansion trajectory. With over 1 billion U.S. users engaging in voice search activities monthly, the integration of smart hubs into daily routines is set to accelerate. The ongoing shift toward home automation underscores the market’s promising future.

Key Takeaways

- The global Smart Home Hub market is projected to grow from USD 136.2 billion in 2024 to USD 404.5 billion by 2034, reflecting a robust CAGR of 11.5% during the forecast period from 2025 to 2034.

- Wi-Fi remains the dominant connectivity technology, accounting for more than 48.6% of the total market share in 2024, attributed to its widespread adoption and reliability.

- The Home Security and Automation sub-segment holds a dominant market share of 41.3% in 2024, driven by increasing consumer demand for enhanced home security and seamless automation solutions.

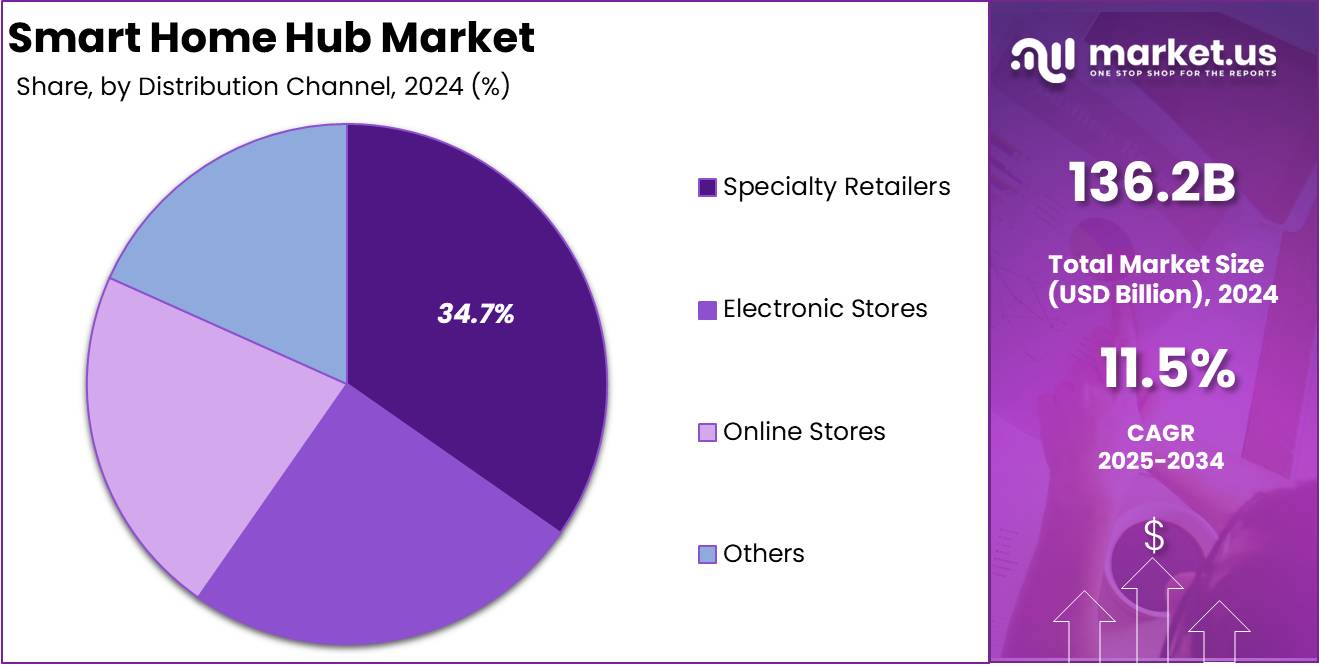

- Specialty Retailers capture the largest share at 34.7%, benefiting from their strong market presence and ability to offer specialized smart home products.

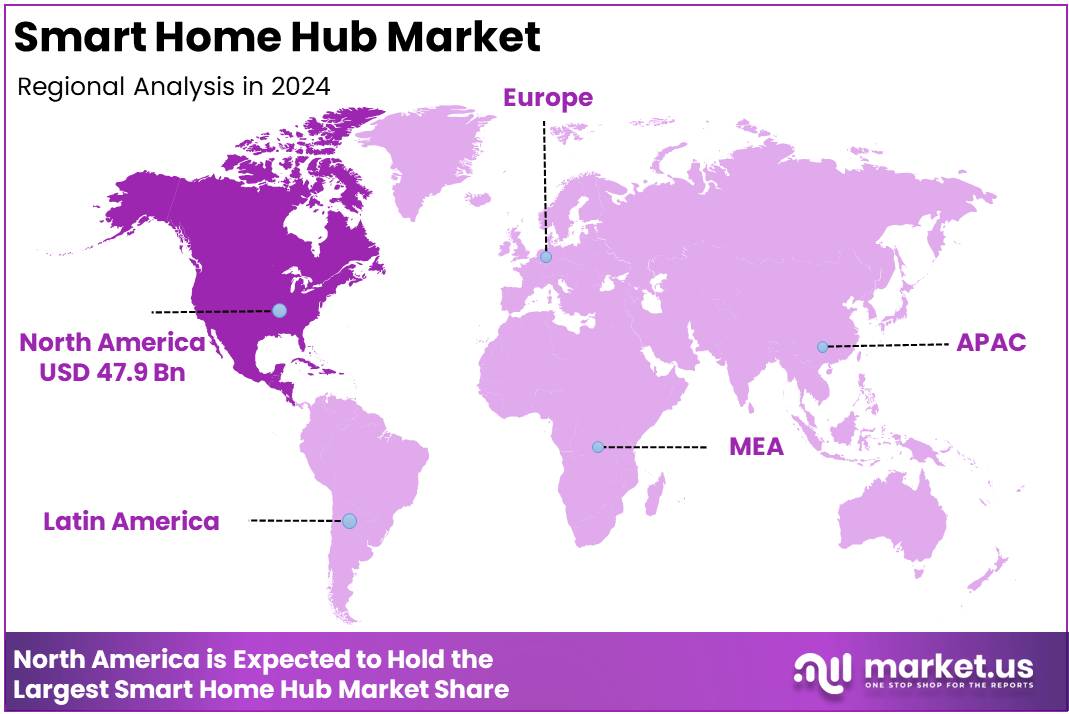

- North America leads the global Smart Home Hub market, with a substantial share of 35.2%, valued at USD 47.9 billion in 2024, supported by the region’s technological advancements and high adoption rate of smart home technologies.

By Connectivity Analysis

In 2024, Wi-Fi maintained a dominant market position in the connectivity segment of the Smart Home Hub market, capturing more than 48.6% of the overall share. This widespread adoption of Wi-Fi-enabled smart hubs can be attributed to the increasing consumer demand for high-speed and reliable connectivity. Wi-Fi’s broad availability and established infrastructure have positioned it as the preferred choice for smart home devices requiring seamless integration with other internet-connected systems.

Bluetooth connectivity plays a pivotal role in the Smart Home Hub market, contributing significantly to its growth. This growth can be attributed to Bluetooth’s low energy consumption and efficient data transmission capabilities, making it well-suited for various personal devices, including speakers, light bulbs, and door locks.

Its interoperability with multiple platforms has facilitated its widespread use in compact, energy-efficient smart home setups, especially among consumers seeking simple, localized solutions. As demand for seamless integration and energy-efficient devices continues to rise, Bluetooth is expected to maintain its strong presence in the market.

The Other category, which encompasses technologies such as Zigbee, Z-Wave, and Thread, represents a notable portion of the Smart Home Hub market. These alternatives cater to specific use cases where Wi-Fi and Bluetooth may not deliver sufficient coverage, particularly in areas requiring enhanced security or lower power consumption.

With the increasing focus on building more robust and interconnected smart home ecosystems, these technologies are expected to gain further momentum in the foreseeable future, addressing a growing demand for specialized connectivity solutions within smart homes.

By Application Analysis

In 2024, Home Security and Automation holds a dominant position in the Smart Home Hub market, capturing over 41.3% of the total market share. This segment’s growth can be attributed to the increasing demand for enhanced safety and automation solutions in residential environments.

Consumers are increasingly adopting smart home hubs that integrate security systems, surveillance cameras, smart locks, and automation features. As safety concerns and the desire for greater convenience continue to drive consumer preferences, this segment is expected to maintain its leadership in the market, offering consumers a comprehensive suite of features for peace of mind and home management.

The Entertainment segment in the Smart Home Hub market holds a significant share, driven primarily by the increasing demand for streaming services, smart televisions, and voice-activated devices. Consumers are progressively seeking ways to integrate their home entertainment systems through centralized hubs that offer seamless control over audio, video, and other media applications.

As the desire for high-quality entertainment experiences and multi-device connectivity within the home continues to rise, this segment is poised for ongoing growth.

The Energy Management segment, while still emerging, is gaining considerable traction. Rising energy costs and an increased focus on sustainability have led consumers to adopt smart home hubs as a means of optimizing energy usage and reducing waste.

The integration of smart thermostats, lighting systems, and appliances that can be remotely monitored and controlled is fueling this trend. With more households prioritizing energy efficiency, the growth of this segment is expected to continue, particularly as advancements in technology make energy management more accessible and effective.

The Healthcare segment, although smaller, is becoming increasingly relevant. The growing interest in remote health monitoring, elderly care, and wellness solutions has driven the adoption of smart hubs that can integrate health devices like wearables and medical sensors.

These hubs play a crucial role in monitoring health conditions and enhancing patient care, especially in the context of aging populations and the increasing demand for health-conscious solutions. As technology in healthcare and home automation evolves, this segment is anticipated to experience steady growth, driven by the rising awareness of the benefits of smart home health solutions.

By Distribution Channel Analysis

In 2024, Specialty Retailers hold a dominant market position in the Smart Home Hub market, capturing more than 34.7% of the market share by application. These retailers offer a wide range of smart home devices, including hubs, accessories, and related products, allowing consumers to experience and compare different systems in-store.

The growth of this segment can be attributed to the convenience and personalized shopping experience that specialty retailers provide, helping consumers make informed decisions about their smart home needs.

Electronic stores represent a significant segment in the Smart Home Hub market, contributing substantially to overall market dynamics. These stores offer a wide range of smart home hubs and complementary technologies, appealing to consumers who prioritize high-quality, branded products. By providing in-store demonstrations and expert advice, electronic stores play a crucial role in educating consumers about the features and benefits of smart home solutions.

This direct engagement fosters greater consumer confidence and facilitates broader adoption of smart home technologies. The online store segment is rapidly gaining ground in the Smart Home Hub market, fueled by the increasing popularity of e-commerce and the convenience of shopping from home.

The ability to easily compare products, access user reviews, and take advantage of competitive pricing has led to a growing consumer preference for purchasing smart home hubs through online platforms. As e-commerce continues to evolve and improve the purchasing experience, this segment is positioned for strong growth, contributing to the broader expansion of the smart home market.

The Other Retailers segment, which encompasses mass merchants, home improvement stores, supermarkets, and similar retail outlets, holds a notable but smaller share of the market. Despite its more modest presence compared to specialty or electronic stores, this segment remains an important access point for consumers seeking smart home hubs.

As smart home devices become increasingly integrated into everyday consumer electronics, this segment is expected to sustain its market relevance, providing consumers with additional purchasing avenues for these technologies.

Key Market Segments

By Connectivity

- Wi-Fi

- Bluetooth

- Others

By Application

- Home Security and Automation

- Entertainment

- Energy Management

- Healthcare

By Distrubution Channel

- Specialty Retailers

- Electronic Stores

- Online Stores

- Others

Driver

Technological Advancements Fueling Market Growth

The continued evolution of technology remains a primary driver for the global Smart Home Hub market. Key advancements in artificial intelligence (AI), machine learning, and internet-of-things (IoT) technologies have significantly enhanced the functionality of smart home hubs.

These technological improvements have enabled seamless integration of devices and services within smart homes, creating a more user-friendly and efficient experience. The increasing adoption of voice assistants, enhanced by AI capabilities, allows users to control various smart home devices through simple voice commands. This ease of use has led to higher consumer adoption, contributing to market expansion.

Furthermore, the rapid development of 5G technology is expected to support the next phase of growth for smart home hubs. With higher data speeds and more stable connectivity, 5G enables devices to communicate faster and more efficiently, thereby enhancing the responsiveness and capabilities of smart home hubs.

As consumers demand greater convenience and automation in their homes, these advancements empower smart home hubs to become the central command points for controlling everything from lighting and security systems to entertainment and climate control. Thus, the convergence of these technological innovations drives a more connected, intelligent, and personalized smart home ecosystem, stimulating continued market growth.

Restraint

Security Concerns and Privacy Issues

Despite the growth potential of the global Smart Home Hub market, concerns regarding security and privacy remain significant barriers to wider adoption. Smart home hubs are susceptible to cyber threats due to their constant connectivity to the internet, creating opportunities for hackers to exploit vulnerabilities in the network. The risk of unauthorized access to personal data and control over household devices raises alarms for consumers who prioritize security.

As more devices are connected to these hubs, the potential impact of security breaches becomes more concerning, especially when sensitive personal information, such as voice recordings and Smart home security footage, is stored or transmitted over the internet.

Moreover, privacy concerns have intensified as the use of voice-activated assistants, which are integral to many smart home hubs, has led to debates about data collection practices. Smart home devices often gather vast amounts of personal data, including behavioral patterns and preferences, raising ethical questions about the extent to which this data should be accessed and used by manufacturers or third parties.

These concerns have led to a reluctance among some consumers to fully embrace smart home technology, limiting the overall growth of the market. As a result, manufacturers and service providers must address these issues by enhancing cybersecurity measures and establishing clearer privacy protocols to build trust and facilitate broader adoption.

Opportunity

Increased Demand for Energy Efficiency

The growing global focus on sustainability and energy conservation presents a significant opportunity for the Smart Home Hub market. As more consumers seek ways to reduce their environmental footprint and optimize energy consumption, smart home hubs are being recognized as a valuable tool for managing energy use.

Through intelligent automation, these hubs enable users to monitor and control the energy consumption of various household appliances, including lighting, heating, and air conditioning systems. By optimizing energy use, smart home hubs can contribute to lower utility bills, which is an attractive proposition for environmentally conscious consumers looking to reduce their energy costs.

Additionally, the rise of smart grids and renewable energy solutions offers an opportunity for smart home hubs to integrate with broader energy management systems. This integration can enable more efficient energy distribution within homes, providing users with greater control over how they consume power.

In particular, features such as real-time energy monitoring, the ability to schedule device usage, and the automation of energy-saving actions during peak hours are expected to drive demand. The potential for energy efficiency to contribute to both economic savings and environmental sustainability makes it a compelling opportunity for further growth in the smart home hub market.

Trends

Integration with Home Automation Systems

A significant trend driving the global Smart Home Hub market is the growing integration of smart home hubs with broader home automation systems. Consumers are increasingly seeking a unified platform that can control a wide range of devices, from smart thermostats and lighting systems to security cameras and entertainment devices.

As a result, smart home hubs are evolving into central control units that not only connect disparate devices but also streamline their operation, offering consumers a seamless experience. This trend is contributing to the increasing adoption of smart home hubs, as they become the foundation for a fully automated and connected home environment.

The push towards integrated home automation is also fueled by the consumer desire for convenience and personalization. By connecting smart home hubs with advanced systems such as home security, entertainment, and energy management, users can create tailored automation routines that suit their lifestyles.

For example, they can program their home to adjust lighting, temperature, and security settings based on their daily routines. This level of personalization and ease of use is attracting a larger consumer base, from tech-savvy early adopters to mainstream households. As these integrations continue to evolve, smart home hubs are poised to play an increasingly central role in the broader home automation ecosystem, further accelerating market growth.

Regional Analysis

North America Smart Home Hub Market with Largest Market Share of 35.2% in 2024

The Smart Home Hub Market is projected to experience significant growth across various regions, with North America currently leading the market with a substantial share of 35.2% in 2024, valued at USD 47.9 billion. This dominance is primarily attributed to the region’s high consumer adoption rate, advanced technological infrastructure, and strong market presence of key players.

In North America, particularly in the United States, the demand for smart home devices continues to rise due to increased consumer awareness, disposable income, and the growing trend of home automation.

Europe holds a considerable share of the market as well. The European region is driven by a rising focus on energy efficiency and sustainability, coupled with government initiatives aimed at supporting smart cities and IoT integration. The expansion of smart home technologies in countries like Germany, the UK, and France is further fueling the market growth.

Asia Pacific is witnessing the fastest growth in the Smart Home Hub Market. Factors such as rapid urbanization, rising disposable incomes, and the increased demand for smart consumer electronics, particularly in China, Japan, and India, are contributing to the region’s market expansion. The growing middle class and an increase in the number of connected devices further drive the adoption of smart home solutions in this region.

In the Middle East & Africa, the market remains in a nascent stage but is gradually growing due to rising investment in smart city projects and growing consumer interest in high-tech living environments. The region is expected to experience a steady growth rate, with countries like the UAE and Saudi Arabia leading the adoption of smart technologies.

Latin America, while contributing a smaller share to the global market, is showing signs of gradual growth. The market in this region is driven by increased internet penetration, the expansion of smart home infrastructure, and the growing middle class in countries such as Brazil and Mexico. However, challenges like economic instability and relatively high product costs may limit faster adoption rates in the short term.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

The Global Smart Home Hub Market in 2024 is characterized by intense competition, with several key players leading the innovation and adoption of connected home technologies. Amazon.com, Inc. (Amazon Echo) remains one of the dominant forces, leveraging its established customer base and advanced AI capabilities, making it a top choice for users seeking seamless integration and ease of use.

Google LLC (Alphabet Inc.) also holds a significant market share with its Google Home ecosystem, offering superior voice recognition and integration with Google’s expansive software suite. Samsung Electronics, with its SmartThings platform, continues to innovate with a robust range of smart devices and strategic partnerships. Apple Inc., known for its premium user experience, competes with its HomeKit framework, driving adoption among iOS-centric households.

LG Electronics and Xiaomi bring unique offerings to the market, with LG focusing on integration across its home appliances and Xiaomi emphasizing affordability and wide product compatibility. Companies like Vivint, Inc. and Control4 (Snap One, LLC) are also expanding their influence by targeting the premium smart home and home automation segments, respectively.

Emerging players like Brilliant NextGen, Inc. and Aqara (Lumi United Technology Co., Ltd.) are gaining traction with their innovative designs and focus on seamless, user-friendly experiences.

Microsoft and Crestron Electronics are capitalizing on their established B2B strengths, delivering robust solutions for larger-scale smart home ecosystems. As the market grows, the competitive landscape is likely to evolve, with companies continuing to differentiate through product innovation, integration, and customer experience.

Top Key Players in the Market

- Amazon.com, Inc. (Amazon Echo)

- Google LLC (Alphabet Inc.)

- Brilliant NextGen, Inc.

- Aeotec Group

- LG Electronics

- Logitech

- Apple Inc.

- Samsung Electronics (Samsung SmartThings)

- Vivint, Inc.

- Hubitat

- Control4 (Snap One, LLC)

- Zipato

- Aqara (Lumi United Technology Co., Ltd.)

- Microsoft Corporation

- Xiaomi

- Cozify Oy

- Crestron Electronics

- Insteon

Recent Developments

- In 2024, Apple launched the HomePod mini in a sleek midnight color, designed with a fully recyclable mesh fabric. Standing at just 3.3 inches, it delivers powerful sound in a compact form. The exterior features an acoustically transparent mesh and a touch surface that lights up from edge to edge. The midnight version joins other vibrant colors, including yellow, orange, blue, and white, and became available on July 17.

- In August 2024, Lutron Electronics expanded its Caséta lineup with new additions aimed at simplifying installations for professionals. The new Diva smart dimmer incorporates ELV+ technology, while the Pico paddle remotes are now offered in five additional colors. These products provide more options for installers and are designed to accommodate a range of load types in the paddle-style aesthetic.

- In 2023, ADT and Google introduced the ADT Self Setup, a DIY smart home security system. This advanced solution integrates Google’s Nest products with ADT’s security technology and monitoring services. The system, controlled via the ADT+ app, is the first offering from ADT and Google to combine home security and smart home functionality for the DIY market.

- In 2024, eufy Security launched a new line of dual-camera home security devices, marking a first in the industry. The devices feature both wide-angle and telephoto lenses, offering enhanced surveillance capabilities. The innovative AI technology enables cross-camera tracking, allowing for seamless monitoring across multiple devices and delivering a unified video notification to users.

Report Scope

Report Features Description Market Value (2024) USD 136.2 Billion Forecast Revenue (2034) USD 404.5 Billion CAGR (2025-2034) 11.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Connectivity (Wi-Fi, Bluetooth, Others), By Application (Home Security and Automation, Entertainment, Energy Management, Healthcare), By Distrubution Channel (Specialty Retailers, Electronic Stores, Online Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Amazon.com, Inc. (Amazon Echo), Google LLC (Alphabet Inc.), Brilliant NextGen, Inc., Aeotec Group, LG Electronics, Logitech, Apple Inc., Samsung Electronics (Samsung SmartThings), Vivint, Inc., Hubitat, Control4 (Snap One, LLC), Zipato, Aqara (Lumi United Technology Co., Ltd.), Microsoft Corporation, Xiaomi, Cozify Oy, Crestron Electronics, Insteon Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Google Inc.

- Amazon

- Logitech

- Securifi

- Microsoft Corporation

- LG Electronics

- Flex (Wink Labs)

- SmartBeings

- Vera Control

- Apple

- Control4