Global Home Office Furniture Market Size, Share, Growth Analysis By Product Type (Desks, Office Chairs, Filing Cabinets, Bookcases, Storage Units, Workstations, Ergonomic Furniture), By Material (Wood, Metal, Glass, Plastic, Upholstery), By End-User (Remote Workers, Freelancers, Small Business Owners, Students, Corporations (Home Office Setup)), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 139503

- Number of Pages: 254

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

The Global Home Office Furniture Market size is expected to be worth around USD 45.3 Billion by 2034, from USD 25.3 Billion in 2024, growing at a CAGR of 6.0% during the forecast period from 2025 to 2034.

Home office furniture is designed for workspaces within a home setting. It includes desks, chairs, storage units, and other furniture items that provide comfort and functionality. This furniture supports a productive environment for individuals working from home or setting up a home office.

The home office furniture market involves the production and sale of furniture tailored for home workspaces. It includes desks, ergonomic chairs, shelves, and storage solutions. The market addresses the growing demand for functional and stylish furniture for remote workers and home-based businesses.

The Home Office Furniture market is growing rapidly, driven by shifts in work habits. According to Quantum Workplace, 32% of employees prefer to work fully remotely, and 41% favor a hybrid setup. These preferences are increasing demand for ergonomic, stylish furniture designed for home offices, creating new opportunities for furniture makers.

As remote and hybrid workplace setups become more common, the demand for home office furniture is rising. This trend is particularly strong in North America and Europe, where people are seeking functional, aesthetically pleasing setups. In addition, HNI Corporation’s $485 million acquisition of Kimball International strengthens its market position, showing confidence in this growing segment.

While the market is expanding, competition is increasing, especially among established players like HNI and smaller brands. The market is not yet saturated, but new entrants face challenges in differentiating products. Companies must innovate, focusing on design, ergonomics, and multi-functionality, to stand out in an increasingly competitive landscape.

Key Takeaways

- Home Office Furniture Market was valued at USD 25.3 billion in 2024 and is expected to reach USD 45.3 billion by 2034, with a CAGR of 6.0%.

- In 2024, Desks dominate the product type segment with 30.4%, crucial for creating functional home office spaces.

- In 2024, Wood leads the material segment with 38.5%, appreciated for its durability and aesthetic quality in home office setups.

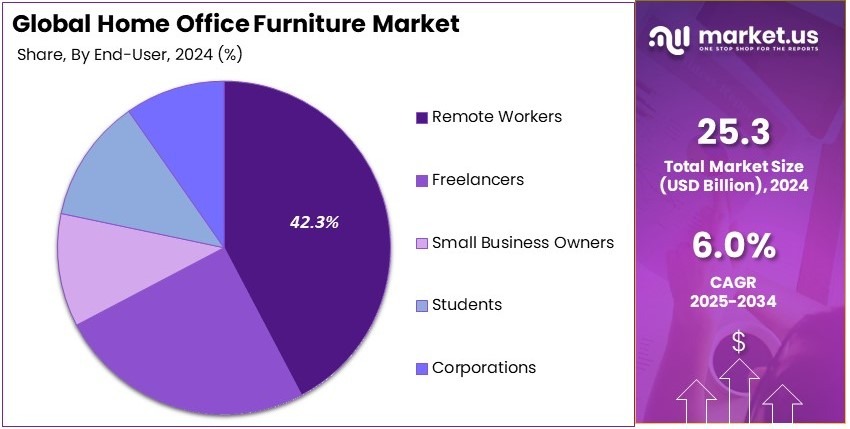

- In 2024, Remote Workers dominate the end-user segment with 42.3%, a reflection of the ongoing remote work trend and demand for ergonomic home office solutions.

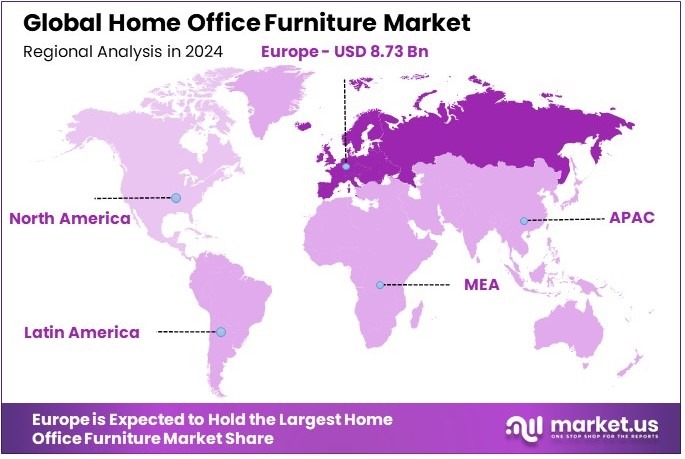

- In 2024, Europe dominates the regional market with 34.5%, contributing USD 8.73 billion, due to the growing adoption of remote work in the region.

Product Type Analysis

Desks dominate with 30.4% due to their essential role in home offices and increasing demand for versatile workstations.

In the Home Office Furniture Market, desks hold the largest share at 30.4%. The rise of remote work and flexible work-from-home arrangements has fueled the demand for desks that offer functionality, comfort, and organization. Desks are central to any home office setup, whether for employees, freelancers, or students.

With the increasing trend of remote working, people are investing in desks that fit their available space and personal style. Modern desks often feature adjustable heights, built-in storage, and cable management systems, making them more versatile and appealing to consumers. This trend has been further amplified by the need for ergonomic solutions, as long hours of work demand a comfortable, supportive desk environment.

Office chairs follow closely in market share, driven by the need for comfort and support in long work hours. Filing cabinets are essential for those who require organized storage for documents and paperwork, although they hold a smaller share compared to desks and chairs.

Bookcases also play an important role, especially in professional home offices where books or other materials need to be stored. Storage units and workstations are similarly growing in demand, as people need multi-functional spaces that support both work and organization.

Ergonomic furniture, though important for health and comfort, occupies a smaller portion of the market compared to desks and office chairs, as it’s often part of a broader ergonomic solution.

Material Analysis

Wood dominates with 38.5% due to its durability, aesthetic appeal, and timeless quality in home office furniture.

Wood remains the most popular material in the home office furniture market, capturing 38.5% of the share. Wood is highly valued for its durability, natural beauty, and versatility. It adds warmth and elegance to home offices, making it an attractive choice for consumers.

Wooden desks and chairs fit well in both modern and traditional home office settings, contributing to their high demand. Wood also has the ability to be customized in various finishes, from dark to light tones, allowing consumers to match their office décor. With more people creating stylish home offices, wood provides a timeless, high-quality material choice that enhances the space.

Metal, while not as dominant as wood, is gaining popularity in modern home office designs. Metal desks and chairs are often chosen for their sleek, contemporary look and durability. Metal’s strength makes it ideal for creating sturdy office furniture that can withstand heavy use.

Plastic materials are also used in some office furniture but are generally seen in lower-cost options like storage units or compact desks. Glass, although popular for modern designs, is often used sparingly due to its fragility.

Upholstery materials are crucial for comfort, especially in office furniture and ergonomic furniture, but they don’t hold as large a share as wood or metal. The comfort factor, however, continues to make upholstered chairs highly popular.

End-User Analysis

Remote Workers dominate with 42.3% due to the surge in work-from-home trends and the need for functional office setups.

Remote workers represent the largest end-user segment in the home office furniture market, with a share of 42.3%. The rise of remote work, accelerated by the COVID-19 pandemic, has significantly increased the demand for home office furniture. Remote workers require a variety of furniture types that allow them to create efficient, comfortable, and personalized workspaces at home.

Desks, chairs, and ergonomic furniture are particularly in demand as remote employees prioritize comfort, health, and productivity during long working hours. The need for versatile furniture solutions that fit into different spaces, from small apartments to larger homes, has led to a boom in the home office furniture market.

Freelancers, while a smaller group than remote workers, contribute significantly to the market. Freelancers often need highly functional and aesthetically pleasing home offices, making them invest in quality desks and ergonomic chairs.

Small business owners also represent a growing segment as they set up home offices or small business spaces in their homes. The demand for home office furniture from small business owners focuses on multi-functional furniture that can serve various purposes.

Students are another key group driving growth in this market. As online learning becomes more prevalent, students need comfortable desks and chairs to create productive study spaces at home. Corporations that set up home offices for employees are also investing in high-quality home office furniture to maintain productivity in remote work setups.

Key Market Segments

By Product Type

- Desks

- Office Chairs

- Filing Cabinets

- Bookcases

- Storage Units

- Workstations

- Ergonomic Furniture

By Material

- Wood

- Metal

- Glass

- Plastic

- Upholstery

By End-User

- Remote Workers

- Freelancers

- Small Business Owners

- Students

- Corporations (Home Office Setup)

Driving Factors

Remote Dynamics and Wellness Trends Drive Market Growth

The surge in remote work and hybrid office trends has transformed the home office furniture market. Many professionals now work from home, creating a strong demand for versatile furniture that supports both productivity and comfort. This shift has led to an urgent need for designs that blend functionality with style.

Increasing emphasis on ergonomics and wellness further boosts demand for advanced furniture solutions. Buyers seek products that promote proper posture and reduce fatigue during long work hours. Ergonomic chairs, adjustable desks, and supportive accessories are now vital for maintaining health and efficiency.

Growing investments in home office renovations signal that remote work is here to stay. Both companies and homeowners are upgrading their spaces with modern, efficient solutions. Urban centers worldwide reflect this trend as permanent remote arrangements reshape residential design priorities.

Expanding digital connectivity and smart home integration enhance the functionality of home office furniture. Modern pieces now incorporate wireless charging, voice control, and automated adjustments. These innovative enhancements truly transform home offices into efficient, inspiring workspaces for success.

Restraining Factors

Space, Costs, and Compliance Restraints Market Growth

Limited space in urban apartments restricts the installation of large-scale home office furniture. Many city dwellers live in compact spaces that do not allow for bulky desks and oversized workstations. This constraint forces buyers to choose smaller, less expensive solutions that fit tight rooms.

High initial investment costs also deter many consumers from upgrading to premium home office furniture. Budget constraints make it difficult for individuals and businesses to commit to high-priced, advanced solutions. The fear of overspending often leads buyers to choose basic models over more sophisticated options.

Supply chain disruptions and material shortages further constrain the market. Frequent delays in production lead to inconsistent availability of home office furniture. These issues cause uncertainty for buyers and complicate inventory management for retailers. Shipping delays and rising costs add extra pressure on manufacturers.

Complex regulatory and safety standards also limit innovative design. Manufacturers face strict guidelines that slow down the introduction of creative solutions. These rules require extra testing and certification, adding time and expense to product launches. Such hurdles impede market growth.

Growth Opportunities

Innovation and Collaboration Provide Opportunities

The market shows strong opportunities through the development of modular and multi-functional home office furniture. Manufacturers are creating pieces that adapt to small spaces and changing needs. Such designs allow users to reconfigure setups easily, combining storage, work surfaces, and seating into one compact solution meeting evolving remote work demands.

Integration of IoT and smart technology opens new avenues for home office furniture. Advanced products now feature wireless connectivity, voice control, and automated adjustments. These features enhance comfort and productivity while offering real-time customization. Such integrations meet the growing demand for technology-driven workspaces that support flexible work.

Strategic collaborations between interior designers and tech innovators create adaptive home office solutions. These partnerships combine aesthetic appeal with cutting-edge functionality to produce furniture that is both stylish and efficient. Joint efforts lead to innovative designs that reflect current trends and meet diverse user needs in changing work environments globally.

Expansion into emerging markets further fuels growth opportunities. Regions with rising remote work cultures, such as parts of Asia and Latin America, show increasing demand for home workspace solutions. Companies expanding into these areas benefit from less competition and new customer bases, thereby driving market expansion and overall revenue growth.

Emerging Trends

Sustainability and Smart Design Are Latest Trending Factor

Sustainable and eco-friendly materials are gaining prominence in home office furniture. Manufacturers are increasingly using recycled components and renewable resources to meet environmental standards. This shift appeals to eco-conscious consumers who prioritize green living. Such sustainable practices reduce waste and support long-term ecological balance in modern workspaces, boosting overall appeal.

Minimalist and Scandinavian design aesthetics are trending in home office interiors. Clean lines, neutral colors, and simple forms create a calm and efficient workspace. These design trends help reduce clutter and foster creativity. Many consumers now favor modern styles that combine beauty with practical functionality, driving dynamic workspace innovation worldwide.

Customization and personalization trends are shaping home office furniture. Consumers seek products that reflect individual lifestyles and work preferences. Furniture that adapts to personal needs offers enhanced comfort and style. Tailored designs enable users to create unique spaces that inspire productivity and mirror their identity in a professional setting remarkably.

Virtual home office showrooms and augmented reality tools are emerging to enhance customer experience. These digital innovations allow buyers to visualize furniture in their space before purchase. AR tools offer interactive previews and accurate measurements. Such virtual experiences simplify selection and boost confidence in product choices for modern consumers effectively.

Regional Analysis

Europe Dominates with 34.5% Market Share

Europe leads the Home Office Furniture Market with a 34.5% market share, worth USD 8.73 billion. This dominance is driven by increasing demand for home office setups, especially in countries like the UK, Germany, and France, where the remote working trend is strongly established. The European market benefits from the region’s well-developed infrastructure, higher disposable incomes, and a shift toward flexible work environments.

Key factors contributing to Europe’s strong position include the rise of the hybrid work model, where employees split their time between home and the office. This has increased demand for ergonomic, aesthetically pleasing, and functional furniture tailored for home offices.

In addition, European consumers are placing greater importance on furniture that is sustainable, with a preference for eco-friendly materials. This aligns with the growing green movement across the continent, where governments and organizations emphasize reducing carbon footprints.

The region also boasts a diverse range of manufacturers and suppliers who cater to the needs of various consumer segments. From budget-friendly to high-end luxury furniture designs, Europe offers a wide variety of options. The focus on customization, ease of use, and comfort also makes Europe a leader in this market.

Regional Mentions:

- North America: North America, with a significant presence in the home office furniture market, benefits from a large workforce shifting to home offices. The U.S. remains a strong driver due to its diverse and tech-savvy population and corporate investments in home office solutions.

- Asia Pacific: Asia Pacific is experiencing rapid growth in home office furniture demand, particularly in countries like China, India, and Japan. Urbanization and a booming middle class are increasing the need for home office furniture solutions in the region.

- Middle East & Africa: The Middle East & Africa’s home office furniture market is growing, mainly driven by increasing urbanization and demand for flexible workspaces. In countries like the UAE, the trend of working from home is gaining momentum.

- Latin America: Latin America is seeing steady growth in home office furniture, particularly in Brazil and Mexico. The rise of remote work and increasing digital connectivity are helping boost the demand for ergonomic and stylish office furniture solutions.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

The Home Office Furniture Market is largely driven by top companies like IKEA, Steelcase, Herman Miller, and Knoll Inc., who set trends in design, functionality, and affordability for home office setups.

IKEA is a global leader known for its affordable and stylish furniture solutions. Offering a wide range of modular furniture for home offices, IKEA is popular for its simple, functional, and easy-to-assemble pieces. Their focus on minimalistic design and value for money has made them a go-to choice for many setting up home offices.

Steelcase brings high-quality, ergonomic furniture to the home office market. Known for its premium office chairs and desks, Steelcase’s products prioritize comfort and productivity. Their innovative designs support long hours of work, and they offer customizable solutions for people looking to create a more ergonomic and efficient home office environment.

Herman Miller is well-known for its design-forward office furniture. Their home office products are not only ergonomic but also modern and stylish. Herman Miller is particularly famous for their iconic office chairs like the Aeron chair, which has become a symbol of comfort and design excellence in home offices.

Knoll Inc. also plays a significant role in the home office furniture market, offering high-end, stylish, and functional furniture. Knoll’s products are designed with a focus on both aesthetics and performance, appealing to individuals seeking both comfort and design sophistication for their home offices.

These key players dominate the market by offering products that combine comfort, functionality, and style, helping individuals create productive and aesthetically pleasing home office spaces.

Major Companies in the Market

- IKEA

- Steelcase

- Herman Miller

- Knoll Inc.

- Ashley Furniture Industries

- HNI Corporation

- Haworth Inc.

- Wayfair

- Kimball International

- Sauder Woodworking

Recent Developments

- KOAS Co.: On April 2024, South Korean furniture manufacturer KOAS Co. launched its new brand, Space, offering minimalist office furniture designed for small workspaces. The product lineup, including desks, height-adjustable sit-stand desks, and bookshelf-desk combos, was introduced through an online mall to meet the growing demand for affordable, premium office furniture in coworking spaces and microenterprises.

- Bentley Home: On April 2024, Bentley Home unveiled a new six-piece furniture collection at Milan Design Week 2024, marking its first venture into home office furniture. The collection, developed in collaboration with designers Carlo Colombo, Federico Peri, and Francesco Forcellini, combines contemporary luxury, sustainability, and customization.

Report Scope

Report Features Description Market Value (2024) USD 25.3 Billion Forecast Revenue (2034) USD 45.3 Billion CAGR (2025-2034) 6.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Desks, Office Chairs, Filing Cabinets, Bookcases, Storage Units, Workstations, Ergonomic Furniture), By Material (Wood, Metal, Glass, Plastic, Upholstery), By End-User (Remote Workers, Freelancers, Small Business Owners, Students, Corporations (Home Office Setup)) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape IKEA, Steelcase, Herman Miller, Knoll Inc., Ashley Furniture Industries, HNI Corporation, Haworth Inc., Wayfair, Kimball International, Sauder Woodworking Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Global Home Office Furniture MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample

Global Home Office Furniture MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- IKEA

- Steelcase

- Herman Miller

- Knoll Inc.

- Ashley Furniture Industries

- HNI Corporation

- Haworth Inc.

- Wayfair

- Kimball International

- Sauder Woodworking