Global Stainless Steel Vacuum Bottle Market By Application (Personal Use, Commercial Use, Sports & Recreation, Others), By Distribution Channel (Online Retail, Supermarkets and Hypermarkets, Specialty Stores, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 14902

- Number of Pages: 301

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

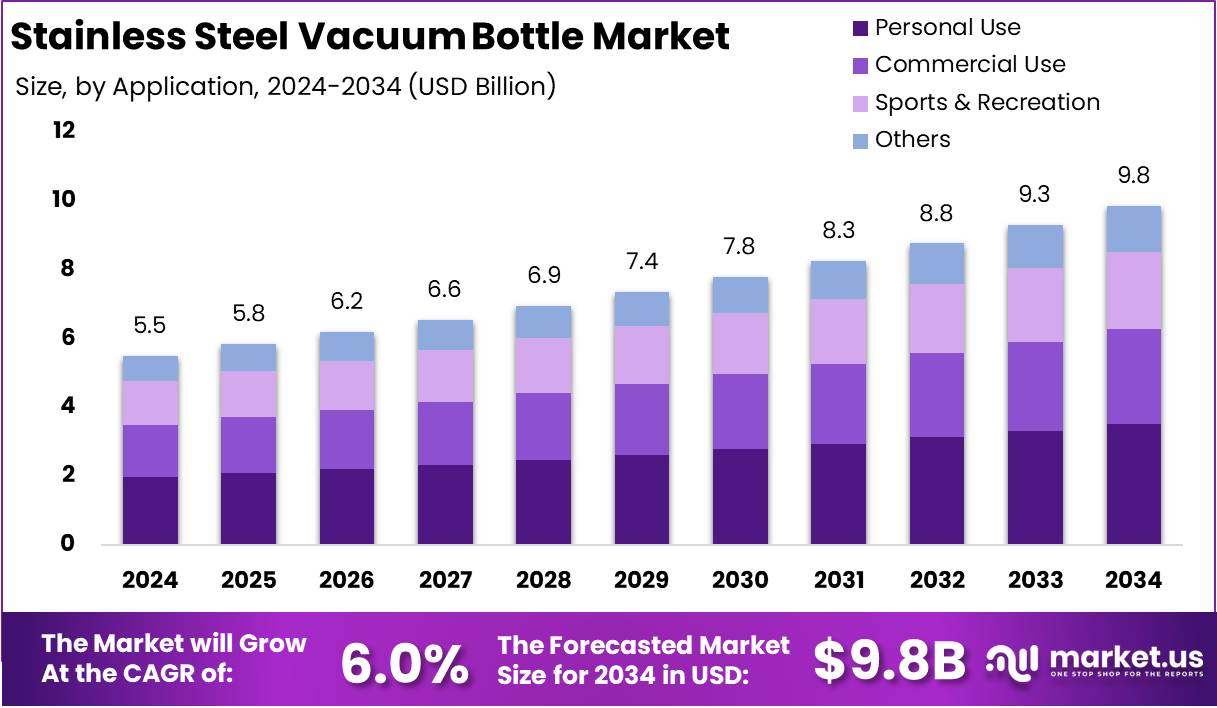

The Global Stainless Steel Vacuum Bottle Market size is expected to be worth around USD 9.8 Billion by 2034 from USD 5.5 Billion in 2024, growing at a CAGR of 6.0% during the forecast period from 2025 to 2034.

A stainless steel vacuum bottle is a type of insulated container engineered to maintain the temperature of beverages for extended durations. Utilizing a double-walled structure with a vacuum-sealed layer between the inner and outer stainless steel walls, these bottles effectively reduce heat transfer through conduction and convection.

This design ensures that hot beverages remain hot and cold liquids stay cool for several hours, making them highly suitable for both everyday use and outdoor activities. Owing to their durability, corrosion resistance, and non-reactive material properties, stainless steel vacuum bottles offer a safe and sustainable alternative to plastic or glass containers.

The stainless steel vacuum bottle market refers to the global commercial landscape encompassing the design, production, distribution, and sale of insulated stainless steel bottles. This market includes a diverse range of products catering to consumers across various sectors such as personal hydration, sports and fitness, corporate gifting, and travel accessories.

The market is segmented by capacity, application, distribution channel, and geography, and is influenced by evolving consumer preferences for sustainable and reusable products. Rapid urbanization, increasing awareness of environmental sustainability, and lifestyle shifts toward health and wellness have collectively contributed to the steady expansion of this market.

The growth of the stainless steel vacuum bottle market can be attributed to the increasing global emphasis on sustainable consumption and the reduction of single-use plastics. Regulatory policies promoting eco-friendly alternatives and heightened consumer consciousness regarding environmental impacts have led to a surge in the adoption of reusable beverage containers.

In parallel, the rising demand for convenient, portable, and temperature-retaining hydration solutions especially among working professionals and fitness enthusiasts has further propelled market growth.

Technological advancements in insulation materials and product design have also played a significant role. The integration of features such as leak-proof lids, ergonomic grips, and smart temperature indicators has enhanced product functionality and consumer appeal. Additionally, strong brand positioning and expanding e-commerce channels have improved accessibility, thereby accelerating global market penetration and revenue potential.

Demand for stainless steel vacuum bottles is witnessing sustained growth, driven by a combination of health, environmental, and lifestyle factors. As consumers become more health-conscious, there is a marked preference for products that are BPA-free, toxin-resistant, and capable of preserving the purity of beverages. The adoption of stainless steel vacuum bottles as a daily essential across home, office, gym, and outdoor settings has solidified their status as both a utility item and a personal accessory.

Significant growth opportunities exist in the expansion of eco-conscious product lines tailored to diverse consumer demographics. Brands investing in biodegradable packaging, minimalist design aesthetics, and smart functionality are well-positioned to capture a larger share of the market. The increasing adoption of stainless steel vacuum bottles in educational institutions, outdoor sports events, and travel gear also presents avenues for targeted product segmentation and marketing.

According to The Roundup, the Stainless Steel Vacuum Bottle Market is experiencing sustained growth, supported by a shift in consumer preference, with 40% of bottle owners favoring stainless steel over plastic 27% and glass 20%. The U.S. consumes 50 billion water bottles annually averaging 13 bottles per person monthly driving concerns over environmental impact. Replacing single-use plastic with reusable bottles could eliminate 156 bottles per person each year.

Notably, manufacturing one stainless steel bottle uses the same energy as 50 plastic bottles, positioning it as a sustainable alternative. Additionally, bottling water demands 16 million barrels of oil and emits 2.5 million tons of CO₂ annually, while switching to reusable stainless steel options can save CO₂ volumes equal to 2,580 balloons per person per year. This transition underscores a strong market opportunity driven by environmental benefits, energy efficiency, and consumer sustainability preferences.

According to worldsteel, the Stainless Steel Vacuum Bottle Market is expected to benefit from the 5.6% year-over-year rise in global crude steel production, which reached 144.5 million tonnes (Mt) in December 2024. Regional output trends reflect strong momentum in Asia and Oceania, which reported a 9.0% increase to 106.3 Mt, and the EU 27, which saw a 7.2% rise to 9.6 Mt both key suppliers of stainless steel used in vacuum bottles.

Key Takeaways

- The global stainless steel vacuum bottle market is projected to reach approximately USD 9.8 billion by 2034, up from USD 5.5 billion in 2024, registering a Compound Annual Growth Rate (CAGR) of 6.0% during the forecast period from 2025 to 2034.

- In 2024, the Personal Use segment emerged as the leading application category, accounting for more than 35.6% of the total market share, highlighting strong consumer preference for individual hydration solutions.

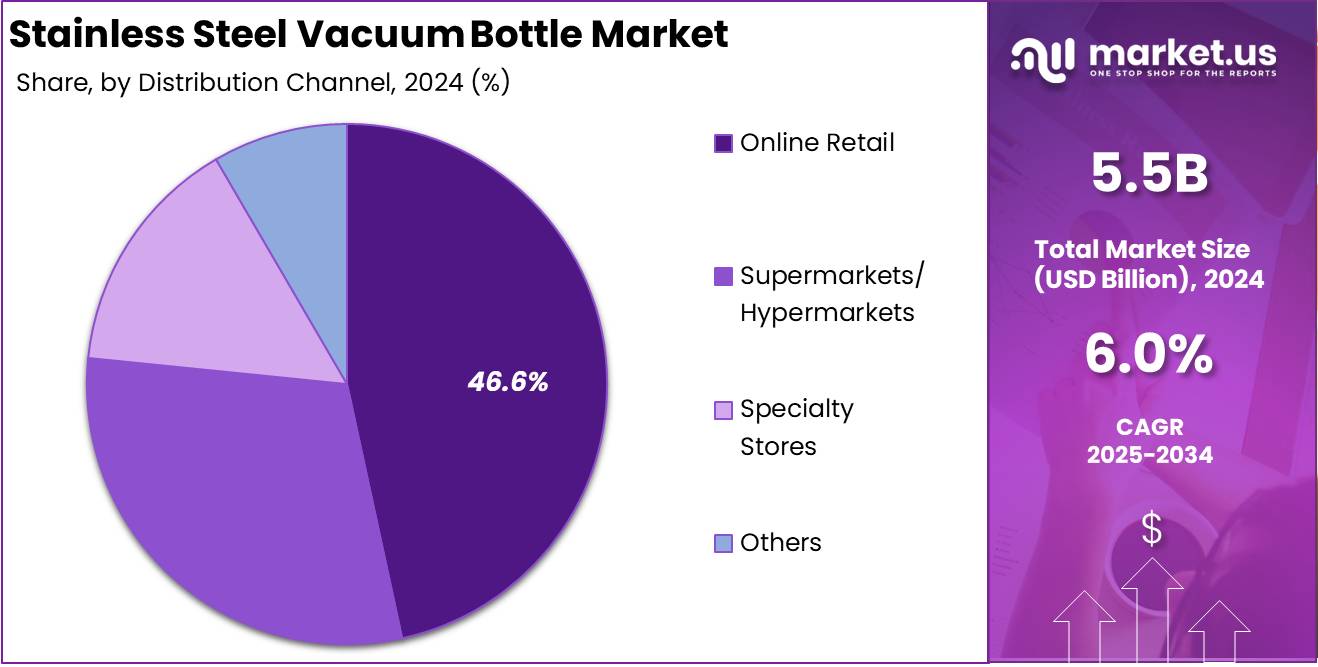

- Online Retail was the dominant distribution channel in 2024, representing over 46.6% of the market share, reflecting the growing reliance on e-commerce platforms for the purchase of stainless steel vacuum bottles.

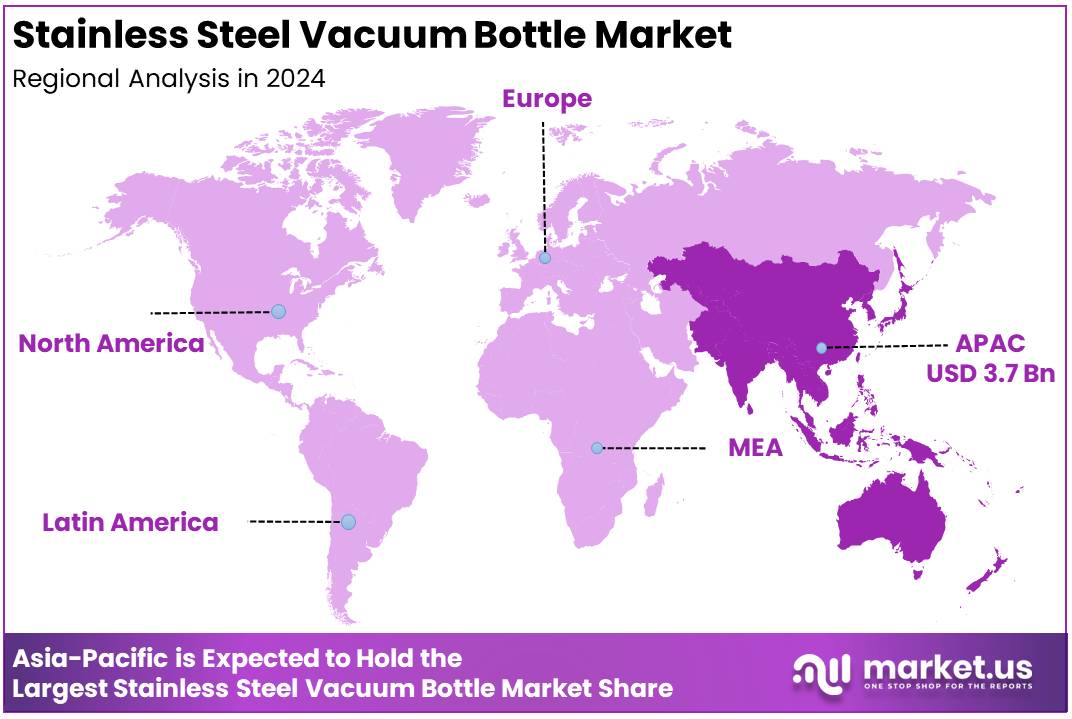

- Asia-Pacific led the global market in 2024, capturing a significant 38.6% share, equivalent to approximately USD 3.7 billion, underscoring the region’s robust consumer demand and manufacturing capacity for stainless steel vacuum bottles.

By Application Analysis

Personal Use dominated the Stainless Steel Vacuum Bottle Market capturing more than a 35.6% share

In 2024, Personal Use held a dominant market position in the Stainless Steel Vacuum Bottle Market by Application, capturing more than a 35.6% share. The growth of this segment is primarily attributed to the rising consumer demand for durable, eco-friendly, and reusable drinkware for everyday hydration needs.

Increasing awareness of health and wellness, combined with the global shift away from single-use plastic bottles, has strengthened the adoption of stainless steel vacuum bottles in personal daily routines. These bottles are favored for their thermal insulation, portability, and resistance to corrosion, which make them ideal for school, office, and home use.

Furthermore, the rise of lifestyle-oriented branding and product personalization in the drinkware market has contributed to growing consumer interest in owning aesthetically designed stainless steel vacuum bottles. E-commerce platforms and retail outlets are increasingly promoting such products through sustainability-focused campaigns.

Additionally, urban consumers are more inclined toward high-quality, BPA-free bottles due to increasing concerns about toxic materials. As a result, the Personal Use segment is expected to remain the largest and most stable revenue contributor in the foreseeable future.

In 2024, the commercial use segment experienced sustained demand across a range of institutional environments including offices, hotels, restaurants, and catering services. Organizations are increasingly adopting reusable thermal bottles to provide environmentally responsible beverage solutions for employees and clients. This shift is driven by growing corporate focus on minimizing operational waste and adhering to sustainable workplace practices.

In the hospitality sector, stainless steel vacuum bottles are valued for their sleek aesthetics and reliable thermal insulation. These bottles are frequently utilized as promotional merchandise and executive gifts, encouraging volume purchases by businesses. Moreover, their commercial adoption supports brand recognition initiatives and aligns with corporate social responsibility (CSR) efforts to reduce dependence on disposable plastic drinkware.

In the sports and recreation segment, the rising engagement in outdoor activities, fitness routines, and recreational tourism has accelerated the demand for performance-oriented stainless steel drinkware. Athletes and outdoor consumers favor these bottles for their ability to preserve beverage temperature and endure rugged usage conditions during extended activities.

Health-conscious lifestyles among younger and mid-aged demographics have further encouraged adoption, with growing gym attendance and participation in sports events. This demand is met by manufacturers offering lightweight, ergonomic designs with features such as leak-proof lids and one-hand operation. The segment continues to show positive momentum supported by increasing awareness of hydration’s role in physical performance and wellness.

The others segment comprises diverse applications such as institutional gifting, travel retail, and promotional distributions. Although it represents a smaller share of the overall market, it benefits from specialized usage in schools, government offices, travel agencies, and public sector initiatives focused on sustainable practices.

By Distribution Channel Analysis

Online Retail dominated the Stainless Steel Vacuum Bottle Market capturing more than a 46.6% share

In 2024, Online Retail held a dominant market position in the Stainless Steel Vacuum Bottle Market by Distribution Channel, capturing more than a 46.6% share. The rapid expansion of e-commerce platforms, combined with growing internet penetration and smartphone usage, has significantly boosted online sales of stainless steel vacuum bottles.

Consumers are increasingly drawn to the convenience of online shopping, where they can compare prices, access customer reviews, and explore a wider variety of brands and styles. In addition, many e-commerce platforms offer competitive pricing and promotional discounts that further encourage purchase behavior.

The segment’s growth is also driven by the ability of online channels to cater to customized demands and doorstep delivery. Brands have leveraged social media marketing, influencer endorsements, and targeted digital advertising to increase product visibility. As a result, both established companies and emerging players are prioritizing their online presence to capture a larger consumer base. The increasing preference for direct-to-consumer (DTC) models further supports the dominance of this distribution channel.

In 2024, supermarkets and hypermarkets continued to play a significant role in the Stainless Steel Vacuum Bottle Market by Distribution Channel. These retail formats appeal to consumers seeking immediate product availability, hands-on inspection, and in-store promotional offers. Organized layouts, a broad selection of brands, and physical visibility contribute to consistent customer engagement across this segment.

This channel is further strengthened by attractive price bundles and discount campaigns that resonate with value-driven buyers. The widespread presence of supermarkets and hypermarkets, particularly in densely populated areas, ensures strong product accessibility. As consumers maintain their preference for in-person purchasing and product comparison, this segment is expected to remain vital for medium- to high-volume sales of stainless steel vacuum bottles.

Specialty stores also contributed meaningfully to the Stainless Steel Vacuum Bottle Market in 2024. These outlets are known for offering curated selections, product-specific expertise, and a personalized shopping experience. Often focused on premium and lifestyle products, specialty stores serve a customer base looking for performance, aesthetics, and long-term durability in their hydration solutions.

These retailers play a critical role in strengthening brand positioning and customer loyalty, supported by knowledgeable staff who offer detailed guidance on product features. Specialty outlets are particularly aligned with consumers prioritizing eco-friendly and health-conscious choices. While their market reach is more limited compared to general retail, their impact on high-end and niche consumer segments remains notable.

The Others segment in 2024 included alternative distribution points such as convenience stores, direct-to-consumer sales, and institutional procurement. Though representing a smaller portion of the market, these channels are important for spontaneous purchases and bulk supply orders from corporate or government buyers.

Convenience stores, particularly in transportation hubs and public venues, serve time-sensitive consumers. Additionally, company-owned retail points and pop-up stores support brand-driven engagement and allow for more targeted outreach. Despite a narrower scope, this segment contributes to the overall market by broadening accessibility and meeting varied consumer needs in specialized contexts.

Key Market Segments

By Application

- Personal Use

- Commercial Use

- Sports & Recreation

- Others

By Distribution Channel

- Online Retail

- Supermarkets/Hypermarkets

- Specialty Stores

- Others

Driver

Rising Global Demand for Sustainable and Reusable Beverage Containers

The primary driver fueling the growth of the global stainless steel vacuum bottle market in 2024 is the increasing consumer shift toward sustainable and reusable beverage containers. The growing environmental awareness among consumers, coupled with a global push to reduce single-use plastics, has significantly enhanced the appeal of stainless steel vacuum bottles. These bottles are not only reusable and long-lasting, but they also offer excellent insulation capabilities, making them ideal for maintaining beverage temperatures over extended periods.

Consumers are becoming more conscious of their ecological footprint, leading to higher demand for products that align with green living. As governments across various regions implement stricter regulations against plastic usage and encourage eco-friendly alternatives, stainless steel vacuum bottles are increasingly adopted as a sustainable replacement.

Additionally, the rise of health-conscious lifestyles has contributed to the market’s expansion. Consumers are increasingly opting to carry their own water and beverages, reducing dependency on plastic bottled drinks, which are often perceived as being less safe due to chemical leaching. Stainless steel bottles, known for being BPA-free and resistant to corrosion, are becoming the preferred option for individuals seeking safe and durable hydration solutions.

This trend is especially prominent in urban areas, where the influence of environmental campaigns and wellness trends is stronger. Furthermore, with a noticeable surge in outdoor and fitness activities post-pandemic, the demand for high-performance, insulated containers has accelerated.

As a result, the stainless steel vacuum bottle market is witnessing steady growth, driven by the merging forces of environmental sustainability and health-conscious behavior. The market is expected to register continued growth as consumers across all age groups, especially millennials and Gen Z, prioritize eco-friendly and reusable product alternatives in their everyday consumption patterns.

Restraint

High Product Cost and Market Competition from Low-Cost Alternatives

One of the critical restraints limiting the growth of the global stainless steel vacuum bottle market in 2024 is the relatively high cost associated with these products compared to alternative materials. Stainless steel vacuum bottles are typically priced higher due to the superior quality of materials used, advanced insulation technologies, and longer durability. While this positions them as premium products, it also restricts their affordability for a large portion of the population, particularly in price-sensitive emerging markets.

In these regions, consumers often opt for low-cost plastic or aluminum bottles that offer basic functionality despite lacking advanced thermal retention or sustainability benefits. This price disparity presents a significant challenge to broader market penetration, especially when economic conditions are uncertain or purchasing power is limited.

In addition to pricing, the market is facing competition from alternative beverage containers such as glass bottles, BPA-free plastics, and even collapsible silicone containers, which cater to specific segments like travel enthusiasts and office users. These substitutes often attract consumers with features such as lightweight portability or transparent aesthetics at a lower price point.

Moreover, counterfeit or low-quality replicas of stainless steel vacuum bottles available in local markets further impact the perception of value and deter first-time buyers. These knockoffs can tarnish consumer confidence when performance fails to meet expectations. Consequently, premium manufacturers struggle to maintain their brand equity and justify higher prices, particularly in highly competitive markets where brand loyalty is still developing.

This pricing challenge, combined with the availability of a wide range of cheaper alternatives, continues to restrain the full potential of the stainless steel vacuum bottle market’s global expansion, despite rising awareness around sustainability and product quality.

Opportunity

Innovation in Design and Smart Technology Integration

A major opportunity shaping the growth trajectory of the global stainless steel vacuum bottle market in 2024 lies in innovation through smart technology integration and modernized design features. With rising consumer expectations for multifunctional and stylish products, manufacturers are exploring new ways to differentiate their offerings.

The integration of features such as temperature display screens, hydration reminders, and even app connectivity that tracks water intake is transforming the conventional bottle into a smart hydration companion.

These innovations appeal especially to the tech-savvy and health-conscious consumers who are actively seeking products that combine utility with technological convenience. The incorporation of such features is also expanding the product’s appeal beyond basic hydration, making it a lifestyle accessory in fitness, travel, and professional settings.

Simultaneously, design innovations that emphasize aesthetic appeal, personalization options, and ergonomic enhancements are further unlocking market potential. Sleek, minimalist, and trendy designs are gaining traction among younger demographics, while custom engraving and color variants are offering opportunities for premium personalization.

This demand for aesthetically pleasing and functional products aligns with the growing gifting culture and corporate branding needs, thus opening up niche segments. Moreover, advancements in manufacturing processes now allow for lighter and more compact stainless steel bottles without compromising insulation performance, making them more portable and user-friendly.

As consumer interest increasingly revolves around convenience, personal expression, and digital engagement, the market is well-positioned to leverage these trends. The strategic integration of smart features and modern designs is expected to catalyze a new wave of demand, especially in developed markets where consumers prioritize innovation and product differentiation. This shift toward tech-enhanced, personalized stainless steel bottles presents a lucrative avenue for growth, elevating the value proposition and fostering long-term customer engagement.

Trends

Surge in Outdoor Recreation and On-the-Go Lifestyles

One prominent trend influencing the stainless steel vacuum bottle market in 2024 is the global surge in outdoor recreation activities and on-the-go lifestyles. The post-pandemic era has seen a significant rise in consumer interest in activities such as hiking, camping, cycling, and fitness pursuits, all of which require durable, portable, and thermally insulated hydration solutions.

Stainless steel vacuum bottles are increasingly viewed as essential accessories for such activities, due to their ability to maintain beverage temperature, resist physical wear, and offer hygienic drinking options.

The bottles’ compatibility with a range of outdoor conditions from high-altitude cold to desert heat makes them a preferred choice for adventurers and fitness enthusiasts alike. This lifestyle-oriented consumption pattern is playing a critical role in reshaping demand dynamics across regional and demographic lines.

Urbanization is further reinforcing this trend, as consumers adapt to fast-paced routines that involve travel, work, and fitness engagements throughout the day. The convenience of carrying a personal bottle that can retain hot or cold liquids for extended hours aligns well with the urban consumer’s need for flexibility and efficiency. Furthermore, the growing trend of wellness on the move is promoting the habit of carrying nutrient-based beverages, herbal teas, or infused water necessitating bottles that preserve freshness and taste.

These behavioral changes are driving not only volume growth but also influencing product development toward lighter, more compact, and leak-proof models. As a result, stainless steel vacuum bottles are evolving into integral lifestyle accessories, benefiting from consumer preferences that favor functionality, mobility, and long-lasting performance. This trend is anticipated to sustain strong market momentum, encouraging continuous innovation to meet evolving usage scenarios in both outdoor and urban contexts.

Regional Analysis

Asia-Pacific Leads the Stainless Steel Vacuum Bottle Market with the Largest Market Share of 38.6% in 2024

In 2024, Asia-Pacific is projected to dominate the global stainless steel vacuum bottle market, capturing the largest market share of 38.6%, equivalent to approximately USD 3.7 billion. This regional leadership can be attributed to the widespread adoption of reusable and sustainable drinkware, supported by a rising awareness of environmental concerns and plastic alternatives.

Countries such as China, Japan, South Korea, and India have witnessed significant urbanization and changing consumer preferences, especially among younger demographics, driving the demand for stylish, durable, and functional vacuum bottles. Additionally, the growth of fitness and outdoor recreational activities, along with a strong presence of local manufacturers offering diverse product lines at competitive prices, continues to support the region’s stronghold in this segment.

North America holds a substantial share in the stainless steel vacuum bottle market, driven by heightened consumer inclination toward eco-friendly and health-conscious hydration solutions. The United States and Canada have demonstrated increased adoption of stainless steel bottles across various user groups, from office-goers to athletes.

The demand is further supported by the region’s well-established retail infrastructure and the growing penetration of e-commerce platforms. Moreover, consumer willingness to invest in premium-quality personal care products, coupled with lifestyle shifts favoring reusable over single-use containers, sustains regional growth.

Europe also represents a significant regional market, supported by stringent environmental regulations and sustainability goals that promote reusable consumer products. Countries such as Germany, the United Kingdom, and France are witnessing an uptick in demand for stainless steel vacuum bottles across schools, offices, and fitness centers.

The increasing popularity of minimalist and durable lifestyle accessories is further stimulating growth across the region. European consumers exhibit high awareness of product safety, material quality, and brand value, which in turn fosters a steady market trajectory.

The Middle East & Africa region, while comparatively nascent in terms of market volume, is experiencing growing demand due to expanding urban middle-class populations and rising interest in modern hydration solutions. Increasing participation in outdoor and wellness activities, combined with rising disposable income in Gulf countries, is gradually fostering market penetration.

Similarly, Latin America is demonstrating gradual market expansion, particularly in countries like Brazil and Mexico, where urbanization, retail modernization, and increasing environmental awareness are supporting the adoption of stainless steel vacuum bottles. Although smaller in contribution compared to other regions, both Middle East & Africa and Latin America are expected to offer incremental opportunities over the forecast period due to evolving consumer lifestyles and increasing product accessibility.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

The competitive landscape of the global stainless steel vacuum bottle market in 2024 is defined by the strategic positioning and brand strength of leading players, each contributing to market growth through differentiated offerings, distribution networks, and innovation capabilities. Thermos LLC, one of the most established brands in the segment, continues to leverage its legacy and extensive product range to maintain a strong foothold in both mature and emerging markets.

Yeti Holdings, Inc. sustains its premium positioning by emphasizing rugged design and outdoor utility, which has gained considerable traction among lifestyle-conscious consumers in North America and Europe. Similarly, Hydro Flask, known for its vibrant color palette and temperature retention performance, targets young, eco-conscious consumers, which has positioned it as a favorite in retail and e-commerce channels.

S’well and Klean Kanteen focus extensively on sustainability messaging, with both brands emphasizing reusable solutions and eco-friendly materials, aligning with the global shift toward environmentally responsible consumption. Contigo and Zojirushi Corporation maintain strong presences through technological integration in lid mechanisms and ergonomic designs, supported by well-established supply chains.

CamelBak and Stanley, meanwhile, strengthen their market share via strategic retail partnerships and outdoor gear integration. Brands like MIRA Brands, Simple Modern, and Ello Products LLC primarily operate in the mid-priced segment and expand through online marketplaces with attractive value-for-money propositions.

GSI Outdoors and Tiger Corporation continue to target niche segments, particularly in outdoor and Asian markets, respectively. Collectively, these players contribute to a competitive, innovation-driven environment, where product differentiation, design innovation, and sustainability remain central to gaining and retaining market share.

Top Key Players in the Market

- Thermos LLC

- Yeti Holdings, Inc.

- Hydro Flask

- S’well

- Klean Kanteen

- Contigo

- Zojirushi Corporation

- CamelBak

- Stanley

- MIRA Brands

- Simple Modern

- Ello Products LLC

- Klean Kanteen

- GSI Outdoors

- Tiger Corporation

Recent Developments

- In 2024, Thermos L.L.C. continued to focus on delivering high-quality insulated containers for food and drinks. Known for its long-standing legacy since 1904, the company ensures its products are strong, safe, and dependable. Thermos items are built with advanced insulation, helping keep beverages hot or cold for long hours. Customers appreciate the leak-proof design and easy-to-use lids, which make daily use convenient and mess-free.

- In 2023, Xiaomi introduced the MIJIA Thermos Flask with a generous 1.8-liter capacity. Built with 316L stainless steel, this product provides strong temperature retention and durability. Xiaomi priced it affordably at 129 yuan, giving more people access to reliable thermal containers. This launch reflects the brand’s strategy to offer everyday lifestyle products with smart and practical designs.

Report Scope

Report Features Description Market Value (2024) USD 5.5 Billion Forecast Revenue (2034) USD 9.8 Billion CAGR (2025-2034) 6.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Application(Personal Use, Commercial Use, Sports & Recreation, Others), By Distribution Channel(Online Retail, Supermarkets/Hypermarkets, Specialty Stores, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Thermos LLC, Yeti Holdings, Inc., Hydro Flask, S’well, Klean Kanteen, Contigo, Zojirushi Corporation, CamelBak, Stanley, MIRA Brands, Simple Modern, Ello Products LLC, Klean Kanteen, GSI Outdoors, Tiger Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Stainless Steel Vacuum Bottle MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Stainless Steel Vacuum Bottle MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Thermos LLC

- Yeti Holdings, Inc.

- Hydro Flask

- S'well

- Klean Kanteen

- Contigo

- Zojirushi Corporation

- CamelBak

- Stanley

- MIRA Brands

- Simple Modern

- Ello Products LLC

- Klean Kanteen

- GSI Outdoors

- Tiger Corporation