Global Drinkware Market Size, Share, Growth Analysis By Product Type (Glass Drinkware, Plastic Drinkware, Metal Drinkware, Ceramic Drinkware, Silicone Drinkware), By Usage (Everyday Drinkware, Specialty Drinkware, Promotional Drinkware), By End User (Residential, Commercial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 145175

- Number of Pages: 231

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

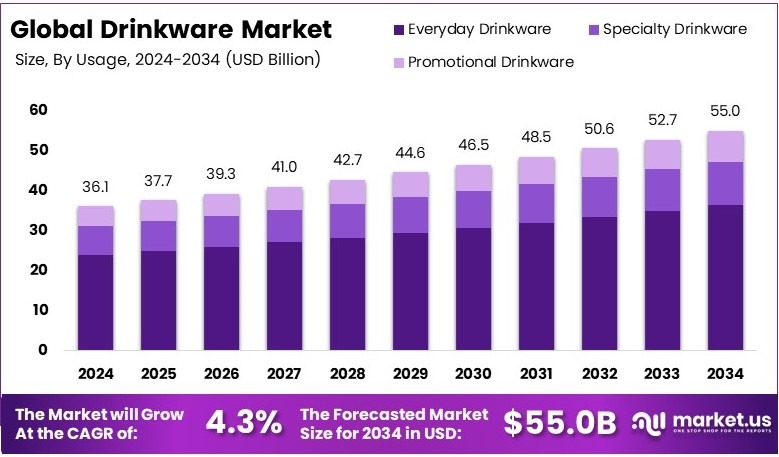

The Global Drinkware Market size is expected to be worth around USD 55.0 Billion by 2034, from USD 36.1 Billion in 2024, growing at a CAGR of 4.3% during the forecast period from 2025 to 2034.

Drinkware includes items used for drinking beverages, such as glasses, mugs, cups, and tumblers. These products are made from various materials, including glass, plastic, ceramic, and metal. Drinkware is designed for different purposes, from casual drinking to formal dining. It is commonly used in households, cafes, restaurants, and bars.

The drinkware market involves the production and sale of drinking vessels. It includes various segments like household, commercial, and premium drinkware. The market is driven by lifestyle changes and consumer preferences for stylish and functional products. Innovations in material and design, such as eco-friendly and insulated drinkware, are shaping the market’s growth.

Drinkware is essential in households, restaurants, and cafes. The market is growing as consumers seek stylish and durable options. Reusable drinkware is gaining traction due to environmental concerns. In the UK, 2.5 to 5 billion single-use coffee cups are disposed of annually. This highlights the need for sustainable alternatives, pushing demand for reusable options.

Efforts to reduce waste are evident. In Killarney, Co Kerry, over 55 local businesses aim to eliminate single-use cups. This initiative reduces waste by approximately 23,000 cups weekly. As a result, more communities are adopting similar practices. Manufacturers are responding by producing eco-friendly drinkware, which aligns with consumer expectations.

Replacing single-use cups with reusable alternatives can cut carbon emissions by 69%. This shift could save 52,000 tons of CO2 equivalent annually in the UK. Therefore, reusable drinkware is not just trendy but also crucial for sustainability. Consumers are increasingly aware of these benefits, boosting market interest.

The drinkware market is competitive. Established brands dominate, but new companies are entering with innovative designs. The rise of sustainable materials is reshaping the landscape. As more consumers prioritize eco-friendliness, traditional plastic options are losing ground. Consequently, companies are investing in research to enhance product durability and aesthetics.

Key Takeaways

- The Drinkware Market was valued at USD 36.1 billion in 2024 and is expected to reach USD 55.0 billion by 2034, with a CAGR of 4.3%.

- In 2024, Glass Drinkware dominates the product type segment with 45.2%, reflecting its premium appeal and reusability.

- In 2024, Everyday Drinkware leads the usage segment with 66.1%, driven by regular home and office consumption.

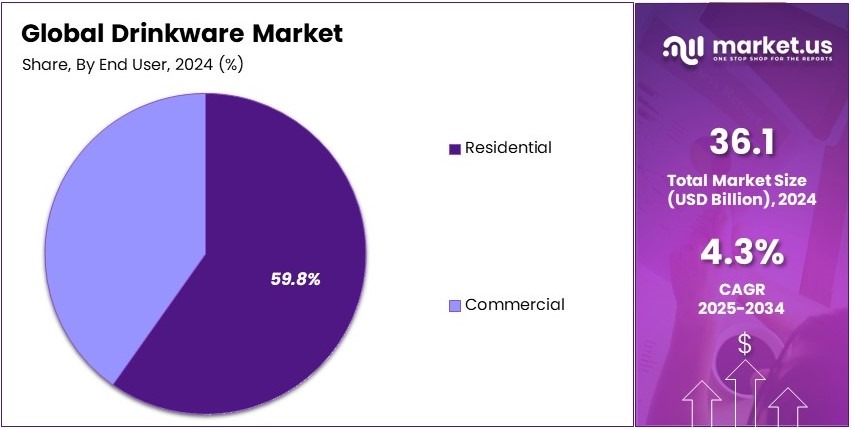

- In 2024, Residential holds the highest share in end users at 59.8%, supported by household demand and lifestyle upgrades.

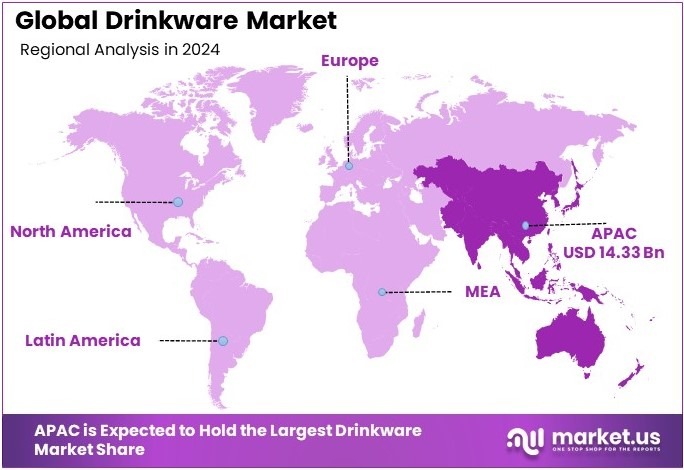

- In 2024, Asia Pacific leads with 39.7% and valued at USD 14.33 billion, driven by rising urbanization and growing middle-class consumption.

Type Analysis

Glass Drinkware dominates with 45.2% due to its aesthetic appeal and versatility.

Glass Drinkware has secured the largest market share in the drinkware industry. This dominance is largely due to the universal appeal of glass for its aesthetic clarity and versatility in both casual and formal settings. Glass is preferred for its ability to maintain the purity of taste, a crucial factor for consumers when enjoying beverages.

Plastic Drinkware holds a 22.3% share in the market. It is valued for its durability and light weight, making it ideal for outdoor activities and casual use where breakage might be a concern.

Metal Drinkware, with a 17.4% market share, is favored for its robustness and ability to keep drinks hot or cold for extended periods. This type is popular among travelers and outdoor enthusiasts.

Ceramic Drinkware, making up 10.6% of the market, is chosen for its traditional and rustic appeal, often used in coffee shops and restaurants for serving hot beverages.

Silicone Drinkware, though smaller with a 4.5% share, is growing due to its portability and collapsibility, making it perfect for camping and sports.

Usage Analysis

Everyday Drinkware leads with 66.1% due to its constant demand in household settings.

Everyday Drinkware is the most prevalent usage category, reflecting the constant demand for drinkware items in daily life. This segment’s growth is driven by the basic need for reliable and accessible drinkware in homes worldwide.

Specialty Drinkware, which holds a 20.9% market share, includes items designed for specific drinks or occasions, like wine glasses and beer steins. This segment benefits from consumer interest in specialty beverages and their presentation.

Promotional Drinkware has a 13.0% share and is often used by companies for branding purposes. This segment grows as businesses continue to recognize the value of branded merchandise for marketing.

End User Analysis

Residential use dominates with 59.8% due to the essential role of drinkware in everyday home life.

The Residential segment leads due to the essential role drinkware plays in everyday home life. As households look for both functional and aesthetically pleasing options, glass drinkware, in particular, remains a popular choice due to its versatility and ability to complement various home decors.

Commercial use accounts for 40.2% of the market, driven by demand from restaurants, cafes, and other hospitality settings. This segment relies heavily on the durability and cost-effectiveness of metal and plastic drinkware, which withstands frequent use and industrial washing processes.

Key Market Segments

By Product Type

- Glass Drinkware

- Plastic Drinkware

- Metal Drinkware

- Ceramic Drinkware

- Silicone Drinkware

By Usage

- Everyday Drinkware

- Specialty Drinkware

- Promotional Drinkware

By End User

- Residential

- Commercial

Driving Factors

Specialty Beverages and Sustainable Choices Drive Market Growth

The drinkware market is experiencing significant growth due to evolving consumer preferences. One of the primary drivers is the rising popularity of specialty beverages, including craft coffee, herbal infusions, and artisanal cocktails. Consumers increasingly seek customized drinkware that complements their favorite drinks. As a result, personalized mugs, tumblers, and glassware have become essential accessories in cafes and at home.

Moreover, the growing focus on sustainability is boosting demand for eco-friendly drinkware. Consumers are actively choosing reusable and biodegradable options over single-use plastic cups. Brands that offer bamboo, stainless steel, and glass alternatives are gaining traction, as buyers prioritize reducing environmental impact.

Additionally, the influence of lifestyle and wellness trends is encouraging the adoption of specialized drinkware. Infuser bottles and insulated containers are popular among health-conscious consumers who prefer to carry detox water and herbal teas on the go.

The integration of technology into drinkware is also a noteworthy trend. Smart drinkware with temperature control and hydration tracking features is gaining popularity, especially among fitness enthusiasts. These products cater to the modern consumer’s desire for functionality and health monitoring.

Restraining Factors

High Competition and Environmental Concerns Restrain Market Growth

Despite its potential, the drinkware market faces notable challenges. One of the primary restraints is the intense competition from low-cost, mass-produced alternatives. Many consumers, especially those on a budget, opt for cheaper plastic or disposable options rather than investing in premium reusable drinkware. This trend makes it challenging for manufacturers of high-quality products to maintain market share.

Environmental issues related to non-biodegradable materials also pose a problem. Disposable drinkware, especially made from plastic, contributes to waste accumulation and pollution. As governments impose stricter regulations on single-use plastics, manufacturers face the dual challenge of finding sustainable alternatives while keeping costs low.

Another obstacle is the fluctuating costs of raw materials. Prices for metals, glass, and eco-friendly composites can vary significantly, affecting pricing strategies and profit margins. In addition, consumer awareness regarding the health impacts of certain drinkware materials remains limited. Some plastic types may leach chemicals, yet many consumers are unaware of the potential risks.

Growth Opportunities

Smart and Sustainable Innovations Provide Opportunities

The drinkware market holds promising opportunities through innovation and sustainability. A key area of growth is the development of smart drinkware with IoT-enabled features. These products offer personalized hydration tracking and temperature control, appealing to tech-savvy and health-conscious consumers. As people become more aware of their daily water intake, the demand for such advanced drinkware is expected to rise.

Sustainable innovation is also a major opportunity. The expansion of biodegradable and plant-based drinkware addresses growing environmental concerns. Brands that introduce compostable cups, biodegradable straws, and bamboo tumblers are likely to gain favor among eco-friendly consumers. Additionally, the demand for multipurpose and stackable drinkware is on the rise. Space-conscious buyers prefer versatile designs that serve various functions and can be easily stored, especially in urban settings.

There is also a growing market for custom-printed and branded drinkware. Companies increasingly use these items for corporate events and promotional purposes. Personalization and branding help businesses increase visibility while providing functional gifts to clients and employees. As the market adapts to consumer preferences for technology, sustainability, and utility, manufacturers have ample opportunities to innovate and thrive.

Emerging Trends

Aesthetic and Functional Designs Are Latest Trending Factor

Modern trends in the drinkware market reflect changing consumer tastes and lifestyle choices. One prominent trend is the popularity of double-walled and vacuum-insulated drinkware. These designs maintain beverage temperatures for extended periods, making them ideal for hot and cold drinks. Coffee lovers and fitness enthusiasts alike appreciate the convenience of maintaining the perfect drink temperature throughout the day.

The influence of social media culture is also shaping the market. Consumers are increasingly drawn to aesthetically pleasing and Instagrammable drinkware. Unique patterns, vibrant colors, and personalized engravings make products visually appealing and shareable on digital platforms. This trend is particularly strong among younger demographics who value stylish, photogenic products.

Another emerging trend is the growth of travel-friendly and leak-proof drinkware. Busy lifestyles demand portable options that can withstand movement without spilling. Leak-proof lids and ergonomic designs are essential for commuters and travelers. Additionally, there is a noticeable surge in the sales of drinkware made from copper, bamboo, and stainless steel. These materials are not only durable but also align with health and sustainability values, attracting consumers focused on wellness.

Regional Analysis

Asia Pacific Dominates with 39.7% Market Share

Asia Pacific leads the Drinkware Market with a 39.7% share and valuation of USD 14.33 Bn, showcasing its significant impact on the global landscape. This dominance is propelled by the region’s massive population, rapid urbanization, and increasing disposable incomes which enhance consumer spending on household goods.

The region is known for its diverse cultures that celebrate various traditional and modern beverages, which drives the demand for various types of drinkware. Additionally, Asia Pacific is home to several major manufacturing countries like China and India, which not only supply local markets but also export worldwide.

Looking forward, Asia Pacific’s role in the global Drinkware Market is expected to grow even stronger. The ongoing economic growth and expansion of middle-class populations are likely to continue boosting the demand for both basic and luxury drinkware items. Technological advancements in manufacturing and a growing focus on sustainable products might also play a crucial role in this growth.

Regional Mentions:

- North America: North America holds a substantial share of the Drinkware Market, driven by consumer preferences for premium and custom drinkware options. The market thrives on a culture that values branded and personalized products, often used in marketing and personal gifts.

- Europe: Europe maintains a steady demand for drinkware, influenced by its strong cafe culture and a preference for high-quality, artisanal glass and ceramic products. The region’s focus on sustainability also drives innovations in eco-friendly drinkware designs.

- Middle East & Africa: The Middle East and Africa are experiencing gradual growth in the drinkware market. This growth is supported by urbanization and an increase in hospitality developments, which demand high-quality drinkware for tourist and luxury markets.

- Latin America: Latin America’s drinkware market is growing, fueled by an increase in local manufacturing and a rising consumer base interested in diverse drinkware options. Cultural trends favoring unique and colorful drinkware also contribute to market expansion.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

In the Drinkware Market, Libbey Inc., Arc International, Duralex International, and Tervis Tumbler are four pivotal companies shaping industry trends and consumer preferences.

Libbey Inc. is a powerhouse in the market, known for its wide range of high-quality glass drinkware. Their products serve various segments, from everyday use to special occasions, making them a household name. Arc International caters to a global audience with its stylish and durable glassware, often leading the market with innovations in design and material.

Duralex International has made a significant impact with its toughened glassware, highly valued for both its durability and classic designs. This makes it particularly popular in both homes and restaurants. Tervis Tumbler is recognized for its insulated tumblers, which are favorites in markets that value drink temperature retention and personalization.

These companies drive the Drinkware Market through their commitment to quality, innovation, and understanding of consumer needs. Their ability to adapt to market trends and introduce compelling products ensures their continued dominance and influence in shaping the future of drinkware.

Major Companies in the Market

- Libbey Inc.

- Arc International

- Duralex International

- Tervis Tumbler

- YETI Holdings, Inc.

- Stanley (PMI Worldwide)

- Thermos LLC

- Hydro Flask (Helen of Troy Limited)

- CamelBak Products, LLC

- Contigo (Newell Brands)

Recent Developments

- PCNA: On February 2025, PCNA expanded its product line by offering nine Stanley drinkware styles to Canadian distributors. These include popular items such as the 30-oz. and 40-oz. Quencher H2.O FlowState Tumblers. This move aligns with Stanley’s sustainability goals, aiming to produce at least 50% of their stainless-steel products from recycled materials by 2025.

- A Second Round Glass: On November 2024, A Second Round Glass, founded in 2019 by the Stokes family in Montgomery, Texas, was featured for its innovative approach to upcycling. The company creates glass drinkware from 100% upcycled bottles, including wine and Topo Chico bottles, through fire-polishing and engraving processes.

Report Scope

Report Features Description Market Value (2024) USD 36.1 Billion Forecast Revenue (2034) USD 55.0 Billion CAGR (2025-2034) 4.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Glass Drinkware, Plastic Drinkware, Metal Drinkware, Ceramic Drinkware, Silicone Drinkware), By Usage (Everyday Drinkware, Specialty Drinkware, Promotional Drinkware), By End User (Residential, Commercial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Libbey Inc., Arc International, Duralex International, Tervis Tumbler, YETI Holdings, Inc., Stanley (PMI Worldwide), Thermos LLC, Hydro Flask (Helen of Troy Limited), CamelBak Products, LLC, Contigo (Newell Brands), Klean Kanteen, Zwiesel Kristallglas AG, Luigi Bormioli Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Libbey Inc.

- Arc International

- Duralex International

- Tervis Tumbler

- YETI Holdings, Inc.

- Stanley (PMI Worldwide)

- Thermos LLC

- Hydro Flask (Helen of Troy Limited)

- CamelBak Products, LLC

- Contigo (Newell Brands)