Global Office Furniture Market By Product Type (Storage Units, Seating, Desks and Tables, Workstation, Other Product Types), By Material Type (Metal, Wood, Plastic, Glass, Other Material Types), By Price Range (Premium, Economic, Medium), By Distribution Channel (Online Retail Stores, Offline Retail Stores), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 32296

- Number of Pages: 215

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

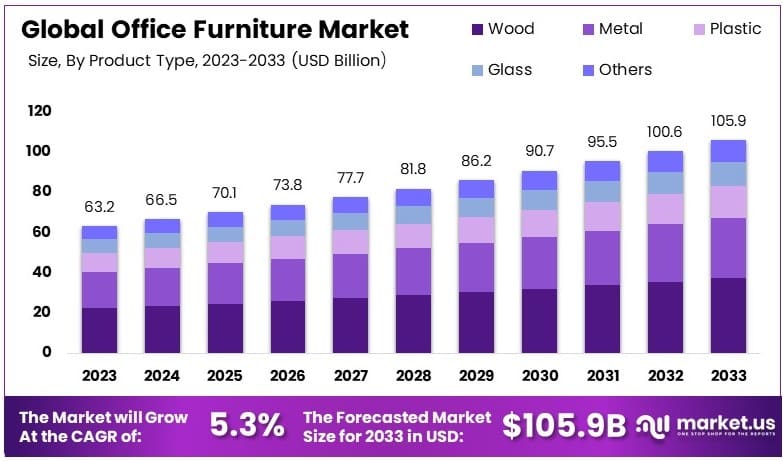

The Global Office Furniture Market size is expected to be worth around USD 105.9 Billion by 2033, from USD 63.2 Billion in 2023, growing at a CAGR of 5.3% during the forecast period from 2024 to 2033.

Office furniture includes items used in workplaces, such as desks, chairs, cabinets, and tables. This furniture is designed for comfort, functionality, and productivity, creating conducive work environments. Office furniture varies widely, from ergonomic chairs to modular desks, adapting to different workplace needs.

The office furniture market comprises the industry dedicated to the production, distribution, and sale of furniture for offices and workplaces. It serves businesses, institutions, and home offices, addressing needs for comfort, efficiency, and space management. This market covers various furniture types, from traditional setups to modern ergonomic solutions.

The office furniture market is experiencing a steady recovery as employees gradually return to physical workspaces. Data from the Real Estate Board of New York shows that office visitation in Manhattan reached 74% of 2019 levels by May 2024, up from 70% in May 2023. This trend is mirrored globally, though return-to-office rates vary.

European and Asian countries generally report higher in-office attendance, while in the U.S., a notable preference for remote work persists. As more companies adopt hybrid workplace models, demand for flexible, ergonomic office furniture is increasing to support varied work environments.

Growth in the office furniture market is fueled by the expansion of coworking spaces and changing office needs. In the U.S., the coworking industry reached over 7,000 spaces in the second quarter of 2024, and by the third quarter, this number climbed to 7,538, marking a 7% quarter-over-quarter increase, as reported by CoworkingCafe.

This rise supports demand for adaptable, modular office furniture that fits coworking models and hybrid workspaces. As companies invest in modernizing their work environments, competition intensifies, with manufacturers focusing on innovation in sustainable and flexible furniture designs.

On a broader scale, the office furniture market supports economic activity in real estate and manufacturing sectors, especially as organizations adapt to new workplace norms. Locally, the expansion of coworking spaces creates opportunities for small and medium-sized furniture suppliers.

Key Takeaways

- The Office Furniture Market was valued at USD 63.2 Billion in 2023 and is expected to reach USD 105.9 Billion by 2033, with a CAGR of 5.3%.

- In 2023, Wood is the leading material type with 40%, due to its aesthetic and durability advantages.

- In 2023, Economic price range dominates at 37%, reflecting demand for affordable office solutions.

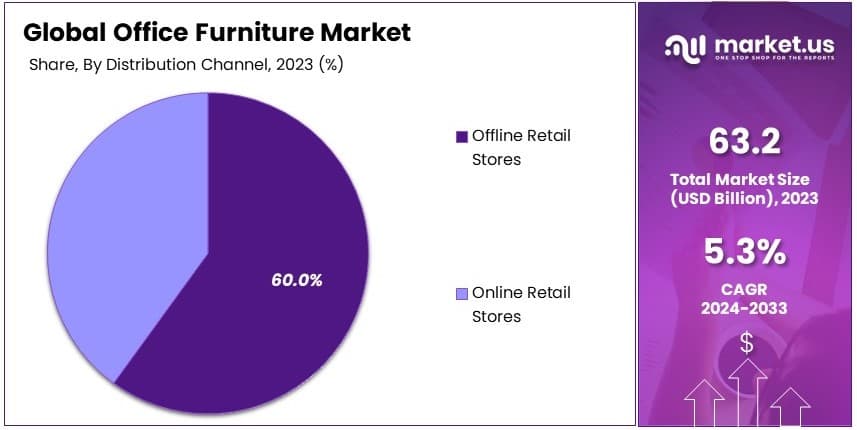

- In 2023, Offline Retail Stores hold 60% of the distribution, highlighting the preference for in-person furniture purchases.

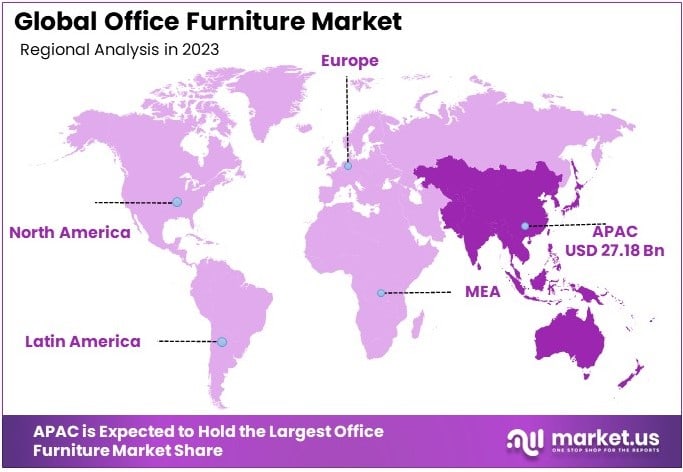

- In 2023, the Asia Pacific region leads with 43.0%, driven by expanding commercial spaces.

Material Type Analysis

Wood dominates with 40% due to its durability and aesthetic appeal.

The Office Furniture Market, segmented by material type, includes Wood, Metal, Plastic, Glass, and other materials. Wood holds the largest market share at 40%. This dominance is attributed to wood’s timeless appeal and robustness, which make it a preferred choice for creating stylish and durable office furniture.

Wood furniture offers a classic aesthetic that can significantly enhance the visual appeal of an office space, making it appealing for companies wishing to project a traditional or prestigious image.

Additionally, wood is highly customizable, which allows for a range of designs that can fit various office layouts and styles. It is also known for its durability, which is essential for office environments where furniture usage is frequent.

Metal furniture is valued for its strength and modern look, making it suitable for contemporary office spaces. It is often used in items that require durability and stability, such as filing cabinets and desks. Plastic furniture offers versatility and is commonly used in more casual or creative office environments because of its adaptability in style and color.

Glass furniture, while less common, is chosen for its sleek and modern aesthetic, typically used to make offices feel more open and bright. Each material type contributes uniquely to the market, catering to different aesthetic preferences and functional needs across diverse office environments.

Price Range Analysis

Economic range dominates with 37% due to its affordability and broad market appeal.

The Office Furniture Market, segmented by price range, includes Premium, Economic, and Medium ranges. The Economic range leads the market with a 37% share. This dominance is primarily due to its affordability, which appeals to a wide range of businesses, especially small and medium-sized enterprises (SMEs) and startups.

The economic price range is particularly significant in regions with emerging markets and rapidly growing business sectors, where cost efficiency is a priority. This segment’s growth is driven by the increasing number of new businesses and the expanding demand for office spaces, which require affordable furnishing options.

Premium office furniture, although smaller in market share, is favored by corporations that regard office aesthetics as an integral part of their brand image and wish to invest in high-quality, durable furniture.

Medium-range furniture offers a balance of quality and cost, suitable for businesses looking for furniture that is both reasonably priced and durable. These segments cater to varied financial capabilities and aesthetic preferences, ensuring a broad market reach.

Distribution Channel Analysis

Offline retail stores dominate with 60% due to strong consumer preference for in-person shopping experiences.

The Office Furniture Market, segmented by distribution channel, includes Online and Offline retail stores. Offline retail stores hold the largest market share at 60%. This dominance is largely due to consumer preference for viewing and testing furniture in person before making significant investment decisions.

The tactile experience of furniture shopping—feeling the materials, testing the ergonomics, and visually inspecting the build quality—is crucial in the decision-making process for many businesses.

Offline stores also benefit from on-site sales expertise, where customers can receive immediate advice and answers to their queries, which helps in making informed purchasing decisions. Furthermore, the immediate availability of products and the avoidance of shipping costs and wait times are significant factors that favor offline purchases.

Online retail stores, while growing, primarily appeal to consumers who value convenience and the ability to easily compare different products and prices. Online platforms are expanding their market share by offering detailed product descriptions, customer reviews, and competitive pricing. They are increasingly becoming popular for businesses looking to furnish remote or home offices, as they provide direct-to-door delivery options.

Key Market Segments

By Product Type

- Storage Units

- Seating

- Desks & Tables

- Workstation

- Other Product Types

By Material Type

- Metal

- Wood

- Plastic

- Glass

- Other Material Types

By Price Range

- Premium

- Economic

- Medium

By Distribution Channel

- Online Retail Stores

- Offline Retail Stores

Drivers

Increasing Demand for Ergonomic Furniture Drives Market Growth

The increasing demand for ergonomic office furniture drives market growth. Businesses are prioritizing employee comfort, leading to a higher demand for adjustable chairs, desks, and accessories.

The growth of co-working spaces further supports this market expansion. Co-working facilities need versatile, modular furniture to accommodate different users, boosting sales of flexible furniture designs.

Rising numbers of start-ups and small to medium-sized enterprises (SMEs) also contribute to demand. These businesses require cost-effective furniture solutions, creating a steady market for affordable yet functional office furniture.

Additionally, the expansion of commercial real estate, especially in urban areas, promotes furniture demand. As new offices open, businesses invest in contemporary office setups, increasing the need for quality furniture.

Restraints

High Cost of Quality Office Furniture Restraints Market Growth

High costs of quality office furniture restrain market growth. Many companies, particularly smaller businesses, find it challenging to invest in expensive yet durable options.

Fluctuations in raw material prices add to the cost burden. Variability in wood, steel, and other essential materials can raise production costs, leading to higher retail prices.

Economic uncertainty further limits market growth. During financial downturns, companies often cut back on furniture spending, preferring to use existing setups instead of buying new items.

Limited space in urban offices also affects furniture demand. Space constraints require compact and multifunctional furniture, limiting the choice and quantity of traditional office furniture purchased.

Opportunity

Growing Demand for Home Office Furniture Provides Opportunities

The growing demand for home office furniture presents significant growth opportunities. Remote work trends have increased demand for home-based workspaces, driving sales of desks, chairs, and storage units.

The emergence of eco-friendly furniture options also opens new avenues. Consumers are increasingly seeking sustainable office furniture, boosting demand for recycled or responsibly sourced materials.

Customization and modular furniture trends offer further growth potential. Companies prefer customizable solutions that fit specific layouts and needs, encouraging manufacturers to offer more flexible products.

Expansion in emerging markets provides additional opportunities. Rapid urbanization and increasing office establishments in regions like Asia-Pacific drive demand for affordable office furniture.

Challenges

Intense Market Competition Challenges Market Growth

Intense market competition poses challenges for the Office Furniture Market. Numerous players compete on pricing, quality, and design, making it difficult to maintain profit margins.

Supply chain disruptions further complicate market stability. Delays in obtaining raw materials and components affect production timelines and delivery schedules, impacting overall sales.

Rapid changes in workspace design trends require constant innovation. Companies must quickly adapt to evolving preferences, which can be costly and time-consuming.

Unstable economic conditions in key regions also challenge growth. Fluctuating economies affect consumer spending, leading to slower sales in certain markets.

Growth Factors

Government Support for Office Infrastructure Development Are Growth Factors

Government support for office infrastructure development drives the Office Furniture Market. Initiatives to enhance commercial spaces promote demand for new furniture.

Rising employment in urban areas supports market growth. As more people join the workforce, businesses expand office spaces, leading to increased furniture purchases.

Increasing investments in office renovations further boost the market. Companies frequently upgrade furniture to improve employee satisfaction and productivity, driving continuous demand.

The growth of the IT and ITES sector also stimulates market expansion. This sector’s rapid growth requires modern office setups, increasing the need for innovative and functional furniture solutions.

Emerging Trends

Adoption of Smart Office Furniture Is Latest Trending Factor

The adoption of smart office furniture is a notable trend in the market. Features like height-adjustable desks and chairs with sensors enhance employee comfort and productivity.

Growing preference for sustainable materials is another trend. Companies are opting for eco-friendly furniture to align with corporate social responsibility goals and reduce environmental impact.

The increased demand for flexible furniture solutions supports market growth. Modular and easily reconfigurable designs allow for adaptable workspaces, catering to changing office layouts.

The rising popularity of collaborative workspace designs also drives trends. Open and shared office spaces require specific furniture types, increasing demand for versatile and collaborative furniture pieces.

Regional Analysis

Asia Pacific Dominates with 43.0% Market Share

Asia Pacific (APAC) leads the Office Furniture Market with a 43.0% share, totaling USD 27.18 billion. This dominance is driven by rapid urbanization, expanding commercial infrastructure, and the rise of small and medium-sized enterprises (SMEs). Major contributors include China, India, and Japan, where office spaces are continuously expanding.

The region benefits from cost-efficient manufacturing, a large workforce, and increasing investments in modern office setups. APAC’s demand for ergonomic and modular furniture is rising as businesses focus on employee well-being and flexible office designs. Additionally, growth in the IT and services sectors supports steady demand for office furniture.

Asia Pacific’s influence in the global office furniture market is projected to strengthen. Continuous development of co-working spaces, combined with the shift towards hybrid work models, will boost future market growth.

Regional Mentions:

- North America: North America shows strong market growth, driven by increasing adoption of ergonomic office furniture and expansion of flexible workspaces. Rising focus on employee productivity supports demand.

- Europe: Europe maintains a robust market share, supported by sustainability trends and a focus on high-quality, eco-friendly furniture. The region’s regulatory standards also boost demand for ergonomic designs.

- Middle East & Africa: The region sees moderate growth, supported by commercial infrastructure developments and increased investments in business hubs. Demand for modern office furniture is rising steadily.

- Latin America: Latin America experiences growth due to the rise of start-ups and expanding commercial sectors. Increased focus on flexible workspaces drives demand for affordable, multi-functional office furniture.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The office furniture market is characterized by innovation, ergonomic design, and a focus on sustainability. The top four players in this market are Steelcase Inc., Herman Miller Inc., HNI Corporation, and Haworth Inc. These companies hold strong positions due to their wide range of products, continuous design innovation, and global distribution networks.

Herman Miller Inc. is recognized for its iconic designs and focus on ergonomic furniture. It caters to both traditional and remote workspaces, enhancing its relevance in the evolving office environment. The company’s emphasis on sustainability and design quality strengthens its market presence.

HNI Corporation offers a broad range of office furniture, from workstations to seating, with a focus on cost-effective solutions. It targets small to medium-sized businesses, ensuring flexibility and affordability in its offerings.

Haworth Inc. combines innovative design with a focus on adaptability, offering modular office furniture solutions. Its strong presence in North America and expanding reach in Asia contributes to its market leadership.

These companies maintain their positions by emphasizing ergonomic design, sustainable materials, and adapting to the growing demand for flexible work environments, making them key players in the global office furniture market.

Top Key Players in the Market

- Steelcase Inc.

- Okamura Corporation

- HNI Corporation

- Herman Miller Inc.

- Haworth Inc.

- Knoll Inc.

- KOKUYO Co., Ltd.

- Meridian Office Group

- Kimball International Inc.

- 9to5 Seating

- Berco Designs

- Hooker Furniture

- La-Z-Boy

- Vitra

- Kinnarps AB

- Sedus Stoll AG

- Other Key Players

Recent Developments

- MillerKnoll: In August 2024, MillerKnoll reported a resurgence in demand for office furniture, including chairs, couches, and desks, marking its first organic order growth in two years. This recovery was attributed to corporate investments in furnishings tailored for hybrid work and nontraditional office settings.

- Godrej & Boyce: In February 2022, Godrej & Boyce, through its Godrej Interior division, launched ‘Move Up,’ an ergonomic office table designed for remote workers. This product release reflected the company’s strategic response to the increased demand for home office furniture due to the rise of remote work.

- IKEA: In March 2024, IKEA introduced MITTZON, its most extensive office system to date, comprising 85 products designed to support various work activities and improve office experiences. The MITTZON collection emphasizes ergonomics, with acoustic screens and biophilic design elements, promoting flexible, comfortable, and healthy work environments.

- HON Office Furniture: In September 2024, HON launched the Sculpt table series, a versatile collection aimed at both individual and collaborative workspaces. With a focus on multifunctional design and modern aesthetics, the series caters to the evolving demands of contemporary offices.

Report Scope

Report Features Description Market Value (2023) USD 63.2 Billion Forecast Revenue (2033) USD 105.9 Billion CAGR (2024-2033) 5.3% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Storage Units, Seating, Desks and Tables, Workstation, Other Product Types), By Material Type (Metal, Wood, Plastic, Glass, Other Material Types), By Price Range (Premium, Economic, Medium), By Distribution Channel (Online Retail Stores, Offline Retail Stores) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Steelcase Inc., Okamura Corporation, HNI Corporation, Herman Miller Inc., Haworth Inc., Knoll Inc., KOKUYO Co., Ltd., Meridian Office Group, Kimball International Inc., 9to5 Seating, Berco Designs, Hooker Furniture, La-Z-Boy, Vitra, Kinnarps AB, Sedus Stoll AG, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Steelcase Inc.

- Okamura Corporation

- HNI Corporation

- Herman Miller Inc.

- Haworth Inc.

- Knoll Inc.

- KOKUYO Co., Ltd.

- Meridian Office Group

- Kimball International Inc.

- 9to5 Seating

- Berco Designs

- Hooker Furniture

- La-Z-Boy

- Vitra

- Kinnarps AB

- Sedus Stoll AG

- Other Key Players