Global Copier Market Size, Share, And Business Benefits By Type (Monochrome Copiers, Color Copiers), By Technology (Analog Copiers, Digital Copiers), By End-User (Commercial Offices, Education Institutions, Government, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 105983

- Number of Pages: 292

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

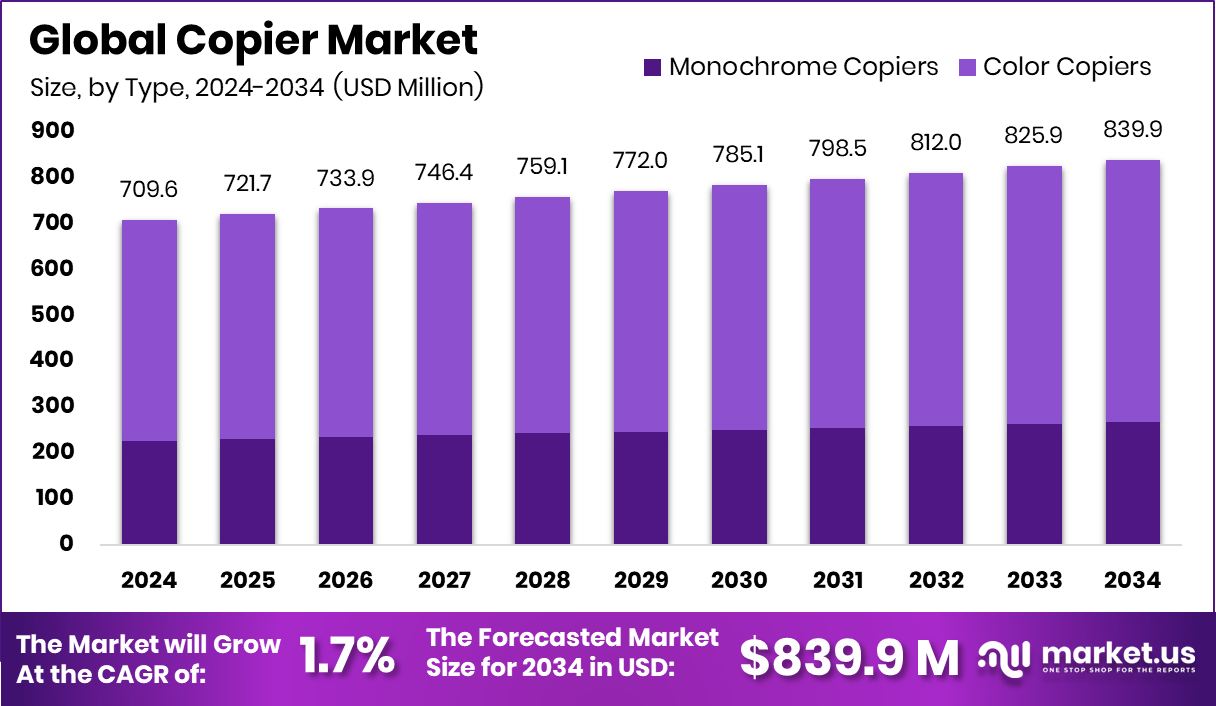

Global Copier Market is expected to be worth around USD 839.9 Million by 2034, up from USD 709.6 Million in 2024, and grow at a CAGR of 1.7% from 2025 to 2034. With 44.5% market share, Asia-Pacific led copier demand, reaching USD 315.7 million.

A copier is a machine used to make paper duplicates of documents or images quickly and efficiently. Traditionally relying on xerographic technology, modern copiers often come with advanced functionalities such as scanning, faxing, wireless printing, and cloud connectivity. These devices are widely used across educational institutions, offices, government agencies, and commercial printing environments to manage day-to-day document processing tasks.

The copier market refers to the global industry that manufactures, distributes, and services photocopy machines and related document reproduction equipment. It includes a range of products from basic black-and-white copiers to high-speed multifunctional devices. The market is shaped by technological innovation, digitization trends, and increasing business demands for document automation and secure information handling.

One of the key growth factors for the copier market is the continuous need for printed documentation across legal, educational, and public service sectors. Despite the shift towards paperless workflows, hard copies remain essential in many regions due to regulatory compliance, internal records, and client communication requirements. This consistent demand sustains copier sales, especially in emerging economies with growing administrative infrastructure.

Another factor driving demand is the shift towards hybrid work models. Offices now require compact, multifunctional machines that support remote management, mobile printing, and cloud-based workflows. These demands are encouraging the adoption of smart copiers that reduce manual effort and improve overall productivity in small and large workplaces alike.

Key Takeaways

- Global Copier Market is expected to be worth around USD 839.9 Million by 2034, up from USD 709.6 Million in 2024, and grow at a CAGR of 1.7% from 2025 to 2034.

- Color copiers dominate the copier market with a 67.3% share due to vibrant output needs.

- Analog copiers lead the copier market at 68.4%, driven by cost-effective duplication processes.

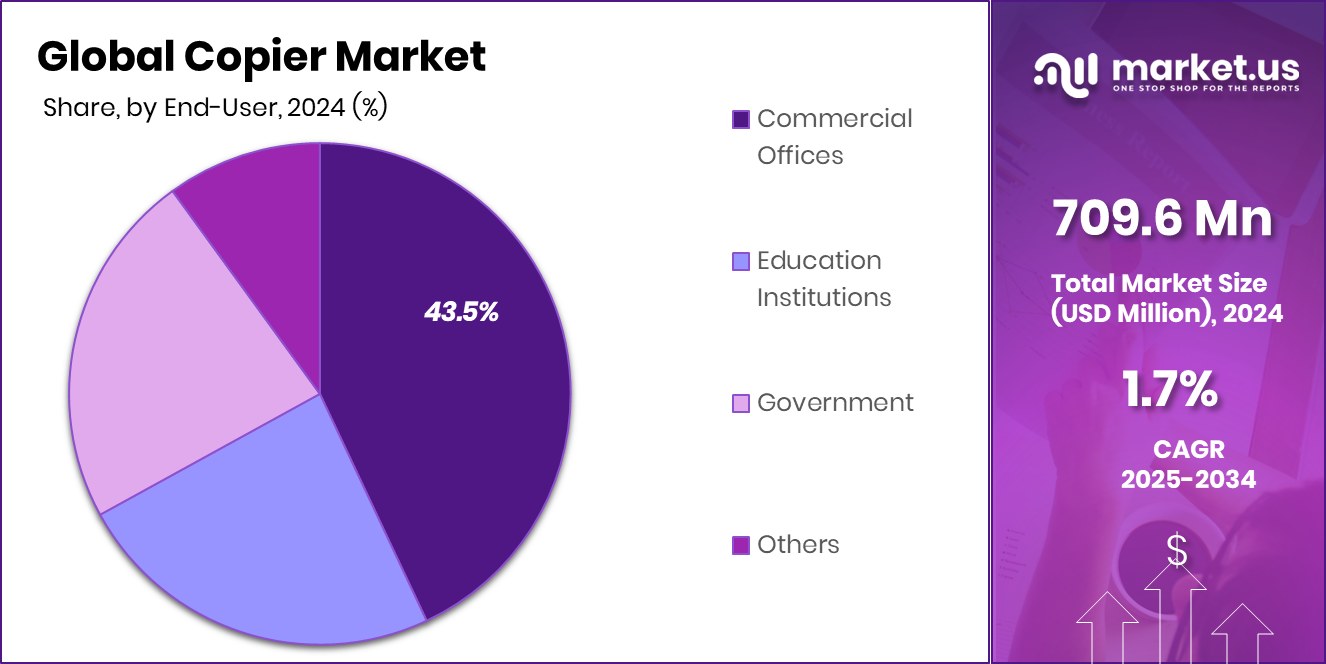

- Commercial offices hold 43.5% of the copier market, reflecting high document usage in daily operations.

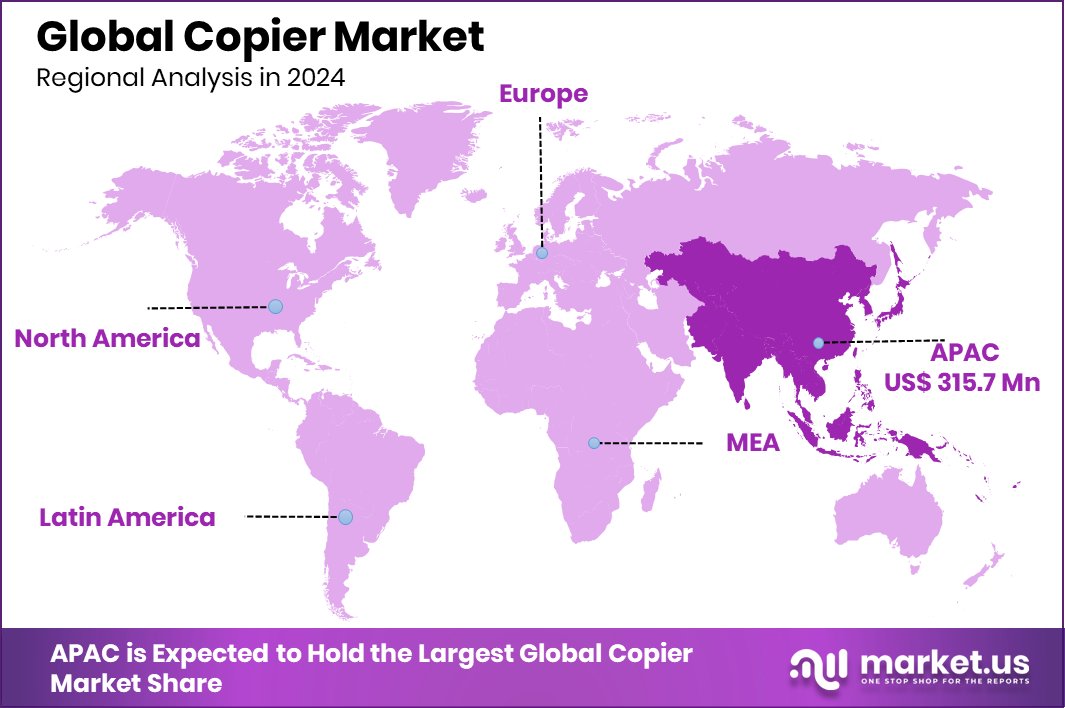

- Asia-Pacific held the highest regional share in copier sales, totaling USD 315.7 million.

By Type Analysis

Color copiers dominated the copier market with a 67.3% share in 2024.

In 2024, Color Copiers held a dominant market position in the By Type segment of the Copier Market, with a 67.3% share. This leadership can be attributed to the growing preference for high-quality visual output across office environments, educational institutions, and creative industries.

The ability of color copiers to produce vibrant, detailed documents has become essential for presentations, marketing materials, and client communications, making them a standard equipment choice in modern office setups.

The rising demand for multifunctional copiers that combine printing, scanning, and copying in color has also contributed to this segment’s growth. With businesses seeking to enhance their in-house document production while reducing dependency on external printing services, color copiers offer a cost-effective and flexible solution.

Furthermore, the shift towards hybrid and digital workflows has increased the value of devices capable of handling both physical and electronic document tasks, where color visibility plays a critical role in clarity and communication.

By Technology Analysis

Analog copiers held 68.4% of the copier market by technology in 2024.

In 2024, Analog Copiers held a dominant market position in the By Technology segment of the Copier Market, with a 68.4% share. This strong market presence was largely driven by their continued adoption in cost-sensitive environments where basic copying needs take precedence over advanced features.

Analog copiers, known for their reliability and straightforward operation, remain a preferred choice in sectors with high-volume document duplication requirements and limited digital infrastructure.

The 68.4% share reflects their appeal in institutions and small offices that prioritize affordability and ease of maintenance over digital integration. These machines are often chosen for their lower upfront cost and minimal technical complexities, making them accessible for users with limited training or resources.

Additionally, analog copiers are valued in specific administrative settings where document handling processes remain predominantly paper-based, and there is no immediate demand for network connectivity or digital storage.

By End-User Analysis

Commercial offices accounted for 43.5% of the copier market share by end-user segment.

In 2024, Commercial Offices held a dominant market position in the By End-User segment of the Copier Market, with a 43.5% share. This significant share was primarily driven by the consistent requirement for document handling, printing, and record-keeping across business operations. Commercial offices rely heavily on copiers for daily administrative functions such as duplicating contracts, internal communications, and client presentations, where speed and efficiency are critical.

The 43.5% market share also reflects the ongoing demand for reliable copying infrastructure to support hybrid work models, where employees operate both on-site and remotely. In this environment, multifunction copiers are often integrated into office networks to enable seamless document access, scanning, and sharing. Even as businesses shift towards digital workflows, the need for physical documentation in legal, financial, and client-facing departments ensures sustained copier usage.

Moreover, commercial offices prioritize productivity and document security, two areas where dedicated copiers continue to play a central role. Their ability to handle large print volumes, combined with consistent output quality, makes them an essential part of daily operations.

Key Market Segments

By Type

- Monochrome Copiers

- Color Copiers

By Technology

- Analog Copiers

- Digital Copiers

By End-User

- Commercial Offices

- Education Institutions

- Government

- Others

Driving Factors

Rising Demand for Office Productivity Solutions

One of the key driving factors for the copier market is the rising demand for office productivity solutions. Offices across the world are focused on improving efficiency and reducing time spent on manual tasks. Copiers help by offering fast and reliable printing, scanning, and document duplication. In many businesses, especially in administration, legal, healthcare, and education, paper-based work is still important. Copiers allow employees to complete tasks faster and keep records easily.

The demand for machines that can handle high-volume printing with less effort is growing. As companies aim to streamline workflows and manage documents better, they continue to invest in modern copier systems. This focus on workplace efficiency is supporting consistent demand in the copier market globally.

Restraining Factors

Growing Shift Towards Paperless Office Workflows

One major factor restraining the growth of the copier market is the growing shift towards paperless office workflows. Many businesses are now choosing to move their documentation and communication processes to digital platforms. With the rise of cloud storage, emails, digital signatures, and document-sharing tools, the need for physical copies has reduced.

This change is especially common in technology firms, financial services, and startups aiming to cut costs and reduce paper waste. As companies focus more on sustainability and data security, digital solutions are replacing traditional copiers in several areas. This trend is slowing down the demand for new copier machines, especially in developed countries where digital adoption is growing rapidly across office environments.

Growth Opportunity

High Demand in Emerging Office Infrastructure Markets

A key growth opportunity for the copier market lies in the rising demand from emerging office infrastructure markets. Countries in Asia, Africa, and Latin America are witnessing rapid urban growth and business expansion. As more offices, schools, and government departments are established, the need for basic office equipment like copiers is increasing.

Many of these regions still rely heavily on paper-based documentation for record-keeping and communication. This creates a strong demand for affordable and reliable copier machines. Additionally, as internet access and digital infrastructure improve in these areas, multifunction copiers that support both paper and digital work will become more popular.

Latest Trends

Smart Copiers with Cloud and Wireless Features

One of the latest trends in the copier market is the growing use of smart copiers with cloud and wireless features. Modern offices are now looking for machines that do more than just copy. Smart copiers can connect to the internet, allowing users to print documents directly from email or cloud storage like Google Drive or Dropbox.

These copiers also support wireless printing from mobile phones and laptops, which is helpful in busy or hybrid work environments. They save time, reduce paper use, and improve security with user access controls. As more companies look for flexible and connected office tools, this trend is becoming more common and is expected to shape the future of copier usage in many industries.

Regional Analysis

In 2024, Asia-Pacific dominated the copier market with a 44.5% share, USD 315.7 million.

In 2024, Asia-Pacific emerged as the dominant region in the global copier market, accounting for 44.5% of the total market share, valued at USD 315.7 million. The region’s leadership is driven by expanding office infrastructure, growing small and medium enterprises, and continued reliance on paper-based workflows in countries such as India, China, and Southeast Asian nations.

North America followed with stable copier demand across corporate and government sectors, supported by the integration of multifunctional copier systems in professional environments. Europe maintained moderate market activity, with steady adoption across educational institutions and administrative offices.

In the Middle East & Africa, copier usage remained consistent due to growing commercial development and government investments in documentation infrastructure. Latin America showed gradual progress, with copier adoption supported by the expansion of urban office environments. Despite varying rates of digital transition, physical document handling remains a necessity across all regions.

However, Asia-Pacific led the market in both share and value, making it the most influential region in copier sales during the year. This regional segmentation underlines how economic development and operational needs directly influence copier demand globally, with Asia-Pacific setting the pace for future growth across emerging and established markets alike.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the global copier market saw stable participation from key players such as Ricoh Group, Xerox Holdings Corporation, Dell Inc., and KYOCERA Document Solutions Inc., each contributing through their specialized approaches in office document technology.

Ricoh Group remained focused on advancing digital integration within copier systems, continuing its commitment to energy-efficient devices tailored for both corporate and public-sector needs. Its strong presence across Asia-Pacific helped reinforce its role in high-volume office environments.

Xerox Holdings Corporation, with its legacy in document management, maintained relevance by offering advanced multifunction copiers that support cloud connectivity and workflow automation. The company’s emphasis on security features and scalable solutions positioned it well in North America, where data protection and productivity remain top priorities.

Dell Inc., known primarily for its computing hardware, continued to align its copier-related offerings with enterprise IT infrastructure. Through integration of printers and document solutions into broader digital office systems, Dell helped streamline document processing across IT-driven workspaces, particularly in small to mid-sized business environments.

KYOCERA Document Solutions Inc. sustained its role in the market by promoting durable and cost-efficient copiers. The company’s emphasis on long-life components and reduced operational costs resonated strongly with institutions and businesses seeking sustainable and low-maintenance solutions.

Top Key Players in the Market

- Ricoh Group

- Xerox Holdings Corporation

- Dell Inc.

- KYOCERA Document Solutions Inc.

- Lexmark International, Inc.

- Sharp Corporation

- Canon Inc.

- Konica Minolta, Inc.

- Toshiba Corporation

- HP Inc.

- Other Key Players

Recent Developments

- In April 2025, Ricoh USA unveiled a new lineup of intelligent A3 colour MFPs (IM C3510SD, C4510SD, C6010SD) equipped with a straight-path single-pass document feeder sourced from its subsidiary PFU. This design enhances media handling, allowing seamless scanning of plastic cards, receipts, and documents of various sizes without jams or misfeeds .

- In June 2024, Xerox introduced the PrimeLink C9200 Series — an entry-level production press designed for small- to medium-sized print environments. It combines automated workflows, compact design, and high-quality output, expanding Xerox’s production printing offerings with enhanced copier-like functions .

Report Scope

Report Features Description Market Value (2024) USD 709.6 Million Forecast Revenue (2034) USD 839.9 Million CAGR (2025-2034) 1.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Monochrome Copiers, Color Copiers), By Technology (Analog Copiers, Digital Copiers), By End-User (Commercial Offices, Education Institutions, Government, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Ricoh Group, Xerox Holdings Corporation, Dell Inc., KYOCERA Document Solutions Inc., Lexmark International, Inc., Sharp Corporation, Canon Inc., Konica Minolta, Inc., Toshiba Corporation, HP Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Ricoh Group

- Xerox Holdings Corporation

- Dell Inc.

- KYOCERA Document Solutions Inc.

- Lexmark International, Inc.

- Sharp Corporation

- Canon Inc.

- Konica Minolta, Inc.

- Toshiba Corporation

- HP Inc.

- Other Key Players