Global Acrylic Acid Market By Derivative(Acrylic Esters, Butyl Acrylate, Ethyl Acrylate, Methyl Acrylate, 2-Ethylhexyl Acrylate, Others), Acrylic Polymer(Superabsorbent Polymers, Water Treatment Polymers, Others, Others), By Application(Paint and Coatings, Adhesives & Sealants, Detergents, Textiles, Diapers and Feminine Hygien Product, Water Treatment, Personal Care Products, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Feb 2024

- Report ID: 112287

- Number of Pages: 307

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

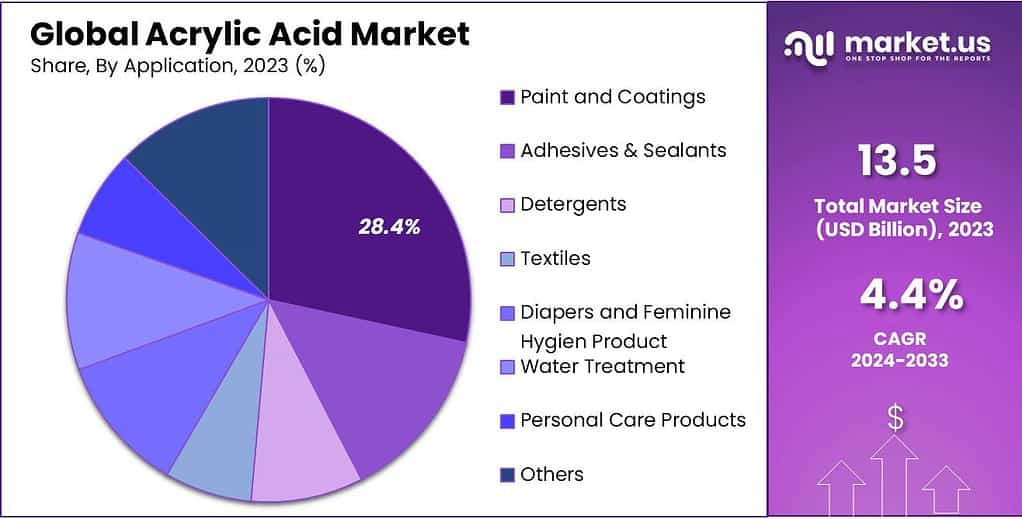

The global Acrylic Acid Market size is expected to be worth around USD 20.8 billion by 2033, from USD 13.5 billion in 2023, growing at a CAGR of 4.4% during the forecast period from 2023 to 2033.

Acrylic acid is a colorless liquid organic compound primarily used to produce acrylic polymers. It’s a key building block for materials like acrylic esters, superabsorbent polymers, and other derivatives.

This versatile compound is known for its ability to polymerize easily, forming robust and durable materials used in paints, coatings, adhesives, textiles, personal care products, and more. Its properties make it valuable in enhancing product performance, durability, and functionality across multiple industries.

Note: Actual Numbers Might Vary In The Final Report

Key Takeaways

- Market Growth: The Acrylic Acid Market is projected to grow substantially, reaching around USD 20.8 billion by 2033 from USD 13.5 billion in 2023, indicating a CAGR of 4.4%. This growth is driven by various industries, including animal feed.

- Derivative Use: Acrylic esters held the largest market share in 2023 (64.5%), displaying their versatile nature across industries.

By Derivative

In 2023, Acrylic Ester was the leader in the acrylic acid market, holding more than 64.5% of the market share. This derivative is widely used in various industries due to its versatile nature and effectiveness.

Butyl Acrylate, another significant derivative, followed closely behind, holding a substantial market share. Its popularity stems from its application in adhesives, sealants, and coatings, making it a pivotal component in many manufacturing processes.

Ethyl Acrylate and Methyl Acrylate derivatives also had a noteworthy presence in the market, catering to different industries like textiles, paints, and plastics. Their versatility and compatibility with various materials contributed to their significant market shares.

Additionally, derivatives like 2-ethylhexyl Acrylate and other variations played crucial roles in specific niche applications, steadily contributing to the overall market growth.

The dominance of Acrylic Esters, followed by the balanced presence of Butyl Acrylate, Ethyl Acrylate, Methyl Acrylate, 2-ethylhexyl Acrylate, and other derivatives, showcases the diverse applications and demand for acrylic acid in multiple industries.

Acrylic Polymer

In the realm of acrylic polymers within the acrylic acid market, Superabsorbent Polymers emerged as a frontrunner in 2023, commanding a substantial portion of the market. These polymers, known for their exceptional water-absorbing capabilities, found extensive usage in various industries like hygiene products, agriculture, and packaging.

Water Treatment Polymers, another significant category, also played a vital role in the market, addressing the growing concerns regarding water purity and treatment. These polymers are instrumental in ensuring effective water purification processes across municipal, industrial, and residential applications.

Furthermore, other specialized acrylic polymer variations cater to specific industry needs, contributing steadily to the market. These diverse acrylic polymers collectively signify the versatility and adaptability of acrylic acid derivatives in fulfilling varied industrial requirements.

Superabsorbent Polymers led the pack, closely followed by Water Treatment Polymers, both showcasing the crucial roles these acrylic polymers play in addressing fundamental needs across diverse industries.

By Application

In 2023, Paint and Coatings emerged as the leading application segment in the acrylic acid market, holding over 28.4% of the market share. This sector heavily relies on acrylic acid due to its versatile properties, contributing to the durability and aesthetics of various surfaces.

Adhesives and sealants followed closely, representing a significant portion of the market. Acrylic acid’s adhesive properties make it crucial in creating strong bonds across diverse materials in the construction, automotive, and packaging industries.

Detergents also claimed a substantial market share, utilizing acrylic acid in formulations for improved cleaning efficiency. Its presence in laundry and dishwashing detergents highlights its role in enhancing cleaning performance.

Textiles benefitted from acrylic acid applications, enhancing fabric durability and dye absorption. The utilization of acrylic acid derivatives in this industry played a notable role in the market landscape.

Diapers and Feminine Hygiene Products showcased a growing reliance on acrylic acid due to its superabsorbent polymer properties, contributing significantly to this niche but expanding segment.

Water Treatment also saw notable usage of acrylic acid in polymer formulations, aiding in water purification across various sectors, from municipal treatment to industrial applications.

Personal Care Products, alongside other specialized applications, capitalized on the unique properties of acrylic acid derivatives, contributing to their respective market shares.

Note: Actual Numbers Might Vary In The Final Report

Маrkеt Ѕеgmеntѕ

By Derivative

- Acrylic Esters

- Butyl Acrylate

- Ethyl Acrylate

- Methyl Acrylate

- 2-Ethylhexyl Acrylate

- Others

Acrylic Polymer

- Superabsorbent Polymers

- Water Treatment Polymers

- Others

By Application

- Paint and Coatings

- Adhesives & Sealants

- Detergents

- Textiles

- Diapers and Feminine Hygiene Products

- Water Treatment

- Personal Care Products

- Others

Drivers

- Growing Demand in Construction and Infrastructure: Acrylic acid’s use in paints, coatings, and adhesives is driven by rapid urbanization and construction activities worldwide. The demand for durable, weather-resistant coatings and high-performance adhesives fuels the market growth.

- Shift Towards Eco-Friendly Products: With increasing environmental concerns, there’s a shift towards eco-friendly alternatives. Acrylic acid’s versatility allows for the development of sustainable, low-VOC (volatile organic compound) products, meeting regulatory standards and consumer demands for environmentally conscious materials.

Restraints

- Fluctuating Raw Material Prices: Acrylic acid’s production heavily relies on propylene, and fluctuations in propylene prices directly impact acrylic acid production costs. These price variations often pose challenges for manufacturers, impacting profit margins.

- Stringent Regulatory Standards: Compliance with stringent environmental regulations regarding VOC emissions and waste disposal presents a significant restraint. Meeting these standards requires substantial investments in research and development to create compliant products.

Opportunities

- Expanding Applications in Personal Care: Acrylic acid’s use in personal care products, such as skincare and hair care items, is growing. The market holds the potential for developing innovative, high-performance formulations to cater to evolving consumer preferences.

- Technological Advancements and Market Expansion: Advancements in production technologies and the exploration of new application areas offer opportunities for market expansion. The development of novel acrylic acid derivatives and their applications across industries presents avenues for growth and diversification.

Trends

- Rising Popularity of Superabsorbent Polymers: The market sees a surge in demand for superabsorbent polymers derived from acrylic acid. These polymers find extensive use in diapers, feminine hygiene products, and agriculture due to their exceptional water-absorbing properties.

- Innovations in Biodegradable Polymers: Ongoing research focuses on creating biodegradable acrylic polymers to address concerns about plastic waste. The development of biodegradable alternatives presents a promising trend, aligning with sustainability goals.

Geopolitical and Recession Impact Analysis

Geopolitical Impact

Trade Import and Tariff Restrictions: Tensions and disputes between nations can lead to the imposition of tariffs and import limitations on acrylic acid and its derivatives. Such actions may disrupt the supply chain, increase production costs, and subsequently raise prices for consumers.

Supply Chain Disruptions: Political instability in major acrylic acid-producing regions can disrupt the global supply chain. Any interruptions in the flow of raw materials or manufacturing processes might cause production delays, affecting the availability of acrylic acid products.

Market Access Challenges: Geopolitical tensions can create barriers for acrylic acid manufacturers seeking entry into new markets. Restrictions on market access or unfavorable trade policies could hinder expansion efforts, limiting growth prospects in specific regions.

Currency Exchange Rate Fluctuations: Geopolitical events can trigger fluctuations in currency exchange rates, impacting the cost of acrylic acid’s raw materials. These shifts may affect the competitiveness of acrylic acid exports globally, influencing both domestic sales and international trade dynamics.

Recession Impact

Reduced Demand in Construction: Economic downturns typically result in decreased construction activities across residential, commercial, and infrastructure sectors. This decline directly affects the demand for acrylic acid-based materials used in paints, coatings, adhesives, and construction-related products, leading to a reduction in sales and production.

Constraints on Consumer Spending: During recessions, consumers tend to limit discretionary spending, impacting sectors like home improvement. This cutback can prompt delays or reductions in projects involving acrylic acid-based materials, affecting the demand for items like paints, textiles, and personal care products.

Cost-Reduction Strategies: Acrylic acid manufacturers might implement cost-cutting measures in response to economic downturns. These measures, such as workforce reductions or scaled-down production, could impact the availability and variety of acrylic acid-based products in the market.

Emphasis on Innovation: Recessions often drive innovation within the acrylic acid market. Manufacturers may focus on developing more cost-effective and eco-friendly acrylic acid solutions to align with changing consumer preferences and budget limitations. This innovation drive may lead to the introduction of novel acrylic acid formulations or applications to remain competitive in a challenging market environment.

Regional Analysis

The Asia-Pacific (APAC) region emerged as a dominant force in the Acrylic Acid Market in 2023, holding a substantial market share of over 44.8%. Its robust demand for Acrylic Acid products drove the market to a valuation of USD 6.04 billion, indicating significant growth within the region.

This dominance underscores the region’s immense appetite for Acrylic Acid and its derivatives across various industries. APAC’s burgeoning industrial landscape, especially in sectors like paints, coatings, adhesives, and textiles, fueled the remarkable demand for Acrylic Acid, contributing substantially to its market expansion.

The region’s economic growth, coupled with infrastructural development and increasing manufacturing activities, propelled the consumption of Acrylic Acid products. Additionally, the rising population and expanding middle-class demographic further boosted the demand for items that incorporate Acrylic Acid derivatives, such as personal care products and construction materials.

Note: Actual Numbers Might Vary In The Final Report

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

The Acrylic Acid Market comprises several key players who significantly impact its dynamics and growth. Some of the prominent companies contributing to this market include

Top Key Рlауеrѕ

- BASF SE

- Arkema

- Nippon Shokubai Co., Ltd.

- LG Chem

- The Dow Chemical Company

- Shanghai Huayi Acrylic Acid Co. Ltd.

- Merck KGaA

- Mitsubishi Chemical Corporation

- Sasol Limited

- Formosa Plastics Corporation

- Cargill, Incorporated

- SNP Inc.

- The Lubrizol Corporation

- Ashland

- Kemira Oyi

Recent Developments

January 2023 BASF: Announced a new acrylic acid complex at the Zhanjiang Verbund site in China. This complex will include production of butyl acrylate (BA), glacial acrylic acid (GAA), and 2-ethylhexyl acrylate (2-EHA).

Report Scope

Report Features Description Market Value (2023) USD 13.5 Bn Forecast Revenue (2033) USD 20.8 Bn CAGR (2024-2033) 4.4% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Derivative(Acrylic Esters, Butyl Acrylate, Ethyl Acrylate, Methyl Acrylate, 2-Ethylhexyl Acrylate, Others), Acrylic Polymer(Superabsorbent Polymers, Water Treatment Polymers, Others, Others), By Application(Paint and Coatings, Adhesives & Sealants, Detergents, Textiles, Diapers and Feminine Hygien Product, Water Treatment, Personal Care Products, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape BASF SE, Arkema, Nippon Shokubai Co., Ltd., LG Chem, The Dow Chemical Company, Shanghai Huayi Acrylic Acid Co. Ltd., Merck KGaA, Mitsubishi Chemical Corporation, Sasol Limited, Formosa Plastics Corporation, Cargill, Incorporated, SNP Inc., The Lubrizol Corporation, Ashland, Kemira Oyi Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is acrylic acid, and what are its primary applications?Acrylic acid is a colorless liquid organic compound used in the production of various acrylic polymers. Its primary applications include paints and coatings, adhesives and sealants, textiles, superabsorbent polymers (used in diapers and hygiene products), detergents, water treatment, and personal care products.

What is the Size of Acrylic Acid Market?Acrylic Acid Market size is expected to be worth around USD 20.8 billion by 2033, from USD 13.5 billion in 2023

What is the Acrylic Acid Market growth?The global Acrylic Acid Market is expected to grow at a compound annual growth rate of 4.4%. From 2024 To 2033

-

-

- BASF SE

- Arkema

- Nippon Shokubai Co., Ltd.

- LG Chem

- The Dow Chemical Company

- Shanghai Huayi Acrylic Acid Co. Ltd.

- Merck KGaA

- Mitsubishi Chemical Corporation

- Sasol Limited

- Formosa Plastics Corporation

- Cargill, Incorporated

- SNP Inc.

- The Lubrizol Corporation

- Ashland

- Kemira Oyi