Global Green and Bio-Solvents Market Type (Bio Alcohol, Bio Diols, Bio Glycols, Lactate Esters, D-Limonene, and Other Types), By Application (Industrial & Domestic Cleaners, Paint & Coating, Adhesives, Printing Inks, Pharmaceuticals, and Other Applications), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2032

- Published date: Nov 2024

- Report ID: 106202

- Number of Pages: 335

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

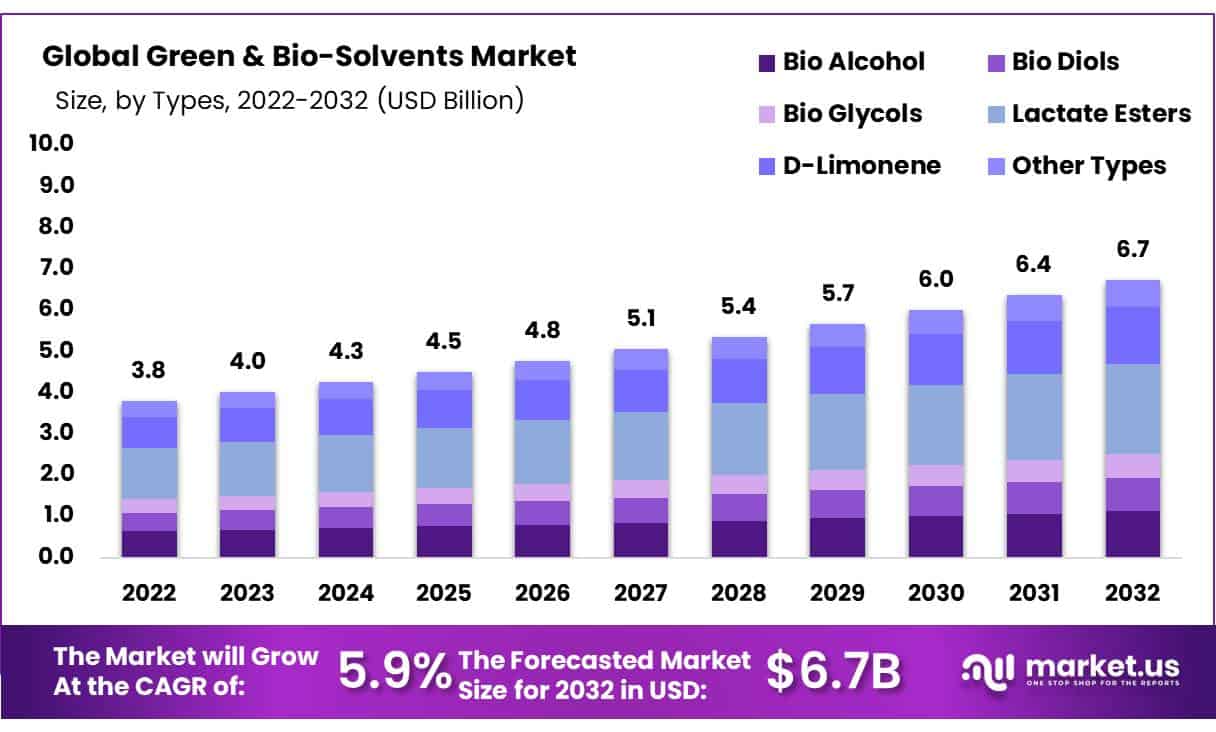

In 2022, the Global Green and Bio-Solvents Market was valued at USD 3.8 Billion, and is expected to reach USD 6.7 Billion in 2032, From 2023 to 2032, this market is estimated to register a CAGR of 5.9%.

Green and bio-solvents offer a renewable and environmentally friendly alternative to traditional petroleum-based solvents. Derived from natural feedstock such as agricultural byproducts, plant-based oils, and waste materials, these solvents are characterized by their low environmental impact and reduced volatile organic compound (VOC) emissions.

The World Health Organization (WHO) reports that green solvents have reduced hazardous air pollutants by 40%. Green chemistry minimizes hazards in chemical feedstock, reagents, and solvents, thereby reducing pollution at its source and preventing pollution generation. These solvents are significantly used in paints & coating, printing Inks, Industrial & domestic cleaners, pharmaceuticals, and cosmetics.

Actual Numbers Might Vary in the Final Report.

Key Takeaways

- Market Size: It is anticipated that the global green and bio-solvents market will experience a compound annual growth rate between 2023-2032, At a CAGR of 5.9%.

- Market Trend: Green and bio-solvents have experienced an explosion of popularity recently due to consumer shift towards eco-friendly, renewable solutions.

- Type Analysis: Of these products, lactate esters dominated the revenue share with an overwhelming 32.50% in 2022.

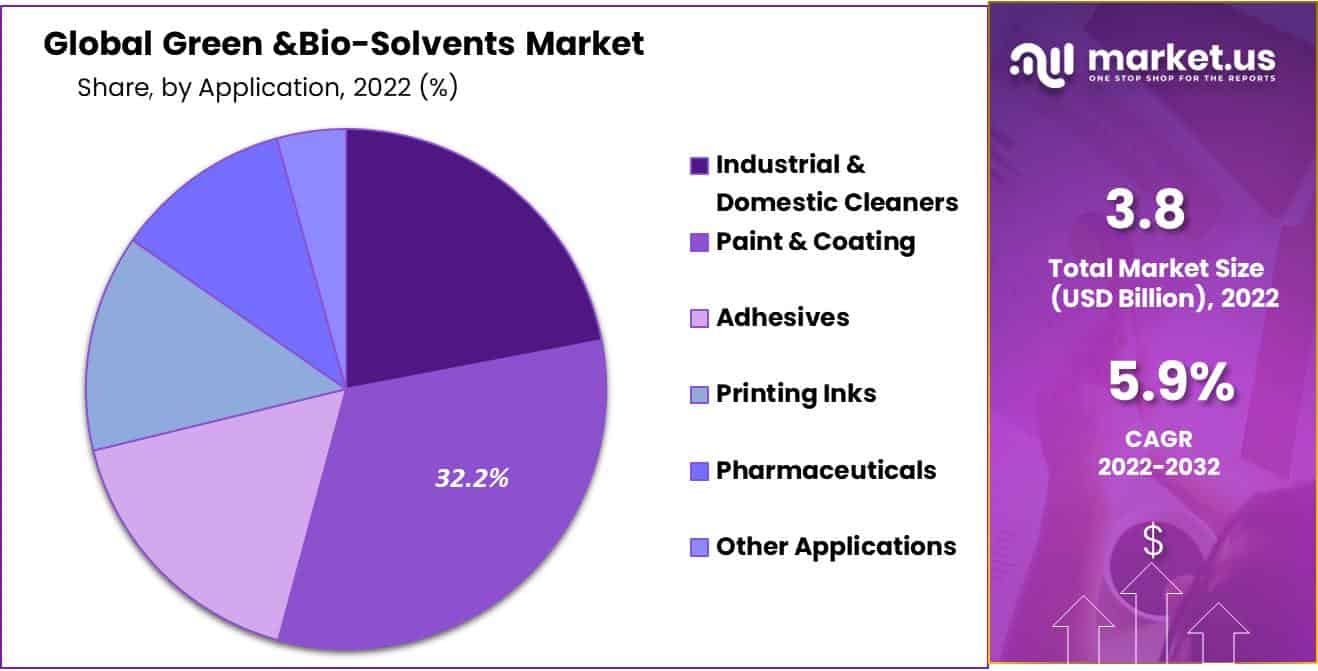

- Application Analysis: Of these applications, paint & coating accounted for 32.2% of revenue share in 2022.

- Drivers: Rising environmental awareness, stringent regulations encouraging green solutions, and the shift toward renewable and biodegradable products as key catalysts of success are driving forces behind industry changes.

- Restraints of Biosolvents: Higher costs compared with conventional solvents, limited availability of raw materials, and challenges related to scaling up are some key concerns of using Biosolvents in processing facilities.

- Opportunities: Research and development for advanced bio-based solvents, expansion into multiple industries, and collaboration for sustainable production represent opportunities.

- Challenges: Reaching cost competitiveness, creating a reliable supply chain, and informing consumers about the merits of green and bio-solvents are some of the major hurdles to be surmounted in business operations.

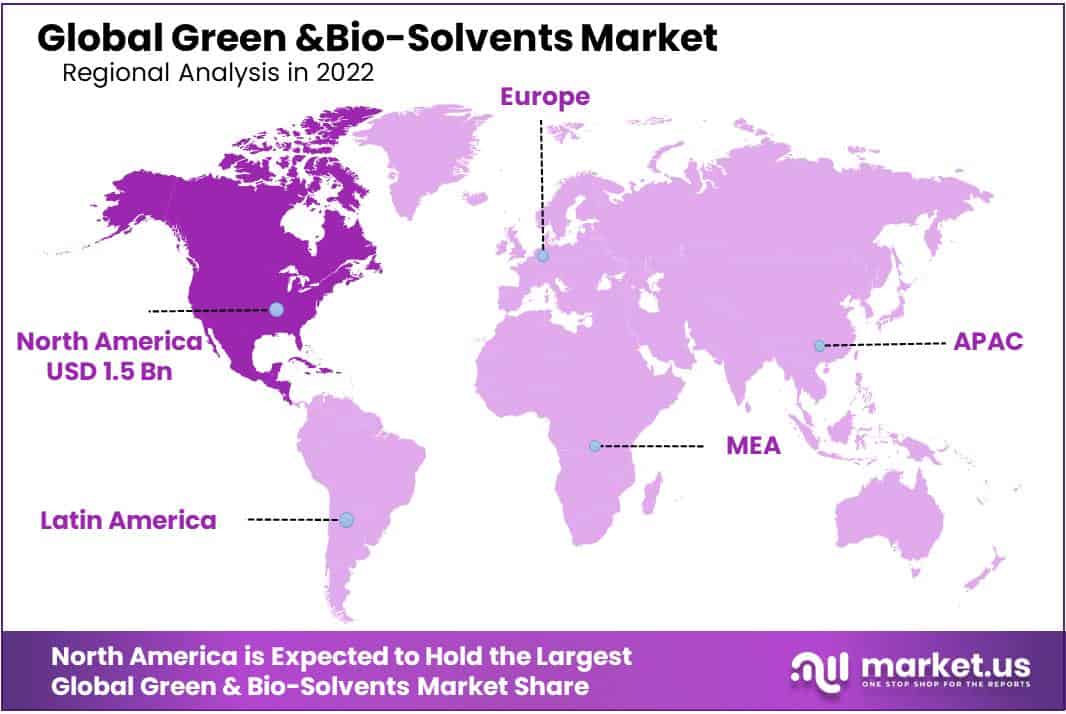

- Regional Analysis: North America maintained its market dominance at 39% within the Global Green and Bio-Solvents Sector during 2022, holding onto its lead market share at 39% of this industry segment. North America remains a powerhouse of green solvent consumption worldwide.

- Key Players Analysis: Major players in the green and bio-solvents market include BASF SE, Myriant Corporation, GF Biochemicals Ltd., Cargill Incorporated, Gevo Inc., Vertec Bio Solvents Inc., Florida Chemicals, LyondellBasell, Solvay SA, Huntsman Corporation, Other Key Players.

Market Scope

Type Analysis

The Increased Demand For Lactase Esters In Various Sectors Because Of Their Effectiveness.

The global green and bio-solvents are segmented based on type into bio alcohol, bio diols, bio glycols, lactate esters, d-limonene, and other types. Among these, lactate esters accounted for the majority of revenue share of 32.5% in 2022. This is due to the increased demand in several end-use sectors, including medicines, industrial, and personal care.

Platform compounds called lactate esters have several commercial uses in the taste, fragrance, and medicinal sectors. Additionally, they are frequently used in the paint and coatings industry and provide several benefits, including easy to recycle, non-corrosive, totally biodegradable, and not ozone-depleting.

D-Limonene is another environmentally friendly solvent with a significant market share globally. Several unpleasant solvents, such as xylene, toluene, methyl ethyl ketone, and acetone, can be substituted with D-limonene solvent. Additionally, it is interchangeable with the majority of chlorinated solvents.

Additionally, it is not naturally water-soluble. Thus, a special surfactant substance is used when producing it for jobs like removing asphalt and tar. There is much D-limonene in cleaning products. Surfactants are “surface active agents,” cleaning supplies are combined with solvents such as D-Limonene and additives like calcium and magnesium to create the cleaning solution.

Application Analysis

The Paints And Coatings Segment Dominated The Market With An Increase In Infrastructure And Building Projects.

Based on applications, the market is divided into industrial and domestic cleaners, paint & coating, adhesives, printing inks, pharmaceuticals, and other applications. Among these applications, paint & coating held the majority of revenue share. In 2022, Paint & Coating accounted for the revenue share of 32.2%.

Its large percentage can be attributed to expanding infrastructural and building projects in developing economies. The market is also driven by increased demand for paints and coatings made with bio-based materials, which provide indoor and outside paints with a glossy, long-lasting, and smooth appearance.

Key Market Segments

Type

- Bio Alcohol

- Bio Diols

- Bio Glycols

- Lactate Esters

- D-Limonene

- Other Types

By Application

- Industrial & Domestic Cleaners

- Paint & Coating

- Adhesives

- Printing Inks

- Pharmaceuticals

- Other Applications

Drivers

Government Policies Encourage the Use of Green and Bio-Solvents Market.

Governments were compelled to create numerous rules on the technology used to produce paints and coatings due to the widespread usage of chemicals in various nations. Using synthesized solvents to manufacture paints may lead to serious injury to factory workers. Moreover, synthetic solvents affect health, which can cause skin disease, nasal infection, and may create discomfort to the eye.

Additionally, these solvents release hazardous volatile organic compounds into the atmosphere. As a result, environmental regulation authorities strictly inspect emissions and waste management practices. Owing to this, manufacturers are investing in reducing harmful emissions during production by adding green and bio-solvents to their product portfolio.

Therefore, green and bio-solvents, a type of solvent derived from plants, are beneficial over synthetic solvents because of their lower environmental impact. These organic solvents reduce the risk of hazardous substances during production and protect workspaces. Government policies encourage the growth of green and bio-solvents.

Restraints

The Market Expansion Of Green And Bio-Based Solvents Is Expected To Be Constrained By Their High Manufacturing Costs.

The price of raw materials required for manufacturing bio-based solvents depends on the availability of the raw material. If there is less production of raw materials, which hampers the price of the product, it means that the price of raw materials increases. Due to this, the manufacturing cost automatically gets increased.

An increase in manufacturing costs automatically increases the prices of the final product, which will decrease the sales of this bio-based solvent. These are the constraints in this green and bio-based solvents market.

Opportunity

The Rising Usage Of Green And Bio-Based Solvents In End-Use Applications Is The Primary Market Driver.

Increasing The market has expanded as a result of the increasing use of green and bio-based solvents in a variety of industries, including paints and coatings, medicines, and cosmetics. Green and bio-based solvents are the greatest alternatives to traditional chemical- and crude oil-based solvents due to their qualities like minimal VOC emissions and eco-friendliness.

These product characteristics were the main factor in manufacturers’ switch to environmentally friendly solvents. Thus, as more and more applications arise, there will be a greater need for environmentally friendly and biodegradable solvents.

Trends

Increase Demand Due To Government Regulation And Environment-Friendly Nature Of Green And Bio-Solvent Products.

According to the strict environmental restrictions put forward by governments all over the world to combat climate change, there is now an increase in demand for environmentally friendly solvents. Industries are being pushed by these rules to switch from solvents based on petroleum to green and bio-solvents. In addition, major firms consistently fund R&D initiatives to bring innovative bio-solvents with enhanced performance characteristics to market.

As a result of their high biological degradation and low toxicity, green and bio-solvents are increasingly being used in various sectors, including paint and coating, medicines, cosmetics, printing inks, and adhesives. Additionally, businesses are being forced to use green and bio-solvents in their operations due to the growing environmental knowledge and concern among the general population. This is a profitable offer for the market.

Regional Analysis

North American region accounted for the Maximum Share of the Global Green and Bio-Solvents Market.

North America held the largest market share, with 39% in Global Green and Bio-Solvents in 2022. The green solvent market has continued to be dominated by North America. Demand, product, and new application innovation are all at the top. The United States is the largest market stockholder, followed by Canada and Mexico.

North America’s bio-based solvent market is still expanding. Italy, Germany, the Netherlands, India, and Germany are major market participants. These countries have recently shown a greater interest in creating, manufacturing and selling green solvent alternatives.

Additionally, the existence of top manufacturers like Stepan Company and Cargill, Inc., among others, positions the market in North America to see significant growth opportunities. The demand from end-use sectors, including paints & and coatings, cosmetics, pharmaceuticals, and industrial, has increased, making the Asia Pacific area one of the product market’s fastest expanding regions.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The Leading Producers And Businesses In The Market Are Using A Range Of Corporate Expansion Tactics.

The level of the product’s competitiveness, the number of producers and suppliers, and their geographic distribution all have a significant impact. The leading producers and businesses in the market are using a range of corporate expansion tactics, including acquisitions and mergers, and ramping up their R&D efforts to develop innovative and creative products and solutions, among other things.

Many companies and stakeholders worldwide for green solvents are focusing on expanding their production capabilities.

Market Key Players

With the presence of several key players across the globe, the Global Green and Bio-Solvents Market is fragmented. New key players are subject to intense competition from leading market players, particularly those with strong brand recognition and high distribution networks. The existence of top manufacturers like Stepan Company and Cargill, Inc., among others, positions the market in North America to see significant growth opportunities.

- BASF SE

- Myriant Corporation

- GF Biochemicals Ltd.

- Cargill Incorporated

- Gevo Inc.

- Vertec Bio Solvents Inc.

- Florida Chemicals

- Lyondellbasell

- Solvay SA

- Huntsman Corporation

- Other Key Players

Recent Development

- In May 2023, Nitto Denko Corporation signed a contract with Crysalis Biosciences Inc. to jointly develop plant-derived acetonitrile as a bio-based solvent and invest in Crysalis to achieve carbon neutrality.

- In July 2022, Merck, a leading science and technology company, announced the launch of a new line of complementary green solvents for photolithographic processes in semiconductor manufacturing.

- In Jan 2022, Solvay and Trillium partnered to create a new carbon fiber material made of bioacrylonitriles. Solvay has a new deal with Trillium renewable chemicals that will help them create sustainable bio-carbon fiber that can be used in various ways.

Report Scope

Report Features Description Market Value (2022) US$ 3.8 Bn Forecast Revenue (2032) US$ 6.7 Bn CAGR (2023-2032) 5.9% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Type (Bio Alcohol, Bio Diols, Bio Glycols, Lactate Esters, D-Limonene, and Other Types), By Application (Industrial & Domestic Cleaners, Paint & Coating, Adhesives, Printing Inks, Pharmaceuticals, and Other Applications) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape BASF SE, Myriant Corporation, Dow, Cargill Incorporated, Gevo Inc., Vertec Bio Solvents Inc., Florida Chemicals, Lyondellbasell, Solvay SA, Huntsman Corporation, and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the Green and Bio-Solvents Market Size?Green and Bio-Solvents Market was valued at USD 3.8 Billion, and is expected to reach USD 6.7 Billion in 2032, From 2023 to 2032

What is the CAGR for the Green & Bio-Solvents Market?The Green & Bio-Solvents Market is expected to grow at a CAGR of 5.9% during 2023-2032.Who are the prominent players in the Green & Bio-Solvents Market?BASF SE, Myriant Corporation, GF Biochemicals Ltd., Cargill Incorporated, Gevo Inc., Vertec Bio Solvents Inc., Florida Chemicals, Lyondellbasell, Solvay SA, Huntsman Corporation, Other Key Players

Green and Bio-Solvents MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample

Green and Bio-Solvents MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- BASF SE

- Myriant Corporation

- GF Biochemicals Ltd.

- Cargill Incorporated

- Gevo Inc.

- Vertec Bio Solvents Inc.

- Florida Chemicals

- Lyondellbasell

- Solvay SA

- Huntsman Corporation

- Other Key Players