Global Xylene Market By Type(Mixed Xylene, Ortho-Xylene, Meta-Xylene, Para-Xylene), By Application(Solvent, Monomer, Others), By Purity(Below 98%, Above 98%), By End-Use(Paints and Coatings, Production of Polyester, Plasticizers Manufacturing, Printing Inks, Adhesives, Others) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: July 2024

- Report ID: 124030

- Number of Pages: 316

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

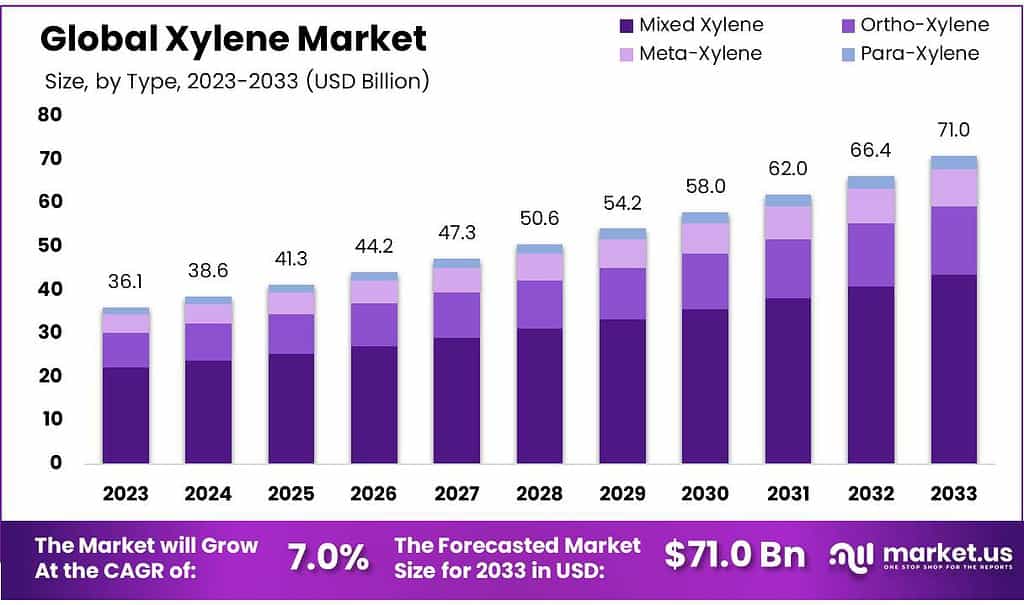

The global Xylene Market size is expected to be worth around USD 71.0 billion by 2033, from USD 36.1 billion in 2023, growing at a CAGR of 7.0% during the forecast period from 2023 to 2033.

The global xylene market encompasses a broad spectrum of activities including the production, consumption, and international trade of xylene—a clear, colorless solvent noted for its distinct sweet smell. Xylene is integral to manufacturing chemicals like terephthalic acid, a key precursor for creating polyethylene terephthalate (PET) used extensively in packaging materials such as bottles. Additionally, its applications as a solvent span various industries including printing, rubber, and leather.

Market dynamics are shaped by a combination of industrial demand in these sectors, technological advancements, environmental regulations, and global economic trends. These factors influence everything from production processes to pricing strategies and regulatory compliance.

For instance, environmental regulations significantly impact operational practices within the xylene industry due to the compound’s volatile and toxic nature, pushing companies towards innovation in production and safety measures.

In terms of trade, government initiatives such as the U.S. National Export Strategy play a pivotal role by supporting the chemical industry, including xylene manufacturers. These policies facilitate trade by streamlining export processes and overcoming international trade barriers, thereby aiding U.S. businesses in expanding their market reach globally. This governmental support is crucial for maintaining competitiveness in the international market.

Furthermore, investments in the xylene sector frequently target technological improvements and expansion of production capacities. These investments are driven by the need to meet growing industrial demands and to adhere to stringent environmental standards. The push towards more sustainable and efficient manufacturing processes reflects a broader industry trend towards environmental sustainability, influenced by regulatory pressures and market demands for eco-friendly practices.

This comprehensive approach to understanding the xylene market underscores the complex interplay of technological, regulatory, and economic factors that companies must navigate to succeed in this competitive industry. These dynamics not only drive strategic business decisions but also foster innovation and sustainability in chemical manufacturing.

Key Takeaways

- The global xylene market is projected to grow from USD 36.1 billion in 2023 to USD 71.0 billion by 2033, at a 7.0% CAGR.

- Mixed Xylene held a dominant position, capturing more than 61.5% of the market due to its versatile industrial applications.

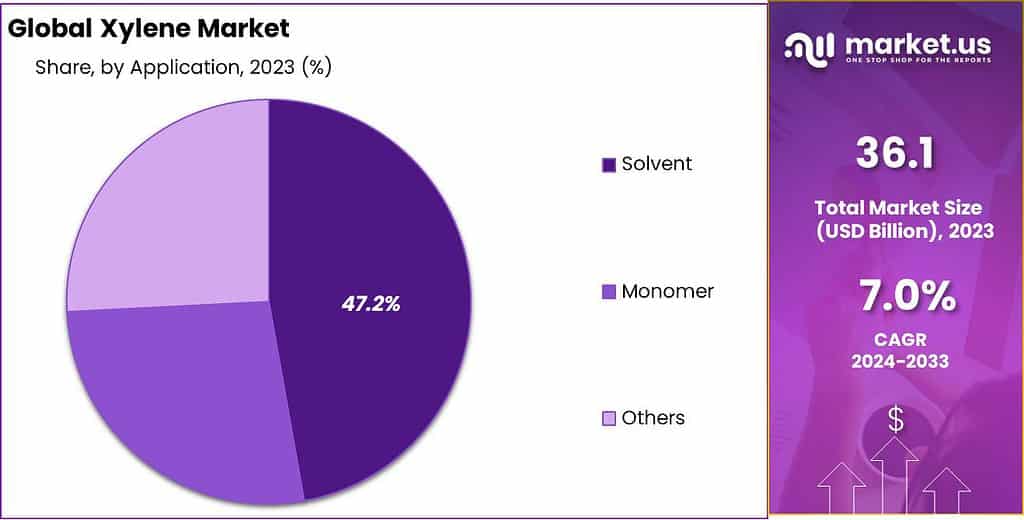

- Solvent applications dominated the market in 2023, holding a 47.2% share, driven by extensive use in paints, coatings, and adhesives.

- Xylene with a purity above 98% captured over 92.4% of the market in 2023, essential for pharmaceuticals, food packaging, and electronics.

- The paints and Coatings sector held a 92.4% market share in 2023, owing to xylene’s critical role as a solvent in high-quality paint production.

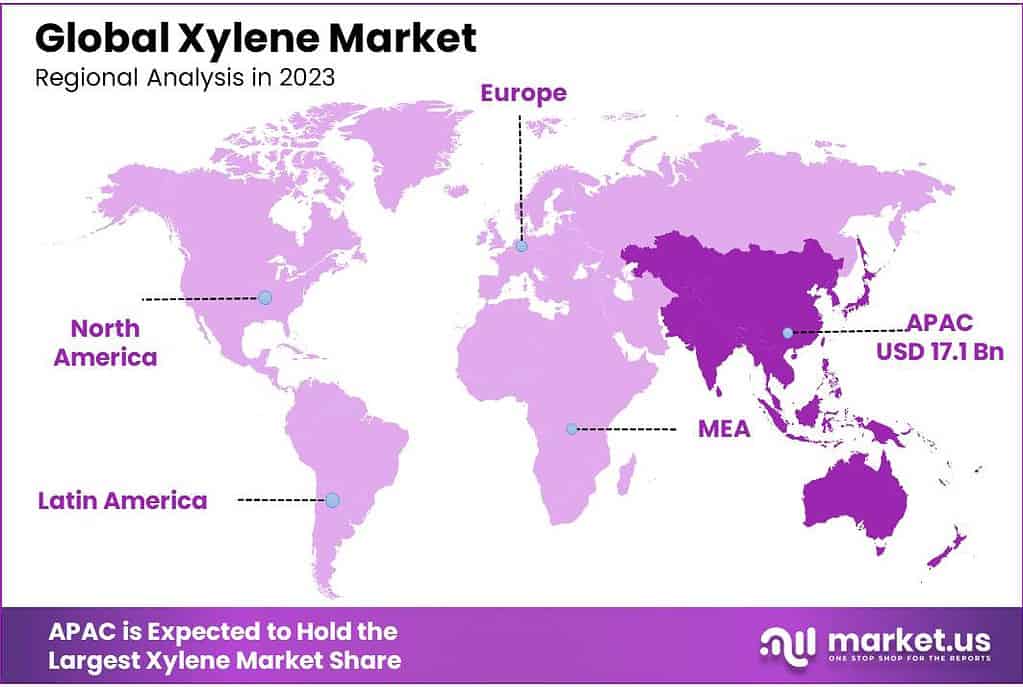

- Asia Pacific dominated the xylene market with a 47.5% share, valued at USD 17.14 billion in 2023, driven by rapid industrialization.

By Type

In 2023, Mixed Xylene held a dominant market position, capturing more than a 61.5% share of the xylene market. This category’s leadership is attributed to its widespread use across multiple industries, including paints, coatings, and adhesives, where its solvent properties are highly valued. Mixed xylene’s versatility makes it a staple in the manufacture of various products, supporting its strong market presence.

Ortho-Xylene, another significant segment, is primarily utilized in the production of phthalic anhydride, an ingredient critical for making plasticizers used in PVC. Its specific applications in the plastic and construction industries help maintain its substantial market share.

Meta-Xylene used less extensively than its counterparts finds its niche in the production of isophthalic acid, which is essential in the manufacture of high-quality resins and PET fibers, influencing its market demand.

Para-xylene stands out due to its critical role in producing purified terephthalic acid (PTA) and dimethyl terephthalate (DMT), which are key precursors for the polyester industry. This segment is vital for the production of polyester fibers and resins, commonly used in textiles and beverage bottles, respectively.

By Application

In 2023, Solvent applications held a dominant market position in the xylene market, capturing more than a 47.2% share. This leading position is largely attributed to xylene’s effectiveness as a solvent in industries such as paints, coatings, and adhesives. Its ability to dissolve other substances makes it indispensable for formulating high-quality products in these sectors.

Another significant application of xylene is as a Monomer in the production of synthetic fibers, plastics, and other polymers. Xylene’s derivatives are essential in creating materials that offer durability and flexibility, critical attributes for a wide range of industrial and consumer products.

By Purity

In 2023, xylene with a purity above 98% held a dominant market position, capturing more than a 92.4% share. This high level of purity is crucial for applications that require stringent quality standards, such as in the pharmaceutical, food packaging, and electronics industries, where impurities can significantly impact product performance and safety. The high demand for this grade of xylene underscores its importance in producing high-quality end products and maintaining manufacturing integrity.

On the other hand, xylene with a purity below 98% caters to less critical applications where high purity is not a necessity. This includes various industrial uses like certain types of rubber manufacturing and lower-grade paint production, where the impact of minor impurities is less significant. Although this segment is smaller, it serves essential niche markets that require cost-effective solutions without the stringent purity standards of their high-purity counterparts.

By End-Use

In 2023, the Paints and Coatings sector held a dominant market position in the xylene market, capturing more than a 92.4% share. This substantial market share is attributed to the critical role of xylene as a solvent in the production of high-quality paints and coatings, where it enhances the smooth application and durability of the finish. Xylene helps in adjusting the consistency and drying properties of paints, making it indispensable in both residential and industrial applications.

The Production of Polyester is another significant use for xylene, particularly in the form of purified terephthalic acid (PTA) and dimethyl terephthalate (DMT) derived from xylene. These compounds are fundamental in creating polyester fibers used extensively in textiles and packaging materials, driving steady demand within this segment.

In Plasticizers Manufacturing, xylene is utilized to produce phthalates that are essential for making flexible PVC used in a variety of products from hoses to vinyl flooring. This application leverages xylene’s effectiveness in producing components that impart flexibility and durability to polymers.

The Printing ink sector also relies on xylene for its solvent properties, which are vital in achieving the correct viscosity and ensuring that inks dry correctly on various substrates, thereby ensuring high-quality print outputs.

Additionally, in Adhesives, xylene is used to dissolve other compounds to create strong and durable adhesives used across multiple industries, including construction and automotive. Its ability to adjust the tackiness and drying time of adhesives makes it a valuable component in this market.

Key Market Segments

By Type

- Mixed Xylene

- Ortho-Xylene

- Meta-Xylene

- Para-Xylene

By Application

- Solvent

- Monomer

- Others

By Purity

- Below 98%

- Above 98%

By End-Use

- Paints and Coatings

- Production of Polyester

- Plasticizers Manufacturing

- Printing Inks

- Adhesives

- Others

Drivers

Rising Demand in Construction and Automotive Sectors

The growing applications of xylene in the construction and automotive industries are identified as the primary drivers of its market. Xylene’s utility as a solvent in producing paints and coatings significantly contributes to its demand within the building and construction sector. With the global construction industry projected to expand, particularly in emerging economies, the demand for xylene is expected to rise accordingly. The robust development activities, fueled by increasing urbanization and industrialization, especially in the Asia-Pacific region, underscore the continuous demand for xylene in this sector.

Furthermore, xylene is crucial in the automotive industry where it is used in manufacturing components such as plasticizers for PVC, and utilized extensively in vehicle interiors and parts. As the automotive sector experiences growth, especially in major car manufacturing nations like China and India, the demand for xylene sees a parallel increase. Innovations aimed at enhancing vehicle durability and efficiency are also pivotal in driving the demand for high-quality xylene-based products.

Strategic investments and expansions in the petrochemical sector, where xylene serves as a fundamental feedstock, further amplify its market growth. These investments are not just about enhancing production capacities but also reflect the long-term expected demand for xylene across various applications. Key market players are continually engaging in strategic expansions and mergers to better meet global demand, highlighting the critical role of xylene in the chemical industry.

Regulatory impacts also play a significant role in shaping the market dynamics for xylene. Environmental regulations aimed at reducing volatile organic compound (VOC) emissions influence the use of xylene in several industries. While these regulations drive innovation towards more sustainable alternatives, the development and approval of new industrial projects that comply with these regulations suggest a supportive policy environment for the controlled use of xylene, thus sustaining its market demand.

Restraints

Stringent Environmental Regulations

A critical restraining factor for the growth of the xylene market is the stringent environmental regulations imposed by various global organizations and governments due to the potential health and environmental risks associated with xylene. Studies by prominent health organizations, such as the International Agency for Research on Cancer (IARC) and the U.S. Environmental Protection Agency (EPA), have highlighted several health concerns linked to xylene exposure. These include symptoms like labored breathing, impaired pulmonary function, increased heart palpitations, fatigue, and dizziness.

Xylene’s environmental impact is also a significant concern, as it can percolate into the soil and groundwater, where it may become toxic and enter the food chain. This characteristic has led governments to implement rigorous laws to regulate its use, further compounded by the availability of substitutes such as limonene reagents and aliphatic hydrocarbons, which are considered less harmful to health and the environment.

The dual challenge of regulatory pressure and the availability of alternative, less hazardous chemicals is prompting industries that traditionally rely on xylene—such as the paint and coatings, adhesives, and cleaning industries—to seek safer substitutes. This shift is not only driven by compliance with regulations but also by growing consumer and corporate demand for environmentally friendly and sustainable products

Opportunity

Expansion in Bio-Based Xylene Production

A significant growth opportunity for the xylene market lies in the rising trend towards bio-based xylene production. As industries and consumers increasingly demand sustainable and environmentally friendly products, the shift towards bio-based alternatives presents a notable expansion path for the xylene market. This transition is driven by the need to reduce dependency on traditional fossil-based chemicals and to align with global sustainability targets.

Bio-based xylene, produced through renewable sources, is gaining traction due to its reduced environmental impact compared to its petroleum-derived counterpart. This shift not only responds to stringent environmental regulations but also opens new market segments that prioritize green chemicals. The adoption of bio-based xylene is expected to grow, particularly in applications where xylene is used as a solvent and a monomer, such as in the production of PET (polyethylene terephthalate), paints, coatings, and adhesives.

The push for bio-based xylene is also spurred by technological advancements and innovations in production processes that make bio-based alternatives more cost-effective and feasible at a commercial scale. For example, developments in catalytic technologies and bioprocessing are improving the efficiency and reducing the costs associated with bio-based xylene production, making it more competitive with petroleum-based products.

In the Asia-Pacific region, where the demand for xylene is notably high due to extensive industrial activities, the potential for bio-based xylene is particularly strong. The region’s large market size combined with growing environmental consciousness among consumers and industries enhances the prospects for bio-based xylene. Moreover, this shift is supported by governmental policies in countries like China and India, which are increasingly promoting the use of environmentally sustainable materials.

Trends

Increasing Use of Bio-Based Xylene

A notable trend in the xylene market is the increasing adoption of bio-based xylene, driven by the growing emphasis on sustainability and the reduction of environmental impact from traditional petrochemical sources. The shift towards bio-based xylene is seen as a strategic move to meet the rising consumer and regulatory demand for more environmentally friendly products. This trend is supported by advancements in technology that improve the efficiency and cost-effectiveness of producing xylene from renewable sources.

Bio-based xylene aligns with global sustainability goals, offering a reduced carbon footprint and less environmental degradation compared to its fossil-fuel-derived counterpart. It is being increasingly utilized in industries such as plastics, textiles, and packaging, where xylene is a key solvent and raw material. The development and scaling of bio-based xylene production are expected to provide significant growth opportunities for market players, positioning this trend as a transformative factor for the industry.

This trend is not only reshaping the production strategies of major xylene producers but also influencing market dynamics, as companies invest in new technologies and expand their bio-based product offerings to gain competitive advantages and comply with stringent environmental regulations.

Regional Analysis

The Asia Pacific region dominates the global xylene market, accounting for 47.5% of the market share, valued at USD 17.14 billion in 2023. This dominance is driven by rapid industrialization, urbanization, and robust growth in the petrochemical and automotive sectors in countries such as China, India, and South Korea.

China, being the largest producer and consumer, significantly influences the regional market dynamics. The high demand for para-xylene for polyester production and ortho-xylene for plasticizers and solvents further propels market growth in the region. Favorable government policies and substantial investments in chemical manufacturing facilities also support the market expansion.

The North American xylene market is characterized by steady growth, driven by substantial demand from the automotive, construction, and packaging industries. The United States is the largest market in the region, benefiting from advanced technological infrastructure and significant investment in research and development. In 2023, North America held approximately 22% of the global xylene market. The region’s growth is further supported by the presence of major chemical companies and the increasing adoption of sustainable production practices.

Europe remains a critical player in the global xylene market, driven by strong industrial activities and stringent environmental regulations. Key markets in the region include Germany, France, and the United Kingdom, which contribute significantly to the overall market. In 2023, Europe accounted for around 20% of the global xylene market. The demand is primarily driven by the automotive and construction sectors, along with the increasing use of xylene in the production of adhesives, sealants, and coatings.

The Middle East & Africa region is witnessing gradual growth in the xylene market, propelled by rising industrialization and expanding petrochemical activities. The GCC countries, particularly Saudi Arabia and the UAE, are leading the demand due to their strong chemical manufacturing base. However, the region’s market share remains relatively small, accounting for around 7% of the global xylene market in 2023. Economic diversification efforts and investments in petrochemical projects are expected to boost market growth in the coming years.

Latin America shows promising growth potential in the xylene market, with Brazil and Mexico being the key markets. The region benefits from increasing industrial activities and growing demand from the automotive and construction sectors. However, economic instability and regulatory challenges pose constraints. In 2023, Latin America held a 3.5% share of the global xylene market. Efforts to enhance manufacturing capabilities and improve regulatory frameworks are anticipated to support market expansion.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The xylene market is highly competitive, featuring prominent global players such as Exxon Mobil Corporation, Reliance Industries Limited, and INEOS. Exxon Mobil Corporation, with its extensive petrochemical operations, remains a leader in xylene production, leveraging its advanced refining technologies and global distribution network.

Reliance Industries Limited, based in India, is another major player, significantly contributing to the market through its large-scale production facilities and strategic investments in petrochemical complexes. INEOS, a multinational chemical company, maintains a strong market presence by continually expanding its production capacities and innovating in chemical manufacturing processes.

In Asia, CNPC (China National Petroleum Corporation) and Mitsubishi Gas Chemical Company, Inc. are pivotal, particularly in the rapidly growing Asia Pacific market. CNPC, with its vast resources and integrated supply chain, ensures a steady supply of xylene, while Mitsubishi Gas Chemical focuses on technological advancements and efficient production methods. Other key players include Braskem S.A. in Brazil, known for its significant contributions to the Latin American market, and Honeywell International Inc., which emphasizes sustainability and innovation in its chemical production.

European players like BP PLC and Merck KGaA are influential, with BP PLC focusing on sustainable practices and chemical recycling, and Merck KGaA specializing in high-purity xylene for pharmaceutical applications. Chevron Phillips Chemical and US Petrochemical Industries Inc. are notable in North America, driving market growth through extensive research and development initiatives.

JX Nippon Oil and Energy Corporation and S.K. Global Chemical are key players in Japan and South Korea, respectively, contributing to the regional dominance in the xylene market. Royal Dutch Shell Plc and Taiyo Oil Company Limited also play significant roles, with Royal Dutch Shell emphasizing global supply chain efficiency and Taiyo Oil focusing on high-quality petrochemical products.

Market Key Players

- Exxon Mobil Corporation

- Reliance Industries Limited

- INEOS

- CNPC (China National Petroleum Corporation)

- Mitsubishi Gas Chemical Company, Inc.

- Braskem S.A.

- Honeywell International Inc.

- BP PLC

- Chevron Phillips Chemical

- Merck KGaA

- US Petrochemical Industries Inc.

- JX Nippon Oil and Energy Corporation

- S.K. Global Chemical

- Royal Dutch Shell Plc

- Taiyo Oil Company Limited

Recent Development

In 2023, ExxonMobil produced approximately 5.3 million barrels per day of xylene-related energy products. Monthly production figures show consistent output, with January seeing 5.2 million barrels per day, which increased slightly to 5.3 million barrels per day by June and maintained this level through December.

In 2023, Reliance commissioned a new paraxylene (PX) plant at its Jamnagar facility, significantly boosting its production capacity. This new plant adds 2.2 million metric tons per annum (MMTPA) of PX capacity, bringing the total capacity at Jamnagar to 4.2 MMTPA.

Report Scope

Report Features Description Market Value (2023) US$ 36.1 Bn Forecast Revenue (2033) US$ 71.0 Bn CAGR (2024-2033) 7.0% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(Mixed Xylene, Ortho-Xylene, Meta-Xylene, Para-Xylene), By Application(Solvent, Monomer, Others), By Purity(Below 98%, Above 98%), By End-Use(Paints and Coatings, Production of Polyester, Plasticizers Manufacturing, Printing Inks, Adhesives, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Exxon Mobil Corporation, Reliance Industries Limited, INEOS, CNPC (China National Petroleum Corporation), Mitsubishi Gas Chemical Company, Inc., Braskem S.A., Honeywell International Inc., BP PLC, Chevron Phillips Chemical, Merck KGaA, US Petrochemical Industries Inc., JX Nippon Oil and Energy Corporation, S.K. Global Chemical, Royal Dutch Shell Plc, Taiyo Oil Company Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of Xylene Market?Xylene Market size is expected to be worth around USD 71.0 billion by 2033, from USD 36.1 billion in 2023

What CAGR is projected for the Xylene Market?The Xylene Market is expected to grow at 7.0% CAGR (2024-2033).

Who are some key players in the Xylene Market?Exxon Mobil Corporation, Reliance Industries Limited, INEOS, CNPC (China National Petroleum Corporation), Mitsubishi Gas Chemical Company, Inc., Braskem S.A., Honeywell International Inc., BP PLC, Chevron Phillips Chemical, Merck KGaA, US Petrochemical Industries Inc., JX Nippon Oil and Energy Corporation, S.K. Global Chemical, Royal Dutch Shell Plc, Taiyo Oil Company Limited

-

-

- Exxon Mobil Corporation

- Reliance Industries Limited

- INEOS

- CNPC (China National Petroleum Corporation)

- Mitsubishi Gas Chemical Company, Inc.

- Braskem S.A.

- Honeywell International Inc.

- BP PLC

- Chevron Phillips Chemical

- Merck KGaA

- US Petrochemical Industries Inc.

- JX Nippon Oil and Energy Corporation

- S.K. Global Chemical

- Royal Dutch Shell Plc

- Taiyo Oil Company Limited