Global Purified Terephthalic Acid (PTA) Market By Form(Powder, Granular), By Application(PET Resin, Polyester, Polybutylene Terephthalate (PBT), Plasticizers, Others), By End-use(Textile, PET Bottles, Packaging, Others), By Sales Channel(Direct Sale, Indirect Sale) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: June 2024

- Report ID: 122518

- Number of Pages: 264

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

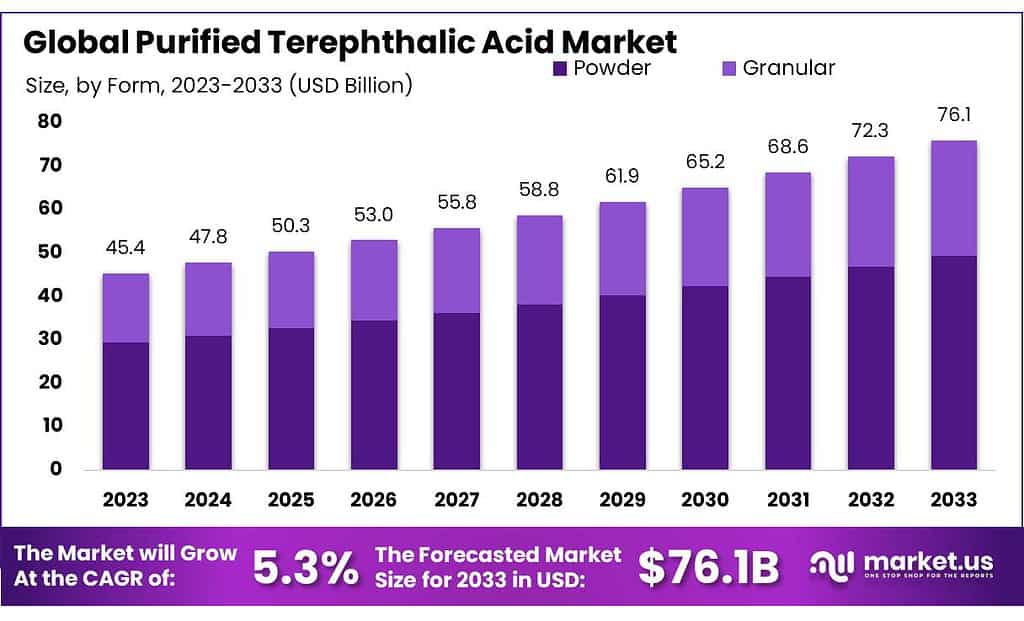

The Global Purified Terephthalic Acid (PTA) Market size is expected to be worth around USD 76.1 billion by 2033, from USD 45.4 billion in 2023, growing at a CAGR of 5.3% during the forecast period from 2023 to 2033.

Purified Terephthalic Acid (PTA) is a chemical compound that serves as a primary raw material in the manufacture of polyester products, including polyester fibers, polyethylene terephthalate (PET) bottle resins, and polyester film.

The substance is produced primarily through the oxidation of p-xylene in acetic acid, in the presence of air or oxygen, catalyzed by a cobalt-manganese system. This process results in a highly pure form of terephthalic acid, which is essential for ensuring the quality and durability of the end products.

PTA is known for its crystalline white powder form and is extensively used due to its robust performance in polymerization processes where it contributes to the thermal stability and mechanical properties of polyester.

The global demand for PTA has been rising steadily, driven by the growing textile industry and an increasing preference for PET bottles and packaging materials due to their lightweight and recyclable properties. This growth is particularly notable in emerging markets, where rapid urbanization and increasing consumer spending power are boosting the consumption of polyester fibers and PET-packaged products.

The production and consumption of PTA are closely tied to environmental considerations. The manufacturing process is energy-intensive and produces significant emissions and byproducts that require careful management to minimize environmental impact. As a result, advancements in production technology that increase efficiency and reduce waste are critical for the sustainability of this industry.

Key Takeaways

- The global PTA market size is expected to reach USD 76.1 billion by 2033, up from USD 45.4 billion in 2023, growing at a CAGR of 5.3% during the forecast period from 2023 to 2033.

- The powder form of Purified Terephthalic Acid (PTA) held a dominant market position, capturing more than a 65.4% share.

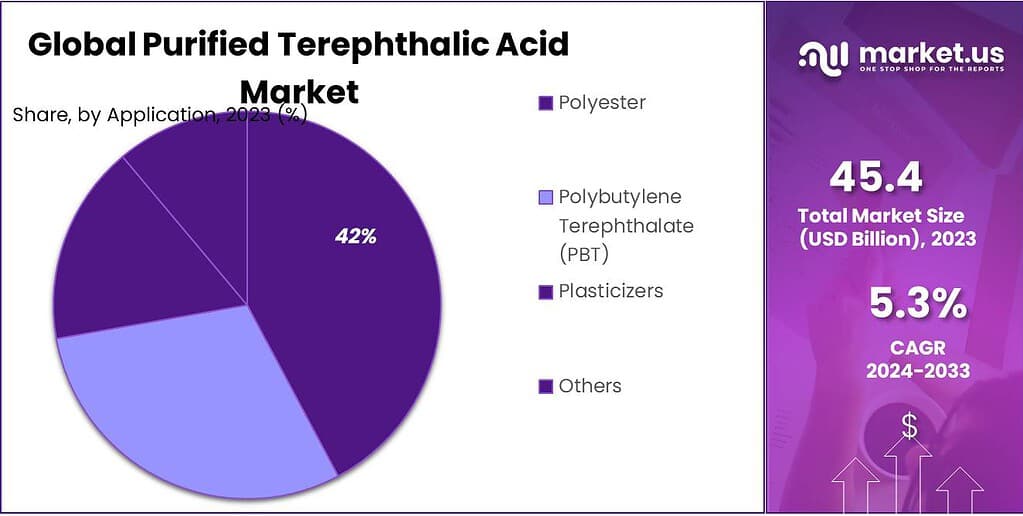

- PET resin accounted for 42.5% of the PTA market in 2023, driven by demand for durable and recyclable containers in the beverage industry.

- The food and beverage sector held a 39.6% market share in 2023, driven by PTA use in PET bottle production.

- Indirect sales channels captured 55.3% of the PTA market in 2023, involving distribution through third-party vendors, distributors, and traders.

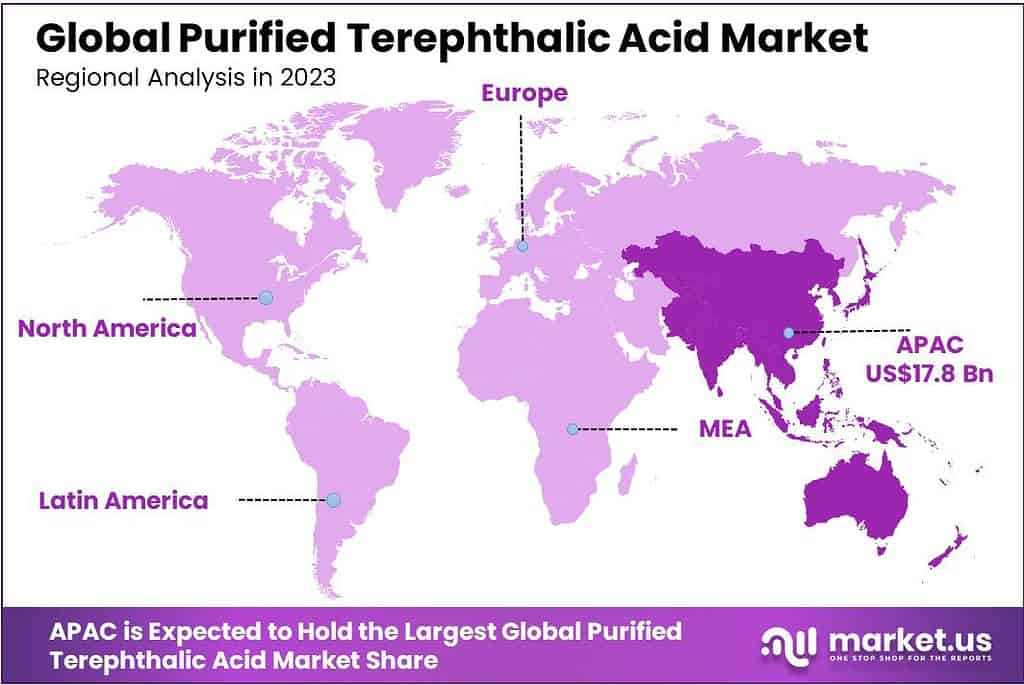

- The Asia Pacific region leads the PTA market with a 39.2% share, projected to reach USD 17.8 billion by the end of the forecast period.

By Form

In 2023, the Powder form of Purified Terephthalic Acid (PTA) held a dominant market position, capturing more than a 65.4% share. This form is preferred for its ease of handling and efficiency in the manufacturing process, especially in the production of polyester fibers and resins. Powder PTA dissolves quickly and uniformly, ensuring consistent quality in polymerization processes, which is crucial for producing high-quality polyester products.

Conversely, the Granular form of PTA, while less prevalent in the market, serves specific needs where slower dissolution rates are beneficial. Granular PTA is often used in applications requiring more controlled processing conditions, helping to manage and stabilize the reaction rates during the polymerization of polyester. This form is appreciated for its lower dusting during handling, which can reduce losses and improve workplace safety.

By Application

In 2023, PET Resin held a dominant market position in the Purified Terephthalic Acid (PTA) market, capturing more than a 42.5% share. This application leverages PTA primarily for manufacturing PET bottles and food packaging, driven by the demand for durable and recyclable containers. The growth in the beverage industry and an increase in consumer preference for sustainable packaging solutions significantly contribute to this segment’s expansion.

Other applications of PTA include Polyester manufacturing, which is extensively used in textiles and apparel industries. The Polyester segment benefits from the rising global fashion consumption and the textile industry’s expansion in emerging economies. Polybutylene Terephthalate (PBT), another derivative of PTA, is utilized in engineering plastics where high-performance material is required, such as in automotive parts and electrical casings.

Additionally, PTA is used as a raw material in Plasticizers, which are added to plastics to increase their flexibility, transparency, durability, and longevity. The ‘Others’ category includes various smaller-scale applications such as film sheets and performance coatings, showcasing PTA’s versatility across multiple industries. Each of these applications highlights the diverse utility of PTA, reinforcing its essential role in modern material production.

By End-use

In 2023, the Food & Beverage sector held a dominant market position in the Purified Terephthalic Acid (PTA) market, capturing more than a 39.6% share. This substantial share is largely attributed to the extensive use of PTA in the production of PET bottles, which are a staple in the food and beverage industry for packaging soft drinks, water, and other liquid products. The demand is driven by the material’s durability, clarity, and recyclability, which align with increasing consumer preferences for sustainable packaging solutions.

Other important end uses of PTA include the Textile industry, where it is utilized to produce polyester fibers used extensively in clothing, home furnishings, and industrial applications. Additionally, PTA finds significant applications in general Packaging beyond just food and beverage, such as in making containers and films that require high strength and chemical resistance.

By Sales Channel

In 2023, the Indirect Sale channel held a dominant market position in the Purified Terephthalic Acid (PTA) market, capturing more than a 55.3% share. This method primarily involves the distribution of PTA through third-party vendors, distributors, and traders who facilitate the supply of PTA to a wide range of end-users. Indirect sales are crucial for reaching smaller manufacturers and industries in diverse geographical locations where direct distribution from producers might be less feasible or cost-effective.

Conversely, Direct Sale involves transactions directly between the manufacturers and large industrial users or major consumers. This channel is preferred for its ability to streamline supply chains, reduce overhead costs, and enhance direct customer relationships.

Direct sales are particularly significant for large-scale consumers in industries like textiles and PET bottle manufacturing, where substantial volumes of PTA are required consistently. Each sales channel plays a pivotal role in the distribution of PTA, addressing different needs of the market and ensuring the broad availability of this essential chemical across various industries.

Key Market Segments

By Form

- Powder

- Granular

By Application

- PET Resin

- Polyester

- Polybutylene Terephthalate (PBT)

- Plasticizers

- Others

By End-use

- Textile

- PET Bottles

- Packaging

- Others

By Sales Channel

- Direct Sale

- Indirect Sale

Drivers

Growth in the Global Textile Industry

A significant driver propelling the Purified Terephthalic Acid (PTA) market is the robust growth of the global textile industry. PTA, as a crucial raw material for producing polyester fibers, benefits directly from the expansion in textile production and consumption worldwide.

The rising demand for polyester fibers is fueled by their cost-effectiveness, versatility, and durability, making them preferred materials for a wide range of applications, including clothing, home furnishings, and industrial textiles.

The textile sector’s growth is driven by an increasing global population and rising income levels, especially in emerging economies like China, India, and other parts of Asia, which have seen significant industrial growth. These regions are not only major producers of textiles but also vast markets for textile products. As urbanization continues to spread, the demand for polyester clothing and other products is expected to keep growing, thus driving the need for PTA.

Furthermore, the shift towards fast fashion contributes significantly to the increased consumption of polyester fibers. Fast fashion relies on quick manufacturing turnaround times and frequently changing styles, which polyester accommodates well due to its ease of processing and ability to blend with other fibers.

Moreover, technological advancements in polyester recycling processes are making polyester production more sustainable, which could further boost the PTA market by aligning with global sustainability goals.

Restraints

Environmental Regulations and Sustainability Concerns

One significant restraint facing the Purified Terephthalic Acid (PTA) market is the stringent environmental regulations and growing sustainability concerns related to its production. The manufacturing process of PTA involves the use of heavy chemicals and generates substantial waste and emissions, including greenhouse gases and other pollutants.

These environmental issues are becoming increasingly problematic as governments worldwide implement stricter regulations to combat climate change and reduce industrial pollution.

The push towards more sustainable and eco-friendly manufacturing processes has led to increased operational costs for PTA producers. Companies are now compelled to invest in pollution control technologies, waste management systems, and cleaner production techniques.

While these changes are beneficial for the environment, they require significant financial outlay and can reduce the profit margins of PTA manufacturers. This economic pressure can deter investment and innovation in the PTA industry, potentially slowing down market growth.

Additionally, the demand for more sustainable materials in the textile and packaging industries is driving research and development into alternative materials that can replace PTA. As consumer awareness and preference for environmentally friendly products grow, the market may see a shift towards biodegradable and recycled materials. This trend could limit the demand for PTA, particularly in applications where sustainable alternatives are viable and increasingly preferred by consumers.

Opportunity

Expansion into Bioplastics and Sustainable Packaging

A significant opportunity for the Purified Terephthalic Acid (PTA) market lies in the burgeoning field of bioplastics and sustainable packaging solutions. As global environmental concerns intensify and consumer preferences shift towards more eco-friendly products, there is a growing demand for sustainable materials in packaging and textiles. PTA, which is a key component in the production of polyethylene terephthalate (PET), has the potential to play a crucial role in these sectors, particularly in the development of recycled and bio-based PET.

The push for sustainability is not just a trend but a major shift in the regulatory and business landscape. Governments worldwide are implementing stricter regulations on single-use plastics and encouraging recycling and the use of renewable resources.

This regulatory environment, coupled with incentives for sustainable practices, presents a vast opportunity for PTA manufacturers to innovate and capture new markets. By developing PTA products that can be efficiently recycled or derived from bio-based sources, manufacturers can meet the increasing demands of environmentally conscious consumers and industries.

Moreover, the technology for recycling PET, which involves PTA, is advancing, allowing for higher quality recycled materials that can be used in a wider range of applications. This not only helps reduce waste but also opens up new applications in consumer goods, automotive, and electronics, where sustainability is becoming increasingly important. Additionally, as the market for bioplastics grows, PTA producers have the opportunity to be at the forefront of this transformation by adapting their processes to support the production of bio-based alternatives.

Embracing these opportunities in bioplastics and sustainable packaging can significantly propel the PTA market forward, aligning it with global sustainability goals and increasing its relevance in the modern materials economy. This strategic shift could not only enhance the environmental profile of PTA but also ensure its long-term viability and profitability in a rapidly evolving market.

Trends

Integration of Circular Economy Practices

A major trend shaping the Purified Terephthalic Acid (PTA) market is the integration of circular economy practices into production and supply chains. This trend is driven by the global push towards sustainability and the reduction of waste in industrial processes. As environmental awareness increases, industries that rely on PTA are looking for ways to minimize their ecological impact, prompting a shift towards more sustainable manufacturing methods.

This trend involves the recycling of PTA from post-consumer products and the development of bio-based alternatives that can reduce dependency on fossil fuels. Companies are increasingly investing in chemical recycling technologies that enable the breakdown of used polyester back into PTA, which can then be purified and reused to produce new polyester fibers. This not only helps reduce landfill waste but also cuts down on greenhouse gas emissions associated with the production of virgin PTA.

Moreover, the market is witnessing a surge in research and development efforts aimed at creating more efficient catalytic processes that can lower energy consumption during PTA production. Innovations such as the use of renewable energy sources in production plants and improvements in catalyst efficiency are becoming more prevalent, enhancing the overall sustainability of the PTA industry.

The adoption of these circular economy practices not only meets regulatory requirements and consumer expectations for sustainability but also opens up new business opportunities. By embracing recycling and bio-based technologies, PTA manufacturers can gain a competitive edge, attract environmentally conscious customers, and contribute positively to global environmental goals. This trend is expected to continue to influence market dynamics significantly, steering the industry toward greater innovation and sustainability.

Regional Analysis

The Asia Pacific region leads the Purified Terephthalic Acid (PTA) Market with a dominant market share of 39.2%. Analysts forecast the market to achieve USD 17.8 billion by the end of the projected period. This growth is driven by widespread adoption across critical sectors such as textiles, packaging, and automotive manufacturing.

Key economies in the region, including China, India, Japan, and South Korea, are pivotal in this growth trajectory. These countries show a significant increase in PTA usage, fueled by growing demand in industries like polyester fiber, PET resin, and films. Additionally, the region’s focus on sustainability and stringent regulatory standards enhances its global position in the PTA market.

In North America, the PTA market is expanding steadily. This growth is propelled by increasing demand from industries using PTA in polyester production, packaging materials, and industrial applications. The region’s strong industrial infrastructure and advancements in chemical processing contribute significantly to the adoption of PTA solutions.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The Purified Terephthalic Acid (PTA) market is marked by significant competition and innovation, driven by key players such as Alpek, British Petroleum (BP), Eastman Chemical Company, and Indian Oil Corporation. Alpek is renowned for its extensive production capabilities and strategic acquisitions, bolstering its market presence.

BP leverages its vast resources and technological advancements within its petrochemical division to maintain a strong foothold. Eastman Chemical Company focuses on sustainability and high-quality production, while Indian Oil Corporation benefits from its extensive refinery and petrochemical infrastructure, facilitating domestic and international market expansion.

Indorama Ventures Public Company, JBF Petrochemicals, Jiaxing Petrochemical Co., Ltd. (JPCL), and Lotte Chemical Corporation also play pivotal roles in the PTA market. Indorama Ventures leads with its global manufacturing network and commitment to sustainability, while JBF Petrochemicals emphasizes efficient production processes.

JPCL’s large-scale production capabilities and focus on innovation strengthen its market standing. Lotte Chemical Corporation, with its advanced technologies and strategic investments, continues to drive market growth.

Other notable players include MCPI, Mitsubishi Chemical Corporation, PetkimPetrokimya Holding A.Ş., Reliance Industries Limited, SABIC, Sinopec Corporation, and Yisheng, each contributing to the market through technological advancements, sustainability initiatives, and extensive production capacities. These companies collectively shape the PTA market’s dynamics, fostering growth and competitive advancements.

Market Key Players

- Alpek

- British Petroleum

- Eastman Chemical Company

- Indian Oil Corporation

- Indorama Ventures Public Company

- JBF Petrochemicals

- Jiaxing Petrochemical Co., Ltd. (JPCL)

- Lotte Chemical Corporation

- MCPI

- Mitsubishi Chemical Corporation

- PetkimPetrokimya Holding A.ª.

- Reliance Industries Limited

- SABIC

- Sinopec Corporation

- Yisheng

Recent Development

Alpek stands as the largest producer of Purified Terephthalic Acid (PTA) in the Americas and one of the largest globally. PTA is an essential raw material primarily used in producing polyethylene terephthalate (PET) resins, PET sheets, and polyester fibers, which find applications in diverse industries including plastics, engineering polymers, coatings, adhesives, and pharmaceuticals.

British Petroleum continues to invest in its proprietary PTA technology, maintaining its position as a market leader and technology provider of choice

Report Scope

Report Features Description Market Value (2023) US$ 45.4 Bn Forecast Revenue (2033) US$ 76.1 Bn CAGR (2024-2033) 5.3% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Form(Powder, Granular), By Application(PET Resin, Polyester, Polybutylene Terephthalate (PBT), Plasticizers, Others), By End-use(Textile, PET Bottles, Packaging, Others), By Sales Channel(Direct Sale, Indirect Sale) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Alpek, British Petroleum, Eastman Chemical Company, Indian Oil Corporation, Indorama Ventures Public Company, JBF Petrochemicals, Jiaxing Petrochemical Co., Ltd. (JPCL), Lotte Chemical Corporation, MCPI, Mitsubishi Chemical Corporation, PetkimPetrokimya Holding A.ª., Reliance Industries Limited, SABIC, Sinopec Corporation, Yisheng Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of Purified Terephthalic Acid (PTA) Market?Purified Terephthalic Acid (PTA) Market size is expected to be worth around USD 76.1 billion by 2033, from USD 45.4 billion in 2023

What is the CAGR for the Purified Terephthalic Acid (PTA) Market?The Purified Terephthalic Acid (PTA) Market is expected to grow at a CAGR of 5.3% during 2024-2033.Name the major industry players in the Purified Terephthalic Acid (PTA) Market?Alpek, British Petroleum, Eastman Chemical Company, Indian Oil Corporation, Indorama Ventures Public Company, JBF Petrochemicals, Jiaxing Petrochemical Co., Ltd. (JPCL), Lotte Chemical Corporation, MCPI, Mitsubishi Chemical Corporation, PetkimPetrokimya Holding A.ª., Reliance Industries Limited, SABIC, Sinopec Corporation, Yisheng

Purified Terephthalic Acid (PTA) MarketPublished date: June 2024add_shopping_cartBuy Now get_appDownload Sample

Purified Terephthalic Acid (PTA) MarketPublished date: June 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Alpek

- British Petroleum

- Eastman Chemical Company

- Indian Oil Corporation

- Indorama Ventures Public Company

- JBF Petrochemicals

- Jiaxing Petrochemical Co., Ltd. (JPCL)

- Lotte Chemical Corporation

- MCPI

- Mitsubishi Chemical Corporation

- PetkimPetrokimya Holding A.ª.

- Reliance Industries Limited

- SABIC

- Sinopec Corporation

- Yisheng