Global Home Bedding Market By Type (Bed Linen, Mattress, Pillows, Blankets, Mattress Toppers and Pads, Others), By Distribution Channel (Offline, Supermarket/Hypermarket, Specialty Stores, Others, Online), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 43703

- Number of Pages: 370

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

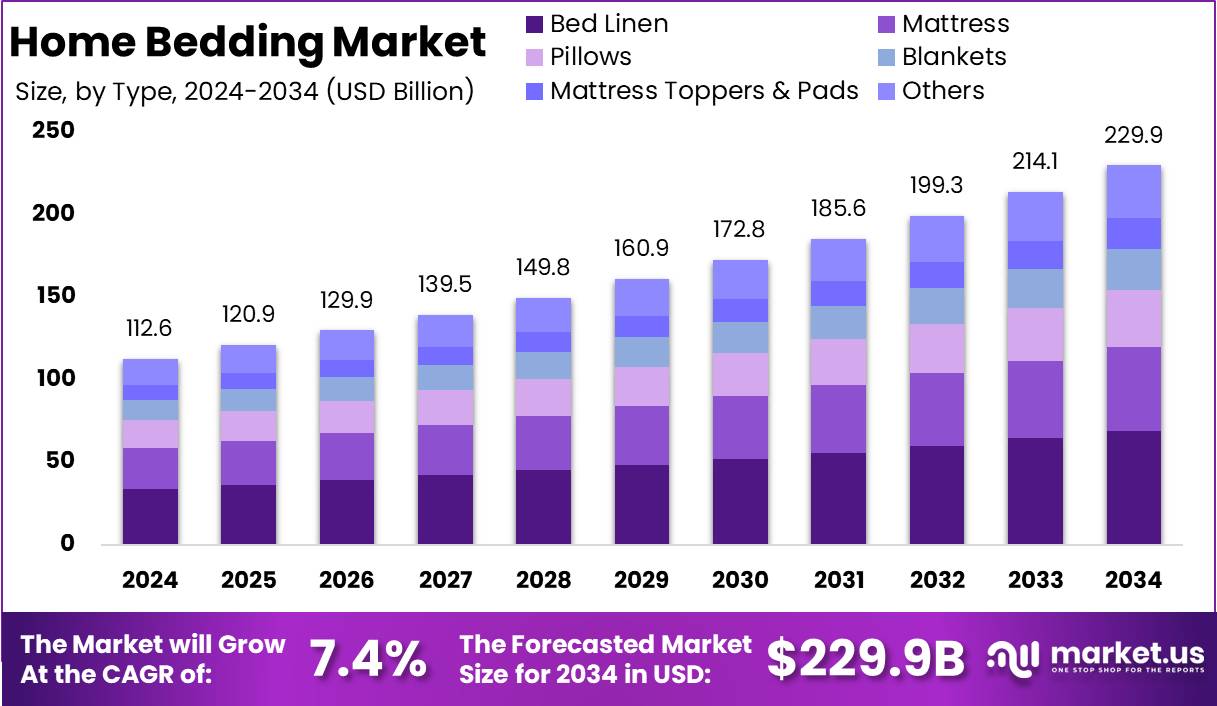

The Global Home Bedding Market size is expected to be worth around USD 229.9 Billion by 2034 from USD 112.6 Billion in 2024, growing at a CAGR of 7.4% during the forecast period from 2025 to 2034.

Home bedding refers to the collection of textiles and fabric-based products used in residential settings to enhance comfort, functionality, and aesthetic appeal. This includes items such as bed sheets, blankets, comforters, pillows, mattress pads, and duvet covers, among others.

The materials used in home bedding can range from natural fibers like cotton, linen, and wool to synthetic fabrics such as polyester and microfiber. The primary function of home bedding is to provide comfort during sleep while also contributing to the overall bedroom décor.

The home bedding market encompasses the production, distribution, and sale of various bedding products designed for residential use. This market includes a wide array of products manufactured from diverse materials to meet varying consumer preferences.

The market covers multiple segments, including luxury bedding, organic bedding, and basic functional bedding, with differentiation based on factors such as material composition, design, brand positioning, and pricing strategies.

The growth of the home bedding market can be attributed to several key factors. First, increasing consumer demand for comfort and wellness has led to a surge in premium and ergonomic bedding products, with consumers willing to invest more in products that promise better sleep quality.

Demand in the home bedding market is primarily driven by factors such as lifestyle changes, increasing disposable income, and greater awareness of the importance of sleep for overall well-being. Rising interest in home decor and interior design has also spurred demand for aesthetically pleasing, high-quality bedding products.

In recent years, the demand for products that offer a combination of both functional and aesthetic benefits has increased, as consumers seek bedding that aligns with their home’s design while enhancing their comfort.

The home bedding market presents numerous opportunities, particularly in the premium and sustainable segments. With the growing consumer preference for organic and eco-friendly materials, companies can capitalize on the demand for bedding products made from sustainable resources such as organic cotton, bamboo, and recycled fabrics.

There is also an opportunity to leverage technological advancements in bedding design, such as temperature control features, smart bedding, and customized sleep solutions. The increasing popularity of online shopping offers companies the opportunity to expand their reach through digital channels, providing consumers with more convenience and choice.

According to Cupcakes and Cashmere, 40% of Americans prefer only a fitted sheet and duvet cover, skipping the top sheet. Given that individuals spend about 1/3 of their lives in bed, the demand for more functional, streamlined bedding products has increased.

According to Ethical Bedding, the eco-friendly bedding sector stands out due to its remarkable resource efficiency, requiring 95% less water and 30% less energy compared to traditional cotton bedding.

Key Takeaways

- The global home bedding market is projected to grow from USD 112.6 billion in 2024 to USD 229.9 billion by 2034, expanding at a CAGR of 7.4%.

- Bed linen leads the market with a 30.1% share in 2024, driven by demand for comfort and aesthetic appeal.

- The mattress segment holds 25.4% of the market share, fueled by increasing consumer awareness of sleep health and comfort.

- Pillows maintain a steady share of 15.6%, with a growing preference for ergonomic and hypoallergenic options.

- The blanket segment accounts for 12.3%, reflecting increased demand for thermal comfort and luxury materials.

- North America holds the largest market share of 33.8% in 2024, supported by high consumer purchasing power and a preference for premium bedding products.

By Type Analysis

In 2024, Bed Linen Holds a Dominant Market Position in the Home Bedding Market, Capturing More than 30.1% Market Share

The global home bedding market in 2024 is significantly shaped by various product categories, with bed linen emerging as the leading segment. Bed linen, including sheets, pillowcases, and duvet covers, occupies the largest share, accounting for more than 30.1% of the total market.

This dominant position is driven by factors such as increasing demand for comfort and aesthetic appeal, as well as a growing preference for quality and durable fabrics. Consumers’ continuous focus on enhancing the overall bedroom experience has bolstered the demand for bed linens, ensuring its sustained leadership in the market.

Following bed linen, the mattress segment occupies a significant portion of the home bedding market. The rising awareness of sleep health and comfort has contributed to the growth of this segment, with a particular emphasis on high-quality mattresses. Innovations in mattress materials and designs, such as memory foam and hybrid mattresses, have further accelerated this growth.

The pillows segment maintains a steady presence in the market, contributing significantly to overall market dynamics. Pillows, which are crucial for comfort and sleep quality, have seen increasing demand for ergonomic and hypoallergenic options. As consumer preferences shift toward specialized products, the pillows segment continues to be a strong component within the broader home bedding category.

The blankets segment also plays a notable role in the home bedding market, driven by increasing demand for thermal comfort. A wide variety of blanket materials, including electric, weighted, and organic cotton blankets, has supported the expansion of this segment. Seasonal changes and a growing preference for comfort and luxury have further reinforced its growth.

The mattress toppers and pads segment is experiencing steady growth as consumers seek affordable ways to enhance mattress comfort and extend their lifespan. This segment is gaining traction due to the increasing focus on sleep quality and the availability of customizable options.

Lastly, the Others category, which includes a range of additional bedding products such as bed skirts, duvet inserts, and protectors, holds a smaller share of the market. While each individual product contributes less to the overall market, their combined presence remains important as consumers continue to seek comprehensive and varied bedding solutions.

By Distribution Channel Analysis

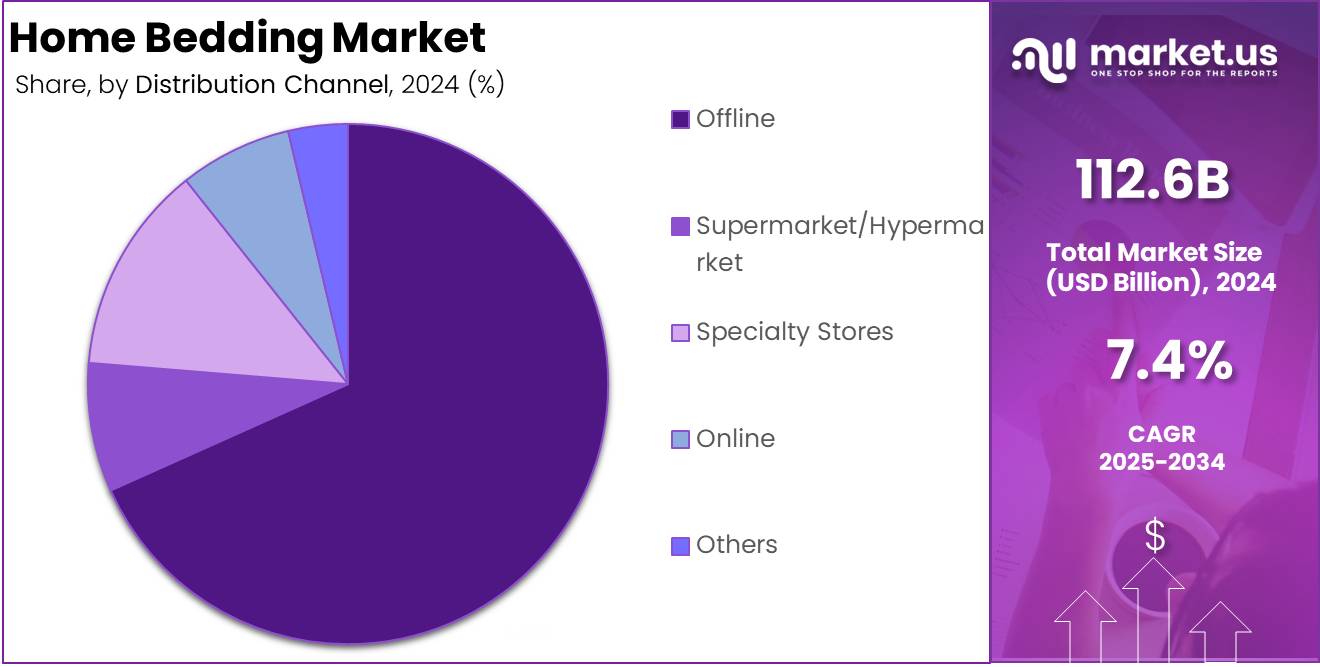

In 2024, Offline Distribution Channels Hold a Dominant Market Position in the Home Bedding Market, Capturing More than 68.3% Market Share

The distribution landscape of the global home bedding market in 2024 is led by offline channels, which collectively account for a significant 68.3% of the total market share.

Offline channels, encompassing supermarkets, hypermarkets, specialty stores, and other traditional retail outlets, remain the preferred shopping destination for many consumers due to their ability to provide direct interaction with products, immediate purchase options, and in-store experience. The tangible nature of home bedding products, combined with the trust consumers place in physical stores, sustains the dominance of offline channels.

The supermarket and hypermarket segment plays a crucial role in the offline distribution channel, holding a significant portion of the market share in 2024. These large retail chains benefit from high foot traffic and a broad customer base, offering a wide range of bedding products. Competitive pricing, convenience, and the ability to physically examine and feel the products contribute to the popularity of this distribution channel.

Specialty stores, which focus specifically on bedding and home textiles, represent an important segment within the offline market. These stores cater to consumers seeking high-quality, often premium, bedding products, and offer a more personalized shopping experience. The expertise and specialized knowledge provided by these retailers attract customers who are looking for specific materials, designs, and advanced features in home bedding.

The online distribution channel has become an increasingly prominent player in the home bedding market. E-commerce platforms provide consumers with the convenience of shopping from home, access to a wide range of products, and competitive pricing. The growth of online sales is supported by the ease of comparing products, the availability of customer reviews, and the convenience of doorstep delivery services.

The Others category within the offline distribution channel, which includes independent retailers, regional chains, and department stores, contributes significantly to the market. Though these outlets individually hold a smaller share, they collectively play an important role by offering local and niche products that meet regional demands or specific consumer preferences.

Key Market Segments

By Type

- Bed Linen

- Mattress

- Pillows

- Blankets

- Mattress Toppers & Pads

- Others

By Distribution Channel

- Offline

- Supermarket/Hypermarket

- Specialty Stores

- Online

- Others

Driver

Growing Consumer Focus on Home Comfort and Wellness

The increasing emphasis on wellness and home comfort is a key driver behind the growth of the global home bedding market. As consumer lifestyles evolve, there is a notable shift towards creating a relaxing and health-oriented living environment. Bedding, as a central element of home decor, plays a significant role in this trend. Consumers are increasingly investing in high-quality bedding materials that contribute to better sleep quality and overall well-being.

Research has shown that sleep is critical for physical and mental health, leading to a rise in demand for products that promote comfort, such as breathable, hypoallergenic, and temperature-regulating bedding solutions. The desire for premium comfort and restful sleep experiences aligns with a larger consumer interest in maintaining a balanced lifestyle, including improving the quality of one’s sleep environment.

This growing interest in home comfort has led to a surge in demand for various bedding items, including mattresses, bed linens, duvets, and pillows made from sustainable, organic, and health-focused materials. Consumers are also becoming more informed about the environmental impact of their purchases, pushing for bedding products made from eco-friendly materials.

This consumer behavior, which values both comfort and sustainability, is significantly influencing the home bedding market. The shift in purchasing patterns towards higher-end, wellness-focused bedding products is expected to drive further market expansion in 2024, as consumer awareness of the importance of sleep health continues to rise. As a result, manufacturers are increasingly prioritizing product innovation in materials and design to cater to this growing demand.

Restraint

Increasing Raw Material Costs

The rising costs of raw materials have emerged as a significant restraint on the global home bedding market. The production of bedding products requires several materials, including cotton, polyester, wool, and down feathers, many of which have been subject to price fluctuations in recent years. A variety of factors, including adverse weather conditions, global supply chain disruptions, and geopolitical instability, have impacted the availability and cost of these raw materials.

For instance, climate change and unpredictable weather patterns have led to lower yields of cotton, a key ingredient in many bedding products. Similarly, supply chain disruptions due to the COVID-19 pandemic and ongoing logistical challenges have added additional pressure on material procurement, further driving up costs.

As raw material costs rise, manufacturers are often faced with the dilemma of either absorbing the increased costs or passing them on to consumers. The latter can lead to higher retail prices, which may reduce the affordability and demand for home bedding products, particularly in price-sensitive markets. Additionally, the rise in the cost of production could potentially limit the profitability of bedding manufacturers, especially smaller players in the market.

This restraint is expected to continue influencing market dynamics in 2024, with the potential for increased competition among manufacturers to find cost-effective ways to manage raw material expenses. The impact of rising raw material prices will likely lead to innovation in production processes, as manufacturers seek ways to optimize efficiency and reduce reliance on expensive materials.

Opportunity

Expansion of E-Commerce and Online Retail Channels

The rapid growth of e-commerce presents a significant opportunity for the global home bedding market. With increasing internet penetration, changing consumer shopping habits, and the convenience of online shopping, more consumers are turning to digital platforms to purchase home bedding products. E-commerce offers bedding manufacturers an expanded reach to global markets, particularly in regions where physical retail infrastructure may be limited or costly to maintain.

The shift towards online shopping has also been accompanied by significant advancements in online marketing and personalized customer experiences. Digital tools such as augmented reality (AR) are increasingly being used by retailers to allow customers to visualize how different bedding products will look in their homes. Moreover, the ability to offer tailored recommendations based on browsing history or preferences has helped to increase consumer engagement and drive sales.

The online retail environment has also opened doors for direct-to-consumer (DTC) models, enabling brands to reduce overhead costs and offer competitive pricing. In 2024, as more consumers opt for the convenience of online shopping, this opportunity is expected to drive significant growth in the home bedding market, particularly for brands that can effectively leverage digital marketing strategies and e-commerce platforms to meet changing consumer expectations.

Trends

Sustainability and Eco-Friendly Bedding Materials

Sustainability is a key trend shaping the global home bedding market in 2024. Increasing environmental awareness among consumers has driven demand for bedding products made from eco-friendly, organic, and sustainable materials. This shift is part of a broader movement towards conscious consumerism, where individuals are more inclined to choose products that have a reduced environmental footprint.

Bedding manufacturers are responding to this trend by sourcing materials such as organic cotton, bamboo, and recycled polyester, which are perceived as more environmentally friendly compared to traditional synthetic options. The growing popularity of sustainable materials is not only driven by consumer preferences but also by a regulatory push towards more sustainable production practices.

As a result, many bedding brands are increasingly adopting eco-certifications and transparency in their sourcing processes. Certifications such as GOTS (Global Organic Textile Standard) and OEKO-TEX Standard 100 have gained importance among consumers who are looking for assurances that the products they buy are free from harmful chemicals and are produced using environmentally responsible methods.

This trend is expected to continue to evolve in 2024, with more consumers prioritizing sustainability when making purchasing decisions. Bedding companies that can demonstrate a commitment to sustainability, both in the materials they use and in their production processes, are well-positioned to capitalize on this growing market segment. Moreover, as sustainability becomes an integral part of brand identity, companies that fail to meet these expectations may struggle to maintain their competitive edge.

Regional Analysis

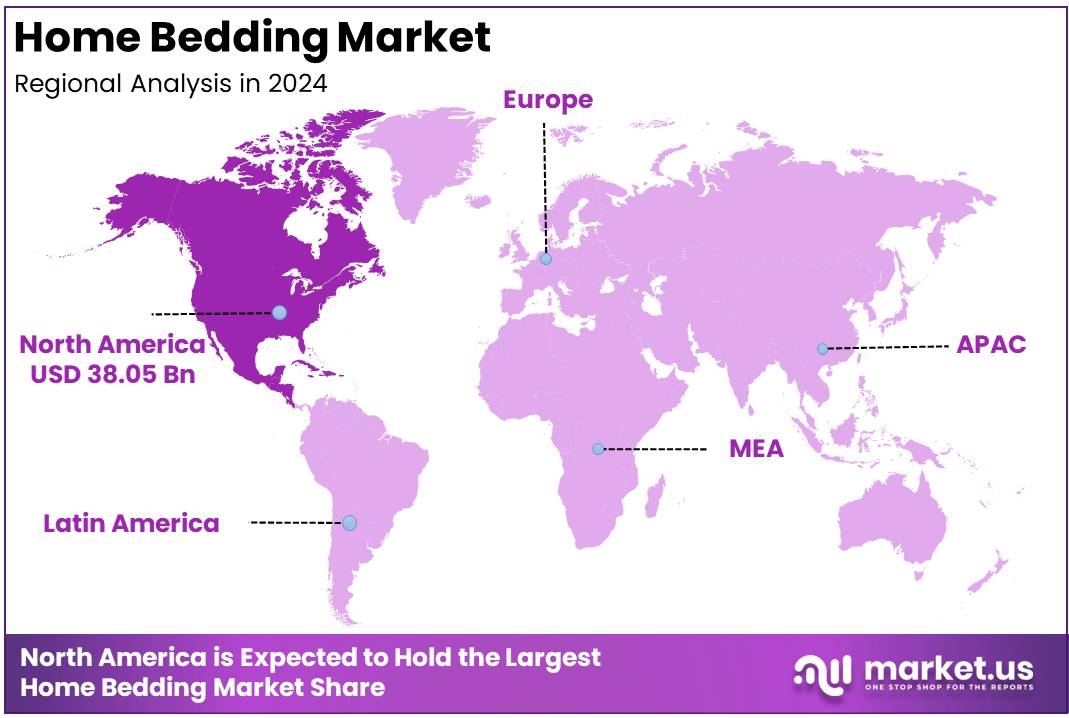

Lead Region: North America with Largest Market Share of 33.8% in the Home Bedding Market

In 2024, North America emerges as the dominant region in the global home bedding market, holding a substantial share of 33.8%, equivalent to USD 38.05 billion. The region’s market leadership is driven by several factors, including high consumer purchasing power, a strong preference for premium bedding products, and a well-developed retail infrastructure. With increasing demand for comfort and wellness products, North American consumers continue to prioritize high-quality home bedding, further solidifying the region’s position in the market.

Europe follows closely with a significant market share. This region benefits from a deep-rooted culture of home decor and a well-established bedding industry. The demand for both luxury and eco-friendly bedding solutions is notably rising in European countries. Factors such as stringent environmental regulations and an increased focus on sustainability have contributed to the region’s growing preference for organic and ethically sourced bedding products.

The Asia Pacific region, while still in a developing stage, presents strong growth potential. With a rapidly growing middle class and increasing urbanization, there is a rising demand for affordable and high-quality bedding products.

Countries such as China, India, and Japan are witnessing substantial growth in the home bedding market due to rising disposable incomes and the shift toward modern, westernized lifestyles. The demand for both functional and decorative bedding solutions is driving market expansion, with consumers opting for a variety of materials and designs.

The Middle East and Africa (MEA) region holds a relatively smaller share. The market here is primarily influenced by changing consumer habits, urbanization, and growing awareness of home decor trends.

While the region’s growth is slower compared to others, the demand for premium home bedding products is gradually increasing, especially in urban areas. The expansion of retail and e-commerce platforms in countries like the UAE and Saudi Arabia is anticipated to further stimulate the home bedding market.

Latin America accounts for a smaller portion of the market share. The region’s market is characterized by a preference for affordable bedding solutions, with moderate growth in demand for higher-end products. Economic challenges in certain countries temper overall market performance, though growing urbanization and changing consumer preferences for modern home decor styles are contributing factors to future growth in this region.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

The competitive landscape of the Global Home Bedding Market in 2024 is marked by the presence of several prominent players that continue to shape industry trends and consumer preferences. Key players such as Tempur Sealy International, Inc. and Purple Innovation, Inc. leverage strong brand recognition and advanced technological innovations, particularly in memory foam and adaptive sleep systems, to maintain market leadership.

Other established brands like Bombay Dyeing and Peacock Alley capitalize on their rich heritage and wide distribution networks to appeal to premium segments. Meanwhile, emerging players such as Casper Sleep Inc. focus on direct-to-consumer models and subscription-based services, further disrupting traditional retail dynamics.

Acton & Acton Ltd., Pacific Coast Feather Company, and Beaumont & Brown differentiate themselves through high-quality, luxury offerings, while Crane & Canopy Inc. and The White Company emphasize minimalist designs and sustainable materials. The overall market remains dynamic, driven by innovation in comfort, eco-conscious consumerism, and diverse product offerings.

Top Key Players in the Market

- Acton & Acton Ltd.

- American Textile Company

- Tempur Sealy International, Inc.

- Bombay Dyeing

- Casper Sleep Inc.

- Beaumont & Brown

- Pacific Coast Feather Company

- Crane & Canopy Inc.

- Peacock Alley

- Purple Innovation, Inc

- The White Company

- Portico New York

Recent Developments

- In 2023, Serta Simmons Bedding, a global leader in sleep solutions, announced that it had successfully completed its financial restructuring, emerging from Chapter 11. This development marks a significant milestone in the company’s ongoing efforts to strengthen its business operations and market position.

- In 2024, Leggett & Platt, a diversified manufacturer, revealed a restructuring initiative focusing mainly on its Bedding Products segment, with some adjustments in the Furniture, Flooring, and Textile Products divisions. The restructuring is designed to enhance manufacturing and distribution efficiency, refine product strategies, and meet evolving customer needs. When fully realized by 2025, these actions are projected to deliver annual EBIT benefits ranging from $40 to $50 million.

- On January 27, 2025, Tempur Sealy International, Inc. announced a strategic collaboration between Tempur-Pedic® and Calm, a leading wellness app. This partnership is aimed at developing exclusive content designed to improve sleep quality and promote relaxation through the use of TEMPUR-Ergo® Smart Bases.

- In 2023, Carpenter Co., a global leader in the polyurethane foam industry, entered into an agreement to acquire the flexible foam assets from NCFI’s Consumer Products Division. This acquisition, based in Mount Airy, North Carolina, strengthens Carpenter’s portfolio in industries such as furniture, mattresses, aerospace, and medical applications.

Report Scope

Report Features Description Market Value (2024) USD 112.6 Billion Forecast Revenue (2034) USD 229.9 Billion CAGR (2025-2034) 7.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Bed Linen, Mattress, Pillows, Blankets, Mattress Toppers and Pads, Others), By Distribution Channel (Offline, Supermarket/Hypermarket, Specialty Stores, Others, Online) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Acton & Acton Ltd., American Textile Company, Tempur Sealy International, Inc., Bombay Dyeing, Casper Sleep Inc., Beaumont & Brown, Pacific Coast Feather Company, Crane & Canopy Inc., Peacock Alley, Purple Innovation, Inc, The White Company, Portico New York Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Acton & Acton Ltd.

- American Textile Company

- Tempur Sealy International, Inc.

- Bombay Dyeing

- Casper Sleep Inc.

- Beaumont & Brown

- Pacific Coast Feather Company

- Crane & Canopy Inc.

- Peacock Alley

- Purple Innovation, Inc

- The White Company

- Portico New York