Global Entertainment Furniture Market By Product (TV Stands, Entertainment Centers, Media Consoles, Others), By Distribution Channel (Offline, Online), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 139316

- Number of Pages: 355

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

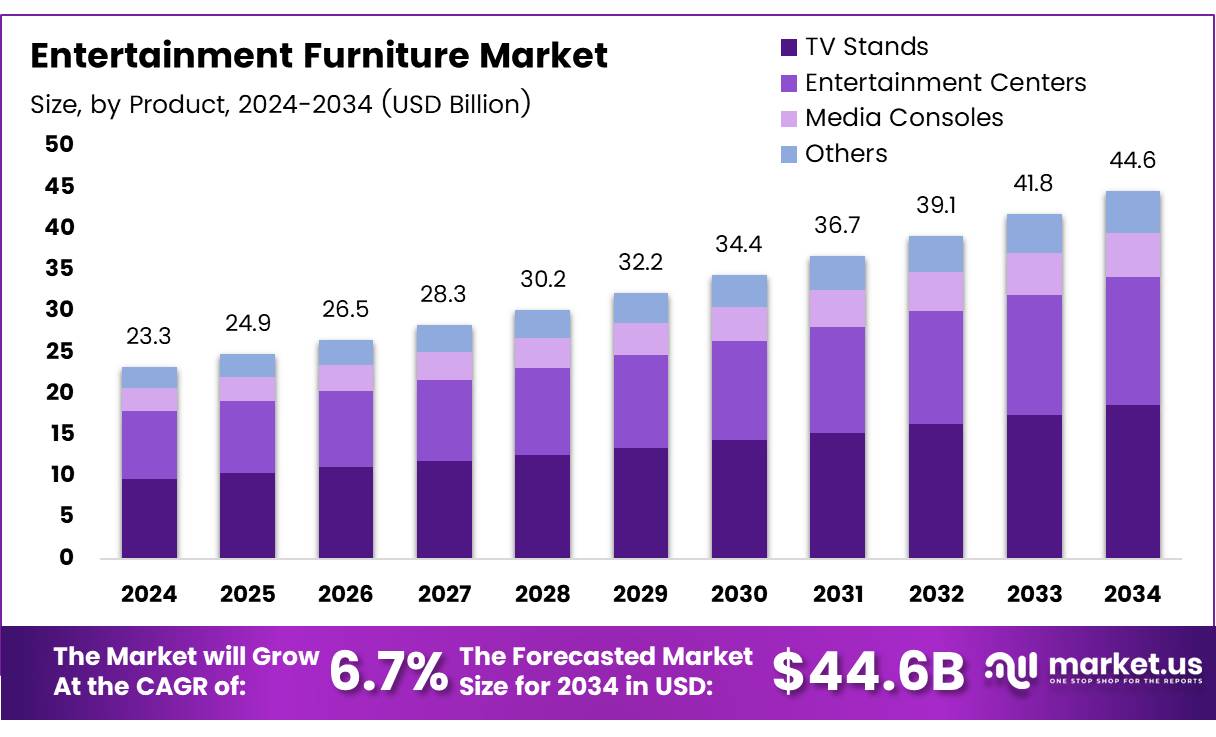

The Global Entertainment Furniture Market size is expected to be worth around USD 44.6 Billion by 2034, from USD 23.3 Billion in 2024, growing at a CAGR of 6.7% during the forecast period from 2025 to 2034.

The Entertainment Furniture Market refers to a specialized segment within the furniture industry, which focuses on products designed to accommodate home entertainment systems. This includes furniture such as TV stands, media consoles, audio furniture, and other pieces specifically designed for the purpose of organizing and enhancing media consumption experiences.

The market has witnessed a steady rise in demand, fueled by growing consumer interest in home entertainment and technology, such as larger flat-screen televisions, streaming services, and gaming consoles. This category has grown in importance as more consumers seek furniture solutions that not only provide storage but also enhance the aesthetics and functionality of their living spaces.

The Entertainment Furniture Market has become increasingly vital as consumer habits evolve in line with technological advancements. According to tv installation one, by 2029, 544 million households worldwide will have access to free-to-air terrestrial television. With TV viewing habits shifting and streaming services becoming more integral to daily life, furniture designed for entertainment spaces is increasingly in demand.

Additionally, in Q2 2023, tv installation one reported that streaming accounted for 36% of all TV usage, surpassing both broadcast and cable. This shift in consumer behavior further drives the need for more innovative and flexible entertainment furniture solutions.

The growth of the Entertainment Furniture Market is underpinned by both shifting consumer preferences and evolving technologies. With the rapid adoption of streaming platforms and increased reliance on mobile gaming, the demand for functional and stylish furniture that accommodates these technologies is on the rise.

For example, according to Study, in Q1 2024, 36% of internet users globally reported playing games on mobile devices. This trend signifies a growing consumer need for multi-functional furniture that can support these new forms of entertainment.

Additionally, government investment in infrastructure that supports digital and broadcast entertainment continues to boost demand for entertainment-related furniture.

As global markets such as the United States, Peru, and Chile lead the world in imports of entertainment furniture (Volza), opportunities abound for manufacturers and distributors to capitalize on the increasing cross-border demand. With 3,386 shipments coming into the United States, and 922 to Peru, the market is expanding both domestically and internationally.

Key Takeaways

- The Global Entertainment Furniture Market is projected to reach USD 44.6 billion by 2034, growing at a CAGR of 6.7%.

- TV Stands lead the product segment with a 39.1% market share in 2024, driven by demand for practical and stylish furniture.

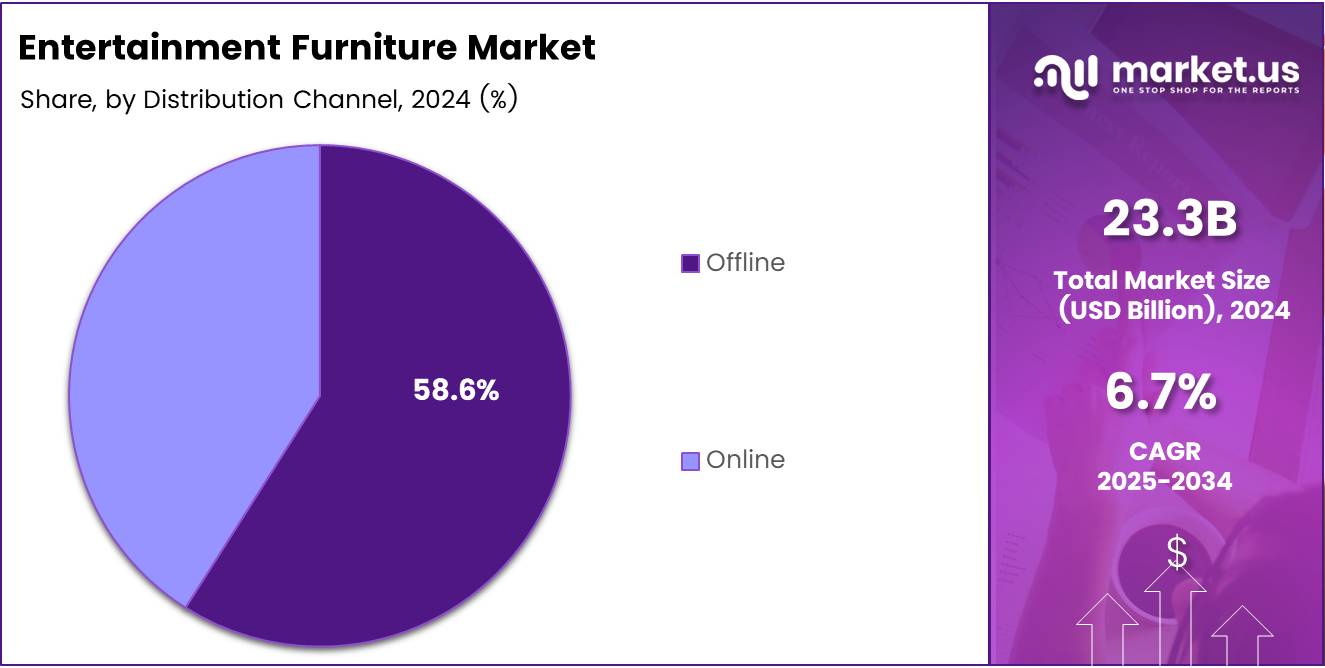

- The Offline distribution channel dominates with a 58.6% share, reflecting consumer preference for in-person shopping.

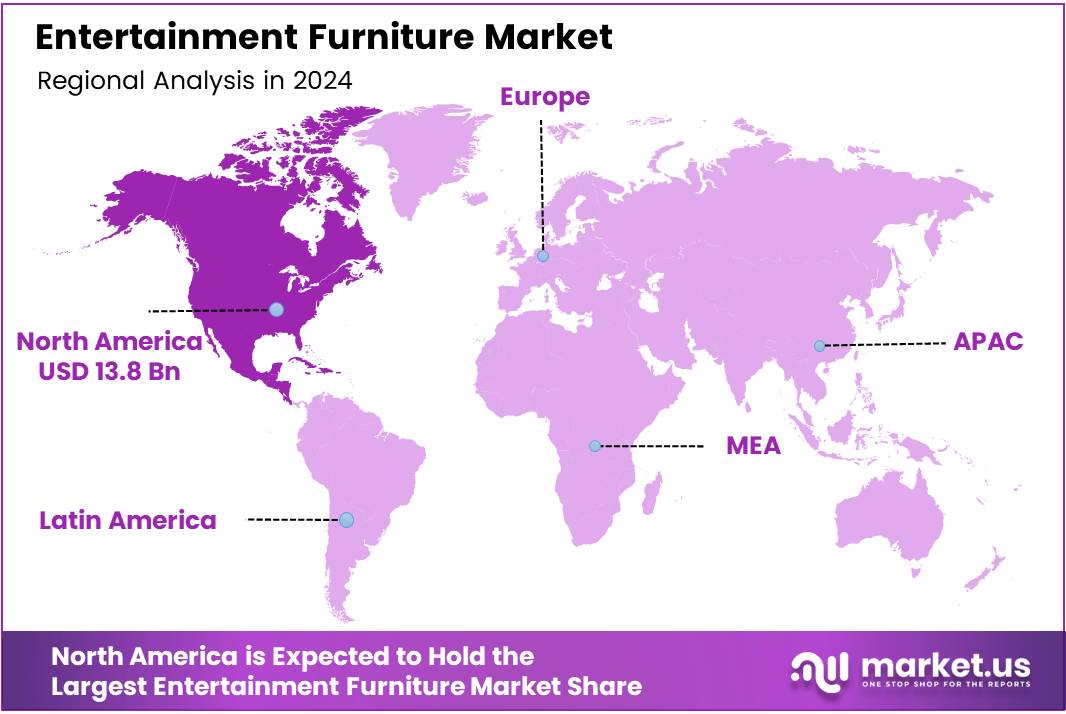

- North America holds the largest market share at 31.2%, valued at USD 13.8 billion, driven by high consumer spending and demand for innovative furniture.

Product Analysis

TV Stands Lead with 39.1% Share in 2024, Dominating the Entertainment Furniture Market

In 2024, TV Stands held a dominant market position in the By Product Analysis segment of the Entertainment Furniture Market, commanding a 39.1% share. This segment’s growth can be attributed to the increasing demand for practical and aesthetically appealing furniture that complements home entertainment setups.

As television viewing remains a staple of home entertainment, TV stands continue to serve as essential furniture, providing storage space for electronic devices, media accessories, and decorative elements, which enhances their value in households.

Entertainment Centers followed closely behind, capturing a significant portion of the market. These larger, multifunctional furniture units have gained popularity due to their ability to house a variety of media devices, including gaming consoles, sound systems, and smart home technology.

Media Consoles, while somewhat smaller in market share, are favored for their minimalist design and space-saving attributes. These units are particularly popular in modern, smaller living spaces where functionality and sleek design are key considerations.

Other products, which include various types of wall-mounted units, shelving, and modular furniture solutions, contribute to the market by offering specialized or customizable solutions, but they represent a smaller segment relative to TV stands and entertainment centers.

Distribution Channel Analysis

Offline Channels Lead Entertainment Furniture Market with 58.6% Share in 2024

In 2024, the Offline distribution channel maintained a dominant position in the Entertainment Furniture Market, holding a significant 58.6% share. This strong market presence is primarily attributed to the widespread consumer preference for in-person shopping, where buyers can physically inspect, feel, and experience the quality and comfort of the furniture before making a purchase.

The ability to immediately take possession of items, along with the opportunity for personalized customer service and the convenience of visiting established retail locations, continues to drive offline sales.

Retailers in this space have also capitalized on showroom experiences and in-store displays, which help consumers visualize the product in a real-world setting. Additionally, offline channels offer exclusive in-store promotions and discounts that further incentivize shoppers.

In contrast, the Online segment, though growing, held a smaller share. The convenience of online shopping, wider product selection, and competitive pricing are contributing factors to its gradual rise in popularity.

However, challenges such as delivery times, return policies, and the inability to physically interact with the furniture limit the online channel’s share compared to offline sales. As a result, Offline remains the preferred distribution channel for entertainment furniture, with expectations of steady growth moving forward.

Key Market Segments

By Product

- TV Stands

- Entertainment Centers

- Media Consoles

- Others

By Distribution Channel

- Offline

- Online

Drivers

Increasing Home Entertainment Demand Fuels Growth in Entertainment Furniture Market

The rising demand for home entertainment systems is one of the main drivers of the entertainment furniture market. As more people set up home theaters, gaming rooms, and entertainment centers, there’s a growing need for furniture that can support these setups. Consumers are looking for items like media consoles, TV stands, and storage units that not only look good but are also functional and designed to hold various electronic devices.

Additionally, advancements in technology are contributing to market growth, with smart furniture gaining popularity. Pieces with built-in speakers, charging stations, and wireless connectivity appeal to tech-savvy buyers who want both comfort and convenience.

The boom in the gaming industry is also a key factor, with increased interest in video games, esports, and streaming services driving demand for specialized furniture. Ergonomic gaming chairs, multi-purpose media consoles, and adjustable stands are all sought-after products in this sector.

Finally, urbanization and the trend of smaller living spaces are pushing consumers toward space-saving solutions. Furniture that can be easily adjusted, like modular units and compact media consoles, is in high demand as people look to maximize the functionality of their smaller homes without compromising on style or comfort. These factors combined make the entertainment furniture market a dynamic and rapidly growing sector.

Restraints

High Cost of Premium Furniture Limits Market Growth in Entertainment Sector

One of the significant restraints in the entertainment furniture market is the high cost of premium furniture, especially those featuring advanced technology or designer elements.

Items with built-in speakers, wireless charging, or customizable features can be expensive, which limits their appeal to a broader range of consumers. Many buyers may find these high-end products beyond their budget, thus restricting the potential market for such items.

Another challenge comes from the intense price competition driven by low-cost alternatives. Many unbranded or lesser-known manufacturers offer more affordable furniture options, which puts pressure on established brands to lower their prices. This creates a price-sensitive market where consumers may opt for cheaper, functional alternatives rather than paying a premium for stylish or tech-integrated products.

As a result, while there’s growing demand for high-end, innovative entertainment furniture, the financial barriers for both consumers and companies alike can limit the growth and expansion of this market.

Additionally, smaller manufacturers entering the market can dilute brand value and lead to price wars that hurt profit margins for premium product makers. These challenges make it difficult for high-end brands to reach their full potential without addressing cost concerns or finding ways to differentiate their products effectively in a crowded market.

Growth Factors

Smart Furniture Integration Presents Key Growth Opportunity in Entertainment Furniture Market

One of the most promising growth opportunities in the entertainment furniture market lies in the integration of smart technology.

Developing furniture that includes built-in charging stations, Bluetooth speakers, or Wi-Fi connectivity could appeal to tech-savvy consumers who value convenience and functionality. This innovation can help brands stand out in a competitive market by meeting the needs of consumers who are increasingly looking for connected living experiences.

Additionally, there’s growing demand for entertainment furniture in the commercial sector, particularly in places like hotels, gaming lounges, and corporate event spaces. These industries require stylish and durable furniture that can enhance the guest experience, opening up new business avenues for furniture manufacturers.

Another exciting opportunity is the rise of sustainability-driven products. Eco-friendly furniture made from recyclable materials or sustainably sourced wood could attract environmentally conscious buyers who are keen to make more responsible purchasing decisions.

Lastly, multi-functional furniture is becoming increasingly popular as consumers seek space-saving solutions, especially in smaller living spaces. Furniture that serves dual purposes—such as storage that doubles as seating or tables with built-in speakers—can tap into this demand for versatile, efficient design.

By focusing on these key growth areas, companies can meet the evolving needs of the market and capitalize on emerging trends, positioning themselves for long-term success in the entertainment furniture sector.

Emerging Trends

Convertible and Multi-purpose Furniture Leads the Way in Entertainment Furniture Trends

A key trend driving the entertainment furniture market is the growing preference for convertible and multi-purpose furniture. Consumers are increasingly seeking space-saving solutions, especially as living spaces shrink, and furniture that can be adapted to different needs is becoming highly sought after.

Items like foldable tables, recliners with hidden storage, and modular seating that can be rearranged are particularly popular. This trend reflects a shift towards more functional and flexible furniture that maximizes space and usability.

Another significant trend is the use of sustainable materials in furniture production. As eco-consciousness continues to rise, many consumers are now prioritizing eco-friendly, recycled, and sustainable materials when purchasing furniture. Brands that adopt green practices are not only appealing to this environmentally aware demographic but are also contributing to reducing waste and carbon footprints.

Home theater seating is also seeing increased demand, as more people create home theater experiences in their homes. Specialized furniture such as recliners, home theater sofas, and modular seating designed for comfort and style is becoming a staple in many households.

Finally, outdoor entertainment furniture is gaining popularity, driven by the rise of outdoor socializing and entertainment. Weather-resistant couches, chairs, and portable media units tailored for outdoor use are in high demand, offering consumers the option to extend their entertainment space into their gardens, patios, or balconies. These trends highlight the evolving needs and preferences of today’s consumers, shaping the direction of the entertainment furniture market.

Regional Analysis

North America leads with 31.2% market share at USD 13.8 billion driven by high consumer spending and a demand for innovative home entertainment furniture

The North American entertainment furniture market stands as a dominant force, accounting for 31.2% of the global market share, valued at approximately USD 13.8 billion. This is primarily driven by high consumer spending, a preference for innovative furniture, and the increasing demand for home entertainment systems.

The growing trend of home renovation and rising disposable incomes further support market expansion. The U.S. remains the largest market, bolstered by a strong presence of leading furniture brands and e-commerce platforms.

Regional Mentions:

Europe, the market is growing steadily, with rising demand for multi-functional and space-saving furniture. This growth is driven by an increasing interest in minimalistic designs and the growing adoption of smart home technologies. Countries like Germany, the U.K., and France are key players in this regional market.

The Asia-Pacific region is set to see the highest growth rate, spurred by the increasing middle-class population, urbanization, and a rising demand for modern furniture. Key markets like China, India, and Japan are seeing growing interest in home entertainment solutions, as consumer spending continues to rise, particularly in urban areas.

In the Middle East and Africa (MEA), the market is smaller but growing, especially in GCC countries where luxury and custom-made furniture are in high demand. Increasing disposable incomes and a preference for upscale home designs contribute to the region’s expansion.

Latin America is also experiencing moderate growth, driven by urbanization and a growing preference for modern home furnishings. Key contributors to market growth include Brazil and Mexico.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global Entertainment Furniture Market is expected to see steady growth in 2024, driven by evolving consumer preferences for multifunctional, stylish, and comfort-oriented home entertainment solutions. Key players in this sector, such as Inter IKEA Systems B.V., Sauder Woodworking Co., and Ashley Furniture, are well-positioned to capture this demand through their diverse product portfolios and strong brand recognition.

Inter IKEA Systems B.V. continues to dominate with its ability to provide cost-effective, modular entertainment furniture solutions that align with current trends in sustainability and design flexibility. Their ability to integrate digital technologies, like smart furniture, will further cement their leadership position.

Sauder Woodworking Co. and Ashley Furniture remain key competitors in the North American market, leveraging their established distribution channels and consumer trust. Sauder’s focus on affordable yet functional pieces, combined with Ashley’s extensive collection catering to various consumer tastes, gives them a competitive edge in serving diverse market segments.

La-Z-Boy offers a premium option, specializing in comfort-oriented furniture. Their strong foothold in the recliner and motion furniture sector positions them well for growth as consumers increasingly value ergonomic and cozy home entertainment solutions.

Williams-Sonoma, Inc. and Basset Furniture target the upper end of the market, offering high-end designs and luxury products, appealing to affluent consumers looking for more sophisticated and aesthetically pleasing entertainment units.

Emerging brands like Urban Ladder and Riverside Furniture are expanding their market presence in the online and direct-to-consumer space, capturing a younger demographic seeking modern, budget-friendly solutions. As the market evolves, these players will likely continue to capitalize on digital platforms to enhance accessibility and convenience.

Top Key Players in the Market

- Inter IKEA Systems B.V.

- Sauder Woodworking Co.

- Ashley Furniture

- SEI Furniture

- La-Z-Boy

- Williams-Sonoma, Inc.

- Basset Furniture

- Bush Furniture

- Urban Ladder

- Riverside Furniture Corporation

Recent Developments

- In October 2024, Molg secured $5.5 million in seed funding to drive its mission of reducing electronics waste through innovative circular manufacturing processes. The investment will enable the company to expand its sustainable solutions for the tech industry.

- In December 2024, Taranga Ventures launched a $50 million global fund focused on investing in media and entertainment startups with high-growth potential. The fund aims to support the development of cutting-edge content and technology solutions worldwide.

- In July 2024, Cosm raised over $250 million in funding to fuel the expansion of its experiential entertainment venues around the globe. The company plans to use the capital to scale its immersive entertainment experiences, bringing them to new markets.

Report Scope

Report Features Description Market Value (2024) USD 23.3 Billion Forecast Revenue (2034) USD 44.6 Billion CAGR (2025-2034) 6.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (TV Stands, Entertainment Centers, Media Consoles, Others), By Distribution Channel (Offline, Online) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Inter IKEA Systems B.V., Sauder Woodworking Co., Ashley Furniture, SEI Furniture, La-Z-Boy, Williams-Sonoma, Inc., Basset Furniture, Bush Furniture, Urban Ladder, Riverside Furniture Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Entertainment Furniture MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample

Entertainment Furniture MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Inter IKEA Systems B.V.

- Sauder Woodworking Co.

- Ashley Furniture

- SEI Furniture

- La-Z-Boy

- Williams-Sonoma, Inc.

- Basset Furniture

- Bush Furniture

- Urban Ladder

- Riverside Furniture Corporation