Global Children Entertainment Centers Market Size, Share, Statistics Analysis Report By Type (Arcade Studios, Soft Play Areas, Educational Play Centers, Adventure and Sports Centers, Others), By Facility Size (Up to 5,000 Sq. Ft., 5,001 to 10,000 Sq. Ft., Above 10,000 Sq. Ft.), By Age (Toddlers (0-5 Years), Children (6-12 Years), Teenagers (13-18 Years)), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: December 2024

- Report ID: 134715

- Number of Pages: 357

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Children Entertainment Centers Statistics

- Type Analysis

- Facility Size Analysis

- Age Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Emerging Trends

- Business Benefits

- Regional Analysis

- Key Player Analysis

- Top Opportunities Awaiting for Players

- Recent Developments

- Report Scope

Report Overview

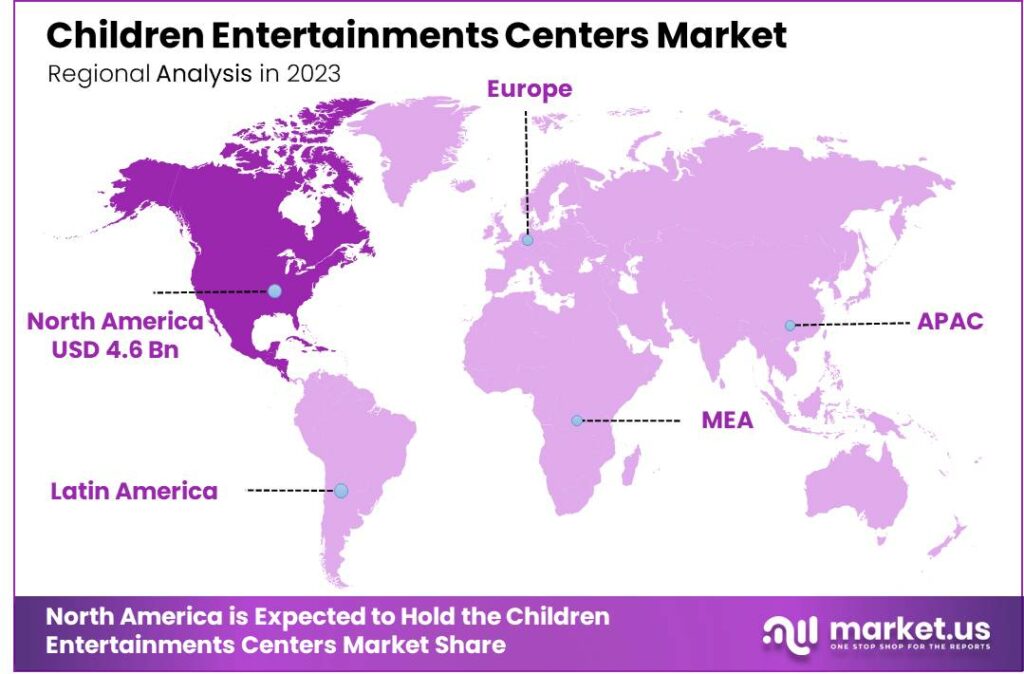

The Global Children Entertainment Centers Market size is expected to be worth around USD 28.8 Billion By 2033, from USD 12.11 Billion in 2023, growing at a CAGR of 9.06% during the forecast period from 2024 to 2033. In 2023, North America dominated the children’s entertainment center market, capturing over 38% of the market share and generating approximately USD 4.6 billion in revenue.

Children Entertainment Centers, commonly known as CECs, are facilities designed specifically to provide amusement and entertainment for children. These venues often include a variety of attractions such as arcade games, rides, play areas, and educational exhibits tailored to the interests and energy levels of children. The primary aim of CECs is to offer a safe and engaging environment where children can play, learn, and socialize under supervision.

The market for Children Entertainment Centers is experiencing significant growth, driven by increasing demand for family-oriented leisure activities. This sector includes both standalone facilities and those located within malls or as part of larger entertainment complexes. Market expansion is influenced by factors such as urbanization, rising disposable incomes, and the growing recognition of the importance of physical activities and social interactions for children’s development.

Several key factors propel the growth of the Children Entertainment Centers market. Firstly, there is a rising awareness among parents about the benefits of physical play in aiding children’s health and development, steering them towards CECs. Additionally, urbanization has led to constrained living spaces in cities, increasing the need for accessible play environments. The expansion of the middle class and their increased leisure spending also significantly contribute to the sector’s growth.

Market demand for Children Entertainment Centers is primarily driven by the increasing need for safe and engaging environments where children can participate in physical and creative activities. This demand is further amplified by the growing number of dual-income households, where parents seek quality recreational options for their children during free time or weekends. The trend towards celebrating children’s birthdays and special occasions at CECs has also boosted demand.

According to data from IAAPA, North American families typically visit full-featured family amusement centers 3.2 to 4.6 times per year. On each visit, families spend an average of $12 to $22, depending on the activities available. These numbers highlight the steady demand for family-oriented entertainment, offering a strong opportunity for businesses in this sector to attract repeat customers by offering engaging and diverse experiences

The Children Entertainment Centers market is ripe with opportunities. There is a noticeable trend towards integrating educational content with entertainment, known as edutainment, which appeals to both parents and children. Additionally, the rise of digital integration in physical play offers potential for interactive and immersive experiences. Expansion into smaller cities and untapped markets, as well as franchising models, present further growth opportunities for the sector.

Technological advancements are playing a pivotal role in transforming Children Entertainment Centers. The integration of augmented reality (AR) and virtual reality (VR) into traditional play structures is enhancing the interactive experiences offered at CECs. These technologies provide immersive environments that encourage creative play and learning. Additionally, advancements in safety and payment technologies ensure smoother operations and enhanced customer satisfaction, bolstering the market’s growth prospects.

Key Takeaways

- The Global Children Entertainment Centers Market size is expected to be worth around USD 28.8 billion by 2033, growing from USD 12.11 billion in 2023, with a CAGR of 9.06% during the forecast period from 2024 to 2033.

- In 2023, the Arcade Studios segment held a dominant position, capturing over 27% of the total market share in the Children’s Entertainment Centers market.

- The 5,001 to 10,000 Sq. Ft. segment dominated the market in 2023, holding more than 41% of the total share in the children’s entertainment center market.

- The Children (6-12 Years) segment also held a dominant position in 2023, capturing more than 57% of the market share in children’s entertainment centers.

- In 2023, North America led the children’s entertainment center market, holding more than 38% of the market share, generating approximately USD 4.6 billion in revenue.

Children Entertainment Centers Statistics

According to Gitnux, family entertainment centers (FECs) are a cornerstone of modern family outings, offering a variety of attractions and activities. Here are some key insights into this thriving industry:

- The average FEC features 20-30 arcade games, catering to gamers of all ages.

- About 60% of FECs include a laser tag arena, providing an adrenaline-filled experience.

- 70% of FECs have a bowling alley, a classic family favorite.

- Virtual reality (VR) is gaining popularity, with 50% of FECs offering VR experiences.

- Most FECs have 3-5 major attractions, ensuring there’s something for everyone.

- The typical FEC boasts 10-15 different games or attractions, keeping visitors entertained.

- On average, families spend about 2.5 hours at an FEC, making it a perfect half-day outing.

- Weekends are crucial, accounting for 60-70% of weekly attendance at FECs.

- Each year, the average FEC welcomes 150,000-200,000 visitors, reflecting their popularity.

- Families typically spend $50-$75 per visit, highlighting the value these centers provide.

- Customer loyalty is strong, with a 40-50% return rate and 30-40% repeat customers.

- To improve their offerings, 70% of FECs use customer feedback surveys.

- Business peaks during 3-5 months annually, often aligning with school vacations and holidays.

Type Analysis

In 2023, the Arcade Studios segment held a dominant market position in the Children Entertainment Centers market, capturing over 27% of the total share. This dominance can be attributed to the widespread appeal and longstanding popularity of arcade-style games, which have been a staple of children’s entertainment for decades.

The Arcade Studios segment also benefits from its ability to provide a high-energy, social environment that encourages children to interact and compete with one another. With advancements in technology, modern arcade games now include immersive experiences like VR (Virtual Reality) and AR (Augmented Reality), which further enhance their attractiveness.

Another factor contributing to the strong performance of the Arcade Studios segment is the relatively low operational cost compared to other entertainment offerings, such as Adventure and Sports Centers or Educational Play Centers, which may require more space, staff, and resources to operate.

Arcade Studios can provide entertainment with less overhead, making them an attractive investment for both independent operators and larger chains. Additionally, arcade games often have a high return on investment due to the revenue generated from pay-per-play models, offering steady profitability.

Facility Size Analysis

In 2023, the 5,001 to 10,000 Sq. Ft. segment held a dominant market position, capturing more than a 41% share of the children’s entertainment center market. This segment has become the most preferred size for operators due to its balance between cost-effectiveness and the ability to offer a wide range of attractions and activities.

Venues in this size range are large enough to accommodate multiple themed areas, such as soft play zones, arcade games, and interactive learning spaces, while still being manageable in terms of operational costs. They can provide enough variety to appeal to different age groups and preferences, making them ideal for family visits.

The popularity of this size segment is further driven by the flexibility it offers in terms of design and layout. Operators can optimize space to create multi-functional areas that host not only traditional entertainment but also birthday parties, educational workshops and events.

Moreover, the 5,001 to 10,000 Sq. Ft. segment strikes a balance between scale and accessibility. Centers of this size are large enough to provide significant entertainment value but not so large that they become overly costly to build or maintain. The relatively lower investment requirements make this segment an attractive option for both independent operators and franchises.

Age Analysis

In 2023, the Children (6-12 Years) segment held a dominant market position in the children’s entertainment centers, capturing more than a 57% share.This age group represents the largest demographic in terms of spending on recreational activities and entertainment.

Parents of children aged 6 to 12 years are more likely to invest in experiences that balance fun and physical activity, which is a key focus of many entertainment centers offering everything from arcade games to adventure parks and trampoline zones.

The growing popularity of birthday parties and group events tailored to children aged 6-12 further boosts the market share of this segment. Many entertainment centers target this demographic with customized packages that cater to school groups, birthday celebrations, or weekend outings, making it a highly attractive market for both parents and service providers.

Additionally, children in the 6-12 age group are more inclined to engage in both active and immersive entertainment experiences, such as go-karting, mini-golf, virtual reality, and climbing walls, which are widely available in entertainment centers. This combination of physical play and technological entertainment appeals to a broad range of interests and provides a diverse array of options for children and their families.

Key Market Segments

By Type

- Arcade Studios

- Soft Play Areas

- Educational Play Centers

- Adventure and Sports Centers

- Others

By Facility Size

- Up to 5,000 Sq. Ft.

- 5,001 to 10,000 Sq. Ft.

- Above 10,000 Sq. Ft.

By Age

- Toddlers (0-5 Years)

- Children (6-12 Years)

- Teenagers (13-18 Years)

Driver

Increasing Demand for Safe and Interactive Experiences

The growing demand for safe, interactive, and immersive play experiences is a key driver in the children’s entertainment center market. With an increased focus on children’s physical and mental well-being, parents are actively seeking venues that provide not only fun but also educational and engaging experiences for their children.

These centers are evolving into multi-sensory spaces, combining physical activity with digital technologies such as virtual reality (VR) or augmented reality (AR), which adds value to the play experience. Additionally, there is a rising trend of experiences that integrate learning with entertainment, often referred to as “edutainment.” This trend meets the needs of modern families who want to balance fun with developmental benefits.

Restraint

Rising Operational Costs

A major restraint facing children’s entertainment centers is the rising operational costs. These centers require substantial investment in infrastructure, maintenance, and safety measures, which can significantly increase overhead expenses. The constant need to upgrade and maintain play equipment, incorporate the latest technology, and ensure compliance with health and safety standards demands significant capital.

Additionally, utility costs such as electricity, water, and heating are rising, impacting profitability. Labor costs also play a significant role, especially with the need for well-trained staff to oversee children’s activities and manage safety. Rising demand for skilled employees in child safety, first aid, and customer service is driving up wages, making it harder for smaller or independent centers to manage costs while keeping prices affordable.

Opportunity

Expanding the Offerings with Digital Integration

The opportunity for children’s entertainment centers lies in expanding their offerings with digital integration, such as incorporating augmented reality (AR), virtual reality (VR), and interactive gaming experiences.

As technology continues to evolve, children are increasingly attracted to digital experiences, and integrating this into physical play zones presents a significant opportunity for innovation. Centers can create immersive environments where kids engage with interactive screens, VR games, and AR-based treasure hunts, all while staying physically active.

This not only enhances the entertainment experience but also blends physical activity with digital play, which aligns with current trends in edutainment. These experiences offer children a chance to explore new worlds, solve problems, and develop new skills, while still engaging with other children in a social setting.

Challenge

Navigating the Impact of Economic Uncertainty

One of the key challenges for children’s entertainment centers is navigating the impact of economic uncertainty, particularly during periods of inflation or economic downturns. With tighter household budgets, families may reduce discretionary spending, including visits to entertainment centers, which can lead to decreased foot traffic and lower revenues.

Economic challenges affect consumers’ willingness to spend on non-essential activities, and children’s entertainment centers are often viewed as leisure expenses that are more easily cut from family budgets during tough times. Rising fuel, food, and entertainment costs make it harder for families to visit these centers often. Businesses face the challenge of balancing price hikes to cover costs without alienating price-sensitive customers.

Emerging Trends

Children’s entertainment centers are evolving to cater to the changing needs and preferences of modern families. One key trend is the integration of technology, where traditional play areas are being enhanced with virtual reality (VR), augmented reality (AR), and interactive games. This technology not only offers a more immersive experience but also helps children develop essential skills such as problem-solving, teamwork, and creativity.

Another notable trend is the focus on health and wellness. Parents are increasingly looking for entertainment options that promote physical activity, as well as mental well-being. As a result, centers are incorporating active play zones with trampolines, climbing walls, and obstacle courses that encourage children to be more physically active.

Family-friendly environments are another emerging trend. These centers are designed not just for children but for families to enjoy together. Offering communal spaces, child-care services, and family-oriented events ensures that parents can relax and socialize while their children are engaged in fun and educational activities.

Business Benefits

Operating a children’s entertainment center offers significant business advantages. There is a steady demand for family-friendly entertainment options. Parents are willing to invest in activities that engage and entertain their children in safe, controlled environments.

Additionally, children’s entertainment centers often benefit from multiple revenue streams. Beyond entry fees, many centers generate income through additional services like birthday parties, merchandise sales, food and beverages, and special events. This diversification makes it easier for business owners to manage risks and maximize profits.

Brand loyalty is another key advantage. Parents who have positive experiences at these centers are likely to return, especially if the center provides excellent customer service, a variety of engaging activities, and a clean, safe environment. Word-of-mouth marketing and social media also play a big role in promoting these centers, as parents are quick to share their experiences with friends and family.

Regional Analysis

In 2023, North America held a dominant market position in the children’s entertainment center market, capturing more than a 38% share, generating approximately USD 4.6 billion in revenue. The region’s leadership can be attributed to the high demand for family-friendly entertainment options, driven by a strong consumer base with significant disposable income.

North America’s well-established infrastructure, urbanization, and robust retail environment provide an ideal foundation for the growth of children’s entertainment centers. With large, well-developed markets in the U.S. and Canada, operators have successfully tapped into a wide demographic of families seeking safe, interactive, and engaging experiences for their children.

Additionally, North America’s dominance is supported by the increasing focus on experience-driven leisure activities. With a growing preference for activities that combine fun with education, many children’s entertainment centers in the region have incorporated STEM-focused play zones, interactive learning environments, and entertainment designed to foster creativity and problem-solving.

The popularity of these entertainment centers is also influenced by North American culture, which places a high value on family entertainment. Children’s entertainment centers are now key features in shopping malls and leisure complexes, offering a convenient one-stop hub for all-ages activities. Their success is driven by location, additional services like birthday parties and camps, and the ability to keep children engaged for long periods.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

Children’s entertainment centers have become an integral part of the modern family entertainment industry, providing fun, engagement, and recreational experiences for kids of all ages. The market is highly competitive, with a few key players dominating the space.

Cinergy Entertainment Group stands out as a leading player in the children’s entertainment market, particularly in the United States. Known for its combination of family-friendly activities, Cinergy offers more than just arcade games; it features immersive experiences, including virtual reality (VR) games, bowling, and even luxury cinemas.

Dave & Buster’s Inc. is one of the most recognizable names in the children’s and family entertainment sector. With hundreds of locations across the U.S., Dave & Buster’s offers a large variety of video games, sports simulators, and interactive play areas for children, alongside entertainment options for adults. The company’s unique selling point lies in its “Eat & Play” concept, where guests can enjoy delicious meals while participating in games.

Fun City India, part of the renowned Landmark Group, holds a strong position in the children’s entertainment space in the Middle East and India. It operates a wide range of amusement parks, arcades, and indoor play zones, providing a safe and exciting environment for children to explore. What makes Fun City unique is its commitment to delivering high-quality, family-friendly experiences, with a focus on both fun and learning.

Top Key Players in the Market

- Cinergy Entertainment Group

- Dave & Buster’s Inc.

- Fun City India (Landmark Group)

- Funriders Leisure & Amusement Pvt. Ltd.

- KidZania S.A.P.I. de C.V.

- Lucky Strike Entertainment

- Scene75 Entertainment Centers

- Smaaash

- The Walt Disney Company

- Other Key Players

Top Opportunities Awaiting for Players

The children’s entertainment center (CEC) market is evolving rapidly, creating exciting opportunities for businesses to explore and grow.

- Increased Demand for Interactive and Immersive Experiences: Today’s children want interactive, hands-on experiences that engage their senses and spark creativity. As virtual reality (VR), augmented reality (AR), and interactive technology become more affordable, CECs can integrate these innovations to create captivating experiences. The use of VR and AR in areas like gaming zones or learning hubs can attract more customers and differentiate a center from competitors.

- Edutainment: Combining Fun with Learning: Parents’ growing demand for educational entertainment has boosted the popularity of “edutainment” options. Children’s centers offering learning through activities like science exhibits, arts workshops, and educational games appeal to this trend, providing both fun and value, while giving businesses a market edge.

- Expansion of Indoor and Outdoor Hybrid Models: These hybrid centers allow for flexibility, ensuring that children can enjoy physical activities year-round, regardless of weather conditions. Outdoor zones with obstacle courses, mini-golf, and other fun physical challenges can attract families seeking a balanced entertainment experience. These hybrid models are especially appealing to families with younger children who need more space to play and explore.

- Franchise and Licensing Opportunities: For entrepreneurs looking to scale, franchising and licensing offers a low-risk path to expand the brand. Franchise models allow business owners to replicate a successful business model in different regions or countries. As consumer interest in high-quality, branded entertainment experiences grows, well-established children’s entertainment centers have the opportunity to expand quickly through franchising. Similarly, licensing popular children’s characters or brands can also attract a larger audience.

- Birthday Parties and Event Hosting: The demand for themed birthday parties and private events at children’s entertainment centers continues to rise. Creating bespoke party packages with customizable themes, entertainment options, and catering services can help boost revenue and attract repeat customers. Additionally, hosting other types of events, like school trips, playdates, or family reunions, can provide additional revenue streams and foster stronger community ties.

Recent Developments

- In June 2024, in partnership with Hasbro, Planet Playskool is launching its first immersive play zone, blending fun and creativity for kids and parents. The Hasbro license brings beloved family brands to life in this exciting new entertainment space.

- In June 2024, Dave & Buster’s unveiled a renovated location in Harrisburg, Pennsylvania. The revamped center features private Social Bays for interactive gaming, a 40-foot screen with surround sound for immersive viewing, an updated menu, and a modern design aimed at enhancing the guest experience.

- In December 2024, Bowlero, the largest bowling alley operator in the U.S., announced plans to rebrand as Lucky Strike Entertainment. This change reflects the company’s strategy to diversify beyond bowling into broader family entertainment, including the acquisition of venues like Raging Waves Waterpark and Boomers Parks.

Report Scope

Report Features Description Market Value (2023) USD 12.11 Bn Forecast Revenue (2033) USD 28.8 Bn CAGR (2024-2033) 9.06% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Arcade Studios, Soft Play Areas, Educational Play Centers, Adventure and Sports Centers, Others), By Facility Size (Up to 5,000 Sq. Ft., 5,001 to 10,000 Sq. Ft., Above 10,000 Sq. Ft.), By Age (Toddlers (0-5 Years), Children (6-12 Years), Teenagers (13-18 Years)) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Cinergy Entertainment Group, Dave & Buster’s Inc., Fun City India (Landmark Group), Funriders Leisure & Amusement Pvt. Ltd., KidZania S.A.P.I. de C.V., Lucky Strike Entertainment, Scene75 Entertainment Centers, Smaaash, The Walt Disney Company, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Children Entertainment Centers MarketPublished date: December 2024add_shopping_cartBuy Now get_appDownload Sample

Children Entertainment Centers MarketPublished date: December 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Cinergy Entertainment Group

- Dave & Buster's Inc.

- Fun City India (Landmark Group)

- Funriders Leisure & Amusement Pvt. Ltd.

- KidZania S.A.P.I. de C.V.

- Lucky Strike Entertainment

- Scene75 Entertainment Centers

- Smaaash

- The Walt Disney Company

- Other Key Players